Phd in Healthcare and Hospital Management Brochure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Healthcare Sector in India Flanders Investment & Trade Market Survey

HEALTHCARE SECTOR IN INDIA FLANDERS INVESTMENT & TRADE MARKET SURVEY Healthcare Sector in India Flanders Investment & Trade Economic Representation of Flanders c/o Embassy of Belgium 50 - N, Shantipath, Chanakyapuri New Delhi - 110 021 India [email protected] T: +91 11 42 42 81 00 F: +91 11 42 42 81 10 Studie Healthcare Sector in India | juni 2015 1 2 TABLE OF CONTENTS ICT in Healthcare Services in India ................................................................................................. 8 Introduction ......................................................................................................................................... 8 Healthcare Information & Communication Technology (HICT) ...................................................... 9 Patient Monitoring & Tracking ........................................................................................................ 9 Healthcare Information Technology (HIT) ..................................................................................... 10 National Health Policy ................................................................................................................... 10 Health Information Management Systems (HIMS) ....................................................................... 10 Grading of Indian States for the use of ICT in Hospitals ................................................................ 12 Telemedicine .................................................................................................................................... -

FHL Annual Report 2020-21

ANNUAL REPORT 2020-2021 COMPANY INFORMATION CONTENTS BOARD OF DIRECTORS CORPORATE OVERVIEW CLINICAL EXCELLENCE Chairman 02 Introduction 66 Dedicated to Serve Responsibly Ravi Rajagopal (Independent Director) 04 Vision and Mission AWARDS AND ACCOLADES 06 Values Vice-Chairman 74 Inspired By Recognitions Shirish Moreshwar Apte (Non-Executive Director) 08 Key Performance Highlights 2020-21 HUMAN RESOURCES Managing Director and CEO BOARD OF DIRECTORS 78 Inspiring Trust Through the People Power Dr. Ashutosh Raghuvanshi 10 Fortis Healthcare Limited 12 SRL Limited Non-Executive Directors STATUTORY REPORTS Dilip Kadambi MANAGEMENT COMMUNIQUE 84 Director’s Report Dr. Farid Bin Mohamed Sani 136 Report on Corporate Governance 14 From the Chairman’s Desk Heng Joo Joe Sim 164 Business Responsibility Report Joerg Ayrle 18 MD & CEO’s Message (FHL) 175 Management Discussion and Analysis Report Dr. Kelvin Loh Chi-Keon 22 CEO’s Message (SRL) Takeshi Saito FINANCIAL STATEMENTS COVID-19 AND OUR RESPONSE Independent Directors 26 A Clear and Compelling Purpose 191 Standalone Financials Indrajit Banerjee 283 Consolidated Financials Shailaja Chandra FORTIS HEALTHCARE LIMITED Suvalaxmi Chakraborty 32 Inspiring Trust Across the Nation Chief Financial Officer OUR TRANSFORMATION Vivek Kumar Goyal 38 The New Journey Company Secretary and Compliance Officer FINANCIAL HIGHLIGHTS Sumit Goel 40 Performance Snapshot Auditors CLINICAL FOCUS B S R & Co. LLP Chartered Accountants 44 New Clinical Offerings Fortis Healthcare Limited 46 Speciality Mix CIN: L85110PB1996PLC045933 -

Fortis Healthcare Limited

FORTIS HEALTHCARE LIMITED Earnings Presentation – Q2FY21 November 12, 2020 Disclaimer This presentation may not be copied, published, distributed or transmitted. The presentation has been prepared solely by the company. Any reference in this presentation to “Fortis Healthcare Limited” shall mean, collectively, the Company and its subsidiaries. This presentation has been prepared for informational purposes only. This presentation does not constitute a prospectus, offering circular or offering memorandum and is not an offer or invitation to buy or sell any securities, nor shall part, or all, of this presentation form the basis of, or be relied on in connection with, any contract or investment decision in relation to any securities. Furthermore, this presentation is not and should not be construed as an offer or a solicitation of an offer to buy securities of the company for sale in the United States, India or any other jurisdiction. Securities may not be offered or sold in the United States absent registration or an exemption from registration. Any public offering in the United States may be made only by means of an offering document that may be obtained from the Company and that will contain detailed information about the Company and its management, as well as financial statements. Any offer or sale of securities in a given jurisdiction is subject to the applicable laws of that jurisdiction. This presentation contains forward-looking statements based on the currently held beliefs and assumptions of the management of the Company, which are expressed in good faith and, in their opinion, reasonable. Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, financial condition, performance, or achievements of the Company or industry results, to differ materially from the results, financial condition, performance or achievements expressed or implied by such forward-looking statements. -

Fortis Healthcare Limited Investor Presentation – Q3 FY2013

Fortis Healthcare Limited Earnings Presentation – FY20 and Q4 FY20 June 17, 2020 Disclaimer This presentation may not be copied, published, distributed or transmitted. The presentation has been prepared solely by the company. Any reference in this presentation to “Fortis Healthcare Limited” shall mean, collectively, the Company and its subsidiaries. This presentation has been prepared for informational purposes only. This presentation does not constitute a prospectus, offering circular or offering memorandum and is not an offer or invitation to buy or sell any securities, nor shall part, or all, of this presentation form the basis of, or be relied on in connection with, any contract or investment decision in relation to any securities. Furthermore, this presentation is not and should not be construed as an offer or a solicitation of an offer to buy securities of the company for sale in the United States, India or any other jurisdiction. Securities may not be offered or sold in the United States absent registration or an exemption from registration. Any public offering in the United States may be made only by means of an offering document that may be obtained from the Company and that will contain detailed information about the Company and its management, as well as financial statements. Any offer or sale of securities in a given jurisdiction is subject to the applicable laws of that jurisdiction. This presentation contains forward-looking statements based on the currently held beliefs and assumptions of the management of the Company, which are expressed in good faith and, in their opinion, reasonable. Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, financial condition, performance, or achievements of the Company or industry results, to differ materially from the results, financial condition, performance or achievements expressed or implied by such forward-looking statements. -

Inner 25 India Pharma & Healthcare Fund

Modera erate tely Mod High to e H w at ig o er h L d o M V e r y w H Tata India Pharma & Healthcare Fund o i L g (An open ended equity scheme investing in Pharma and Healthcare Services Sector) h Riskometer Investors understand that their principal As on 30th June 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of Primarily focuses on investment in at least 80% of its net Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets assets in equity/equity related instruments of the companies in the Pharma & Healthcare sectors in India. Equity & Equity Related Total 55184.24 97.88 Glenmark Pharmaceuticals Ltd. 167000 1089.76 1.93 INVESTMENT OBJECTIVE Healthcare Services Sanofi India Ltd. 13000 997.39 1.77 The investment objective of the scheme is to seek long Apollo Hospitals Enterprise Ltd. 70500 2551.99 4.53 Gland Pharma Ltd. 19662 673.29 1.19 term capital appreciation by investing atleast 80% of its Fortis Healthcare Ltd. 795000 1935.03 3.43 Laurus Labs Ltd. 90000 619.79 1.10 net assets in equity/equity related instruments of the companies in the pharma & healthcare sectors in Syngene International Ltd. 265000 1545.75 2.74 India.However, there is no assurance or guarantee that the investment objective of the Scheme will be Narayana Hrudayalaya Ltd. 301420 1483.74 2.63 Other Equities^ 1186.14 2.10 achieved.The Scheme does not assure or guarantee any Metropolis Healthcare Ltd. -

“Re-Engineering Indian Healthcare”

“Re‐engineering Indian Healthcare” Aug 31 ‐Sep 1, 2016 FICCI, New Delhi PROGRAM As on August 30, 2016 Day 1 – Wednesday, August 31, 2016 8:30 am Registration 10:00 am – 11:20 am Opening Session Session Moderator Ms Shobha Mishra Ghosh, Senior Director, FICCI Welcome Address Dr Nandakumar Jairam, Chair, FICCI Health Services Committee; Chairman, NABH & Chairman & Group Medical Director, Columbia Asia Hospitals India Presentation on 10th year of HEAL Ms Shobha Mishra Ghosh, Senior Director, FICCI Theme Address Mr Vishal Bali, Chair, FICCI HEAL 2016 Organizing Committee; Co‐Chair, FICCI Health Services Committee & Asia Head ‐ Healthcare, TPG Growth Keynote Address Mr Sunil Kant Munjal, Jt. Managing Director, Hero Motocorp Ltd. & Chairman, Hero Corporate Service Ltd. Release of Knowledge Paper: FICCI‐ EY paper on ‘Nursing Reforms: A paradigm shift for bright future’ Announcement of Poster Presentation Competition on the Theme “Re‐ engineering Indian Healthcare’ Keynote Address Mr C K Mishra, Secretary, Ministry of Health & Family Welfare, GoI Vote of Thanks Dr A Didar Singh, Secretary General, FICCI On Dais Mr Ashok Kakkar, Co‐Chair, FICCI Health Services Committee and Senior MD, Varian Medical Systems International India Pvt Ltd 11:20 am ‐ 11:45 am Tea Break 1 “Re‐engineering Indian Healthcare” Aug 31 ‐Sep 1, 2016 FICCI, New Delhi 11:45 am – 12:30 pm Keynote Session Moderator: Dr Nandakumar Jairam, Chair, FICCI Health Services Committee; Chairman, NABH & Chairman & Group Medical Director, Columbia Asia Hospitals India Presentation on the -

CORPORATE PRESENTATION January 2021 DISCLAIMER

CORPORATE PRESENTATION January 2021 DISCLAIMER The information contained in this presentation is provided by Apollo Hospitals Enterprise Limited (the “Company”) to you solely for your reference. This document is being given solely for your information and for your use and may not be retained by you and neither this presentation nor any part thereof may be (i) used or relied upon by any other party or for any other purpose; (ii) copied, photocopied, duplicated or otherwise reproduced in any form or by any means; or (iii) redistributed, passed on or otherwise disseminated, to any other person without the prior written consent of the Company. Although care has been taken to ensure that the information in this presentation is accurate, and that the opinions expressed are fair and reasonable, the information is subject to change without notice, its accuracy is not guaranteed and has not been independently verified. No representation, warranty, guarantee or undertaking (express or implied) is made as to, and no reliance should be placed on, the accuracy, completeness or correctness of any information, including any projections, estimates, targets and opinions, contained herein, and accordingly, none of the Company, its advisors, representatives or any of its directors assumes any responsibility or liability for, the accuracy or completeness of, or any errors or omissions in, any information or opinions contained herein. None of the Company, its advisors, representatives and its directors, officers, employees or affiliates nor any other person -

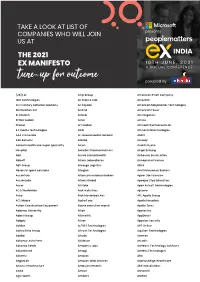

Partial List Ex Conference 20

Artemis Health Institute Bharat Serums & Vaccines Carrier CP Milk & Food Products Discovery FCDO GlaxoSmithkline Henkel India Shelter Finance Corporation Kadtech Infraprojects LSEG MIND NIIT Paytm Money PT Bank BTPN RTI Shyam Spectra Stryker ThoughtWorks ValueMined Technologies Y-Axis Solutions Arth Group Bharti Axa Life Insurance Cars24 CP Plus Dksh FE fundinfo Glenmark Pharmaceuticals Herbalife Nutition IndiaMART Kaivalya Educatiion Foundation LTI MindTickle Nineleaps technology solutions PayU PT. Media Indra Buana Ruby Seven Studios Shyam Spectra STT Global Data Centres Thryve Digital Valuex Technologies Yamaha Motor Arvind Fashions Bhel Caterpillar CP Wholesale DLF Fedex GlobalEdge Here Technologies Indigo Kalpataru Luminous Power Technologies Mindtree Nippon Koei PCCPL PTC Network Rustomjee Sidel Successive Technologies Tierra Agrotech Varroc Engineering Yanbal Asahi India Glass BIC CDK Global CPI DMD ADVOCATES Ferns n Petals GlobalLogic Herman Miller Indmoney Kama Ayurveda Luthra Group MiQ Digital NISA Global PCS Publicis Media S P Setia Siemens Sulzer Pumps Tifc Varuna Group Yanmar TAKE A LOOK AT LIST OF Ashirvad Pipes Bidgely Technologies CEAT Creditas Solutions DP World Ferrero GMR Hero Indofil industries Kanishk Hospital Luxury Personified Mizuho Bank Nissan Peak Infrastructure Management PUMA Group S&P Global Sigma AVIT Infra Services Summit Digitel Infrastructure TIL Vastu Housing Finance Corpora- Yara COMPANIES WHO WILL JOIN Asian paints Bigtree Entertainment Celio Cremica Dr Reddy's Ferring Pharmaceuticals Godrej & Boyce -

(Lux) Worldwide Fund

Semi-Annual Report 30 September 2020 Wells Fargo (Lux) Worldwide Fund ▪ Alternative Risk Premia Fund ▪ China Equity Fund ▪ Emerging Markets Equity Fund ▪ Emerging Markets Equity Income Fund ▪ EUR Investment Grade Credit Fund ▪ EUR Short Duration Credit Fund ▪ Global Equity Fund ▪ Global Equity Absolute Return Fund ▪ Global Equity Enhanced Income Fund ▪ Global Factor Enhanced Equity Fund ▪ Global Investment Grade Credit Fund ▪ Global Long/Short Equity Fund ▪ Global Low Volatility Equity Fund ▪ Global Multi-Asset Income Fund ▪ Global Opportunity Bond Fund ▪ Global Small Cap Equity Fund ▪ Small Cap Innovation Fund ▪ U.S. All Cap Growth Fund ▪ U.S. High Yield Bond Fund ▪ U.S. Large Cap Growth Fund ▪ U.S. Select Equity Fund ▪ U.S. Short-Term High Yield Bond Fund ▪ U.S. Small Cap Value Fund ▪ USD Government Money Market Fund ▪ USD Investment Grade Credit Fund Alternative Risk Premia Fund, China Equity Fund, EUR Short Duration Credit Fund, Global Equity Enhanced Income Fund, Global Factor Enhanced Equity Fund, Global Investment Grade Credit Fund, Global Small Cap Equity Fund, Small Cap Innovation Fund and USD Government Money Market Fund have not been authorised by the Hong Kong Securities and Futures Commission and are not available for investment by Hong Kong retail investors. Wells Fargo (Lux) Worldwide Fund is incorporated with limited liability in the Grand Duchy of Luxembourg as a Société d’Investissement à Capital Variable under number RCS Luxembourg B 137.479. Registered office of Wells Fargo (Lux) Worldwide Fund: 80, route d’Esch, L-1470 Luxembourg, Grand Duchy of Luxembourg. Table of Contents Portfolio of investments Alternative Risk Premia Fund ....................................... -

2021 Creative Agencies New Business

2021 CREATIVE AGENCIES NEW BUSINESS India / Feb 2021 ESTIMATED ESTIMATED YTD RANK THIS RANK LAST OVERALL YTD No.of AGENCY RECENT WINS WIN REVENUE RECENT LOSSES MONTH MONTH REVENUE Wins (Crore) (Crore) Unilever Wall's Global, PoCo 1 13 DDB Mudra Group 21.1 21.1 9 Mobiles Project, Twin Health Marico, KFC Projects, Axis Bank 2 1 VMLY&R 20.9 Bel Cheese 20.9 27 Project 3 2 IPG Team Dynamic BMW 13.4 13.4 1 4 3 The Womb MPL, WheelsEMI 12.9 12.9 2 Emami Ltd, Lixil India, Dole Asia 5 Wondrlab 7.4 7.4 19 Holdings Project MullenLowe Group Waah Jobs, AkzoNobel Brands, 6 8 7.2 7.2 8 Lintas Group UPSTOX Awlencan Innovations India, 7 5 Havas Worldwide Dabur Tea, Visual Wizard 6.2 6.2 7 Acadamy IOCL (India Oil) 8 4 FCB Lamke, Elle 18 6.7 5.4 2 Project 9 7 Leo Burnett Udemy Project 3.5 Fortis Healthcare 3.5 7 Carrier Airconditioning and Refrigeration, Coromandel 10 15 Wunderman Thompson 3.2 3.2 7 Project, GlaxoSmithKline India Project Publicis + Publicis 11 6 Capital Foods 2.2 2.2 1 Ambiance Manipal-UNEXT Project, Aster DM 12 9 McCann WorldGroup 1.2 1.2 3 Healthcare Project, Y-Axis, Tata Mutual Fund Project, 13 12 Grey Group 0.7 0.7 3 Aditya Birla Group Project 14 10 BBDO Finance Client 0.4 0.4 2 CaratLane, Hotstar Project, 15 11 BBH 0.2 0.2 3 GoodWorker Project 16 14 Ogilvy Acko General Insurance Project 0.1 0.1 1 2021 (Jan-Feb): 103.5 105 2020 (Jan-Feb): 77.4 69 YoY Comparison: 33.7% 52.2% 1 2021 MEDIA AGENCIES NEW BUSINESS India / Feb 2021 ESTIMATED ESTIMATED YTD RANK THIS RANK LAST OVERALL YTD No.of AGENCY RECENT WINS WIN REVENUE RECENT LOSSES MONTH -

Rethinking Cross-Border Talent Management: the Emerging Markets Perspective Tejpavan Gandhok

Singapore Management University Institutional Knowledge at Singapore Management University Research Collection Lee Kong Chian School Of Lee Kong Chian School of Business Business 11-2014 Rethinking cross-border talent management: The emerging markets perspective Tejpavan Gandhok Richard SMITH Singapore Management University, [email protected] Follow this and additional works at: https://ink.library.smu.edu.sg/lkcsb_research Part of the Asian Studies Commons, Human Resources Management Commons, International Business Commons, and the Strategic Management Policy Commons Citation Gandhok, Tejpavan and SMITH, Richard. Rethinking cross-border talent management: The mee rging markets perspective. (2014). Asian Management Insights. 1, (2), 18-25. Research Collection Lee Kong Chian School Of Business. Available at: https://ink.library.smu.edu.sg/lkcsb_research/4359 This Magazine Article is brought to you for free and open access by the Lee Kong Chian School of Business at Institutional Knowledge at Singapore Management University. It has been accepted for inclusion in Research Collection Lee Kong Chian School Of Business by an authorized administrator of Institutional Knowledge at Singapore Management University. For more information, please email [email protected]. 18 INDUSTRY WATCH Rethinking Cross-Border Talent Management A closer look at the relatively little understood issue of how and why THE EMERGING MARKETS PERSPECTIVE emerging market MNCs manage their senior talent for international growth leads us to question the conventional wisdom on talent management practices. By Tejpavan Singh Gandhok and Richard R. Smith Markets are grappling with volatility and management approach is thus a must for the were publicly-listed, had recorded over 25 unpredictability, and becoming increasingly health, prosperity and long term viability of percent sales outside India with operations in reactive to economic conditions surrounding many organisations and their ambitious more than four countries, and had revenues them. -

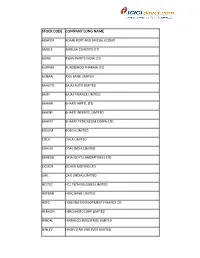

Stock Code Company Long Name

STOCK CODE COMPANY LONG NAME ADAPOR ADANI PORT AND SPECIAL ECONO AMBCE AMBUJA CEMENTS LTD ASIPAI ASIAN PAINTS INDIA LTD AURPHA AUROBINDO PHARMA LTD AXIBAN AXIS BANK LIMITED BAAUTO BAJAJ AUTO LIMITED BAJFI BAJAJ FINANCE LIMITED BHAAIR BHARTI AIRTEL LTD BHAINF BHARTI INFRATEL LIMITED BHAPET BHARAT PETROLEUM CORPN LTD BOSLIM BOSCH LIMITED CIPLA CIPLA LIMITED COALIN COAL INDIA LIMITED DRREDD DR REDDY'S LABORATORIES LTD EICMOT EICHER MOTORS LTD GAIL GAIL (INDIA) LIMITED HCLTEC HCL TECHNOLOGIES LIMITED HDFBAN HDFC BANK LIMITED HDFC HOUSING DEVELOPMENT FINANCE CO HERHON HERO MOTOCORP LIMITED HINDAL HINDALCO INDUSTRIES LIMITED HINLEV HINDUSTAN UNILEVER LIMITED HINPET HINDUSTAN PETROLEUM CORP ICIBAN ICICI BANK LIMITED INDBA INDUSIND BANK LIMITED INDOIL INDIAN OIL CORPORATION LIMITED INFTEC INFOSYS LTD ITC ITC LIMITED INDHO JAIN IRRIGATION SYSTEMS LTD KOTMAH KOTAK MAHINDRA BANK LTD LARTOU LARSEN AND TOUBRO LIMITED LUPIN LUPIN LIMITED MAHMAH MAHINDRA & MAHINDRA LIMITED MARUTI MARUTI SUZUKI INDIA LTD NTPC NTPC LIMITED ONGC OIL AND NATURAL GAS CORPORATIO POWGRI POWER GRID CORPORATION OF INDI RELIND RELIANCE INDUSTRIES STABAN STATE BANK OF INDIA SUNPHA SUN PHARMACEUTICAL INDUSTRIES TATMOT TATA MOTORS LIMITED TATSTE TATA STEEL LIMITED TCS TATA CONSULTANCY SERVICES LTD TECMAH TECH MAHINDRA LIMITED ULTCEM ULTRATECH CEMENT LIMITED UNIP UPL LIMITED VEDLIM VEDANTA LIMITED WIPRO WIPRO LTD YESBAN YES BANK LIMITED ZEEENT ZEE ENTERTAINMENT ENTERPRISES ACC ACC LIMITED ADAENT ADANI ENTERPRISES LIMITED ADAPOW ADANI POWER LIMITED AJAPHA AJANTA PHARMA LTD ALLBAN