2020 Global Review of M&A in the Bakery Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

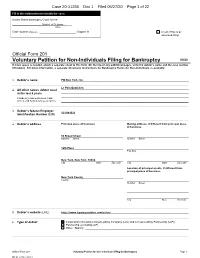

Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20 If More Space Is Needed, Attach a Separate Sheet to This Form

Case 20-11266 Doc 1 Filed 05/27/20 Page 1 of 22 Fill in this information to identify the case: United States Bankruptcy Court for the: ____________________ District of Delaware (State) Case number (If known): _________________________ Chapter 11 Check if this is an amended filing Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy 04/20 If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtor’s name and the case number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is available 1. Debtor’s name PQ New York, Inc. Le Pain Quotidien 2. All other names debtor used in the last 8 years Include any assumed names, trade names, and doing business as names 3. Debtor’s federal Employer 13-3841022 Identification Number (EIN) 4. Debtor’s address Principal place of business Mailing address, if different from principal place of business 50 Broad Street Number Street Number Street 12th Floor P.O. Box New York, New York 10004 City State Zip Code City State Zip Code Location of principal assets, if different from principal place of business New York County County Number Street City State Zip Code 5. Debtor’s website (URL) https://www.lepainquotidien.com/us/en/ 6. Type of debtor Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP)) Partnership (excluding LLP) Other. Specify: Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy Page 1 RLF1 22931188v.9 Debtor PQ New York, Inc. -

IN the UNITED STATES BANKRUPTCY COURT for the DISTRICT of DELAWARE in Re

Case 20-11266 Doc 3 Filed 05/27/20 Page 1 of 15 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE _________________________________________ ) In re: ) Chapter 11 ) PQ New York, Inc., et al.,1 ) Case No. 20-[●] ([●]) ) ) (Joint Administration Requested) Debtors. ) _________________________________________ ) DECLARATION OF STEVEN J. FLEMING IN SUPPORT OF DEBTORS’ CHAPTER 11 PETITIONS AND FIRST DAY MOTIONS Under 28 U.S.C. § 1764, I, Steven J. Fleming, declare as follows under penalty of perjury: 1. I am the proposed Chief Restructuring Officer (“CRO”) of PQ New York, Inc. (“PQ NY”), a Delaware corporation, and its affiliates (collectively the “Debtors”) in the above- captioned chapter 11 cases (the “Chapter 11 Cases”). I am authorized to submit this declaration (the “First Day Declaration”) on behalf of the Debtors. 2. I am a Principal of PricewaterhouseCoopers LLP (“PwC”), an experienced, leading, full-service financial services, consulting, and accounting firm with over seventy-five (75) offices and more than 50,000 employees in the United States. I am the leader of the firm’s U.S. Business Recovery Services Practice, a position that I have held since 2016 after being a senior member in the group for seven years. Prior to these positions, I held a senior position in PwC’s Transaction Services practice in Dubai, UAE, where I was responsible for expanding the firm’s Corporate Finance and Valuation practices across the Middle East and North Africa. I have been 1 The last four digits of PQ New York, Inc.’s federal tax identification number are 1022. The mailing address for the debtors is 50 Broad Street, New York, New York 10004. -

Boost Your Profits with Bakery Products Powernov | 2020

| 2020 NOV Boost your profits with bakery products bakery with profits your Boost power Out of home magazine — NOVEMBER | 2020 Baking Baking 3 Welcome Welcome Published by: H2O Publishing, Media House, 3 Topley Dr, Rochester, ME3 8PZ Tel: 0345 500 6008 www.oohmagazine.co.uk @OOHmagazine We sadly come to you this month against the Managing Director Jamie Robbins backdrop of increasing infection rates and Divisional Director Rob Molinari restrictions. As I type, Manchester is (apparently) 07850 797 252 [email protected] set to enter the highest level of lockdown following Twitter: @RobMolinari Director a prolonged stand-off between the government Daniel Hillman 07833 248 788 and local leaders that always looked destined to [email protected] Twitter: @hillmandan end in tiers. Director Marc Sumner There is, however, plenty of room for optimism for out of home operators. It has been truly 07730 217 747 [email protected] heartening – and, frankly, somewhat surprising – to receive word of so many businesses that are Twitter: @sumner_marc not only surviving but thriving, to the extent that they are currently moving on with expansion plans. Classified Sales Sue Stunt Simply turn to the News (page 6) to read about five such examples (kudos to Knoops, Tim Hortons, 01474 520 243 Soho Coffee Co, Which Wich and Slim Chickens). [email protected] Editor The other stories include Le Pain Quotidien reopening its estate and itsu launching a brand-new Henry Norman 01474 520 248 ‘store of the future’, specifically conceived to combat coronavirus – and beyond. Incorporating [email protected] Twitter: @HenryHNorman innovations such as robot sushi chefs, it truly sounds like a cutting-edge concept – look out for a Editorial Director future issue when we will conduct a deeper dive into the finer details. -

Consumer Trendspotter: PE Funds, Lockdown Winners Pair up to Drive Uneven Recovery | Mergermarket

7/17/2020 Consumer Trendspotter: PE funds, lockdown winners pair up to drive uneven recovery | Mergermarket P R O P R I E TA R Y Consumer Trendspotter: PE funds, lockdown winners pair up to drive uneven recovery Analysis 17 JUL 2020 Cosmetics a standout subsector for deal activity Strategic disposals offer hope of return to big-ticket M&A European consumer-sector M&A shows signs of an uneven post-COVID-19 recovery, with targets in lockdown-friendly niches meeting PE funds’ ample dry powder, sector bankers told this news service. This recovery will be from a low base. European M&A in the sector had a rough start to 2020, Mergermarket data show. The region saw 277 deals for a combined EUR 13.8bn in 1H20, this value being 24.3% of the sector’s global total. In 1H19 the region saw 476 deals for a combined EUR 24.6bn, which was 29% of the sector’s global total. COVID-19 may not be entirely to blame for this drop, as deal activity in 2019 was below the recent trendline. “We started to see a decrease in activity as we went into 2019,” said Conor Cahill, partner at Deloitte. “When COVID-19 came along, it hampered things even further.” Globally, the value of consumer-sector M&A hit a high of EUR 448bn in 2015, then fell consecutively from EUR 358bn in 2017 to EUR 218bn in 2018 and EUR 192bn last year, Mergermarket data show. In Europe, it fell from EUR 188bn in 2015 to EUR 50bn last year. -

Dining Concepts Holdings Limited

896111 DC Prospectus_Fancy Cover (eng).pdf 1 7/21/2016 12:01:58 AM (Incorporated in the Cayman Islands with limited liability) Stock Code: 8056 BY WAY OF PLACING C M Y CM MY CY CMY K Sole Sponsor Sole Bookrunner and Sole Lead Manager IMPORTANT If you are in any doubt about any of the contents of this prospectus, you should obtain independent professional advice. DINING CONCEPTS HOLDINGS LIMITED (Incorporated in the Cayman Islands with limited liability) LISTING ON THE GROWTH ENTERPRISE MARKET OF THE STOCK EXCHANGE OF HONG KONG LIMITED BY WAY OF PLACING Number of Placing Shares : 200,000,000 Placing Shares (comprising 140,990,000 New Shares and 59,010,000 Sale Shares, and subject to the Offer Size Adjustment Option) Placing Price : Not more than HK$0.60 and not less than HK$0.40 per Placing Share (payable in full on application in Hong Kong dollars) plus brokerage fee of 1%, SFC transaction levy of 0.0027% and Stock Exchange trading fee of 0.005%, subject to refund Nominal value : US$0.01 per Share Stock code : 8056 Sole Sponsor Sole Bookrunner and Sole Lead Manager Co-Managers Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus. A copy of this prospectus, having attached thereto the documents specified in the paragraph headed “Documents delivered to the Registrar of Companies” in Appendix V to this prospectus, has been registered by the Registrar of Companies in Hong Kong as required by section 342C of the Companies (WUMP) Ordinance. -

July-Dec2020-V2-W-Backlist-2.Pdf

Welcome to the Octopus Autumn/Winter 2020 New Titles and Complete Backlist Catalogue Food & Drink 2 Narrative Non-Fiction 18 Gardening 26 Wellness 29 Arts & Crafts 37 Photography & Film 44 For exciting news about Octopus titles, Music 51 competitions and more, why not: Design & Fashion 54 »Follow us on twitter @Octopus_Books Reference 56 »Find us on Facebook at Octopus Publishing Group Sport 62 We can’t wait to connect with you. Humour & Gift 64 Philip’s 69 OPG Backlist 72 Contacts 155 FOOD & DRINK « Simply Easy everyday dishes from the bestselling author of Persiana By Sabrina Ghayour Sabrina Ghayour's new collection of unmissable dishes in her signature style, influenced by her love of fabulous flavours, is full of delicious food that can be enjoyed with a minimum of fuss. With sections ranging from Effortless Eating to Traditions With a Twist, Simply provides over 100 bold and exciting recipes that can be enjoyed every day of the week. CONTENTS Chapter one: Effortless Eating Chapter two: Traditions with a Twist Chapter three: The Melting Pot Chapter four: Something Special Chapter five: Cakes, Bakes & Sweet Treats Simply | SSN (246x189) | Hardback | 03/09/2020 | £26.00 | 240 pages | Mitchell Beazley | 9781784725167 Author Biography: A chef, food writer and cookery teacher, Sabrina Ghayour is one of the strongest voices in Middle Eastern food today Sabrina's debut cookbook, Persiana, was awarded 'Best New Cookbook' at the Observer Food Monthly awards 2014 and 'Book of the Year' at the 2015 Food & Travel Awards. Her follow ups, Sirocco, Feasts and Bazaar were all Sunday Times bestsellers. -

Xpresspa Appoints Scott Milford As First Chief People Officer

XpresSpa Appoints Scott Milford as First Chief People Officer July 15, 2019 Continues to execute on its key strategic priorities NEW YORK, July 15, 2019 (GLOBE NEWSWIRE) -- XpresSpa Group, Inc. (Nasdaq: XSPA), a health and wellness holding company, today announced today that Scott Milford has joined the Company as Chief People Officer, effective immediately. This is a new position at XpresSpa as the brand implements its key strategic priorities to improve performance as outlined by the Company’s CEO, Mr. Doug Satzman, who joined the Company earlier this year. Mr. Milford will be responsible for attracting top talent across the organization, developing employees through training and retention, fostering a people-first culture, and elevating the customer experience. Doug Satzman, XpresSpa Group CEO, stated, "We are thrilled to be adding Scott to our executive management team. Scott’s extensive background and proven track record of success makes him the ideal candidate to oversee our talent management both domestically and internationally. Having worked with him at previous companies, I can personally attest to his skillset. Everything we do is about people and as an organization we aspire to be the employer of choice in our industry. To get there, we must have a leader that will drive that vision. Scott is an excellent fit within the XpresSpa team and culture and will play an important part in our strategic plans." Mr. Satzman continued, “As a result of our improved capital structure and sales improvements, we are now in a better position to attract top talent like Scott, while embarking on new efforts to improve the business, renovate select spas, and build new spas. -

Casual Dining and QSR Sector See Fast Track Growth in India India

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Voluntary - Public Date: 7/13/2015 GAIN Report Number: IN5089 India Post: New Delhi Casual Dining and QSR Sector See Fast Track Growth in India Report Categories: Beverages Coffee Food Processing Ingredients Food Service - Hotel Restaurant Institutional Market Promotion/Competition Promotion Opportunities Retail Foods Snack Foods Approved By: Adam Branson Prepared By: Priya Jashnani Report Highlights: India witnessed a surge in the number of its casual dining and quick service restaurant outlets over the past several years. International and domestic brands are expanding their operations and newer brands are flowing into the opportunities the market presents. Sources encourage U.S. companies and suppliers to explore whether shifting consumer trends and the growth in this sector create a market opportunity. IN5089 – Casual Dining and QSR Sector Sees Fast Track Growth in India Page 1 General Information: Market Overview of Restaurant Growth India has witnessed a sizeable shift in its casual dining restaurant (CDR) and quick service restaurant (QSR) sector. CDRs and QSRs have gone from largely serving Indian snacks to now serving western foods with an Indian flavor. The size of the Indian food service industry is approximately $38.6 billion (INR 247,680 crore) as of 2013 and is projected to grow to approximately $63.6 billion (INR 408,040 crore) by 2018. The restaurant sector in India is divided into the organized and unorganized market. The unorganized international-style market includes roadside vendors, vans and trolleys serving Chinese and Italian-style foods. -

Maoz Vegetarian NETHERLANDS

OPERATIONS ONES TO WATCH FINANCE FRANCHISEE FORUM Handling Harassment Cava Mezze Grill McDonald’s v. Chipotle The Success Equation ® JANUARY 2015 / NO. 201 WWW.QSRMAGAZINE.COM International INVASION Why international brands like Giraf as, led by CEO João Barbosa, think now is the time for U.S. expansion PAGE 42 PLUS TIM HORTONS AT A CROSSROADS PAGE 50 NAFEM SHOW PREVIEW PAGE 56 INTERNATIONAL BRANDS International Adventurous menus, operational know-how, and cultured brand positioning INVASIONhave these 10 international brands poised for success in the U.S. market. BY TAMARA OMAZIC Le Pain Quotidien 42 JANUARY 2015 | QSR | www.qsrmagazine.com INTERNATIONAL BRANDS Nando’s NANDO’S hen it comes to global expansion, international operators are quick to point to the U.S. as the gateway to success. Foodservice here is booming, with expected restaurant industry sales in 2014 surpassing $680 Wbillion, according to the National Restaurant Association—and the limited-service sector accounts for about $230 billion of it. The rise of Millennials as tastemakers and an increasingly diverse population has led to global and ethnic flavors becoming more in demand than ever before, opening the door for international brands to grow explosively across the states. These 10 brands are likely to lead the charge. Giraffas GIRAFFAS Brioche Dorée Pret A Manger LE PAIN QUOTIDIEN BRIOCHE DORÉE PRET A MANGER www.qsrmagazine.com | QSR | JANUARY 2015 43 INTERNATIONAL BRANDS to self-serve, drip-brew coffee. The change, along with a menu that Pret A Manger borrows flavor profiles from various cultures, has resonated well with ENGLAND Pret’s target urban-consumer base. -

Time for Nourishment Lee Tung Avenue Omega-3 Pork Chilean Food & Wine

OCT / NOV 2016 Time for nourishment Lee Tung Avenue Omega-3 pork Chilean food & wine EDITOR'S MESSAGE Time for nourishment We Chinese have a sagacious saying that when autumn leaves start drifting by your window (I know, that sounds more like Nat King Cole!) with the dry, nippy air, it’s time for some nourishing food to reinforce your body functions in preparation for the onset of wintry weather. Good advice, that. I’ll drink to it! It’s been a pleasantly hectic time for foodies and wine connoisseurs, what with the annual Wine & Dine Festival, the Hong Kong International Wine & Spirits Fair, the Italian white truffle season, the Hong Kong Great November Feast, the annual announcements of the Michelin Guide, and other gastronomic events, criss-crossing one another in town. With no let up in the opening of new restaurants, cafes and specialty eateries, it looks as though we are in for one long tongue-tingling season all the way to Christmas and the New Year! As a leading culinary capital of the world, Hong Kong is blessed with a plethora of wining and dining hubs scattered all over town, and for this issue, we take a stroll down the quaint Lee Tung Avenue in Wan Chai. The great thing about these hot spots is that they have each developed its own distinctive character and charm to court patronage. Long live this indomitable epicurean spirit! Andy Ng Features Editor FOOD & WINE • OCTOBER 2016 1 FOOD & WINE OCT / NOV 2016 CONTENTS 04 Foodie Hotspot Your guide to the gastronomic paradise: Lee Tung Avenue 12 Thanksgiving Unbeatable Thanksgiving -

Global Food & Beverage Market

THE GLOBAL FOOD & BEVERAGE MARKET What’s on the Menu? SUMMER 2017 4 / Cushman & Wakefield CONTENTS 1. INTRODUCTION 6 2. CONSUMER TRENDS 8 3. GLOBAL OVERVIEW 14 4. THE MIDDLE EAST & AFRICA 20 4.1 Key facts and figures 20 4.2 Changing consumer lifestyles 22 4.3 Case studies 23 5. THE AMERICAS 24 5.1 Key facts and figures 24 5.2 Food Halls and restaurants in the USA 26 5.3 Case studies 27 6. ASIA PACIFIC 28 6.1 Key facts and figures 28 6.2 ‘Entertainment’ and ‘gourmet food’ 30 6.3 Case studies 31 7. EUROPE 32 7.1 Key facts and figures 32 7.2 Quality and variety of food: the key to success 34 7.3 Case studies 35 8. OUTLOOK FOR THE GLOBAL F&B MARKET 37 9. CAVEATS & DEFINITIONS 38 cushmanwakefield.com / 5 1. INTRODUCTION The global food and beverage (F&B) market has Most forecasters suggest that the share of online seen healthy growth over the last ten years and purchases will rise further, increasing the pressure on this is expected to continue. The proportion of landlords and retailers to be flexible and to develop comparison retail (clothing, footwear, white goods) as new strategies to create shopping experiences that a percentage of total retail is decreasing and is being cannot be replicated with purchases bought online, partially replaced by F&B, leisure and entertainment while also meeting consumers desire for convenience offerings in shopping malls, out-of-town retail parks and speed. and the main retail thoroughfares. This is being driven by changing consumer shopping habits and the This report looks at key trends in the global F&B growth of ‘experience retailing’, reflecting consumers’ market, beginning with how consumer demands have desire to enhance their physical shopping experience been evolving and how retailers and shopping centre with a social/leisure experience. -

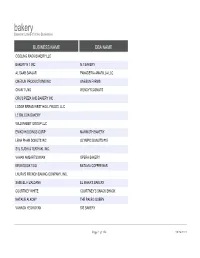

Bakery Based on Listing of Active Businesses

bakery Based on Listing of Active Businesses BUSINESS NAME DBA NAME COOLING RACK BAKERY LLC BAKERY N 1 INC N.1 BAKERY AL SAAB SANJAR PANADERIA AMARILLA LLC ONESUN PRODUCTIONS INC ONESUN FARMS CHAN T UNG WENDY'S DONUTS ORO'S PIZZA AND BAKERY INC LODGE BREAD WEST HOLLYWOOD, LLC LE BALCON BAKERY WILD RABBIT GROUP LLC EMIKO HOLDINGS CORP MAMMOTH BAKERY LENA PHAM DONUTS INC OLYMPIC DONUTS #15 SYL SUSHI & TERIYAKI, INC. VAHAN AMBARTSUMIAN OPERA BAKERY KEUN SOOK YOO BATAVIA COFFEE BAR LAURA'S FRENCH BAKING COMPANY, INC. SAMUEL H ZALDANA EL MANA'S BAKERY COURTNEY WHITE COURTNEY'S SNACK SHACK NATALIE ALKOBY THE PALEO QUEEN VAHAGN YEGHOYAN SIS BAKERY Page 1 of 156 09/24/2021 bakery Based on Listing of Active Businesses STREET ADDRESS ZIP CODE 2735 190TH STREET APT #9 90278-5400 5117 SANTA MONICA BLVD 90029-2413 1201 SANTEE STREET 90015-2544 5920 CLOVER HEIGHTS AVENUE 90265-3705 4000 LINCOLN BLVD 90292-5614 7221 BALBOA BLVD 91406-2702 936 W FLORENCE AVENUE 90301-1510 7300 W SUNSET BLVD #H 90046-3429 8533 EDWIN DRIVE 90046-1027 833 W 182ND STREET 90248-3409 4507 VALLEY BLVD #103 90032-3780 6411 SEPULVEDA BLVD SUITE #1F 91411-1304 1446 N PACIFIC AVENUE 91202-1616 633 W 5TH STREET #2FL 90071-2005 1901 S ALAMEDA STREET SUITE #105 90058-1037 849 S VERMONT AVENUE 90005-1522 319 E 75TH STREET 90003-2317 16932 RINALDI STREET 91344-3637 11009 BURBANK BLVD #123 91601-5747 Page 2 of 156 09/24/2021 bakery Based on Listing of Active Businesses PRIMARY NAICS DESCRIPTION Bakeries & tortilla mfg.