Zbwleibniz-Informationszentrum

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Country Report Romania 2020

EUROPEAN COMMISSION Brussels, 26.2.2020 SWD(2020) 522 final COMMISSION STAFF WORKING DOCUMENT Country Report Romania 2020 Accompanying the document COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT, THE EUROPEAN COUNCIL, THE COUNCIL, THE EUROPEAN CENTRAL BANK AND THE EUROGROUP 2020 European Semester: Assessment of progress on structural reforms, prevention and correction of macroeconomic imbalances, and results of in-depth reviews under Regulation (EU) No 1176/2011 {COM(2020) 150 final} EN EN CONTENTS Executive summary 4 1. Economic situation and outlook 9 2. Progress with country-specific recommendations 17 3. Summary of the main findings from the MIP in-depth review 21 4. Reform priorities 25 4.1. Public finances and taxation 25 4.2. Financial sector 30 4.3. Labour market, education and social policies 33 4.4. Competitiveness, reforms and investment 45 4.5. Environmental Sustainability 63 Annex A: Overview Table 67 Annex B: Commission debt sustainability analysis and fiscal risks 75 Annex C: Standard Tables 76 Annex D: Investment guidance on Just Transition Fund 2021-2027 for Romania 82 Annex E: Progress towards the Sustainable Development Goals (SDGs) 85 References 90 LIST OF TABLES Table 1.1: Key economic and financial indicators 16 Table 2.1: Assessment of 2019 CSR implementation 19 Table 3.1: MIP assessment matrix (*) - Romania 2020 23 Table C.1: Financial market indicators 76 Table C.2: Headline Social Scoreboard indicators 77 Table C.3: Labour market and education indicators 78 Table C.4: Social inclusion and health -

Romanian Financial Highlights EN December

NEWS Romanian Financial Highlights – December 2012 Currency quotations Foreign exchange rates BNR base interest December 31, 2012 Quotation Date RON/EUR RON/USD Date Inflation rate % rate EUR/USD 1,32 21.dec 4,4451 3,3636 oct.12 0,29 Oct 5.25% USD/JPY 0,86 24.dec 4,4231 3,3468 nov.12 0,04 Nov 5.25% GBP/USD 1,62 27.dec 4,4296 3,3384 dec.12 0,60 Dec 5.25% USD/CHF 0,92 28.dec 4,4291 3,3619 2011 5,79 EUR/CHF 1,21 31.dec 4,4287 3,3575 2012 4,95 Source: National Bank of Romania, National Institute of Statistics RON/USD Evolution of National Currency (2010-2012) Evolution of national Currency (last month) - RON/EUR Evolution of national Currency (last month) - RON/USD RON/EUR 4,7 4,6800 3,5500 4,6400 4,2 3,4800 4,6000 4,5600 3,4100 3,7 4,5200 3,3400 4,4800 3,2 3,2700 4,4400 4,4000 3,2000 2,7 c c c c c c c 1 2 2 ec ec ec ec ec ec e e ec ec ec ec ec ec ec ec -10 11 -11 -11 -1 -11 12 -12 12 -12 -12 -1 12 D D D D D D D D D D D D D D D b-11 r- n ct b-12 n g-1 p ct v- -De -D -De - -De ec Jan-11 e pr Ju Jul-11 Jan- e pr ay- Ju Jul-12 u e 1-Dec 3- 5-Dec 7-Dec 9-Dec 9-De 1- 3 5- 7- 9-Dec 9-De D F Ma A May-11 Aug-11 Sep-11 O Nov Dec-11 F Mar-12 A M A S O No Dec-12 11- 13- 15 17- 1 21 23-Dec 25 27-Dec 29- 31-Dec 11-Dec 13-Dec 15- 17-Dec 19- 21- 23- 25- 27- 2 31 Deposits interest Futures quotations BMFMS 1) Futures quotations BMFMS Maturity Interest Interest Contract Maturity Amount Contract Maturity Amount ROBID ROBOR RON RON 1 month 5,54% 6,04% EUR/RON mar.13 4,5050 DESNP mar.13 0,4315 3 months 5,55% 6,05% EUR/RON iun.13 4,5500 DETLV mar.13 0,8715 6 months -

The Policy of the Exchange Rate Promoted by National Bank of Romania and Its Implications Upon the Financial Stability

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Research Papers in Economics THE POLICY OF THE EXCHANGE RATE PROMOTED BY NATIONAL BANK OF ROMANIA AND ITS IMPLICATIONS UPON THE FINANCIAL STABILITY Vechiu Camelia “Constantin Brâncoveanu” University Pite 2ti, Faculty of Management-Marketing in Economic Affairs, Br ;ila Enache Elena “Constantin Brâncoveanu” University Pite 2ti, Faculty of Management-Marketing in Economic Affairs, Br ;ila Marin Carmen “Constantin Brâncoveanu” University Pite 2ti, Faculty of Management-Marketing in Economic Affairs, Br ;ila Chifane Cristina “Constantin Brâncoveanu” University Pite 2ti, Faculty of Management-Marketing in Economic Affairs, Br ;ila The more profound world economic crisis has strongly marked the evolution of the Romanian financial system. The size of current account deficit, the relatively high external financing needs and the dependence of the banks on it, the high ratio between loans in foreign currency and deposits in foreign currency made of the Romanian economy, a risky destination for investors. In these conditions, since the end of 2008 and throughout 2009, the government's economic program was focused on reducing the external deficit in both public and private sector, on minimizing the effects of recession, on avoiding a crisis of the exchange rate and on cooling the inflationary pressures. Keywords: monetary policy, exchange rate, external financing, budget deficit JEL classification: E58 1. The interventions of NBR on the foreign exchange market Supported by the global financial crisis, the evolution of the Leu rate has raised major problems. As in the period 2005-2007, the currency incomings have overestimated the Romanian national currency way above the level indicated by the fundamental factors of the exchange rate, the reduction of the foreign financing and the incertitude have afterwards determined an unjustified depreciation of the Romanian Leu. -

Timeline / 1870 to After 1930 / ROMANIA

Timeline / 1870 to After 1930 / ROMANIA Date Country Theme 1871 Romania Rediscovering The Past Alexandru Odobescu sends an archaeological questionnaire to teachers all over the country, who have to return information about archaeological discoveries or vestiges of antique monuments existing in the areas where they live or work. 1873 Romania International Exhibitions Two Romanians are members of the international jury of the Vienna International Exposition: agronomist and economist P.S. Aurelian and doctor Carol Davila. 1873 Romania Travelling The first tourism organisation from Romania, called the Alpine Association of Transylvania, is founded in Bra#ov. 1874 Romania Rediscovering The Past 18 April: decree for the founding of the Commission of Public Monuments to record the public monuments on Romanian territory and to ensure their conservation. 1874 Romania Reforms And Social Changes Issue of the first sanitation law in the United Principalities. The sanitation system is organised hierarchically and a Superior Medical Council, with a consultative role, is created. 1875 - 1893 Romania Political Context Creation of the first Romanian political parties: the Liberal Party (1875), the Conservative Party (1880), the Radical-Democratic Party (1888), and the Social- Democratic Party of Romanian Labourers (1893). 1876 Romania Reforms And Social Changes Foundation of the Romanian Red Cross. 1876 Romania Fine And Applied Arts 19 February: birth of the great Romanian sculptor Constantin Brâncu#i, author of sculptures such as Mademoiselle Pogany, The Kiss, Bird in Space, and The Endless Column. His works are today exhibited in museums in France, the USA and Romania. 1877 - 1881 Romania Political Context After Parliament declares Romania’s independence (May 1877), Romania participates alongside Russia in the Russian-Ottoman war. -

The History of the Romanian Monetary System in a European Context

Mugur Isărescu: The history of the Romanian monetary system in a European context Opening speech by Mr Mugur Isărescu, Governor of the National Bank of Romania, on the occasion of the inauguration of the Euro Exhibition at Banca Naţională a României, Bucharest, 10 March 2011. * * * Dear Mr González-Páramo, Your Excellencies, Distinguished guests, It is an honour for us and we are glad to welcome you today, at the opening of an exhibition not only educational and attractive, but also relevant considering Romania’s euro adoption. We do hope the Euro Exhibition that the National Bank of Romania is hosting, on behalf of Romania, will prove successful all the more so as our country is destination No. 10 of the European Central Bank’s travelling exhibition. Let me thank Mr. José Manuel González-Páramo for accepting to jointly launch the Euro Exhibition today in Bucharest where it will be open for about three months, here, in the old financial centre of Bucharest where the Romanian leu was born. The leu-euro relation is thus acquiring a symbolical dimension with a certain meaning in the current European context. The reference to the European context is neither conventional nor formal. It reveals that the Romanian leu is one of the strong historical bonds that put our country on the European map. Its roots in the olden leeuwendaalder or the Dutch lion-thaler show not only its descent from the former Dutch coin (and therefore its being related to the US dollar), but also its European dimension as ever since its birth, shortly after the creation of the modern Romanian state, our leu currency was French. -

Mugur Isărescu

Mugur Isărescu: Is European financial integration stalling? Opening remarks by Mr Mugur Isărescu, Governor of the National Bank of Romania, at the EUROFI High Level Seminar, Bucharest, 3 April 2019. * * * Honourable guests, Ladies and gentlemen, Please allow me to welcome you here, at the Royal Palace. We are honoured to host here, in Bucharest, so many outstanding guests at such a landmark event. It is a perfect occasion to exchange views and liaise with representatives of public and banking authorities and of the financial industry across the European Union. During the talks over the past few days, and particularly on the occasion of the EUROFI High- level Seminar, I heard strong voices from the banking community which were rather pessimistic about the prospects of further banking and financial integration. We, at the Eastern frontier of the EU, are compelled to take a more positive outlook regarding the future of our continent. Speaking about the difficulties of the financial sector in Europe, it is important to point out the positive aspects and evolutions as well. Certainly, favourable developments have taken place all over Europe and we should acknowledge them and move forward with more confidence. Specifically, financial fragmentation has been mitigated as a result of broad-based non-standard policy measures taken by the ECB. Looking ahead, completing the Economic and Monetary Union, which involves risk-sharing tools and risk-reduction efforts, is the way forward to address financial fragmentation. In the case of Romania, I could say we have already taken important steps towards joining the banking union: no public funds were resorted to after the crisis outbreak to support the banking system and now its liquidity and solvency ratios are well above the prudential thresholds. -

Short-Run Determinants of the USD/PLN Exchange Rate and Policy Implications

Theoretical and Applied Economics FFet al Volume XXII (2015), No. 2(603), Summer, pp. 247-254 Short-run determinants of the USD/PLN exchange rate and policy implications Yu HSING Southeastern Louisiana University, Hammond, USA [email protected] Abstract. This paper examines short-run determinants of the U.S. dollar/Polish zloty (USD/PLN) exchange rate based on a simultaneous-equation model of demand and supply. Using a reduced form equation and the EGARCH model, the paper finds that the USD/PLN exchange rate is positively associated with the real reference rate in Poland, real GDP in the U.S., the real stock index in Poland and the expected exchange rate and is negatively influenced by the U.S. real federal funds rate, real GDP in Poland, and the real stock index in the U.S. Hence, monetary policy is effective in influencing the USD/PLN exchange rate. Keywords: exchange rates, interest rates, real GDP, stock indexes, EGARCH. JEL Classification: F31, F41. 248 Yu Hsing 1. Introduction The Polish zloty/U.S. dollar exchange rate has experienced fluctuations like most other currencies in transition economies. During its early transformation from a socialist to a market economy, the zloty had declined significantly against the U.S. dollar from 0.0506 in 1989.M1 to 4.6369 in 2000.M10. The adoption of a managed floating exchange rate regime in April 2000, the joining of the EU in May 2004, relative political stability, improvements in international trade, and economic growth had made the zloty stronger as evidenced by the change in the exchange rate against the U.S. -

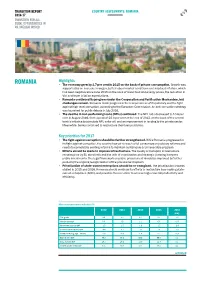

Romania 01 2016-17 Transition for All: Equal Opportunities in an Unequal World

TRANSITION REPORT COUNTRY ASSESSMENTS: ROMANIA 01 2016-17 TRANSITION FOR ALL: EQUAL OPPORTUNITIES IN AN UNEQUAL WORLD Highlights ROMANIA • The economy grew by 3.7 per cent in 2015 on the back of private consumption. Growth was supported by an increase in wages, better labour market conditions and subdued inflation, which has been negative since June 2015 on the back of lower food and energy prices, the reduction in VAT and lower inflation expectations. • Romania continued its progress under the Cooperation and Verification Mechanism, but challenges remain. Romania made progress in the independence of its judiciary and the fight against high-level corruption, according to the European Commission. An anti-corruption strategy was launched for public debate in July 2016. • The decline in non-performing loans (NPLs) continued. The NPL ratio decreased to 10.6 per cent in August 2016, from a peak of 22.0 per cent at the end of 2013, on the back of the central bank’s initiative to stimulate NPL write-off, and an improvement in lending to the private sector. Meanwhile, banks continued to restructure their loan portfolios. Key priorities for 2017 • The fight against corruption should be further strengthened. While Romania progressed in its fight against corruption, the country has yet to reach a full consensus on judiciary reforms and needs to consolidate existing reforms to maintain sustainable and irreversible progress. • Efforts should be made to improve infrastructure. The quality of transport infrastructure remains poor by EU standards and the lack of coordination and strategic planning hampers public investments. The legal framework on public procurement should be improved by further pursuing the ongoing reorganisation of the procurement system. -

Zbwleibniz-Informationszentrum

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Milea, Camelia Article Vulnerabilities of the Romanian economy generated by the foreign trade, the external debt and the exchange rate after Romania's accession to the European Union Financial Studies Provided in Cooperation with: "Victor Slăvescu" Centre for Financial and Monetary Research, National Institute of Economic Research (INCE), Romanian Academy Suggested Citation: Milea, Camelia (2018) : Vulnerabilities of the Romanian economy generated by the foreign trade, the external debt and the exchange rate after Romania's accession to the European Union, Financial Studies, ISSN 2066-6071, Romanian Academy, National Institute of Economic Research (INCE), "Victor Slăvescu" Centre for Financial and Monetary Research, Bucharest, Vol. 22, Iss. 4 (82), pp. 41-56 This Version is available at: http://hdl.handle.net/10419/231670 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. -

WM/Refinitiv Closing Spot Rates

The WM/Refinitiv Closing Spot Rates The WM/Refinitiv Closing Exchange Rates are available on Eikon via monitor pages or RICs. To access the index page, type WMRSPOT01 and <Return> For access to the RICs, please use the following generic codes :- USDxxxFIXz=WM Use M for mid rate or omit for bid / ask rates Use USD, EUR, GBP or CHF xxx can be any of the following currencies :- Albania Lek ALL Austrian Schilling ATS Belarus Ruble BYN Belgian Franc BEF Bosnia Herzegovina Mark BAM Bulgarian Lev BGN Croatian Kuna HRK Cyprus Pound CYP Czech Koruna CZK Danish Krone DKK Estonian Kroon EEK Ecu XEU Euro EUR Finnish Markka FIM French Franc FRF Deutsche Mark DEM Greek Drachma GRD Hungarian Forint HUF Iceland Krona ISK Irish Punt IEP Italian Lira ITL Latvian Lat LVL Lithuanian Litas LTL Luxembourg Franc LUF Macedonia Denar MKD Maltese Lira MTL Moldova Leu MDL Dutch Guilder NLG Norwegian Krone NOK Polish Zloty PLN Portugese Escudo PTE Romanian Leu RON Russian Rouble RUB Slovakian Koruna SKK Slovenian Tolar SIT Spanish Peseta ESP Sterling GBP Swedish Krona SEK Swiss Franc CHF New Turkish Lira TRY Ukraine Hryvnia UAH Serbian Dinar RSD Special Drawing Rights XDR Algerian Dinar DZD Angola Kwanza AOA Bahrain Dinar BHD Botswana Pula BWP Burundi Franc BIF Central African Franc XAF Comoros Franc KMF Congo Democratic Rep. Franc CDF Cote D’Ivorie Franc XOF Egyptian Pound EGP Ethiopia Birr ETB Gambian Dalasi GMD Ghana Cedi GHS Guinea Franc GNF Israeli Shekel ILS Jordanian Dinar JOD Kenyan Schilling KES Kuwaiti Dinar KWD Lebanese Pound LBP Lesotho Loti LSL Malagasy -

Euro Adoption in Romania: an Exploration of Convergence Criteria

“Ovidius” University Annals, Economic Sciences Series Volume XX, Issue 2 /2020 Euro Adoption in Romania: An Exploration of Convergence Criteria Georgiana-Loredana Schipor “Ovidius” University of Constanta, Faculty of Economic Sciences, Romania [email protected] Abstract The aim of this paper is to analyze the position of Romania towards the Maastricht criteria, starting from the assumption that meeting the nominal convergence criteria is no longer enough for the Romanian adoption of euro. The most significant risks that the artificially integrated countries must face after the accession to the Euro Area were identified, using a large number of economic indicators that were distilled in order to design the Romanian progress in the process. The Romanian entrance into the Eurozone emphasize its major cost: the loss of monetary policy independence. The current methodological approach is twofold. First, the nominal and real convergence criteria were examined based on one-point-in-time approach. Second, it was considered the Romanian people perception about the adoption of the euro currency in accordance with a sequence of key-events suggesting a significant change due to multiple abandoned adoption targets, Brexit event or the pandemic context. Key words: nominal convergence, real convergence, Euro Area, Romania J.E.L. classification: F15, F44, E52 1. Introduction The European monetary integration is subject to a permanent debate in the Romanian context, the opinions being in the direction that meeting the nominal convergence criteria is no longer enough for the Romanian adoption of euro. If the cyclical economic events are not correlated among the Member States, the catalysts efforts transform into a significant risk the artificially integrated countries. -

The National Bank of Romania Uses FT Content to Foster Its Agility and Adaptability Ft.Com/Group

The National Bank of Romania uses FT content to foster its agility and adaptability ft.com/group The challenge The solution The benefits The strategic decisions taken by the An FT Group Subscription provides Teams and senior colleagues across National Bank of Romania originate a common source of analysis that the National Bank of Romania are in trustworthy political and economic strategists and decision-makers can on the same page when it comes to insight on Europe and beyond. Up use to gain a big picture view of the their understanding of the global to date information is constantly world and identify key themes that financial and political outlook. required in order to adapt to the their specialised teams can then Major policy decisions are informed demanding new challenges facing a explore in greater depth. by accurate analysis and trusted modern central bank. intelligence. You have to go beyond your own box and your own culture. Reading the FT enriches your knowledge and makes us more skilful as an institution. Gabriela Mihailovici Strategy consultant, National Bank of Romania Supporting Romania’s Although the long-term aim is a return to a normal monetary stance, the ‘new normal’ is likely to be rather economic health different. It’s commonly acknowledged that the core objective of Teams across the NBR therefore need to ensure they the majority of central banks is to ensure and maintain have access to accurate sources of analysis in order to price stability. be agile in their strategic decision-making. The National Bank of Romania (NBR), headquartered in Bucharest, shares this primary goal with its EU/ESCB counterparts but equally, the role of central banks is A complicated, global game ever-growing in an environment marked by unusually elevated uncertainties.