Market Perspectives

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Report (PDF)

Innovation We strive to create opportunities with new approaches and resources. Our Guiding Integrity Principles We do the right thing for the right reasons. Our culture is defined by six core values. They are the key to our storied legacy and the guide to our daily business decisions. Excellence We pride ourselves on the quality of our work, and we seek to exceed expectations. Entrepreneurship We believe that great organizations are built by employing and partnering with the best and brightest people. Talent We believe in fostering individual creativity and a sense of ownership. Stewardship We are dedicated to safeguarding the capital and trust of our clients, and advancing their best interests. A Letter From Managing Partner Peter Lawson-Johnston II At the time of writing this letter, the world is enduring a health crisis while the United States is undergoing a self-examination of societal inequities, both of which are challenging our preconceived notions of where and how we work, learn, worship, and most importantly, how we connect with each other as a community. This is our fourth annual Impact Report that documents our achievements and values as they relate to contributing to the communities where we live and work. But how do you assess your impact on the world, as a business, and as a corporate citizen, when the world seemingly has fundamentally changed? A crisis of this scale is remarkable in how it forces one to focus simultaneously on the uncertainty of today as well as the uncertainty of next year or future decades. Uncertainty can be insidious, and it is easy to withdraw or disengage. -

Emerging Trends in Real Estate®

GREGG GALBRAITH, RED STUDIO GREGG GALBRAITH, NICO MARQUES Emerging Trends in Real Estate® United States and Canada 2017 Emerging Trends in Real Estate® 2017 A publication from: Emerging Trends in Real Estate® 2017 Contents 3 Chapter 1 Playing for Advantage, Guarding 68 Chapter 5 Emerging Trends in Canadian the Flank Real Estate 4 Context: A Kinder, Gentler Real Estate Cycle? 68 More Than Mixed Use, It’s about Building 5 Optionality Communities 6 Transformation through Location Choice 78 Affordability on the Decline 8 Recognizing the Role of the Small 98 Renting for the Long Term Entrepreneurial Developer 09 Technology Disruptors Hold a Competitive 9 Labor Scarcity in Construction Costs Advantage 1 1 Housing Affordability: Local Governments 09 Global Uncertainties Weigh on the Mind Step Up 09 Ongoing Oil and Gas Woes 3 1 Gaining Entry beyond the Velvet Rope 29 Waiting for Deals 4 1 The Connectedness of Cities 92 Economic Outlook 5 1 Ready for Augmented Reality? 93 Property Type Outlook 7 1 Blockchain for 21st-Century Real Estate 69 Markets to Watch in 2017 8 1 Expected Best Bets for 2017 102 Expected Best Bets for 2017 02 Chapter 2 Capital Markets 104 Interviewees 1 2 The Debt Sector 72 The Equity Sector 33 Summary 43 Chapter 3 Markets to Watch 43 2017 Market Rankings 43 Market Summaries 1 7 Chapter 4 Property Type Outlook 2 7 Industrial 74 Apartments 67 Single-Family Homes 77 Hotels 79 Office 81 Retail 38 Niche Sectors 85 Summary Emerging Trends in Real Estate® 2017 i Editorial Leadership Team Emerging Trends Chairs PwC Advisers and Contributing Researchers Mitchell M. -

Participating Companies & Organizations As of September 19

Participating Companies & Organizations As of September 19, 2019 ADNOC George W. Bush Institute OYO Hotels and Homes African Development Bank GMO Asset Management Paramount Pictures Akbank Government Pension Investment Patagonia Allianz Global Investors Fund (GPIF) Japan PensionDanmark Alphabet and Google Greentech Capital Advisors Perella Weinberg Partners Anheuser-Busch InBev Guggenheim Partners Planet Labs AP7 Gulf International Bank (UK) Ltd. Propper Daley Apollo Global Management Harvest Fund Management Qatar Investment Authority Arm Hellman & Friedman Qatar Stock Exchange Atlassian HSBC Revolution AustralianSuper Hudson Institute Royal DSM Avenue Capital India Today Group Royal Dutch Shell Aviva Investors Indonesia Investment Sesame Workshop AXA Group Ingersoll Rand Sinovation Ventures Bain Capital Inspired Capital Snap Inc. Bank of America International Monetary Fund Softbank Bank of England Investec Group Spring Labs Bank of Canada Islamic Development Bank Group SRMG BGD Holdings, LLC JPMorgan Chase State Street Corp. BlackRock, Inc. K5 Global Suez Blackstone Group Kering Sygnia Group Bloomberg LP Kissinger Associates Temasek International Bloomberg Philanthropies Kohlberg Kravis Roberts & Co. Teneo BNP Paribas Kuwait Investment Authority Tesco Boudica Macquarie Group The Carlyle Group Brazilian Agribusiness Association Mahindra Group The Goldman Sachs Group, Inc. Business Roundtable Marathon Asset The New York Times Canaccord Mars, Incorporated The Paulson Institute Capital Market Authority Mastercard The Saudi Stock Exchange Carlsberg Group/Carlsberg Matarin Capital (Tadawul) Foundation Merck The Walt Disney Company CBS Metlife The World Bank Group China General Chamber of MidOcean TIAA Commerce (CGCC) Moelis & Company Tigress Financial Partners Cisneros Moody’s Tudor Investment Corp Citigroup MSNBC U.S. Department of State CNN National Geographic Partners Uber ConsenSys National Stock Exchange of Unitel SA Angola Cowen, Inc. -

GOF Semiannual Report November 2019

11.30.2019 (Unaudited) Guggenheim Funds Semiannual Report Guggenheim Strategic Opportunities Fund Beginning on January 1, 2021, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website address to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary or, if you are a registered shareholder and your shares are held with the Fund’s transfer agent, Computershare, you may log into your Investor Center account at www.computershare.com/investor and go to “Communication Preferences” or call 1-866-488-3559. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you may call Computershare at 1-866-488-3559. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all closed-end funds you hold. GuggenheimInvestments.com CEF-GOF-SAR-1119 GUGGENHEIMINVESTMENTS.COM/GOF .. -

GEQ Annual Report

12.31.2016 Guggenheim Funds Annual Report Guggenheim Equal Weight Enhanced Equity Income Fund GuggenheimInvestments.com CEF-GEQ-AR-1216 Section 19(a) Notices Guggenheim Equal Weight Enhanced Equity Income Fund’s (the “Fund”) reported amounts and sources of distributions are estimates and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon the Fund’s investment experience during the year and may be subject to changes based on the tax regulations. The Fund will provide a Form 1099-DIV each calendar year that will explain the character of these dividends and distributions for federal income tax purposes. December 31, 2016 Total Cumulative Distribution % Breakdown of the Total Cumulative For the Fiscal Year Distributions for the Fiscal Year Net Net Net Net Realized Realized Realized Realized Net Short-Term Long-Term Total per Net Short-Term Long-Term Total Per Investment Capital Capital Return of Common Investment Capital Capital Return of Common Income Gains Gains Capital Share Income Gains Gains Capital Share $0.2785 $0.0 $1.034 $0.0 $1.3125 21.22% 0.0% 78.78% 0.0% 100.0% If the Fund has distributed more than its income and net realized capital gains, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of a shareholder’s investment in a Fund is returned to the shareholder. A return of capital distribution does not necessarily reflect a Fund’s investment performance and should not be confused with “yield” or “income.” Section 19(a) notices for the Fund are available on the Fund’s website at guggenheiminvestments.com/geq. -

2018 Annual Report

2018 ANNUAL REPORT 1 Table of Contents 4 MISSION 5 LETTER FROM CHIEF EXECUTIVE OFFICER 6-19 YOUTH PROGRAMS 20-28 GRANTMAKING 29 AWARDS 30-44 FUNDRAISING 45 STATEMENT OF ACTIVITIES 46 CONTACT 2 3 Dear Partner, ounded in 1995, the Los Angeles Dodgers Foundation (LADF) is the official Thank you so much for playing an integral role in propelling the team charity of the Los Angeles Dodgers. An award-winning leader in Los Angeles Dodgers Foundation to such great heights. 2018 was a sports-based youth development, LADF harnesses the power of the Dodger monumental year full of increased partnerships and programming - Fbrand, and a passionate fan base, to significantly impact underserved youth impacting 2.3 million youth. in some of the most challenged neighborhoods of Los Angeles. With a focus on Sports + Recreation, Education + Literacy, and Health + Wellness, LADF administers We’re inspired and geared up for more. direct programs serving youth and communities at large and provides grants to local nonprofit organizations. Our commitment to engaging kids in sports helps them lead healthy lifestyles in childhood and beyond, all while building confidence and With a bigger than baseball mentality, LADF is focused on finding innovative ways to promoting their academic success. create opportunities for children through programs that engage with kids in sports, In our sixth consecutive season of Dodgers RBI, LADF served nearly helps kids stay active and promote academic success. With the support of partners, 10,000 youth across 69 locations on more than 700 teams across stakeholders and fans, LADF produces incredible results on fields, in classrooms and Los Angeles, including three public housing developments. -

Indiana Department of Insurance Approves Plan to Protect the Policyholders and Employees of Standard Life of Indiana, Now in Rehabilitation

INDIANA DEPARTMENT OF INSURANCE APPROVES PLAN TO PROTECT THE POLICYHOLDERS AND EMPLOYEES OF STANDARD LIFE OF INDIANA, NOW IN REHABILITATION INDIANAPOLIS, DECEMBER 22, 2010 – Indiana Insurance Commissioner Stephen W. Robertson today announced an agreement by which Standard Life Insurance Company of Indiana, which has been in rehabilitation for two years, would be reorganized. Among other things, the agreement contemplates that Guggenheim Life and Annuity Company would reinsure policies originally issued by Standard Life. As part of the transaction, Guggenheim Life and Annuity and its affiliates also would take over Standard Life’s offices in Carmel and guarantee employment to Standard Life’s 55 employees for at least 18 months. Guggenheim Life and Annuity currently has its principal place of business in Indianapolis. The agreement, which is still subject to approval by the Marion County Circuit Court and other closing conditions, would provide security for the nearly 34,000 individuals, including 3,400 Indiana residents, who hold annuities and other insurance policies issued by Standard Life. “This agreement promises a successful conclusion to the Department’s efforts to protect the policyholders of this company,” Robertson said. “It’s a credit to our rehabilitation team and to Guggenheim Life and Annuity that the solution, in addition to achieving our primary goal of protecting consumers, would keep the business operations and the jobs in Indiana.” Robertson said that the orderly process for the reorganization of Standard Life and transfer of its policies means that the Department’s rehabilitation efforts would not result in additional costs to taxpayers and would protect the full cash value of policies for its customers. -

Attendee Bios

ATTENDEE BIOS Ejim Peter Achi, Shareholder, Greenberg Traurig Ejim Achi represents private equity sponsors in connection with buyouts, mergers, acquisitions, divestitures, joint ventures, restructurings and other investments spanning a wide range of industries and sectors, with particular emphasis on technology, healthcare, industrials, consumer packaged goods, hospitality and infrastructure. Rukaiyah Adams, Chief Investment Officer, Meyer Memorial Trust Rukaiyah Adams is the chief investment officer at Meyer Memorial Trust, one of the largest charitable foundations in the Pacific Northwest. She is responsible for leading all investment activities to ensure the long-term financial strength of the organization. Throughout her tenure as chief investment officer, Adams has delivered top quartile performance; and beginning in 2017, her team hit its stride delivering an 18.6% annual return, which placed her in the top 5% of foundation and endowment CIOs. Under the leadership of Adams, Meyer increased assets managed by diverse managers by more than threefold, to 40% of all assets under management, and women managers by tenfold, to 25% of AUM, proving that hiring diverse managers is not a concessionary practice. Before joining Meyer, Adams ran the $6.5 billion capital markets fund at The Standard, a publicly traded company. At The Standard, she oversaw six trading desks that included several bond strategies, preferred equities, derivatives and other risk mitigation strategies. Adams is the chair of the prestigious Oregon Investment Council, the board that manages approximately $100 billion of public pension and other assets for the state of Oregon. During her tenure as chair, the Oregon state pension fund has been the top-performing public pension fund in the U.S. -

GEQ | SEMIANNUAL REPORT Guggenheim Equal Weight Enhanced Equity Income Fund Section 19(A) Notices

CEF June 30, 2015 (UNAUDITED) GEQ | SEMIANNUAL REPORT Guggenheim Equal Weight Enhanced Equity Income Fund Section 19(a) Notices Guggenheim Equal Weight Enhanced Equity Income Fund’s (the “Fund”) reported amounts and sources of distributions are estimates and are not being provided for tax purposes. The actual amounts and sources for tax reporting purposes will depend upon the Fund’s investment experience during the year and may be subject to changes based on the tax regulations. The Fund will provide a Form 1099-DIV each calendar year that will explain the character of these dividends and distributions for federal income tax purposes. June 30, 2015 Total Cumulative Distribution % Breakdown of the Total Cumulative For the Fiscal Year Distributions for the Fiscal Year Net Net Net Net Realized Realized Realized Realized Net Short-Term Long-Term Total per Net Short-Term Long-Term Total Per Investment Capital Capital Return of Common Investment Capital Capital Return of Common Income Gains Gains Capital Share Income Gains Gains Capital Share $0.0647 $0.0000 $0.8103 $0.0000 $0.8750 7.4% 0.0% 92.6% 0.0% 100.0% If the Fund has distributed more than its income and net realized capital gains, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of a shareholder’s investment in the Fund is returned to the shareholder. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.” Section 19(a) notices for the Fund are available on the Fund’s website at guggenheiminvestments.com/geq. -

Core Fixed Income Strategy

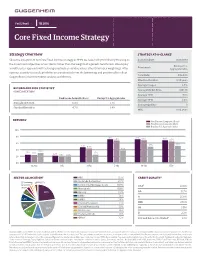

Fact Sheet 1Q 2016 Core Fixed Income Strategy Strategy Overview STRATEGY AT-A-GLANCE1 Since the inception of our Core Fixed Income strategy in 1999, we have built portfolios by focusing on Inception Date 01.01.1999 the investment objectives of our clients rather than the weights of a generic benchmark. We employ Barclays U.S. Benchmark a multi-sector approach with a strong emphasis on relative value rather than index weightings. After Aggregate Index rigorous security research, portfolios are constructed from the bottom up and positioned to reflect Total AUM $92.0 bn Guggenheim’s macroeconomic analysis and themes. Effective Duration 6.59 years Average Coupon 4.5% RETURN AND RISK STATISTICS1 Average Market Price $101.36 (SINCE INCEPTION) Average YTM 5.1% Fixed Income Composite (Gross) Barclays U.S. Aggregate Index Average YTW 5.0% Annualized Return 6.8% 5.1% Average Quality2 A Standard Deviation 4.7% 3.4% WAL 8.86 years 1 RETURNS Fixed Income Composite (Gross) Fixed Income Composite (Net) Barclays U.S. Aggregate Index 10% 8% 7.1% 7.2% 6.8% 6.8% 6.8% 6.5% 6% 4.9% 5.1% 4.7% 4.4% 3.8% 4% 3.0% 2.5% 2.4% 2.5% 2.2% 1.9% 2.0% 2% 0% 1Q 2016 1 YR 3 YRS 5 YRS 10 YRS ITD* SECTOR ALLOCATION1 ABS 23.1% CREDIT QUALITY2 1.5% 3.2% Inv Grade Corporates 21.7% 1.6% Commercial Mortgage Loans 10.9% AAA5 22.6% 1.9% Municipals3 10.6% 3.5% 23.1% Agency 8.8% AA 15.7% CMBS 7.6% A 25.8% 5.6% RMBS 5.6% Private Placement 3.5% BBB 27.6% 7.6% 21.7% Limited Partnership 1.9% BB 3.0% Bank Loans 1.6% 8.8% B 2.2% 10.6% Preferred Stock 1.5% Other4 3.2% CCC and Below / Not Rated6 3.1% *Inception to Date. -

Market Perspectives by Scott Minerd, Chairman of Investments and Global CIO

Market Perspectives By Scott Minerd, Chairman of Investments and Global CIO June 2014 Central Banks Chart a Course for Overheating On the evening of Oct. 30, 1938, millions of Americans tuned their radios to CBS and heard Ramón Raquello’s orchestra playing “La Cumparsita”. The popular tango music was interrupted by a news bulletin about explosions of incandescent gas on the planet Mars and a subsequent report of a huge, flaming object landing on a farm in New Jersey. If you had not heard the introduction to Orson Welles’ interpretation of “The War of the Worlds,” you would have been excused for thinking that the sky was falling. Thousands of frightened people called the police in a panic. While entertainment has changed in the intervening decades, we are no less susceptible to panic. Today in financial markets the most overplayed story is that we are at risk of some manner of imminent crisis, whether it’s Europe facing deflation, Japan’s Abenomics experiment failing, China heading toward a real estate crisis or problems in any number of other countries from Ukraine to Thailand. Heightening these worries is the fact that both equities and fixed income have rallied in tandem and fears of asset bubbles exist in categories from high-yield bonds to technology stocks. Especially with credit, some investors have begun to fear that a crisis must be around the corner. After all, with valuations evocative of 1993 or 2005/2006, logic suggests that what might come next could be akin to the massive bond-market correction of 1994, or the credit-market freeze of 2007 and the full-blown meltdown that followed in 2008. -

BBA GRADUATES Amazon Goldman Sachs Group Piper Jaffray & Co

CLASS OF 2016 2016 HIRING COMPANIES BBA BBA A.T. Kearney Inc. General Electric Co. PepsiCo Inc. Accenture General Motors Corp. Perella Weinberg Partners LP 16 AIG Geofeedia Inc. Peter J. Solomon Co. 1 6 BBA GRADUATES Amazon Goldman Sachs Group Piper Jaffray & Co. AMCON Google Inc. Plante Moran American Express Co. Grainger PNC Bank American Israel Public Affairs Committee Green Courte Partners LLC Poshmark Anheuser-Busch Companies Inc. Guggenheim Partners Prime Finance Partners AOL Hanover Street Capital Partners Prophet Apollo Global Management LLC Harris Williams & Co. Prudential Securities AppFolio HMS Development PwC BAE Systems Houlihan Lokey Qualtrics Bain & Co. HSBC Securities (USA) Inc. Raymond James Financial Bank of America Merrill Lynch Huron Consulting Group RBC Capital Markets Barclays PLC IBM Corp. Reckitt Benckiser BlackRock Inc. Insight Venture Partners Resinate Materials Group Blackstone Group Intel Corporation Roland Berger Strategy Consultants Bloomberg LP Jefferies LLC Rothschild Inc. Bloomingdales Inc. JPMorgan Chase & Co. S.C. Johnson & Son Inc. BNP Paribas KeepTruckin Sagent Advisors Inc. The Boston Consulting Group Keurig Green Mountain Saks Fifth Avenue Brunswick Corp. KeyBanc Capital Markets Sharethrough Burger King Corp. KPMG LLP Shell Cambridge Group Kraft Heinz Co. Stout Risius Ross Inc. Our Bachelor of Business Administration students graduate from Capital One Lazard Frères & Co. LLC SunTrust Banks Inc. a top-ranked program with an innovative curriculum emphasizing Cardinal Health Inc. Lightstone Group Target Corp. hands-on learning. Students take about half their credits outside CBS Sports Lincoln International Textron Inc. CEB LinkedIn Title Source Inc. of Ross, ensuring that our graduates are well-rounded, creative, Cisco Systems Inc.