Notice of 2017 Ordinary General Meeting of Shareholders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

<Translation> June 24, 2021 Name of Company

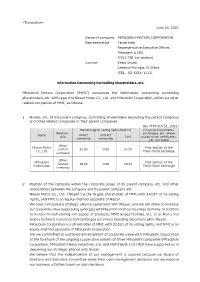

<Translation> June 24, 2021 Name of company: MITSUBISHI MOTORS CORPORATION Representative: Takao Kato Representative Executive Officer, President & CEO (7211 TSE 1st section) Contact: Keiko Sasaki General Manager, IR Office (TEL.03-3456-1111) Information Concerning Controlling Shareholders, etc. Mitsubishi Motors Corporation (“MMC”) announces the information concerning controlling shareholders, etc. with regard to Nissan Motor Co., Ltd. and Mitsubishi Corporation, which are other related companies of MMC, as follows: 1 Names, etc. of the parent company, controlling shareholders (excluding the parent company) and other related companies or their parent companies (As of March 31, 2021) Percentage of voting rights held (%) Financial instruments Relation- exchanges, etc. where Name Direct Indirect ship Total issued share certificates, ownership ownership etc. are listed Other Nissan Motor First Section of the related 34.03 0.00 34.03 Co., Ltd. Tokyo Stock Exchange company Other Mitsubishi First Section of the related 20.02 0.00 20.02 Corporation Tokyo Stock Exchange company 2 Position of the company within the corporate group of its parent company, etc. and other relationships between the company and its parent company, etc. Nissan Motor Co., Ltd. (“Nissan”) is the largest shareholder of MMC with 34.03% of its voting rights, and MMC is an equity-method associate of Nissan. We have concluded a strategic alliance agreement with Nissan, and we will strive to increase our corporate value by pursuing synergies with Nissan in all of our business domains. In addition to mutual manufacturing and supply of products, MMC leases facilities, etc. to or from, and shares technical resources and exchanges personnel including executives with, Nissan. -

Into the Future on Three Wheels

Mitsubishi The 9th Grand Prix Winner A Bimonthly Review of the Mitsubishi Companies and Their People Around the World 2009-2010 Asian Children's2008- Enikki Festa 2009 Winners December & January Grand Prix Japan Humans are social beings. People live in groups. We Bangladeshis like to live with our parents, our brothers and sisters, our grandparents, and other relatives. In our family, I live with my brother, my parents, and my grandmother. We share each other’s joys and sorrows. That makes our lives fulfilling. Cycling * The above sentences contained in this Enikki has been translated from Bengali to English. Into the Future The 9th Grand Prix Winner on Three Wheels Sadia Islam Mowtushy Age:11 Girl People’s Republic of Bangladesh “Wrapping Up the Year with Toshikoshi Soba” oba is a Japanese noodle that is eaten in various ways longevity, because it is long and thin. There are many other depending on the season. In summer, soba is served cold explanations and no single theory can claim to be the definitive S and dipped in a chilled sauce; in winter, it comes in a hot truth, but this only adds to the mystique of toshikoshi soba. broth. Soba is often garnished with tasty tidbits, such as tempura shrimp, or with a bit of boiled spinach to add a touch of color. Soba has been a favorite of Japanese people for centuries and the popular buckwheat noodle has even secured a role in various Japanese traditions, including the New Year’s celebration. Japanese people commonly eat soba on New Year’s Eve, when the old year intersects with the new year, and this is known as toshikoshi or “year-crossing” soba. -

Monthly Trading Value of Most Active Stocks (Sep.2011) 1St Section

Monthly Trading Value of Most Active Stocks (Sep.2011) 1st Section Rank Code Issue Trading Value \ mil. 1 3632 Gree,Inc. 621,681 2 9984 SOFTBANK CORP. 525,472 3 7203 TOYOTA MOTOR CORPORATION 508,576 4 6954 FANUC CORPORATION 474,028 5 9501 The Tokyo Electric Power Company,Incorporated 383,303 6 8316 Sumitomo Mitsui Financial Group,Inc. 371,373 7 9433 KDDI CORPORATION 367,528 8 7751 CANON INC. 344,371 9 6301 KOMATSU LTD. 342,788 10 8306 Mitsubishi UFJ Financial Group,Inc. 335,566 11 7267 HONDA MOTOR CO.,LTD. 325,041 12 7201 NISSAN MOTOR CO.,LTD. 300,329 13 8411 Mizuho Financial Group,Inc. 292,432 14 2432 DeNA Co.,Ltd. 280,373 15 8058 Mitsubishi Corporation 273,889 16 2914 JAPAN TOBACCO INC. 268,618 17 8031 MITSUI & CO.,LTD. 257,682 18 6502 TOSHIBA CORPORATION 257,679 19 6758 SONY CORPORATION 247,379 20 6501 Hitachi,Ltd. 245,548 21 9983 FAST RETAILING CO.,LTD. 242,756 22 4502 Takeda Pharmaceutical Company Limited 232,589 23 9437 NTT DOCOMO,INC. 229,511 24 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 199,544 25 8591 ORIX CORPORATION 197,121 26 8604 Nomura Holdings, Inc. 182,408 27 3382 Seven & I Holdings Co.,Ltd. 182,138 28 8035 Tokyo Electron Limited 161,453 29 7202 ISUZU MOTORS LIMITED 161,231 30 7011 Mitsubishi Heavy Industries,Ltd. 159,430 31 6971 KYOCERA CORPORATION 153,831 32 5233 TAIHEIYO CEMENT CORPORATION 152,939 33 6665 Elpida Memory,Inc. 151,463 34 6762 TDK Corporation 150,719 35 8001 ITOCHU Corporation 149,228 36 6752 Panasonic Corporation 148,099 37 4063 Shin-Etsu Chemical Co.,Ltd. -

Financial Crime

Japan’s Shifting Geopolitical and Geo-economic relations in Africa A view from Japan Inc. By Dr Martyn Davies, Managing Director: Emerging Markets & Africa, Frontier Advisory Deloitte and Kira McDonald, Research Analyst, Frontier Advisory Deloitte The Japanese translation was published in changer” in Africa since the turn of the century; Building Hitotsubashi Business Review geopolitical stature and influence in Africa with a (Vol. 63, No. 1, June 2015, pp. 24-41). potential view toward gaining a permanent seat on the United Nations Security Council (UNSC); and the strategic Introduction need for securing resource assets with special emphasis on energy resources and key metals for its industrial Japan has been grappling with defining its Africa economy.1 strategy. Historically, Japanese engagement with Since 2000, Japan’s strategy toward Africa has begun Africa has emphasised aid and development rather to shift. Whereas previously the relationship was than focused pragmatic commercial interest. Japan’s characterised by a donor-recipient model to a more engagement in Africa is seen as benign due in large part commercially-orientated approach, encouraging to its non-involvement in the continent’s colonial history. development through private investment, and However, Japan’s engagement of Africa is undergoing a incorporating a greater focus on business aligned shift due in large part by the increased prominence of the to the interests of Japan Inc. But as Africa itself is African continent and rising competition from emerging rapidly changing, so too much the foreign policy and actors who this century are rapidly accumulating both commercial strategy of Japan toward the continent. geopolitical and geo-economic capital on the continent. -

NIKON REPORT 2018 Unleashing the Limitless Possibilities of Light

NIKON REPORT 2018 Year Ended March 31, 2018 Unlock the future with the power of light Unleashing the limitless possibilities of light. Striving to brighten the human experience. Focused, with purpose, on a better future for all. THIS IS THE ESSENCE OF NIKON. Creation of New Value by Unlocking the Future with the Power of Light Throughout a century since its founding, Nikon has continued to win customer trust by contributing to the development of society with products and solutions based on its core opto-electronics and precision technologies. The technologies, the human resources, and the brand cultivated through this process have become reliable strengths supporting Nikon today. After completing the restructuring that began in November 2016, it will be crucial to further hone these strengths and fulfill our role as the “new eyes for people and industry” in order to create new value and support our growth strategies. Our vision formulated in 2017 will guide us in fostering corporate culture in which each employee is encouraged to think about what is necessary in order to accomplish growth and to tackle the challenges this introspection reveals. With this culture, everyone at Nikon will unite in our quest to consistently create corporate value. Nikon Report 2018 puts a spotlight on the value we have provided thus far and the strengths cultivated over the years. Moreover, the report seeks to communicate the basis for the growth strategies to be implemented after the completion of the restructuring and the tasks that will need to be addressed in order to effectively implement those strategies. -

Raising the Raising Power Of

Financial Section of Integrated Report 2017 For the year ended March 31, 2017 Financial Section of Integrated Report 2017 Financial RAISING THE POWER OF MC ANNUAL FINANCIAL REPORT <FOR THE YEAR ENDED MARCH 2017> CONTENTS Management’s Discussion and Analysis of Financial Condition and Results of Operations ��������������������������������������������������������������������������������������������������������� 01 Independent Auditors’ Report ����������������������������������������������������������������������������������������������������� 20 Supplementary Explanation ��������������������������������������������������������������������������������������������������������� 22 Management Internal Control Report (Translation) ��������������������������������������������������������������������� 23 Independent Auditor’s Report filed under the Financial Instruments and Exchange Act in Japan (Translation) . 25 Consolidated Financial Statements . 29 Consolidated Statement of Financial Position . 29 Consolidated Statement of Income . 31 Consolidated Statement of Comprehensive Income . 32 Consolidated Statement of Changes in Equity . 33 Consolidated Statement of Cash Flows ��������������������������������������������������������������������������������������� 34 Notes to Consolidated Financial Statements . 35 Responsibility Statement ����������������������������������������������������������������������������������������������������������� 138 Forward-Looking Statements This financial section of Mitsubishi Corporation's Integrated Report for -

Mitsubishi Motors Corporation. Owned By

Official name: Mitsubishi Motors Corporation. Owned by: Nissan Motor Co (34%), Mitsubishi Heavy Industries Ltd (12.63%), Mitsubishi Corporation (10.06%), The Bank of Tokyo-Mitsubishi (3.91%), plus institutional and private investors. Current situation: Although Mitsubishi is the sixth-largest automaker in Japan, globally it’s only the 16th-largest. Mitsubishi Motors is currently in nosedive after years of consistently losing money. Facing multi-billon dollar losses and legal action over falsified fuel economy figures, Mitsubishi was recently rescued by Nissan. Most of Mitsubishi’s Western investors have bailed out and won’t come back. Mitsubishi now has less than a 1% share of the American car market. Mitsubishi’s Chinese sales and Japanese sales are nosediving. Chances of survival: poor. Mitsubishi is likely to be absorbed into the Nissan-Renault group • 1 All content © The Dog & Lemon Guide 2017. All rights reserved A brief history of Mitsubishi OUNDED IN 1870, Mitsubishi began producing cars in 1917, Fbut full-scale production did not commence until the early 1960s. With typical Japanese thoroughness, Mitsubishi Motors produced well-built, well-designed cars. They were mostly too small for the American market, because Mitsubishi built its cars for Japanese roads, which were small and congested. Mitsubishi Motors had its big break in the 1970s fuel crisis: sud- denly the world fell in love with small, fuel-economic, reliable Japa- nese cars. For decades it seemed that Mitsubishi Motors could do no wrong. Mitsubishis were reli- able and well built. They weren’t very safe, but people didn’t care so much in those days. -

1 - It Is Confirmed That the Share Transfer Does Not Fall Under a Change in Major Shareholders for Both Mitsubishi UFJ Lease and Hitachi Capital

March 19, 2021 To whom it may concern, Company Name Mitsubishi UFJ Lease & Finance Company Limited Representative Takahiro Yanai, President & CEO (Code: 8593, 1st Section of Tokyo Stock Exchange, and 1st Section of Nagoya Stock Exchange) Company Name Hitachi Capital Corporation Representative Seiji Kawabe, President & CEO (Code: 8586, 1st Section of Tokyo Stock Exchange) Notice concerning Major Shareholders after the Business Integration As announced in the “Signing of Share Transfer Agreement” announced by Mitsubishi UFJ Financial Group, Inc. (“Mitsubishi UFJ Financial Group”), a major shareholder of Mitsubishi UFJ Lease & Finance Company Limited (“Mitsubishi UFJ Lease”) and Hitachi Capital Corporation (“Hitachi Capital”) as of today, and “Signing of Agreement to Transfer Shares of MUL and HCC to MC” announced by Mitsubishi Corporation (“Mitsubishi Corporation”), a major shareholder of Mitsubishi UFJ Lease as of today, a portion of the shares of Mitsubishi UFJ Lease and Hitachi Capital held by Mitsubishi UFJ Financial Group and its consolidated subsidiary companies is expected to be transferred to Mitsubishi Corporation as of March 25, 2021 (the “Share Transfer”). Thus, it is hereby notified given the prospect of major shareholders after the Business Integration (to be defined below) in consideration of the Share Transfer. 1. Background As announced in the press release titled “Notice concerning Conclusion of Agreement on Business Integration through Merger between Mitsubishi UFJ Lease and Hitachi Capital” dated September 24, 2020, Mitsubishi UFJ Lease and Hitachi Capital will conduct the business integration (the “Business Integration”) through the absorption-type merger (the “Merger”) with April 1, 2021, being the effective date and in which Mitsubishi UFJ Lease will be the surviving company, and Hitachi Capital will be the merged company. -

Changes of Directors and Officers for FY2021(158KB)

January 15, 2021 Changes of Directors and Officers for FY2021 Ⅰ.Executive Officers(“Shikko-Yakuin”) 1. Newly appointed: April 1, 2021 Name Present SHINOHARA, General Manager, Global Strategy and Regional Management Dept. Tetsuya KONDO, Shota General Manager, Natural Gas Group CEO Office KOYAMA, Satoshi General Manager, Mineral Resources Group CEO Office MAEKAWA, Toshiaki Seconded to Tri Petch Isuzu Sales Co., Ltd. (President Director) (Concurrently) Seconded to Tri Petch Isuzu Leasing Co., Ltd. (Vice Chairman, Director) HORI, Hideyuki General Manager, Corporate Strategy & Planning Dept. ONO, Koji General Manager, Industrial Materials Group CEO Office SUZUKI, Akifumi Division COO, Petrochemicals Div. 2. Promoted: April 1, 2021 New Present Name Executive Vice President Senior Vice President TAKEUCHI, Osamu KASHIWAGI, Yutaka KIKUCHI, Kiyotaka 3. Retiring: March 31, 2021 Title Name Present Executive Vice HAGIWARA, Takeshi Group CEO, Petroleum & Chemicals Group President YOSHIDA, Shinya Corporate Functional Officer, Business Development for Japan (Concurrently) General Manager, Kansai Branch KYOYA, Yutaka Group CEO, Consumer Industry Group 1 Title Name Present Executive Vice SAKAKIDA, Masakazu Corporate Functional Officer, President Corporate Communications, Corporate Sustainability & CSR, Corporate Administration, Legal (Concurrently) Chief Compliance Officer, Officer for Emergency Crisis Management Headquarters Senior Vice YANAGIHARA, Tsunehiko EVP, Mitsubishi Corporation (Americas) President [Work location: Silicon Valley] (Concurrently) General Manager, Silicon Valley Branch, Mitsubishi Corporation (Americas) YAMASAKI, Nodoka Division COO, Healthcare Div. NISHIO, Kazunori Division COO, Retail Div. ARAKAWA, Takeshi Division COO, Consumer Products Div. Ⅱ.Related Personnel Changes 1. Corporate Staff Section (March 1, 2021) New Present Name Assistant to Corporate General Manager, ANDO, Keigo Functional Officer, IT Service Dept. Corporate Staff Section General Manager, IT Service Dept. -

UAE: Keolis Wins 15-Year Contract to Operate Dubai's World Class

PRESS RELEASE Paris, 22 March 2021 UAE: Keolis wins 15-year contract to operate Dubai’s world class driverless metro and tram networks • Following Dubai’s Roads & Transport Authority (RTA) announcement on 20 March 2021, Keolis is honoured that the company and its international partners were the successful bidders for a 9-year contract, with a possible 6-year extension1 and worth approximately 125 million euros per year, to operate and maintain the city’s world class metro and tram networks. • The new contract provides a perfect opportunity to blend the RTA’s reputation for innovation and efficiency with Keolis’ international experience and expertise. Keolis will be the lead partner in a joint venture (JV)2, which will also deliver the talents of both Mitsubishi Heavy Industries Engineering (MHI) and Mitsubishi Corporation (MC). Both partners have already worked successfully with the RTA over several years. Under this contract, Keolis and its partners will manage Dubai’s world-leading metro and tram network from September 2021. • Keolis has been a dominant force in automated metros for 40-years. The company has a track record of running one of the world’s most iconic systems in London (Docklands Light Railway) and is also the long-standing operator of choice for the world’s first automated metro in Lille. The extent of Keolis’ metro experience is reflected in the many other automated metro networks the business successfully manages across the world, which includes Lyon and Rennes in France, Doha (Qatar), Shanghai (China) and Hyderabad (India). • The value of Keolis’ experience of operating tram networks across the world will be an equally important feature of the new contract. -

Notice of 2020 Ordinary General Meeting of Shareholders

NOTICE OF 2020 ORDINARY GENERAL MEETING OF SHAREHOLDERS (Note) This is an unofficial translation of the Japanese language original version, and is provided for your convenience only, without any warranty as to its accuracy or as to the completeness of the information. The Japanese original version is the sole official version. If minor amendments are required to matters contained in the Business Report, the financial statements, the Matters for Resolution or other documents, Mitsubishi Corporation will post revisions on its website (https://www.mitsubishicorp.com). CONTENTS Notice of 2020 Ordinary General Meeting of Shareholders ······················································ 1 [Matters for Resolution] Reference Documents 1. To Approve the Proposed Appropriation of Surplus ···················································· 2 2. To Elect 11 Directors ························································································ 3 3. To Elect 3 Audit & Supervisory Board Member ······················································· 21 <Reference>Corporate Framework and Policies ······················································ 29 [Matters for Reporting] Business Report Review of Operations Summary of Operating Results for the Mitsubishi Corporation Group ································ 40 Operating Results and Financial Position ································································· 54 Key Themes for the Mitsubishi Corporation Group ····················································· 56 Efforts toward -

Members of the Board

Management (As of August 7, 2020) Members of the Board Takao Kato Kozo Shiraji Member of the Board Member of the Board Apr. 1984 Joined MMC Apr. 1977 Joined Mitsubishi Corporation Apr. 2002 Manager of the Body Production Engineering Apr. 2009 Senior Vice President, Division COO of Motor Dept., Vehicle Production Division, Vehicle Vehicle Business Div., Mitsubishi Corporation Production Headquarters, MMC Apr. 2013 Executive Vice President, Group CEO of Apr. 2003 Section Manager of the Body Section, Machinery Group, Mitsubishi Corporation Production Dept., Nagoya Plant, MMC Apr. 2016 Senior Executive Officer, Assistant to Apr. 2007 Vice General Manager of Production Dept., President, MMC Nagoya Plant, MMC Jun. 2016 Member of the Board, Executive Vice Aug. 2008 Expert of Production Dept., Nagoya Plant, MMC President (Overseas Operations, Global After Apr. 2009 Expert of the Russian Assembly Business Sales), MMC Promotion Office, MMC Jan. 2017 Member of the Board, Executive Vice Apr. 2010 Senior Expert of the Russian Assembly President (Overseas Operations, Global After Business Promotion Office, MMC Sales), CPO, MMC May 2010 Transferred to PCMA Rus, LLC Apr. 2018 Member of the Board, Assistant CEO, MMC Apr. 2014 Vice Plant General Manager of Nagoya Plant, MMC Jun. 2018 Audit and Supervisory Board Member, MMC Apr. 2015 President, PT Mitsubishi Motors Krama Yudha Jun. 2019 Member of the Board, MMC (to the present) Indonesia Jun. 2019 Member of the Board and Representative Executive Officer, CEO, MMC (to the present) Shunichi Miyanaga Ken Kobayashi Setsuko Egami Outside Director Outside Director Outside Director Apr. 1972 Joined Mitsubishi Heavy Industries, Ltd. July 1971 Joined Mitsubishi Corporation Apr.