2017 Q4 Retail

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kanata Light Rail Transit Planning and Environmental Assessment Study (Moodie Drive to Hazeldean Road) – Recommendations

1 Report to Rapport au: Transportation Committee Comité des transports 2 May 2018 / 2 mai 2018 and Council et au Conseil 9 May 2018 / 9 mai 2018 Submitted on April 17, 2018 Soumis le 17 avril 2018 Submitted by Soumis par: John Manconi, General Manager / Directeur général, Transportation Services Department / Direction générale des transports Contact Person Personne ressource: Vivi Chi, Director / Directeur, Transportation Planning / Planification des transports, Transportation Services Department / Direction générale des transports (613) 580-2424, 21877, [email protected] Ward: KANATA NORTH (4) / KANATA File Number: ACS2018-TSD-PLN-0002 NORD (4) / STITTSVILLE (6) / BAY (7) / BAIE (7) / COLLEGE (8) / COLLÈGE (8) / KANATA SOUTH (23) / KANATA-SUD (23) SUBJECT: Kanata Light Rail Transit Planning and Environmental Assessment Study (Moodie Drive to Hazeldean Road) – Recommendations OBJET: Étude de planification et d’évaluation environnementale du Train léger sur rail proposé vers Kanata (de la promenade Moodie au chemin Hazeldean) – Recommandations 2 REPORT RECOMMENDATIONS That Transportation Committee recommend that Council: 1. Approve the functional design for the Kanata Light Rail Transit (Moodie Drive to Hazeldean Road), as described in this report and supporting documents one and two; and, 2. Direct Transportation Planning staff to initiate the Transit Project Assessment Process in accordance with the Ontario Environmental Assessment Act (Regulation 231/08), including the preparation and filing of the Environmental Project Report for final public review and comment. RECOMMANDATIONS DU RAPPORT Que le Comité des transports recommande au Conseil : 1. d’approuver la conception fonctionnelle du Train léger sur rail vers Kanata (de la promenade Moodie au chemin Hazeldean), comme présentée dans le présent rapport et dans les documents un à deux; et, 2. -

Report Template

1 Report to/Rapport au : Transportation Committee Comité des transports and Council / et au Conseil November 7, 2013 7 novembre 2013 Submitted by/Soumis par : Nancy Schepers, Deputy City Manager/Directrice municipale adjointe, Planning and Infrastructure/Urbanisme et Infrastructure Contact Person / Personne ressource: Vivi Chi, Manager/Gestionnaire, Transportation Planning/Planification des transports, Planning and Growth Management/Urbanisme et Gestion de la croissance (613) 580-2424 x 21877, [email protected] CITY WIDE / À L'ÉCHELLE DE LA VILLE Ref N°: ACS2013-PAI-PGM-0230 SUBJECT: TRANSPORTATION MASTER PLAN, OTTAWA PEDESTRIAN PLAN AND OTTAWA CYCLING PLAN UPDATE – ADDENDUM REPORT OBJET : PLAN DIRECTEUR DES TRANSPORTS, PLAN DE LA CIRCULATION PIÉTONNIÈRE D’OTTAWA ET PLAN SUR LE CYCLISME D’OTTAWA – ADDENDA REPORT RECOMMENDATION That Transportation Committee recommend Council approve the recommended changes identified in this report (Table 1) to the draft Transportation Master Plan, Ottawa Pedestrian Plan and Ottawa Cycling Plan that was tabled on October 9, 2013 at the Joint Transportation Committee and Transit Commission meeting. RECOMMANDATION DU RAPPORT Que le Comité des transports recommande au Conseil d’approuver les modifications recommandées et précisées dans le présent rapport (tableau 1) pour la version provisoire du Plan directeur des transports, le Plan de la circulation piétonnière d’Ottawa et le Plan sur le cyclisme d’Ottawa qui ont été déposé le 9 octobre 2013 lors de la réunion conjointe du Comité des transports et de la Commission du transport en commun. 2 EXECUTIVE SUMMARY Assumptions and Analysis This is an addendum to the October 9, 2013 joint Transportation Committee and Transit Commission staff report (ACS2013-PAI-PGM-0193) to summarize the consultation feedback and proposed changes following the tabling and public release of the draft 2013 Transportation Master Plan (TMP), Ottawa Pedestrian Plan (OPP) and Ottawa Cycling Plan (OCP). -

Report Template

1 Report to/Rapport au : Transportation Committee Comité des transports November 27, 2012 27 novembre 2012 Submitted by/Soumis par : Nancy Schepers, Deputy City Manager/Directrice municipale adjointe, Planning and Infrastructure/Urbanisme et Infrastructure Contact Person / Personne ressource: Bob Streicher, Acting Manager/Gestionnaire par intérim, Transportation Planning/Planification des transports, Planning and Growth Management/Urbanisme et Gestion de la croissance (613) 580-2424 x 22723, [email protected] CITY WIDE / À L’ÉCHELLE DE LA VILLE Ref N°: ACS2012-PAI-PGM-0260 SUBJECT: JOINT STUDY TO ASSESS CUMULATIVE EFFECTS OF TRANSPORTATION INFRASTRUCTURES ON THE NATIONAL CAPITAL GREENBELT – STUDY REPORT OBJET : ÉTUDE CONJOINTE VISANT À ÉVALUER LES EFFETS CUMULATIFS DES INFRASTRUCTURES DE TRANSPORT SUR LA CEINTURE DE VERDURE DE LA CAPITALE NATIONALE – RAPPORT D’ÉTUDE REPORT RECOMMENDATIONS That the Transportation Committee receive this report for information. RECOMMANDATIONS DU RAPPORT Que le Comité des Transports prenne connaissance de ce rapport. BACKGROUND The purpose of this study undertaken in partnership with the National Capital Commission (NCC) was to identify projects within the Transportation Master Plan (TMP) and other transportation projects that have emerged since the completion of the TMP that could have an impact on the environmental integrity of the federal Greenbelt lands. By examining the cumulative effects of the construction of this infrastructure on the Greenbelt lands, a framework now has been established to ensure that the associated Environmental Assessments (EAs) that require federal approval will move forward more expediently. 2 One of the NCC’s mandates is to protect the Greenbelt. Current practice has been that the NCC only comments or provides input on projects that are identified in its Greenbelt Master Plan (GBMP). -

Active Commuting to Star Top

Defence Research and Recherche et de´veloppement Development Canada pour la de´fense Canada CAN UNCLASSIFIED Active commuting to Star Top Some suggestions from scientist-cyclists Matthew R. MacLeod Talia J. Beech Terms of Release: This document is approved for release to Public Release. Further distribution of this document or information contained herein is prohibited without the written approval of Defence Research and Development Canada (DRDC). Defence Research and Development Canada Reference Document DRDC-RDDC-2019-D077 July 2019 CAN UNCLASSIFIED CAN UNCLASSIFIED IMPORTANT INFORMATIVE STATEMENTS This document was reviewed for Controlled Goods by DRDC using the Schedule to the Defence Production Act. Disclaimer: This publication was prepared by Defence Research and Development Canada an agency of the Department of National Defence. The information contained in this publication has been derived and determined through best practice and adherence to the highest standards of responsible conduct of scientific research. This information is intended for the use ofthe Department of National Defence, the Canadian Armed Forces (“Canada") and Public Safety partners and, as permitted, may be shared with academia, industry, Canada’s allies, and the public (“Third Parties"). Any use by, or any reliance on or decisions made based on this publication by Third Parties, are done at their own risk and responsibility. Canada does not assume any liability for any damages or losses which may arise from any use of, or reliance on, the publication. Endorsement statement: This publication has been published by the Editorial Office of Defence Research and Development Canada, an agency of the Department of National Defence of Canada. -

Line by Mileage

Beachburg - by Mileage MileageLocation Date Number Notes 0Hurdman 13/07/1910 11172 CNOR authorized to construct its lines and tracks across the lines and tracks of the GTR near Ottawa in the County of Carleton. CNOR to install a Manganese Steel Diamond, derails and semaphores at the crossing, - the said derails and semaphores to be operated from the tower already located at Rideau Junction. 06/08/1910 11386 Rescinds 11172. CNOR authorized to construct its lines and tracks across the lines and tracks of the GTR and CPR near Ottawa in the County of Carleton. CNOR to install a Manganese Steel Diamond, derails and semaphores at the crossing, - the said derails and semaphores to be operated from the tower already located at Rideau Junction. This is the same as 11172 except for the additional reference to CPR. 04/12/1911 15544 CNOR authorized to operate construction trains across the CPR at St. Lawrence and Ottawa Junction on the east side of the Rideau River. This shall be a temporary measure until 25 Dec 1911 only. All trains to be brought to a full stop and flagged over the crossing by a watchman appointed by the CPR and paid for by the CNOR. 10/12/1911 15638 Time for installation of interlocking authorized by 11386 extended to 1 June 1912. 03/05/1912 16451 CNOR to bear the cost of changes to the interlocking plant and that the cost of operating and maintaining the interlocking plant be divided equally between the NY&O, CPR, GTR and CNOR. 31/05/1912 16656 Time for installation of permanent interlocking plant extended until 1 Oct. -

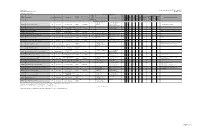

Confederation Line Structures Geometric Structural Requirements Scope of Work Bridge Rehabilitation3 5

City of Ottawa Project Agreement - Schedule 15-2 Part 2 - Appendix E Confederation Line Extension Project Execution Version Confederation Line Structures Geometric Structural Requirements Scope of Work Bridge Rehabilitation3 5 Structure Structure Minimum Vertical Aesthetic 4 Structure Name NMI or SI Relevant Authority Structure Type Additional Comments/Requirements Number Conveyance Clearance Exceptions1,2 Level and Cross Section to Accommodate Structure to Span Over OCS Install Fence Replace Security Classification Removal Requires Crack Crack Patch Patch Concrete Structural Evaluation Repairs Repairs Replace Bearings Install Crash Concrete Concrete Concrete Construction Architectural Walls at Piers New Design & Accommodate Confederation Line East Structures • Existing Blair Road • EB & WB Track Alignment configuration • Emergency walkways SN226780 Blair Road Bridge over Transitway NMI City of Ottawa Concrete Rigid Frame Roadway No Exceptions - X X X X • Replace longitudinal seal in median. • Future Cumberland Transitway Post-tensioned Voided • Existing Ramp configuration • EB & WB Track Alignment SN226790 Blair Road E-NS Ramp NMI City of Ottawa Roadway No Exceptions - X X X X X Concrete Slab • Emergency walkways Post-tensioned Voided - - SN224880 Transitway Bridge over OR174 - City of Ottawa Transitway - - X Includes the removal of culverts A224636 and A224635 Concrete Slab • EB & WB track Alignment • Future widening of OR174 WB SN224980 Montreal Road Flyover SI City of Ottawa New Elevated Guideway Railway No Exceptions 1 - High X • -

NCC Land Designations.Pdf

NATIONAL CAPITAL COMMISION DESIGNATIONS GREENBELT, PARKS, TRAILS AND PATHWAYS A partial list of the NCC Greenbelt areas, parks, trails and pathways and their designations is below. More information regarding NCC lands and their designations is available by following the links provided after the list. Whether walking in public or on private property, all dog owners should be familiar with all laws, bylaws and regulations pertaining to their dogs, including the National Capital Commission Domestic Animal Regulations, the Ottawa’s Animal Care and Control Bylaws and Ontario’s Dog Owner Liability Act (2005). Owners of dogs that are restricted under the Provincial Dog Owners’ Liability Act should also be familiar with the new Pit Bull Controls. Dog owners have a legal and moral obligation to keep their dogs under control at all times for the safety of the public, other animals, and their own dogs. NATIONAL CAPITAL COMMISSION LANDS GREENBELT RECREATONAL ADDRESS OR LOCATION DESIGNATION PATHWAYS AND TRAILS BEAVER TRAIL AND Moodie Drive (P8) NO DOGS ALLOWED CHIMPMUNK TRAILS Cedarview Road (between Hunt BRUCE PIT LEASH FREE * Club and Baseline Road) Conroy Road (south of Hunt Club CONROY PIT LEASH FREE * Road) DEWBERRY TRAIL Dolman Ridge Road (P20) NO DOGS ALLOWED JACK PINE TRIAL Moodie Drive (P9) NO DOGS ALLOWED GATINEAU PARK (MOST TRAILS) Gatineau Park, Quebec DOGS ON LEASH * * South from Watts Creek Pathway to Robertson Road South from Shirleys Bay to Watts GREENBELT PATHWAY (TRANS Creek pathway DOGS ON LEASH * CANADA TRAIL) South of the Ottawa -

590 Hazeldean Road Ottawa, on Transportation Impact Study Richcraft Homes

590 Hazeldean Road Ottawa, ON Transportation Impact Study Richcraft Homes Prepared By: Stantec Consulting Ltd. September 2013 590 HAZELDEAN ROAD, OTTAWA, ON TRANSPORTATION IMPACT ASSESSMENT SEPTEMBER 2013 TIA GUIDELINES CHECKLIST – TRANSPORTATION IMPACT STUDY Report Context ☒ Municipal Address Comment: Section 1.1 ☒ Location relative to major elements of the existing transportation system Comment: Section 1.3 ☒ Existing land uses or permitted use provisions in the Official Plan, Zoning By-Law, etc. Comment: Section 1.3. ☒ Proposed land uses and relevant planning regulations to be used in the analysis Comment: Secion 1.3 ☒ Proposed development size (building size, number of residential units, etc.) and location on site Comment: Section 1.3 ☒ Estimated date of occupancy Comment: Section 1.4 ☒ Planned phasing of development Comment: Section 1.4 ________________________ ☐ Proposed number of parking spaces (not relevant for Draft Plans of Subdivision) Comment: N/A – Draft Plan of Subdivision ☒ Proposed Access points and type of access (full turns, right-in/right-out, turning restrictions, etc.) Comment: Figure 13, Figure 14, Figure 15, Figure 16 ☒ Study area Comment: Figure 1 ☒ Time periods and phasing Comment: Section 1.4 ☒ Horizon years (including reference to phased development) Comment: Section 1.4 Existing Conditions ☒ Existing roads, ramps in the study area, including jurisdiction, classification, number of lanes and posted speed limit Comment: Section 2.1 _______ ☒ Existing intersections, indicating type of control, lane configurations, -

Project Description for the Canadian Environmental Assessment Registry

AECOM Delcan Future Interprovincial Crossings in the National Capital Region Environmental Assessment Study Project Description for the Canadian Environmental Assessment Registry NCC File No : SC2050 AECOM Delcan Ref : 05-19680 January 2010 AECOM Delcan This report has been prepared by the following personnel of AECOM Delcan: 14 January 2010 Valerie McGirr, P. Eng. Tomasz Wlodarczyk, M.E.S. Catherine Parker, B.Soc. Sc. 14 January 2010 Patrick G. Déoux, MCIP, OUQ, RPP Distribution 1 pdf NCC/CCN Project folder Project Description for the Canadian Environmental Assessment Registry, Future Interprovincial Crossings in the National Capital Region iii Ref : 05-19680 AECOM Delcan Table of Contents page 1. Introduction ............................................................................................... 1 1.1 Purpose of This Document ..................................................................................... 6 1.2 Proponents .............................................................................................................. 6 1.2.1 Contact Information .................................................................................... 6 2. Environmental Assessment and Approvals ........................................... 7 2.1 Provincial and Municipal Permits ............................................................................ 7 2.2 Federal Permits and Authorizations ........................................................................ 7 2.3 Federal-Provincial Financial Support to the EA study ........................................... -

South, East & West

South, East & West About Stage 2 LRT ASTURE MARCH YVIEW RIDEAU uOttawa Y YON ARLIAMENT SOLANDT Y DOMINIONWESTBOROTUNNEY’S P PIMISI L BA P RENT Stage 2 LRT is a package of three U RIDEAU . LA -LAURENTST LEES MONTREAL CLEAR SCOTT TREMBLA ST CYRVILLE BLAIR MONTREAL JEANNE D’ARCPROM D’ORLÉANSPLACE D’ORLÉANS TRIM NEW ORCHARD ELGI extensions – south, east and west LINCOLN FIELDS MCARTHUR CARLING N 174 YSHORE Y FOX ESTON PR MOODIE BA M I HOLLAND OGILVIE – totalling 44 kilometres of new rail KIRKWOOD CARLING TR TERR MAIN NE 417 BANK I RICHMOND RONSON B R and 24 new LRT stations. Stage 2 AI TENTH L GLADSTONE 417 BL SMYT INNES H will bring 77% of residents within BASELINE CARLING ER HURDMAN ROBERTSON 417 EAGLESON IRIS ISH 416 F TERRY FOX HE RO N MEADOWLANDS CARLETON five kilometres of rail. That means Y WALKLEY PINECREST NAVAN QUEENSVIEW MOODIE GREENBORO E shorter commutes, cleaner air, and EAGLESON WEST HUNT CLUB O-Train System K ERSON VERSID D BASELINE I R SOUTH KEYS AN LKLEY HUNT CLUB MOONEY’S BA Confederation Line a stronger economy. GREENBAN WA WOODROFFE MERIVALE Trillium Line CEDARVIEW FALLOWFIELD LBION CONROY RUSSELL A FALLOWFIELD ILLE Stage 2 will launch V Trillium Line Extension MSAY MARKETPLACE AWTHORNE UPLANDS RA 417 416 T H Confederation Line Extension East E OF RIVER C ES LEITRIM in staggered openings: PRIN WAL LEITRIM LEITRIM AIRPOR Confederation Line Extension West • Trillium Line South in 2022 LIMEBANK EARL ARMSTRONG Bus Rapid Transit EARL ARMSTRONG/ BOWESVILLE • Confederation Line East in 2024 • Confederation Line West in 2025 Stage 2 will expand the O-Train network as far east as Trim Road, and as far west as Moodie Drive and Algonquin College. -

979 Richmond Road Ottawa, Ontario

FOR SALE TRANSIT ORIENTED DEVELOPMENT OPPORTUNITY 979 RICHMOND ROAD OTTAWA, ONTARIO NEW ORCHARD LRT STATION 979 RICHMOND ROAD *Oultine Not To Scale 979 RICHMOND ROAD | OTTAWA, ONTARIO | OTTAWA, 979 RICHMOND ROAD CBRE | MARKETING FLYER THE OPPORTUNITY NEIGHBOURHOOD CONTEXT CBRE Limited (“CBRE” or the “Advisor”) has been retained by the Vendor to act as its exclusive advisor to The Property is uniquely located in Ottawa West between the residential communities of Woodpark, Westboro facilitate the sale of 979 Richmond Road, Ottawa, Ontario (the “Property”). and Woodroffe North, along the main arterial street of Richmond Road. The Property is being sold on an as-is basis, as offers are received, at an asking price of $8,999,997. The surrounding area currently offers a broad range of uses, which include; single family homes, high-rise residential buildings, car dealerships, various types of retail and abundant greenspace. Situated 120 meters from the Stage 2 New Orchard Light Rail Transit Station, the Property has benefited from the Cleary – New Orchard secondary planning study and resulting policy that supports increased Immediately to the east of the Property is Ottawa Honda, an established full service car dealership. East of height and density (Aug 1, 2018). Ottawa Honda is a 9-storey rental apartment building and The Azure, a 20 storey rental apartment development. This urban infill Property is located between the mature neighborhoods of Woodpark and Woodroofe North. The northern boundary of the Property is the National Capital Commission Sir John A. Parkway lands, Located immediately west of the site is a standalone drive-thru Tim Horton’s, who have recently extended providing immediate access to multi-use pathways, greenspaces and the Ottawa River. -

Ottawa (Canada) 2001

2001 Census Analysis The Jewish Community of Ottawa Part 3 The Jewish Elderly By Charles Shahar UIA Federations Canada would like to thank the following members of the 2001 Census Analysis “Professional Advisory Committee” for their expert assistance throughout this project. Their technical and conceptual knowledge was an invaluable resource for the researchers involved in this effort. Dr. Jonathan Berkowitz, Vancouver, BC Dr. Jay Brodbar, Toronto, ON Prof. Leo Davids, Toronto, ON Mr. Colin Geitzler, Aylmer, QC Ms. Jean Gerber, Vancouver, BC Dr. Gustave Goldmann, Ottawa, ON Dr. Jack Jedwab, Montreal, QC Prof. Marty Lockshin, Toronto, ON Mr. Greg Mason, Winnipeg, MB Dr. Sheva Medjuck, Halifax, NS Prof. Allan Moscovitch, Ottawa, ON Prof. Morton Weinfeld, Montreal, QC Dr. Morty Yalovsky, Montreal, QC UIA Federations Canada would also like to thank Réal Lortie and Marc Pagé of Statistics Canada for their expertise and meticulous attention to detail. The researchers would like to express appreciation to Mitchell Bellman for contributing his knowledge and insights regarding the Ottawa Jewish community. Without his input this report would not be possible. Finally, a special acknowledgment is extended to Lioudmila Medvedtchenko for her diligent work in the extraction and verification of statistical data. All data in this report are adapted from: Statistics Canada, special order tabulations for UIA Federations Canada. Highlights of Results • There are 1,575 Jewish elderly 65+ years residing in the Ottawa CMA. Seniors comprise 11.7% of the 13,420 members of the Jewish community here. There are 780 Jews 75+ years, comprising 5.8% of Ottawa’s Jewish population. These figures do not include Jewish seniors living in institutions.