RENTAL MARKET REPORT Calgary CMA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

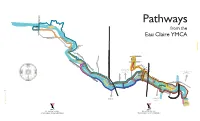

ECY Running Map:Layout 1.Qxd

Pathways from the Eau Claire YMCA GOING EAST 13. EDWORTHY PARK LOOP (15.1 km): Head west on the South side of the river beyond the CPR Rail 1. LANGEVIN LOOP (3.5 km): Go East on the South side of the river, past Centre Street underpass. way Crossing at Edworthy Park. Cross Edworthy Bridge to the North side of the river and head East. Cross over at the Langevin Bridge and head West. Return via Prince’s Island Bridge. Return to the South side via Prince’s Island Bridge. 2. SHORT ZOO (6.1 km): Go East on the South side of the river past Langevin Bridge to St George’s 14. SHOULDICE BRIDGE (20.4 km): Cross Prince’s Island Bridge to the North side of the river and head Island footbridge. Cross to the North side via Baines Bridge. Return on the North side heading West West to Shouldice Bridge at Bowness Road. Return the same way heading East. via Prince’s Island Bridge. 15. BOWNESS PARK via BOW CRESCENT (32.4 km): Follow North side of river going West from 3. LONG ZOO (7.6 km): Go East on the South side of the river over 9th Avenue Bridge. Travel through Prince’s Island to Bowness Road. Cross over Shouldice Bridge. Follow Bow Crescent, 70th Street, and the zoo to Baines Bridge. Return heading west on the North side of the river, crossing back via 48th Avenue to Bowness Park. Make loop of paved road (West) and return to YMCA same way. pathway around zoo and returning through Prince’s Island. -

Deerfoot Trail Study December 2020 Contents

Deerfoot Trail Study December 2020 Contents Background and Fast Facts ...............................................04 Study Goals, Objectives and Outcomes .......................06 Study Phases and Timeline ...............................................08 Identifying Challenges .......................................................12 What We Heard, What We Did ..........................................14 Developing Improvement Options................................18 Option Packages ...................................................................20 Option Evaluation ................................................................32 Recommended Improvements .......................................36 A Phased Approach for Implementation .....................44 Next Steps ...............................................................................52 2 The City of Calgary & Alberta Transportation | Deerfoot Trail Study Introduction The City of Calgary and Alberta Transportation In addition to describing the recommended are pleased to present the final recommendations improvements to the Deerfoot Trail corridor, this of the Deerfoot Trail Study. document provides a general overview of the study The principal role of the Deerfoot Trail within The process which involved a comprehensive technical City of Calgary is to provide an efficient, reliable, and program and multiple engagement events with safe connection for motor vehicle traffic and goods key stakeholders and city residents. movement within, to, and from the city. These key -

17 Ave. SE Corridor Study

Welcome to the 17 Avenue S.E. Corridor Study Open House Ask us about the study! Our team will be happy to talk with you about it. It will take about 10 minutes. You can also provide input at calgary.ca/17avestudy. calgary.ca/17avestudy | contact 311 17 Ave. S.E. Corridor Study Project(Stoney Trail to purposeEast City Limit) & goals The City is conductingTitle or headline a Myriad transportation Pro Light 60 ptStudy study Area on 17 Avenue S.E., between Stoney Trail andTitle the subhead east Myriad Pro city Light 48 limit pt (116 Street S.E.), to identify what the road will look like in the17 Ave. next S.E. 10-30 Corridor years. Study (Stoney Trail to East City Limit) Stoney Trail SE Trail Stoney 1 16 Street SE 1 16 Street 100 Street SE 100 Street 52 Street SE 52 Street Header and footer will have SE 68 Street 0.25” of bleed all the way around. SE 84 Street Title or headline Myriad Pro Light 60 pt Title subhead Myriad Pro Light 48 pt 17 Avenue SE Header and footer will have 0.25” of bleed all the way around. Study Area Urban Boulevard Parkway Deerfoot-Stoney Study Area Calgary City Limit Chestermere Study Area 17calgary.ca/17avestudycalgary.ca Avenue | contact 311 S.E. provides an important regional connection between Calgary and Chestermere. It is also identified in the Calgary Transportationcalgary.ca | contact 311 Plan as part of the Primary Transit and Primary Cycling Networks. Outcome: The study will result in a staged concept plan (short-, medium- and long-term) for all transportation modes (walking, cycling, taking transit and driving). -

Macleod Trail Corridor Study TT2015-0183 Information Brochure ATTACHMENT 2

Macleod Trail Corridor Study TT2015-0183 Information Brochure ATTACHMENT 2 MACLEOD TRAIL CORRIDOR STUDY A balanced approach to transportation planning 2015-0626 calgary.ca | contact 311 Onward/ Providing more travel choices helps to improve overall mobility in Calgary’s transportation system. TT2015-0183 Macleod Trail Corridor Study - Att 2.pdf Page 1 of 12 ISC: Unrestricted Macleod Trail Corridor Study Information Brochure 100 YEARS OF MACLEOD TRAIL: PAST, PRESENT, FUTURE Photo of Macleod Trail circa 1970. The City of Calgary, Corporate Records, Archives. Photo of Macleod Trail circa 2005. The City of Calgary, Corporate Records, Archives. Macleod Trail, as we know it today, has remained much the same since the 1960’s. It was, and continues to be, characterized by low-rise buildings accompanied by paved parking lots and poor infrastructure for pedestrians. The development of low-density land use and long distances between destinations or areas of interest has encouraged driving as the primary way for people to get to and from key destinations along Macleod Trail. What will Macleod Trail look like Because people will be living within walking or cycling distances to businesses and major activity centres over the next 50 years? (e.g. shopping centres), there will be a need for quality Many of the older buildings along Macleod Trail are sidewalks, bikeways, and green spaces that help enhance approaching the end of their lifecycle. Now is an safety of road users and improve the overall streetscape. opportune time to put in place conditions that will help guide a different type of land use and development along PEOPLE WILL HAVE ACCESS TO SAFE, Macleod Trail for the next 50 years. -

Stand Alone Office Building for Lease 431 - 58Th Avenue Se, Calgary, Ab

STAND ALONE OFFICE BUILDING FOR LEASE 431 - 58TH AVENUE SE, CALGARY, AB N 4 Street SE P P 58 Avenue SE Dining Major Public Transit Services Thoroughfares Accessibility Petro Canada Subway 58th Avenue SE Serviced by Bus Wholesale Foods Tim Hortons Blackfoot Trail Routes: 66, 72, 73 TD Canada Trust Wendy’s Macleod Trail Oriental Phoenix RBC Royal Bank Gaucho 7-Eleven Alexi Olcheski, Principal Paul McKay, Vice President Eric Demaere, Associate 403.232.4332 587.293.3365 587.293.3366 [email protected] [email protected] [email protected] © 2018 Avison Young Real Estate Alberta Inc. All rights reserved. E. & O.E.: The information contained herein was obtained from sources which we deem reliable and, while thought to be correct, is not guaranteed by Avison Young. 431 - 58TH AVENUE SE, CALGARY, AB Particulars estled on 58th Avenue SE between the major Available Space: 5,048 SF (Demisable) Nthouroughfares of Blackfoot Trail and Macleod Trail, this rare stand alone office space is a one-of-a Demising A. 1,528 SF kind opportunity for various tenants. Whether the Options: B. 2,099 SF use is medical or business, this space is guaranteed to be the perfect location to build and expand your C. 2,949 SF business. Within a 3 km radius, the 2017 daytime D. 3,520 SF population was 58,467, with 24,000 vehicles per day (VPD) on 58th Avenue SE and 57,000 VPD on Rental Rates: Market Blackfoot Trail SE. Op. Costs: $12.76 PSF (2018 est.) Zoning: I-G (Industrial-General) Occupancy: 30 days Term: 5 - 10 years Highlights - Located on the southwest corner of 58th Avenue and 4th Street SE - Minutes away from Chinook Centre, Calgary’s largest enclosed mall (1.2M GLA) - 23 surface parking stalls at the rear of the property - High quality interior finishes - Features include showers, washing machine, and dryer Alexi Olcheski, Principal Paul McKay, Vice President Eric Demaere, Associate 403.232.4332 587.293.3365 587.293.3366 [email protected] [email protected] [email protected] © 2018 Avison Young Real Estate Alberta Inc. -

3200, 17Th Avenue SE Calgary, Alberta

FOR LEASE Multiple CRU’s 500 ± sf - 10,000 ± sf 3012 - 3200, 17th Avenue SE Calgary, Alberta Property Features Prime retail units available immediately in the vibrant business district of 17th Avenue Tenant mix includes TD Canada Trust, Shopper’s Drug Mart, Mac’s, Co-op Liqour, Salvation Army, Aaron’s Furniture, Forest Lawn Medical Clinics and, many more Ample on-site customer parking with easy access and egress Minutes to the Calgary Downtown Core and Deerfoot Trail as well as 10 minutes away form the Calgary International Airport Largest multi-tenant shopping centre in this trade area with access to over 42,000 vehicles per day (2016), via 17th avenue Please contact agents for more information Brian West, Senior Associate 833 34 Avenue SE [email protected] Calgary AB, T2G 4Y9 (403) 984.6303 Barlow Trail SE Barlow Trail FOR LEASE Multiple CRU’s 500 ± sf - 10,000 ± sf Deerfoot Trail 17 Ave SE 16 Avenue SE 28 Street SE 17 Avenue SE 17 Avenue SE Property Details District: Forest Lawn Term: 5 -10 Years Zoning: C-C2 Signage: Fascia & Pylon Op Costs: $10.76 (Est. 2017) Traffic Count: 42,000 VPD (17th Avenue) Net Rent: Market Availability: Immediately Parking: 400 Stalls (Ample Parking) Brian West, Senior Associate 833 34 Avenue SE [email protected] Calgary AB, T2G 4Y9 (403) 984.6303 FOR LEASE Multiple CRU’s 500Site ± sf - Plan10,000 ± sf Unit 21 H & I Dr. Yoshida Dr. Unit 21 C-6&5 Unit 4 & 5 Unit 11 Unit 2 V&T Meats Dr. Lukenchuk Dr. Future Nails Future Chicago Pizza Momma Jeans TopTreme Hair TopTreme Unit 21 Food & Spice Nature’s A & -

Leasing Opportunity 88% Occupied 1000 Sf

LEASING OPPORTUNITY 88% OCCUPIED 1,000 S.F. — 2,800 S.F. OF MEDICAL OFFICE SPACE AVAILABLE 1 2 OVERVIEW D&P Commercial Group is a private real estate investor, developer, owner, and manager that specializes in destination medical facilities. Founded by physicians, we understand the unique requirements of our tenants (healthcare providers) and their patrons (patients). An experienced team and network of trusted partners ensures that global trends are combined with local needs to create sustainable properties that make lasting contributions to the overall health and wellness of people and communities. From inception to operation, D&P Commercial Group’s goal for each project remains steadfast: provide tenants (healthcare providers) the best opportunity to run successful practices and give every patron (patient) the optimal environment for healing. With this in mind, novel concepts and high-quality materials are used to build state-of-the-art destination medical facilities with iconic architecture, modern design, cutting-edge technology, environmentally-friendly features, and efficient flow. In addition, we take great pride in strategic planning, meticulous attention to detail, and timely execution before and during construction as well as proactive and responsible management after completion. Meadows Mile Professional Building—the first in a series of projects by D&P Commercial Group—is located in the thriving southeast quadrant of Calgary, Alberta, Canada. Brilliantly situated along a major thoroughfare and in close proximity to a unique blend of residential, retail, and industrial areas, this site has high visibility and easy accessibility. With visually stunning and fully integrated spaces, Meadows Mile Professional Building is the true confluence of form and function, enabling a positive and seamless experience for tenants (healthcare providers) and patrons (patients) alike. -

Unit 17, 18 & 19, 3012

FOR LEASE Retail Unit Commercial Real Estate Services, Worldwide. 916 SF & 1,662 SF Unit 17, 18 & 19, 3012 - 17th Avenue SE Calgary, Alberta Property Features CONTACT AGENTS • 916 sf and 1,662 sf retail unit available immediately FOR MORE INFORMATION • Tenant mix includes TD Canada Trust, Shopper’s Drug Mart, Mac’s, Co-op Liqour, Salvation Army, Aaron’s, Forest Lawn Brian West Medical Clinics and, many more +1 403 630 7881 +1 403 984 6303 • Excellent location with exposure for retail users, just minutes [email protected] from Deerfoot Trail and the Calgary Downtown Core Matt Johnson • Minutes to the Calgary Downtown Core and Deerfoot Trail +1 403 604 3110 and 10 minutes to the Calgary International Airport +1 403 984 9801 [email protected] • Largest multi-tenant shopping centre in this trade area with access to over 28,000 vehicles per day, via 17th avenue • Available immediately THIS BROCHURE IS INTENDED FOR INFORMATION PURPOSES ONLY AND SHOULD NOT BE RELIED UPON FOR ACCURATE FACTUAL INFORMATION BY THE RECIPIENTS HEREOF. THE INFORMATION CONTAINED HEREIN 833 34th Avenue SE IS BASED ON INFORMATION WHICH NAI ADVENT DEEMS RELIABLE, HOWEVER, NAI ADVENT ASSUMES NO RESPONSIBILITY FOR THE DEGREE OF ACCURACY OF SUCH INFORMATION, NOR DOES NAI ADVENT Calgary, Alberta T2G 4Y9 REPRESENT OR WARRANT THE INFORMATION CONTAINED HEREIN. RECIPIENTS HEREOF SHOULD CONDUCT +1 403 984 9800 THEIR OWN INVESTIGATIONS TO DETERMINE THE ACCURACY OF INFORMATION CONTAINED HEREIN. THE INFORMATION CONTAINED HEREIN IS SUBJECT TO CHANGE WITHOUT NOTICE. A LICENSED ASSOCIATE OF naiadvent.com NAI ADVENT IS A PRINCIPAL OF THE OWNER OF THE PROPERTY. -

Dragon City Mall

FOR SALE > Dragon City Mall #202, 328 Centre Street SE, PROPERTY HIGHLIGHTS Calgary, AB > 3 storey office / retail condominium LEIGH KIRNBAUER > Centrally located on the corner of Centre Street 403 298 0408 and 4th Avenue [email protected] > Within 3 blocks of the LRT line > +15 connection across the street in F1RST Tower COLLIERS INTERNATIONAL or Asia Pacific Centre Royal Bank Building, Suite 900 335, 8th Avenue SW, Calgary, AB > Second floor unit (202) available consisting of 403 266 5544 1,476 square feet www.collierscanada.com FOR SALE > #202, 328 Centre Street SE SITE BUILDING DESCRIPTION > 328 Centre Street SE > Legal Description: Condominimum Plan 9711528, Units 31, 32 and 33 > 83,486 square feet total square feet > 27,829 square foot floorplate > 3 storeys BUILDING AMENITIES > 97 underground parking stalls in the building available on a hourly, daily or monthly basis > Numerous services and retailers in the building and immediate area UNIT DETAILS > Second floor unit (202) available consisting of 1,476 square feet > Layout consists of 2 offices, server room, kitchen, washroom and open area for approximately 12 - 14 workstations > Utilities separately metered (approximately $225 per month) > 2015 property taxes $5,145.41 or $429 per month > 2015 condo fees $1,422.75 per month LISTING PRICE $349,000 FOR SALE > #202, 328 Centre Street SE SITE PLAN CENTRE STREET SUITE 202 - 1,476 SQUARE FEET CONDO FINANCIAL - OWN VS LEASE Owning Scenario Leasing Scenario Total SF 1,476 Total SF 1476 Price per SF $236.45 Lease Term 5 years Purchase Price $349,000 Annual Rate Per SF $15.00 Down Payment $104,700 Annual Lease Cost $22,140.00 Mortgage Amount $244,300 Net Savings on Own vs. -

CCAA Creditors List

ROSEBUD CREEK FINANCIAL CORP. AND 957855 ALBERTA LTD. Preliminary list of creditors as at June 17, 2020 as submitted by Rosebud Creek Financial Corp. and 957855 Alberta Ltd., (Unaudited) Creditor Address Amount due (CDN$)* #1 CONVENIENCE 924 EDMONTON TRAIL N.E. CALGARY AB T2E 3J9 3,306.39 #1 CONVENIENCE STORE 1 - 10015 OAKFIELD DR.S.W. CALGARY AB T2V 1S9 313.20 1178160 ALBERTA LTD. DEALER #3424 15416 BEAUMARIS ROAD EDMONTON AB T5X 4C1 1,364.04 12TH AVENUE PHARMACY 529 1192 - 101ST STREET NORTH BATTLEFORD SK S9A 0Z6 1,017.80 21 VARIETY BOX 729 PETROLIA ONN0N 1R0 1,498.12 2867-8118 QC INC (PJC 06 501 MONT ROYAL EST MONTREAL QC H2J 1W6 191.53 329985 ONTARIO LIMITED o/a KISKO PRODUCTS 50 ROYAL GROUP CRES, Unit 1 WOODBRIDGE ON L4H 1X9 44,357.47 3RD AVENUE MARKET 148 - 3 AVENUE WEST BOX 2382 MELVILLE SK S0A 2P0 613.72 407 ETR PO BOX 407, STN D SCARBOROUGH ONM1R 5J8 1,224.96 5 CORNERS CONVENIENCE 176 THE QUEENSWAY SOUTH KESWICK ON L4P 2A4 1,077.00 649 MEGA CONVENIENCE 5651 STEELES AVE E, UNIT 22 SCARBOROUGH ON M1V 5P6 853.72 7-ELEVEN CANADA INC 13450 102ND AVE, SUITE 2400 SURREY BC V3T 5X5 1,602.73 881 CORNER GAS BOX 360, 67165 LAKELAND DR LAC LA BICHE AB T0A 2C0 1,700.24 9334-3580 QUEBE 289 BOUL ST-JEAN POINTE CLAIRE QC H9R 3J1 15,964.29 957855 ALBERTA LTD. 120 SINNOTT ROAD SCARBOROUGH ON M1L 4N1 1,000,000.00 9666753 CANADA CORP. -

Report to Council from Calgary Planning Commission

CALGARY PLANNING COMMISSION ISC: UNRESTRICTED REPORT TO COUNCIL CPC2016-238 2016 SEPTEMBER 12 LOC2016-0072 Page 1 of 8 LAND USE AMENDMENT SOUTHVIEW (WARD 10 ) 34 STREET SE SOUTH OF 17 AVENUE SE BYLAW 239D2016 MAP 9E EXECUTIVE SUMMARY This land use application proposes redesignation of a parcel located in the Community of Southview from DC Direct Control District to Commercial – Corridor 1 (C-COR1 f2.5 h16) District. As per applicant’s submission, the redesignation is to allow for a four storey mixed-use development that includes commercial at grade and residential above. PREVIOUS COUNCIL DIRECTION None. ADM INISTRATION RECOMMENDATION(S ) 2016 July 28 That Calgary Planning Commission recommends APPROVAL of the proposed Land Use Amendment. RECOMMENDATION(S) OF THE CALGARY PLANNING COMMISSION That Council hold a Public Hearing on Bylaw 239D2016; and 1. ADOPT the proposed redesignation of 0.06 hectares ± (0.14 acres ±) located at 1804 – 34 Street SE (Plan 5682GI, Block 2, Lot 19) from DC Direct Control District to Commercial – Corridor 1f2.5h16 (C-COR1f2.5h16) District, in accordance with Administration’s recommendation; and 2. Give three readings to the proposed Bylaw 239D2016 REASON(S) FOR RECOMMENDATION: The proposed redesignation is in alignment with the Municipal Development Plan policies related to Established Developed Residential and Urban Corridors. It also supports the Main Streets project’s vision for the area. ATTACHMENT 1. Proposed Bylaw 239D2016 L. Burga Ghersi CALGARY PLANNING COMMISSION ISC: UNRESTRICTED REPORT TO COUNCIL CPC2016-238 2016 SEPTEMBER 12 LOC2016-0072 Page 2 of 8 LAND USE AMENDMENT SOUTHVIEW (WARD 10 ) 34 STREET SE SOUTH OF 17 AVENUE SE BYLAW 239D2016 MAP 9E LOCATION MAPS L. -

Notice of Hearing

Notice of Hearing Proceeding ID No. 234 South Calgary 69-kV Transmission Upgrade Application No. 1604960 Alberta Electric System Operator Needs Identification Document Application Application No. 1604977 AltaLink Management Ltd. Facility Application – Alter Transmission Line 832L Application No. 1604978 ENMAX Power Corporation Facility Application – Phase 1 Application No. 1606127 ENMAX Power Corporation Facility Application – Phase 2 Application No. 1606901 ENMAX Power Corporation Facility Application – Phase 3 The Alberta Utilities Commission (AUC or the Commission) is a quasi-judicial regulatory body responsible for making decisions about utility-related applications, such as building transmission lines, substations and power plants. The AUC is also responsible for making decisions about the need for some transmission system developments, including the need for new or rebuilt transmission lines and substations. Alberta Electric System Operator (AESO) Application No. 1604960 - Needs identification document (NID) The AESO, responsible for planning electric facility development in Alberta, applied to the AUC for approval of the need for new transmission development in the areas identified in the maps attached. This NID application (or needs application) deals with the need to upgrade the south Calgary 69-kilovolt (kV) transmission system to a 138-kV transmission system (the project). The NID does not include the siting and construction of the facilities. In Application No. 1604960, the AESO states that there is a need to upgrade the south Calgary 69-kV transmission system which extends from ENMAX No. 28 substation located at the corner of Glenmore Trail and Sarcee Trail in the southwest quadrant of Calgary to ENMAX No. 23 - 2 - substation located at 49 Avenue and 24 Street in the southeast quadrant of Calgary.