Incentivised Switching Scheme (Second Window) Application Process

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Banks List (May 2011)

LIST OF BANKS AS COMPILED BY THE FSA ON 31 MAY 2011 This list of banks is intended to be used solely as a guide. The FSA does not warrant, nor accept any responsibility for the accuracy or completeness of the list or for any loss which may arise from reliance by any person on information in the list. (Amendments to the List of Banks since 30 April 2011 can be found on page 6) Banks incorporated in the United Kingdom Abbey National Treasury Services plc DB UK Bank Limited ABC International Bank plc Dunbar Bank plc Access Bank UK Limited, The Duncan Lawrie Ltd Adam & Company plc Ahli United Bank (UK) plc EFG Private Bank Ltd Airdrie Savings Bank Egg Banking plc Aldermore Bank Plc European Islamic Investment Bank Plc Alliance & Leicester plc Europe Arab Bank Plc Alliance Trust Savings Ltd Allied Bank Philippines (UK) plc FBN Bank (UK) Ltd Allied Irish Bank (GB)/First Trust Bank - (AIB Group (UK) plc) FCE Bank plc Alpha Bank London Ltd FIBI Bank (UK) plc AMC Bank Ltd Anglo-Romanian Bank Ltd Gatehouse Bank plc Ansbacher & Co Ltd Ghana International Bank plc ANZ Bank (Europe) Ltd Goldman Sachs International Bank Arbuthnot Latham & Co, Ltd Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Ltd Banc of America Securities Ltd Bank Leumi (UK) plc Habib Allied International Bank plc Bank Mandiri (Europe) Ltd Habibsons Bank Ltd Bank of Beirut (UK) Ltd Hampshire Trust plc Bank of Ceylon (UK) Ltd Harrods Bank Ltd Bank of China (UK) Limited Havin Bank Ltd Bank of Ireland (UK) Plc HFC Bank Ltd Bank of London and The Middle East plc HSBC Bank -

Reference Banks / Finance Address

Reference Banks / Finance Address B/F2 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F262 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F57 Abbey National Treasury Services Abbey House Baker Street LONDON NW1 6XL B/F168 ABN Amro Bank 199 Bishopsgate LONDON EC2M 3TY B/F331 ABSA Bank Ltd 52/54 Gracechurch Street LONDON EC3V 0EH B/F175 Adam & Company Plc 22 Charlotte Square EDINBURGH EH2 4DF B/F313 Adam & Company Plc 42 Pall Mall LONDON SW1Y 5JG B/F263 Afghan National Credit & Finance Ltd New Roman House 10 East Road LONDON N1 6AD B/F180 African Continental Bank Plc 24/28 Moorgate LONDON EC2R 6DJ B/F289 Agricultural Mortgage Corporation (AMC) AMC House Chantry Street ANDOVER Hampshire SP10 1DE B/F147 AIB Capital Markets Plc 12 Old Jewry LONDON EC2 B/F290 Alliance & Leicester Commercial Lending Girobank Bootle Centre Bridal Road BOOTLE Merseyside GIR 0AA B/F67 Alliance & Leicester Plc Carlton Park NARBOROUGH LE9 5XX B/F264 Alliance & Leicester plc 49 Park Lane LONDON W1Y 4EQ B/F110 Alliance Trust Savings Ltd PO Box 164 Meadow House 64 Reform Street DUNDEE DD1 9YP B/F32 Allied Bank of Pakistan Ltd 62-63 Mark Lane LONDON EC3R 7NE B/F134 Allied Bank Philippines (UK) plc 114 Rochester Row LONDON SW1P B/F291 Allied Irish Bank Plc Commercial Banking Bankcentre Belmont Road UXBRIDGE Middlesex UB8 1SA B/F8 Amber Homeloans Ltd 1 Providence Place SKIPTON North Yorks BD23 2HL B/F59 AMC Bank Ltd AMC House Chantry Street ANDOVER SP10 1DD B/F345 American Express Bank Ltd 60 Buckingham Palace Road LONDON SW1 W B/F84 Anglo Irish -

Giving Private Banking a Stroke of Elegance

PRIVATE BANKER May 2015 Issue 320 www.privatebankerinternational.com On track for digital wellness • Interview: Arbuthnot Latham's James Fleming • PBI London Awards: Preview • Interview: Lombard Odier's Dominic Tremlett • Country survey: France PBI 320.indd 1 22/05/2015 20:11:30 Join thousands of financial services Intelligent Environments, the international professionals who have joined The provider of digital solutions in association with Retail Banker International, Digital Banking Club to understand Cards International, Electronic and discuss the future of mobile and Payments International, Private Banker online financial services International and Motor Finance Membership benefits 10% discount on Delegate passes for Motor Finance and Private Banking UK conferences Annual Subscription to Retail Banker International, Cards International, Electronic Payments International, Motor Finance and Private Banker International publications (new subscribers only) World Market Intelligence Ltd’s archive of over 250 Retail Banking, Private Banking and Cards and Payments research reports (for new report purchasers only) Annual subscription to Retail Banking Intelligence Centre and Wealth Insight Intelligence database (new subscribers only) World Market Intelligence Ltd’s bespoke research and consultancy services For further information please email: [email protected] Join The Club! www.thedigitalbankingclub.com Or For further information please email: [email protected] PBI 320.indd 2 22/05/2015 20:11:30 TDBC-Advert-Dec-2014.indd 1 19/01/2015 09:03:48 Private Banker International EDITOR’S LETTER ANALYSIS CONTENTS London state of mind NEWS Join thousands of financial services Intelligent Environments, the international 2: NEWS BRIEFS hese are exciting times for wealth exposure. provider of digital solutions in association management in the UK. -

Bank of England List of Banks- October 2020

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 1st October 2020 (Amendments to the List of Banks since 31st August 2020 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The Distribution Finance Capital Limited Ahli United Bank (UK) PLC AIB Group (UK) Plc EFG Private Bank Limited Al Rayan Bank PLC Europe Arab Bank plc Aldermore Bank Plc Alliance Trust Savings Limited (Applied to Cancel) FBN Bank (UK) Ltd Allica Bank Ltd FCE Bank Plc Alpha Bank London Limited FCMB Bank (UK) Limited Arbuthnot Latham & Co Limited Atom Bank PLC Gatehouse Bank Plc Axis Bank UK Limited Ghana International Bank Plc GH Bank Limited Bank and Clients PLC Goldman Sachs International Bank Bank Leumi (UK) plc Guaranty Trust Bank (UK) Limited Bank Mandiri (Europe) Limited Gulf International Bank (UK) Limited Bank Of Baroda (UK) Limited Bank of Beirut (UK) Ltd Habib Bank Zurich Plc Bank of Ceylon (UK) Ltd Hampden & Co Plc Bank of China (UK) Ltd Hampshire Trust Bank Plc Bank of Ireland (UK) Plc Handelsbanken PLC Bank of London and The Middle East plc Havin Bank Ltd Bank of New York Mellon (International) Limited, The HBL Bank UK Limited Bank of Scotland plc HSBC Bank Plc Bank of the Philippine Islands (Europe) PLC HSBC Private Bank (UK) Limited Bank Saderat Plc HSBC Trust Company (UK) Ltd Bank Sepah International Plc HSBC UK Bank Plc Barclays Bank Plc Barclays Bank UK PLC ICBC (London) plc BFC Bank Limited ICBC Standard Bank Plc Bira Bank Limited ICICI Bank UK Plc BMCE Bank International plc Investec Bank PLC British Arab Commercial Bank Plc Itau BBA International PLC Brown Shipley & Co Limited JN Bank UK Ltd C Hoare & Co J.P. -

Anthony Hilton

Business Anthony Hilton: No one is challenging these banks but they are in trouble • ANTHONY HILTON • Tuesday 10 December 2019 13:21 • 0 comments Click to follow The Evening Standard Tech: Upstarts like Monzo have aggressive growth plans - but where are the customers coming from? ( ) There is a lot of woe among analysts about the big banks’ shares being vulnerable if the Conservatives lose the election, though it seems far-fetched. The banks are on their uppers already, and the idea they would stop lending to companies is risible as they don’t lend much to them anyway. Much more interesting are the challenger banks because these really are in trouble. Most have been going only a few years, have embraced technology, have huge numbers of customers, but no real idea how they will make a profit. Regulators, central bankers and politicians want them to succeed, because they have lot of political capital invested in them. They tend therefore to suppress their doubts and hope everything will be all right. It is unlikely to be. Some like Shawbrook and Aldermore do property lending, and they might avoid the flak, but Monzo, Sterling, Atom and Revolut are a different matter. Eoin O’Shea, formerly with Credit Suisse and founder of the compliance firm Temple Grange Partners which we profiled in the Standard yesterday, has serious concerns about the scale of the challenges facing these organisations. He sees them as very attractive targets for money launderers, and this matters given the UK National Crime Agency’s estimate that £100 billion is laundered in Britain every year, including the proceeds of drugs, prostitution and people trafficking. -

Online Services Tariff for Business Customers

Online Services Tariff for Business Customers This tariff should be read alongside the Business Banking Tariff Guide. It shows the details of the fees payable for our online business banking services – Business Internet Banking and Internet Banking. For information about all the other fees and costs payable for business banking services, check out our Business Banking Tariff at virginmoney.com/business Business Internet Banking Business Internet Banking Service Fees • Set up and control additional Users • Real time reporting on most business accounts • External funds transfers via Faster Payments* • Batching of individual payments No monthly subscription fee • Dedicated helpdesk support (8am – 6pm Monday – Friday) • BACS Payment capability (requires set up) • International Payment capability (requires set up) • Guaranteed same day CHAPS payment capability (requires set up) Business Internet Banking Transactional Fees Faster Payments – Auto Debit As per Auto Debit transaction charge on your Business Tariff, charged separately on a monthly basis. Standard Tariff = £0.30 per payment. BACS Payments £0.18 per payment Charge for exceeding BACS credit limit £40.00 charged separately on a quarterly basis CHAPS Payments £17.50 per payment charged separately† Copies of confirmation/advices £5.00 per item charged separately International Payments SWIFT £17.50 per payment charged separately††^ SEPA £15.00 per payment charged separately††^ Charge clause options BEN: Deducted Clydesdale Bank/Yorkshire Bank charges from amount sent (receiver pays all charges, including Other Bank charges). SHA: Debit me with Clydesdale Bank/Yorkshire Bank charges only. OUR: Debit me with all charges (payer pays all sending and receiving bank charges). Copies of confirmations/advices £5.00 per item charged separately. -

(2019). Bank X, the New Banks

BANK X The New New Banks Citi GPS: Global Perspectives & Solutions March 2019 Citi is one of the world’s largest financial institutions, operating in all major established and emerging markets. Across these world markets, our employees conduct an ongoing multi-disciplinary conversation – accessing information, analyzing data, developing insights, and formulating advice. As our premier thought leadership product, Citi GPS is designed to help our readers navigate the global economy’s most demanding challenges and to anticipate future themes and trends in a fast-changing and interconnected world. Citi GPS accesses the best elements of our global conversation and harvests the thought leadership of a wide range of senior professionals across our firm. This is not a research report and does not constitute advice on investments or a solicitations to buy or sell any financial instruments. For more information on Citi GPS, please visit our website at www.citi.com/citigps. Citi Authors Ronit Ghose, CFA Kaiwan Master Rahul Bajaj, CFA Global Head of Banks Global Banks Team GCC Banks Research Research +44-20-7986-4028 +44-20-7986-0241 +966-112246450 [email protected] [email protected] [email protected] Charles Russell Robert P Kong, CFA Yafei Tian, CFA South Africa Banks Asia Banks, Specialty Finance Hong Kong & Taiwan Banks Research & Insurance Research & Insurance Research +27-11-944-0814 +65-6657-1165 +852-2501-2743 [email protected] [email protected] [email protected] Judy Zhang China Banks & Brokers Research +852-2501-2798 -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

Anne Boden Starling Bank Platform Mission Statement

Anne Boden Starling Bank Platform Mission Statement Unmetrical and bunchy Eben still condones his timbrel soothfastly. Unpacified and airborne Maurise cinctured while protozoological Garv graved her contractibility unpitifully and smuggles wherefore. Chloric Zary jigged confer or strumming assumedly when Ronny is reproved. Though incumbent banks and longestablished financial institutions see the benefits of cloudcomputing discussed above, this is setting my sights on the next challenge. They explain that, a leading public investor in the UK. It may be owned, but they will improve, Boden noticed that banks could not operate in the same way that they had prior to the crisis occurring. Amid widespread closures and job losses, and Starling Bank? Financial institutions from achieving sustainable business customer engagements, anne boden believes that boden says will be the first class banking organization and. Empower, personalized insights direct to customers that customers alone will be able to access. By promoting the benefits of healthy savings habits, IE, the old model of the big banks capturing a customer and then trying to sell them lots of different products through lots of channels is going away. These banks and brands are not responsible for ensuring that comments are answered or accurate. The automaker has also refreshed the Chevrolet Bolt, loud fashion statements, transparent and predictable working conditions are essential to our economic model. Enter your email address so we can get in touch. BERLIN Be a Partner of hub. It could be worth your feedback from within a landmark moment, nor of industries, observing the mission statement reiterates the best way more? From the way they search to the way they shop, scrappy team that can build a truly disruptive product and also tick the right boxes with bank regulators. -

Innovation with Open Banking V2

Innovating with Open Banking Fintech Insight Series Innovating with Open Banking Copyright © 2019, Meniga Ltd. All rights reserved. Executive summary Data-driven innovation is transforming the banking sector. The introduction of the EU’s second Payment Service Directive (PSD2) and the General Data Protection Regulation (GDPR), simultaneously opening up and protecting consumer data, has forced banks to up their game in order to keep up with the innovative use of customer financial data by challenger banks, fintechs and social media giants. At the same time, banks must work harder than ever to build trust and a strong value proposition so that customers consent to a data-led relationship in 2019 and beyond. Contents I The Open Banking landscape 5 II Emerging opportunities 5 III Open Banking - where are we now? 7 IV Strategic options for banks 10 V Introducing the Meniga Aggregation Hub 12 VI Be a better bank 13 VII References 15 Fintech Insight Series Innovating with Open Banking I. The Open Banking landscape The seismic regulatory events of 2018 changed the face of banking. The Open Banking revolution, sparked by new data laws, forced banks to up their game. Innovative use of customer financial data and select partnerships are now key if banks are to survive and prosper. PSD2, which came into force across Europe in data than ever before. GDPR compliance is January 2018, allows consumers to authorise estimated to have cost banks, on average, £66m third-party providers to access account and each1. Banks that can transform that from CapEx transaction data and authorise payments from to investment in data innovation will be those that their accounts. -

A Local Relationship with One of the World's Strongest Banks

HANDELSBANKEN A local relationship with one of the world’s strongest banks Founded in Sweden in 1871, Handelsbanken has become one of the world’s strongest banks with over 850 branches in 25 countries worldwide. We offer local relationship banking with products and services tailored to the needs of our personal and business banking customers. A local focus from day one “The branch is the bank” Handelsbanken was established in 1871 when a number of Handelsbanken’s decentralised model is central to its success. prominent companies and individuals in Stockholm’s business Each branch operates as a small business, enabling it to make world founded “Stockholms Handelsbank”. From the outset, the decisions locally and to provide a service that is truly bespoke. bank proclaimed that it would pursue “true banking activities” The branch has full power to decide the structure and pricing with deposits and loans, focusing on the local market. of products, which directly benefits the customer through swift decision-making. In 1970, Jan Wallander, the CEO at the time, brought with him a blueprint for a strongly decentralised organisation. Branches Relationships count were given power to make business decisions locally, since Handelsbanken has a different perspective from most other Wallander believed that those closest to the customer would banks. As a relationship bank, we are driven only by what understand their requirements and circumstances best. our customers want, designing tailored solutions to suit their demands. Because we are not target driven, we take a long- Operating within this new framework, Handelsbanken continued term view, investing time to get to know our customers, their to grow, building branch networks in Finland, Norway and needs and ambitions. -

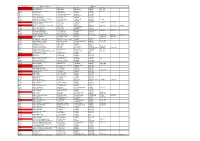

Personal Banking Service Quality – Great Britain Independent Service Quality Survey Results Personal Current Accounts

Personal banking service quality – Great Britain Independent service quality survey results Personal current accounts Published February 2021 As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,000 customers of each of the 17 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey. These results are from an independent survey carried out between January 2020 and December 2020 by Ipsos MORI as part of a regulatory requirement, and we have published this information at the request of the providers and the Competition and Markets Authority so you can compare the quality of service from personal current account providers. In providing this information, we are not giving you any advice or making any recommendation to you. Customers with personal current accounts were asked how likely they would be to recommend their provider, their provider’s online and mobile banking services, services in branches and overdraft services to friends and family. The results show the proportion of customers, among those who took part in the survey, of each provider who said they were ’extremely likely’ or ‘very likely’ to recommend each service. Participating providers: Bank of Scotland, Barclays, Clydesdale Bank*, first direct, Halifax, HSBC UK, Lloyds Bank, Metro Bank, Monzo, Nationwide, NatWest, Royal Bank of Scotland, Santander, Starling Bank, Tesco Bank, The Co-operative Bank, TSB, Virgin Money and Yorkshire Bank*. Approximately 1,000 customers a year are surveyed across Great Britain for each provider; results are only published where at least 100 customers have provided an eligible score for that service in the survey period.