The World Bank Public Disclosure Authorized Report No.: 35624

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Islamic Traditions of Cirebon

the islamic traditions of cirebon Ibadat and adat among javanese muslims A. G. Muhaimin Department of Anthropology Division of Society and Environment Research School of Pacific and Asian Studies July 1995 Published by ANU E Press The Australian National University Canberra ACT 0200, Australia Email: [email protected] Web: http://epress.anu.edu.au National Library of Australia Cataloguing-in-Publication entry Muhaimin, Abdul Ghoffir. The Islamic traditions of Cirebon : ibadat and adat among Javanese muslims. Bibliography. ISBN 1 920942 30 0 (pbk.) ISBN 1 920942 31 9 (online) 1. Islam - Indonesia - Cirebon - Rituals. 2. Muslims - Indonesia - Cirebon. 3. Rites and ceremonies - Indonesia - Cirebon. I. Title. 297.5095982 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without the prior permission of the publisher. Cover design by Teresa Prowse Printed by University Printing Services, ANU This edition © 2006 ANU E Press the islamic traditions of cirebon Ibadat and adat among javanese muslims Islam in Southeast Asia Series Theses at The Australian National University are assessed by external examiners and students are expected to take into account the advice of their examiners before they submit to the University Library the final versions of their theses. For this series, this final version of the thesis has been used as the basis for publication, taking into account other changes that the author may have decided to undertake. In some cases, a few minor editorial revisions have made to the work. The acknowledgements in each of these publications provide information on the supervisors of the thesis and those who contributed to its development. -

Amed-Amlapuratour

AMED - AMLAPURA TOUR Salt extraction , Viewpoint, Rice fields and terrace s, Tirta Gangga, Royal Palace, Ujung Water Palace The Amed -Amlapura Tour starts from Alam Anda and leads south -east along the coast. Around Amed you can see beautiful rice fields . Also there a re places where you can discover the Balinese way to extract sea s alt. From the viewpoint in Jemeluk the beautiful bay and Mount Agung can be seen. Now our way leads to the famous area of Tirta Gangga which features some of Bali’s best views of rice terraces. The following three sites were all built by the Kingdom of Karangasem , between 1900 and 1946. First we visit the latest building , the Royal Water Palace , Taman Tirta Gangga. It features beautiful water basins with ornaments from the Rajah period. In Amlapura we visit Pura Agung Palace , built around 1900 . The Palace has a typical traditional Balinese structure, but you can see western and Chinese Influence in the decoration and old furniture. Outside Amlapura is the picturesque Ujung water palace . Start: Our Tour starts from Alam Anda at 9:00 am , return will be around 3:00 pm. Price: Euro 26 .-/person ( minimum 2 persons ) The price is subject to 21 % service charge & government tax Incl. transfer, entrance fees, drinking water , driver Please note: Our guide is not allowed to follow you inside Tirta Gangga. It is not necessary but possible to hire a local guide. To bring: Suitabl e clothes for the temple visit Sambirenteng • Buleleng • Bali • Indonesia www.alamand a.de . -

Indonesia 12

©Lonely Planet Publications Pty Ltd Indonesia Sumatra Kalimantan p509 p606 Sulawesi Maluku p659 p420 Papua p464 Java p58 Nusa Tenggara p320 Bali p212 David Eimer, Paul Harding, Ashley Harrell, Trent Holden, Mark Johanson, MaSovaida Morgan, Jenny Walker, Ray Bartlett, Loren Bell, Jade Bremner, Stuart Butler, Sofia Levin, Virginia Maxwell PLAN YOUR TRIP ON THE ROAD Welcome to Indonesia . 6 JAVA . 58 Malang . 184 Indonesia Map . 8 Jakarta . 62 Around Malang . 189 Purwodadi . 190 Indonesia’s Top 20 . 10 Thousand Islands . 85 West Java . 86 Gunung Arjuna-Lalijiwo Need to Know . 20 Reserve . 190 Banten . 86 Gunung Penanggungan . 191 First Time Indonesia . 22 Merak . 88 Batu . 191 What’s New . 24 Carita . 88 South-Coast Beaches . 192 Labuan . 89 If You Like . 25 Blitar . 193 Ujung Kulon Month by Month . 27 National Park . 89 Panataran . 193 Pacitan . 194 Itineraries . 30 Bogor . 91 Around Bogor . 95 Watu Karang . 195 Outdoor Adventures . 36 Cimaja . 96 Probolinggo . 195 Travel with Children . 52 Cibodas . 97 Gunung Bromo & Bromo-Tengger-Semeru Regions at a Glance . 55 Gede Pangrango National Park . 197 National Park . 97 Bondowoso . 201 Cianjur . 98 Ijen Plateau . 201 Bandung . 99 VANY BRANDS/SHUTTERSTOCK © BRANDS/SHUTTERSTOCK VANY Kalibaru . 204 North of Bandung . 105 Jember . 205 Ciwidey & Around . 105 Meru Betiri Bandung to National Park . 205 Pangandaran . 107 Alas Purwo Pangandaran . 108 National Park . 206 Around Pangandaran . 113 Banyuwangi . 209 Central Java . 115 Baluran National Park . 210 Wonosobo . 117 Dieng Plateau . 118 BALI . 212 Borobudur . 120 BARONG DANCE (P275), Kuta & Southwest BALI Yogyakarta . 124 Beaches . 222 South Coast . 142 Kuta & Legian . 222 Kaliurang & Kaliadem . 144 Seminyak . -

Environment, Trade and Society in Southeast Asia a Longue Durée Perspective

Environment, Trade and Society in Southeast Asia A Longue Durée Perspective David Henley and Henk Schulte Nordholt d Environment, Trade and Society in Southeast Asia <UN> Verhandelingen van het Koninklijk Instituut voor Taal-, Land- en Volkenkunde Edited by Rosemarijn Hoefte (kitlv, Leiden) Henk Schulte Nordholt (kitlv, Leiden) Editorial Board Michael Laffan (Princeton University) Adrian Vickers (Sydney University) Anna Tsing (University of California Santa Cruz) VOLUME 300 The titles published in this series are listed at brill.com/vki <UN> Environment, Trade and Society in Southeast Asia A Longue Durée Perspective Edited by David Henley Henk Schulte Nordholt LEIDEN | BOSTON <UN> This is an open access title distributed under the terms of the Creative Commons Attribution- Noncommercial 3.0 Unported (CC-BY-NC 3.0) License, which permits any non-commercial use, distri- bution, and reproduction in any medium, provided the original author(s) and source are credited. The realization of this publication was made possible by the support of kitlv (Royal Netherlands Institute of Southeast Asian and Caribbean Studies). Cover illustration: Kampong Magetan by J.D. van Herwerden, 1868 (detail, property of kitlv). Library of Congress Cataloging-in-Publication Data Environment, trade and society in Southeast Asia : a longue durée perspective / edited by David Henley, Henk Schulte Nordholt. pages cm. -- (Verhandelingen van het Koninklijk Instituut voor Taal-, Land- en Volkenkunde ; volume 300) Papers originally presented at a conference in honor of Peter Boomgaard held August 2011 and organized by Koninklijk Instituut voor Taal-, Land- en Volkenkunde. Includes bibliographical references and index. ISBN 978-90-04-28804-1 (hardback : alk. paper) -- ISBN 978-90-04-28805-8 (e-book) 1. -

Visitorsguidebali.Com YOUR GUIDE to BALI, the ISLAND of GODS

visitorsguidebali.com YOUR GUIDE TO BALI, THE ISLAND OF GODS DINING SHOPPING ACCOMMODATION CULTURE TOURS CAFES & BARS & ACTIVITIES $8 | €7 | 1000K Visitor’s Guide From the Founder The aim of this booklet is to give our readers some valuable information about Bali, Indonesia, as well as to some extent about the neighbouring island of Lombok. The population of Bali is predominantly Hindu and has a rich culture steeped in religious ceremonies. Our first Visitors guide publication began in Northern Europe in 1999. It was a success among tourists and staff in hotels, guesthouses and information centers alike. Having travelled to 60 countries myself, I have accrued a great deal of knowledge and insight into travellers´ needs. Indonesia has unexpectedly become one of my favourite countries. This is due to the warm and friendly people and Bali’s rich cultural traditions. You also get good value for your money there, which is always a pleasure for an economist! I hope this booklet will serve to help you in your travels. Welcome to Bali! Hakon Thor Sindrason M.Sc. Business Administr. Economics CEO FOR RECYCLING AND BUSINESS PURPOSES, PLEASE DON‘T THROW THIS BOOK. IF YOU HAVE A PRINTED VERSION, GIVE IT TO ANOTHER Visi TRAVELER TO USE OR SOMEONE GOING TO BALI. VisitorsguideTravel 2 3 Practical Information Currency • Transport • Visas • Alcohol 6 • Co-working • Health clinics • Flight search engines Dining Nature of cuisine • Popular dishes • Budget Options • Recommended restaurants • Recipes 8 • Cooking class Culture Balinese religion and nature • -

World Heritage Sites in Indonesia Java (October 2009)

World Heritage Sites in Indonesia Site name Entered Borobudur Temple Compounds 1991 Prambanan Temple Compounds 1991 Komodo National Park 1991 Ujung Kulon National Park 1991 Sangiran Early Man Site 1996 Lorentz National Park 1999 Tropical Rainforest Heritage of Sumatra 2004 The Cultural Landscape of Bali Province: the Subak System as a Manifestation of 2012 the Tri Hita Karana Philosophy Tentative list of Indonesia Banda Islands Banten Ancient City Bawomataluo Site Belgica Fort Besakih Betung Kerihun National Park (Transborder Rainforest Heritage of Borneo) Bunaken National Park Derawan Islands Elephant Cave Great Mosque of Demak Gunongan Historical Park Muara Takus Compound Site Muarajambi Temple Compound Ngada traditional house and megalithic complex Penataran Hindu Temple Complex Prehistoric Cave Sites in Maros-Pangkep Pulau Penyengat Palace Complex Raja Ampat Islands Ratu Boko Temple Complex Sukuh Hindu Temple Taka Bonerate National Park Tana Toraja Traditional Settlement Trowulan Ancient City Wakatobi National Park Waruga Burial Complex Yogyakarta Palace Complex Sites that have been nominated in the past Lore Lindu NP Maros Prehistoric Cave Toraja Java (October 2009) The Indonesian island of Java holds three cultural WHS, among which is the iconic Borobudur. I visited all three sites on daytrips from Yogyakarta, a city that in its Sultan's Palace (kraton) also has a monument worthy of WH status. Borobudur . Sangiran Early Man Site . Prambanan Borobudur The Borobudur Temple Compounds is a ninth century Buddhist temple complex. It was built on several levels around a natural hill. Borobudur is built as a single large stupa, and when viewed from above takes the form of a giant tantric Buddhist mandala, simultaneously representing the Buddhist cosmology and the nature of mind. -

Proceedings Full Papers Proceedings Full Papers

P A A A A A A P The 16 Congress AAAP Sustainable Livestock Production in the Perspective of th Food Security, Policy, Genetic Resources, and Climate Change Food Security, Policy, Genetic Resources, and Climate Change Policy, Food Security, Sustainable Livestock Production in the Perspective of Proceedings Full Papers Proceedings Full Papers The 16th AAAP Congress Ministry of Agriculture Indonesian Society of Animal Sciences Gadjah Mada University Gold Sponsor: Silver Sponsor: Bronze Sponsor: Supporting Sponsor: SUSTAINABLE LIVESTOCK PRODUCTION IN THE PRESPECTIVE OF FOOD SECURITY, POLICY, GENETIC RESOURCES, AND CLIMATE CHANGE PROCEEDINGS FULL PAPERS Editors: Subandriyo Kusmartono Krishna Agung Santosa Edi Kurnianto Agung Purnomoadi Akhmad Sodiq Komang G. Wiryawan Siti Darodjah Ismeth Inounu Darmono Atien Priyanti Peter Wynn Jian Lin Han Jih Tay-Hsu Zulkifli Idrus The 16th AAAP Congress Cataloguing-in-Publication Data The 16th Asian-Australasian Associations of Animal Production Socities Proceedings Full Papers Sustainable Livestock Production in the Perspective of Food Security, Policy, Genetic Resources, and Climate Change 10-14 November 2014, Yogyakarta, Indonesia / editors Subandriyo et al; 2825 p: ill.; 21 x 29,7 cm Organized by Indonesian Society of Animal Sciences In Collaboration with Ministry of Agriculture Faculty of Animal Sciences Universitas Gadjah Mada ISBN 978-602-8475-87-7 1. Livestock 2. Food Security 3. Policy 4. Genetic Resources 5. Climate Change I. Title II. Subandriyo Scope of AAAP: AAAP is established to devote for the efficient animal production in the Asian-Australasian region through national, regional, international cooperation and academic conferences. Brief History of AAAP: AAAP was founded in 1980 with 8 charter members representing 8 countries-those are Australia, Indonesia, Japan, Korea, Malaysia, New Zealand, Philippines and Thailand. -

Candi, Space and Landscape

Degroot Candi, Space and Landscape A study on the distribution, orientation and spatial Candi, Space and Landscape organization of Central Javanese temple remains Central Javanese temples were not built anywhere and anyhow. On the con- trary: their positions within the landscape and their architectural designs were determined by socio-cultural, religious and economic factors. This book ex- plores the correlations between temple distribution, natural surroundings and architectural design to understand how Central Javanese people structured Candi, Space and Landscape the space around them, and how the religious landscape thus created devel- oped. Besides questions related to territory and landscape, this book analyzes the structure of the built space and its possible relations with conceptualized space, showing the influence of imported Indian concepts, as well as their limits. Going off the beaten track, the present study explores the hundreds of small sites that scatter the landscape of Central Java. It is also one of very few stud- ies to apply the methods of spatial archaeology to Central Javanese temples and the first in almost one century to present a descriptive inventory of the remains of this region. ISBN 978-90-8890-039-6 Sidestone Sidestone Press Véronique Degroot ISBN: 978-90-8890-039-6 Bestelnummer: SSP55960001 69396557 9 789088 900396 Sidestone Press / RMV 3 8 Mededelingen van het Rijksmuseum voor Volkenkunde, Leiden CANDI, SPACE AND LANDscAPE Sidestone Press Thesis submitted on the 6th of May 2009 for the degree of Doctor of Philosophy, Leiden University. Supervisors: Prof. dr. B. Arps and Prof. dr. M.J. Klokke Referee: Prof. dr. J. Miksic Mededelingen van het Rijksmuseum voor Volkenkunde No. -

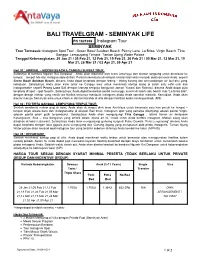

Seminyak Life

BALI TRAVELGRAM - SEMINYAK LIFE PN 1621006 Instagram Tour SEMINYAK Tour Termasuk: Instagram Spot Tour : Green Bowl/ Suluban Beach Penny Lane La Brisa Virgin Beach Tirta Gangga Lempuyang Temple Taman Ujung Water Palace Tanggal Keberangkatan: 29 Jan 21 / 05 Feb 21, 12 Feb 21, 19 Feb 21, 26 Feb 21 / 05 Mar 21, 12 Mar 21, 19 Mar 21, 26 Mar 21 / 02 Apr 21, 09 Apr 21 Hari 01 : ARRIVAL – HIDDEN BEACH & CANGGU SUNSET TOUR Setibanya di bandara Ngurah Rai Denpasar , Anda akan disambut oleh team AntaVaya dan diantar langsung untuk berwisata ke tempat – tempat hits dan instagramable di Bali. Pantai tersembunyi di wilayah selatan Bali akan menjadi destinasi awal Anda, seperti Green Bowl/ Suluban Beach, dimana Anda dapat berphoto dengan tebing - tebing karang dan pemandangan air laut biru yang kehijauan. Selanjutnya Anda akan kami antar ke Canggu area untuk menikmati santap siang di salah satu café unik dan instagramable seperti Penny Lane Bali dengan konsep bergaya bangunan zaman Yunani dan Romawi, dimana Anda dapat pula berphoto di spot - spot favorite. Selanjutnya, Anda dapat bersantai sambil menunggu sunset di salah satu beach club “La Brisa Bali”, dengan design interior yang cantik ala Karibia tentunya membuat instagram photo Anda semakin menarik. Kemudian, Anda akan diantar menuju Seminyak area untuk check in dan beristirahat di villa dengan fasillitas kolam renang pribadi. (MS) Hari 02 : F/D TIRTA GANGGA, LEMPUYANG TEMPLE TOUR Setelah menikmati makan pagi di hotel, Anda akan di jemput oleh team AntaVaya untuk berwisata satu hari penuh ke tempat – tempat objek wisata baru dan instagramable di wilayah Bali timur. Instagram spot yang pertama dikunjungi adalah pantai Virgin, sebuah pantai pasir putih tersembunyi. -

Bali East Tour Experience Indonesia, Bali | 8 to 10 Hours | 1 - 15 Pax

Bali east tour experience Indonesia, Bali | 8 to 10 hours | 1 - 15 Pax Overview Itinerary This is a typical itinerary for this product Stop At: Tenganan Ancient Village, Tenganan, Manggis, Bali Tenganan is a traditional village on the island of Bali. This village is located in Manggis District, Karangasem Regency on the east of the island of Bali. Tenganan can be reached from Candi Dasa tourism place and the location is about 10 kilometers from there Duration: 1 hour Pass By: Candi Dasa, Karangasem, Bali Candi Dasa is a coastal city in eastern Bali that is located on the edge of a freshwater lagoon. The city is a popular tourist stop and is often described as a more calm and relaxed beach alternative Stop At: Ujung Water Palace, Karangasem, Bali Taman Ujung or Taman Sukasada, is a park in the banjar Ujung, Tumbu village, Karangasem sub-district, Karangasem, Bali. This park is located about 5 km southeast of the city of Amlapura. During the Dutch East Indies the place was known as the Waterpaleis or water palace Duration: 1 hour Stop At: Virgin Beach, Karangasem, Bali Looking for the best white sand beach in Bali, you can visit Bali`s white sand beach, which is also called virgin beach Bali and local people call it Perasi beach Bali. Duration: 1 hour Stop At: Tirta Gangga, Karangasem, Bali Tirta Gangga is a former royal palace located in the eastern part of Bali Island, Indonesia, about 5 kilometers from Karangasem, near Mount Agung. This park is famous for its water palace, which is owned by the Kingdom of Karangasem. -

ASEAN Bankers Association Website: 2 ASEAN Bankers Association I May/Jun 2020 Aspire, Build, Achieve

Aspire, Build, Achieve ASEAN BANKER May/Jun 2020 To achieve higher growth through cooperation amongst ASEAN banks MCI(P) 003/01/2020 50TH ASEAN BANKING COUNCIL MEETING SECOND HALF 2021 VENUE: LABUAN BAJO, REPUBLIC OF INDONESIA HOST: PERBANAS (INDONESIAN BANKS ASSOCIATION) Seven Wonders of Nature), Komodo National Park with the beautiful underwater life on the western tip of Flores, with Hunting Whales tradition in Lembata, at the eastern tip of Nusa Nipa (Snake Island) Flores. Some even say today, Labuan Bajo is a big village or regency that is growing into a tourism city in the near future. The Uniqueness of Labuan Bajo Different to other cities in Indonesia, Labuan Bajo has some uniqueness as follow: § It is a port city with a beautiful city landscape. § Labuan Bajo fortified by uninhabited small islands. The existence of islands creates the beauty of Labuan Bajo so it is no exaggeration to say it is beautiful city. THE REPUBLIC OF INDONESIA § Labuan Bajo is a safe city. Beside being secure, you will also find Indonesia, officially known as the Republic of Indonesia, is situated in hospitality of locals Flores. When you meet with others unknown the Southeast Asia, between the Pacific and the Indian Ocean. It is often though, the locals Flores will always give a smile. referred to as the world's largest archipelago which represents about 17,000 islands and covers 735,358 square miles (1,904,568 sq km) in About Komodo in Labuan Bajo total. Indonesia is the founder of numerous significant organisations As Indonesia’s fastest growing regency, such as: Non-Aligned Movement, Association of Southeast Asian Labuan Bajo serves as the launching point Nations, Asia-Pacific Economic Cooperation, East Asia Summit and Asian to Komodo National Park. -

Candi Space and Landscape: a Study on the Distribution, Orientation and Spatial Organization of Central Javanese Temple Remains

Candi Space and Landscape: A Study on the Distribution, Orientation and Spatial Organization of Central Javanese Temple Remains Proefschrift ter verkrijging van de graad van Doctor aan de Universiteit Leiden, op gezag van Rector Magnificus Prof. mr. P.F. van der Heijden, volgens besluit van het College voor Promoties te verdedigen op woensdag 6 mei 2009 klokke 13.45 uur door Véronique Myriam Yvonne Degroot geboren te Charleroi (België) in 1972 Promotiecommissie: Promotor: Prof. dr. B. Arps Co-promotor: Dr. M.J. Klokke Referent: Dr. J. Miksic, National University of Singapore. Overige leden: Prof. dr. C.L. Hofman Prof. dr. A. Griffiths, École Française d’Extrême-Orient, Paris. Prof. dr. J.A. Silk The realisation of this thesis was supported and enabled by the Netherlands Organisation for Scientific Research (NWO), the Gonda Foundation (KNAW) and the Research School of Asian, African and Amerindian Studies (CNWS), Leiden University. Acknowledgements My wish to research the relationship between Ancient Javanese architecture and its natural environment is probably born in 1993. That summer, I made a trip to Indonesia to complete the writing of my BA dissertation. There, on the upper slopes of the ever-clouded Ungaran volcano, looking at the sulfurous spring that runs between the shrines of Gedong Songo, I experienced the genius loci of Central Javanese architects. After my BA, I did many things and had many jobs, not all of them being archaeology-related. Nevertheless, when I finally arrived in Leiden to enroll as a PhD student, the subject naturally imposed itself upon me. Here is the result, a thesis exploring the notion of space in ancient Central Java, from the lay-out of the temple plan to the interrelationship between built and natural landscape.