Remuneration Report 2016 Asmi Statutory Annual Report 2016 | Remuneration Report 2016 | 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FTSE Publications

2 FTSE Russell Publications 20 May 2021 FTSE Developed ex UK Indicative Index Weight Data as at Closing on 31 March 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 Drillisch <0.005 GERMANY Alfa Laval 0.02 SWEDEN Arch Capital Gp 0.03 USA 3M Company 0.21 USA Alfresa Holdings 0.01 JAPAN Archer Daniels Midland 0.06 USA A P Moller - Maersk A 0.02 DENMARK Align Technology Inc 0.08 USA Argenx S.E 0.03 BELGIUM A P Moller - Maersk B 0.03 DENMARK Alimentation Couche-Tard B 0.05 CANADA Ariake Japan <0.005 JAPAN a2 Milk 0.01 NEW ZEALAND Alleghany 0.02 USA Arista Networks 0.03 USA A2A 0.01 ITALY Allegion PLC 0.02 USA Aristocrat Leisure 0.03 AUSTRALIA AAC Technologies Holdings 0.01 HONG KONG Allegro 0.01 POLAND Arkema 0.02 FRANCE Aalberts NV 0.01 NETHERLANDS Alliant Energy 0.03 USA Aroundtown SA 0.02 GERMANY ABB 0.1 SWITZERLAND Allianz SE 0.2 GERMANY Arrow Electronics 0.02 USA Abbott Laboratories 0.39 USA Allstate Corp 0.07 USA Arthur J Gallagher 0.05 USA AbbVie Inc 0.36 USA Ally Financial 0.03 USA As One <0.005 JAPAN ABC-Mart <0.005 JAPAN Alnylam Pharmaceuticals 0.03 USA Asahi Group Holdings 0.03 JAPAN Abiomed Inc 0.03 USA Alony Hetz Properties & Inv <0.005 ISRAEL Asahi Intecc 0.01 JAPAN ABN AMRO Bank NV 0.01 NETHERLANDS Alphabet Class A 1.17 USA Asahi Kasei Corporation 0.03 JAPAN Accenture Cl A 0.33 USA Alphabet Class C 1.14 USA Ascendas Real Estate Investment Trust 0.01 SINGAPORE Acciona S.A. -

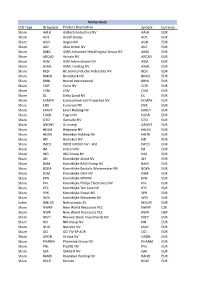

CFD Type IB Symbol Product Description Symbol Currency Share

Netherlands CFD Type IB Symbol Product Description Symbol Currency Share AALB Aalberts Industries NV AALB EUR Share AO1 Accell Group AO1 EUR Share AGN Aegon NV AGN EUR Share AKZ Akzo Nobel NV AKZ EUR Share AMG AMG Advanced Metallurgical Group NV AMG EUR Share ARCAD Arcadis NV ARCAD EUR Share ASM ASM International NV ASM EUR Share ASML ASML Holding NV ASML EUR Share BESI BE Semiconductor Industries NV BESI EUR Share BINCK BinckBank NV BINCK EUR Share BRNL Brunel International BRNL EUR Share COR Corio NV COR EUR Share CSM CSM CSM EUR Share DL Delta Lloyd NV DL EUR Share ECMPA Eurocommercial Properties NV ECMPA EUR Share ENX Euronext NV ENX EUR Share EXACT Exact Holding NV EXACT EUR Share FUGR Fugro NV FUGR EUR Share GTO Gemalto NV GTO EUR Share GRONT Grontmij GRONT EUR Share HEIJM Heijmans NV HEIJM EUR Share HEHN Heineken Holding NV HEHN EUR Share HEI Heineken NV HEI EUR Share IMCD IMCD GROUP NV - W/I IMCD EUR Share IM Imtech NV IM EUR Share ING ING Groep NV ING EUR Share AH Koninklijke Ahold NV AH EUR Share BAM Koninklijke BAM Groep NV BAM EUR Share BOKA Koninklijke Boskalis Westminster NV BOKA EUR Share DSM Koninklijke DSM NV DSM EUR Share KPN Koninklijke KPN NV KPN EUR Share PHI Koninklijke Philips Electronics NV PHI EUR Share KTC Koninklijke Ten Cate NV KTC EUR Share VPK Koninklijke Vopak NV VPK EUR Share WES Koninklijke Wessanen NV WES EUR Index IBNL25 Netherlands 25 IBNL25 EUR Share NWRP New World Resources PLC NWRP CZK Share NWR New World Resources PLC NWR GBP Share NISTI Nieuwe Steen Investments NV NISTI EUR Share NN NN Group NV -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

Remuneration Policy Supervisory Board

Signify N.V. Remuneration Policy Supervisory Board 1 Introduction The total remuneration of members of the Supervisory Board is targeted around the median The objective of the remuneration policy of the level of a representative labor market peer group and Supervisory Board is to support long-term value benchmarked periodically. This peer group is the same creation of the company. The following principles apply as used for benchmarking the remuneration of the for this remuneration policy: Board of Management. The peer group consists of 50% • The remuneration policy aims to attract, reward and Dutch headquartered cross-industry companies that are retain qualified Supervisory Board members, together included in the AEX or AMX, and 50% European sector forming a diverse and balanced Supervisory Board specific companies. For use for the remuneration of the with the appropriate level of skills, competences and Chairman of Supervisory Board, peer group companies experience for overseeing the (execution of the) having a one-tier board structure are excluded. Company’s strategy and performance, whilst taking the interest of all the company’s stakeholders into As of January 2020, the labor market peer group account. consists of the following 14 companies: • Given the nature of the responsibilities of the Supervisory Board as an independent body, the Signify labor market peer group remuneration is not dependent on the performance Aalberts DSM Prysmian Group of the company and therefore consists of fixed AkzoNobel KPN Rexel components only. ASML Legrand Rheinmetall Group • The remuneration reflects the time spent and BAM Nexans Siemens Gamesa responsibilities of each individual member of the Boskalis Osram Supervisory Board. -

Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 22.01.2018 Page 1

Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 22.01.2018 Page 1 ********************************************************************************** AMENDMENTS ARE MARKED AS FOLLOWS: INSERTIONS ARE UNDERLINED DELETIONS ARE CROSSED OUT ********************************************************************************** 1. Part: Contract Specifications for Futures Contracts […] 2. Subpart: Contract Specifications for Index Options […] 2.6.11 Price Gradations The price of a stock option or LEPO will generally be quoted with three or four decimal place. The smallest price change (Tick) shall be EUR 0.0005, EUR 0.001, EUR 0.01 or CHF 0.01 or GBX* 0.5, GBX 0.25 or USD 0.01. For stock options with group ID NL11, NL12 and NL13, the tick size will increase to EUR 0.05 for contracts with a premium above a predefined threshold stipulated in Annex B (Premium Threshold). The Management Boards of the Eurex Exchanges shall determine the relevant decimal place and the smallest price change (Tick) and shall notify all Exchange participation of any such decision. 3. Part: Contracts Off-Book […] Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 22.01.2018 Page 2 3.3.4.2 Annex B: in relation to Subsection 2.6 of the Contract Specifications: […] Options on shares of Product-ID Group ID Minimum price Premium Minimum price change below Threshold change above threshold threshold Aalberts Industries N.V. AAI NL12 0.01 0.5 0.05 ABN AMRO Group AAR NL11 0.01 5 0.05 AEGON N.V. AEN NL11 0.01 5 0.05 Koninklijke Ahold NL11 Delhaize N.V. -

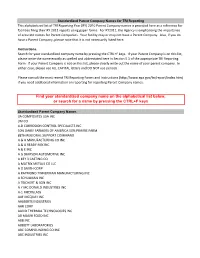

Standardized Parent Company Names for TRI Reporting

Standardized Parent Company Names for TRI Reporting This alphabetized list of TRI Reporting Year (RY) 2010 Parent Company names is provided here as a reference for facilities filing their RY 2011 reports using paper forms. For RY2011, the Agency is emphasizing the importance of accurate names for Parent Companies. Your facility may or may not have a Parent Company. Also, if you do have a Parent Company, please note that it is not necessarily listed here. Instructions Search for your standardized company name by pressing the CTRL+F keys. If your Parent Company is on this list, please write the name exactly as spelled and abbreviated here in Section 5.1 of the appropriate TRI Reporting Form. If your Parent Company is not on this list, please clearly write out the name of your parent company. In either case, please use ALL CAPITAL letters and DO NOT use periods. Please consult the most recent TRI Reporting Forms and Instructions (http://www.epa.gov/tri/report/index.htm) if you need additional information on reporting for reporting Parent Company names. Find your standardized company name on the alphabetical list below, or search for a name by pressing the CTRL+F keys Standardized Parent Company Names 3A COMPOSITES USA INC 3M CO 4-D CORROSION CONTROL SPECIALISTS INC 50% DAIRY FARMERS OF AMERICA 50% PRAIRIE FARM 88TH REGIONAL SUPPORT COMMAND A & A MANUFACTURING CO INC A & A READY MIX INC A & E INC A G SIMPSON AUTOMOTIVE INC A KEY 3 CASTING CO A MATRIX METALS CO LLC A O SMITH CORP A RAYMOND TINNERMAN MANUFACTURING INC A SCHULMAN INC A TEICHERT -

ASMI 2020 Annual Report

ABOUT VALUE CREATION GOVERNANCE FINANCIAL STATEMENTS NON-FINANCIAL SUMMARY GENERAL INFORMATION 1 NOTES TO THE READER PDF/PRINTED VERSION This document is the PDF/printed version of ASM International N.V.’s 2020 Annual Report and has been prepared for ease of use. The 2020 Annual Report in European Single Electronic Reporting format (the ESEF reporting package) is the official version. The ESEF reporting package is available on the company’s website. In any case of discrepancies between this PDF version and the ESEF reporting package, the latter prevails. UNROUNDED FIGURES Amounts in the Annual Report may not add up due to rounding differences. The total amounts may therefore deviate from the sum of the parts. Percentage changes are based on the unrounded figures. ABOUT VALUE CREATION GOVERNANCE FINANCIAL STATEMENTS NON-FINANCIAL SUMMARY GENERAL INFORMATION 2 IN A YEAR UNDERSCORED BY COVID-19, ASMI Our focus on the health and safety of our people has always been DELIVERED A STRONG FINANCIAL PERFORMANCE our key priority. The commitment and focus of our employees in challenging operating conditions created by COVID-19 enabled AND MADE IMPORTANT PROGRESS IN MANY us to continue serving our customers in the best possible ways. STRATEGIC AREAS. Demand remained strong as our customers continued to invest in the most advanced technologies that will shape tomorrow’s advances in trends such as 5G, cloud computing, and autonomous driving. ASMI delivered its fourth consecutive year of double-digit revenue growth. We further strengthened our position as we significantly expanded our R&D engagements. Looking ahead, we will continue to invest in the potential of our company. -

Annual Report 2017 Aalberts.Com/2017 Annual Report 2017 Key Figures 2017

annual report 2017 aalberts.com/2017 annual report 2017 key figures 2017 revenue operating profit net profit (EBITA) (before amortisation) (in EUR million) (in EUR million) (in EUR million) 2,040 2,201 2,475 2,522 2,694 225 247 272 298 336 152 168 190 212 238 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 2,694 336 238 +7% +13% +12% revenue spread per business per region per end market (in %) (in %) 13 3 3 1 4 3 3 2 10 4 5 25 19 13 27 13 41 22 15 23 27 24 Installation Technology 41% Benelux, United Kingdom, Nordic 25% Commercial Buildings 27% Material Technology 27% North America 23% Residential Buildings 24% Climate Technology 19% Germany, Austria, Switzerland 22% General Industries 15% Industrial Technology 13% France, Southern Europe 13% Automotive 13% Russia, Eastern Europe 10% Industrial Installations 5% Far East 3% Water & Gas Supply, Irrigation 4% Middle East & Africa 3% Semicon & Science 4% Other countries 1% Power Generation, Aerospace 3% Beverage Dispense 3% District Energy, Gas 2% 2 Aalberts Industries N.V. Annual report 2017 earnings per share free cash flow return on capital (before amortisation) (before interest and tax) employed (ROCE) (in EUR) (in EUR million) (in %) 1.38 1.52 1.72 1.92 2.15 175 222 243 273 310 14.6 14.1 14.3 14.7 16.2 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 2.15 310 16.2 +12% +13% more 2013-2017 figures on page 108 locations worldwide Benelux, United Kingdom, Nordic 31 14 Russia, Eastern Europe Germany, Austria, Switzerland 40 North America -

Annual Report 2004 ABN AMRO Holding N.V

Annual Report 2004 Annual Report 2004Annual Report ABN AMRO Holding N.V. 23.0.3.05 Annual Report 2004 Annual Report 2004Annual Report ABN AMRO Holding N.V. 23.0.3.05 Profile ABN AMRO • Asset Management, which is one of the world’s leading asset managers, ABN AMRO Holding N.V. • is a prominent international bank with origins going back to 1824 operating from over 20 locations worldwide and managing EUR 161 billion Gustav Mahlerlaan 10 • is the 11th biggest bank in Europe and 20th in the world (ranked by tier 1 worth of assets as of year-end 2004 for private investors and institutional clients 1082 PP Amsterdam capital) • Transaction Banking Group, which is our product organisation covering all The Netherlands • has over 3,000 branches in almost 60 countries and territories, a staff of about payments and trade in the bank for our retail, private client, commercial and 97,000 full-time equivalents worldwide and total assets of EUR 609 billion as of wholesale markets. Mailing address: year-end 2004 P.O. Box 283 • is listed among others on the Euronext Amsterdam and New York Stock To provide our clients across the Group with even better products and services, 1000 EA Amsterdam Exchange. we have also created a cross-(S)BU Consumer segment and a cross-(S)BU The Netherlands Commercial segment. These segments work closely with Asset Management, Our business strategy is built on five elements: Transaction Banking Group, Wholesale Clients and other product units to Telephone: 1. Creating value for our clients by offering high-quality financial solutions deliver high-quality solutions to our client bases in countries across the world. -

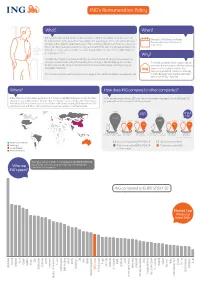

2015 Remuneration Fact Sheet

ING’s Remuneration Policy What? When? ING needs to attract and retain excellent leaders so that it can deliver on its promise to its Changes to ING’s Executive Board 34 million clients in the more than 40 countries it is operating in. At the same time, ING has Remuneration are eective as of to balance the interests of all stakeholders. The Supervisory Board reconfirms its support of 1 Jan 2016. ING´s Executive Board Remuneration Policy aimed at further reducing the gap between the total direct compensation of ING’s Executive Board and the median of the EURO STOXX 50 peer group over time. Why? For 2016, the Supervisory Board decided to increase the total (at target) remuneration of Executive Board members by 2%. Including these changes, ING will still pay its Executive To remain competitive, ING needs to attract Board well below the median for national and international companies in its peer group and retain the best leaders with international (the EURO STOXX 50). experience for its global activities. The Supervisory Board will continue to annually For more information see the remuneration page or the full Annual Report on www.ing.com. monitor developments and the applicable benchmark (EURO STOXX 50). Where? How does ING compare to other companies? ING is a European bank with a global presence. It has over 54,000 employees serving 34 million ING’s total remuneration for its CEO is far below the median (see graph). Also, its CFO and CRO customers across 40 countries. At least 70% of employees work outside of the Netherlands. -

Euronext Options and Futures Traded at the Amsterdam Derivatives Markets

Euronext Options and Futures traded at the Amsterdam Derivatives Markets Last change: Added new Spotlight option contracts AFU & HAL Date: Effective per 07-06-2021 STANDARD EXPIRY CYCLE Trading American style equity options Serial Quarterly HY Annual symbol 1 2 3 6 9 12 18 24 36 48 60 ABN AMRO Bank ABN x x x x x x x x x x x AEGON AGN x x x x x x x x x x x Koninklijke Ahold Delhaize AH x x x x x x x x x x x Akzo Nobel AKZ x x x x x x x x x x x ASML Holding ASL x x x x x x x x x x x Koninklijke DSM DSM x x x x x x x x x x x Heineken HEI x x x x x x x x x x x ING Groep ING x x x x x x x x x x x Koninklijke KPN KPN x x x x x x x x x x x ArcelorMittal MT x x x x x x x x x x x Koninklijke Philips Electronics PHI x x x x x x x x x x x Royal Dutch Shell (A-shares) RD x x x x x x x x x x x RELX PLC (EUR) REN x x x x x x x x x x x Unilever UN x x x x x x x x x x x ASM International ASM x x x x x x x x x Prosus PRX x x x x x x x x x Adyen (contract size 10) ADY x x x x x x x x Air France-KLM AFA x x x x x x x x Ageas AGA x x x x x x x x Koninklijke BAM Groep BAM x x x x x x x x Fugro FUR x x x x x x x x Just Eat Takeaway.com TKW x x x x x x x x Koninklijke PostNL PNL x x x x x x x x Randstad RND x x x x x x x x SBM Offshore SBM x x x x x x x x TomTom TTM x x x x x x x x Unibail-Rodamco-Westfield UBL x x x x x x x x Wolters Kluwer WKL x x x x x x x x Alfen ALF x x x x x x AMG AMG x x x x x x Aperam AP x x x x x x BE Semiconductor Industries BES x x x x x x Koninklijke Boskalis westminster BOS x x x x x x Klépierre CIO x x x x x x JDE Peet's JDE x -

Premium Thresholds for Equity Options Traded at Euronext Amsterdam

Premium Based Tick Size Premium thresholds for equity options traded at Euronext Amsterdam Trading Trading Premium Company Underlying symbol symbol threshold American European €0.50 €5.00 1 Aalberts Industries AAI x 2 ABN AMRO Group ABN x 3 Accell Group ACC x 4 Adidas ADQ x 5 Adyen (contract size 10) ADY x 6 Air France-KLM AFA x 7 Aegon AGN x 8 Ageas AGA x 9 Koninklijke Ahold Delhaize AH AH9 x 10 Akzo Nobel AKZ x 11 Altice Europe ATC x 12 AMG AMG x 13 Aperam AP x 14 Arcadis ARC x 15 ASML Holding ASL AS9 x 16 ASM International ASM x 17 ASR Nederland ASR x 18 Allianz AZQ x 19 Koninklijke BAM Groep BAM x 20 BinckBank BCK x 21 BE Semiconductor Industries BES x 22 Basf BFQ x 23 Brunel International BI x 24 Koninklijke Boskalis Westminster BOS x 25 Bayerische Motoren Werke BWQ x 26 Bayer REG BYQ x 27 Klépierre CIO x 28 Coca-Cola European Partners CCE x 29 CSM CSM x 30 Deutsche Bank DBQ x 31 Daimler REGISTERED SHARES DMQ x 32 Deutsche Post REG DPQ x 33 Koninklijke DSM DSM x 34 Euronext ENX x 35 E.ON EOQ x 36 Flow Traders FLW x 37 Fresenius SE & CO KGAA FSQ x 38 Fugro FUR x 39 Grandvision GVN x 40 Heineken HEI x 41 Heijmans HEY x 42 IMCD IMD x 43 ING Groep ING IN9 x 44 Intertrust ITR x 45 Kiadis Pharma KDS x 46 Koninklijke KPN KPN x 47 Muenchener Rueckver REG MRQ x 48 ArcelorMittal MT MT9 x 49 NIBC Holding NIB x 50 NN Group NN x 51 NSI NSI x 52 OCI OCI x 53 Ordina ORD x 54 Pharming Group PHA x 55 Koninklijke Philips Electronics PHI PH9 x 56 Koninklijke PostNL PNL x 57 Royal Dutch Shell (A-shares) RD RD9 x 58 RELX PLC (EUR) REN x 59 Randstad RND