190616 GS Call Notice Turbo Certificates

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PREFERENCE SHARES, NOMINAL VALUE of E2.24 PER SHARE, in the CAPITAL OF

11JUL200716232030 3JUL200720235794 11JUL200603145894 Public Offer by RFS Holdings B.V. FOR ALL OF THE ISSUED AND OUTSTANDING (FORMERLY CONVERTIBLE) PREFERENCE SHARES, NOMINAL VALUE OF e2.24 PER SHARE, IN THE CAPITAL OF ABN AMRO Holding N.V. Offer Memorandum and Offer Memorandum for ABN AMRO ordinary shares (incorporated by reference in this Offer Memorandum) 20 July 2007 This Preference Shares Offer expires at 15:00 hours, Amsterdam time, on 5 October 2007, unless extended. OFFER MEMORANDUM dated 20 July 2007 11JUL200716232030 3JUL200720235794 11JUL200603145894 PREFERENCE SHARES OFFER BY RFS HOLDINGS B.V. FOR ALL THE ISSUED AND OUTSTANDING PREFERENCE SHARES, NOMINAL VALUE OF e2.24 PER SHARE, IN THE CAPITAL OF ABN AMRO HOLDING N.V. RFS Holdings B.V. (‘‘RFS Holdings’’), a company formed by an affiliate of Fortis N.V. and Fortis SA/NV (Fortis N.V. and Fortis SA/ NV together ‘‘Fortis’’), The Royal Bank of Scotland Group plc (‘‘RBS’’) and an affiliate of Banco Santander Central Hispano, S.A. (‘‘Santander’’), is offering to acquire all of the issued and outstanding (formerly convertible) preference shares, nominal value e2.24 per share (‘‘ABN AMRO Preference Shares’’), of ABN AMRO Holding N.V. (‘‘ABN AMRO’’) on the terms and conditions set out in this document (the ‘‘Preference Shares Offer’’). In the Preference Shares Offer, RFS Holdings is offering to purchase each ABN AMRO Preference Share validly tendered and not properly withdrawn for e27.65 in cash. Assuming 44,988 issued and outstanding ABN AMRO Preference Shares outstanding as at 31 December 2006, the total value of the consideration being offered by RFS Holdings for the ABN AMRO Preference Shares is e1,243,918.20. -

Inside Allianz Series #1

Allianz Insurance UK Jon Dye CEO Allianz Insurance UK Inside Allianz Series London, June 19, 2015 Allianz Insurance UK UK at a glance Key data 2014 P/C market size1 and growth (GPW, GBP bn) . Population: 64.5mn CAGR +1.3% . GDP (GBP): 1,758bn 50 . GDP growth: 2.6% 43 43 45 45 46 . GDP/capita (GBP): 26,317 . Inflation: 1.5% . Insurance penetration2: 2.6% . Country rating (S&P): AAA 2010 2011 2012 2013 2014 2017e Market specifics Market shares and combined ratios . Largest European insurance market (2014, GPW, %) . Personal lines P/C insurance policies are 99.5% 102.9% 95.3% 102.5% 97.6% 100.9% 95.5% 98.5% sold approx. to 1/3 via brokers, 1/3 direct and 1/3 via other channels 13.4% . Increasing regulatory pressure from 9.9% both PRA5 and FCA6 7.9% 5.7% . Overcapacity making rate increases 5.3% 4.6% 4.4% 3.5% difficult despite poor market results 2015 Aviva RSA DLG3 AXA Ageas Zurich LV4 1) Excluding accident & health insurance 4) Liverpool Victoria SE Allianz © 2) GPW as % of GDP 5) Prudential Regulation Authority 3) Direct Line Group 6) Financial Conduct Authority Sources: SynThesys PRA Returns, peers’ company reports, Association of British Insurers (ABI), S&P sovereigns rating list 2 Allianz Insurance UK Allianz Insurance in UK (1) Revenues (EUR mn) Operating profit (EUR mn) Highlights CAGR +7.6% CAGR -8.9% . Fifth largest P/C insurer in the UK 2,684 . Highest GPW growth compared to peers over past 3 years 2,318 2,274 215 201 178 . -

ASM INTERNATIONAL N.V. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F ¨ Registration Statement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934. x Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. For the fiscal year ended December 31, 2008 ¨ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Date of event requiring this shell company report For the transition period from to Commission File Number: 0-13355 ASM INTERNATIONAL N.V. (Exact name of Registrant as specified in its charter) The Netherlands (jurisdiction of incorporation or organization) Versterkerstraat 8, 1322 AP, Almere, the Netherlands (Address of principal executive offices) Richard Bowers Telephone: (602) 432-1713 Fax: (602) 470-2419 Email: [email protected] Address: 3440 E. University Dr., Phoenix, AZ 85034, USA (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Shares, par value € 0.04 The NASDAQ Stock Market LLC Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 54,275,131 common shares; 21,985 preferred shares. -

CN DASHBOARD Marketing Meer Informatie? Ga Naar: of Bel 0900 MARKETS (0900-6275387; Lokaal Tarief) Samenstelling Document: Nico P.R

BNP PARIBAS - Corparate & Intitutional Banking TA: CN DASHBOARD Marketing Meer informatie? Ga naar: www.bnpparibasmarkets.nl of bel 0900 MARKETS (0900-6275387; lokaal tarief) Samenstelling document: Nico P.R. Bakker & Wouter de Boer www.nicoprbakker.nl updates via Twitter @TheDailyTurbo De weergegeven signalen zijn momentopnamen en kunnen na publicatie van dit document veranderen. Check dan ook de actuele rangen en standen als u transacties overweegt. DASHBOARD Coaching en Conditie EL Enter Long Coaching UP Up, koopstatus, stijging in uptrend XL Exit Long Coaching RES Resistance, correctiestatus, daling in uptrend ES Enter Short Coaching CN Dashboard DOWN Down, verkoopstatus, daling in downtrend Coaching & Conditie XS Exit Short Coaching SUP Support, herstelstatus, stijging in downtrend DW Dag- en weekgrafiek hebben dezelfde conditie (c) (d) closed of delayed koersdata Update DAILY Coaching en Conditie WEEKLY Coaching en Conditie 25-2-2020 Koers Fondsen Nederland Fondsen Nederland DAILY Signalen Nederlandse Fondsen Aantal van Signaal DW EL UP XL RES ES DOWN XS SUP EL UP XL RES ES DOWN XS SUP 0 AALBERTS NV 40,31 1 AALBERTS NV 1 DOWN ABN AMRO BANK N.V. 14,16 1 ABN AMRO BANK N.V. 1 0 ADYEN 841,40 1 ADYEN 1 DOWN AEGON 3,52 1 AEGON 1 0 AEX25 Index 596,83 1 AEX25 Index 1 0 AHOLD DEL 23,00 1 AHOLD DEL 1 DOWN AIR FRANCE -KLM 8,37 1 AIR FRANCE -KLM 1 DOWN AKZO NOBEL 81,36 1 AKZO NOBEL 1 UP ALTICE EUROPE N.V. 6,18 1 ALTICE EUROPE N.V. 1 DOWN AMG 20,40 1 AMG 1 0 AMX-INDEX 927,92 1 AMX-INDEX 1 0 APERAM 29,55 1 APERAM 1 RES ARCADIS 23,36 1 ARCADIS -

Part VII Transfers Pursuant to the UK Financial Services and Markets Act 2000

PART VII TRANSFERS EFFECTED PURSUANT TO THE UK FINANCIAL SERVICES AND MARKETS ACT 2000 www.sidley.com/partvii Sidley Austin LLP, London is able to provide legal advice in relation to insurance business transfer schemes under Part VII of the UK Financial Services and Markets Act 2000 (“FSMA”). This service extends to advising upon the applicability of FSMA to particular transfers (including transfers involving insurance business domiciled outside the UK), advising parties to transfers as well as those affected by them including reinsurers, liaising with the FSA and policyholders, and obtaining sanction of the transfer in the English High Court. For more information on Part VII transfers, please contact: Martin Membery at [email protected] or telephone + 44 (0) 20 7360 3614. If you would like details of a Part VII transfer added to this website, please email Martin Membery at the address above. Disclaimer for Part VII Transfers Web Page The information contained in the following tables contained in this webpage (the “Information”) has been collated by Sidley Austin LLP, London (together with Sidley Austin LLP, the “Firm”) using publicly-available sources. The Information is not intended to be, and does not constitute, legal advice. The posting of the Information onto the Firm's website is not intended by the Firm as an offer to provide legal advice or any other services to any person accessing the Firm's website; nor does it constitute an offer by the Firm to enter into any contractual relationship. The accessing of the Information by any person will not give rise to any lawyer-client relationship, or any contractual relationship, between that person and the Firm. -

3I Group PLC 3M Co 58.Com Inc A2A Spa AAC Technologies Holdings

3i Group PLC 3M Co 58.com Inc A2A SpA AAC Technologies Holdings Inc ABB Ltd Abbott Laboratories AbbVie Inc Accenture PLC Accton Technology Corp ACS Actividades de Construccio Activision Blizzard Inc Acuity Brands Inc Adani Ports & Special Economic Adaro Energy Tbk PT Adecco Group AG Adelaide Brighton Ltd adidas AG Adient PLC Adobe Systems Inc Advance Auto Parts Inc Advanced Ceramic X Corp Advanced Micro Devices Inc Advanced Semiconductor Enginee Aegon NV AES Corp/VA Aetna Inc Affiliated Managers Group Inc Aflac Inc Aga Khan Fund for Economic Dev AGFA-Gevaert NV Agilent Technologies Inc AGL Energy Ltd Agnaten SE AIA Group Ltd Air Products & Chemicals Inc AirAsia Bhd Airtac International Group Akamai Technologies Inc Akbank Turk AS Akzo Nobel NV Alaska Air Group Inc Albemarle Corp Alcoa Corp Alexandria Real Estate Equitie Alexion Pharmaceuticals Inc Alibaba Group Holding Ltd Align Technology Inc ALK-Abello A/S Allegion PLC Allergan PLC Alliance Data Systems Corp Alliant Energy Corp Allianz SE Allstate Corp/The Ally Financial Inc Alphabet Inc ALS Ltd Altaba Inc/Fund Family Altice NV Altran Technologies SA Altria Group Inc Alumina Ltd Amadeus IT Group SA Amazon.com Inc Amcor Ltd/Australia Ameren Corp America Movil SAB de CV American Airlines Group Inc American Axle & Manufacturing American Electric Power Co Inc American Express Co American International Group I American Tower Corp American Water Works Co Inc Ameriprise Financial Inc AmerisourceBergen Corp AMETEK Inc Amgen Inc Amorepacific Corp AMOREPACIFIC Group AMP Ltd Amphenol Corp ams AG -

FTSE Publications

2 FTSE Russell Publications 20 May 2021 FTSE Developed ex UK Indicative Index Weight Data as at Closing on 31 March 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 Drillisch <0.005 GERMANY Alfa Laval 0.02 SWEDEN Arch Capital Gp 0.03 USA 3M Company 0.21 USA Alfresa Holdings 0.01 JAPAN Archer Daniels Midland 0.06 USA A P Moller - Maersk A 0.02 DENMARK Align Technology Inc 0.08 USA Argenx S.E 0.03 BELGIUM A P Moller - Maersk B 0.03 DENMARK Alimentation Couche-Tard B 0.05 CANADA Ariake Japan <0.005 JAPAN a2 Milk 0.01 NEW ZEALAND Alleghany 0.02 USA Arista Networks 0.03 USA A2A 0.01 ITALY Allegion PLC 0.02 USA Aristocrat Leisure 0.03 AUSTRALIA AAC Technologies Holdings 0.01 HONG KONG Allegro 0.01 POLAND Arkema 0.02 FRANCE Aalberts NV 0.01 NETHERLANDS Alliant Energy 0.03 USA Aroundtown SA 0.02 GERMANY ABB 0.1 SWITZERLAND Allianz SE 0.2 GERMANY Arrow Electronics 0.02 USA Abbott Laboratories 0.39 USA Allstate Corp 0.07 USA Arthur J Gallagher 0.05 USA AbbVie Inc 0.36 USA Ally Financial 0.03 USA As One <0.005 JAPAN ABC-Mart <0.005 JAPAN Alnylam Pharmaceuticals 0.03 USA Asahi Group Holdings 0.03 JAPAN Abiomed Inc 0.03 USA Alony Hetz Properties & Inv <0.005 ISRAEL Asahi Intecc 0.01 JAPAN ABN AMRO Bank NV 0.01 NETHERLANDS Alphabet Class A 1.17 USA Asahi Kasei Corporation 0.03 JAPAN Accenture Cl A 0.33 USA Alphabet Class C 1.14 USA Ascendas Real Estate Investment Trust 0.01 SINGAPORE Acciona S.A. -

Remuneration Report

REMUNERATION REPORT The first part of this report outlines the remuneration policy REMUNERATION POLICY for the Board of Management as it has been adopted over The main objective of Fugro’s remuneration policy is to time, while the second part contains details of the attract, motivate and retain qualified management that is remuneration in 2015 of the members of the Board of needed for a global company of the size and complexity of Management and of the Supervisory Board. Fugro. The members of the Board of Management are More information on remuneration and on option and share rewarded accordingly. Variable remuneration is an important ownership of members of the Board of Management is part of the total package. The remuneration policy aims at available in note 5.64.2 of the financial statements in this compensation in line with the median of the labour market annual report. This remuneration report is also available reference group. The current remuneration policy was on Fugro’s website. adopted by the AGM on 6 May 2014 and took effect retroactively as from 1 January 2014. As mentioned above, This report has been prepared by the remuneration the policy was amended in the AGM on 30 April 2015. Within committee of the Supervisory Board. The main function of the framework of the remuneration policy, compensation for this committee is to prepare the decision-making of the the Board of Management is determined by the Supervisory Supervisory Board regarding the remuneration policy for the Board on the advice of the remuneration committee. Board of Management and the application of this policy to the remuneration of the individual members of the Board of Labour market reference group Management. -

European Insurance – an Analyst’S View

European insurance – an analyst’s view September 2018 Sami Taipalus (Executive Director) Goldman Sachs International 44-20-7051-7237 [email protected] Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S. Many investors see insurance as a black box European insurance – an analyst’s view Insurer Premiums + capital ? Global Investment Research 2 Presentation overview European insurance – an analyst’s view Equity markets – what you need to know Sector themes – opportunities and challenges Case studies Conclusions Global Investment Research 3 The traditional view of the market has limitations Equity markets – all you need to know Equity value = NPV of cash flows The traditional view< has some practical limitations Cash flows based on consensus IFRS E3S and book value metrics EPS/DPS expectations are not “economic” Risks are reflected in the cost of The market does not wait around for equity changes in consensus estimates Global Investment Research 4 SourceDGoldman Datastream,SachsGlobal Investment Indexed 12-month forward consensus netincome consensusforward 12-month Indexed 100 120 140 160 180 60 80 ene.-10 ul.-10 Allianz ene.-11 7markets Equity to know need all you The market moves fasterthan accounting profits ul.-11 ene.-12 ul.-12 ene.-10 AAA ul.-10 ene.-14 Research ul.-14 ene.-15 Generali ul.-15 ene.-16 ul.-16 ene.-1. -

ABN AMRO Annual Report 2003

Annual Report 2003 ABN AMRO Holding N.V. Profile ABN AMRO • is a prominent international bank with origins going back to 1824 • ranks eleventh in Europe and twenty-third in the world based on tier 1 capital • has more than 3,700 branches in over 60 countries and territories, a staff of about 110,000 full-time equivalents and total assets of EUR 560 billion as of year-end 2003 • is listed on the Euronext Amsterdam, London and New York Stock Exchanges, among others. Our business strategy is built on five key elements: 1. Creating value for our clients by offering high-quality financial solutions which best meet their current needs and long-term goals 2. Focusing on: • consumer and commercial clients in our home markets of the Netherlands, the United States Midwest, Brazil and in selected growth markets around the world • selected wholesale clients with an emphasis on Europe, and financial institutions • private clients 3. Leveraging our advantages in products and people to benefit all our clients 4. Sharing expertise and operational excellence across the group 5. Creating ‘fuel for growth’ by allocating capital and talent according to the principles of Managing for Value, our value-based management model. The goal is sustainable growth which will benefit all our stakeholders: clients, shareholders, employees and society at large. ABN AMRO’s Corporate Values and Business Principles guide everything we do as an organisation and as individuals. We basically implement the strategy through three Strategic Business Units: • Consumer & Commercial Clients (C&CC) – for individual and corporate clients requiring day-to-day banking. -

Abn Amro Bank Nv

7 MAY 2020 ABN AMRO ABN AMRO BANK N.V. REGISTRATION DOCUMENT constituting part of any base prospectus of the Issuer consisting of separate documents within the meaning of Article 8(6) of Regulation (EU) 2017/1129 (the "Prospectus Regulation") 250249-4-270-v18.0 55-40738204 CONTENTS Page 1. RISK FACTORS ...................................................................................................................................... 1 2. INTRODUCTION .................................................................................................................................. 26 3. DOCUMENTS INCORPORATED BY REFERENCE ......................................................................... 28 4. SELECTED DEFINITIONS AND ABBREVIATIONS ........................................................................ 30 5. PRESENTATION OF FINANCIAL INFORMATION ......................................................................... 35 6. THE ISSUER ......................................................................................................................................... 36 1.1 History and recent developments ............................................................................................. 36 1.2 Business description ................................................................................................................ 37 1.3 Regulation ............................................................................................................................... 40 1.4 Legal and arbitration proceedings .......................................................................................... -

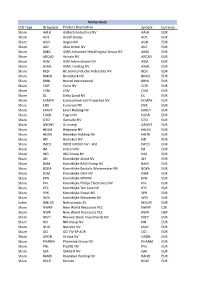

CFD Type IB Symbol Product Description Symbol Currency Share

Netherlands CFD Type IB Symbol Product Description Symbol Currency Share AALB Aalberts Industries NV AALB EUR Share AO1 Accell Group AO1 EUR Share AGN Aegon NV AGN EUR Share AKZ Akzo Nobel NV AKZ EUR Share AMG AMG Advanced Metallurgical Group NV AMG EUR Share ARCAD Arcadis NV ARCAD EUR Share ASM ASM International NV ASM EUR Share ASML ASML Holding NV ASML EUR Share BESI BE Semiconductor Industries NV BESI EUR Share BINCK BinckBank NV BINCK EUR Share BRNL Brunel International BRNL EUR Share COR Corio NV COR EUR Share CSM CSM CSM EUR Share DL Delta Lloyd NV DL EUR Share ECMPA Eurocommercial Properties NV ECMPA EUR Share ENX Euronext NV ENX EUR Share EXACT Exact Holding NV EXACT EUR Share FUGR Fugro NV FUGR EUR Share GTO Gemalto NV GTO EUR Share GRONT Grontmij GRONT EUR Share HEIJM Heijmans NV HEIJM EUR Share HEHN Heineken Holding NV HEHN EUR Share HEI Heineken NV HEI EUR Share IMCD IMCD GROUP NV - W/I IMCD EUR Share IM Imtech NV IM EUR Share ING ING Groep NV ING EUR Share AH Koninklijke Ahold NV AH EUR Share BAM Koninklijke BAM Groep NV BAM EUR Share BOKA Koninklijke Boskalis Westminster NV BOKA EUR Share DSM Koninklijke DSM NV DSM EUR Share KPN Koninklijke KPN NV KPN EUR Share PHI Koninklijke Philips Electronics NV PHI EUR Share KTC Koninklijke Ten Cate NV KTC EUR Share VPK Koninklijke Vopak NV VPK EUR Share WES Koninklijke Wessanen NV WES EUR Index IBNL25 Netherlands 25 IBNL25 EUR Share NWRP New World Resources PLC NWRP CZK Share NWR New World Resources PLC NWR GBP Share NISTI Nieuwe Steen Investments NV NISTI EUR Share NN NN Group NV