National IR Survey 2007 Rematch 18Th Edition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

Annual Report and Financial Statements

Annual Report and Financial Statements for the year ended 31 December 2019 Dimensional Funds ICVC Authorised by the Financial Conduct Authority No marketing notification has been submitted in Germany for the following Funds of Dimensional Funds ICVC: Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund Accordingly, these Funds must not be publicly marketed in Germany. Table of Contents Dimensional Funds ICVC General Information* 2 Investment Objectives and Policies* 3 Authorised Corporate Director’s Investment Report* 5 Incorporation and Share Capital* 9 The Funds* 9 Fund Cross-Holdings* 9 Fund and Shareholder Liability* 9 Regulatory Disclosure* 9 Potential Implications of Brexit* 9 Responsibilities of the Authorised Corporate Director 10 Responsibilities of the Depositary 10 Report of the Depositary to the Shareholders 10 Directors' Statement 10 Independent Auditors’ Report to the Shareholders of Dimensional Funds ICVC 11 The Annual Report and Financial Statements for each of the below sub-funds (the “Funds”); Emerging Markets Core Equity Fund Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund are set out in the following order: Fund Information* 13 Portfolio Statement* 30 Statement of Total Return 139 Statement of Change in Net Assets Attributable to Shareholders 139 Balance Sheet 140 Notes to the Financial Statements 141 Distribution Tables 160 Remuneration Disclosures (unaudited)* 169 Supplemental Information (unaudited)* 170 * These collectively comprise the Authorised Corporate Director’s (“ACD”) Report. Dimensional Fund Advisors Ltd. -

FTSE Publications

2 FTSE Russell Publications 20 May 2021 FTSE Developed ex UK Indicative Index Weight Data as at Closing on 31 March 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 Drillisch <0.005 GERMANY Alfa Laval 0.02 SWEDEN Arch Capital Gp 0.03 USA 3M Company 0.21 USA Alfresa Holdings 0.01 JAPAN Archer Daniels Midland 0.06 USA A P Moller - Maersk A 0.02 DENMARK Align Technology Inc 0.08 USA Argenx S.E 0.03 BELGIUM A P Moller - Maersk B 0.03 DENMARK Alimentation Couche-Tard B 0.05 CANADA Ariake Japan <0.005 JAPAN a2 Milk 0.01 NEW ZEALAND Alleghany 0.02 USA Arista Networks 0.03 USA A2A 0.01 ITALY Allegion PLC 0.02 USA Aristocrat Leisure 0.03 AUSTRALIA AAC Technologies Holdings 0.01 HONG KONG Allegro 0.01 POLAND Arkema 0.02 FRANCE Aalberts NV 0.01 NETHERLANDS Alliant Energy 0.03 USA Aroundtown SA 0.02 GERMANY ABB 0.1 SWITZERLAND Allianz SE 0.2 GERMANY Arrow Electronics 0.02 USA Abbott Laboratories 0.39 USA Allstate Corp 0.07 USA Arthur J Gallagher 0.05 USA AbbVie Inc 0.36 USA Ally Financial 0.03 USA As One <0.005 JAPAN ABC-Mart <0.005 JAPAN Alnylam Pharmaceuticals 0.03 USA Asahi Group Holdings 0.03 JAPAN Abiomed Inc 0.03 USA Alony Hetz Properties & Inv <0.005 ISRAEL Asahi Intecc 0.01 JAPAN ABN AMRO Bank NV 0.01 NETHERLANDS Alphabet Class A 1.17 USA Asahi Kasei Corporation 0.03 JAPAN Accenture Cl A 0.33 USA Alphabet Class C 1.14 USA Ascendas Real Estate Investment Trust 0.01 SINGAPORE Acciona S.A. -

Remuneration Report

REMUNERATION REPORT The first part of this report outlines the remuneration policy REMUNERATION POLICY for the Board of Management as it has been adopted over The main objective of Fugro’s remuneration policy is to time, while the second part contains details of the attract, motivate and retain qualified management that is remuneration in 2015 of the members of the Board of needed for a global company of the size and complexity of Management and of the Supervisory Board. Fugro. The members of the Board of Management are More information on remuneration and on option and share rewarded accordingly. Variable remuneration is an important ownership of members of the Board of Management is part of the total package. The remuneration policy aims at available in note 5.64.2 of the financial statements in this compensation in line with the median of the labour market annual report. This remuneration report is also available reference group. The current remuneration policy was on Fugro’s website. adopted by the AGM on 6 May 2014 and took effect retroactively as from 1 January 2014. As mentioned above, This report has been prepared by the remuneration the policy was amended in the AGM on 30 April 2015. Within committee of the Supervisory Board. The main function of the framework of the remuneration policy, compensation for this committee is to prepare the decision-making of the the Board of Management is determined by the Supervisory Supervisory Board regarding the remuneration policy for the Board on the advice of the remuneration committee. Board of Management and the application of this policy to the remuneration of the individual members of the Board of Labour market reference group Management. -

1994 Foundation of Nutreco

‘11 CONTENTS CONTENTS Overview Operations and and strategy 2 business performance 32 OVERVIEW AND STRATEGY OPERATIONAL DEVELOPMENTS Our track record and ambitions 2 Premix and Feed Specialties 34 Statement by the Chief Executive Officer 4 Fish Feed 36 Profile & financial highlights 6 Animal Nutrition Canada 38 Key figures 8 Compound Feed Europe 40 Report of the Executive Board 10 Meat and Other 42 Operating result 13 Strategic agenda 2012 14 Innovation 46 Strategy 17 Sustainability 56 Strategic objectives and highlights 24 Human Resources 60 Information about the Nutreco share 27 OPERATIONS GOVERNANCE OVERVIEW AND AND BUSINESS AND FINANCIAL STRATEGY PERFORMANCE COMPLIANCE STATEMENTS 1 Governance Financial and compliance 64 statements 91 Risk management 64 FINANCIAL STATEMENTS Management review and reporting 73 Corporate governance 74 Consolidated financial statements 92 Remuneration Report 79 Notes to the consolidated financial statements 98 Report of the Supervisory Board 85 Company’s financial statements 182 Notes to the company’s financial statements 183 Other information 185 Independent auditor’s report 186 Ten years of Nutreco 188 ADDENDUM Executive Board 190 Supervisory Board 191 Business Management & corporate staff 193 Participations of Nutreco N.V. 194 2 OUR TRACK RECORD AND AMBITIONS Our track record and ambitions AquaVision and Agri Vision Annual international conference organised by Nutreco since 1996, Sustainability bringing multiple stakeholders together • First Sustainability Report in 2000. at a professional, non-political forum to • Establishment of Innovation and discuss challenges and opportunities Sustainability Committee in in agriculture and aquaculture. About Supervisory Board in 2009 and 5,000 delegates have attended. performance targets on sustainability for top management since 2010. -

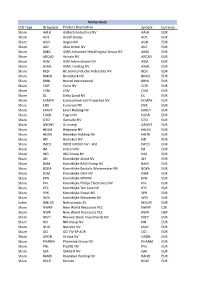

CFD Type IB Symbol Product Description Symbol Currency Share

Netherlands CFD Type IB Symbol Product Description Symbol Currency Share AALB Aalberts Industries NV AALB EUR Share AO1 Accell Group AO1 EUR Share AGN Aegon NV AGN EUR Share AKZ Akzo Nobel NV AKZ EUR Share AMG AMG Advanced Metallurgical Group NV AMG EUR Share ARCAD Arcadis NV ARCAD EUR Share ASM ASM International NV ASM EUR Share ASML ASML Holding NV ASML EUR Share BESI BE Semiconductor Industries NV BESI EUR Share BINCK BinckBank NV BINCK EUR Share BRNL Brunel International BRNL EUR Share COR Corio NV COR EUR Share CSM CSM CSM EUR Share DL Delta Lloyd NV DL EUR Share ECMPA Eurocommercial Properties NV ECMPA EUR Share ENX Euronext NV ENX EUR Share EXACT Exact Holding NV EXACT EUR Share FUGR Fugro NV FUGR EUR Share GTO Gemalto NV GTO EUR Share GRONT Grontmij GRONT EUR Share HEIJM Heijmans NV HEIJM EUR Share HEHN Heineken Holding NV HEHN EUR Share HEI Heineken NV HEI EUR Share IMCD IMCD GROUP NV - W/I IMCD EUR Share IM Imtech NV IM EUR Share ING ING Groep NV ING EUR Share AH Koninklijke Ahold NV AH EUR Share BAM Koninklijke BAM Groep NV BAM EUR Share BOKA Koninklijke Boskalis Westminster NV BOKA EUR Share DSM Koninklijke DSM NV DSM EUR Share KPN Koninklijke KPN NV KPN EUR Share PHI Koninklijke Philips Electronics NV PHI EUR Share KTC Koninklijke Ten Cate NV KTC EUR Share VPK Koninklijke Vopak NV VPK EUR Share WES Koninklijke Wessanen NV WES EUR Index IBNL25 Netherlands 25 IBNL25 EUR Share NWRP New World Resources PLC NWRP CZK Share NWR New World Resources PLC NWR GBP Share NISTI Nieuwe Steen Investments NV NISTI EUR Share NN NN Group NV -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

Integrated Reporting As a Driver for Integrated Thinking?

Integrated Reporting as a driver for Integrated Thinking? Maturity of <IR> in the Netherlands 2015 Contributors Patrick Seinstra Jennifer Muller Royal BAM Group: Barry Oesman Partner Integrated & Sustainability Deloitte Audit Master Student at London School of Economics and Group Controller Political Science Anneke Sipkens DSM: Kimberley Chan Director Sustainability Deloitte Risk Services Michiel van der Valk Sustainability Manager Master Student Sustainable Business & Innovation at Udeke Huiskamp Utrecht University Nutreco: Jose Villalon Senior Manager Sustainability Deloitte Risk Services Corporate Sustainability Director CSR the Netherlands (MVO Nederland) Erica Kostense-Smit Willem Lageweg Nutreco: Sigrid van Amerongen Manager Sustainability Deloitte Risk Services CEO CSR The Netherlands (MVO Nederland) CSR Manager Ashley Myers Vincent van Marle Heineken International: Jan-Willem Vosmeer Manager Sustainability Deloitte Risk Services Manager CSR Manager Frank Geelen Interviewees Delta Lloyd: David Hoppe Partner CFO Services & Finance Transformation NS: Carola Wijdoogen Communications Advisor Deloitte Consulting Director Sustainable Business Ministry of Economic Affairs: Martin Lok Marco van der Vegte KPN: Hans Koeleman Program Manager Natural Capital Managing Partner Audit and Member Executive Board Director Corporate Communications & CSR Deloitte Holding Avans Hogeschool: Marleen Janssen Groesbeek KPN: Brechtje Spoorenberg Professor Sustainable Finance and Accounting Olivier van Thuijl Manager CSR Senior Manager CFO Services Deloitte -

VBDO Responsible Supply Chain Benchmark 2012

VBDO Responsible Supply Chain Benchmark 2012 a comparative investigation into CSR in the supply chain of 40 multinationals Pieterstraat 11 3512 JT Utrecht T +31 (0) 30 234 00 31 [email protected] www.vbdo.nl VBDO Responsible Supply Chain Benchmark 2012 a comparative investigation into CSR in the supply chain of 40 multinationals A research paper by VBDO (Dutch Association of Investors for Sustainable Development) VBDO: Chris Bres Philip Cotterell Rukiye Kaya Saskia Verbunt November 2012 This report has been made possible by ICCO. The contents, conclusions and recommendations are, however, the sole responsibility of the VBDO. © VBDO report by the Dutch Association of Investors for Sustainable Development (Vereniging van Beleggers voor Duurzame Ontwikkeling) Disclaimer VBDO will assume no responsibility or legal liability for incorrect or misleading information provided by the sources used for this report. THE DUTCH A SSOCIATION OF INVESTO2RS FOR SUSTAINABLE DEVELOPMENT 2 Contents Foreword 5 Executive Summary 6 Chapter 1 Introduction 8 1.1 Mission and vision of the VBDO 8 1.2 Vision on Corporate Social Responsibility (CSR) 8 1.3 Vision on Responsible Supply Chain Management (RSCM) 10 Chapter 2 Method 12 2.1 Introduction to the method 12 2.2 Basic principles and demarcation 13 2.2.1 Basic principles 13 2.2.2 Demarcation 13 2.3 Benchmark indicators 14 2.4 Modifications in the benchmark criteria 2012 16 2.5 Scoring in practice 17 2.6 Role of the jury and the Award 18 Chapter 3 Results - Company Performance 19 3.1 Chemicals 19 AkzoNobel 19 DSM 20 -

Remuneration Policy Supervisory Board

Signify N.V. Remuneration Policy Supervisory Board 1 Introduction The total remuneration of members of the Supervisory Board is targeted around the median The objective of the remuneration policy of the level of a representative labor market peer group and Supervisory Board is to support long-term value benchmarked periodically. This peer group is the same creation of the company. The following principles apply as used for benchmarking the remuneration of the for this remuneration policy: Board of Management. The peer group consists of 50% • The remuneration policy aims to attract, reward and Dutch headquartered cross-industry companies that are retain qualified Supervisory Board members, together included in the AEX or AMX, and 50% European sector forming a diverse and balanced Supervisory Board specific companies. For use for the remuneration of the with the appropriate level of skills, competences and Chairman of Supervisory Board, peer group companies experience for overseeing the (execution of the) having a one-tier board structure are excluded. Company’s strategy and performance, whilst taking the interest of all the company’s stakeholders into As of January 2020, the labor market peer group account. consists of the following 14 companies: • Given the nature of the responsibilities of the Supervisory Board as an independent body, the Signify labor market peer group remuneration is not dependent on the performance Aalberts DSM Prysmian Group of the company and therefore consists of fixed AkzoNobel KPN Rexel components only. ASML Legrand Rheinmetall Group • The remuneration reflects the time spent and BAM Nexans Siemens Gamesa responsibilities of each individual member of the Boskalis Osram Supervisory Board. -

Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 22.01.2018 Page 1

Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 22.01.2018 Page 1 ********************************************************************************** AMENDMENTS ARE MARKED AS FOLLOWS: INSERTIONS ARE UNDERLINED DELETIONS ARE CROSSED OUT ********************************************************************************** 1. Part: Contract Specifications for Futures Contracts […] 2. Subpart: Contract Specifications for Index Options […] 2.6.11 Price Gradations The price of a stock option or LEPO will generally be quoted with three or four decimal place. The smallest price change (Tick) shall be EUR 0.0005, EUR 0.001, EUR 0.01 or CHF 0.01 or GBX* 0.5, GBX 0.25 or USD 0.01. For stock options with group ID NL11, NL12 and NL13, the tick size will increase to EUR 0.05 for contracts with a premium above a predefined threshold stipulated in Annex B (Premium Threshold). The Management Boards of the Eurex Exchanges shall determine the relevant decimal place and the smallest price change (Tick) and shall notify all Exchange participation of any such decision. 3. Part: Contracts Off-Book […] Contract Specifications for Futures Contracts and Eurex14e Options Contracts at Eurex Deutschland and Eurex Zürich As of 22.01.2018 Page 2 3.3.4.2 Annex B: in relation to Subsection 2.6 of the Contract Specifications: […] Options on shares of Product-ID Group ID Minimum price Premium Minimum price change below Threshold change above threshold threshold Aalberts Industries N.V. AAI NL12 0.01 0.5 0.05 ABN AMRO Group AAR NL11 0.01 5 0.05 AEGON N.V. AEN NL11 0.01 5 0.05 Koninklijke Ahold NL11 Delhaize N.V. -

Remuneration Report

REMUNERATION REPORT The first part of this report outlines the current remuneration ■ Performance related conditional shares and performance policy as adopted by the Annual General Meeting (AGM) on related conditional options as part of the long-term 6 May 2014. The second part contains details of the incentive instead of unconditional options. remuneration in 2014 of the members of the Board of Management and of the Supervisory Board. More The remuneration policy is also applicable to members of the information on remuneration and on share and option Executive Committee who are not a member of the Board of ownership of members of the Board of Management is Management. available in note 5.63 of the financial statements in this annual report. This remuneration report is also available on The revised remuneration policy was adopted by the AGM Fugro’s website. on 6 May 2014 and took effect retroactively as from 1 January 2014. This report has been prepared by the remuneration committee of the Supervisory Board. The main function of Labour market reference group this committee is to prepare the decision-making of the In preparing the revised remuneration policy, the Supervisory Board regarding the remuneration policy for the remuneration committee used external benchmark Board of Management and the application of this policy to information to assess market comparability of the the remuneration of the individual members of the Board of remuneration. The labour market reference group consists of Management. The remuneration policy will be reviewed every 14 Dutch listed companies of comparable scope with highly three years to verify its market conformity.