Q4 2015 Quarterly Commentary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Highlights in Space 2010

International Astronautical Federation Committee on Space Research International Institute of Space Law 94 bis, Avenue de Suffren c/o CNES 94 bis, Avenue de Suffren UNITED NATIONS 75015 Paris, France 2 place Maurice Quentin 75015 Paris, France Tel: +33 1 45 67 42 60 Fax: +33 1 42 73 21 20 Tel. + 33 1 44 76 75 10 E-mail: : [email protected] E-mail: [email protected] Fax. + 33 1 44 76 74 37 URL: www.iislweb.com OFFICE FOR OUTER SPACE AFFAIRS URL: www.iafastro.com E-mail: [email protected] URL : http://cosparhq.cnes.fr Highlights in Space 2010 Prepared in cooperation with the International Astronautical Federation, the Committee on Space Research and the International Institute of Space Law The United Nations Office for Outer Space Affairs is responsible for promoting international cooperation in the peaceful uses of outer space and assisting developing countries in using space science and technology. United Nations Office for Outer Space Affairs P. O. Box 500, 1400 Vienna, Austria Tel: (+43-1) 26060-4950 Fax: (+43-1) 26060-5830 E-mail: [email protected] URL: www.unoosa.org United Nations publication Printed in Austria USD 15 Sales No. E.11.I.3 ISBN 978-92-1-101236-1 ST/SPACE/57 *1180239* V.11-80239—January 2011—775 UNITED NATIONS OFFICE FOR OUTER SPACE AFFAIRS UNITED NATIONS OFFICE AT VIENNA Highlights in Space 2010 Prepared in cooperation with the International Astronautical Federation, the Committee on Space Research and the International Institute of Space Law Progress in space science, technology and applications, international cooperation and space law UNITED NATIONS New York, 2011 UniTEd NationS PUblication Sales no. -

59864 Federal Register/Vol. 85, No. 185/Wednesday, September 23

59864 Federal Register / Vol. 85, No. 185 / Wednesday, September 23, 2020 / Rules and Regulations FEDERAL COMMUNICATIONS C. Congressional Review Act II. Report and Order COMMISSION 2. The Commission has determined, A. Allocating FTEs 47 CFR Part 1 and the Administrator of the Office of 5. In the FY 2020 NPRM, the Information and Regulatory Affairs, Commission proposed that non-auctions [MD Docket No. 20–105; FCC 20–120; FRS Office of Management and Budget, funded FTEs will be classified as direct 17050] concurs that these rules are non-major only if in one of the four core bureaus, under the Congressional Review Act, 5 i.e., in the Wireline Competition Assessment and Collection of U.S.C. 804(2). The Commission will Bureau, the Wireless Regulatory Fees for Fiscal Year 2020 send a copy of this Report & Order to Telecommunications Bureau, the Media Congress and the Government Bureau, or the International Bureau. The AGENCY: Federal Communications indirect FTEs are from the following Commission. Accountability Office pursuant to 5 U.S.C. 801(a)(1)(A). bureaus and offices: Enforcement ACTION: Final rule. Bureau, Consumer and Governmental 3. In this Report and Order, we adopt Affairs Bureau, Public Safety and SUMMARY: In this document, the a schedule to collect the $339,000,000 Homeland Security Bureau, Chairman Commission revises its Schedule of in congressionally required regulatory and Commissioners’ offices, Office of Regulatory Fees to recover an amount of fees for fiscal year (FY) 2020. The the Managing Director, Office of General $339,000,000 that Congress has required regulatory fees for all payors are due in Counsel, Office of the Inspector General, the Commission to collect for fiscal year September 2020. -

PUBLIC NOTICE FEDERAL COMMUNICATIONS COMMISSION 445 12Th STREET S.W

PUBLIC NOTICE FEDERAL COMMUNICATIONS COMMISSION 445 12th STREET S.W. WASHINGTON D.C. 20554 News media information 202-418-0500 Internet: http://www.fcc.gov (or ftp.fcc.gov) TTY (202) 418-2555 Report No. SES-02141 Wednesday March 6, 2019 Satellite Communications Services Information re: Actions Taken The Commission, by its International Bureau, took the following actions pursuant to delegated authority. The effective dates of the actions are the dates specified. SES-AMD-20180618-01655 E E180603 KHNL/KGMB License Subsidiary, LLC Amendment Grant of Authority Date Effective: 02/27/2019 Class of Station: Fixed Earth Stations Nature of Service: Fixed Satellite Service SITE ID: 1 LOCATION: 420 Waiakamilo Road Suite 205, Honolulu, Honolulu, HI 21 ° 19 ' 21.20 " N LAT. 157 ° 52 ' 44.00 " W LONG. ANTENNA ID: 1 6 meters ViaSat 6 meter 3700.0000 - 4200.0000 MHz 36M0G7W Digital Video Carrier ANTENNA ID: 2 6 meters VIASAT 6 METER 3700.0000 - 4200.0000 MHz 36M0G7W Digital Video Carrier ANTENNA ID: 3 6 meters VIASAT 6 METER1 3700.0000 - 4200.0000 MHz 36M0G7W Digital Video Carrier Points of Communication: 1 - PERMITTED LIST - () Page 1 of 17 SES-AMD-20180809-02131 E E180603 KHNL/KGMB License Subsidiary, LLC Amendment Grant of Authority Date Effective: 02/27/2019 Class of Station: Fixed Earth Stations Nature of Service: Fixed Satellite Service SITE ID: 1 LOCATION: 420 Waiakamilo Road Suite 205, Honolulu, Honolulu, HI 21 ° 19 ' 21.20 " N LAT. 157 ° 52 ' 44.00 " W LONG. ANTENNA ID: 1 6 meters ViaSat 6 METER 3700.0000 - 4200.0000 MHz 36M0G7W Digital Video Carrier ANTENNA ID: 2 6 meters VIASAT 6 METER 3700.0000 - 4200.0000 MHz 36M0G7W Digital Video Carrier ANTENNA ID: 3 6 meters VIASAT 6 METER 3700.0000 - 4200.0000 MHz 36M0G7W Digital Video Carrier Points of Communication: 1 - PERMITTED LIST - () SES-AMD-20181016-03227 E E181561 CCO SoCal I, LLC / INACTIVE FRN / DO NOT USE Amendment Grant of Authority Date Effective: 02/27/2019 Class of Station: Fixed Earth Stations Nature of Service: Fixed Satellite Service See IBFS File No. -

Federal Register/Vol. 86, No. 91/Thursday, May 13, 2021/Proposed Rules

26262 Federal Register / Vol. 86, No. 91 / Thursday, May 13, 2021 / Proposed Rules FEDERAL COMMUNICATIONS BCPI, Inc., 45 L Street NE, Washington, shown or given to Commission staff COMMISSION DC 20554. Customers may contact BCPI, during ex parte meetings are deemed to Inc. via their website, http:// be written ex parte presentations and 47 CFR Part 1 www.bcpi.com, or call 1–800–378–3160. must be filed consistent with section [MD Docket Nos. 20–105; MD Docket Nos. This document is available in 1.1206(b) of the Commission’s rules. In 21–190; FCC 21–49; FRS 26021] alternative formats (computer diskette, proceedings governed by section 1.49(f) large print, audio record, and braille). of the Commission’s rules or for which Assessment and Collection of Persons with disabilities who need the Commission has made available a Regulatory Fees for Fiscal Year 2021 documents in these formats may contact method of electronic filing, written ex the FCC by email: [email protected] or parte presentations and memoranda AGENCY: Federal Communications phone: 202–418–0530 or TTY: 202–418– summarizing oral ex parte Commission. 0432. Effective March 19, 2020, and presentations, and all attachments ACTION: Notice of proposed rulemaking. until further notice, the Commission no thereto, must be filed through the longer accepts any hand or messenger electronic comment filing system SUMMARY: In this document, the Federal delivered filings. This is a temporary available for that proceeding, and must Communications Commission measure taken to help protect the health be filed in their native format (e.g., .doc, (Commission) seeks comment on and safety of individuals, and to .xml, .ppt, searchable .pdf). -

Introduction of NEC Space Business (Launch of Satellite Integration Center)

Introduction of NEC Space Business (Launch of Satellite Integration Center) July 2, 2014 Masaki Adachi, General Manager Space Systems Division, NEC Corporation NEC Space Business ▌A proven track record in space-related assets Satellites · Communication/broadcasting · Earth observation · Scientific Ground systems · Satellite tracking and control systems · Data processing and analysis systems · Launch site control systems Satellite components · Large observation sensors · Bus components · Transponders · Solar array paddles · Antennas Rocket subsystems Systems & Services International Space Station Page 1 © NEC Corporation 2014 Offerings from Satellite System Development to Data Analysis ▌In-house manufacturing of various satellites and ground systems for tracking, control and data processing Japan's first Scientific satellite Communication/ Earth observation artificial satellite broadcasting satellite satellite OHSUMI 1970 (24 kg) HISAKI 2013 (350 kg) KIZUNA 2008 (2.7 tons) SHIZUKU 2012 (1.9 tons) ©JAXA ©JAXA ©JAXA ©JAXA Large onboard-observation sensors Ground systems Onboard components Optical, SAR*, hyper-spectral sensors, etc. Tracking and mission control, data Transponders, solar array paddles, etc. processing, etc. Thermal and near infrared sensor for carbon observation ©JAXA (TANSO) CO2 distribution GPS* receivers Low-noise Multi-transponders Tracking facility Tracking station amplifiers Dual- frequency precipitation radar (DPR) Observation Recording/ High-accuracy Ion engines Solar array 3D distribution of TTC & M* station image -

REDACTED for PUBLIC INSPECTION Appendix A

REDACTED - FOR PUBLIC INSPECTION Appendix A Intelsat License LLC REDACTED -- FOR PUBLIC INSPECTION Transponder and Contract Information Satellite Call Sign Transponder name Frequency Total Capacity Total Capacity (MHz) Total Capacity (MHz) Percentage Used for Range (MHz) (MHz) Under Contract Under Contract March Customer outside March 2019 2016 the U.S. Galaxy 12 S2422 10C/10C 3882 - 3918 36 0% 11C/11C 3902 - 3938 36 0% 12C/12C 3922 - 3958 36 0% 13C/13C 3942 - 3978 36 0% 14C/14C 3962 - 3998 36 0% 15C/15C 3982 - 4018 36 0% 16C/16C 4002 - 4038 36 0% 17C/17C 4022 - 4058 36 0% 18C/18C 4042 - 4078 36 0% 19C/19C 4062 - 4098 36 0% 1C/1C 3702 - 3738 36 0% 20C/20C 4082 - 4118 36 0% 21C/21C 4102 - 4138 36 0% 22C/22C 4122 - 4158 36 0% 23C/23C 4142 - 4178 36 0% 24C/24C 4162 - 4198 36 0% 2C/2C 3722 - 3758 36 0% 3C/3' 3742 - 3778 36 0% 4C/4C 3762 - 3798 36 0% SC/SC 3782 - 3818 36 0% 6C/6C 3802 - 3838 36 0% 7C/7C 3822 - 3858 36 0% 8C/8C 3842 - 3878 36 0% 9C/9C 3862 - 3898 36 0% 'This transponder is used for occasion/al use "OU" services. Intelsat License LLC REDACTED -- FOR PUBLIC INSPECTION Transponder and Contract Information Satellite Call Sign Transponder name Frequency Total Capacity Total Capacity (MHz) Total Capacity (MHz) Percentage Used for Range (MHz) (MHz) Under Contract Under Contract March Customer outside March 2019 1 2016 the U.S. Galaxy 13 S2386 10C/10C 3882 - 3918 36 0% 11C/11C 3902 - 3938 36 0% 12C/12C 3922 - 3958 36 0% 13C/13C 3942 - 3978 36 0% 14C/14C 3962 - 3998 36 0% 15C/15C 3982 - 4018 36 0% 16C/16C 4002 - 4038 36 0% 17C/17C 4022 -

China Dream, Space Dream: China's Progress in Space Technologies and Implications for the United States

China Dream, Space Dream 中国梦,航天梦China’s Progress in Space Technologies and Implications for the United States A report prepared for the U.S.-China Economic and Security Review Commission Kevin Pollpeter Eric Anderson Jordan Wilson Fan Yang Acknowledgements: The authors would like to thank Dr. Patrick Besha and Dr. Scott Pace for reviewing a previous draft of this report. They would also like to thank Lynne Bush and Bret Silvis for their master editing skills. Of course, any errors or omissions are the fault of authors. Disclaimer: This research report was prepared at the request of the Commission to support its deliberations. Posting of the report to the Commission's website is intended to promote greater public understanding of the issues addressed by the Commission in its ongoing assessment of U.S.-China economic relations and their implications for U.S. security, as mandated by Public Law 106-398 and Public Law 108-7. However, it does not necessarily imply an endorsement by the Commission or any individual Commissioner of the views or conclusions expressed in this commissioned research report. CONTENTS Acronyms ......................................................................................................................................... i Executive Summary ....................................................................................................................... iii Introduction ................................................................................................................................... 1 -

2013 Commercial Space Transportation Forecasts

Federal Aviation Administration 2013 Commercial Space Transportation Forecasts May 2013 FAA Commercial Space Transportation (AST) and the Commercial Space Transportation Advisory Committee (COMSTAC) • i • 2013 Commercial Space Transportation Forecasts About the FAA Office of Commercial Space Transportation The Federal Aviation Administration’s Office of Commercial Space Transportation (FAA AST) licenses and regulates U.S. commercial space launch and reentry activity, as well as the operation of non-federal launch and reentry sites, as authorized by Executive Order 12465 and Title 51 United States Code, Subtitle V, Chapter 509 (formerly the Commercial Space Launch Act). FAA AST’s mission is to ensure public health and safety and the safety of property while protecting the national security and foreign policy interests of the United States during commercial launch and reentry operations. In addition, FAA AST is directed to encourage, facilitate, and promote commercial space launches and reentries. Additional information concerning commercial space transportation can be found on FAA AST’s website: http://www.faa.gov/go/ast Cover: The Orbital Sciences Corporation’s Antares rocket is seen as it launches from Pad-0A of the Mid-Atlantic Regional Spaceport at the NASA Wallops Flight Facility in Virginia, Sunday, April 21, 2013. Image Credit: NASA/Bill Ingalls NOTICE Use of trade names or names of manufacturers in this document does not constitute an official endorsement of such products or manufacturers, either expressed or implied, by the Federal Aviation Administration. • i • Federal Aviation Administration’s Office of Commercial Space Transportation Table of Contents EXECUTIVE SUMMARY . 1 COMSTAC 2013 COMMERCIAL GEOSYNCHRONOUS ORBIT LAUNCH DEMAND FORECAST . -

Quarterly Commentary Quarterly Total Revenue And

Quarterly Commentary First Quarter 2018 January 1, 2018 - March 31, 2018 May 1, 2018 First Quarter 2018 Performance Summary Our performance in the first quarter of 2018 includes many examples of the benefits of our global scale, regional expertise and technology. In the first quarter, we advanced our operating priorities, gaining new Intelsat EpicNG contracts with wireless operators in Asia and Africa and winning a new hosted payload for a government customer that will ride on one of our planned North America replacement satellites. On January 1, 2018, we adopted the provisions of the Financial Accounting Standards Board Accounting Standards Codification Topic 606, Revenue from Contracts with Customers (“ASC 606”). The most significant adjustments to our reported results were related to contracts with a significant financing component, typically with respect to our long-term media and government contracts for which a prepayment was received, which resulted in an increase in revenue and an increase in interest expense, both of which are non-cash. Only a small portion of our total contracts required accounting changes as a result of implementing ASC 606. This change further aligns Intelsat with international accounting practices consistent with our peer group. Quarterly Total Revenue and Adjusted AEBITDA $600 $544 $500 $539 $538 $538 $533 $519 $419 $400 $410 $418 $420 $416 $392 Revenue Millions $300 AEBITDA $200 $100 $- 1Q17 2Q17 3Q17 4Q17 1Q18 Total revenue was $544 million in the first quarter of 2018, an increase of $5 million or 1 percent as compared to the first quarter of 2017. Total revenue excluding the effects of ASC 606 was $519 million for the first quarter of 2018, a decline of $20 million or 4 percent as compared to the first quarter of 2017. -

Changes to the Database for May 1, 2021 Release This Version of the Database Includes Launches Through April 30, 2021

Changes to the Database for May 1, 2021 Release This version of the Database includes launches through April 30, 2021. There are currently 4,084 active satellites in the database. The changes to this version of the database include: • The addition of 836 satellites • The deletion of 124 satellites • The addition of and corrections to some satellite data Satellites Deleted from Database for May 1, 2021 Release Quetzal-1 – 1998-057RK ChubuSat 1 – 2014-070C Lacrosse/Onyx 3 (USA 133) – 1997-064A TSUBAME – 2014-070E Diwata-1 – 1998-067HT GRIFEX – 2015-003D HaloSat – 1998-067NX Tianwang 1C – 2015-051B UiTMSAT-1 – 1998-067PD Fox-1A – 2015-058D Maya-1 -- 1998-067PE ChubuSat 2 – 2016-012B Tanyusha No. 3 – 1998-067PJ ChubuSat 3 – 2016-012C Tanyusha No. 4 – 1998-067PK AIST-2D – 2016-026B Catsat-2 -- 1998-067PV ÑuSat-1 – 2016-033B Delphini – 1998-067PW ÑuSat-2 – 2016-033C Catsat-1 – 1998-067PZ Dove 2p-6 – 2016-040H IOD-1 GEMS – 1998-067QK Dove 2p-10 – 2016-040P SWIATOWID – 1998-067QM Dove 2p-12 – 2016-040R NARSSCUBE-1 – 1998-067QX Beesat-4 – 2016-040W TechEdSat-10 – 1998-067RQ Dove 3p-51 – 2017-008E Radsat-U – 1998-067RF Dove 3p-79 – 2017-008AN ABS-7 – 1999-046A Dove 3p-86 – 2017-008AP Nimiq-2 – 2002-062A Dove 3p-35 – 2017-008AT DirecTV-7S – 2004-016A Dove 3p-68 – 2017-008BH Apstar-6 – 2005-012A Dove 3p-14 – 2017-008BS Sinah-1 – 2005-043D Dove 3p-20 – 2017-008C MTSAT-2 – 2006-004A Dove 3p-77 – 2017-008CF INSAT-4CR – 2007-037A Dove 3p-47 – 2017-008CN Yubileiny – 2008-025A Dove 3p-81 – 2017-008CZ AIST-2 – 2013-015D Dove 3p-87 – 2017-008DA Yaogan-18 -

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, DC 20554

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, DC 20554 In the Matter of ) ) Fourth Report to Congress on ) IB Docket No. 14-229 Status of Competition in the Provision of ) Satellite Services ) To: The Commission COMMENTS OF THE SATELLITE INDUSTRY ASSOCIATION SATELLITE INDUSTRY ASSOCIATION Tom Stroup President 1200 18th Street, NW, Suite 1001 Washington, DC 20036 February 6, 2015 Tel. (202) 503-1561 SUMMARY The Satellite Industry Association (“SIA”) hereby responds to the International Bureau’s Public Notice requesting information on competition in the provision of satellite services. As discussed herein and in the attached 2014 State of the Satellite Industry Report, the satellite industry has continued to grow and innovate, providing an ever-increasing array of services and using spectrum more efficiently. During the 2011-2013 time frame on which the Bureau seeks comment, existing providers added capacity and new operators entered the market in every region of the globe. Meanwhile, there has been no significant change in the level of vertical integration within the industry. Despite the long lead times and substantial upfront costs that characterize the satellite industry economic structure, entry by additional competitors has continued. Indeed, one notable trend has been the establishment of new national operators, particularly in emerging markets. In addition, the past few years have seen the introduction of high throughput satellites that add significant capacity, decrease costs per unit, and permit faster broadband speeds. Furthermore, consumers of satellite services have an increasing array of alternatives available to them, including many terrestrial services that compete directly with satellite offerings. This leads to robust competition on both price and non-price factors. -

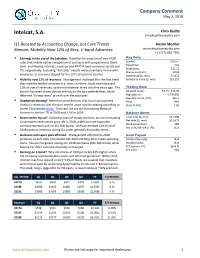

Intelsat, S.A. [email protected]

Company Comment May 2, 2018 Chris Quilty Intelsat, S.A. [email protected] Q1 Boosted by Accounting Change, but Core Trends Austin Moeller Remain; Mobility Now 12% of Revs, C-band Advances [email protected] +1 (727)-828-7601 • Earnings in the eye of the beholder. Aided by the adoption of new FASB Key Data rules that enable earlier recognition of contracts with prepayments (think Symbol: EXCH: I Govt. and Media), Intelsat’s revenue and EBITDA beat consensus by 5% and Fiscal Year: Dec Stock price: $12.31 7%, respectively. Excluding “ASC 606,” results were essentially in-line with th Shares out (mm): 119.9 consensus as revenues dipped for the 19 consecutive quarter Market cap ($, mm) $1,476 • Mobility now 12% of revenues. Management disclosed (for the first time) Enterprise value ($, mm) $15,153 that mobility-related revenues (i.e. aero, maritime, land) now represent 12% of overall revenues, up from immaterial levels only five years ago. This Trading Data growth has been driven almost entirely by the Epic satellite fleet, which 52-week range: $2.44 - $13.86 delivered “strong teens” growth over the past year. Avg daily vol: 3,776,000 Avg daily vol ($, mm): $46.5 • Headwinds abating? Relentless price declines that that have battered Float: 30% Intelsat’s revenues over the past several years may be abating according to Short % float 11% recent Euroconsult study. That said, we are still forecasting Network Services to decline 7% in 2018 and 3.5% in 2019. Balance Sheet • Government leg up? Following years of steady declines, we are forecasting Total debt ($, mm): $14,188 Government revenues to grow 4% in 2018, aided by more favorable Net debt ($, mm): $13,677 Book value/share: NM contract renewals and an ASC 606 bump.