FATCA-CRS-Faqs.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How to Apply for a Social Insurance Number in Some EU States

Professional European and Worldwide Accounts and Tax Advisors How to Apply for a Social Insurance Number in Some EU States This document provides information on obtaining a Social Insurance number in the following EU member states: Ø Spain Ø Belgium Ø Germany Ø Italy Ø Sweden Ø Poland Ø Norway Ø Denmark Ø Portugal Ø Greece Ø Hungary Ø Lithuania Ø Malta Ø The Netherlands Spain To apply for a Social Insurance number in Spain you first need to apply for a NIE number. How to get an NIE number in Spain The application process is quite easy. Go to your local National Police Station, to the Departmento de Extranjeros (Foreigners Department) and ask for the NIE application form. The following documents must be submitted to the police station to obtain a NIE number: Ø Completed and signed original application and a photocopy (original returned) Form can be downloaded here: http://www.mir.es/SGACAVT/extranje/regimen_general/identificacion/nie.htm Ø Passport and photocopy Address in Spain (you can use a friend's) Ø Written justification of why you need the NIE (issued by an accountant, a notary, a bank manager, an insurance agent a future employer, etc.) If you have any questions, call the National Police Station, the Departamento de Extranjeros (Foreigners Department) Tel: (+34) 952 923 058 When you hand in the documentation, a stamped photocopy of the application is returned to you along with your passport. Ask them when you should come back to pick up the document. The turnaround time fluctuates and your NIE can take one to six weeks. -

Tax ID Table

Country Flag Country Name Tax Identification Number (TIN) type TIN structure Where to find your TIN For individuals, the TIN consists of the letter "E" or "F" followed by 6 numbers and 1 control letter. TINs for Número d’Identificació residents start with the letter "F." TINs for non-residents AD Andorra Administrativa (NIA) start with the letter "E". AI Anguilla N/A All individuals and businesses receive a TIN (a 6-digit number) when they register with the Inland Revenue Department. See http://forms.gov. AG Antigua & Barbuda TIN A 6-digit number. ag/ird/pit/F50_Monthly_Guide_Individuals2006.pdf CUIT. Issued by the AFIP to any individual that initiates any economic AR Argentina activity. The CUIT consists of 11 digits. The TIN is generated by an automated system after registering relevant AW Aruba TIN An 8-digit number. data pertaining to a tax payer. Individuals generally use a TFN to interact with the Australian Tax Office for various purposes and, therefore, most individuals have a TFN. This includes submitting income tax returns, reporting information to the ATO, obtaining The Tax File Number (TFN) is an eight- or nine-digit government benefits and obtaining an Australian Business Number (ABN) AU Australia Tax File Number (TFN) number compiled using a check digit algorithm. in order to maintain a business. TINs are only issued to individuals who are liable for tax. They are issued by the Local Tax Office. When a person changes their residence area, the TIN AT Austria TIN Consists of 9 digits changes as well. TINs are only issued to people who engage in entrepreneurial activities and AZ Azerbaijan TIN TIN is a ten-digit code. -

Trend Micro Data Protection Lists (Release 3.0)

Trend Micro Incorporated reserves the right to make changes to this document and to the products described herein without notice. Before installing and using the software, please review the readme files, release notes, and the latest version of the applicable user documentation, which are available from the Trend Micro Web site at: http://docs.trendmicro.com/ Trend Micro, the Trend Micro t-ball logo, and OfficeScan are trademarks or registered trademarks of Trend Micro Incorporated. All other product or company names may be trademarks or registered trademarks of their owners. Copyright © 2014. Trend Micro Incorporated. All rights reserved. Document Part No. LPEM55806/121205 Release Date: September 2014 Document Version No.: 3.0 Protected by U.S. Patent No.: 5,623,600; 5,889,943; 5,951,698; 6,119,165 This document contains information common to all Trend Micro products that support data protection features. Detailed information about how to use specific features within your product may be available in the Trend Micro Online Help Center and/or the Trend Micro Knowledge Base at the Trend Micro website. Read through the documentation before installing or using the product. Trend Micro is always seeking to improve its documentation. Your feedback is always welcome. Please evaluate this documentation on the following site: http://www.trendmicro.com/download/documentation/rating.asp Table of Contents Chapter 1: Data Loss Prevention - Predefined Data Identifiers and Templates Predefined Expressions ................................................................................ -

Sis Ii S the Schengen Information System a Guide

SIS II SUPERVISION COORDINATION GROUP THE SCHENGEN INFORMATION SYSTEM A GUIDE FOR EXERCISING THE RIGHT OF ACCESS Secretariat postal address: rue Wiertz 60 - B-1047 Brussels Offices: rue Montoyer 30 E-mail : [email protected] Tel.: 02-283 19 13 - Fax : 02-283 19 50 This guide has been compiled by the SIS II Supervision Coordination Group Address: rue Wiertz 60 - B-1047 Brussels Offices: rue Montoyer 30 E-mail : [email protected] Tel.: 02-283 19 13 - Fax : 02-283 19 50 SIS II Supervision Coordination Group - A Guide for exercising the right of access Issued in October 2014 - Updated in October 2015 TABLE OF CONTENTS I. Introduction to the second generation Schengen information system (SIS II) ........................... 5 II. Rights recognized to individuals whose data is processed in the SIS II ..................................... 7 II.1. Right of access .................................................................................................................. 8 II.1.1. Direct access ................................................................................................... 8 II.1.2. Indirect access ................................................................................................ 9 II.2. Right to correction and deletion of data ............................................................................ 9 II.3. Remedies: the right to complain to the data protection authority or to initiate a judicial proceeding ........................................................................................................... -

Common Reporting Standard

COMMON REPORTING STANDARD TAX IDENTIFICATION NUMBERS LEAFLET Version updated as of October 31th, 2019 Disclaimer: The present informative document, subject to modification, is communicated for information purposes only and has no contractual value. This document is defined based on the information provided by the OECD portal. It contains information that it is the sole responsibility of each country and is (i) of a general nature only and not intended to address the specific circumstances of any particular individual or entity, (ii) not necessarily comprehensive, complete, accurate or up to date,(iii) sometimes linked to external sites over which SG Group has no control and for which SG Group assumes no responsibility and (iv) not professional or legal advice. If you need specific advice, you should always consult a professional tax advisor. TAX IDENTIFICATION NUMBERS This document provides an overview of domestic rules in the countries listed below governing the issuance, structure, use and validity of Tax Identification Numbers (“TIN”) or their functional equivalents. It is split into two sections: Countries that have already published the information on the OECD portal and can 1 be accessed by clicking on the name of the country below Cook Andorra Hungary Malaysia Saudi Arabia Islands Argentina Costa Rica Iceland Malta Seychelles Marshall Aruba Croatia India Islands Singapore Australia Curacao Indonesia Mauritius Slovak Republic Ireland Austria Mexico Cyprus Slovenia Isle of Man Azerbaijan Czech Montserrat Republic South Africa Bahrain -

ISSN: 2320-5407 Int. J. Adv. Res. 5(9), 958-965

ISSN: 2320-5407 Int. J. Adv. Res. 5(9), 958-965 Journal Homepage: - www.journalijar.com Article DOI: 10.21474/IJAR01/5409 DOI URL: http://dx.doi.org/10.21474/IJAR01/5409 RESEARCH ARTICLE NATIONAL IDENTIFICATION SYSTEM IN THE COUNTRIES AROUND THE GLOBE: AN OUTSIDE REVIEW FROM ETHIOPIAN PERSPECTIVE. Dr. Gavendra Singh1, Mr Ashenafi Chalchissa2 and Mulugeta Kejela3. 1. Assistant Professor, Deptt. of Software Engineering, College of Computing and Informatics, Haramaya University, 138, Dire Dawa, Ethiopia. 2. HOD ,Deptt. of Software Engineering, College of Computing and Informatics, Haramaya University, 138, Dire Dawa, Ethiopia. 3. Deptt. of Software Engineering, College of Computing and Informatics, Haramaya University, 138, Dire Dawa, Ethiopia. …………………………………………………………………………………………………….... Manuscript Info Abstract ……………………. ……………………………………………………………… Manuscript History A national identification numberor national identity number is used by the governments of many countries as a means of tracking Received: 12 July 2017 their citizens, permanent residents, and temporary residents for the Final Accepted: 14 August 2017 purposes ofvarious e-governmentally-related functions. Published: September 2017 The ways in which such a system is implemented vary among Key words:- countries, but in most cases citizens are issued an identification e-ID, e-Government, Capitals, System, number upon reaching legal age, or when they are born.Identification is Identification, internet, face-to-face routinely used to help facilitate commercial and government transaction transactions [1].Such as taking out a loan or applying for government benefits. While individuals can use traditional forms of identification in face-to-face transactions, these forms of identification are less useful for conducting business on the Internet. Individuals can use an National Identification System to authenticate to online services, securely communicate online, purchase goods and services, and create legally-binding electronic signatures, such as to sign a contract. -

Nnnnnnnnnnnn Nnnnnnnnnnnn

NNNNNNNNNNNN Dear Investor, The Internal Revenue Service (IRS) requires that the status of a non-U.S. investor be certified by completing Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals). Our records indicate that your account remains in an uncertified status. In order to avoid the implementation of a 24% U.S. backup withholding tax on your account, please complete and return the enclosed form as soon as possible. To certify your non-U.S. status and obtain any applicable treaty benefits, please review the instructions below and those found on the back of Form W-8BEN. NNNNNNNNNNNN Part I: Identification of Beneficial Owner 1. If the address printed on the top of the Form W-8BEN is your mailing address and does not reflect your permanent residence address, please provide us with your permanent residence address in the space provided. 2. If applicable, enter your U.S. Social Security Number or Individual Taxpayer Identification Number in the US Taxpayer Identification Number box. 3. REQUIRED: Enter your country of citizenship. 4. REQUIRED: Enter the Foreign Taxpayer Identifying Number (TIN) issued to you by your jurisdiction of residence in the Foreign Taxpayer Identifying Number box. More information about TINs can be found in OECD CRS portal under Tax identification Numbers (TINs). • If you do not have a Foreign TIN and reside in or are claiming treaty benefits in Part II Number 9 in one of the countries listed on the back of this page, then you are required to provide a reason for not providing a Foreign TIN. -

국가별 납세자 번호 (Tax Information Number)

<다자간 금융정보 자동교환 참고자료 1> 국가별 납세자 번호 (Tax Information Number) 2015.12. 기 획 재 정 부 ※ 본 자료는 각 국가가 OECD CRS Implementation and Assistance (www.oecd.org/tax /automatic-exchange)에 제출한 납세자 번호(Tax Information Number, TIN) 규정 관련 주요 내용을 요약한 것이므로 보다 정확하고 구체적인 내용은 원문을 확인하시기 바랍니다. 또한, 추가 정보 및 의문사항에 관해서는 국가별 자료에 기재된 웹사이트 및 문의처를 활용해주시기 바랍니다. (자료문의 : 기획재정부 국제조세협력과 (044-215-4442)) 순 서 아르헨티나 ······································································································1 호주 ···················································································································3 벨기에 ···············································································································6 브라질 ···············································································································7 캐나다 ·············································································································10 중국 ·················································································································15 코스타리카 ····································································································18 크로아티아 ····································································································20 체코 ·················································································································23 덴마크 ·············································································································25 에스토니아 ····································································································28 -

Trend Micro Data Protection Lists (Release 2.0)

Trend Micro Incorporated reserves the right to make changes to this document and to the products described herein without notice. Before installing and using the software, please review the readme files, release notes, and the latest version of the applicable user documentation, which are available from the Trend Micro Web site at: http://docs.trendmicro.com/ Trend Micro, the Trend Micro t-ball logo, and OfficeScan are trademarks or registered trademarks of Trend Micro Incorporated. All other product or company names may be trademarks or registered trademarks of their owners. Copyright © 2012. Trend Micro Incorporated. All rights reserved. Document Part No. LPEM55806/121205 Release Date: September 2014 Document Version No.: 2.0 Protected by U.S. Patent No.: 5,623,600; 5,889,943; 5,951,698; 6,119,165 This document contains information common to all Trend Micro products that support data protection features. Detailed information about how to use specific features within your product may be available in the Trend Micro Online Help Center and/or the Trend Micro Knowledge Base at the Trend Micro website. Read through the documentation before installing or using the product. Trend Micro is always seeking to improve its documentation. Your feedback is always welcome. Please evaluate this documentation on the following site: http://www.trendmicro.com/download/documentation/rating.asp Table of Contents Chapter 1: Data Loss Prevention - Predefined Data Identifiers and Templates Predefined Expressions ................................................................................ -

Egovernment in the EU Member States

eGovernment in the Member States of the European Union June 2005 This report was prepared for the IDABC Programme by: François-Xavier Chevallerau GOPA-Cartermill Rue de Trèves 45 1040 Brussels Belgium Contract No. IDA.20040616 Disclaimer The views expressed in this document are purely those of the writer and may not, in any circumstances, be interpreted as stating an official position of the European Commission. The European Commission does not guarantee the accuracy of the information provided in this document, nor does it accept any responsibility for any use thereof. Reference herein to any specific products, specifications, process, or service by trade name, trademark, manufacturer, or otherwise, does not necessarily constitute or imply its endorsement, recommendation, or favouring by the European Commission. All care has been taken by the author to ensure that s/he has obtained, where necessary, permission to use any parts of manuscripts including illustrations, maps, and graphs, on which intellectual property rights already exist from the titular holder(s) of such rights or from her/his or their legal representative. This paper can be downloaded from the IDABC eGovernment Observatory website: http://europa.eu.int/idabc/egovo © European Communities, 2005 Reproduction is authorised, except for commercial purposes, provided the source is acknowledged. 2 INTRODUCTION The IDABC eGovernment Observatory is a reference information source on e-government issues and developments across Europe. It provides the community of e-government decision-makers and professionals with a unique set of information resources and with valuable insight into e-government strategies, initiatives and projects in Europe and beyond, focusing on developments of pan-European relevance or interest. -

Tax Identification SGPB.Pdf

MARCH 2016 COMMON REPORTING STANDARD TAX IDENTIFICATION NUMBERS LEAFLET Disclaimer: The present informative document, subject to modification, is communicated for information purposes only and has no contractual value. This document is defined based on the information provided by the OECD portal. It contains information that it is the sole responsibility of each country and is (i) of a general nature only and not intended to address the specific circumstances of any particular individual or entity, (ii) not necessarily comprehensive, complete, accurate or up to date,(iii) sometimes linked to external sites over which SG Group has no control and for which SG Group assumes no responsi- bility and (iv) not professional or legal advice. If you need specific advice, you should always consult a professional tax advisor. TAX IDENTIFICATION NUMBERS This document provides an overview of domestic rules in the countries listed below governing the issuance, structure, use and validity of Tax Identification Numbers (“TIN”) or their functional equivalents. It is split into two sections: Countries that have already published the information on the OECD portal 1 and can be accessed by clicking on the name of the country below Argentina Faroe Islands Japan Seychelles Australia Finland South Korea Singapore Austria France Latvia Slovak Republic Belgium Germany Liechtenstein Slovenia Belize Gibraltar Lithuania South Africa Brazil Greece Luxembourg Spain Bulgaria Greenland Malaysia Sweden Canada Guernsey Malta Switzerland Cayman Islands Hong Kong Mexico -

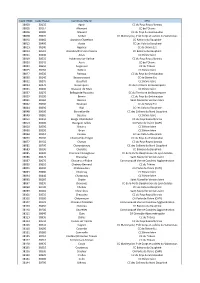

Code INSEE Code Postal Commune Mairie EPCI 38003 38150 Agnin

Code INSEE Code Postal Commune Mairie EPCI 38003 38150 Agnin CC du Pays Roussillonnais 38005 38114 Allemont CC de l'Oisans 38006 38580 Allevard CC du Pays du Grésivaudan 38008 38970 Ambel CC Matheysine, P de Corps et vallées du Valbonnais 38010 38460 Annoisin-Chatelans CC Balcons du Dauphiné 38012 38490 Aoste CC Les Vals du Dauphiné 38013 38140 Apprieu CC de Bièvre Est 38014 38510 Arandon/Arandon-Passins CC Balcons du Dauphiné 38015 38440 Artas CC Bièvre Isère 38019 38550 Auberives-sur-Varèze CC du Pays Roussillonnais 38020 38142 Auris CC de l'Oisans 38023 38650 Avignonet CC du Trièves 38025 38260 Balbins CC Bièvre Isère 38027 38530 Barraux CC du Pays du Grésivaudan 38030 38140 Beaucroissant CC de Bièvre Est 38032 38270 Beaufort CC Bièvre Isère 38034 38270 Beaurepaire CC du Territoire de Beaurepaire 38035 38440 Beauvoir-de-Marc CC Bièvre Isère 38037 38270 Bellegarde-Poussieu CC du Territoire de Beaurepaire 38039 38190 Bernin CC du Pays du Grésivaudan 38041 38160 Bessins Saint Marcellin Vercors Isère 38042 38690 Bevenais CC de Bièvre Est 38044 38690 Biol CC Les Vals du Dauphiné 38048 38090 Bonnefamille CC des Collines du Nord Dauphiné 38049 38260 Bossieu CC Bièvre Isère 38051 38150 Bouge-Chambalud CC du Pays Roussillonnais 38053 38300 Bourgoin-Jallieu CA Porte de l'Isère (CAPI) 38058 38590 Brezins CC Bièvre Isère 38060 38590 Brion CC Bièvre Isère 38064 38110 Cessieu CC Les Vals du Dauphiné 38070 38190 Champ-Près-Froges CC du Pays du Grésivaudan 38072 38150 Chanas CC du Pays Roussillonnais 38081 38790 Charantonnay CC des Collines du Nord