Defence Companies Anti-Corruption Index (DCI) 2019 Full List of Companies Included Part of the 2019 Assessment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Materials and Components for Missiles Innovation and Technology Partnership, MCM ITP Is a Dstl and DGA Sponsored Research Fu

The Materials and Components for Missiles Innovation and Technology Partnership, MCM ITP is a dstl and DGA sponsored research fund open to all UK or French companies and academic institutions. Launched in 2007, the MCM ITP develops novel, exploitable technologies for generation-after-next missile systems. The MCM ITP aims to consolidate the UK-French Complex Weapons capability, strengthen the technological base and allow better understanding of common future needs. The programme manages a portfolio of over 100 cutting-edge technologies which hold the promise of major advances, but are still at the laboratory stage today. The MCM ITP is aligned into eight technical domains, each of which is led by one of the MCM ITP industrial consortium partners1. 1 The MCM ITP Industrial Consortium partners are: MBDA; THALES; Roxel; Selex ES; Safran Microturbo; QinetiQ; Nexter Munitions. Funding The programme is funded equally by the governments and the industrial partners and is composed of research projects on innovative and exploratory technologies and techniques for future missiles. There is strong participation from SMEs and academia with 76 participating in the programme to date, and a total of 121 organisations involved in the overall programme. With an annual budget of up to 12.5M€ and 30% of the budget targeted towards SMEs and Academia, the MCM has become the cornerstone of future collaborative research and technology demonstration programmes for UK-French missile systems. Conference On 21st and 22nd October 2015, DGA, dstl, MBDA and its partners will review the last two years of the MCM ITP programme, and present the technical advances that have been made possible thanks to this cooperative programme. -

CBI South East Regional Council Directory of Members

CBI South East Regional Council Directory of members South East Delivering prosperity through private-sector growth Getting Britain building Creating a global role for Britain in a new Europe Encouraging high-growth export champions Delivering for consumers and communities CBI South East Regional Council: Directory of members 3 Chairman’s message Having been an active member of the CBI SE These are all great foundations but to make real council for a number of years I am delighted to progress a great deal more building work needs to begin my two year term as the CBI South East be done. To achieve this we have set out our Regional Chairman, taking over the reins from workplan – our own growth agenda – for 2013, Debbie McGrath who I must congratulate and under the banner ‘Delivering prosperity through thank for doing such a fine job. private sector growth.’ The four central pillars will In addition to being an informal networking seek to: Get Britain Building; Create a global role opportunity and an unrivalled forum in which to for the UK; To encourage high-growth export share views on the current state of business and champions; and Deliver for consumers and trade, the Council above all, plays a vital role in communities. ensuring that the CBI’s national campaigns reflect These though will not be in isolation to the many the views of businesses in the region. I am looking other issues affecting business, so members will forward to working with so many experienced continue to contribute to discussions on, for business leaders and council members from a example, aviation, energy, business reputation diverse range of business and educational and of course the economic and business case establishments that singles out the South East relevant to the European referendum debate that and Thames Valley as unique and highly will gain momentum over the next two years. -

Investment Checklist

ukvalueinvestor.com UKValueInvestor High quality value investing for income & growth May 2012 Back in recession again Contents Although we’ve managed to avoid it for quite some time, the UK is back in recession. I don’t Market Overview think this is much of a surprise to most people; the UK economy has gone pretty much With the FTSE 100 at 5,700 the nowhere since the credit crunch started back in 2007/8. market is once again back in the ‘cheap’ range, with 7-year total As always though, it isn’t the end of the world just yet. The US is starting to show signs of returns expected to be around recovery and in the past most recessions ended when the US pulled us out. With any luck, 10% per annum. the same process will apply this time round. Model Portfolio Obviously most people would much prefer that we got back to growth sooner rather than Annual results are in from JD later, but from an investing point of view it shouldn’t matter too much one way or the other. Sports One of the basic assumptions of sound investing is that the future will always hold unpleasant Buy Alert surprises and that prudent and rational investors should be prepared for them at all times. A leading home shopping retailer This means sticking to the basics of being diversified, picking high quality companies, buying will be joining the portfolio. them when they are attractively valued and selling them when they’re not. FTSE 350 Sorted by Rating Find the top rated stocks in next New name, new rating system to no time. -

Uk Dti-Report 2014.Pdf

1 This is the second year that UKTI DSO has released defence and security export figures as ‘Official Statistics’. This year’s release has been compiled in conjunction with the BIS Statistics - Analysis team. The document takes into account feedback from readers via a User Engagement survey. Our defence statistics relate to sales to overseas Ministries of Defence and associated Armed Services. This makes them customer‐based, rather than product-based. Security data is provided by a contractor called kMatrix, under a multi-year contract to UKTI DSO. All the information collected on the defence and security markets is vital to our understanding of the shape of the market and trends. It helps UKTI DSO in targeting support to all sections of the defence and security industries. 2 3 The global defence export market in 2014 is estimated to be valued at more than £50Bn ($83Bn). In an increasingly competitive global export market, the UK’s defence export total of £8.5Bn in 2014 is a considerable achievement, particularly coming off the back of major platform exports in 2013. UK defence companies enjoyed global success throughout 2014. Selected UK defence wins included Trent 700 engines for A330 Multi-Role Tanker Transport (MRTT) aircraft to France; Advanced Short Range Air-to-Air Missiles (ASRAMM) to India and the ForceShield Integrated Air Defence System plus Starstreak Missiles to Indonesia. By geographic customer destination, the UK’s most important markets for defence and security exports were in the Middle East, North America and the Asia-Pacific. 4 Year-on-year, the global defence export market experiences peaks and troughs in response to fluctuations in defence spending levels, threat perception and national requirements. -

Restoring Strength, Building Value

Restoring Strength, Building Value QinetiQ Group plc Annual Report and Accounts 2011 Group overview Revenue by business The Group operates three divisions: US Services, 29% UK Services and Global Products; to ensure efficient 35% leverage of expertise, technology, customer relationships and business development skills. Our services businesses which account for more 36% than 70% of total sales, are focused on providing 2011 2010 expertise and knowledge in national markets. Our £m £m products business provides the platform to bring US Services 588.2 628.0 valuable intellectual property into the commercial UK Services 611.6 693.9 markets on a global basis. Global Products 502.8 303.5 Total 1,702.6 1,625.4 Division Revenue Employees US Services £588.2m 4,500 (2010: £628.0m) (2010: 5,369) Underlying operating profit* £44.3m (2010: £52.6m) Division Revenue Employees UK Services £611.6m 5,045 (2010: £693.9m) (2010: 5,707) Underlying operating profit* £48.7m (2010: £59.1m) Division Revenue Employees Global £502.8m 1,663 Products (2010: £303.5m) (2010: 2,002) Underlying operating profit* £52.4m (2010: £8.6m) * Definitions of underlying measures of performance are in the glossary on page 107. Underlying operang profit* by business Revenue by major customer type Revenue by geography 7% 17% 36% 31% 52% 37% 56% 31% 33% 2011 2010 2011 2010 2011 2010 £m £m £m £m £m £m US Services 44.3 52.6 US Government 894.3 754.1 North America 949.2 825.3 UK Services 48.7 59.1 UK Government 526.5 614.5 United Kingdom 623.7 720.0 Global Products 52.4 8.6 Other 281.8 -

Weekend News Summary

Weekend News Summary THE SUNDAY TIMES INDICES THIS MORNING Current (%) 1W% Change Profits go Sky high for Robey Warshaw partners: Three bankers at Value Change* Robey Warshaw have shared almost £50 million after advising on FTSE 100 7,502.3 2.0% 1.6% blockbuster takeovers. Profits at the boutique Mayfair firm more than DAX 30 13,351.0 0.5% 0.9% doubled to £48.4 million from £21.3 million in the year to the end of CAC 40 5,966.2 0.8% 0.8% March, accounts at Companies House show. DJIA** 28,135.4 - 0.4% Labour rout relieves investors in rail and utility providers: Industries S&P 500** 3,168.8 - 0.7% threatened with nationalisation by Labour rallied as the party’s NASDAQ Comp.** 8,734.9 - 0.9% resounding defeat erased the threat of cut-price state takeovers. Nikkei 225 23,952.4 -0.3% 2.9% Energy, water, rail and telecoms stocks including those of SSE, Severn Hang Seng 40 27,508.1 -0.6% 4.5% Trent, Go-Ahead and BT all posted strong gains as Executives and Shanghai Comp 2,984.4 0.6% 1.9% investors breathed a sigh of relief at the Conservative victory. Kospi 2,168.2 -0.1% 4.2% Minouche Shafik favourite as decision on Bank of England governor BSE Sensex 40,938.7 -0.2% 1.4% expected within days: A new Bank of England Governor is expected to S&P/ASX 200 6,849.7 1.6% 0.5% be named within days to succeed Mark Carney, who leaves at the end Current Values as at 11:15 BST, *%Chg from Friday Close, ** As on Friday Close of January. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Chair's Introduction

Governance statement I have also met with a number of our major customers. I see it as an important part of the Chair’s role to have a strong relationship with key customers that complements the depth and breadth of the Group’s management relationships, through a programme of regular senior-level meetings. I intend to develop this role further, and am committed to supporting the continued improving momentum of dialogue with our primary customers. We have been pleased to welcome customers to participate in a number of contract reviews at the Board during the year. I have also enjoyed meeting many of Babcock’s shareholders to hear, directly from them, their views, concerns and Ruth Cairnie priorities. The Board and I are clear about Chair the importance of corporate governance and its role in the long-term success of the Group. Purpose and culture Chair’s introduction At the Board we recognise the essential role that a clear purpose and a strong corporate culture play in assuring the I am pleased to present my first Group’s long-term success. During the year the Board has worked to clarify Chair’s report on the work of the Babcock’s purpose, which we describe on Babcock Board. Since joining the page 10, and we expect to do more on Board in April last year, I have focused this over the coming year. This purpose is underpinned by the corporate culture, much time engaging with Babcock’s based on strong values that I found in stakeholders in order to get a real evidence across my induction visits. -

MBDA Modern Slavery Statement Response 2020

UK MODERN SLAVERY STATEMENT RESPONSE 2020 UK MODERN SLAVERY STATEMENT RESPONSE 2020 This statement is made pursuant to Section 54 of the Modern Slavery Act 2015 (the ‘Act’) and constitutes MBDA UK Limited’s (‘MBDA UK’) Modern Slavery and Human Trafficking statement for the financial year ending 31 December 2019. MBDA Group (‘MBDA’) has a zero tolerance approach to modern slavery of any kind within its operations and supply chain. This statement references the principles applicable to MBDA UK with respect to modern slavery and human trafficking and sets out the steps that MBDA UK has taken to ensure that modern slavery and human trafficking are not present in its business or its supply chain. MBDA IS THE ONLY EUROPEAN GROUP INTRODUCTION CAPABLE OF DESIGNING AND PRODUCING MISSILES AND MISSILE SYSTEMS TO MEET Modern slavery is the illegal exploitation of people for personal or THE WHOLE RANGE OF CURRENT AND commercial gain, often in horrendous conditions which the victim FUTURE NEEDS OF THE THREE cannot escape. Businesses, including MBDA, have a key part to play in ARMED FORCES the effort to tackle this crime and protect vulnerable workers from exploitation. Forced, bonded or compulsory labour, human trafficking and other kinds of slavery and servitude represent some of the gravest forms of human rights abuse in any society. The Act is a globally leading piece of legislation. It sets out a range of measures on how modern slavery and human trafficking should be dealt with in the UK and impacts the corporate sector. OUR BUSINESS A EUROPEAN INTEGRATED MBDA is a world leader in missiles and missile systems, with DEFENCE COMPANY a significant presence in five European countries and with more than 90 armed forces customers around the world. -

MINISTERO DELLA DIFESA Allegato “D”

MINISTERO DELLA DIFESA Allegato “D” TABELLA RIASSUNTIVA DEI PROGRAMMI DI COPRODUZIONE INTERNAZIONALE PAESI NR. PROGRAMMA TIPOLOGIA DITTE ITALIANE PARTECIPANTI PARTECIPANTI AEREA,ALENIA AERMACCHI, SELEX GALILEO, AGUSTA, ELETTRONICA, ELETTRONICA ASTER, A.S.E., AVIO, NORTHROP- GRUMMAN ITALIA, LOGIC, SELEX ITALIA, COMMUNICATIONS, VELIVOLO GERMANIA, GRAN MICROTECNICA, OMA, SECONDO 1 EFA MULTIRUOLO BRETAGNA, MONA, SICAMB, SIMMEL DIFESA, SPAGNA, AUSTRIA SIRIO PANEL, FIMAC, NOVURANIA, SELEX SISTEMI INTEGRATI, M.B.D.A., MES, JOINTEK, ALENIA AERONAUTICA, TESEO, OTO MELARA, THALES AEREA, AVIO, AGUSTA, ELETTRONICA, SELEX COMMUNICATIONS, MICROTECNICA, OMA, SICAMB, ELICOTTERO ITALIA, GRAN SECONDO MONA, PIAGGIO 2 EH 101 TRASPORTO BRETAGNA AEROINDUSTRIES, SELEX SISTEMI INTEGRATI, SELEX GALILEO, NORTHROP GRUMMAN ITALIA, M.B.D.A., LOGIC SELEX SISTEMI INTEGRATI, AVIO, RHEINMETALL ITALIA, MISSILE DIFESA NORTHROP GRUMMAN ITALIA, 3 FSAF ITALIA, FRANCIA S/A MES, I.S.I. GEIE, SIMMEL DIFESA, SELEX GALILEO, OTO MELARA, M.B.D.A. SISTEMA SELEX SISTEMI INTEGRATI, MES, HAWK ITALIA, FRANCIA, 4 MISSILISTICO VITROCISET, GAROFOLI, SELEX VIABILITY USA TERRA/ARIA GALILEO, M.B.D.A. 1 MINISTERO DELLA DIFESA Allegato “D” GERMANIA, NORTHROP GRUMMAN ITALIA, ITALIA, SVEZIA, SELEX SISTEMI INTEGRATI, AVIO, 5 IRIS-T MISSILE ARIA/ARIA NORVEGIA, M.B.D.A., MAGNAGHI GRECIA, SPAGNA AERONAUTICA, SIMMEL DIFESA SELEX SISTEMI INTEGRATI, SISTEMA SELEX GALILEO, M.B.D.A., 6 MEADS ITALIA, USA, MISSILISTICO NORTHROP GRUMMAN ITALIA, GERMANIA DIFESA AEREA OTO MELARA ITALIA, FRANCIA, M.B.D.A., NORTHROP -

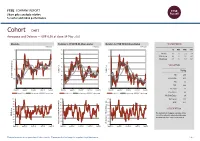

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Cohort CHRT Aerospace and Defense — GBP 6.56 at close 14 May 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-May-2021 14-May-2021 14-May-2021 7 115 105 1D WTD MTD YTD 110 Absolute 0.6 0.3 2.2 3.8 100 Rel.Sector -2.2 -1.3 -1.1 -0.1 105 Rel.Market -0.5 1.7 1.5 -5.0 6.5 100 95 VALUATION 95 6 90 90 Trailing Relative Price Relative Price Relative 85 85 PE 27.5 Absolute Price (local currency) (local Price Absolute 5.5 EV/EBITDA 13.9 80 80 PB 3.5 75 PCF 22.6 5 70 75 Div Yield 1.6 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 Price/Sales 2.0 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.4 100 90 90 Div Payout 43.4 90 80 80 ROE 13.1 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 The Company is the parent company of five 40 40 40 RSI RSI (Absolute) innovative, agile and responsive businesses 30 operating in defence and related markets. -

The Defence Industry in the 21St Century

The Defence Industry in the 21st Century “With nine countries (and their collective industrial prowess) involved in its development, the F-35 repre- sents a new model of inter- national cooperation, ensuring affordable U.S. and coalition partner security well into the 21st century” – Sources: Photograph by US Department of Defense, Quote by Lockheed Martin Corporation Thinking Global … or thinking American? “With nine countries (and their collective industrial prowess) involved in its development, the F-35 represents a new model of international cooperation, ensuring affordable U.S. and coalition partner security well into the 21st century” – Sources: Photograph by US Department of Defense, Quote by Lockheed Martin Corporation Welcome The purpose of this paper is to provoke a debate. To stimulate further the dialogue we enjoy with our clients around the world. As the world’s largest professional services firm, PricewaterhouseCoopers works with clients in every segment of the defence industry – from the Americas to the whole of Europe; from the Middle East and Africa to Asia and the Pacific Rim. On many occasions, our discussions focus on the technical issues in which we are pre-eminently well-qualified to advise. Here, however, we seek to debate the issues that affect your industry. To review the factors that shaped today’s environment, to assess the implications for contractors and to look at the factors that might shape the future. Our views are set out in the following pages. We have debated some of these issues with some of our clients already but the time is right for a broader discus- sion.