B $0.77 GM Reports Income of $1.1 Billion and EBIT- Adjusted of $2.6

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Competing in the Global Truck Industry Emerging Markets Spotlight

KPMG INTERNATIONAL Competing in the Global Truck Industry Emerging Markets Spotlight Challenges and future winning strategies September 2011 kpmg.com ii | Competing in the Global Truck Industry – Emerging Markets Spotlight Acknowledgements We would like to express our special thanks to the Institut für Automobilwirtschaft (Institute for Automotive Research) under the lead of Prof. Dr. Willi Diez for its longstanding cooperation and valuable contribution to this study. Prof. Dr. Willi Diez Director Institut für Automobilwirtschaft (IfA) [Institute for Automotive Research] [email protected] www.ifa-info.de We would also like to thank deeply the following senior executives who participated in in-depth interviews to provide further insight: (Listed alphabetically by organization name) Shen Yang Senior Director of Strategy and Development Beiqi Foton Motor Co., Ltd. (China) Andreas Renschler Member of the Board and Head of Daimler Trucks Division Daimler AG (Germany) Ashot Aroutunyan Director of Marketing and Advertising KAMAZ OAO (Russia) Prof. Dr.-Ing. Heinz Junker Chairman of the Management Board MAHLE Group (Germany) Dee Kapur President of the Truck Group Navistar International Corporation (USA) Jack Allen President of the North American Truck Group Navistar International Corporation (USA) George Kapitelli Vice President SAIC GM Wuling Automobile Co., Ltd. (SGMW) (China) Ravi Pisharody President (Commercial Vehicle Business Unit) Tata Motors Ltd. (India) © 2011 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. All rights reserved. Competing in the Global Truck Industry – Emerging Markets Spotlight | iii Editorial Commercial vehicle sales are spurred by far exceeded the most optimistic on by economic growth going in hand expectations – how can we foresee the with the rising demand for the transport potentials and importance of issues of goods. -

CHINA FIELD TRIP May 10Th –12Th, 2011

CHINA FIELD TRIP May 10th –12th, 2011 This presentation may contain forward-looking statements. Such forward-looking statements do not constitute forecasts regarding the Company’s results or any other performance indicator, but rather trends or targets, as the case may be. These statements are by their nature subject to risks and uncertainties as described in the Company’s annual report available on its Internet website (www.psa-peugeot-citroen.com). These statements do not reflect future performance of the Company, which may materially differ. The Company does not undertake to provide updates of these statements. More comprehensive information about PSA PEUGEOT CITROËN may be obtained on its Internet website (www.psa-peugeot-citroen.com), under Regulated Information. th th China Field Trip - May 10 –12 , 2011 2 PSA in Asia – Market Forecast, PSA in China: ongoing successes and upsides Frédéric Saint-Geours Executive VP, Finance and Strategic Development Grégoire Olivier, Executive VP, Asia Table of contents Introduction China: the new auto superpower China: a global economic power The world’s largest automotive market The growth story is set to continue PSA in China China: a second home market for PSA 2 complementary JVs Key challenges in China and PSA differentiation factors A sustainable profitable growth Extending the Chinese Success ASEAN strategy Capturing the Indian opportunity th th China Field Trip - May 10 –12 , 2011 4 PSA – a global automotive player (1/2) > 39% of PSA’s 2010 sales are realized outside of Europe, of -

2016 Annual Report

ANNUAL REPORT 2016 年 報 2016 年報 ANNUAL REPORT 2016 Contents Corporate Profile 02 Corporate Information 04 Our Products 06 Business Overview 10 Financial Highlights 20 Chairman’s Statement 22 Management Discussion and Analysis 24 Directors and Senior Management 33 Directors’ Report 41 Corporate Governance Report 58 Independent Auditor’s Report 69 Consolidated Balance Sheet 76 Consolidated Income Statement 78 Consolidated Statement of Comprehensive Income 79 Consolidated Statement of Changes in Equity 80 Consolidated Statement of Cash Flows 81 Notes to the Consolidated Financial Statements 82 Five Years’ Financial Summary 146 NEXTEER AUTOMOTIVE GROUP LIMITED ANNUAL REPORT 2016 02 Corporate Profile Nexteer Automotive Group Limited (the Company) together with its subsidiaries are collectively referred to as we, us, our, Nexteer, Nexteer Automotive or the Group. Nexteer Automotive is a global leader in advanced steering and driveline systems, advanced driver assistance systems (ADAS) and autonomous vehicle technologies. In-house development and full integration of hardware, software and electronics give Nexteer a competitive advantage as a full service supplier. Our vision is to remain a leader in intuitive motion control – leveraging our strengths in advanced steering and driveline systems. We maintain product focus on electric power steering (EPS), a socially responsible technology that offers automakers increased fuel economy and reduced emissions. Nexteer Automotive has put more than 40 million EPS units on the road, since 1999, saving more than 4 billion gallons of fuel. Our ability to integrate our systems seamlessly into automotive original equipment manufacturer (OEM) vehicles is a testament of our 110-year heritage of vehicle integration expertise and product craftsmanship. -

2021 Gmc Yukon Contents

YUKON 2021 GMC YUKON CONTENTS INTRODUCTION DENALI AT4 TECHNOLOGY CAPABILITY YUKON XL TRAILERING CONNECTIVITY FEATURES AND OPTIONS ACCESSORIES 3 LIVE LIKE A PRO Living large is no small feat. Pros do it with confidence and plenty of companions. Whether they’re hitting the highways (and fairways), pulling their passions, catching their limit or bagging that trophy, pros do it all. The Next Generation Yukon and Yukon XL were inspired by and built for them. And now, the First Ever Yukon AT4 allows pros to follow their imagination to travel beyond the paved and predictable. Experience Professional Grade—the 2021 GMC Yukon and Yukon XL. Preproduction models shown throughout. Actual production models may vary. INTRODUCTION DENALI AT4 TECHNOLOGY CAPABILITY YUKON XL TRAILERING CONNECTIVITY FEATURES AND OPTIONS ACCESSORIES 4 MADE TO REIGN FIRST-CLASS EXPERIENCE I EXCLUSIVE INTERIOR ON DENALI I POWER-SLIDING CENTER CONSOLE IS AVAILABLE (LATE AVAILABILITY) I FOUR-CORNER AIR RIDE ADAPTIVE SUSPENSION IS AVAILABLE (LATE AVAILABILITY) TECHNOLOGY I MULTICOLOR 15" DIAGONAL HEAD-UP DISPLAY IS AVAILABLE I UP TO NINE CAMERA VIEWS1 ARE AVAILABLE PROFESSIONAL GRADE CAPABILITY I 6.2L 420-HP V8 ENGINE ON DENALI I ALL-NEW ACTIVE RESPONSE 4WD™ SYSTEM IS AVAILABLE (LATE AVAILABILITY) The Next Generation 2021 Yukon is ready for anything. Designed to be bigger and bolder than ever,2 it delivers first-class accommodations for up to nine, available technologies and legendary Professional Grade capability. Travel in the premium-packed Yukon Denali or give free rein to your wanderlust by traveling beyond the predictable—and the paved—in the First Ever Yukon AT4. -

CHINA CORP. 2015 AUTO INDUSTRY on the Wan Li Road

CHINA CORP. 2015 AUTO INDUSTRY On the Wan Li Road Cars – Commercial Vehicles – Electric Vehicles Market Evolution - Regional Overview - Main Chinese Firms DCA Chine-Analyse China’s half-way auto industry CHINA CORP. 2015 Wan Li (ten thousand Li) is the Chinese traditional phrase for is a publication by DCA Chine-Analyse evoking a long way. When considering China’s automotive Tél. : (33) 663 527 781 sector in 2015, one may think that the main part of its Wan Li Email : [email protected] road has been covered. Web : www.chine-analyse.com From a marginal and closed market in 2000, the country has Editor : Jean-François Dufour become the World’s first auto market since 2009, absorbing Contributors : Jeffrey De Lairg, over one quarter of today’s global vehicles output. It is not Du Shangfu only much bigger, but also much more complex and No part of this publication may be sophisticated, with its high-end segment rising fast. reproduced without prior written permission Nevertheless, a closer look reveals China’s auto industry to be of the publisher. © DCA Chine-Analyse only half-way of its long road. Its success today, is mainly that of foreign brands behind joint- ventures. And at the same time, it remains much too fragmented between too many builders. China’s ultimate goal, of having an independant auto industry able to compete on the global market, still has to be reached, through own brands development and restructuring. China’s auto industry is only half-way also because a main technological evolution that may play a decisive role in its future still has to take off. -

GM End of Lease Guide

END-OF-LEASE GUIDE GOOD THINGS SHOULD NEVER COME TO AN END. As the end of your current lease with GM Financial draws near, we’d like to thank you for your business, and we hope that you’ve had an excellent driving experience in your General Motors vehicle. To help guide you through the end-of-lease process, we’ve created this step-by- step guide. Or, visit gmfinancial.com/EndofLease. What should you do with your current TABLE OF CONTENTS leased GM vehicle? You have several options from which to choose: Your Lease-End Options 1 • Purchase or lease a new GM vehicle Trade in Your Vehicle 2 • Purchase your current leased vehicle Turn in Your Vehicle 2 • Turn in your leased vehicle Want to continue enjoying the GM driving experience? Select Your Next GM Vehicle 3 GM has many new and exciting models available. Check your mail in the coming weeks because you may become Schedule Your Inspection 4 eligible to receive incentives towards the purchase or lease of a new GM vehicle. Review Your Vehicle’s Condition 6 Frequently Asked Questions 11 What will you be driving this time next year? Contact Us 12 GM is consistently developing new and exciting models for our customers. Visit GM.com to check out Wear-and-Tear Card 13 new vehicles and determine which one fits your needs. YOUR LEASE-END OPTIONS Buick Envision Chevrolet Cruze Cadillac XT5 OPTION 1: OPTION 2: OPTION 3: TURN IN YOUR GM VEHICLE PURCHASE YOUR TURN IN YOUR GM VEHICLE AND PURCHASE OR LEASE LEASED GM VEHICLE Return the vehicle to the GM A NEW GM VEHICLE You can purchase your leased vehicle dealership where it was leased.* Are you ready for your next at any time during your lease period, Remember to bring your GM vehicle? Visit your nearest or you may do so near the end of your owner’s manual, extra set of GM dealer to test drive the lease. -

GM Financial Privacy Notice 04.07.2020

Rev. 6 / 20 FACTS WHAT DOES GM FINANCIAL DO WITH YOUR PERSONAL INFORMATION? Why? Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. What? The types of personal information we collect and share depend on the product or service you have with us. This information can include: . Social Security number and income . account balances and payment history . credit history and credit scores How? All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers' personal information; the reasons GM Financial chooses to share; and whether you can limit this sharing. Does GM Financial Can you limit this Reasons we can share your information share? sharing? For our everyday business purposes— such as to process your transactions, maintain Yes No your account(s), respond to court orders and legal investigations, or report to credit bureaus For our marketing purposes— Yes No to offer our products and services to you For joint marketing with other financial companies Yes No For our affiliates’ everyday business purposes— Yes No information about your transactions and experiences For our affiliates’ everyday business purposes— Yes Yes information about your creditworthiness For our affiliates to market to you Yes Yes For nonaffiliates to market to you Yes Yes To limit . Call toll- free 1-888-249-2763 – our menu will prompt you through your choices or . -

Motor Components Llc Elmira, New York 14903

FACET/PUROLATOR# FUEL PUMP TYPE APPLICATION FEP2000 IN-LINE 1991 - 1983 FORD, MERCURY, LINCOLN FEP2001 IN-TANK 1997 - 1989 FORD, MERCURY, MAZDA FEP2002 IN-TANK 1997 - 1986 FORD & MAZDA FEP2015 IN-TANK 1990 - 1985 FORD & MERCURY FEP2036 IN-TANK 1988 - 1985 FORD TRUCK FEP2042 IN-TANK 1995 - 1986 FORD, MERCURY, LINCOLN FEP2044 IN-TANK 1997 - 1985 FORD, MERCURY, LINCOLN FEP2059MN MODULE 1997 - 1989 FORD & MERCURY TRUCK FEP2061 IN-TANK 1997 - 1985 FORD & MERCURY FEP2064MN MODULE 1997 - 1990 FORD TRUCK FEP2065 IN-TANK 1997 - 1988 FORD & MERCURY FEP2068 IN-TANK 2002 - 1986 FORD, LINCOLN, MAZDA, MERCURY, NISSAN FEP2157 IN-TANK 2002 - 1993 FORD, FORD TRUCK, LINCOLN, MERCURY, MAZDA FEP2182 IN-TANK 1991 - 1980 FIAT, FORD, LINCOLN, MERCURY, TRIUMPH FEP2471 IN-TANK 2004 - 1996 FORD, LINCOLN, HYUNDAI, KIA, MITSUBISHI, NISSAN FEP3212 IN-TANK 1998 - 1985 BUICK, CADILLAC, CHEVROLET, GMC, OLDSMOBILE, PONTIAC FEP3240 IN-TANK 1996 - 1984 BMW, BUICK, CADILLAC, CHEVROLET, GMC, OLDSMOBILE, PONTIAC FEP3265 IN-TANK 1997 - 1988 BUICK, CADILLAC, CHEVROLET, GMC, OLDSMOBILE, PONTIAC FEP3270 IN-TANK 2000 - 1989 BUICK, CADILLAC, CHEVROLET, GMC, OLDSMOBILE, PONTIAC FEP3290 IN-TANK 1999 - 1993 BUICK, OLDSMOBILE, PONTIAC FEP3500M MODULE 2004 - 1999 CHEVROLET & GMC TRUCKS FEP3501M MODULE 2003 - 1999 CHEVROLET & GMC TRUCKS FEP3506M MODULE 2005 - 2000 CHEVROLET ASTRO & GMC SAFARI VANS FEP3507M MODULE 2005 - 2000 CHEVROLET, OLDSMOBILE, PONTIAC FEP3508M MODULE 2003 - 2000 CADILLAC ESCALADE, CHEVROLET TAHOE, GMC YUKON FEP3621S HANGER 1995 - 1988 CHEVROLET & GMC TRUCKS FEP3622S -

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] Whatsapp: +86 13634216230 QYT No

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] WhatsApp: +86 13634216230 QYT no. Description Corss Ref. Application TOYOTA;LEXUS (SO0001‐SO0300) TOYOTA CAMRY ACV40 06‐12; SO0001 Steering Tie rod ends 45470‐09090 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY ACV40 06‐12; SO0002 Steering Tie rod ends 45460‐09140 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY SO0003 Steering Tie rod ends 45460‐09160 ACV50(2012‐) TOYOTA CAMRY SO0004 Steering Tie rod ends 45460‐09250 ACV50(2012‐) GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0005 Steering Tie rod ends 45047‐49045 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0006 Steering Tie rod ends 45046‐49115 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0007 Steering Tie rod ends 45460‐39615 LEXUS ES300/MCV30 01‐06 CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0008 Steering Tie rod ends 45470‐39215 LEXUS ES300/MCV30 01‐06 BYD SURUI,SONG MAX;ZOTYE Z300; SO0009 Steering Tie rod ends 45046‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ BYD SURUI ,SONG MAX;ZOTYE Z300; SO0010 Steering Tie rod ends 45047‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ SO0011 Steering Tie rod ends 45464‐30060 TOYOTA REIZ/CROWN;LEXUS LEXUS IS250/300 06‐,GS300/350/430 05‐ SO0012 Steering Tie rod ends 45463‐30130 TOYOTA REIZ/CROWN;LEXUS LEXUS -

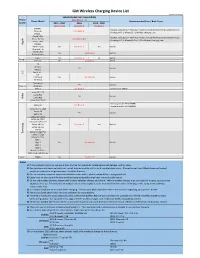

GM Wireless Charging Device List

GM Wireless Charging Device List Revision: Aug 30, 2019 Vehicle Model Year Compatibility Phone ( See Notes 1 - 7) Phone Model Recommended Case / Back Cover Brand 2015 - 2017 2018 2019 - 2020 (See Note 8) (See Note 8) (See Note 9) iPhone 6 ŸBEZALEL Latitude [Qi + PMA] Dual-Mode Universal Wireless Charging Receiver Case iPhone 6s See Note: A ŸAircharge MFi Qi iPhone 6S / 6 Wireless Charging Case iPhone 7 iPhone 6 Plus ŸBEZALEL Latitude [Qi + PMA] Dual-Mode Universal Wireless Charging Receiver Case e iPhone 6s Plus See Note: A & B l ŸAircharge MFi Qi iPhone 6S Plus / 6 Plus Wireless Charging Case p iPhone 7 Plus p A iPhone 8 iPhone X (10) No See Note: C Yes Built-in iPhone Xs / Xr iPhone 8 Plus No See Note: B Built-in iPhone Xs Max Pixel 3 No See Note: C Yes Built-in Google Pixel 3XL No See Note: B Built-in G6 Nexus 4 Yes Built-in Nexus 5 G Spectrum 2 L V30 V40 ThinQ No See Note: B Built-in G7 ThinQ Droid Maxx Yes Built-in Motorola Droid Mini Moto X See Note: A Incipio model: MT231 Lumia 830 / 930 a i Lumia 920 k Yes Built-in o Lumia 928 N Lumia 950 / 950 XL ŸSamsung model: EP-VG900BBU Galaxy S5 See Note: A ŸSamsung model: EP-CG900IBA Galaxy S6 / S6 Edge Galaxy S8 Yes Built-in Galaxy S9 Galaxy S10 / S10e Galaxy S6 Active Galaxy S7 / S7 Active g Galaxy S8 Plus No See Note: C Yes Built-in n u Galaxy S9 Plus s m S10 5G a Galaxy S6 Edge Plus S Galaxy S7 Edge Galaxy S10 Plus Note 5 Note 7 No See Note: B Built-in Note 8 Note 9 Note 10 / 10 Plus Note 10 5G / 10 Plus 5G Xiami MIX2S No See Note: B Built-in Notes: 1) If phone does not charge: remove it from charger for 3 seconds, rotate phone 180 degrees, and try again. -

The Ohio Motor Vehicle Industry

Research Office A State Affiliate of the U.S. Census Bureau The Ohio Motor Vehicle Report February 2019 Intentionally blank THE OHIO MOTOR VEHICLE INDUSTRY FEBRUARY 2019 B1002: Don Larrick, Principal Analyst Office of Research, Ohio Development Services Agency PO Box 1001, Columbus, Oh. 43216-1001 Production Support: Steven Kelley, Editor; Jim Kell, Contributor Robert Schmidley, GIS Specialist TABLE OF CONTENTS Page Executive Summary 1 Description of Ohio’s Motor Vehicle Industry 4 The Motor Vehicle Industry’s Impact on Ohio’s Economy 5 Ohio’s Strategic Position in Motor Vehicle Assembly 7 Notable Motor Vehicle Industry Manufacturers in Ohio 10 Recent Expansion and Attraction Announcements 16 The Concentration of the Industry in Ohio: Gross Domestic Product and Value-Added 18 Company Summaries of Light Vehicle Production in Ohio 20 Parts Suppliers 24 The Composition of Ohio’s Motor Vehicle Industry – Employment at the Plants 28 Industry Wages 30 The Distribution of Industry Establishments Across Ohio 32 The Distribution of Industry Employment Across Ohio 34 Foreign Investment in Ohio 35 Trends 40 Employment 42 i Gross Domestic Product 44 Value-Added by Ohio’s Motor Vehicle Industry 46 Light Vehicle Production in Ohio and the U.S. 48 Capital Expenditures for Ohio’s Motor Vehicle Industry 50 Establishments 52 Output, Employment and Productivity 54 U.S. Industry Analysis and Outlook 56 Market Share Trends 58 Trade Balances 62 Industry Operations and Recent Trends 65 Technologies for Production Processes and Vehicles 69 The Transportation Research Center 75 The Near- and Longer-Term Outlooks 78 About the Bodies-and-Trailers Group 82 Assembler Profiles 84 Fiat Chrysler Automobiles NV 86 Ford Motor Co. -

Electrifying the World's Largest New Car Market; Reinstate At

August 31, 2016 ACTION Buy BYD Co. (1211.HK) Return Potential: 15% Equity Research Electrifying the world’s largest new car market; reinstate at Buy Source of opportunity Investment Profile Electrification is set to reshape China’s auto market and we expect BYD to Low High lead this trend given its strong product portfolio, vertically integrated model Growth Growth and high OPM vs. peers. A comparative analysis with Tesla shows many Returns * Returns * strategic similarities but BYD’s new energy vehicle business trades at a sizable Multiple Multiple discount, which we see as unjustified given its large cost savings, capacity Volatility Volatility utilization, and front-loaded investment. China’s new energy vehicle market is Percentile 20th 40th 60th 80th 100th poised to deliver c.30% CAGR (vs. 4% for traditional cars) over the next decade. BYD Co. (1211.HK) We have removed the RS designation from BYD. It is on the Buy List with a Asia Pacific Autos & Autoparts Peer Group Average * Returns = Return on Capital For a complete description of the investment 12-m TP of HK$61.93, implying 15% upside. Our scenario analysis, flexing profile measures please refer to the disclosure section of this document. sales volume and margin assumptions, implies a further 30% valuation upside. Catalyst Key data Current Price (HK$) 54.00 1) More cities in China are likely to announce local preferential policies in 12 month price target (HK$) 61.93 Market cap (HK$ mn / US$ mn) 110,705.4 / 14,270.1 the new energy vehicle (NEV) segment once the result of the subsidy fraud Foreign ownership (%) -- probe is announced.