Old Mutual Dublin Funds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Diamond Technical Account and Methodology

Diamond Technical Account and Methodology What is Diamond? Diamond is designed to answer two questions: - Does the workforce on UK productions, both on and off-screen, reflect the diversity of the UK population? - Are audiences seeing themselves reflected on-screen. With the support of production companies, Diamond collects diversity data directly from cast and crew working on TV programmes (actual data), as well as information about how those on-screen might be perceived by viewing audiences (perceived data). Diamond data collection Scope Diamond is collecting data from: UK original productions commissioned by BBC, ITV, Channel 4, C5/ViacomCBS and Sky. All genres (although we do not currently report on film, sport and news) A large number of on and off-screen TV production roles (see Appendix 2) Programmes broadcast across the following channels BBC One, BBC Two, BBC Scotland, CBBC, CBEEBIES, CITV, GMTV1, GMTV2, ITV Encore, ITV1, ITV2, ITV3, ITV4, ITVBe, 4seven, Channel4, E4, Film Four, More 4, 5 Star, Channel5, Challenge TV, Paramount Network, Pick TV, Real Lives, Sky Arts, Sky Atlantic, Sky One, Sky Two, Sky Witness1 Data about 6 diversity characteristics: gender, gender identity, age, ethnicity, disability and sexual orientation. Diamond is not collecting data about: Programmes which have not been commissioned by the five Diamond broadcasters People working across broadcasting more generally, outside of production (our data are not overall workforce statistics). People who are not making a significant contribution to a programme (for example part of a crowd scene) More information about what is and isn’t collected can be found in the guidance notes issued to producers. -

Broadcasting in Transition

House of Commons Culture, Media and Sport Committee Broadcasting in transition Third Report of Session 2003–04 Report, together with formal minutes, oral and written evidence Ordered by The House of Commons to be printed 24 February 2004 HC 380 [incorporating HC101-i and HC132-i] Published on 4 March 2004 by authority of the House of Commons London: The Stationery Office Limited £15.50 The Culture, Media and Sport Committee The Culture, Media and Sport Committee is appointed by the House of Commons to examine the expenditure, administration, and policy of the Department for Culture, Media and Sport and its associated public bodies. Current membership Mr Gerald Kaufman MP (Labour, Manchester Gorton) (Chairman) Mr Chris Bryant MP (Labour, Rhondda) Mr Frank Doran MP (Labour, Aberdeen Central) Michael Fabricant MP (Conservative, Lichfield) Mr Adrian Flook MP (Conservative, Taunton) Mr Charles Hendry MP (Conservative, Wealden) Alan Keen MP (Labour, Feltham and Heston) Rosemary McKenna MP (Labour, Cumbernauld and Kilsyth) Ms Debra Shipley (Labour, Stourbridge) John Thurso MP (Liberal Democrat, Caithness, Sutherland and Easter Ross) Derek Wyatt MP (Labour, Sittingbourne and Sheppey) Powers The Committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available on the Internet via www.parliament.uk Publications The Reports and evidence of the Committee are published by The Stationery Office by Order of the House. All publications of the Committee (including press notices) are on the Internet at http://www.parliament.uk/parliamentary_committees/culture__media_and_sport. cfm Committee staff The current staff of the Committee are Fergus Reid (Clerk), Olivia Davidson (Second Clerk), Grahame Danby (Inquiry Manager), Anita Fuki (Committee Assistant) and Louise Thomas (Secretary). -

Annual Report 2002 Doc 1A

GWASANAETH RHAGLENNI CYMRAEG Drama Ein hamcan yw cynnig cyfres ddrama estynedig (tri chwarter awr neu awr o hyd) bob nos Sul ynghyd ag o leiaf un, os nad dwy, gyfres hanner awr yn ystod corff yr wythnos, yn ogystal ag ‘opera sebon’. Llwyddwyd eleni i gyflwyno arlwy oedd yn cyfuno’r newydd a’r traddodiadol, y dwys a’r ysgafn – gan gynnwys cyfresi newydd sbon ynghyd â nifer o gyfresi a oedd yn dychwelyd. Cyfres ffug wyddonol oedd Arachnid (Elidir) gyda chryfderau mawr o ran gwaith cyfrifiadurol gwreiddiol, cyfarwyddo llawn dychymyg a stori gymhleth ddifyr. Roedd yn braf edrych ar ddrama ‘sci-fi’ Gymraeg a oedd yn argyhoeddi. Cymhlethdodau bod yn wraig ifanc â dyheadau cyfoes tra’n byw yng nghefn gwlad yn wraig i weinidog, oedd canolbwynt y gyfres ddychmygus Fondue, Rhyw a Deinosors (HTV). Denodd ymateb a oedd yn pegynnu’r gynulleidfa gyda llawer yn ei mwynhau yn arw iawn tra oedd eraill yn wrthwynebus i’w chynnwys a’i harddull. Cafwyd cyfres ardderchog o Amdani (Nant) - sy’n seiliedig ar helyntion tîm rygbi merched - a ddenodd ymateb gwerthfawrogol dros ben. Dwy gyfres arall boblogaidd a ddychwelodd oedd Iechyd Da (Bracan), a oresgynnodd newidiadau gorfodol yn y cast sylfaenol yn llwyddiannus, a Talcen Caled (Nant) sy’n llwyddo i gynnwys cryn dipyn o hiwmor er gwaethaf y cefndir teuluol a chymdeithasol tywyll. Cyfres yn seiliedig ar nofel Marion Eames am y Crynwyr ym Meirionnydd yn yr ail ganrif ar bymtheg oedd Y Stafell Ddirgel (Llifon/HTV). Denodd ymateb ffafriol gan wylwyr yn enwedig wrth i’r gyfres fynd yn ei blaen, er efallai nad oedd y gyfres drwyddi draw mor llwyddiannus â dramâu cyfnod eraill o’r un stabl. -

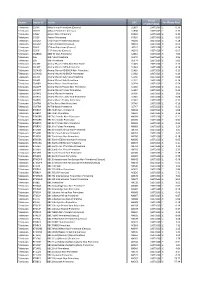

S1867 16071609 0

Period Domain Station ID Station UDC Per Minute Rate (YYMMYYMM) Television CSTHIT 4Music Non-Primetime (Census) S1867 16071609 £ 0.36 Television CSTHIT 4Music Primetime (Census) S1868 16071609 £ 0.72 Television C4SEV 4seven Non-Primetime F0029 16071608 £ 0.30 Television C4SEV 4seven Primetime F0030 16071608 £ 0.60 Television CS5USA 5 USA Non-Primetime (Census) H0010 16071608 £ 0.28 Television CS5USA 5 USA Primetime (Census) H0011 16071608 £ 0.56 Television CS5LIF 5* Non-Primetime (Census) H0012 16071608 £ 0.34 Television CS5LIF 5* Primetime (Census) H0013 16071608 £ 0.67 Television CSABNN ABN TV Non-Primetime S2013 16071608 £ 7.05 Television 106 alibi Non-Primetime S0373 16071608 £ 2.52 Television 106 alibi Primetime S0374 16071608 £ 5.03 Television CSEAPE Animal Planet EMEA Non-Primetime S1445 16071608 £ 0.10 Television CSEAPE Animal Planet EMEA Primetime S1444 16071608 £ 0.19 Television CSDAHD Animal Planet HD EMEA Non-Primetime S1483 16071608 £ 0.10 Television CSDAHD Animal Planet HD EMEA Primetime S1482 16071608 £ 0.19 Television CSEAPI Animal Planet Italy Non-Primetime S1530 16071608 £ 0.08 Television CSEAPI Animal Planet Italy Primetime S1531 16071608 £ 0.16 Television CSANPL Animal Planet Non-Primetime S0399 16071608 £ 0.54 Television CSDAPP Animal Planet Poland Non-Primetime S1556 16071608 £ 0.11 Television CSDAPP Animal Planet Poland Primetime S1557 16071608 £ 0.22 Television CSANPL Animal Planet Primetime S0400 16071608 £ 1.09 Television CSAPTU Animal Planet Turkey Non-Primetime S1946 16071608 £ 0.08 Television CSAPTU Animal -

Channel Guide July 2019

CHANNEL GUIDE JULY 2019 KEY HOW TO FIND WHICH CHANNELS YOU CAN GET 1 PLAYER 1 MIXIT 1. Match your package 2. If there’s a tick in 3. If there’s a plus sign, it’s to the column your column, you available as part of a 2 MIX 2 MAXIT get that channel Personal Pick collection 3 FUN PREMIUM CHANNELS 4 FULL HOUSE + PERSONAL PICKS 1 2 3 4 5 6 101 BBC One/HD* + 110 Sky One ENTERTAINMENT SPORT 1 2 3 4 5 6 1 2 3 4 5 6 100 Virgin Media Previews HD 501 Sky Sports Main Event HD 101 BBC One/HD* 502 Sky Sports Premier League HD 102 BBC Two HD 503 Sky Sports Football HD 103 ITV/STV HD* 504 Sky Sports Cricket HD 104 Channel 4 505 Sky Sports Golf HD 105 Channel 5 506 Sky Sports F1® HD 106 E4 507 Sky Sports Action HD 107 BBC Four HD 508 Sky Sports Arena HD 108 BBC One HD/BBC Scotland HD* 509 Sky Sports News HD 109 Sky One HD 510 Sky Sports Mix HD + 110 Sky One 511 Sky Sports Main Event 111 Sky Witness HD 512 Sky Sports Premier League + 112 Sky Witness 513 Sky Sports Football 113 ITV HD* 514 Sky Sports Cricket 114 ITV +1 515 Sky Sports Golf 115 ITV2 516 Sky Sports F1® 116 ITV2 +1 517 Sky Sports Action 117 ITV3 518 Sky Sports Arena 118 ITV4 + 519 Sky Sports News 119 ITVBe + 520 Sky Sports Mix 120 ITVBe +1 + 521 Eurosport 1 HD + 121 Sky Two + 522 Eurosport 2 HD + 122 Sky Arts + 523 Eurosport 1 123 Pick + 524 Eurosport 2 + 124 GOLD HD 526 MUTV + 125 W 527 BT Sport 1 HD + 126 alibi 528 -

Utjecaj Digitalnih Tv Kanala (Dvb-T) Na Postojeûu Analognu Tv Mrežu U Republici Hrvatskoj

Sveuþilište u Zagrebu Fakultet elektrotehnike i raþunarstva Unska 3, HR-10000 Zagreb, HRVATSKA UTJECAJ DIGITALNIH TV KANALA (DVB-T) NA POSTOJEûU ANALOGNU TV MREŽU U REPUBLICI HRVATSKOJ Zagreb, veljaþa 2004. Ugovor: Ugovor o izradi studije: UTJECAJ DIGITALNIH TV KANALA (DVB-T) NA POSTOJEûU ANALOGNU TV MREŽU U REPUBLICI HRVATSKOJ zakljuþen je kao ugovor broj HZT-16/03, FER 0114-24/163-2003. od 02. prosinca 2003. godine, izmeÿu Hrvatskog zavoda za telekomunikacije, Jurišiüeva 13, Zagreb i Fakulteta elektrotehnike i raþunarstva Sveuþilišta u Zagrebu, Unska 3, Zagreb. Voditelj projekta: prof.dr.sc. Branka Zovko-Cihlar Radna skupina: prof.dr.sc. Branka Zovko-Cihlar prof.dr.sc. Sonja Grgiü doc.dr.sc. Tomislav Kos doc.dr.sc. Mislav Grgiü Željko Tabakoviü, dipl.ing. Teo Schönbaum Sadržaj Sadržaj 1. Uvod 1 2. Tehnologija digitalnog radiodifuznog odašiljaþa 6 2.1. Arhitektura DVB-T sustava 6 2.1.1. DVB-T odašiljaþ - pobudni stupanj 7 2.1.2. DVB-T odašiljaþ - izlazni stupanj 8 2.1.3. Glavne karakteristike i prednosti DVB-T sustava 10 2.2. Parametri koji utjeþu na kvalitetu izvedbe DVB-T 10 2.3. Rezultati mjerenja polja digitalnog TV odašiljaþa Sljeme 11 3. Postupak MPEG kodiranja 22 3.1. MPEG-2 video kodiranja 22 3.1.1. Digitalni prikaz videosignala 22 3.1.2. MPEG postupak za kodiranje videosignala 24 3.1.3. MPEG-2 kodiranje videosignala 29 3.1.3.1. Opüe karakteristike 29 3.1.3.2. Profili i razine 30 3.1.4. MPEG-2 sustav 31 3.1.4.1. Oblikovanje paketa programskog toka podataka 33 3.1.4.2. -

View Annual Report

ITV plc Annual Report and Accounts 2018 December 31 ended year the for ITV plc Annual Report and Accounts for the year ended 31 December 2018 Welcome to the 2018 Annual Report We are an integrated producer broadcaster, creating, owning and distributing high-quality content on multiple platforms. This is so much More than TV as we have known it. 4 ITV at a Glance 18 28 Market Review Key Performance Indicators 6 32 Chairman’s Operating and Statement Performance Review 1 Strengthen Integrated broadcaster 8 24 producer Chief Executive’s Our Strategy 2 3 Grow Create UK and global Direct to Report production consumer 26 46 54 Our Business Model Finance Risks and Review Uncertainties Contents Strategic Report Strategic Key financial highlights Contents Group external revenue1 Non-advertising revenue2 Strategic Report 2018 Highlights 2 ITV at a Glance 4 Governance £3,211m £1,971m Chairman’s Statement 6 Chief Executive’s Report 8 (+3%) (+5%) Investor Proposition 14 (2017: £3,130m) (2017: £1,874m) Non-Financial Information Statement 15 Corporate Responsibility Strategy 16 Adjusted EBITA3 Statutory EBITA Market Review 18 Our Strategy 24 £810m £785m Our Business Model 26 Key Performance Indicators 28 (-4%) (-3%) Operating and Performance Review 32 (2017: £842m) (2017: £810m) Alternative Performance Measures 44 Financial Statements Finance Review 46 Adjusted EPS Statutory EPS Risks and Uncertainties 54 15.4p 11.7p (-4%) (+15%) Governance Chairman’s Governance Statement 64 (2017: 16.0p) (2017: 10.2p) Board of Directors 66 Management Board 68 Dividend per share p (ordinary) Leverage4 Corporate Governance 70 Audit and Risk Committee Report 80 8.0p 1.1x Remuneration Report 92 Additional information (+3%) (2017: 1.0x) Directors’ Report 109 (2017: 7.8p) Financial Financial Statements 117 Statements Independent Auditor’s Report 118 Primary Statements 125 Corporate website ITV plc Company Financial We maintain a corporate website at www.itvplc.com containing Statements 189 our financial results and a wide range of information of interest to institutional and private investors. -

Report for the APFI on the Television Market Landscape in the UK and Eire

APFI Report: UK, Eire and US Television Market Landscape • Focusing on childrens programming • See separate focus reports for drama MediaXchange encompasses consultancy, development, training and events targeted at navigating the international entertainment industry to advance the business and content interests of its clients. This report has been produced solely for the information of the APFI and its membership. In the preparation of the report MediaXchange reviewed a range of public and industry available sources and conducted interviews with industry professionals in addition to providing MediaXchange’s own experience of the industry and analysis of trends and strategies. MediaXchange may have consulted, and may currently be consulting, for a number of the companies or individuals referred to in these reports. While all the sources in the report are believed to represent current and accurate information, MediaXchange takes no responsibility for the accuracy of information derived from third-party sources. Any recommendations, data and material the report provides will be, to the best of MediaXchange’s judgement, based on the information available to MediaXchange at the time. The reports contain properly acknowledged and credited proprietary information and, as such, cannot under any circumstances be sold or otherwise circulated outside of the intended recipients. MediaXchange will not be liable for any loss or damage arising out of the collection or use of the information and research included in the report. MediaXchange Limited, 1 -

Del Apagón Analógico a La Liberación Del Dividendo Digital

UNIVERSIDAD COMPLUTENSE DE MADRID FACULTAD DE CIENCIAS DE LA INFORMACIÓN DEPARTAMENTO DE COMUNICACIÓN AUDIOVISUAL Y PUBLICIDAD II TESIS DOCTORAL Del apagón analógico a la liberación del Dividendo Digital. Análisis del fracaso de la TDT como medio de difusión de televisión de pago en España MEMORIA PARA OPTAR AL GRADO DE DOCTOR PRESENTADA POR Enrique Domingo Garcés DIRECTOR Francisco García García Madrid, 2015 © Enrique Domingo Garcés, 2015 UNIVERSIDAD COMPLUTENSE DE MADRID FACULTAD DE CIENCIAS DE LA INFORMACIÓN Departamento de Comunicación Audiovisual y Publicidad II Del apagón analógico a la liberación del Dividendo Digital. Análisis del fracaso de la TDT como medio de difusión de televisión de pago en España. Memoria para optar al grado de doctor presentada por Enrique Domingo Garcés Bajo la dirección del doctor Francisco García García Madrid, 2015 Enrique Domingo Garcés 2 Del apagón analógico a la liberación del Dividendo Digital. Análisis del fracaso de la TDT como medio de difusión de televisión de pago en España. I. Agradecimientos. Esta tesis es fruto de la disciplina y de la doctrina de la constancia en el trabajo. Ha sido una carrera de fondo y de velocidad al mismo tiempo, cargada de un sacrificio voluntario para llegar a un fin mejor cargado de satisfacciones. Con ello, quiero agradecer triplemente y en primer lugar, sin importar el orden de los factores, a tres piezas clave sin las cuales esta tesis simplemente no hubiera existido. Francisco García García, mi director de tesis, ha sido quien ha sabido encontrarme cuando estaba perdido y quien me ha animado en todo momento a continuar con el empeño. -

2016 Annual Report

ITV plc Annual Report and Accounts for the year ended 31 December 2016 Rebalanced ITV delivers continued growth ITV plc Annual Report and Accounts for the year ended 31 December 2016 Strategic Report Overview We are an integrated producer broadcaster, creating, owning and distributing high-quality content on multiple platforms. Contents Strategic Report Overview Governance Chairman’s Governance Statement 58 Provides a 2016 Highlights 2 Presents a clear view Board of Directors 60 comprehensive review Investor Proposition 4 of ITV’s governance. Management Board 62 of ITV’s business ITV at a Glance 6 Corporate Governance 64 and strategy. Market Review 8 Audit and Risk Committee Report 68 Remuneration Report 75 Strategy and Operations Annual Report on Remuneration 79 Our Strategy and Business Model 12 Remuneration Policy 89 Chairman’s Statement 14 Directors’ Report 98 Chief Executive’s Review 16 Strategic Priorities 20 Performance Dashboard 32 Financial Financial Statements 105 Performance and Financials Statements Independent Auditor’s Report 106 Alternative Performance Measures 34 ITV’s audited financial Primary Statements 110 Key Performance Indicators 36 statements for ITV plc Company Financial Financial and Performance Review 40 the year ended Statements 175 Risks and Uncertainties 50 31 December 2016. Additional Shareholder Information 189 information Glossary 190 Key Read more content within this report Read more content online Corporate website We maintain a corporate website at www.itvplc.com containing our financial results and a wide range of information of interest to institutional and private investors. ITV plc Annual Report and Accounts 2016 Strategic Report maximising We invest over £1 billion annually in our programming, significantly more than our commercial competitors, and have an unrivalled ability to deliver mass audiences Series 16 of I’m a Celebrity...Get Me Out of Here! across all demographics for our advertisers. -

ITV Plc Annual Report and Accounts for the Year Ended 31 December 2015 Welcome to Our Annual Report 2015

Delivering strong growth and building scale ITV plc Annual Report and Accounts for the year ended 31 December 2015 Welcome to our Annual Report 2015 We are an integrated producer broadcaster, creating, owning and distributing high-quality content on multiple platforms. Emmerdale had an average share of viewing of 32% in 2015 maximising and reached 62% of the UK population, which is more than 35 million We invest over £1 billion annually in our programming, viewers. Emmerdale significantly more than our commercial competitors, has been sold to 139 countries. and have an unrivalled ability to deliver mass audiences across all demographics for our advertisers. See page 18 for more The Chase has now been produced in nine countries and sold growing to over 130 countries. As an integrated producer broadcaster we create value from world-class content that we develop, own and distribute around the world. See page 22 for more Thunderbirds Are Go! has now been sold to 90 countries, including building a four-series deal with Amazon to debut on Prime Video in the US. As we grow our investment in content, we are We are also starting creating more windows to extend the reach of that to drive value from merchandising as we content and monetise it across more markets and extend the franchise platforms, both free and pay. beyond the television set. See page 26 for more Front Cover Clockwise from the top: Poldark (ITV Studios UK for the BBC); 2015 Rugby World Cup winners New Zealand; Rovers Return from Coronation Street; I’m A Celebrity...Get Me Out Of Here!; Family Guy launched in February 2016 on ITV2; The Voice (Talpa Media for the BBC). -

Rebalanced ITV Delivers Continued Growth

Rebalanced ITV delivers continued growth Full year results for the year ended 31st December 2016 Revenue growth driven by double-digit increase in non-NAR • Total external revenue up 3% to £3,064m (2015: £2,972m), including currency benefit • Total non-NAR revenue up 11% to £1,855m (2015: £1,664m), now 53% of total revenues • Total ITV Studios revenue up 13% to £1,395m (2015: £1,237m) • Online, Pay & Interactive revenue up 23% to £231m (2015: £188m) • Net Advertising revenue down 3% to £1,672m (2015: £1,719m), performing ahead of the TV ad market Rebalanced business delivering adjusted profit growth • Adjusted EBITA up 2% to £885m (2015: £865m), despite the decline in the ad market • Studios adjusted EBITA up 18% to £243m (2015: £206m) • Broadcast & Online adjusted EBITA down 3% to £642m (2015: £659m) • Adjusted EPS up 3% to 17.0p (2015: £16.5p) • Statutory EPS down 10% to 11.2p (2015: 12.4p) impacted by restructuring and earnout costs Confident in the underlying strength of the business • Broadcast business remains robust: Main channel SOV up 3%, online viewing up 42% • ITV Studios has a healthy pipeline of new and returning programmes • Building our digital business in Studios and Broadcast Strong balance sheet, healthy liquidity • Flexibility and capacity to continue to invest across the business and deliver sustainable returns to our shareholders • Given our good performance the Board is proposing a final dividend of 4.8p, giving a full year dividend of 7.2p, up 20%, in line with our policy • Reflecting ITV’s strong cash generation and the Board’s confidence in the business, the Board is proposing a special dividend of 5.0p per share, worth just over £200 million • The Board is committed to a long term sustainable dividend policy.