Annual-Report-2014.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANNUAL REPORT 2018 to Generate Economic and Social Value Through Our Companies and Institutions

ANNUAL REPORT 2018 To generate economic and social value through our companies and institutions. We have established a mission, a vision and values that are both our beacons and guidelines to plan strategies and projects in the pursuit of success. Fomento Económico Mexicano, S.A.B. de C.V., or FEMSA, is a leader in the beverage industry through Coca-Cola FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume; and in the beer industry, through ownership of the second largest equity stake in Heineken, one of the world’s leading brewers with operations in over 70 countries. We participate in the retail industry through FEMSA Comercio, comprising a Proximity Division, operating OXXO, a small-format store chain; a Health Division, which includes all drugstores and related operations; and a Fuel Division, which operates the OXXO GAS chain of retail service stations. Through FEMSA Negocios Estratégicos (FEMSA Strategic Businesses) we provide logistics, point-of-sale refrigeration solutions and plastics solutions to FEMSA’s business units and third-party clients. FEMSA’s 2018 integrated Annual Report reflects our commitment to strong corporate governance and transparency, as exemplified by our mission, vision and values. Our financial and sustainability results are for the twelve months ended December 31, 2018, compared to the twelve months ended December 31, 2017. This report was prepared in accordance with the Global Reporting Initiative (GRI) Standards and the United Nations Global Compact, this represents our Communication on Progress for 2018. Contents Discover Our Corporate Identity 1 FEMSA at a Glance 2 Value Creation Highlights 4 Social and Environmental Value 6 Dear Shareholders 8 FEMSA Comercio 10 Coca-Cola FEMSA 18 FEMSA Strategic Businesses 28 FEMSA Foundation 32 Corporate Governance 40 Financial Summary 44 Management’s Discussion & Analysis 46 Contact 52 Over the past several decades, FEMSA has evolved from an integrated beverage platform to a multifaceted business with a broad set of capabilities and opportunities. -

Femsa: Un Grupo Económico Nacional

ISSN: 2448-5101 Año 1 Número 1 621 Julio 2014 - Junio 2015 FEMSA: UN GRUPO ECONÓMICO NACIONAL Primer Autora: Dra. Beatriz Pérez Sánchez Institución De Adscripción: Universidad Juárez Autónoma De Tabasco Dirección: Calle Tabasco Número 115 Colonia Gil Y Sáenz Código Postal 06080 Villahermosa, Centro, Tabasco, México Correo Electrónico: [email protected] Nacionalidad: Mexicana Cuarto Autor: Estudiante Jesús Alberto Morales Méndez Institución De Adscripción: Universidad Juárez Autónoma De Tabasco Dirección: Calle Romelio Oropeza De La Cruz Número 143 Fraccionamiento Jalapa Código Postal 86850 Jalapa, Tabasco, México Correo Electrónico: [email protected] Nacionalidad: Mexicano Fecha de envio:19/Marzo/2015 Fecha de aceptación: 20/Mayo/2015 ____________________________________________________________________ RESUMEN Analizar como los grupos económicos o corporativos deben adaptarse a entornos dinámicos e inestables tanto en el ámbito nacional e internacional, así como la influencia política que logran alcanzar por su poder económico, sigue siendo vigente en la era de la globalización de los mercados. En México el rol de los grandes corporativos en el crecimiento y desarrollo del capitalismo permite visualizar sus estrategias. Se particulariza el caso de FEMSA en un periodo de estudio de 1899 a 2013. En el porfiriato, entre 1890 y 1910 se da una marcada diversificación de las inversiones que iniciaron tanto industrias dedicadas a abastecer el consumo productivo (grandes fundiciones, cemento, vidrio) como el consumo personal (cerveza y otras bebidas, textiles, artículos para higiene, materiales para la construcción, alimentos elaborados), el ramo minero, el crédito y los bancos, la propiedad y explotación de la tierra, los servicios y el transporte. En 1891 se creó la Fábrica de Cerveza y Hielo Cuauhtémoc comenzó a operar a finales de 1891 y es el origen de Femsa. -

Latin American State Oil Companies and Climate

LATIN AMERICAN STATE OIL COMPANIES AND CLIMATE CHANGE Decarbonization Strategies and Role in the Energy Transition Lisa Viscidi, Sarah Phillips, Paola Carvajal, and Carlos Sucre JUNE 2020 Authors • Lisa Viscidi, Director, Energy, Climate Change & Extractive Industries Program at the Inter-American Dialogue. • Sarah Phillips, Assistant, Energy, Climate Change & Extractive Industries Program at the Inter-American Dialogue. • Paola Carvajal, Consultant, Mining, Geothermal Energy and Hydrocarbons Cluster, Inter-American Development Bank. • Carlos Sucre, Extractives Specialist, Mining, Geothermal Energy and Hydrocarbons Cluster, Inter-American Development Bank. Acknowledgments We would like to thank Columbia University's Center on Global Energy Policy and Philippe Benoit, Adjunct Senior Research Scholar at the Center, for inviting us to participate in the workshop on engaging state-owned enterprises in climate action, a meeting which played an instrumental role in informing this report. We would also like to thank Nate Graham, Program Associate for the Inter-American Dialogue’s Energy, Climate Change & Extractive Industries Program, for his assistance. This report was made possible by support from the Inter-American Development Bank in collaboration with the Inter- American Dialogue’s Energy, Climate Change & Extractive Industries Program. The opinions expressed in this publication are those of the authors and do not necessarily reflect the views of the Inter- American Development Bank, its Board of Directors, or the countries they represent. The views contained herein also do not necessarily reflect the consensus views of the board, staff, and members of the Inter-American Dialogue or any of its partners, donors, and/or supporting institutions. First Edition Cover photo: Pxhere / CC0 Layout: Inter-American Dialogue Copyright © 2020 Inter-American Dialogue and Inter-American Development Bank. -

Coca-Cola Femsa, S.A.B

PROSPECTO DEFINITIVO. Los valores mencionados en el Prospecto Definitivo han sido registrados en el Registro Nacional de Valores que lleva la CNBV, los cuales no podrán ser ofrecidos ni vendidos fuera de los Estados Unidos Mexicanos, a menos que sea permitido por las leyes de otros países. DEFINITIVE PROSPECTUS. These securities have been registered with the securities section of the National Registry of Securities (RNV) maintained by the CNBV. They can not be offered or sold outside the United Mexican States unless it is permitted by the laws of other countries. COCA-COLA FEMSA, S.A.B. DE C.V. PROGRAMA DUAL REVOLVENTE DE CERTIFICADOS BURSÁTILES MONTO TOTAL AUTORIZADO $10,000,000,000.00 (DIEZ MIL MILLONES DE PESOS 00/100 M.N. O SU EQUIVALENTE EN UNIDADES DE INVERSIÓN) Cada emisión de Certificados Bursátiles (según se define más adelante) realizada al amparo del Programa que se describe en este Prospecto contará con sus propias características. El monto total de cada Emisión, el valor nominal, la fecha de emisión y liquidación, el plazo, la fecha de vencimiento, la tasa de interés aplicable (y la forma de calcularla) y la periodicidad de pago de interés, entre otras características de los Certificados Bursátiles de cada Emisión, serán acordados por Coca-Cola FEMSA, S.A.B. de C.V. (“Coca-Cola FEMSA”, “KOF”, el “Emisor” o la “Com- pañía”, indistintamente) con el colocador respectivo al momento de dicha emisión y se darán a conocer al momento de cada Emisión en el Suplemento respectivo. Los Certificados Bursátiles se denominarán en Pesos, en Pesos indizados al tipo de cambio del Dólar de los Estados Unidos de América o al tipo de cambio de cualquier otra moneda, o en UDIs, según se señale en la Convocatoria (según se define más adelante) y en el Aviso (según se define más adelante) o en el Suplemento (según se define más adelante) respectivo, según sea el caso. -

Coca-Cola FEMSA, S.A.B. De C.V. Proposed Audit Committee 2021

Coca-Cola FEMSA, S.A.B. de C.V. Proposed Audit Committee 2021 Víctor Alberto Tiburcio Celorio Chairman and Financial Born: February 1951 Expert First elected to Committee: 2018 Principal occupation: Independent consultant Other directorships: Member of the board of directors and member of the audit committee of Fomento Económico Mexicano, S.A.B. de C.V. (“FEMSA”), Grupo Palacio de Hierro S.A.B. de C.V., Grupo Financiero Scotiabank Inverlat, Profuturo Afore, S.A. de C.V., Grupo Nacional Providencial S.A.B. and Fresnillo, PLC. Business Worked for over forty-three years at Mancera, S.C. (Ernst & Young Mexico), experience: serving as partner for thirty three years and as Chief Executive Officer and Chairman of the board of directors for thirteen years until his retirement in 2013. He was chairman of the board of Mexican Financial Reporting Standards and served as President of the Mexican Institute of Public Accountants. Education: Holds a Public Accountant degree from the Universidad Iberoamericana (IBERO) and Master in Business Administration from Instituto Tecnológico Autónomo de México (ITAM). Alfonso González Migoya Born: January 1945 First elected to Committee: 2007 Principal occupation: Business consultant and managing partner of Acumen Empresarial, S.A. de C.V. Other directorships: Chairman of the board of directors of Invercap Holdings, S.A.P.I. de C.V. and member of the board of directors of FEMSA, Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (Volaris), Grupo Cuprum, S.A.P.I. de C.V., y Pinturas Berel, S.A. de C.V. Member of the board of directors and member of the audit and corporate practices committees of Nemak, S.A.B. -

Relevance of Country Allocation of FDI Flows and Positions the Case of Mexico Outline

RelevanceTítulo of da country apresentação allocation of TítuloFDI flows da apresentaçãoand positions Alejandro Barajas del Pino Autores da apresentação Chief Capital movements office Autores da apresentação Banco de México Autores da apresentação Autores da apresentação Relevance of country allocation of FDI Flows and Positions The Case of Mexico Outline 1) Why it is important? 2) Estimation Methods of inward FDI flows and position. 3) Different ways to get involved in the globalization 4) Round trip position 5) Ultimate investor and immediate counterpart country 6) Conclusion Inward estimation 1) All the firms with foreign owners have to send information to the National Register of Foreign Investment (RNIE in Spanish) of the secretary of Economy. 2) A committee of Bank of Mexico and Ministry of Economy staff using the register information estimates the FDI flow each quarter. 3) The investment position is estimated by the Bank of México with information from the RNIE. 4) Some firms present late reports so the historical information is subject to revisions. Outward estimation 1) Bank of Mexico estimates outward flows and position using surveys to the main Mexican corporations. 2) The quarterly survey collects information for the FDI flows. 3) An annual survey is used to correct the quarter flows estimates. 4) The investment position es estimated with data from the annual survey. Relevance 1) Does it matter the source of foreign saving? 2) Is FDI different? It moves more than just purchasing power 1. Technology 2. Know how 3. Access to trade chains 4. Managerial practices 3) Spillovers? Depends on: 1. Investment firm origin, sector 2. -

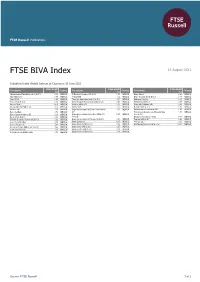

FTSE BIVA Index

2 FTSE Russell Publications 19 August 2021 FTSE BIVA Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Administradora Fibra Danhos S.A. de C.V. 0.15 MEXICO El Puerto de Liverpool SA de CV 0.53 MEXICO Grupo Mexico 8.89 MEXICO Alfa SAB de CV 0.89 MEXICO Femsa UBD 9.2 MEXICO Grupo Rotoplas S.A.B. de C.V. 0.17 MEXICO Alpek S.A.B. 0.28 MEXICO Fibra Uno Administracion S.A. de C.V. 1.91 MEXICO Industrias Penoles 1.02 MEXICO Alsea S.A.B. de C.V. 0.56 MEXICO Genomma Lab Internacional S.A.B. de C.V. 0.46 MEXICO Kimberly Clark Mex A 0.88 MEXICO America Movil L 13.59 MEXICO Gentera SAB de CV 0.35 MEXICO Megacable Holdings SAB 0.64 MEXICO Arca Continental SAB de CV 1.53 MEXICO Gruma SA B 1.37 MEXICO Nemak S.A.B. de C.V. 0.16 MEXICO Bachoco Ubl 0.36 MEXICO Grupo Aeroportuario del Centro Norte Sab de 1.31 MEXICO Orbia Advance Corporation SAB 1.59 MEXICO Banco del Bajio 0.76 MEXICO CV Promotora y Operadora de Infraestructura 1.05 MEXICO Banco Santander Mexico (B) 0.43 MEXICO Grupo Aeroportuario del Pacifico SAB de CV 2.27 MEXICO S.A. de C.V. Becle S.A.B. de C.V. 0.86 MEXICO Series B Qualitas Controladora y Vesta 0.48 MEXICO Bolsa Mexicana de Valores SAB de CV 0.62 MEXICO Grupo Aeroportuario del Sureste SA de CV 2.21 MEXICO Regional SAB de CV 0.83 MEXICO Cementos Chihuahua 0.79 MEXICO Grupo Banorte O 11.15 MEXICO Televisa 'Cpo' 4.38 MEXICO Cemex Sa Cpo Line 7.43 MEXICO Grupo Bimbo S.A.B. -

Striving to Overcome the Economic Crisis: Progress and Diversification of Mexican Multinationals’ Export of Capital

Striving to overcome the economic crisis: Progress and diversification of Mexican multinationals’ export of capital Report dated December 28, 2011 EMBARGO: The contents of this report cannot be quoted or summarized in any print or electronic media before December 28, 2011, 7:00 a.m. Mexico City; 8:00 a.m. NewYork; and 1 p.m. GMT. Mexico City and New York, December 28, 2011: The Institute for Economic Research (IIEc) of the National Autonomous University of Mexico (UNAM) and the Vale Columbia Center on Sustainable International Investment (VCC), a joint initiative of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their third survey of Mexican multinationals today. 1 The survey is part of a long-term study of the rapid global expansion of multinational enterprises 2 (MNEs) from emerging markets. The present report focuses on data for the year 2010. Highlights In 2010, the top 20 Mexican MNEs had foreign assets of USDD 123 billion (table 1 below), foreign sales of USDD 71 billion, and employed 255,340 people abroad (see annex table 1 in annex I). The top two firms, America Movil and CEMEX, together controlled USDD 85 billion in foreign assets, accounting for nearly 70% of the assets on the list. The top four firms (including FEMSA and Grupo Mexico) jointly held USDD 104 billion, which represents almost 85% of the list’s foreign assets. Leading industries in this ranking, by numbers of MNEs, are non-metallic minerals (four companies) and food and beverages (another four companies). -

SANTANDER LATIN AMERICAN INVESTMENT GRADE ESG BOND Agosto 2021 Información General Política De Inversión

SANTANDER LATIN AMERICAN INVESTMENT GRADE ESG BOND Agosto 2021 Información general Política de inversión El Subfondo invertirá principalmente en bonos corporativos emitidos por emisores corporativos latinoamericanos o por empresas que obtienen más del 60% de sus ingresos de sus operaciones en la región. El Subfondo trata de mantener una puntuación ESG superior a la de su índice de referencia. Gestor Alfredo Mordezki ISIN LU2208607957 Fecha de lanzamiento 22/02/2021 Divisa de Clase USD Rentabilidad acumulada (%)¹ Aportación Mínima 500.000,00 $ Comisión de Gestión 0,25% 1M 3M 6M YTD 1Y Lanzam. Valor Liquidativo 101,79 $ Fondo 0,50 2,41 2,34 - - 2,39 Patrimonio de Fondo $32,62M Índice 0,69 2,42 2,00 - - 1,47 Número de posiciones 51 Duración Media 6,97 YTM Media 3,27% Índice100% JPM CEMBI IG Global Diversified Latam Categoría Rentabilidad anual (%)¹ Entidad gestora Santander AM Lux 2021* 2020 2019 2018 2017 2016 Fondo 2,39 - - - - - Índice 1,47 - - - - - * Desde inicio. Estadísticas* Fondo Índice Volatilidad (%) Ratio de Sharpe Volatilidad anual (%)¹ Ratio de Información Beta 2021* 2020 2019 2018 2017 2016 R2 Fondo 1,92 - - - - - Alfa (%) Índice 1,83 - - - - - Alfa de Jensen (%) * Desde inicio. Correlación Ratio de Treynor Tracking Error (%) * Menos de un año de história, imposible calcular estadísticos. Rendimiento acumulado desde lanzamiento Rentabilidad mensual (%)¹ Ene Feb Mar Abr May Jun Jul Ago Sep Oct Nov Dic Total 2021 - - -0,83 0,45 0,32 1,23 0,65 0,50 - - - - 2,39 2020 - - - - - - - - - - - - 2019 - - - - - - - - - - - - 2018 - - - - - - - - - - - - 2017 - - - - - - - - - - - - 2016 - - - - - - - - - - - - ¹ Cálculos netos de comisiones. Pág. 1 Distribución de cartera 10 principales posiciones (%) 28,47 Divisa (%) Cable Onda Sa 4.5% 30-jan-2030 3,11 USD 100,02 Banco Santander-chile 2.7% 10-jan-2025 2,89 EUR -0,02 Corporacion Lindley S.a. -

FEMSA Presentación a La

Bolsa Mexicana de Valores Agosto 2005 Esta presentación de FEMSA contiene cierta información estimada sobre el comportamiento futuro de la empresa que deberán considerarse como supuestos de buena fe por parte de FEMSA. Dichos comentarios reflejan las expectativas de la Administración y están basados en información actualmente disponible. Los resultados están sujetos a eventos e incertidumbres futuras, los cuales podrían afectar de manera material a la empresa. Poderosa Plataforma de Bebidas Público Inversionista 15% 40% 45% 100% 100% Embotellador de Coca- Empresa líder en Líder del mercado y Cola más grande de innovación en México, cadena de tiendas de Latinoamérica y el enfocada al consumidor mayor crecimiento en segundo más grande México del mundo 2 Con Orientación al Crecimiento EBITDA 1,950 (US$ millones) 1,812 1,543 1,329 1,298 1,108 945 715 670 428 296 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Últimos 12 US$ CAC 1995 –2005: 21% meses a Junio 3 Nota: Cifras en pesos Mexicanos convertidas en dólares estadounidenses al tipo de cambio de fin de periodo respectivo. Empresa Integrada de Bebidas más Grande de América Latina Líder en América Latina medido Compañías Líderes en por Ingresos en el 2004 América Latina en el 2004 (US$ millones) (US$ millones) 8,430 Petrobras 36,992 Cemex(2) 15,500 Walmex 12,548 5,150 Telmex 12,453 4,021 América Móvil 12,089 8,430 1,872 1,244 CVRD 8,066 895 757 744 Gerdau 8,003 ) o a a l a 1 l i c a n Eletrobras 6,870 ( e r t CU v a Ar n C di e od v Co An B M Ba Am Telenorte Leste 5,416 Fuente: Reportes públicos de las Compañías. -

Perfil De Los Grupos Econmicos Privados En Monterrey

Perfil de los Grupos Económicos Privados en Monterrey: la fiesta que precedió la crisis Óscar Flores Universidad de Monterrey [email protected] En el sector de la industria nacional, el desarrollo económico ha propiciado la formación de Grupos Económicos Privados (GEP). En ellos ahora confluye una diversidad de intereses más allá del rubro industrial pues han incursionado en otros sectores como el de servicios y en los rubros comercial, financiero, turismo y comunicaciones. En el año 2003, de las quinientas empresas mas grandes del mundo fuera de Estados Unidos, siete fueron mexicanas y, de ellas, tres tienen origen en Monterrey: ALFA, CEMEX y FEMSA, las más grandes de la región y lideres globales en su rama. Su relevancia se refleja en la actividad económica de la ciudad de Monterrey y en particular en el producto interno bruto. De acuerdo al listado del Grupo Forbes de las 500 empresas con mayores ventas fuera de Estados Unidos, las mexicanas incluidas fueron: Carso Global Telecom en el puesto 226, Wal-Mart de México en el 246 y posteriormente CEMEX, América Telecom, FEMSA, Grupo Carso y ALFA1. En efecto, el estado de Nuevo León concentra más de 200 grupos industriales, la gran mayoría con sede en Monterrey y su área metropolitana. Sin embargo, a pesar del crítico ajuste administrativo a consecuencia de las últimas crisis, en especial de la de 1982, estos grupos (cuando menos los de capital nativo) aun son manejados por las familias de los fundadores. Este control se ha mantenido principalmente a través de la posesión directa de la mayoría de las acciones con derecho al voto; la concentración de estas acciones en empresas a través de los corporativos, y el ejercicio de la mayoría de los cargos del consejo de administración (Flores, 2005 y 2001 y Cerutti, 2000). -

Cocacolafemsa-Relatorio Sustentabilidada Br VFF-Pt.Pdf

Relatório de sustentabilidade 2019 1 SUMÁRIO 1. Apresentação 4 2. Linha do tempo e Cadeia de Valor 10 3. Governança e Gestão – Nossa Gente 14 4. Social – Nossa Comunidade 32 5. Ambiental – Nossa Planeta 46 6. Instituto Coca-Cola 64 7. Fundação FEMSA 68 8. Conclusão 70 2 Coca-Cola FEMSA EDITORIAL Caro(a) leitor(a), Chegamos ao nosso segundo Relatório de Sustentabilidade e, mais do que uma continuidade, estamos orgulhosos do quan- to conseguimos avançar. Neste documento, reapresentamos conceitos e diretrizes e relatamos ações e iniciativas realizadas ao longo do ano de 2019. Mas vamos além: compartilhamos nos- sos principais indicadores de sustentabilidade dentro da gestão Coca-Cola FEMSA Brasil com foco em um planejamento estratégico de médio e longo prazo. O ano que passou teve um grande marco, o lançamento da SustentaPET, pro- jeto de Agregadora Multimateriais que já chega a receber mais de 700 mil garrafas PET por dia no centro logístico criado em São Paulo, e que tem um objetivo ambi- cioso: otimizar a reciclagem desse material no Brasil. A iniciativa nos enche de orgu- lho, uma vez que, além de ser fundamental para a questão ambiental, gera impactos sociais muito importantes, como o fomento à economia circular e agregação de valor ao trabalho das cooperativas e catadores individuais. Além da reciclagem, também tivemos grandes avanços na temática água, elemen- to fundamental para o nosso negócio e um ponto sensível para as comunidades onde estamos presentes. Por isso, nosso olhar sempre tem um duplo viés: como melhorar nossa eficiência na fabricação dos produtos e como garantir que não haja impactos negativos para as comunidades dos entornos da nossa operação.