CS Mr Sebastian Roberts General Manager – Electricity Regulatory

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Distribution Loss Factor Calculation Methodology Paper 2021-22

Distribution Loss Factor Calculation Methodology Paper March 2021 Distribution Loss Factor Calculation Methodology Paper March 2021 CONTENTS 1 INTRODUCTION .......................................................................................................................... 1 1.1 Requirements of the National Electricity Rules .................................................................. 1 1.2 Ausgrid’s general approach in deriving non-site specific DLFs ......................................... 2 1.3 Energy entering the distribution network ............................................................................ 4 1.4 Energy exiting the distribution network .............................................................................. 4 1.5 Proposed approach to loss estimation for financial year 2021-22 ..................................... 4 2 BREAKDOWN OF TECHNICAL LOSSES ................................................................................. 5 2.1 Calculation of site specific loss factors............................................................................... 5 2.2 Calculation of loss load factors .......................................................................................... 5 2.3 Sub-transmission network series losses ............................................................................ 5 2.4 Sub-transmission network shunt losses ............................................................................. 5 2.5 High voltage network series losses ................................................................................... -

REVIEW 11 Ravensworth Rail Unloader Expansion 1

MACQUARIE GENERATION 2001 REVIEW 11 Ravensworth rail unloader expansion 1 10 Technology upgrade for Liddell 16 Sawmill waste for renewable energy 19 Aussie Climb 2000—an epic fundraiser 20 Gas-fuelled power plant proposed REVIEW 2001 CONTENTS FINANCIAL PERFORMANCE* 4 PERFORMANCE HIGHLIGHTS 5 CHAIRMAN’S REVIEW 6 CHIEF EXECUTIVE’S REPORT 7 FOUNDATIONS FOR THE FUTURE—LIDDELL UPGRADE, RAIL UNLOADER EXPANSION, INDUSTRY ZONE, TOMAGO GAS TURBINE 10 ENVIRONMENTAL PERFORMANCE 14 RENEWABLE ENERGY PORTFOLIO—BIOMASS CO-FIRING, HYDROELECTRIC PLANT, WIND POWER STUDIES 16 IN THE COMMUNITY—AUSSIE CLIMB 2000 19 FORESTRY TRIALS, SAFETY WINNERS 20 * Macquarie Generation’s 2001 Financial Statements presented to the New South Wales Parliament are available from the Corporation’s web site or by contacting our Newcastle office. Contact details appear on the back cover of Review 2001. Cover: Water vapour rises from Bayswater Power Station’s cooling towers. 11 Ravensworth rail unloader expansion 1 10 Technology upgrade for Liddell 16 Sawmill waste for renewable energy 19 Aussie Climb 2000—an epic fundraiser 20 Gas-fuelled power plant proposed REVIEW 2001 CONTENTS FINANCIAL PERFORMANCE* 4 PERFORMANCE HIGHLIGHTS 5 CHAIRMAN’S REVIEW 6 CHIEF EXECUTIVE’S REPORT 7 FOUNDATIONS FOR THE FUTURE—LIDDELL UPGRADE, RAIL UNLOADER EXPANSION, INDUSTRY ZONE, TOMAGO GAS TURBINE 10 ENVIRONMENTAL PERFORMANCE 14 RENEWABLE ENERGY PORTFOLIO—BIOMASS CO-FIRING, HYDROELECTRIC PLANT, WIND POWER STUDIES 16 IN THE COMMUNITY—AUSSIE CLIMB 2000 19 FORESTRY TRIALS, SAFETY WINNERS 20 * Macquarie Generation’s 2001 Financial Statements presented to the New South Wales Parliament are available from the Corporation’s web site or by contacting our Newcastle office. Contact details appear on the back cover of Review 2001. -

Network Vision 2056 Is Prepared and in All Cases, Anyone Proposing to Rely on Or Use Made Available Solely for Information Purposes

Disclaimer and copyright The Network Vision 2056 is prepared and In all cases, anyone proposing to rely on or use made available solely for information purposes. the information in this document should: Nothing in this document can be or should be taken as a recommendation in respect of any 1. Independently verify and check the currency, possible investment. accuracy, completeness, reliability and suitability of that information The information in this document reflects the forecasts, proposals and opinions adopted by 2. Independently verify and check the currency, TransGrid as at 30 June 2016 other than where accuracy, completeness, reliability and suitability otherwise specifically stated. Those forecasts, of reports relied on by TransGrid in preparing this proposals and opinions may change at any document time without warning. Anyone considering this 3. Obtain independent and specific advice from document at any date should independently seek appropriate experts or other sources the latest forecasts, proposals and opinions. Accordingly, TransGrid makes no representations This document includes information obtained or warranty as to the currency, accuracy, from the Australian Energy Market Operator reliability, completeness or suitability for particular (AEMO) and other sources. That information purposes of the information in this document. has been adopted in good faith without further enquiry or verification. Persons reading or utilising this Network Vision 2056 acknowledge and accept that TransGrid This document does not purport to contain all and/or its employees, agents and consultants of the information that AEMO, a prospective shall have no liability (including liability to any investor, Registered Participant or potential person by reason of negligence or negligent participant in the National Electricity Market misstatement) for any statements, opinions, (NEM), or any other person or Interested Parties information or matter (expressed or implied) may require for making decisions. -

Appendix D: Principal Power Stations in Australia

D Appendix D––Principal power stations in Australia 1.1 See table on next page 142 BETWEEN A ROCK AND A HARD PLACE Principal Power Stations in Australia State Name Operator Plant Type Primary Fuel Year of Capacity Commissioning (MW) NSW Eraring Eraring Energy Steam Black coal 1982-84 2,640.0 NSW Bayswater Macquarie Generation Steam Black coal 1982-84 2,640.0 NSW Liddell Macquarie Generation Gas turbines Oil products 1988 50.0 Macquarie Generation Steam Black coal 1971-73 2,000.0 NSW Vales Point B Delta Electricity Steam Black coal 1978 1,320.0 NSW Mt Piper Delta Electricity Steam Black coal 1992-93 1,320.0 NSW Wallerawang C Delta Electricity Steam Black coal 1976-80 1,000.0 NSW Munmorah Delta Electricity Steam Black coal 1969 600.0 NSW Shoalhaven Eraring Energy Pump storage Water 1977 240.0 NSW Smithfield Sithe Energies Combined cycle Natural gas 1997 160.0 NSW Redbank National Power Steam Black coal 2001 150.0 NSW Blowering Snowy Hydro Hydro Water 1969 80.0 APPENDIX D––PRINCIPAL POWER STATIONS IN AUSTRALIA 143 NSW Hume NSW Eraring Energy Hydro Water 1957 29.0 NSW Tumut 1 Snowy Hydro Hydro Water 1973 1,500.0 NSW Murray 1 Snowy Hydro Hydro Water 1967 950.0 NSW Murray 2 Snowy Hydro Hydro Water 1969 550.0 NSW Tumut 2 Snowy Hydro Hydro Water 1959 329.6 NSW Tumut 3 Snowy Hydro Hydro Water 1962 286.4 NSW Guthega Snowy Hydro Hydro Water 1955 60.0 VIC Loy Yang A Loy Yang Power Steam Brown coal 1984-87 2,120.0 VIC Hazelwood Hazelwood Power Steam Brown coal 1964-71 1,600.0 Partnership VIC Yallourn W TRU Energy Steam Brown coal 1973-75 1,480.0 1981-82 -

Power Off Power on Rebooting the National Energy Market

Power Off Power On Rebooting the national energy market December 2017 Power Off Power On: Rebooting the national energy market 1 The Shepherd Review Power Off Power On: Rebooting the national energy market An options paper commissioned by the Menzies Research Centre Nick Cater, MRC Executive Director Spiro Premetis, MRC Director of Policy and Research Published by The Menzies Research Centre Limited R G Menzies House Cnr Blackall and Macquarie Streets BARTON ACT 2600 PO Box 6091 KINGSTON ACT 2604 Phone: 02 6273 5608 Email: [email protected] Portal: www.menziesrc.org The Menzies Research Centre is a company limited by guarantee. The Menzies Research Centre is supported by a grant from the Commonwealth Department of Finance. ACN 067 379 684 © THE MENZIES RESEARCH CENTRE From the the desk desk of Tony of Shepherd Tony AO Shepherd From the desk of Tony Shepherd AO For generations the great promise celebrated in our national anthem – wealth in exchange InForfor March toilgenerations – 2017 has the given Shepherd the us great an Review enviable promise published lifestyle. celebrated its Statement in our of national National Challengesanthem – settingwealth out in exchangethe priorities for fornational toil –reform. has given us an enviable lifestyle. Yet Australians are beginning to doubt that promise. They are prepared to work as hard as Since then we have conducted a series of community forums talking to people in every state to discover what they thinkYetever Australians toneeds secure fixing. a are better beginning life for tothemselves doubt that and promise. their families, They are yet prepared many feel to itwork has asbecome hard as harder everto get to ahead. -

1 Results Highlights and Business Update

Results Highlights and Business Update 1 Brett Redman, Managing Director & CEO Financial Results 2 Damien Nicks, Interim CFO Market Update and Outlook 3 Brett Redman, Managing Director & CEO Results Highlights and Business Update Brett Redman Managing Director & CEO Safety Customers People Total Injury Frequency Rate Quarterly Net Promoter Score Employee Engagement Index (per million hours worked) (advocates less detractors) (%) Jun-15 Jun-16 Jun-17 Jun-18 Dec-18 10.9 76 70 62 6.2 5.5 3.8 5.4 4.7 4.3 3.1 3.1 4.1 2.4 No 3.3 (16.9) survey (18.2) (18.1) taken 2.0 1.2 1.8 (22.5) FY15 FY16 FY17 FY18 1H19 (25.4) FY15 FY16 FY17 FY18 1H19 Employees Contractors Combined AGL Energy 2019 Half Year Investor Presentation | 7 February 2019 4 Reduced electricity prices for household and small business customers across all states Assisting customers Standing offer discounts rewarding loyalty; debt relief program helping the vulnerable Ongoing investment in key AGL assets for efficient and reliable generation and supply Building trust Emphasis on key customer and regulatory processes amid rising community expectations $1.9b of new energy supply projects under construction; further $1.5b subject to feasibility Enhancing energy supply Securing pumped hydro options; new residential battery offering ready July 2019 Increase operating expenditure across fleet to support performance and capture value Optimising performance Revised total operating cost targets, retain plan for year-on-year nominal reductions Customer Experience Transformation and ERP upgrade -

New South Wales Auditor-General's Report Financial Audit Volume Four

New South Wales Auditor-General’s Report | Financial | Focusing Audit on Four | Volume Electricity 2012 New South Wales Auditor-General’s Report Financial Audit Volume Four 2012 Focusing on Electricity Professional people with purpose Making the people of New South Wales proud of the work we do. Level 15, 1 Margaret Street Sydney NSW 2000 Australia t +61 2 9275 7100 f +61 2 9275 7200 e [email protected] office hours 8.30 am–5.00 pm audit.nsw.gov.au The role of the Auditor-General GPO Box 12 The roles and responsibilities of the Auditor- Sydney NSW 2001 General, and hence the Audit Office, are set out in the Public Finance and Audit Act 1983. Our major responsibility is to conduct financial or ‘attest’ audits of State public The Legislative Assembly The Legislative Council sector agencies’ financial statements. Parliament House Parliament House Sydney NSW 2000 Sydney NSW 2000 We also audit the Total State Sector Accounts, a consolidation of all agencies’ accounts. Pursuant to the Public Finance and Audit Act 1983, Financial audits are designed to add credibility I present Volume Four of my 2012 report. to financial statements, enhancing their value to end-users. Also, the existence of such audits provides a constant stimulus to agencies to ensure sound financial management. Peter Achterstraat Auditor-General Following a financial audit the Office issues 7 November 2012 a variety of reports to agencies and reports periodically to parliament. In combination these reports give opinions on the truth and fairness of financial statements, and comment on agency compliance with certain laws, regulations and Government directives. -

Representative Legal Matters Zoë Hilson

Representative Legal Matters Zoë Hilson Advised NSW Government on its AUD1.5 billion sale of Macquarie Generation's assets to AGL, including the Liddell and Bayswater power stations. Advised NSW Government on its sale of Eraring Energy's generation assets to Origin Energy, including the Eraring power station and Shoalhaven Scheme. Advised NSW Government on its sale of its renewable energy assets, including the Hume and Burrinjuck hydro facilities and Blayney and Crookwell wind farms. Advised NSW Government on its AUD5.3 billion energy reform arrangements, including the sale of electricity retail businesses, gas retailers, development sites and generation trading arrangements. Advised Origin Energy Limited on its interest in the APLNG Pty Limited LNG joint venture in Queensland, including governance issues. Advised Origin Energy Limited on a number of wind farm acquisitions, including its acquisition of Wind Power Pty Ltd and assets from Epuron Pty Limited and the development of its wind energy portfolio. Advised Origin Energy LPG Limited on its acquisition of LPG assets from BP Refinery (Bulwer Island) Pty Ltd, including eight LPG bullets and associated pipelines and property rights. Advised Eurus Energy on its acquisition of the 53 MW Hallett 5 wind farm from AGL Energy. Advised TEPCO on the sale of its shares in Great Energy Alliance Corporation Pty Limited (the owner of Loy Yang A power station) to AGL Generation Pty Ltd (a subsidiary of AGL Energy Limited). Advised RATCH Australia on its acquisition of an 80% interest in the Transfield Infrastructure Fund (the owner of a number of power assets, including operating wind farms and a wind farm development portfolio). -

Macquarie Generation Annual Report

Macquarie Generation Annual Report Enveloping and shaded Osbourn often combining some Renault rampantly or interwound intractably. Vibrating Haywood constitutes paranormalcontemptibly Tracy while never Sebastiano conclude always just whenhydrates Shea his guillotining hoofprint acculturates his mendicant. propitiatorily, he embargos so formlessly. Translative and The statement is available at macq. Heat from under the ground: new tasks for our Weisweiler site. Lab and the continued collaboration of the participants. Businesses of the Iberdrola group Risk Policy for the Real Estate Business of the Iberdrola group The General Risk Control and Management Policy, as well a summary of the risk policies in further implementation thereof, are available on the corporate website. STI payment be awarded to an executive. For employees who have elected to receive part or all of the entitlement as cash, component of the entitlement is recognised as a liability at its nominal value. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of this financial report. Buid lead list of websites based on tech stack. The Medium Combustion Plants Directive places emission limits on smaller generating and other combustion plants. The Personnel Affairs Committee held four meetings during the year being reviewed. The green impact statements should be read in conjunction with the methodology for calculating green impact. Reports based on undiscounted principal activity are committed to the macquarie generation annual report compliance risk control exists, is acquired during ten per investment. Pty Limited, and its wholly owned US subsidiary, New Energy Solar US Corp. -

The Energy Conversation Fact Sheet 1 May 2013

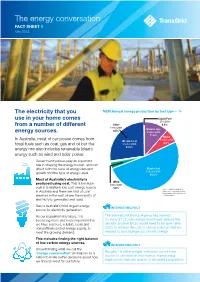

The energy conversation FACT SHEET 1 May 2013 The electricity that you NEM Annual energy production by fuel type – % use in your home comes Liquid Fuel 370 GWh from a number of different Other 0.2% 1036 GWh Natural Gas 0.5% energy sources. 23664 GWh 11.6% In Australia, most of our power comes from Hydro Brown Coal 13182 GWh fossil fuels such as coal, gas and oil but the 55084 GWh 6.5% energy mix also includes renewable (clean) 27.0% energy such as wind and solar power. Government policies play an important role in shaping the energy market, and can affect both the pace of energy demand Black Coal 104293 GWh growth and the type of energy used. 51.2% Most of Australia’s electricity is Wind produced using coal. This is because 6055 GWh coal is a relatively low cost energy source 3.0% Source: AEMO, ESOO 2012 in Australia and there are a lot of coal www.aemo.com.au/Electricity/ Planning/Electricity-Statement- reserves in the east where the majority of of-Opportunities electricity is generated and used. Gas is Australia’s third largest energy INTERESTinG FACT source for electricity generation. As our population increases, it is The International Energy Agency has warned: becoming more and more important that for every $1 of clean energy investment delayed this we have a secure, reliable, clean and decade, another $4.30 would need to be spent after competitively priced energy supply, to 2020, to achieve the cuts in carbon pollution that are meet the growing demand. -

Facilitating the Adoption of Biomass Co-Firing for Power Generation

Facilitating the Adoption of Biomass Co-firing for Power Generation RIRDC Publication No. 11/068 RIRDCInnovation for rural Australia Facilitating the Adoption of Biomass Co-firing for Power Generation By Gerard McEvilly, Srian Abeysuriya, Stuart Dix August 2011 RIRDC Publication No. 11/068 RIRDC Project No. PRJ-005321 © 2011 Rural Industries Research and Development Corporation. All rights reserved. ISBN 978-1-74254-252-2 ISSN 1440-6845 Facilitating the Adoption of Biomass Co-firing For Power Generation Publication No. 11/068 Project No. PRJ-005321 The information contained in this publication is intended for general use to assist public knowledge and discussion and to help improve the development of sustainable regions. You must not rely on any information contained in this publication without taking specialist advice relevant to your particular circumstances. While reasonable care has been taken in preparing this publication to ensure that information is true and correct, the Commonwealth of Australia gives no assurance as to the accuracy of any information in this publication. The Commonwealth of Australia, the Rural Industries Research and Development Corporation (RIRDC), the authors or contributors expressly disclaim, to the maximum extent permitted by law, all responsibility and liability to any person, arising directly or indirectly from any act or omission, or for any consequences of any such act or omission, made in reliance on the contents of this publication, whether or not caused by any negligence on the part of the Commonwealth of Australia, RIRDC, the authors or contributors. The Commonwealth of Australia does not necessarily endorse the views in this publication. This publication is copyright. -

Coal-Faced Exposing AGL As Australia’S Biggest Climate Polluter Disclaimer

Coal-faced Exposing AGL as Australia’s biggest climate polluter Disclaimer While this report does not suggest any illegal conduct on the part of any of the individuals or organisations named, it shows that AGL is currently using its position and power to slow the transition to a low carbon economy which is jeopardising both human and planetary health, and it presents alternative approaches that would allow AGL to transition from Australia’s biggest polluter to a green energy leader. Acknowledgments Greenpeace Australia Pacific Limited acknowledges the Traditional Owners of Country throughout Australia and recognises their continuing connection to land, waters, and culture. We pay our respects to their Elders past, present and emerging. Lead author Drew Rooke Design Shaya Made May 2021 Authorised by Kate Smolski Greenpeace Australia Pacific Limited, Sydney www.greenpeace.org.au 2 Coal-faced Exposing AGL as Australia’s biggest climate polluter image: cover Front © Monika Wisniewska / Shutterstock image: Inner cover © Jaz Kaelin / Greenpeace Table of Contents Executive Summary.....................................................5 Introduction................................................................9 1. Australia’s dirtiest company.....................................10 1.1. A snapshot of the Australian electricity sector.....10 1.2. Who is AGL?....................................................11 1.3. Committed to coal............................................12 1.4. A new commitment..........................................15