Notice Concerning Transfer and Acquisition of Assets, and Related Cancellation of Lease and Leasing of Assets

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

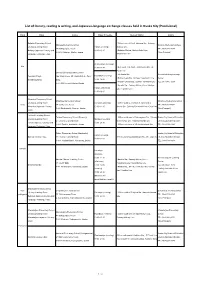

List of Literacy, Reading & Writing, and Japanese-Language Exchange

List of literacy, reading & writing, and Japanese-language exchange classes held in Osaka City (Provisional) Ward Class Venue Class Schedule Nearest Station Inquiry Nakatsu Elementary School • 700 m north of Exit 5, Nakatsu Sta., Subway Nakatsu Elementary School Nakatsu Elementary School Lifelong Learning Room Fridays (evening) Midosuji Line 2F Multi-purpose Room TEL: 06–6371–2047 Nakatsu Japanese Literacy and 19:00–20:30 • Nakatsu Station, Hankyu Kobe Line, 3-34-18 Nakatsu, Kita-ku, Osaka (Vice-Principal) Language Exchange Class Takarazuka Line Wednesdays (evening) Kita 18:45–20:45 • Near East Ticket Gate, Kitashinchi Sta., JR Tozai Line General Lifelong Learning Center • JR Osaka Sta. General Lifelong Learning Yomikaki-Chaya 2nd Study Room, 6F, Osaka Ekimae Dai-2 Thursdays (morning) • Nishi-Umeda Sta., Subway Yotsubashi Line Center (Reading/writing) Bldg. 10:00–12:00 • Higashi-Umeda Sta., Subway Tanimachi Line TEL: 06–6345–5004 1-2-2-500 Umeda, Kita-ku, Osaka • Umeda Sta., Subway Midosuji Line / Hankyu Fridays (afternoon) Line / Hanshin Line 14:00–16:00 Minamioe Elementary School Minamioe Elementary School Minamioe Elementary School Lifelong Learning Room Tuesdays (morning) • 200 m south west of Exit 8, Tanimachi 4- Chuo 1F Conference Room TEL: 06–6942–0501 Minamioe Japanese Literacy 10:00–11:30 chome Sta., Subway Tanimachi Line / Chuo Line 1-3-3 Nonimbashi, Chuo-ku, Osaka (Vice-Principal) Class Tateba Elementary School Tateba Elementary School (Formerly) • 500 m south west of Sakuragawa Sta., Subway Osaka City Board of Education Lifelong -

Shanghai, China Overview Introduction

Shanghai, China Overview Introduction The name Shanghai still conjures images of romance, mystery and adventure, but for decades it was an austere backwater. After the success of Mao Zedong's communist revolution in 1949, the authorities clamped down hard on Shanghai, castigating China's second city for its prewar status as a playground of gangsters and colonial adventurers. And so it was. In its heyday, the 1920s and '30s, cosmopolitan Shanghai was a dynamic melting pot for people, ideas and money from all over the planet. Business boomed, fortunes were made, and everything seemed possible. It was a time of breakneck industrial progress, swaggering confidence and smoky jazz venues. Thanks to economic reforms implemented in the 1980s by Deng Xiaoping, Shanghai's commercial potential has reemerged and is flourishing again. Stand today on the historic Bund and look across the Huangpu River. The soaring 1,614-ft/492-m Shanghai World Financial Center tower looms over the ambitious skyline of the Pudong financial district. Alongside it are other key landmarks: the glittering, 88- story Jinmao Building; the rocket-shaped Oriental Pearl TV Tower; and the Shanghai Stock Exchange. The 128-story Shanghai Tower is the tallest building in China (and, after the Burj Khalifa in Dubai, the second-tallest in the world). Glass-and-steel skyscrapers reach for the clouds, Mercedes sedans cruise the neon-lit streets, luxury- brand boutiques stock all the stylish trappings available in New York, and the restaurant, bar and clubbing scene pulsates with an energy all its own. Perhaps more than any other city in Asia, Shanghai has the confidence and sheer determination to forge a glittering future as one of the world's most important commercial centers. -

Fiscal Period Business Report Th (Statement of Financial Performance) 19 December 1, 2014 – May 31, 2015

Fiscal Period Business Report th (Statement of Financial Performance) 19 December 1, 2014 – May 31, 2015 The Daiwa Office Investment Corporation logo symbolizes hospitality with an open door and the desire to be a bright and open investment corporation. We will continue to aim to be a highly-transparent investment corporation that is further cherished and trusted by our investors and tenants. 6-2-1 Ginza, Chuo Ward, Tokyo http://www.daiwa-of_ce.co.jp/en/ I. Overview of Daiwa Office Investment Corporation To Our Investors We would like to express our deep gratitude to all our unitholders for your support of Daiwa Office Investment Corporation (DOI). In the 19th Fiscal Period, DOI posted operating revenues of 10,387 million yen and operating income of 4,770 million yen. Our distribution per unit for the 19th Fiscal Period is 9,142 yen, an increase by 886 yen from the 18th Fiscal Period. See page 4 for financial and management highlights Average contract rent at the end of the 19th Fiscal Period increased 875 yen from the end of the previous fiscal period to 18,674 yen and greatly contributed to further internal growth. Rent revisions contributed to 5 million yen increase in monthly contracted rents from the end of the previous fiscal period, which was a 5.2% increase rate for the average monthly rent. Tenants moving in/out led to 14 million yen of net increase in monthly contracted rents from the end of the previous fiscal period, and the increase rate for the average monthly rent increased 9.2% due to replacement of tenants. -

Time-Out-Tokyo-Magazine-Issue-22

• G-SHOCK GMW-B5000D Time out TOKYO AD (H297xW225) Discover regional Japan in Tokyo From the courtly refinement of Kyoto to the street smart vibes of Osaka and the tropical flavour of Okinawa, Japan is an amazingly diverse country, with 47 prefectures having their own unique customs, culture and cuisine. Oh Inside yes, the amazing regional cuisines, which keep travellers salivating on every step of a Japanese journey, from the seafood mecca of Hokkaido in the cold north to Fukuoka, the birthplace of the globally famed tonkatsu ramen in the April – June 2019 southern Kyushu prefecture. We know it all too well, the struggle is real: there are too many places to visit, things to do, food to eat – and too little time to do it all. But the good news is that you can easily experience the best of regional Japan right here in Tokyo. Think of our city as a Japan taster, which will inspire you to go visit a different part of the country. START YOUR EXPLORATION ON PAGE 24 â Swing this way The best jazz bars and venues in Tokyo PAGE 60 â KEISUKE TANIGAWA KEISUKE Tsukiji goes dark The former fish market reinvents itself as a nightlife destination PAGE 62 GMW-B5000D â KEISUKE TANIGAWA KEISUKE KISA TOYOSHIMA Playing footsie For heaven’s sake Evolution End a long day of sightseeing Where to savour the drink at these footbath cafés of Japan: sake PAGE 50 PAGE 40 â â back to the HOGUREST PIPA100/DREAMSTIME Origin â FEATURES AND REGULARS 06 Tokyo Update 12 Courtesy Calls 14 Open Tokyo 18 To Do 24 Discover regional Japan in Tokyo 44 Eating & Drinking 48 Shopping & Style 50 Things to Do 54 Art & Culture 58 Music 62 Nightlife 64 LGBT 65 Film 66 Travel & Hotels 70 Getting Around 74 You know you’re in Tokyo when… SMARTPHONE LINK MULTI BAND 6 TOUGH SOLAR * Bluetooth® is a registered trademark or trademark of Bluetooth SIG, Inc. -

Notice on the Formation of Private Fund Targeting Apartment Buildings

December 25, 2020 Mitsui & Co., Realty Management Ltd. Notice on the Formation of Private Fund Targeting Apartment Buildings We are pleased to announce that Mitsui & Co., Realty Management Ltd. (“Mitsui Realty Management”, President: Takashi Oya) has formed a private fund targeting apartment buildings, and that the acquisition of the property detailed below was completed on December 25, 2020. 1. Asset Acquired 1) Asset acquired Real estate in Japan (trust beneficiary rights) 2) Name of property Ginza Residence 3) Acquisition date December 25, 2020 2. Property Characteristics An apartment building with 39 total units completed in February 2015, Ginza Residence offers access to four stations. It is located an approximately five-minute walk from the closest station, the Tsukiji Station on the Tokyo Metro Hibiya Line, and also offers access to the Shintomicho Station on the Tokyo Metro Yurakucho Line, the Higashi-ginza Station on the Toei Asakusa Line, and the Tsukijishijo Station on the Toei Oedo Line. It is also within walking distance of the Ginza and Tsukijishijo areas, and we expect stable occupancy owing to the high lifestyle convenience of the surrounding area. 3. Property Summary Location: 12-4, Tsukiji 7-chome, Chuo-ku, Tokyo Transportation: Approximately a 5-minute walk from the Tsukiji Station on the Tokyo Metro Hibiya Line Lot area: 245.53 m2 (total) Floor area: 1,504.21 m2 (total) Construction completion date: February 2015 Scale and structure: 11-floor (above ground) reinforced concrete structure Mitsui Realty Management will continue to use its accumulated knowledge of real estate fund formation and management to provide investment opportunities in superior properties that meet investors’ needs and to realize high-quality investment management. -

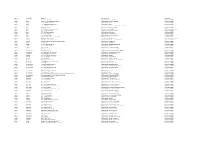

Area Locality Address Description Operator Aichi Aisai 10-1

Area Locality Address Description Operator Aichi Aisai 10-1,Kitaishikicho McDonald's Saya Ustore MobilepointBB Aichi Aisai 2283-60,Syobatachobensaiten McDonald's Syobata PIAGO MobilepointBB Aichi Ama 2-158,Nishiki,Kaniecho McDonald's Kanie MobilepointBB Aichi Ama 26-1,Nagamaki,Oharucho McDonald's Oharu MobilepointBB Aichi Anjo 1-18-2 Mikawaanjocho Tokaido Shinkansen Mikawa-Anjo Station NTT Communications Aichi Anjo 16-5 Fukamachi McDonald's FukamaPIAGO MobilepointBB Aichi Anjo 2-1-6 Mikawaanjohommachi Mikawa Anjo City Hotel NTT Communications Aichi Anjo 3-1-8 Sumiyoshicho McDonald's Anjiyoitoyokado MobilepointBB Aichi Anjo 3-5-22 Sumiyoshicho McDonald's Anjoandei MobilepointBB Aichi Anjo 36-2 Sakuraicho McDonald's Anjosakurai MobilepointBB Aichi Anjo 6-8 Hamatomicho McDonald's Anjokoronaworld MobilepointBB Aichi Anjo Yokoyamachiyohama Tekami62 McDonald's Anjo MobilepointBB Aichi Chiryu 128 Naka Nakamachi Chiryu Saintpia Hotel NTT Communications Aichi Chiryu 18-1,Nagashinochooyama McDonald's Chiryu Gyararie APITA MobilepointBB Aichi Chiryu Kamishigehara Higashi Hatsuchiyo 33-1 McDonald's 155Chiryu MobilepointBB Aichi Chita 1-1 Ichoden McDonald's Higashiura MobilepointBB Aichi Chita 1-1711 Shimizugaoka McDonald's Chitashimizugaoka MobilepointBB Aichi Chita 1-3 Aguiazaekimae McDonald's Agui MobilepointBB Aichi Chita 24-1 Tasaki McDonald's Taketoyo PIAGO MobilepointBB Aichi Chita 67?8,Ogawa,Higashiuracho McDonald's Higashiura JUSCO MobilepointBB Aichi Gamagoori 1-3,Kashimacho McDonald's Gamagoori CAINZ HOME MobilepointBB Aichi Gamagori 1-1,Yuihama,Takenoyacho -

Meiji Shrine 33 Harajuku Southern Tokyo

NORTHERN TOKYO CONTENTS DESTINATIONS EASTERN TOKYO SENSOJI TEMPLE SOUTHERN TOKYO WESTERN TOKYO 北部の東京 NORTHERN TOKYO SENSOJI TEMPLE SENSOJI TEMPLE SENSOJI TEMPLE SENSOJI TEMPLE SENSOJI TEMPLE NORTHERN TOKYO CONTENTS WHEN PEOPLE THINK OF TOKYO THEY THINK OF A MEGALOPOLIS TOKYO, JAPAN OF MODERN SKYSCRAPERS. THAT’S A PRETTY ACCURATE DE- CITY TRAVEL GUIDE SCRIPTION OF MOST OF TOKYO. THE EXCEPTION TO THIS ARE THE NORTHERN NEIGHBORHOODS OF ASAKUSA AND UENO. VOL. 13 JUNE 2017 02 $8.99 DESTINATIONS EASTERN TOKYO 05 SENSOJI TEMPLE EASTERN TOKYO IS LARGELY RESIDENTIAL AND INDUSTRIAL. MOST 07 TOKYO SKYTREE SIGHTS ARE CONCENTRATED IN THE SUMIDA NEIGHBORHOOD 09 EDO-MUSEUM SUCH AS TOKYO’S MAIN SUMO STADIUM RYOGOKU KOKUGIKAN. 13 AKIHABARA 15 TSUKIJI MARKET 17 KOISHIKAWA 21 TOKYO TOWER 23 ODAIBA 25 ROPPONGI HILLS 10 29 SHIBUYA 31 MEIJI SHRINE 33 HARAJUKU SOUTHERN TOKYO WITH ITS NUMEROUS SKYSCRAPERS AND DEPARTMENT STORES, SOUTHERN TOKYO IS ONE OF THE CITY’S HIPPER AREAS. THIS YOUNGER DISTRICT IS HOME TO THE LATEST FASHION, ENTER- 18 TAINMENT, FOOD AND TRENDS IN JAPAN. WESTERN TOKYO WESTERN TOKYO IS THE MOST POPULATED AREA, MOST ACTIVELY CHANGING, AND THE MOST VIBRANT AND STYLISH AREA IN TOKYO. IT IS THE DEFINITION OF THE CITY THAT NEVER SLEEPS. 26 A JOURNEY THROUGH THE FOUR MAJOR REGIONS の 考 超 東 地 例 え 高 京 域 外 て 層 を 北方 で は、い ビ 考 す。浅 ま ル え 草 す。の る と メ 人 上 ガ は、 野 ポ 近 の リ 代 北 ス 的 部 を な WHEN PEOPLE THINK OF TOKYO THEY THINK OF A MEGALOPOLIS OF MODERN SKYSCRAPERS. -

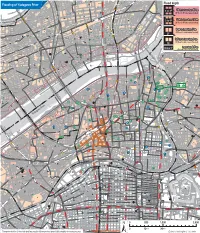

Flood Depth Flooding of Yodogawa River

Mikuni Station Mikuni 9 X 9 9 9 9 Miyahara Flood depth 9 9 Flooding of Yodogawa River 9 X 9 9 Hankyu Kobe Line 9 9 9 9 9 9 9 9 9R Higashiawaji 9 Nishimiyahara 10 m to less than 20 m 9 9 5 to 7F X 9 9 (5F floor to 7F under eaves flooded) Mikunihommachi 9 9 Niitaka JR Osaka Higashi Line 9 9 Shin-Osaka Station 9R 9X X 9 9 9 Kanzakigawa Station 9 9 X 5 m to less than 10 m 9R 3 to 4F Kanzaki River 9 (3F floor to 4F under eaves flooded) Higashinakajima 9 9 9 9 9R 9 Sozenji X 9 9 9 9 Station 9 9 9 San-yo Shinkansen 9 9 X 9 9 9 9 9 3 m to less than 5 m Mitsuyakita 9 Kikawahigashi 9 Nonakakita 9R 9 9 9 9 9 9R 9 9 9 (2F floor to under eaves flooded) 9 9 9 9 9 9 Akagawa 9 Kunijima Station 2F 9 9 9 9 9 9 9 9 9R X X Nishinakajima -Minamigata 9 X X ] Nishinakajima 9 Yodogawa Ward Station 9 9 Mitsuyanaka 9 9 Kunijima 0.5 m to less than 3 m 9 9 Daitocho 9 9 9 Nonakaminami X 9 9 (1F floor to under eaves flooded) 9 Hankyu Kyoto Line 9 9 9R 9 9 1F 9 9 9 9 Minamikata Station Mitsuyaminami 9 Yodogawa-ozeki Bridge 9 Less than 0.5 m 9 9 Below 1F 9 9 (Below 1F floor flooded) 9 9\ 9 9 Kemacho Shirokitakoendori Station 9 9 9X Kikawanishi X X X Tagawakita 9g X Shin-Yodogawa-ohashi Bridge 9\ 9 9 99 9 9 9 X 9\ Nagara Bridge 9 9 National Highway Route 423 9 9 9 9 9 X 9X Hankyu Senri Line Jusohommachi X 9 9 9 9 X 9 9 9 9 X Juso Station Tagawa Jusohigashi 9 Jusomotoimazato 9R 9 X 9 9 9 9R X 9 9 9 9 Nagaranishi 9229 9 9439 69 Tomobuchicho 9R 9 9 9 9X X 9 9R 9239 9 9 9 Juso-ohashi Bridge Honjohigashi916 319 79 9 Nagarahigashi 9R 9 X 9 Honjonishi Shin-Juso-ohashi Bridge Hankyu Kobe Line 91ų 95 9 ~ 9R National Highway Route 176 Toyosaki 99 9 9 Shinkitano Line Kyoto JR X Tsukamoto 9X 9 910 79 9 9 9 9479 9 915 9 9Tsukamoto Station 9 989 Nagaranaka 9249 309 9 X 9 Nakatsu 9R 9X 9 279 9 Zengenjicho Nakatsu Station 9469 9925 9269 X 9 9 9 Kashiwazato Hanshin Expressway Osaka Ikeda Line (No. -

Keio Presso Inn Higashi-Ginza

KEIO PRESSO INN HIGASHI-GINZA TEL -3542-0202 Check-in 3:00 p.m. 03 We may cancel your reservation, if you do not arrive at the indicated FAX 03-3542-0203 arrival time without any notice. URL www.presso-inn.com/higashiginza/ Check-out 10:00 a.m. 4-7-3 Tsukiji, Chuo-ku, Number of Guest Rooms 250 Tokyo 104-0045 Number Room Type Room Size Capacity of Rooms Single 238Rooms 12m2 1Person Standerd Double 8Rooms 14m2 1-2Persons Moderate Double A 2Rooms 17m2 1-2Persons Moderate Double B 1Room 20m2 1-3Persons Complimentary Breakfast (Example pictured above) Universal- 2 Room 24m 1-2Persons : : Designed Twin 1 6 30a.m. 9 30a.m. Ginza Sta. JR Yamanote Line Chuo Dori San-Ai● ●WAKO Ginza Line To Ikebukuro ● To Narita Airport ●Mitsukoshi Toei Asakusa Line Matsuya ExitA5 To Shinjuku Marunouchi Line Higashi-ginza Sta. Tokyo Showa Dori Toei Asakusa Line Yurakucho Nihombashi Hibiya Line Ginza Miharabashi Crossing ●Kabukiza Theatre Toei Oedo Line Toei Oedo Line Higashi-ginza Exit6 Exit5 ● Mannembashi Sengakuji Shimbashi Shimbashi Enbujo Shiodome Tsukiji Togeki Bldg.● ●Ginza Shochiku Shinagawa Keikyu Line (NATURAL LAWSON) Square Harumi Dori Takeshiba National Cancer Center Post Office● Yurikamome Tsukiji-shijo Tsukiji-shijo Sta. ● Tsukiji 4 chome Crossing Exit2 Shin-ohashi Dori Hibiya Line Tsukiji Sta. Haneda Airport ● ExitA1 ●Tsukiji Market Exit1 Tsukiji Honganji Temple Ariake 3-minute walk from Higashi-ginza Station Exit 6 Access from Major Stations and Airports on the Tokyo Metro Hibiya Line/Toei Asakusa Line minutes from Tokyo Station 8 3-minute walk from -

1545 Osaka to Tokyo • Get JR Pass KIX to Shin-Osaka Station

KUL – Friday 2nd Dec 0820 –Osaka (KIX) 1545 Osaka to Tokyo Get JR Pass KIX to Shin-Osaka station . KIX – 2nd Floor . Use JR Haruka – 50 mins *source from KIX Shin-Osaka to Tokyo – platform 24,25,26 . SHINKANSEN HIKARI 484 – Hikari (3 hrs) *make reservation in JR station . *sit on left – row E for Mt Fuji view Shinagawa to Ikebukuro . JR Yamanote Line Inner (green color) – platform 2 . 34 mins Ikebukuro station - West exit near Tobu Platform Guidance Saikyo Line for Shinjuku Saikyo Line for Omiya Shonan-Shinjuku Line for Tokaido, Yokosuka, Yamanote Line Inner Tracks for Shinjuku Tohoku (Utsunomiya), Takasaki Yamanote Line Outer Tracks for Ueno "Narita Express" for Narita Airport *source from Kimi Ryokan IKEBUKURO ----Yamanote Inner (18mins)/Saikyo Line (13mins) ---EBISU Yebisu Garden Place is a five minute walk from Ebisu Station, one station south of Shibuya Station on the JR Yamanote Line. It is connected with the station by the well marked "Yebisu Skywalk". Op: Megurogawa minna illumination IKEBUKURO ----Yamanote Inner(22mins) ---Gotanda (2 stations away frm Ebisu) Saturday – 3rd Dec Tsukiji Fish Market – 7am Tsukiji Market is just above Tsukiji Shijo Station on the Oedo Subway Line. Alternatively, it can be reached in a five minute walk from Tsukiji Station on the Hibiya Subway Line. The closest JR station is Shimbashi, from where you can walk to the market in about 15 minutes. Ikebukuro –# Tokyo Metro Marunouchi (18 mins) – Ginza -- #T.M Hibiya 4mins -– Tsukiji => 190Y Ueno Park – 9.00am . Frm TSUKIJI --T.M Hibiya (12mins) –UENO => 160Y . West exit (park exit – near platform 3. -

3Rs in TOKYO

3Rs in TOKYO Contents PresentPresent State State of Wa ofste Waste and Recyclables and Recyclables 1 Towards Forming a Sound material-cycle Society・・・ 1 2 Present State of General Waste・・・4 ・ Change in waste volume・・・ 4 ・ Waste Composition・・・ 5 ・ Change in Final Disposal Volumes・・・ 6 ・ Amount of Human Waste Disposal・・・ 7 ・ General Waste Disposal Facilities, etc・・・ 8 ・ TMG Landfill Disposal Areas ・・・13 3 Municipal Government Efforts・・・18 ・ Promoting Waste Amount Reduction ・・・18 Shinjuku Eco Jiman Point: Shinjuku Ward Bring Your Own “My Bag” - Petit Eco Campaign: Musashino City Raw Garbage Reduction Measures with Drainer Nets: Inagi City Making Biodiesel Fuel from Waste Cooking Oil: Higashi-Kurume City ・ Promotion of Recycling and Proper Waste Disposal in Tokyo Municipalities・・・25 4 Present State of Industrial Waste・・・38 ・ Changes in Industrial Waste Volume・・・38 ・ Waste Amounts Generated by Type・・・40 ・ State of Recycling・・・41 ・ Final Disposal Amounts・・・42 ・ Status of Construction Mud・・・43 ・ State of Improper Disposal・・・44 ・ Efforts within TMG Main Buildings・・・45 5 TMG Waste and Recycling Chronology・・・50 1 Present State of Waste第1章 and 廃棄物・リサイクルの現状 Recyclables 1. Towards Forming a Sound material-cycle Society • Forming a sound material-cycle society In order to build a sound material-cycle economic system, we need to reform our current system of massive production, consumption and waste, and aim at making a society which minimizes the burden on the environment and can provide sustainable growth. Promotion of waste generation control and recycling retroactive all the way back to production and distribution stages are important issues in making this happen. To this end, a series of laws relevant to waste and recycling have been created or adjusted, starting with the Basic Law for Establishing a Sound material-cycle Society. -

DAIKYO Completes Construction of Its Lions Forsia Akihabara East And

DAIKYO Completes Construction of Its Lions Forsia Akihabara East and Lions Forsia Tsukiji Station Rental Condominiums—Tenancy Begins Towards End of January ~Catering to teleworking needs through the installation of wall‐mounted work spaces~ TOKYO, Japan ‐ January 22, 2021 ‐ DAIKYO INCORPORATED (“DAIKYO”) announced that tenants can begin moving in to its Lions Forsia Akihabara East and Lions Forsia Tsukiji Station rental condominiums towards end of January. These newly constructed condominiums feature unit plans tailored to teleworking, such as wall‐ mounted storage rails and wall‐mounted desks. Lions Forsia Akihabara East Lions Forsia Tsukiji Station Wall‐mounted storage rails Wall‐mounted desk As work styles such as teleworking diversify, there is a growing need for homes to offer comfortable work spaces. For this reason, DAIKYO is offering unit plans tailored to teleworking in some of its one‐bedroom units at these rental condominiums. Lions Forsia Akihabara East is located six minutes on foot from Akihabara Station on the Tokyo Metro Hibiya Line; it offers a wide variety of unit plans, including one‐bedroom units with a kitchen; one‐bedroom units with a kitchen and dining area; one‐bedroom units with a kitchen, dining, and living area; and two‐bedroom units with a kitchen, dining, and living area. Wall‐mounted storage rails have been installed in five of the condominium’s 38 units. These unique wall‐mounted rails enable tenants to create their own work spaces by attaching and removing shelves and desks. Lions Forsia Tsukiji Station is situated two minutes on foot from Tsukiji Station on the Tokyo Metro Hibiya Line; it occupies an extremely convenient location, with tenants able to access multiple train lines.