INVEST in TIRANA I TABLE of CONTENTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FOR TRAUMA and TORTURE of Honor

Decorated by the President THE ALBANIAN REHABILITATION CENTRE ofRepublic ofAlbania with the FOR TRAUMA AND TORTURE of Honor ALTERNATIVE REPORT To the list of issues (CAT / C ALB / 2 ), dated 15 December 2011 Prepared by the UN Committee against Torture to be considered in connection with the consideration of the second periodic report of ALBANIA AlbanianRehabilitationCentrefor Trauma and Torture(ARCT) April 2012 Contents INTRODUCTORYREMARKS 2 WITHREGARDSTO ARTICLES1 AND4 2 WITH REGARDSTO ARTICLE 2 : 2 WITH REGARDSTO ARTICLES 5-9 9 WITH REGARDSTO ARTICLE 10 ...... 10 WITH REGARDSTO ARTICLE 11: ..... ......... WITH REGARDSTO ARTICLE 14:. 11 OTHERISSUESOFCONCERN: 12 DISABLED PERSONS ...... 12 CHILDREN AND JUVENILES . 12 LEGAL AID SCHEMES 13 RECOMMENDATIONS : 13 ANNEX 1 - CASES IDENTIFIED DURING REGULAR AND AD - HOC VISITS , LETTERS AND MEDIA MONITORING 14 ANNEX 2 - COURT REPRESENTATIONOF A SELECTION OF CASES AS OF 2011:. 26 ANNEX 3 - PREVALENCEOF TORTURE AND ILL TREATMENT IN POLICE, PRE-TRIAL AND DETENTION, RESULTS FROM THE NATIONAL SURVEY BASED ON THE ARCT & SCREENING INSTRUMENT 36 1 Introductory remarks Coming from one of the most difficult and atrocious dictatorial regime, Albania is representing a challenge for the political, social and cultural developments of the Balkans, and more widely of the Europe. Since early 90s, significant legal reforms have been made hereby establishing a legal framework in the area of human rights and setting up key institutions, such as the Ombudsman's Office (People's Advocate). However, serious problems from the communist era prevail and Albania is still a society governed by weak state institutions, lack of the Rule ofLaw and widespread corruption; receiving criticisms on the implementation oflaws. -

Monitoring SPAK and the Special Court: Building At

Rr. “Alqi Boshnjaku” (ish Reshit Collaku) Pallati Bora, Ap.11 TIRANË [email protected] [email protected] COLLECTION OF CASE REPORTS AND UPDATES JULY 2020 – APRIL 2021 PROJECT: “Monitoring SPAK and the Special Court: Building a track record of prosecutions and convictions?”, supported by the Embassy of the Kingdom of the Netherlands, through the MATRA funds. Implemented by: The Center for Legal and Social Studies (LSSC) MAY 2021 Rr. “Alqi Boshnjaku” (ish Reshit Collaku) Pallati Bora, Ap.11 TIRANË [email protected] [email protected] SUMMARY This collection of case reports and updates is produced by the Center for Legal and Social Studies (LSSC), in the framework of the project: “Monitoring SPAK and the Special Court: Building a track record of prosecutions and convictions?”, supported by the Embassy of the Kingdom of the Netherlands, through the MATRA funds. In total there are 40 case reports and/or updates of indictments/ convictions prosecuted by SPAK and adjudicated by the Special Court (First Instance and Court of Appeals). The cases selected are mostly of a high profile, either due to the public officials involved, or because of the important trend they represent in tackling organized crime and corruption. The independent comments provided for each case aim to evaluate, from a qualitative perspective, whether these two new institutions are delivering concrete results, worthy of building a track record against organized crime and corruption. The reports are published periodically and can be found in Albanian and in English at: https://lssc-al.com/activities/?lang=en Rr. “Alqi Boshnjaku” (ish Reshit Collaku) Pallati Bora, Ap.11 TIRANË [email protected] [email protected] ROLLING TRACK RECORD REPORT July 2020 Prepared and published by: Legal and Social Studies Center, 01 August 2020. -

Response of the Albanian Government

CPT/Inf (2006) 25 Response of the Albanian Government to the report of the European Committee for the Prevention of Torture and Inhuman or Degrading Treatment or Punishment (CPT) on its visit to Albania from 23 May to 3 June 2005 The Albanian Government has requested the publication of this response. The report of the CPT on its May/June 2005 visit to Albania is set out in document CPT/Inf (2006) 24. Strasbourg, 12 July 2006 Response of the Albanian Government to the report of the European Committee for the Prevention of Torture and Inhuman or Degrading Treatment or Punishment (CPT) on its visit to Albania from 23 May to 3 June 2005 - 5 - REPUBLIC OF ALBANIA MINISTRY OF FOREIGN AFFAIRS Legal Representative Office No.______ Tirana, on 20.03.2006 Subject: The Albanian Authority’s Responses on the Report of the European Committee for the Prevention of Torture and other Inhuman or Degrading Treatment (CPT) The Committee for the Prevention of Torture and other Inhuman or Degrading Treatment (CPT) Mrs. Silvia CASALE - President Council of Europe - Strasbourg Dear Madam, Referring to your letter date 21 December 2005 in the report of 2005 of CPT for Albania, we inform that our state authorities are thoroughly engaged to realize the demands and recommendations made by the CPT and express their readiness to cooperate for the implementation and to take the concrete measures for the resolution of the evidenced problems in this report. Responding to your request for information as regards to the implementation of the submitted recommendations provided in the paragraphs 68, 70, 98, 131, 156 of the report within three months deadline, we inform that we have taken a response form the Ministry of Justice and the Ministry of Health meanwhile the Ministry of interior will give a response as soon as possible. -

People's Advocate… ………… … 291

REPUBLIC OF ALBANIA PEOPLE’S ADVOCATE ANNUAL REPORT On the activity of the People’s Advocate 1st January – 31stDecember 2013 Tirana, February 2014 REPUBLIC OF ALBANIA ANNUAL REPORT On the activity of the People’s Advocate 1st January – 31st December 2013 Tirana, February 2014 On the Activity of People’s Advocate ANNUAL REPORT 2013 Honorable Mr. Speaker of the Assembly of the Republic of Albania, Honorable Members of the Assembly, Ne mbeshtetje te nenit 63, paragrafi 1 i Kushtetutes se republikes se Shqiperise dhe nenit26 te Ligjit N0.8454, te Avokatit te Popullit, date 04.02.1999 i ndryshuar me ligjin Nr. 8600, date10.04.200 dhe Ligjit nr. 9398, date 12.05.2005, Kam nderin qe ne emer te Institucionit te Avokatit te Popullit, tj’u paraqes Raportin per veprimtarine e Avokatit te Popullit gjate vitit 2013. Pursuant “ to Article 63, paragraph 1 of the Constitution of the Republic of Albania and Article 26 of Law No. 8454, dated 04.02.1999 “On People’s Advocate”, as amended by Law No. 8600, dated 10.04.2000 and Law No. 9398, dated 12.05.2005, I have the honor, on behalf of the People's Advocate Institution, to submit this report on the activity of People's Advocate for 2013. On the Activity of People’s Advocate Sincerely, PEOPLE’S ADVOCATE Igli TOTOZANI ANNUAL REPORT 2013 Table of Content Prezantim i Raportit Vjetor 2013 8 kreu I: 1Opinione dhe rekomandime mbi situaten e te drejtave te njeriut ne Shqiperi …9 2) permbledhje e Raporteve te vecanta drejtuar Parlamentit te Republikes se Shqiperise......................... -

Albania 2020 Report

EUROPEAN COMMISSION Brussels, 6.10.2020 SWD(2020) 354 final COMMISSION STAFF WORKING DOCUMENT Albania 2020 Report Accompanying the Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions 2020 Communication on EU Enlargement Policy {COM(2020) 660 final} - {SWD(2020) 350 final} - {SWD(2020) 351 final} - {SWD(2020) 352 final} - {SWD(2020) 353 final} - {SWD(2020) 355 final} - {SWD(2020) 356 final} EN EN Table of Contents 1. INTRODUCTION 3 1.1. Context 3 1.2. Summary of the report 4 2. FUNDAMENTALS FIRST: POLITICAL CRITERIA AND RULE OF LAW CHAPTERS 8 2.1. Functioning of democratic institutions and public administration reform 8 2.1.1 Democracy 8 2.1.2. Public administration reform 14 2.2.1. Chapter 23: Judiciary and fundamental rights 18 2.2.2. Chapter 24: Justice, freedom and security 37 3. FUNDAMENTALS FIRST: ECONOMIC DEVELOPMENT AND COMPETITIVENESS 51 3.1. The existence of a functioning market economy 51 3.2. The capacity to cope with competitive pressure and market forces within the Union 57 4. GOOD NEIGHBOURLY RELATIONS AND REGIONAL COOPERATION 59 5. ABILITY TO ASSUME THE OBLIGATIONS OF MEMBERSHIP 62 5.1. Chapter 1: Free movement of goods 62 5.2. Chapter 2: Freedom of movement of workers 64 5.3. Chapter 3: Right of establishment and freedom to provide services 64 5.4. Chapter 4: Free movement of capital 65 5.5. Chapter 5: Public procurement 67 5.6. Chapter 6: Company law 69 5.7. Chapter 7: Intellectual property law 70 5.8. -

Missing Segments of Ring Roads in Tirana

Missing Segments of Ring Roads in Tirana about project PROJECT DESCRIPTION The completion of the ring roads of Tirana requires a number of investments in several missing segments that are listed below: • Komuna e Parisit & Medar Shtylla Road development Project is 1.66 Km long. A new section M07 of 0.6 Km from the Outer Ring Road up to the Medar shtylla Road (Tish Daia Road) is yet to be built. The remaining existing section of 1.06 Km long from Outer Ring Road up to Bajram Curri Boulevard needs to be reconstructed; Budget -Komuna e Parisit & Medar • The Intermediate Ring Road Project is 2.16 Km long in total. A new section of 1.54 Km from Shtylla Road Development Zhan D’Ark Boulevard up to Qemal Stafa Road, from Dibra Road up to Zogu I Boulevard and ALL 1.482.000.000 -Intermediate Ring Road from Durres Road up to Myslym Shyri Road is yet to be built. The remaining existing section ALL 4.317.500.000 of 0.62 Km long stretching from Qemal Stafa Road to Dibra Road needs to be reconstructed; -Middle Ring Road ALL 2.037.600.000 • The Middle Ring Road Project is 1.36 Km long in total. A New section of 0.80 Km from Ali Demi -North section of the Outer Ring Road Road up to Qamil Guranjaku Road is yet to be built. The remaining existing section of 0.56 ALL 13.630.050.000 Km including the north section of Qemal Guranjaku Road and Asim Zeneli Road needs to be - North section of the Outer reconstructed. -

Economic Bulletin Economic Bulletin December 2009

volume 12 volume 12 number 4 number 4 December 2009 Economic Bulletin Economic Bulletin December 2009 E C O N O M I C December B U L L E T I N 2 0 0 9 B a n k o f A l b a n i a PB Bank of Albania Bank of Albania 1 volume 12 volume 12 number 4 number 4 December 2009 Economic Bulletin Economic Bulletin December 2009 If you use data from this publication, you are requested to cite the source. Published by: Bank of Albania, Sheshi “Skënderbej”, Nr.1, Tirana, Albania Tel.: 55-4-222220; 225568; 225569 Fax.: 55-4-222558 E-mail: [email protected] www.bankofalbania.org Printed in: 70 copies Printed by Adel PRINT 2 Bank of Albania Bank of Albania volume 12 volume 12 number 4 number 4 December 2009 Economic Bulletin Economic Bulletin December 2009 content S MONETARY POLICY REPORT FOR THE SECOND HALF OF 2009 7 I. GOVERNOR’S SPEECH 7 II. DEVELOPMENTS IN THE WORLD ECONOMY 11 II.1 Economic growth and macroeconomic balances 11 II.2 Monetary Policy, Financial Markets and the Exchange rate 14 II. Oil and commodity price development 15 III. PRICE STABILITY AND BANK OF ALBANIA TARGET 16 III.1 Consumer price, inflation target and monetary policy 17 III.2 Price performance of Main CPI Basket Items 19 III. Main inflation trends 21 IV. MACROECONOMIC DEVELOPMENTS AND THEIR EFFECTS ON INFLATION 22 IV.1 Gross Domestic Product and performance of aggregate demand 2 IV.2 Labour market and wage 49 IV. -

Final Monitoring Report Final Monitoring Report

ELECTIONS FOR THE ASSEMBLY OF ALBANIA 25 JUNE 2017 FINAL MONITORING REPORT FINAL MONITORING REPORT uesv zhg e Ve Vë nd i o i r n e io c i l www.zgjedhje.al a ISBN: o K THE COALITION OF DOMESTIC OBSERVERS GRUPIM I 34 ORGANIZATAVE JOFITIMPRURËSE VENDASE, LOKALE APO QENDRORE, QË VEPROJNË NË FUSHËN E DEMOKRACISË DHE TË 9 789992 786833 DREJTAVE TË NJERIUT THE COALITION OF DOMESTIC OBSERVERS ABOUT CDO The Coalition of Domestic Observers is an alliance of non-governmental and non-partisan organizations, the core of activity of which is the development of democracy in Albania and defense for human rights, especially the observation of electoral processes. Since its establishment in 2005, the network of organizations in CDO has grown to include dozens of members. CDO considers the observation of electoral processes by citizen groups as the most appropriate instrument for ensuring transparency, integrity and credibility of elections. CDO strongly believes that engaging citizens in following electoral processes does more than just promote good elections. Empowering citizens to observe the electoral process, among other things, helps to ensure greater accountability of public officials. The leading organizations of CDO - the Society for Democratic Culture, KRIIK Albania and the For Women and Children Association - are three of the most experienced domestic groups. In fulfillment of the philosophy of action, these organizations announce relevant actions depending on the electoral or institutional process to be followed. All interested civil society organizations are invited to join the action, thus CDO re-assesses periodically, openly, and in a transparent manner the best values of network functioning. -

An Investigation on Water Supply And

COMPETING URBAN VISIONS FOR THE CAPITAL OF ALBANIA: INTERNATIONAL PROJECTS FOR TIRANA CITY CENTRE A THESIS SUBMITTED TO THE GRADUATE SCHOOL OF NATURAL AND APPLIED SCIENCES OF MIDDLE EAST TECHNICAL UNIVERSITY BY ODETA DURMİSHİ IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE IN ARCHITECTURAL DESIGN IN ARCHITECTURE OCTOBER, 2008 Approval of the thesis: COMPETING URBAN VISIONS FOR THE CAPITAL OF ALBANIA: INTERNATIONAL PROJECTS FOR TIRANA CITY CENTRE submitted by ODETA DURMİSHİ in partial fulfilment of the requirements for the degree of Master of Science in the Department of Architecture, Middle East Technical University and approved by, Prof. Dr. Canan Özgen Dean, Graduate School of Natural and Applied Sciences ___________________ Assoc. Prof. Dr. Güven Arif Sargın Head of Department, Architecture ___________________ Assoc. Prof. Dr. Cânâ Bilsel Supervisor, Architecture Dept., METU ___________________ Members of the Examining Committee: Assoc. Prof. Dr. Ali Cengizkan City and Regional Planning Dept., METU ___________________ Assoc. Prof. Dr. Cânâ Bilsel Architecture Dept., METU ___________________ Assoc. Prof. Dr. Güven Arif Sargın Architecture Dept., METU ___________________ Assoc. Prof. Dr. Baykan Günay Architecture Dept., METU ___________________ Inst. Namık Erkal Architecture Dept., METU ___________________ Date: (October, 6th 2008) ii I hereby declare that all information in this document has been obtained and presented in accordance with academic rules and ethical conduct. I also declare that, as required by these rules and conduct, I have fully cited and referenced all material and results that are not original to this work. Name, Last Name: Odeta DURMİSHİ Signature: iii ABSTRACT COMPETING URBAN VISIONS FOR THE CAPITAL OF ALBANIA: INTERNATIONAL PROJECTS FOR TIRANA CITY CENTRE Durmishi, Odeta M. -

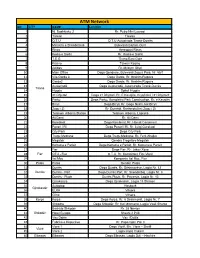

ATM Network NO CITY NAME Location 1 Nj

ATM Network NO CITY NAME Location 1 Nj. Bashkiake 2 Rr. Petro Nini Luarasi 2 Taiwan Taiwan 3 Q.T.U Q.T.U Autostrada Tiranë-Durrës 4 Ministria e Shëndetsisë Bulevardi Bajram Curri 5 Rinas Aereoport Rinas 6 Kodra e Diellit Rr. Kodra e Diellit 7 T.E.G Tirana East Gate 8 Kasino Taiwan Kasino 9 Adidas Rr. Myslym Shyri 10 Main Office Dega Qendrore, Bulevardi Zogu i Parë, Nr. 55/1 11 Vila Garda 3 Dega Garda, Rr. Ibrahim Rugova 12 Garda2 Dega Garda, Rr. Ibrahim Rugova 13 Autostradë Dega Autostradë, Autorstrada Tiranë-Durrës Tiranë 14 Hygeia Spitali Hygeia 15 21 Dhjetori Dega 21 Dhjetori, Rr. E Kavajës, Kryqëzimi i 21 Dhjetorit 16 Parku Dega Parku, Kompleksi Park Construction, Rr. e Kavajës 17 Brryli Dega Brryli, Rr. Gogo Nushi, tek Brryli 18 Zogu i Zi Rr. Durrësit, Rrethrrotullimi Zogu i Zi 19 Telekom Albania Station Telekom Albania, Laprakë 20 Ali Demi Rr. Ali Demi 21 Kombinat Dega Kombinat, Rr. Hamdi Cenoimeri 22 Pazari i Ri Dega Pazari i Ri, Rr. Luigj Gurakuqi 23 City Park Dega City Park 24 Tregu Medrese Dega Tregu Medrese, Rr. Ferit Xhajko 25 Megatek Qendra Tregëtare Megatek 26 Komuna e Parisit Dega Komuna e Parisit, Rr. Komuna e Parisit 27 Fier Dega Fier, Rr. Jakov Xoxe 28 Fier QTU - Fier Q.T.U, Rr. Kombëtare Fier-Vlorë 29 Ital Mec Kompania Ital Mec, Fier 30 Patos Patos Qendër Patos 31 Durrës Dega Durrës, Rr. Dëshmorëve, Lagjia Nr. 12 32 Durrës Durrës - Port Dega Durrës Port, Rr. Skendërbej, Lagjia Nr. 3 33 Durrës - Plazh Durrës Plazh, Rr. -

Topic in Case of Penology Execution of Criminal Sanctions in the Republic of Albania

E-ISSN 2281-4612 Academic Journal of Interdisciplinary Studies Vol 4 No 3 S1 ISSN 2281-3993 MCSER Publishing, Rome-Italy December 2015 Topic in Case of Penology Execution of Criminal Sanctions in the Republic of Albania PhD Candidate Esmeralda Thomai Department of Law Pena list Branch, SEEU University, Macedonia; [email protected] Doi:10.5901/ajis.2015.v4n3s1p188 Abstract After the 1990 reform of the penitentiary system in Albania included all aspects of the system: reform in the legal system, reform of the administration, the way of organizing. It is a major role in the reform process has played the Council of Europe, which drew up concrete programs and managed the legal and institutional reform. Currently operating in Albania are 13 prisons and four other construction stageCriminal Code of the Republic of Albania was approved in 1995, Law no. 7895, dated 27.01.1995. For the first time the new code was predicted alternatives to imprisonment in chapter VII of its General Part. Although the doctrine recognizes alternatives to criminal penalties, the title of the code still talks about alternatives to imprisonment, even after legal changes that were made in 2008 to reform the alternative measures 1 . Keywords: Albanian criminal code, criminal penalties, cases of violations. 1. Introduction Criminal Code of the Republic of Albania was approved in 1995, Law no. 7895, dated 27.01.1995. For the first time the new code was predicted alternatives to imprisonment in chapter VII of its General Part. Although the doctrine recognizes alternatives to criminal penalties, the title of the code still talks about alternatives to imprisonment, even after legal changes that were made in 2008 to reform the alternative measures 2 . -

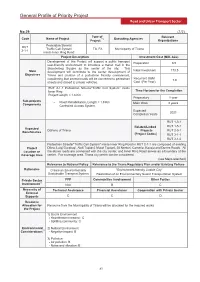

中 General Profiles of Priority Projects Ol.Ai

General Profile of Priority Project RoadandUrbanTransportSector No.29 (1/2) Type of Relevant Code Name of Project Executing Agencies Project *1 Organizations Pedestrian Streets/ RUT ”Traffic Cell System” TA. FA Municipality of Tirana 2-1-1 inside Inner Ring Road Project Description Investment Cost (Mill. ALL) Development of this Project will support a public transport Preparation 6.5 user-friendly environment to introduce a transit mall in the Skanderbeg Square as the center of the city. This Initial Investment 173.5 Main development will contribute to the center development of Objectives Tirana and creation of a pedestrian friendly environment, Recurrent O&M considering that several roads will be converted to pedestrian 7.8 streets and closed to private vehicles. Cost (Per Year) RUT 2-1-1 Pedestrian Streets/”Traffic Cell System” inside Inner Ring Time Horizon for the Completion Project Length = 1.8 Km Preparatory 1 year Sub-projects Road Rehabilitation, Length = 1.8 Km Main Work 3 years Components Controlled Access System. Expected 2021 Completion Years RUT 1-3-1 Related/Linked RUT 1-5-1 Expected Citizens of Tirana Projects RUT 2-3-1 Beneficiaries (Project Codes) RUT 3-1-1 RUT 3-1-2 Pedestrian Streets/”Traffic Cell System” inside Inner Ring Road in RUT 2-1-1 are composed of existing Project Dibra, Luigj Gurakuqi, Abdi Toptani, Murat Toptani, 28 Nentori, Cameria, Kavaja and Durres Roads. All Location or the above roads are connected with the city center, and Inner Ring Road serves as a boundary of the Coverage Area center. For coverage area, Tirana city center can be considered.