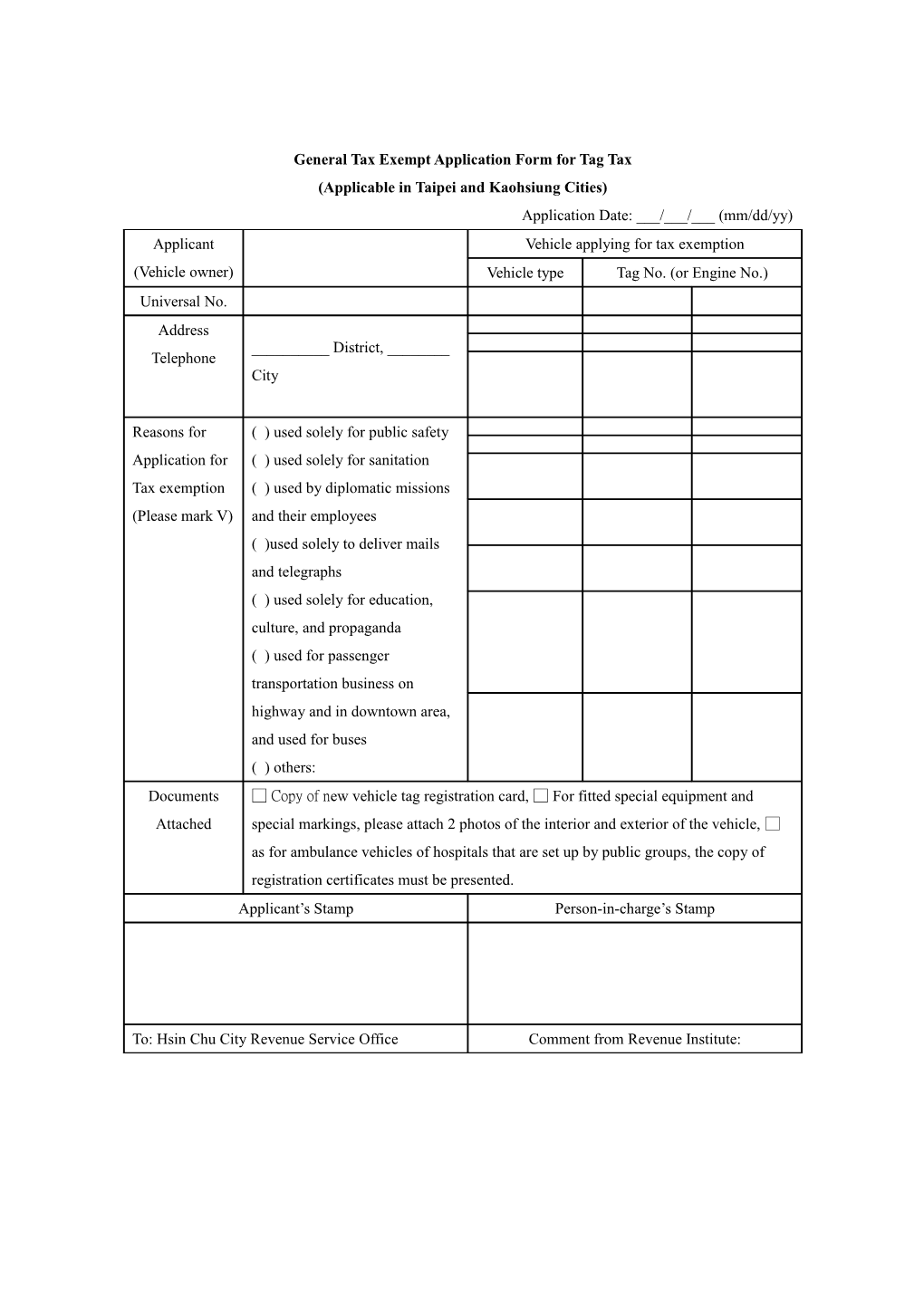

General Tax Exempt Application Form for Tag Tax (Applicable in Taipei and Kaohsiung Cities) Application Date: ___/___/___ (mm/dd/yy) Applicant Vehicle applying for tax exemption (Vehicle owner) Vehicle type Tag No. (or Engine No.) Universal No. Address ______District, ______Telephone City

Reasons for ( ) used solely for public safety Application for ( ) used solely for sanitation Tax exemption ( ) used by diplomatic missions (Please mark V) and their employees ( )used solely to deliver mails and telegraphs ( ) used solely for education, culture, and propaganda ( ) used for passenger transportation business on highway and in downtown area, and used for buses ( ) others: Documents □ Copy of new vehicle tag registration card, □ For fitted special equipment and Attached special markings, please attach 2 photos of the interior and exterior of the vehicle, □ as for ambulance vehicles of hospitals that are set up by public groups, the copy of registration certificates must be presented. Applicant’s Stamp Person-in-charge’s Stamp

To: Hsin Chu City Revenue Service Office Comment from Revenue Institute: Through verification, the application is in accordance with regulations so that the exemption from Tag Tax is granted. Above vehicle meets the requirement of Article Approved by Level ____ 7.1.____ of Tag Tax Law. Please grant tax Approved by ______(undertaking unit) exemption of Tag Tax!

Description 1. The vehicle first being delivered to Motor Vehicle Office and inspected qualified, and the applying party having applied for tax exemption with attached documents and being approved by a Revenue Service Office, the applying party may receive the tag from Motor Vehicle Office (or its branch). 2. If applicant is an institute or a group, this application form must be applied additional stamp the seal for the institute or the group as well as the personal chop of its person-in charge. 3. This application form is one from in two copies. After verification, the first copy will be kept by Revenue Service Office and the second copy will be used by the applicant for receiving the tag. 4. Once the application form being approved, on condition that the reason for tax exemption remains unchanged, it is not necessary to apply for tax exemption annually. 5. Once the reason for tax exemption becomes invalid, the applicant must automatically apply for resumption of tag taxation in a Revenue Service Office.