Leadership Responsibility Performance Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

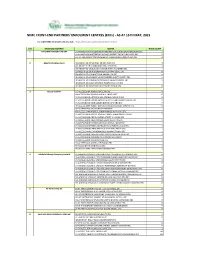

NIMC FRONT-END PARTNERS' ENROLMENT CENTRES (Ercs) - AS at 15TH MAY, 2021

NIMC FRONT-END PARTNERS' ENROLMENT CENTRES (ERCs) - AS AT 15TH MAY, 2021 For other NIMC enrolment centres, visit: https://nimc.gov.ng/nimc-enrolment-centres/ S/N FRONTEND PARTNER CENTER NODE COUNT 1 AA & MM MASTER FLAG ENT LA-AA AND MM MATSERFLAG AGBABIAKA STR ILOGBO EREMI BADAGRY ERC 1 LA-AA AND MM MATSERFLAG AGUMO MARKET OKOAFO BADAGRY ERC 0 OG-AA AND MM MATSERFLAG BAALE COMPOUND KOFEDOTI LGA ERC 0 2 Abuchi Ed.Ogbuju & Co AB-ABUCHI-ED ST MICHAEL RD ABA ABIA ERC 2 AN-ABUCHI-ED BUILDING MATERIAL OGIDI ERC 2 AN-ABUCHI-ED OGBUJU ZIK AVENUE AWKA ANAMBRA ERC 1 EB-ABUCHI-ED ENUGU BABAKALIKI EXP WAY ISIEKE ERC 0 EN-ABUCHI-ED UDUMA TOWN ANINRI LGA ERC 0 IM-ABUCHI-ED MBAKWE SQUARE ISIOKPO IDEATO NORTH ERC 1 IM-ABUCHI-ED UGBA AFOR OBOHIA RD AHIAZU MBAISE ERC 1 IM-ABUCHI-ED UGBA AMAIFEKE TOWN ORLU LGA ERC 1 IM-ABUCHI-ED UMUNEKE NGOR NGOR OKPALA ERC 0 3 Access Bank Plc DT-ACCESS BANK WARRI SAPELE RD ERC 0 EN-ACCESS BANK GARDEN AVENUE ENUGU ERC 0 FC-ACCESS BANK ADETOKUNBO ADEMOLA WUSE II ERC 0 FC-ACCESS BANK LADOKE AKINTOLA BOULEVARD GARKI II ABUJA ERC 1 FC-ACCESS BANK MOHAMMED BUHARI WAY CBD ERC 0 IM-ACCESS BANK WAAST AVENUE IKENEGBU LAYOUT OWERRI ERC 0 KD-ACCESS BANK KACHIA RD KADUNA ERC 1 KN-ACCESS BANK MURTALA MOHAMMED WAY KANO ERC 1 LA-ACCESS BANK ACCESS TOWERS PRINCE ALABA ONIRU STR ERC 1 LA-ACCESS BANK ADEOLA ODEKU STREET VI LAGOS ERC 1 LA-ACCESS BANK ADETOKUNBO ADEMOLA STR VI ERC 1 LA-ACCESS BANK IKOTUN JUNCTION IKOTUN LAGOS ERC 1 LA-ACCESS BANK ITIRE LAWANSON RD SURULERE LAGOS ERC 1 LA-ACCESS BANK LAGOS ABEOKUTA EXP WAY AGEGE ERC 1 LA-ACCESS -

Full Year 2020 Results Presentation to Investors and Analysts

FULL YEAR 2020 RESULTS PRESENTATION TO INVESTORS AND ANALYSTS Disclaimer The information presented herein is based on sources which Access Bank The information should not be interpreted as advice to customers on the Plc. (the “Bank”) regards dependable. This presentation may contain purchase or sale of specific financial instruments. Access Bank Plc. bears no forward looking statements. These statements concern or may affect future responsibility in any instance for loss which may result from reliance on the matters, such as the Bank’s economic results, business plans and information. strategies, and are based upon the current expectations of the directors. Access Bank Plc. holds copyright to the information, unless expressly They are subject to a number of risks and uncertainties that might cause indicated otherwise or this is self-evident from its nature. Written permission actual results and events to differ materially from the expectations from Access Bank Plc. is required to republish the information on Access expressed in or implied by such forward looking statements. Factors that Bank or to distribute or copy such information. This shall apply regardless of could cause or contribute to differences in current expectations include, but the purpose for which it is to be republished, copied or distributed. Access are not limited to, regulatory developments, competitive conditions, Bank Plc.'s customers may, however, retain the information for their private technological developments and general economic conditions. The Bank use. assumes no responsibility to update any of the forward looking statements contained in this presentation. Transactions with financial instruments by their very nature involve high risk. -

Equipment Leasing in Africa Handbook of Regional Statistics 2017 Including an Overview of 10 Years of IFC Leasing Intervention in the Region

AFRICA LEASING FACILITY II Equipment Leasing in Africa Handbook of Regional Statistics 2017 Including an overview of 10 years of IFC leasing intervention in the region © 2017 INTERNATIONAL FINANCE CORPORATION 2121 Pennsylvania Avenue, N.W., Washington, DC 20433 All rights reserved. First printing, March 2018. This document may not be reproduced in whole or in part without the written consent of the International Finance Corporation. This information, while based on sources that IFC considers to be reliable, is not guaranteed as to accuracy and does not purport to be complete. The conclusions and judgments contained in this handbook should not be attributed to, and do not necessarily represent the views of IFC, its partners, or the World Bank Group. IFC and the World Bank do not guarantee the accuracy of the data in this publication and accept no responsibility for any consequence of its use. Rights and Permissions Reference Section III. What is Leasing? and parts of Section IV. Value of Leasing in Emerging Economies are taken from IFC’s “Leasing in Development: Guidelines for Emerging Economies.” 2005, which draws upon: Halladay, Shawn D., and Sudhir P. Amembal. 1998. The Handbook of Equipment Leasing, Vol. I-II, P.R.E.P. Institute of America, Inc., New York, N.Y.: Available from Amembal, Deane & Associates. EQUIPMENT LEASING IN AFRICA: ACKNOWLEDGEMENT Acknowledgement This first edition of Equipment Leasing in Africa: A handbook of regional statistics, including an overview of 10 years of IFC leasing intervention in the region, is a collaborative efort between IFC’s Africa Leasing Facility team and the regional association of leasing practitioners, known as Africalease. -

List of NIMASA Accredited Medical Providers

NIGERIAN MARITIME ADMINISTRATION AND SAFETY AGENCY SEARCH AND RESCUE BASE CLINIC MASTER LIST OF THE ACCREDITED SEAFARERS MEDICAL CERTIFYING HOSPITALS/CLINICS (UPDATED 2020) S/No Hospital/Clinic Name of Medical Director Allotted Code Address and Location GSM and Emailaddress WESTERN ZONAL REGISTER SAR BASE CLINIC APAPA WZL 000101 14, idewu Street, Olodi Apapa lagos [email protected] 1 Abbey Medical Dr. Otusanya O. A. WZL 000126 26A Pelewura Crescent Apapa 08033951195, 26A Pelewura Crescent 2 Adeiza Medical Centre Dr Peter Adeiza WZL 000125 A+B92:F92papa No 41, Cardoso Street, Kiri-Kiri 08050400776, 08093765811, 3 Asheco Hospital Dr. ISAH A. WZL 000114 [email protected] 2A KEFFI STREET IKOYI LAGOS 08029596408, 4 Bestcare Hospital Limited Dr. Bola Lawal WZL 000117 b/[email protected] 28, Randle Road, Apapa, Lagos 0803333031, [email protected], 5 Christ Medical Centre Ltd. Dr. P. I. Akinbodoye WZL 000127 [email protected] 37 Akinwunmi Street, joku Road, Sango Otta, Ogun 08036368730, 08023408686, 6 Faramed Clinic Dr. Farabiyi O. O. WZL 000106 State [email protected] 10 Alhaji kareem Akande Street, Off Sun Rise Bus Stop, 08033513638, 7 Grayma Medical Centre Dr. Ndukwe Emmanuel WZL 000102 Apapa - Oshodi Express Way Olodi Apapa [email protected], [email protected] 2 Nwabueze Close,Off Princess Aina Jegede Close, Ajao 08033270656 ,08037951190, 08033229546, Estate Lagos. [email protected] 8 Heda Hospital Dr. Ohaka Emma WZL 000104 1,Takoradi Road Apapa GRA, Lagos 08034020041, 08051186468, 9 Iduna Specialist Hospital Dr. UNUANE M. B WZL 000108 [email protected], [email protected] 11, ogunmodede street by Alade market, off Allen 08099726926, 08083126494, 10 Ikeja Medical Centre DR. -

Access Bank Plc Group Audited Results for the 12 Months Ended 31

Access Bank Plc Group Audited results for the 12 months ended 31 December 2011 ACCESS BANK PLC REPORTS 26% RISE IN PROFIT BEFORE TAX FOR THE 12 MONTHS ENDED 31 DECEMBER 2011. CUSTOMER DEPOSITS UP 70% QUARTER ON QUARTER FOLLOWING BUSINESS COMBINATION WITH INTERCONTINENTAL BANK LAGOS, NIGERIA – 16 MARCH 2011 – Access Bank Plc, (Bloomberg: ACCESS NL / Thomson Reuters: ACCESS.LG) (“Access Bank” or the “Bank”), the full service commercial bank with headquarters in Nigeria and with operations across Sub-Saharan Africa and the UK, announces third quarter results for the twelve months ended 31 December 2011. Speaking from the Bank’s headquarters in Lagos, Aigboje Aig-Imoukhuede, Group Managing Director of Access Bank, said: “As intended 2011 will be remembered as the year Access Bank became a top tier bank in Nigeria. Following a year of meticulous planning our business combination with Intercontinental Bank was realised in October and the legal merger process was completed by January 2012. I am extremely proud that by March 5 2012, we had concluded all aspects of the customer, branch, systems, people, brand and product integration positioning us to unlock the transformational value of the combination. I am confident that having cemented our position as a leader in the Nigerian banking industry we have a sustainable market leading platform with which to combine our tradition of innovation and efficiency with the scale of our enlarged balance sheet. Today perhaps more than ever before in the successful and exciting history of our bank we are better -

Articles in the Issue

Volume: 3 Issue: 4 ISSN: 2618 - 6578 BLACK SEA JOURNAL OF AGRICULTURE (BSJ AGRI) Black Sea Journal of Agriculture (BSJ Agri) is a double-blind peer-reviewed, open-access international journal published electronically 4 times (January, April, July and October) in a year since January 2018. It publishes, in English and Turkish, full-length original research articles, innovative papers, conference papers, reviews, mini-reviews, rapid communications or technical note on various aspects of agricultural science like agricultural economics, agricultural engineering, animal science, agronomy, including plant science, theoretical production ecology, horticulture, plant breeding, plant fertilization, plant protect and soil science, aquaculture, biological engineering, including genetic engineering and microbiology, environmental impacts of agriculture and forestry, food science, husbandry, irrigation and water management, land use, waste management etc. ISSN: 2618 - 6578 Phone: +90 362 408 25 15 Fax: +90 362 408 25 15 Email: [email protected] Web site: http://dergipark.gov.tr/bsagriculture Sort of publication: Periodically 4 times (January, April, July and October) in a year Publication date and place: October 01, 2020 - Samsun, TURKEY Publishing kind: Electronically OWNER Prof. Dr. Hasan ÖNDER DIRECTOR IN CHARGE Assoc. Prof. Uğur ŞEN EDITOR BOARDS EDITOR IN CHIEF Prof. Dr. Hasan ÖNDER Ondokuz Mayis University, TURKEY Assoc. Prof. Uğur ŞEN Ondokuz Mayis University, TURKEY SECTION EDITORS* Prof. Dr. Kürşat KORKMAZ, Ordu University, TURKEY Prof. Dr. Mehmet KURAN, Ondokuz Mayis University, TURKEY Prof. Dr. Muharrem ÖZCAN, Ondokuz Mayis University, TURKEY Prof. Dr. Mustafa ŞAHİN, Kahramanmaraş Sütçü İmam University, TURKEY Assoc. Prof. Dr. Esmeray Küley BOĞA, Cukurova University, TURKEY Assoc. Prof. Dr. Hasan Gökhan DOĞAN, Kirsehir Ahi Evran University, TURKEY Assoc. -

Africa Digest Vol. 2019-04

Vol. 2019 – 04 Contents 1. Trends on China in Africa ................................................................................ 2 2. Financial Services in Africa ............................................................................. 6 3. Western Companies in Africa .......................................................................... 9 4. Fintech and Mobile Money ............................................................................ 12 5. Linking Africa to the World ............................................................................. 16 1 Vol. 2019 – 04 1. Trends on China in Africa INTRODUCTION China’s presence in Africa is the topic of many papers, articles and arguments. Over the past few years, the Chinese government and its private sector became major players on the continent in trade, investments, and support for African governments. AFRICA China has diversified its sources of energy to meet growing domestic demand. Three of its national oil companies (NOCs) increased their investment in Africa to secure oil supplies, which accounts for almost 30% of their combined international upstream capital spending (capex). Within the next five years, these NOCs are projected to become the fourth highest source of capex in Africa’s upstream sector, after global counterparts BP, Shell and Eni SpA. They will invest US$15 billion in Africa, with two-thirds of their investment going to Nigeria, Angola, Uganda and Mozambique.1 The opportunity for exports from Africa to China presents an interesting counterpoint to China’s investments in Africa. Some commentators suggest that China can narrow its trade surplus with African countries and help them develop more economic growth by importing more value-added products from Africa. China’s consumer market is the world’s largest, and is growing at 16% compared to a US consumer market that is growing at only 2%. Unsurprisingly, private sector companies from Africa are increasingly interested in entering the Chinese market. -

Personal Banking

2019 ANNUAL REPORT & ACCOUNTS ACCESS BANK PLC 1 access more 2019 ANNUAL REPORT & ACCOUNTS 2 ACCESS BANK PLC MERGING CAPABILITIES FOR SUSTAINABLE GROWTH 2019 ANNUAL REPORT & ACCOUNTS ACCESS BANK PLC 3 1 OVERVIEWS .............08 10 • Business and Financial Highlights 12 • Locations and Offices 14 • Chairman’s Statement CONTENTS// 18 • Chief Executive Officer's Review 2 BUSINESS REVIEW.............22 24 • Corporate Philosophy 25 • Reports of the External Consultant 26 • Commercial Banking 30 • Business Banking 34 • Personal Banking 40 • Corporate and Investment Banking 44 • Transaction Services, Settlement Banking and IT 46 • Digital Banking 50 • Our People, Culture and Diversity 54 • Sustainability Report 74 • Risk Management Report 3 GOVERNANCE .............92 94 • The Board 106 • Directors, Officers & Professional Advisors 107 • Management Team 108 • Directors’ Report 116 • Corporate Governance Report 136 • Statement of Directors’ Responsibilities 138 • Report of the Statutory Audit Committee 140 • Customers’ Complaints & Feedback 144 • Whistleblowing Report 4 FINANCIAL STATEMENTS ............148 150 • Independent Auditor’s Report 156 • Consolidated Statement of Comprehensive Income 157 • Consolidated Statement of Financial Position 158 • Consolidated Statement of Changes in Equity 162 • Consolidated Statement of Cash Flows 164 • Notes to the Consolidated Financial Statements 203 • Other National Disclosures SHAREHOLDER 5 INFORMATION ............404 406 • Shareholder Engagement 408 • Notice of Annual General Meeting 412 • Explanatory -

Registered Attendees

Registered Attendees Company Name Job Title Country/Region 1996 Graduate Trainee (Aquaculturist) Zambia 1Life MI Manager South Africa 27four Executive South Africa Sales & Marketing: Microsoft 28twelve consulting Technologies United States 2degrees ETL Developer New Zealand SaaS (Software as a Service) 2U Adminstrator South Africa 4 POINT ZERO INVEST HOLDINGS PROJECT MANAGER South Africa 4GIS Chief Data Scientist South Africa Lead - Product Development - Data 4Sight Enablement, BI & Analytics South Africa 4Teck IT Software Developer Botswana 4Teck IT (PTY) LTD Information Technology Consultant Botswana 4TeckIT (pty) Ltd Director of Operations Botswana 8110195216089 System and Data South Africa Analyst Customer Value 9Mobile Management & BI Nigeria Analyst, Customer Value 9mobile Management Nigeria 9mobile Nigeria (formerly Etisalat Specialist, Product Research & Nigeria). Marketing. Nigeria Head of marketing and A and A utilities limited communications Nigeria A3 Remote Monitoring Technologies Research Intern India AAA Consult Analyst Nigeria Aaitt Holdings pvt ltd Business Administrator South Africa Aarix (Pty) Ltd Managing Director South Africa AB Microfinance Bank Business Data Analyst Nigeria ABA DBA Egypt Abc Data Analyst Vietnam ABEO International SAP Consultant Vietnam Ab-inbev Senior Data Analyst South Africa Solution Architect & CTO (Data & ABLNY Technologies AI Products) Turkey Senior Development Engineer - Big ABN AMRO Bank N.V. Data South Africa ABna Conseils Data/Analytics Lead Architect Canada ABS Senior SAP Business One -

Download This Report

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION This document is important and should be read carefully. If you are in any doubt about its contents or the action to take, please consult your Stockbroker, Accountant, Banker, Solicitor or any other professional adviser for guidance immediately. For Information concerning certain risk factors which should be considered by Shareholders, see “Risk Factors” commencing on page 58. ACCESS BANK PLC RC 125384 RIGHTS ISSUE OF 7,627,639,636 ORDINARY SHARES OF N0.50 EACH AT N6.90 PER SHARE ON THE BASIS OF 1 (ONE) NEW ORDINARY SHARE FOR EVERY 3 (THREE) ORDINARY SHARES HELD AS AT 23 OCTOBER, 2014 PAYABLE IN FULL ON ACCEPTANCE ACCEPTANCE LIST OPENS: JANUARY 26, 2015 ACCEPTANCE LIST CLOSES: MARCH 04, 2015 ISSUING HOUSES LEAD ISSUING HOUSE RC 622258 JOINT ISSUING HOUSES RC 204920 RC 1031358 RC 685973 RC 189502 RC 160502 THE RIGHTS BEING OFFERED IN THIS CIRCULAR ARE TRADEABLE ON THE FLOOR OF THE NIGERIAN STOCK EXCHANGE FOR THE DURATION OF THE RIGHTS ISSUE. This Rights Circular and the Securities which it offers have been cleared and registered by the Securities & Exchange Commission. It is a civil wrong and a criminal offence under the Investments and Securities Act No. 29 2007 (the “Act”) to issue a Rights Circular which contains false or misleading information. Clearance and Registration of this Rights Circular and the Securities which it offers do not relieve the parties from any liability arising under the Act for false and misleading statements contained herein or for any omission of a material fact. -

FY-2020-Results-Announcement.Pdf

LAGOS, NIGERIA 1 April 2021 Group Audited Results for the Full Year ended 31 December 2020 Access Bank delivered solid and resilient top-line figures despite a challenging economic and regulatory landscape. This is an attestation to our long history of resilience, scale, dedicated people and sustainable business model. Our resilient business model ensured that the Group adapted to accommodate the resultant macro-economic downturn and headwinds of the COVID-19 pandemic. The Group recorded gross earnings of ₦764.7bn (+15% y/y), arising from a 112% y/y growth in non- interest income to ₦275.5bn, which is testimonial to the effectiveness of our strategy and capacity to generate sustainable revenue. Profit Before Tax stood at ₦125.9bn despite the high cost of operating the enlarged franchise and the increase in net impairment charge of near ₦43bn arising principally (~50% of net impairment) from a Structured Trade Finance (“STF”) portfolio in the Access Bank UK. The STF impairment is one-off/COVID related and recoverable over the next 12-18 months against insurance cover from world class insurers. We also recorded consistent growth in our retail banking business, leading to a 5.8mn growth in customer sign-on during the year via our financial inclusion drive and retail revenue of ₦177.2bn (FY 2019: ₦107.8bn). Customer deposits grew by 31% to ₦5.59trn in Dec 2020 (Dec 2019: ₦4.26trn) with savings account deposits of ₦1.31trn. Similarly, net loans and advances grew by 18% to ₦3.61trn (Dec 2019: ₦3.06trn). Our asset quality also continued to improve as guided to 4.3% (Dec. -

ACCESS BANK PLC DECEMBER 2009 FULL YEAR and FIRST QUARTER 2010 RESULTS PRESENTATION Outline

ACCESS BANK PLC DECEMBER 2009 FULL YEAR AND FIRST QUARTER 2010 RESULTS PRESENTATION Outline About Access Bank Operating Environment 9 Months (December 2009) Performance Review Q1 March 2010 Performance review Ongoing Strategic Initiatives 2 December 31, 2009 2009 FULL YEAR RESULTS PRESENTATION Access Group – Fact Sheet United KingdomUnited Parent Company : Access Bank Plc registered in Nigeria as Kingdom a Universal bank and commenced operations Access Bank Group in May 1989 OmniFinance Bank Access Bank 75% 88% No of Employees : Over 2000 Professional staff Gambia Cote d’Ivoire Access Bank Access Bank 85% 75% Listing : Ordinary Shares & 3 years Convertible Bond Sierra Leone Zambia listed on NSE; Several International GDR The Access Bank Access Bank 100% 100% Holders. Paper traded OTC in London Rwanda UK FinBank 79% 100% Access Bank (RD Auditors : KPMG Professional Services Burundi Congo) Access Homes & 100% 75% Access Bank Credit Rating : A- / B+/ BB/ BBB- Mortgage Ghana (GCR/S&P/Agusto/Fitch) United 100% Access Securities 75% Investments & Securities Partners : Focus Client Segments Institutional (& Public Sector) Awards & Recognitions : 2007 Award of Recognition for “Innovation in Middle Market Trade Structures” 2008 Award of Recognition for “Best Network Distributors & Professionals Banks” Key Industry Segments : Telecoms, Food & Beverages, Cements, Oil & Treasury Gas and Financial Institutions Cash Management Channels : 131 Business Offices Trade Finance 216 ATMs, 204 POS, Call Centre Cards & Payment Services 3 Non-Banking subsidiaries; 9 Banking subsidiaries Asset Mgt. & Custodial Services Capabilities Key Relationship Management Geographical Coverage : Africa and Europe Banking subsidiaries in all monetary zones in Africa December 31, 2009 3 2009 FULL YEAR RESULTS PRESENTATION Board & Management Expertise Our Management Team possesses the requisite skills and experience required to emerge as Winners in a challenging operating environment.