Download This Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

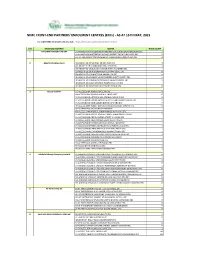

NIMC FRONT-END PARTNERS' ENROLMENT CENTRES (Ercs) - AS at 15TH MAY, 2021

NIMC FRONT-END PARTNERS' ENROLMENT CENTRES (ERCs) - AS AT 15TH MAY, 2021 For other NIMC enrolment centres, visit: https://nimc.gov.ng/nimc-enrolment-centres/ S/N FRONTEND PARTNER CENTER NODE COUNT 1 AA & MM MASTER FLAG ENT LA-AA AND MM MATSERFLAG AGBABIAKA STR ILOGBO EREMI BADAGRY ERC 1 LA-AA AND MM MATSERFLAG AGUMO MARKET OKOAFO BADAGRY ERC 0 OG-AA AND MM MATSERFLAG BAALE COMPOUND KOFEDOTI LGA ERC 0 2 Abuchi Ed.Ogbuju & Co AB-ABUCHI-ED ST MICHAEL RD ABA ABIA ERC 2 AN-ABUCHI-ED BUILDING MATERIAL OGIDI ERC 2 AN-ABUCHI-ED OGBUJU ZIK AVENUE AWKA ANAMBRA ERC 1 EB-ABUCHI-ED ENUGU BABAKALIKI EXP WAY ISIEKE ERC 0 EN-ABUCHI-ED UDUMA TOWN ANINRI LGA ERC 0 IM-ABUCHI-ED MBAKWE SQUARE ISIOKPO IDEATO NORTH ERC 1 IM-ABUCHI-ED UGBA AFOR OBOHIA RD AHIAZU MBAISE ERC 1 IM-ABUCHI-ED UGBA AMAIFEKE TOWN ORLU LGA ERC 1 IM-ABUCHI-ED UMUNEKE NGOR NGOR OKPALA ERC 0 3 Access Bank Plc DT-ACCESS BANK WARRI SAPELE RD ERC 0 EN-ACCESS BANK GARDEN AVENUE ENUGU ERC 0 FC-ACCESS BANK ADETOKUNBO ADEMOLA WUSE II ERC 0 FC-ACCESS BANK LADOKE AKINTOLA BOULEVARD GARKI II ABUJA ERC 1 FC-ACCESS BANK MOHAMMED BUHARI WAY CBD ERC 0 IM-ACCESS BANK WAAST AVENUE IKENEGBU LAYOUT OWERRI ERC 0 KD-ACCESS BANK KACHIA RD KADUNA ERC 1 KN-ACCESS BANK MURTALA MOHAMMED WAY KANO ERC 1 LA-ACCESS BANK ACCESS TOWERS PRINCE ALABA ONIRU STR ERC 1 LA-ACCESS BANK ADEOLA ODEKU STREET VI LAGOS ERC 1 LA-ACCESS BANK ADETOKUNBO ADEMOLA STR VI ERC 1 LA-ACCESS BANK IKOTUN JUNCTION IKOTUN LAGOS ERC 1 LA-ACCESS BANK ITIRE LAWANSON RD SURULERE LAGOS ERC 1 LA-ACCESS BANK LAGOS ABEOKUTA EXP WAY AGEGE ERC 1 LA-ACCESS -

List of NIMASA Accredited Medical Providers

NIGERIAN MARITIME ADMINISTRATION AND SAFETY AGENCY SEARCH AND RESCUE BASE CLINIC MASTER LIST OF THE ACCREDITED SEAFARERS MEDICAL CERTIFYING HOSPITALS/CLINICS (UPDATED 2020) S/No Hospital/Clinic Name of Medical Director Allotted Code Address and Location GSM and Emailaddress WESTERN ZONAL REGISTER SAR BASE CLINIC APAPA WZL 000101 14, idewu Street, Olodi Apapa lagos [email protected] 1 Abbey Medical Dr. Otusanya O. A. WZL 000126 26A Pelewura Crescent Apapa 08033951195, 26A Pelewura Crescent 2 Adeiza Medical Centre Dr Peter Adeiza WZL 000125 A+B92:F92papa No 41, Cardoso Street, Kiri-Kiri 08050400776, 08093765811, 3 Asheco Hospital Dr. ISAH A. WZL 000114 [email protected] 2A KEFFI STREET IKOYI LAGOS 08029596408, 4 Bestcare Hospital Limited Dr. Bola Lawal WZL 000117 b/[email protected] 28, Randle Road, Apapa, Lagos 0803333031, [email protected], 5 Christ Medical Centre Ltd. Dr. P. I. Akinbodoye WZL 000127 [email protected] 37 Akinwunmi Street, joku Road, Sango Otta, Ogun 08036368730, 08023408686, 6 Faramed Clinic Dr. Farabiyi O. O. WZL 000106 State [email protected] 10 Alhaji kareem Akande Street, Off Sun Rise Bus Stop, 08033513638, 7 Grayma Medical Centre Dr. Ndukwe Emmanuel WZL 000102 Apapa - Oshodi Express Way Olodi Apapa [email protected], [email protected] 2 Nwabueze Close,Off Princess Aina Jegede Close, Ajao 08033270656 ,08037951190, 08033229546, Estate Lagos. [email protected] 8 Heda Hospital Dr. Ohaka Emma WZL 000104 1,Takoradi Road Apapa GRA, Lagos 08034020041, 08051186468, 9 Iduna Specialist Hospital Dr. UNUANE M. B WZL 000108 [email protected], [email protected] 11, ogunmodede street by Alade market, off Allen 08099726926, 08083126494, 10 Ikeja Medical Centre DR. -

Access Bank Plc Group Audited Results for the 12 Months Ended 31

Access Bank Plc Group Audited results for the 12 months ended 31 December 2011 ACCESS BANK PLC REPORTS 26% RISE IN PROFIT BEFORE TAX FOR THE 12 MONTHS ENDED 31 DECEMBER 2011. CUSTOMER DEPOSITS UP 70% QUARTER ON QUARTER FOLLOWING BUSINESS COMBINATION WITH INTERCONTINENTAL BANK LAGOS, NIGERIA – 16 MARCH 2011 – Access Bank Plc, (Bloomberg: ACCESS NL / Thomson Reuters: ACCESS.LG) (“Access Bank” or the “Bank”), the full service commercial bank with headquarters in Nigeria and with operations across Sub-Saharan Africa and the UK, announces third quarter results for the twelve months ended 31 December 2011. Speaking from the Bank’s headquarters in Lagos, Aigboje Aig-Imoukhuede, Group Managing Director of Access Bank, said: “As intended 2011 will be remembered as the year Access Bank became a top tier bank in Nigeria. Following a year of meticulous planning our business combination with Intercontinental Bank was realised in October and the legal merger process was completed by January 2012. I am extremely proud that by March 5 2012, we had concluded all aspects of the customer, branch, systems, people, brand and product integration positioning us to unlock the transformational value of the combination. I am confident that having cemented our position as a leader in the Nigerian banking industry we have a sustainable market leading platform with which to combine our tradition of innovation and efficiency with the scale of our enlarged balance sheet. Today perhaps more than ever before in the successful and exciting history of our bank we are better -

Articles in the Issue

Volume: 3 Issue: 4 ISSN: 2618 - 6578 BLACK SEA JOURNAL OF AGRICULTURE (BSJ AGRI) Black Sea Journal of Agriculture (BSJ Agri) is a double-blind peer-reviewed, open-access international journal published electronically 4 times (January, April, July and October) in a year since January 2018. It publishes, in English and Turkish, full-length original research articles, innovative papers, conference papers, reviews, mini-reviews, rapid communications or technical note on various aspects of agricultural science like agricultural economics, agricultural engineering, animal science, agronomy, including plant science, theoretical production ecology, horticulture, plant breeding, plant fertilization, plant protect and soil science, aquaculture, biological engineering, including genetic engineering and microbiology, environmental impacts of agriculture and forestry, food science, husbandry, irrigation and water management, land use, waste management etc. ISSN: 2618 - 6578 Phone: +90 362 408 25 15 Fax: +90 362 408 25 15 Email: [email protected] Web site: http://dergipark.gov.tr/bsagriculture Sort of publication: Periodically 4 times (January, April, July and October) in a year Publication date and place: October 01, 2020 - Samsun, TURKEY Publishing kind: Electronically OWNER Prof. Dr. Hasan ÖNDER DIRECTOR IN CHARGE Assoc. Prof. Uğur ŞEN EDITOR BOARDS EDITOR IN CHIEF Prof. Dr. Hasan ÖNDER Ondokuz Mayis University, TURKEY Assoc. Prof. Uğur ŞEN Ondokuz Mayis University, TURKEY SECTION EDITORS* Prof. Dr. Kürşat KORKMAZ, Ordu University, TURKEY Prof. Dr. Mehmet KURAN, Ondokuz Mayis University, TURKEY Prof. Dr. Muharrem ÖZCAN, Ondokuz Mayis University, TURKEY Prof. Dr. Mustafa ŞAHİN, Kahramanmaraş Sütçü İmam University, TURKEY Assoc. Prof. Dr. Esmeray Küley BOĞA, Cukurova University, TURKEY Assoc. Prof. Dr. Hasan Gökhan DOĞAN, Kirsehir Ahi Evran University, TURKEY Assoc. -

**Wekpe V.O, Chukwu-Okeah, G.O & Godspower Kinikanwo Department

ROAD CONSTRUCTION AND TRACE HEAVY METALS IN ROADSIDE SOILS ALONG A MAJOR TAFFIC CORRIDOR IN AN EXPANDING METROPOLIS **Wekpe V.O, Chukwu-Okeah, G.O & Godspower Kinikanwo Department of Geography and Environmental Management, Faculty of Social Sciences, University of Port Harcourt, Rivers State, Nigeria. **Corresponding Author: [email protected] Abstract City growth often time results in advancement and development in transportation which comes with its attendant changes in road infrastructure and transport support services such as road side mechanic workshops, vulcanizers and bus stops. A byproduct of these attendant contiguous activities and processes is the emission and release of trace heavy metals. Trace heavy metals have been identified as major carcinogens. This study aimed at determining the occurrence and concentration of heavy metals in roadside soils in an expanding third world metropolis. To achieve the aim of the research, the total length of the road within the study section was measured. Ten sample locations were indentified at about 2.5km intervals along the road section under review. The heavy metal concentration was determined the using Buck Scientific 210 VGP Atomic Absorption Spectrophotometer. Heavy metals such as Iron (Fe), Copper (Cu), Cadmium (Cd), Lead (Pb) and Mercury (Hg) were determined. The result of the analysis showed that the concentration values ranged from <0.001 to 48.90 µg/mg. The results also revealed that the experimental sample points recorded higher values than the control samples; however, some of the control points had relatively higher concentration values. This observation may have emanated from the low lying trajectory and topography of the surrounding area, which allows run-off from the road side soils to wash off heavy metals and deposit them at these lower lying areas. -

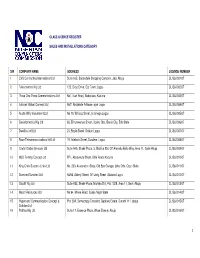

S/N COMPANY NAME ADDRESS LICENSE NUMBER 1 CVS Contracting International Ltd Suite 16B, Sabondale Shopping Complex, Jabi, Abuja CL/S&I/001/07

CLASS LICENCE REGISTER SALES AND INSTALLATIONS CATEGORY S/N COMPANY NAME ADDRESS LICENSE NUMBER 1 CVS Contracting International Ltd Suite 16B, Sabondale Shopping Complex, Jabi, Abuja CL/S&I/001/07 2 Telesciences Nig Ltd 123, Olojo Drive, Ojo Town, Lagos CL/S&I/002/07 3 Three One Three Communications Ltd No1, Isah Road, Badarawa, Kaduna CL/S&I/003/07 4 Latshak Global Concept Ltd No7, Abolakale Arikawe, ajah Lagos CL/S&I/004/07 5 Austin Willy Investment Ltd No 10, Willisco Street, Iju Ishaga Lagos CL/S&I/005/07 6 Geoinformatics Nig Ltd 65, Erhumwunse Street, Uzebu Qtrs, Benin City, Edo State CL/S&I/006/07 7 Dwellins Intl Ltd 21, Boyle Street, Onikan Lagos CL/S&I/007/07 8 Race Telecommunications Intl Ltd 19, Adebola Street, Surulere, Lagos CL/S&I/008/07 9 Clarfel Global Services Ltd Suite A45, Shakir Plaza, 3, Michika Strt, Off Ahmadu Bello Way, Area 11, Garki Abuja CL/S&I/009/07 10 MLD Temmy Concept Ltd FF1, Abeoukuta Street, Bida Road, Kaduna CL/S&I/010/07 11 King Chris Success Links Ltd No, 230, Association Shop, Old Epe Garage, Ijebu Ode, Ogun State CL/S&I/011/07 12 Diamond Sundries Ltd 54/56, Adeniji Street, Off Unity Street, Alakuko Lagos CL/S&I/012/07 13 Olucliff Nig Ltd Suite A33, Shakir Plaza, Michika Strt, Plot 1029, Area 11, Garki Abuja CL/S&I/013/07 14 Mecof Resources Ltd No 94, Minna Road, Suleja Niger State CL/S&I/014/07 15 Hypersand Communication Concept & Plot 29A, Democracy Crescent, Gaduwa Estate, Durumi 111, abuja CL/S&I/015/07 Solution Ltd 16 Patittas Nig Ltd Suite 17, Essence Plaza, Wuse Zone 6, Abuja CL/S&I/016/07 1 17 T.J. -

Sound Hazard Survey of Telecommunication Mast in Port Harcourt Metropolis Nigeria

© APR 2019 | IRE Journals | Volume 2 Issue 10 | ISSN: 2456-8880 Sound Hazard Survey of Telecommunication Mast in Port Harcourt Metropolis Nigeria NTE F.U1, EZE C.2, GOODNEWS T.3 1,2,3 Department of physics, faculty of science, University of port harcourt, Nigeria Abstract -- The communication industry has helped to 1. Rumuokoro: The Rumuokoro cluster contains boost the economy of most nation as well as improve on two mast; Airtel and 9Mobile network. The the standard of living but the hazards are still frightening two Masts are about 30m apart. The area is to many. This paper looks at the sound related hazards by majorly residential but also contains taking the noise survey and comparing with the health companies, schools, hotels e.t.c. hazards. Four base stations were selected for the study and these include Mile 1, Mile 3, Garrison and 2. Mile 3: This cluster contains 2 masts which Rumuokoro. The noise source was traceable to the house MTN and Glo network. The Glo mast is generators, transformers, traffic, flux, sparks and located inside a police station while the MTN electromagnetic sources. The peak noise level was found mast is near a filling station. The masts are to be 76.8dBA for mile 1, 80.0dBA for mile 3, 79.7dBA for about 100m apart. Mile 3 is mainly a business Garrison and 79.9dBA for Rumuokoro. Statistically, there area with few residential settlements. It is no significant difference in the noise level of the four contains about the biggest market in Rivers base stations, aggravated by motor traffic, commercial State. -

Annual Report 2012

ANNUAL REPORT 2012 SUSTAINABLE BANKING THAT INSPIRES GROWTH A Passion For Excellence Contents OVERVIEW CORPORATE GOVERNANCE 2 About Us 27 Directors, Officers & Advisors 3 Performance Highlights 28 Board Of Directors 4 At a Glance 30 Management Team 6 Locations & Offices 32 Directors’ Report 9 Chairman’s Statement 35 Corporate Governance Report 37 Independent Auditors Report BUSINESS REVIEW 12 MD’s Review FINANCIAL STATEMENTS 13 Institutional Banking 14 Commercial Banking 40 Statements of Financial Position 15 Retail Banking 41 Statements of Comprehensive Income 16 Treasury Group 42 Statement of Changes in Equity 17 Products & Services 44 Statement of Cash Flows 18 IT Services 45 Notes to Financial Statements 19 Our People, Culture & Diversity 21 Service Quality Improvements 23 Corporate Social Responsibility CORPORATE DIRECTORY 25 Risk Management 88 Branch Network Page8 Page12 Page13 Chairman’s MD’s statement Institutional statement Banking Page14 Page15 Page16 Commercial Retail Treasury Banking Banking Group Page19 Page21 Page22 Our People, Culture Service Quality Community & Diversity Improvements Investment About Us As a key player in the financial services industry, we have incorporated sustainable business practices into our operations to protect the interest of our shareholders, employees, customers and the community. Thus, we remain confident about our own future and that of those we serve. • The Bank was established in 2009 as a full service Commercial Bank licensed to carry out universal banking services. • The Bank is a member of the Access Bank Group, an emerging financial services group with presence in all of Africa’s monetary zones (UEMOA, SADC, WAMZ, EAC) and in the United Kingdom. • The Banks shareholders’ funds is GHS 170.993 million as at 31st December, 2012. -

Effects of Mergers and Acquisitions on Shareholders’ Wealth in Nigerian Banking Industry

British Journal of Marketing Studies Vol.2, No.4, pp.52-71, August 2014 Published by European Centre for Research Training and Development UK (www.ea-journals.org) EFFECTS OF MERGERS AND ACQUISITIONS ON SHAREHOLDERS’ WEALTH IN NIGERIAN BANKING INDUSTRY Onikoyi, Idris Adegboyega (Ph.D.) 1 & Awolusi, Olawumi Dele (Ph.D.)2* 1Department of Business Administration, Achievers University, Owo, P.M.B. 1030, Owo, Ondo State, Nigeria. 2Department of Business Administration, Faculty of Management Sciences, Ekiti State University, P.M.B 5363, Ado Ekiti, Ekiti State, Nigeria. ABSTRACT: Mergers and acquisitions that took place in Nigerian Banking Industry in 2005 were to create wealth for shareholders, provide solid and reliable banking institutions that can compete favourably with foreign financial institutions. Going by market value of the merged banks, shareholders wealth had been eroded, in some cases completely destroyed. The visible problems that confront the shareholders of merged banks include melt down of market prices of their shares on the stock market, depletion of shareholders fund due to huge losses incurred by the merged banks and lack of dividend pay out to the shareholders. Exploratory and correlation research designs were used. The population of this study is twenty five (25) consolidated banks as at 1st January, 2006. Stratified Sampling technique was adopted to arrive at fifteen (15) merged banks. Questionnaires were distributed to the staff of the merged banks. The instrument was validated and Cronbach’s Alpha coefficient result of 0.708 was obtained indicating the internal consistency of the instrument. Five hundred and fifty-seven (557) questionnaires were administered and a response rate of 58.3% was obtained. -

Comparison of Regression Model Concepts for Estimating Traffic Noise

Journal of Engineering Research and Reports 12(1): 25-32, 2020; Article no.JERR.55784 ISSN: 2582-2926 Comparison of Regression Model Concepts for Estimating Traffic Noise Amah, Victor Emeka1* and Atuboyedia, Tam-Jones1 1Department of Civil and Environmental Engineering, University of Port Harcourt, P.M.B. 5323, Port Harcourt, Rivers State, Nigeria. Authors’ contributions This work was carried out in collaboration between both authors. Author AVE designed the study, wrote the protocol, carried out the field work, performed the statistical analysis, managed the analyses of the study and wrote the first draft of the manuscript. Author ATJ reviewed the draft and contributed to the literature searches. Both authors read and approved the final manuscript. Article Information DOI: 10.9734/JERR/2020/v12i117072 Editor(s): (1) Grzegorz Sierpiński, Silesian University of Technology, Poland. Reviewers: (1) Kunio Takezawa, Institute for Agro-Environmental Sciences, NARO (NIAES), Japan. (2) Adam Torok, Budapest University of Technology and Economics, Hungary. (3) . Virnei Silva Moreira, Federal University of Paraná, Brazil. Complete Peer review History: http://www.sdiarticle4.com/review-history/55784 Received 28 January 2020 Accepted 04 April 2020 Original Research Article Published 09 April 2020 ABSTRACT Traffic noise at two locations which are Rumuokoro and Rumuola in Port Harcourt city, Rivers state Nigeria was studied. The study was done for 3 days at each location. Variables such as atmospheric parameters and traffic density were measured along with the noise measurement. The atmospheric parameters measured were temperature, relative humidity and wind speed. Traffic density includes number of small cars and trucks per 20m radius. Three empirical model concepts were proposed, calibrated using multiple regression analysis and validated by cross validation and coefficient of determination (R2). -

Access Bank Branches Nationwide

LIST OF ACCESS BANK BRANCHES NATIONWIDE ABUJA Town Address Ademola Adetokunbo Plot 833, Ademola Adetokunbo Crescent, Wuse 2, Abuja. Aminu Kano Plot 1195, Aminu Kano Cresent, Wuse II, Abuja. Asokoro 48, Yakubu Gowon Crescent, Asokoro, Abuja. Garki Plot 1231, Cadastral Zone A03, Garki II District, Abuja. Kubwa Plot 59, Gado Nasko Road, Kubwa, Abuja. National Assembly National Assembly White House Basement, Abuja. Wuse Market 36, Doula Street, Zone 5, Wuse Market. Herbert Macaulay Plot 247, Herbert Macaulay Way Total House Building, Opposite NNPC Tower, Central Business District Abuja. ABIA STATE Town Address Aba 69, Azikiwe Road, Abia. Umuahia 6, Trading/Residential Area (Library Avenue). ADAMAWA STATE Town Address Yola 13/15, Atiku Abubakar Road, Yola. AKWA IBOM STATE Town Address Uyo 21/23 Gibbs Street, Uyo, Akwa Ibom. ANAMBRA STATE Town Address Awka 1, Ajekwe Close, Off Enugu-Onitsha Express way, Awka. Nnewi Block 015, Zone 1, Edo-Ezemewi Road, Nnewi. Onitsha 6, New Market Road , Onitsha. BAUCHI STATE Town Address Bauchi 24, Murtala Mohammed Way, Bauchi. BAYELSA STATE Town Address Yenagoa Plot 3, Onopa Commercial Layout, Onopa, Yenagoa. BENUE STATE Town Address Makurdi 5, Ogiri Oko Road, GRA, Makurdi BORNO STATE Town Address Maiduguri Sir Kashim Ibrahim Way, Maiduguri. CROSS RIVER STATE Town Address Calabar 45, Muritala Mohammed Way, Calabar. Access Bank Cash Center Unicem Mfamosing, Calabar DELTA STATE Town Address Asaba 304, Nnebisi, Road, Asaba. Warri 57, Effurun/Sapele Road, Warri. EBONYI STATE Town Address Abakaliki 44, Ogoja Road, Abakaliki. EDO STATE Town Address Benin 45, Akpakpava Street, Benin City, Benin. Sapele Road 164, Opposite NPDC, Sapele Road. -

IFC Mobile Money Scoping Country Report: Lebanon Alaa Abbassi, Andrew Lake, Cherine El Sayed

IFC Mobile Money Scoping Country Report: Lebanon Alaa Abbassi, Andrew Lake, Cherine El Sayed May, 2012 Lebanon Summary Overall readiness rating 4 (Moderately high readiness for Bank Centric Mobile Money deployment in high income segments) 3 (Medium readiness for the mid market, those unable to afford smart phones) Current mobile money solution The banks have begun implementing mobile money – both mobile payments and mobile banking. This is being done by the banks on their own and in conjunction with Mobile payments suppliers within Lebanon. Population 4.14 mil * Mobile Penetration 68% 2010 (High) ** Banked Population 2.5 mil (60%) (Moderately high) *** Remittance % of GDP Outbound $3,737 mil (9.7%) *** Inbound $7,558 mil (19.6%) *** Percent under poverty line 28% * Economically Active population 1,48 mil (36%) * Adult Literacy 87.4% * Main banks Bank Audi, Blom Bank, Byblos Bank, Fransabank, Bankmed, BLF MobileIFC Opportunities Network Operators MTC Touch 1,724,854 (54%) Alfa 1,482,819 (46%) Ease of doing business Ranked 104 in the world, better than Pakistan, worse than Seychelles **** Sources: * https://www.cia.gov/library/publications/the-world-factbook/geos/le.html ** TRA annual report 2010 *** http://elibrary-data.imf.org/DataReport.aspx?c=2529608&d=33060&e=161939 **** http://doingbusiness.org/rankings • Macro-economic Overview • Regulations • Financial Sector • Telecom Sector • Distribution Channel • Mobile Financial Services Landscape Macro-Economic Overview Key Country Statistics Insights • Population: 4.14 mil • Lebanon is a small country, both in terms of population size and geography. • Age distribution: 23% (0 – 14 years) 68% (15 - 64 years) 9% (>65 years) • It has a sophisticated banking industry which serves 60% of the population (2.48 mil • Urban/rural split: 87% urban people, through 900 branches).