2020 Annual Report What Do We Do? We Provide Technology to Power Financial Services

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

June 2019 42

y 4 6 Equit 2019 June High Conviction High Quarterly NewsletterQuarterly No. Selector Fund In this quarterly edition, we review performance and attribution for the quarter. We highlight the importance of innovation and culture within organisations and profile ResMed and Cochlear, two leading healthcare businesses. We visit Fisher & Paykel Healthcare in New Zealand and look at one of the biggest growth industries in the world today, cyber security. Photo. Selector analyst trekking through the Atlas Mountains and local Berber kids. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 8, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612 www.selectorfund.com.au P Selector is a boutique fund manager. Our team, combined, have over 150 years of experience in financial markets. We believe in long-term wealth creation and building lasting relationships with our investors. We focus on stock selection, the funds are high conviction, concentrated and index unaware. As a result, the portfolios have low turnover and produce tax effective returns. Selector has a 15-year track record of outperformance and we continue to seek businesses with leadership qualities, run by competent management teams, underpinned by strong balance sheets and with a focus on capital management. Selector High Conviction Equity Fund Quarterly Newsletter #64 CONTENTS IN BRIEF – JUNE QUARTER 3 PORTFOLIO OVERVIEW 5 PORTFOLIO CONTRIBUTORS 7 MARKET INSIGHTS AND OBSERVATIONS 13 INNOVATION + CULTURE = SUCCESS 17 RESMED INC. 20 WAKE-UP CALL 31 FISHER & PAYKEL HEALTHCARE – JUNE 2019 42 RISK OUT…UPFRONT 45 COMPANY VISIT DIARY – JUNE 2019 QUARTER 57 2 Selector Funds Management IN BRIEF – JUNE QUARTER Dear Investor, Looking back on 2019, it would be fair to say that few identify the businesses we want to own on a case by case foresaw how the events of the financial year would basis, understand them to the best of our abilities and unfold. -

Australian Investment Strategy

2 November 2016 Asia Pacific/Australia Equity Research Investment Strategy Australian Investment Strategy Research Analysts STRATEGY Hasan Tevfik ,CFA 61 2 8205 4284 [email protected] Aussie darlings Peter Liu 61 2 8205 4071 ■ Aussies love their darlings: Australia currently has the most expensive [email protected] equity market "Darlings" in the world. Our darlings trade on a forward P/E Damien Boey of 38x. The other commodity-focused market, Canada, has the second 61 2 8205 4615 [email protected] most expensive darlings. Darlings in Australia have been more expensive only during the Nasdaq bubble when they touched 45x. ■ Darling derating: Buying Australian darlings at these valuations has been a poor strategy in the past. Also, the current high valuation for Australia's darlings suggest they are especially vulnerable to rising bond yields and the coming end of the Australian profits recession. A rising discount rate and a lower premium for growth suggest investors should focus on stocks that could be future darlings. ■ Hello Daaarling: Future market darlings have shared many similar characteristics over the last 20 years. They are generally well managed, have strong balance sheets and operate on high margins. Our "Hello Daaarling" strategy highlights potential future darlings and they currently trade on just 17x P/E and include Caltex, Eclipx, Mayne Pharma, Nufarm, Star Entertainment and South 32. We add Eclipx to our long Portfolio. Figure 1: Australia has the most expensive darlings in the world Median 12-month forward P/E of "market darlings" around the world* 40 35 30 25 20 15 10 Australia Canada Cont. -

Smallco Investment Fund

Smallco Investment Fund Quarterly Update 30 September 2014 SIF Portfolio Commentary SIF Performance Smallco Investment Fund (SIF) delivered 6.8% during the Return to 30 September 2014 September quarter and for the 12 months was up a solid 12.3%. During the quarter Iress, Isentia Group and Sirtex 3 months 6.8% Medical performed positively, while Carsales.com, Ozforex 1 year 12.3% Group and Macquarie Atlas Roads were negative 3 year p.a. 36.4% contributors. 5 year p.a. 22.5% For the September quarter the Small Ordinaries index was 10 year p.a. 13.6% modestly positive at 1.5% while for the year to 30 Since inception (31.10.00) p.a. 14.2% September it was down -0.1%. Value of $100,000 invested at inception $631,173 In general the Australian market had a solid reporting Fund returns calculated after all fees and expenses and based season and that was reflected in share prices during upon exit price and reinvestment of distributions. August, particularly for Industrial companies. However, towards the end of the quarter, the Australian and international markets became concerned about global political tensions – Ukraine, Iraq and Hong Kong – with a falling iron ore price having a significant negative impact on the Australian resources index. SIF Structure: by sector (look through) One of our major holdings is IRESS (IRE). SIF originally invested in IRE in 2002 when it had a market capitalisation of $260m. At the time we invested it was already the dominant provider of information systems to the professional equity market in Australia and New Zealand (ANZ). -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

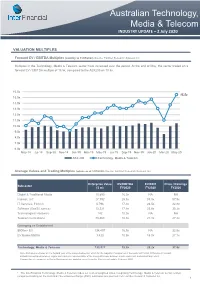

Australian Technology, Media & Telecom

Australian Technology, Media & Telecom INDUSTRY UPDATE – 2 July 2020 VALUATION MULTIPLES Forward EV / EBITDA Multiples (monthly to 31/05/2020) Source: FactSet Research Systems Inc. Multiples in the Technology, Media & Telecom sector have increased over the period. At the end of May, the sector traded on a forward EV / EBITDA multiple of 15.5x, compared to the ASX200 on 10.5x. 16.0x 15.5x 15.0x 14.0x 13.0x 12.0x 11.0x 10.0x 9.0x 8.0x 7.0x 6.0x May-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar-19 May-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar-20 May-20 ASX 200 Technology, Media & Telecom Average Values and Trading Multiples (values as at 1/07/2020) Source: FactSet Research Systems Inc. Enterprise Value EV/EBITDA EV/EBIT Price / Earnings Subsector ($ m) FY2020 FY2020 FY2020 Digital & Traditional Media 10,890 16.9x NA NA Internet, IoT 27,792 25.3x 33.3x 57.9x IT Services, Fintech 5,796 17.3x 24.5x 32.8x Software (SaaS/Licence) 13,221 17.9x 23.9x 35.2x Technological Hardware 142 10.0x NA NA Telecommunications 73,468 10.3x 21.1x 27.2x Emerging vs Established $500m+ EV 134,497 16.9x NA 32.9x EV Below $500m 1,420 10.9x 15.0x 27.7x Technology, Media & Telecom 135,917 15.5x 29.2x 31.8x Note: Multiples are based on the forward year of the unreported period, which for the majority of companies in the sector is FY2020. Difference in forward EV/EBITDA multiples between Figure and Table are representative of the timing difference between month-end result, and current day result. -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Hush, and Hear Amalgamated's Charms Who Wants Golden Dividends?; Blog Links ASX Half-Year Result BHP Half-Year Result IRESS Fu

WEEkly REviEW | ISSUE 362a | 16–22 February 2013 CONTENTS IN THIS ISSUE STOCK REVIEWS Hush, and hear Amalgamated’s charms STOCK ASX CODE REcoMMENdaTioN PAGE Greg Hoffman Amalgamated Holdings AHD Long Term Buy 2 Greg Hoffman explains why this owner of hotels, cinemas and a skiing stock UPdates resort may be just the ticket for those looking for a steady, growing ARB Corp ARP Hold 3 dividend. (p2) Amcor AMC Avoid 4 ANZ Bank ANZ Avoid 5 Who wants golden dividends?; Blog links ASX ASX Hold 5 Australand ASSETS AAZPB Sell 6 Gaurav Sodhi BHP Billiton BHP Hold 7 Below is a list of Doddsville and Bristlemouth blog articles published BlueScope Steel BSL Hold 8 by our analysts this week. (p25) Boart Longyear BLY Avoid 8 Brambles BXB Avoid 9 ASX half-year result BWP Trust BWP Long Term Buy 9 Coca-Cola Amatil CCL Hold 10 James Carlisle Infigen Energy IFN Hold 11 Competition and weak market sentiment took a bite out of ASX’s InvoCare IVC Hold 11 revenue in the first half, but today’s result left plenty of room for IRESS IRE Hold 12 optimism. (p5) Monadelphous MND Avoid 13 NAB CPS NABPA Avoid 14 Platinum Asset Management PTM Hold 15 BHP half-year result ResMed RMD Long Term Buy 16 Gaurav Sodhi Rio Tinto RIO Hold 17 Good results were only part of the story, with management preparing Sunland Group SDG Hold 17 the business for a different world. (p7) Sonic Healthcare SHL Hold 18 Servcorp SRV Hold 19 Sirtex Medical SRX Hold 20 IRESS full-year result Suncorp Group SUN Hold 21 Jason Prowd Tassal Group TGR Hold 21 A growing market for its wealth management software failed to offset Treasury Group TRG Hold 22 lower demand for its market data products both here and abroad. -

Vanguard Total World Stock Index Fund Annual Report October 31, 2020

Annual Report | October 31, 2020 Vanguard Total World Stock Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard. -

LISTED INVESTMENT COMPANIES Share Price and NTA Correlations Diverge

LISTED INVESTMENT COMPANIES QUANTITATIVE RESEARCH Share Price and NTA Correlations Diverge Listed investment companies are essentially listed equivalents of managed funds but have higher levels of transparency, tend to charge 16 December 2013 lower fees than its unlisted counterparts and are closed end funds. This means investors buy and sell the LIC vehicle so the LIC managers are not Analyst: Kien Trinh under pressure to meet redemptions. A key risk is that LICs cannot be Phone: (+61 3) 9242 4027 redeemed for its underlying face value and share prices may deviate Email: [email protected] significantly from its underlying NTA. Prices are at close on 13th December 2013. This report compares 29 different LICs and identifies those that are most attractive on a number of quantitative measures including price to NTA, dividend yield, NTA growth, and total returns. The key criterion in the evaluation of a LIC is its track record. Those with the best long-term performances (measured by total return, dividends and NTA growth) are the ones that are likely to give the best future returns. In the Appendix, we provide a list of top 20 holdings and a historical price to NTA chart for each LIC. Key Ideas: . Most Attractive – A breakdown in correlation between . Strongest NTA Growth – The LICs with the strongest NTA growth and price to NTA in the last quarter has NTA growth over the year have mainly been the provided better value opportunities. An analysis of price to international players. These include Templeton Global NTA and long term NTA growth rates reveal that Cadence (TGG), Magellan Flagship (MFF), Platinum Capital Capital (CDM), AMCIL (AMH), Carlton Investments (CIN), (PMC), and AMP Capital China (AGF). -

STOXX Pacific 100 Last Updated: 01.08.2017

STOXX Pacific 100 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 98.1 1 1 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 72.3 2 2 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 58.9 3 3 AU000000BHP4 6144690 BHP.AX 614469 BHP Billiton Ltd. AU AUD Y 56.2 4 5 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 54.3 5 4 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 38.8 6 6 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 33.0 7 7 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 31.3 8 8 AU000000WOW2 6981239 WOW.AX 698123 Woolworths Ltd. AU AUD Y 23.4 9 9 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 18.9 10 11 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 18.6 11 10 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 15.9 12 12 AU000000SCG8 BLZH0Z7 SCG.AX AU01Z4 SCENTRE GROUP AU AUD Y 14.9 13 14 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. AU AUD Y 14.4 14 13 AU000000SUN6 6585084 SUN.AX 658508 SUNCORP GROUP LTD. AU AUD Y 12.5 15 15 AU000000AMC4 6066608 AMC.AX 606660 Amcor Ltd. AU AUD Y 12.0 16 16 AU000000QBE9 6715740 QBE.AX 671574 QBE Insurance Group Ltd.