The Phillips Curve Evaluating Short-Run Inflation/Unemployment Dynamics

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

After the Phillips Curve: Persistence of High Inflation and High Unemployment

Conference Series No. 19 BAILY BOSWORTH FAIR FRIEDMAN HELLIWELL KLEIN LUCAS-SARGENT MC NEES MODIGLIANI MOORE MORRIS POOLE SOLOW WACHTER-WACHTER % FEDERAL RESERVE BANK OF BOSTON AFTER THE PHILLIPS CURVE: PERSISTENCE OF HIGH INFLATION AND HIGH UNEMPLOYMENT Proceedings of a Conference Held at Edgartown, Massachusetts June 1978 Sponsored by THE FEDERAL RESERVE BANK OF BOSTON THE FEDERAL RESERVE BANK OF BOSTON CONFERENCE SERIES NO. 1 CONTROLLING MONETARY AGGREGATES JUNE, 1969 NO. 2 THE INTERNATIONAL ADJUSTMENT MECHANISM OCTOBER, 1969 NO. 3 FINANCING STATE and LOCAL GOVERNMENTS in the SEVENTIES JUNE, 1970 NO. 4 HOUSING and MONETARY POLICY OCTOBER, 1970 NO. 5 CONSUMER SPENDING and MONETARY POLICY: THE LINKAGES JUNE, 1971 NO. 6 CANADIAN-UNITED STATES FINANCIAL RELATIONSHIPS SEPTEMBER, 1971 NO. 7 FINANCING PUBLIC SCHOOLS JANUARY, 1972 NO. 8 POLICIES for a MORE COMPETITIVE FINANCIAL SYSTEM JUNE, 1972 NO. 9 CONTROLLING MONETARY AGGREGATES II: the IMPLEMENTATION SEPTEMBER, 1972 NO. 10 ISSUES .in FEDERAL DEBT MANAGEMENT JUNE 1973 NO. 11 CREDIT ALLOCATION TECHNIQUES and MONETARY POLICY SEPBEMBER 1973 NO. 12 INTERNATIONAL ASPECTS of STABILIZATION POLICIES JUNE 1974 NO. 13 THE ECONOMICS of a NATIONAL ELECTRONIC FUNDS TRANSFER SYSTEM OCTOBER 1974 NO. 14 NEW MORTGAGE DESIGNS for an INFLATIONARY ENVIRONMENT JANUARY 1975 NO. 15 NEW ENGLAND and the ENERGY CRISIS OCTOBER 1975 NO. 16 FUNDING PENSIONS: ISSUES and IMPLICATIONS for FINANCIAL MARKETS OCTOBER 1976 NO. 17 MINORITY BUSINESS DEVELOPMENT NOVEMBER, 1976 NO. 18 KEY ISSUES in INTERNATIONAL BANKING OCTOBER, 1977 CONTENTS Opening Remarks FRANK E. MORRIS 7 I. Documenting the Problem 9 Diagnosing the Problem of Inflation and Unemployment in the Western World GEOFFREY H. -

Neoliberal Austerity and Unemployment

E L C I ‘…following Stuckler and Basu (2013) T it is not economic downturns per se that R matter but the austerity and welfare A “reform” that may follow: that “austerity Neoliberal austerity kills” and – as I argue here – that it particularly “kills” those in lower socio- economic positions.’ and unemployment The scale of contemporary unemployment consequent upon David Fryer and Rose Stambe examine critical psychological issues neoliberal austerity programmes is colossal. According to labour market statistics released in June 2013 by the UK Neoliberal fiscal austerity policies I am really sorry to bother you again. Office for National Statistics, 2.51 million decrease public expenditure God. But I am bursting to tell you all people were unemployed in the UK through cuts to central and local the stuff that has been going on (tinyurl.com/neu9l47). This represents five government budgets, welfare behind your back since I first wrote to unemployed people competing for every services and benefits and you back in 1988. Oh God do you still vacancy. privatisation of public resources remember? Remember me telling Official statistics like these, which have resulting in job losses. This article you of the war that was going on persisted now for years, do not, of course, interrogates the empirical, against the poor and unemployed in prevent the British Prime Minister – theoretical, methodological and our working class communities? Do evangelist of neoliberal government - ideological relationships between you remember me telling you, God, asking in a speech delivered in June 2012 neoliberalism, unemployment and how the people in my community ‘Why has it become acceptable for many the discipline of psychology, were being killed and terrorised but people to choose a life on benefits?’ arguing that neoliberalism that there were no soldiers to be Talking of what he termed ‘Working Age constitutes rather than causes seen, no tanks, no bombs being Welfare’, Mr Cameron opined: ‘we have unemployment. -

Unemployment in an Extended Cournot Oligopoly Model∗

Unemployment in an Extended Cournot Oligopoly Model∗ Claude d'Aspremont,y Rodolphe Dos Santos Ferreiraz and Louis-Andr´eG´erard-Varetx 1 Introduction Attempts to explain unemployment1 begin with the labour market. Yet, by attributing it to deficient demand for goods, Keynes questioned the use of partial analysis, and stressed the need to consider interactions between the labour and product markets. Imperfect competition in the labour market, reflecting union power, has been a favoured explanation; but imperfect competition may also affect employment through producers' oligopolistic behaviour. This again points to a general equilibrium approach such as that by Negishi (1961, 1979). Here we propose an extension of the Cournot oligopoly model (unlike that of Gabszewicz and Vial (1972), where labour does not appear), which takes full account of the interdependence between the labour market and any product market. Our extension shares some features with both Negishi's conjectural approach to demand curves, and macroeconomic non-Walrasian equi- ∗Reprinted from Oxford Economic Papers, 41, 490-505, 1989. We thank P. Champsaur, P. Dehez, J.H. Dr`ezeand J.-J. Laffont for helpful comments. We owe P. Dehez the idea of a light strengthening of the results on involuntary unemployment given in a related paper (CORE D.P. 8408): see Dehez (1985), where the case of monopoly is studied. Acknowledgements are also due to Peter Sinclair and the Referees for valuable suggestions. This work is part of the program \Micro-d´ecisionset politique ´economique"of Commissariat G´en´eral au Plan. Financial support of Commissariat G´en´eralau Plan is gratefully acknowledged. -

Department of Business, Economic Development & Tourism

DEPARTMENT OF BUSINESS, ECONOMIC DEVELOPMENT & TOURISM RESEARCH AND ECONOMIC ANALYSIS DIVISION DAVID Y. IGE GOVERNOR MIKE MC CARTNEY DIRECTOR DR. EUGENE TIAN CHIEF STATE ECONOMIST FOR IMMEDIATE RELEASE August 19, 2021 HAWAI‘I'S UNEMPLOYMENT RATE AT 7.3 PERCENT IN JULY Jobs increased by 53,000 over-the-year HONOLULU — The Hawai‘i State Department of Business, Economic Development & Tourism (DBEDT) today announced that the seasonally adjusted unemployment rate for July was 7.3 percent compared to 7.7 percent in June. Statewide, 598,850 were employed and 47,200 unemployed in July for a total seasonally adjusted labor force of 646,000. Nationally, the seasonally adjusted unemployment rate was 5.4 percent in July, down from 5.9 percent in June. Seasonally Adjusted Unemployment Rate State of Hawai`i Jul 2019 - Jul 2021 28.0% 24.0% 20.0% 16.0% 12.0% 8.0% 4.0% 0.0% Ma Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr Ma Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr Jun Jul y 19 19 19 19 19 19 20 20 20 20 y20 20 20 20 20 20 20 20 21 21 21 21 21 21 21 Percent 2.5 2.4 2.3 2.2 2.1 2.1 2.0 2.1 2.1 21. 21. 14. 14. 14. 14. 14. 10. 10. 10. 9.2 9.1 8.5 8.0 7.7 7.3 The unemployment rate figures for the State of Hawai‘i and the U.S. in this release are seasonally adjusted, in accordance with the U.S. -

Emergency Unemployment Compensation (EUC08): Current Status of Benefits

Emergency Unemployment Compensation (EUC08): Current Status of Benefits Julie M. Whittaker Specialist in Income Security Katelin P. Isaacs Analyst in Income Security March 28, 2012 The House Ways and Means Committee is making available this version of this Congressional Research Service (CRS) report, with the cover date shown, for inclusion in its 2012 Green Book website. CRS works exclusively for the United States Congress, providing policy and legal analysis to Committees and Members of both the House and Senate, regardless of party affiliation. Congressional Research Service R42444 CRS Report for Congress Prepared for Members and Committees of Congress Emergency Unemployment Compensation (EUC08): Current Status of Benefits Summary The temporary Emergency Unemployment Compensation (EUC08) program may provide additional federal unemployment insurance benefits to eligible individuals who have exhausted all available benefits from their state Unemployment Compensation (UC) programs. Congress created the EUC08 program in 2008 and has amended the original, authorizing law (P.L. 110-252) 10 times. The most recent extension of EUC08 in P.L. 112-96, the Middle Class Tax Relief and Job Creation Act of 2012, authorizes EUC08 benefits through the end of calendar year 2012. P.L. 112- 96 also alters the structure and potential availability of EUC08 benefits in states. Under P.L. 112- 96, the potential duration of EUC08 benefits available to eligible individuals depends on state unemployment rates as well as the calendar date. The P.L. 112-96 extension of the EUC08 program does not allow any individual to receive more than 99 weeks of total unemployment insurance (i.e., total weeks of benefits from the three currently authorized programs: regular UC plus EUC08 plus EB). -

Downward Nominal Wage Rigidities Bend the Phillips Curve

FEDERAL RESERVE BANK OF SAN FRANCISCO WORKING PAPER SERIES Downward Nominal Wage Rigidities Bend the Phillips Curve Mary C. Daly Federal Reserve Bank of San Francisco Bart Hobijn Federal Reserve Bank of San Francisco, VU University Amsterdam and Tinbergen Institute January 2014 Working Paper 2013-08 http://www.frbsf.org/publications/economics/papers/2013/wp2013-08.pdf The views in this paper are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Federal Reserve Bank of San Francisco or the Board of Governors of the Federal Reserve System. Downward Nominal Wage Rigidities Bend the Phillips Curve MARY C. DALY BART HOBIJN 1 FEDERAL RESERVE BANK OF SAN FRANCISCO FEDERAL RESERVE BANK OF SAN FRANCISCO VU UNIVERSITY AMSTERDAM, AND TINBERGEN INSTITUTE January 11, 2014. We introduce a model of monetary policy with downward nominal wage rigidities and show that both the slope and curvature of the Phillips curve depend on the level of inflation and the extent of downward nominal wage rigidities. This is true for the both the long-run and the short-run Phillips curve. Comparing simulation results from the model with data on U.S. wage patterns, we show that downward nominal wage rigidities likely have played a role in shaping the dynamics of unemployment and wage growth during the last three recessions and subsequent recoveries. Keywords: Downward nominal wage rigidities, monetary policy, Phillips curve. JEL-codes: E52, E24, J3. 1 We are grateful to Mike Elsby, Sylvain Leduc, Zheng Liu, and Glenn Rudebusch, as well as seminar participants at EIEF, the London School of Economics, Norges Bank, UC Santa Cruz, and the University of Edinburgh for their suggestions and comments. -

Modern Monetary Theory: a Marxist Critique

Class, Race and Corporate Power Volume 7 Issue 1 Article 1 2019 Modern Monetary Theory: A Marxist Critique Michael Roberts [email protected] Follow this and additional works at: https://digitalcommons.fiu.edu/classracecorporatepower Part of the Economics Commons Recommended Citation Roberts, Michael (2019) "Modern Monetary Theory: A Marxist Critique," Class, Race and Corporate Power: Vol. 7 : Iss. 1 , Article 1. DOI: 10.25148/CRCP.7.1.008316 Available at: https://digitalcommons.fiu.edu/classracecorporatepower/vol7/iss1/1 This work is brought to you for free and open access by the College of Arts, Sciences & Education at FIU Digital Commons. It has been accepted for inclusion in Class, Race and Corporate Power by an authorized administrator of FIU Digital Commons. For more information, please contact [email protected]. Modern Monetary Theory: A Marxist Critique Abstract Compiled from a series of blog posts which can be found at "The Next Recession." Modern monetary theory (MMT) has become flavor of the time among many leftist economic views in recent years. MMT has some traction in the left as it appears to offer theoretical support for policies of fiscal spending funded yb central bank money and running up budget deficits and public debt without earf of crises – and thus backing policies of government spending on infrastructure projects, job creation and industry in direct contrast to neoliberal mainstream policies of austerity and minimal government intervention. Here I will offer my view on the worth of MMT and its policy implications for the labor movement. First, I’ll try and give broad outline to bring out the similarities and difference with Marx’s monetary theory. -

July Unemployment Rate Decreases to 5.8 Percent

FOR IMMEDIATE RELEASE CONTACT: September 16, 2021 Margaux Fontaine 401-209-0153 [email protected] Rhode Island-Based Jobs Rose by 800 from July; August Unemployment Rate Increases to 5.8 Percent CRANSTON, R.I. - The state’s seasonally adjusted Aug 21 Jul 21 Aug 20 unemployment rate was 5.8 percent in August, the Department of R.I. Unemployment Rate 5.8% 5.7% 12.6% Labor and Training announced Thursday. The August rate was up one-tenth of a percentage point from the revised July rate of 5.7 U.S. Unemployment Rate 5.2% 5.4% 8.4% percent. Last year the rate was 12.6 percent in August. R.I. Job Count (in thousands) 477.9 477.1 457.3 Highlights: The U.S. unemployment rate was 5.2 percent in August, down two-tenths of a percentage point from July. The U.S. rate was 8.4 The Rhode Island unemployment rate was 5.8 percent percent in August 2020. in August, up one-tenth of a percentage point from last month’s revised rate of 5.7 percent. The number of unemployed Rhode Island residents — those Through August, the Rhode Island economy has residents classified as available for and actively seeking recovered 78,700 or nearly 73 percent of the 108,000 jobs lost during the pandemic shutdown. employment — was 30,900, up 100 from July. The number of unemployed residents decreased by 35,800 over the year. The number of employed Rhode Island residents was 503,800, down 1,500 from July. -

Karl Marx's Thoughts on Functional Income Distribution - a Critical Analysis

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Herr, Hansjörg Working Paper Karl Marx's thoughts on functional income distribution - a critical analysis Working Paper, No. 101/2018 Provided in Cooperation with: Berlin Institute for International Political Economy (IPE) Suggested Citation: Herr, Hansjörg (2018) : Karl Marx's thoughts on functional income distribution - a critical analysis, Working Paper, No. 101/2018, Hochschule für Wirtschaft und Recht Berlin, Institute for International Political Economy (IPE), Berlin This Version is available at: http://hdl.handle.net/10419/175885 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Institute for International Political Economy Berlin Karl Marx’s thoughts on functional income distribution – a critical analysis Author: Hansjörg Herr Working Paper, No. -

What Is Unemployment Insurance (Ui)? Am I Eligible? How Do I Apply?

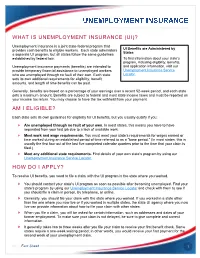

WHAT IS UNEMPLOYMENT INSURANCE (UI)? Unemployment Insurance is a joint state-federal program that provides cash benefits to eligible workers. Each state administers UI Benefits are Administered by States a separate UI program, but all states follow the same guidelines established by federal law. To find information about your state’s program, including eligibility, benefits, Unemployment insurance payments (benefits) are intended to and application information, visit our provide temporary financial assistance to unemployed workers Unemployment Insurance Service who are unemployed through no fault of their own. Each state Locator. sets its own additional requirements for eligibility, benefit amounts, and length of time benefits can be paid. Generally, benefits are based on a percentage of your earnings over a recent 52-week period, and each state sets a maximum amount. Benefits are subject to federal and most state income taxes and must be reported on your income tax return. You may choose to have the tax withheld from your payment. AM I ELIGIBLE? Each state sets its own guidelines for eligibility for UI benefits, but you usually qualify if you: Are unemployed through no fault of your own. In most states, this means you have to have separated from your last job due to a lack of available work. Meet work and wage requirements. You must meet your state’s requirements for wages earned or time worked during an established period of time referred to as a "base period." (In most states, this is usually the first four out of the last five completed calendar quarters prior to the time that your claim is filed.) Meet any additional state requirements. -

Long-Term Unemployment and the 99Ers

Long-Term Unemployment and the 99ers An Emerging Issues Report from the January 2012 Long-Term Unemployment and the 99ers The Issue Long-term unemployment has been the most stubborn consequence of the Great Recession. In October 2011, more than two years after the Great Recession officially ended, the national unemployment rate stood at 9.0%, with Connecticut’s unemployment rate at 8.7%.1 Americans have been taught to connect the economic condition of the country or their state to the unemployment Millions of Americans— rate, but the national or state unemployment rate does not tell known as 99ers—have the real story. Concealed in those statistics is evidence of a exhausted their UI benefits, substantial and challenging structural change in the labor and their numbers grow market. Nationally, in July 2011, 31.8% of unemployed people every month. had been out of work for at least 52 weeks. In Connecticut, data shows 37% of the unemployed had been jobless for a year or more. By August 2011, the national average length of unemployment was a record 40 weeks.2 Many have been out of work far longer, with serious consequences. Even with federal extensions to Unemployment Insurance (UI), payments are available for a maximum of 99 weeks in some states; other states provide fewer (60-79) weeks. Millions of Americans—known as 99ers— have exhausted their UI benefits, and their numbers grow every month. By October 2011, approximately 2.9 million nationally had done so. Projections show that five million people will be 99ers, exhausting their benefits, by October 2012. -

The Return of the Wage Phillips Curve

THE RETURN OF THE WAGE PHILLIPS CURVE Jordi Gal´ı CREI, Universitat Pompeu Fabra and Barcelona GSE Abstract The standard New Keynesian model with staggered wage setting is shown to imply a simple dynamic relation between wage inflation and unemployment. Under some assumptions, that relation takes a form similar to that found in empirical wage equations—starting from Phillips’ (1958) original work—and may thus be viewed as providing some theoretical foundations to the latter. The structural wage equation derived here is shown to account reasonably well for the comovement of wage inflation and the unemployment rate in the US economy, even under the strong assumption of a constant natural rate of unemployment. (JEL: E24, E31, E32) 1. Introduction The past decade has witnessed the emergence of a new popular framework for monetary policy analysis, the so-called New Keynesian (NK) model. The new framework combines some of the ingredients of Real Business Cycle theory (for example dynamic optimization, general equilibrium) with others that have a distinctive Keynesian flavor (for example monopolistic competition, nominal rigidities). Many important properties of the NK model hinge on the specification of its wage- setting block. While basic versions of that model, intended for classroom exposition, assume fully flexible wages and perfect competition in labor markets, the larger, more realistic versions (including those developed in-house at different central banks and policy institutions) typically assume staggered nominal wage setting which, following the lead of Erceg, Henderson, and Levin (2000), are modeled in a way symmetric to The editor in charge of this paper was Fabrizio Zilibotti.