Loyalty Policies in Telecommunications Services Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CRM System in VODAFONE AGENDA

CRM System in VODAFONE AGENDA I. Introduction – Vodafone III. Benefits to Vodafone from CRM a. Company Profile b. Vodafone in India IV. Issues Faced in CRM Implementation c. Market Shares in India a. Program b. People II. Gartner’s Eight Building Blocks c. Processes a. CRM Vision d. Technology b. CRM Strategy c. Valued Customer Experiences V. Consumer Research d. Collaborative Efforts e. CRM Process VI. Best CRM Practices in the Industry f. CRM Information g. CRM Technology h. CRM Metrics I. INTRODUCTION COMPANY PROFILE Name VODAFONE comes from “Voice”, “Data” & “Phone” Largest telecom company in the world (turnover) 2nd largest telecom company in the world (subscriber base) after China Mobile Public limited company Operations in 31 countries & partner networks in another 40 countries Listed on NYSE Founded : 1983 as RACAL TELECOM, Demerged from Racal Electronics (parent company) in 1991 and named VODAFONE HQ : Newbury, England Revenues : US $ 69 bn (2008) Profits : US $ 6.75 bn (2008) Employees : ~ 79,000 Source : WIKINVEST Important Subsidiaries : Vodafone UK Vodafone Spain Vodafone Essar Vodafone Portugal Vodafone Australia Vodafone Turkey Vodafone Ireland Vodafone Germany Vodafone New Zealand Vodafone Netherlands Vodafone Egypt Vodafone Hungary Vodafone Italy Vodafone Sweden VODAFONE IN INDIA 2005 : Acquired a 10 % stake in Bharti Airtel 2007 : Acquired a controlling 67 % stake in Hutchinson Essar for US $ 11.1 bn. Sold back 5.6% of its Airtel stake back to the Mittals & retained 4.4% In September, Hutch was rebranded to Vodafone in India. Source : WIKINVEST MARKET SHARE IN INDIA Others 1% Reliance Airtel 19% 24% Aircel 5% Idea 11% Vodafone 18% Tata 9% BSNL / MTNL 13% Source : TRAI Report JUN’09 VODAFONE’S OFFERINGS Global Managed Enterprise Telecom Device Mobility Central1 Management2 3 4 Portfolio Services Mobile Vodafone Vodafone Vodafone Money Connect to 5 Live6 Mobile7 8 Transfer Connect Friends Vodafone Vodafone At Vodafone Vodafone9 Freedom10 11 12 Passport Home Media Packs Systems Source : vodafone.com II. -

Discussienota Over Stralingsrisico's in De Publieke Ruimte

Discussienota over stralingsrisico’s in de publieke ruimte 1 Inhoudsopgave 1. Samenvatting ........................................................................................................................... - 4 - 2. Advies voor gemeenten ........................................................................................................... - 4 - 3. Inleiding discussienota over stralingsrisico’s in de publieke ruimte ....................................... - 5 - 4. Bespreken introductie 5G in Papendrecht, oproep tot een maatschappelijke discussie ....... - 7 - 5. Wat is het kernvraagstuk? ....................................................................................................... - 8 - 6. Waarom is het belangrijk? ...................................................................................................... - 9 - 7. Waarom moet het nu besproken worden? ........................................................................... - 10 - 8. Om welke politieke keuzes vraagt het kernvraagstuk? ......................................................... - 10 - 9. Welke informatie is nodig voor beeldvorming, oordeelsvorming en besluitvorming? ........ - 10 - 10. Welke eisen willen wij aan het proces stellen? ................................................................. - 10 - 11. Welke financiële aspecten spelen een rol? ....................................................................... - 11 - 12. Big Brother is watching ..................................................................................................... -

Mobile Data Consumption Continues to Grow – a Majority of Operators Now Rewarded with ARPU

Industry analysis #3 2019 Mobile data – first half 2019 Mobile data consumption continues to grow – a majority of operators now rewarded with ARPU Taiwan: Unlimited is so last year – Korea: 5G boosts usage Tefficient’s 24th public analysis on the development and drivers of mobile data ranks 115 operators based on average data usage per SIM, total data traffic and revenue per gigabyte in the first half of 2019. tefficient AB www.tefficient.com 5 September 2019 1 The data usage per SIM grew for all; everybody climbed our Christmas tree. More than half of the operators could turn that data usage growth into ARPU growth – for the first time a majority is in green. Read on to see who delivered on “more for more” – and who didn’t. Speaking of which, we take a closer look at the development of one of the unlimited powerhouses – Taiwan. Are people getting tired of mobile data? We also provide insight into South Korea – the world’s leading 5G market. Just how much effect did 5G have on the data usage? tefficient AB www.tefficient.com 5 September 2019 2 Fifteen operators now above 10 GB per SIM per month Figure 1 shows the average mobile data usage for 115 reporting or reported1 mobile operators globally with values for the first half of 2019 or for the full year of 2018. DNA, FI 3, AT Zain, KW Elisa, FI LMT, LV Taiwan Mobile, TW 1) FarEasTone, TW 1) Zain, BH Zain, SA Chunghwa, TW 1) *Telia, FI Jio, IN Nova, IS **Maxis, MY Tele2, LV 3, DK Celcom, MY **Digi, MY **LG Uplus, KR 1) Telenor, SE Zain, JO 3, SE Telia, DK China Unicom, CN (handset) Bite, -

Zero-Rating Practices in Broadband Markets

Zero-rating practices in broadband markets Report by Competition EUROPEAN COMMISSION Directorate-General for Competition E-mail: [email protected] European Commission B-1049 Brussels [Cataloguenumber] Zero-rating practices in broadband markets Final report February 2017 Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). LEGAL NOTICE The information and views set out in this report are those of the author(s) and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein. Les informations et opinions exprimées dans ce rapport sont ceux de(s) l'auteur(s) et ne reflètent pas nécessairement l'opinion officielle de la Commission. La Commission ne garantit pas l’exactitude des informations comprises dans ce rapport. La Commission, ainsi que toute personne agissant pour le compte de celle-ci, ne saurait en aucun cas être tenue responsable de l’utilisation des informations contenues dans ce rapport. More information on the European Union is available on the Internet (http://www.europa.eu). Luxembourg: Publications Office of the European Union, 2017 Catalogue number: KD-02-17-687-EN-N ISBN 978-92-79-69466-0 doi: 10.2763/002126 © European Union, 2017 Reproduction is authorised provided the source is acknowledged. -

Lists of Current Accreditations for Operators (Networks)

Rich Communications Services Interoperability and Testing / Accreditation Lists of current accreditations for Operators (networks) Lists of current accreditations for Operators (networks) Accreditation List of services/service # Company name Network brand name Country Accreditation level Accreditation status type clusters UP-Framework, UP- Approved (valid until 1 Evolve Cellular Inc. Evolve Cellular USA Provisional Messaging, UP- Universal Profile 1.0 4.12.2018) EnrichedCalling China Mobile Communication UP-Framework, UP- Approved (valid until 2 China Mobile China Provisional Universal Profile 1.0 Co. Ltd. Messaging 25.02.2019) UP-Framework, UP- Universal Profile Approved (valid until 3 Vodafone Group Vodafone-Spain Spain Provisional Messaging, UP- Transition – Phase 1 20.12.2018) EnrichedCalling UP-Framework, UP- Universal Profile Approved (valid until 4 Vodafone Group Vodafone-Deutschland Germany Provisional Messaging, UP- Transition – Phase 1 20.12.2018) EnrichedCalling UP-Framework, UP- Vodafone Albania Sh. Universal Profile Approved (valid until 5 Vodafone Group Albania Provisional Messaging, UP- A Transition – Phase 1 20.12.2018) EnrichedCalling 29 January 2018 Rich Communications Services Interoperability and Testing / Accreditation Lists of current accreditations for Operators (networks) Accreditation List of services/service # Company name Network brand name Country Accreditation level Accreditation status type clusters UP-Framework, UP- Vodafone Czech Czech Universal Profile Approved (valid until 6 Vodafone Group Provisional -

Proposta De Um Novo Sistema De Serviço Com Vista À Melhoria Da Experiência Do Cliente Em Loja De Operadora De Telecomunicações

Proposta de um novo sistema de serviço com vista à melhoria da experiência do cliente em loja de operadora de telecomunicações O caso da Vodafone Bernardo da Silva Vieira Bagorro de Matos Dissertação para obtenção do Grau de Mestre em Engenharia e Gestão Industrial Orientadores: Prof. Carlos Manuel Pinho Lucas de Freitas Prof. João Carlos da Cruz Lourenço Júri Presidente: Prof. Carlos António Bana e Costa Orientador: Prof. João Carlos da Cruz Lourenço Vogal: Prof. António Miguel Areis Dias Amaral Novembro 2019 i Agradecimentos É difícil mencionar em apenas duas dimensões quem contribuiu para que eu me encontrasse onde estou, prestes a tornar-me engenheiro. Em primeiro lugar, ao meu Pai Fernando, pelos seus conselhos nas horas chave e por me ter permitido escolher o caminho que me pareceu o correto, proporcionando-me estabilidade emocional e ensinando- me que nunca nada é o fim do mundo. Ao irmão Manel, irmã Maria do Mar, mãe Susana, queridos avós e Adelaide, que acompanharam de perto este percurso e que me ajudaram a tornar no que sou hoje. É impossível mencionar tudo o que ainda hoje fazem por mim, e por isso vos estou tão grato. Ao restante clã Vieira, que me faz sentir abençoado por pertencer a esta família. À Inês, que através da sua lente testemunhou o processo de A a Z, irradiando apoio incondicional desde antes eu sequer ter começado a escrever este documento. A todos os meus amigos, a família que se escolhe, e que sem a qual muito dificilmente estaria tão satisfeito com as memórias que levo do meu percurso académico. -

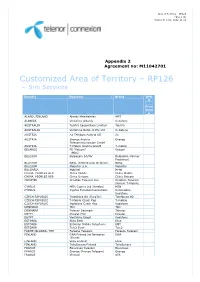

Customized Area of Territory – RP126 – Sim Services

Area of Territory – RP126 Page 1 (3) Version D rel01, 2012-11-21 Appendix 2 Agreement no: M11042701 Customized Area of Territory – RP126 – Sim Services Country Operator Brand GPR S Price Grou p ALAND, FINLAND Alands Mobiltelefon AMT ALBANIA Vodafone Albania Vodafone AUSTRALIA Telstra Corporation Limited Telstra AUSTRALIA Vodafone Network Pty Ltd Vodafone AUSTRIA A1 Telekom Austria AG A1 AUSTRIA Orange Austria Orange Telecommunication GmbH AUSTRIA T-Mobile Austria GmbH T-mobile BELARUS FE “Velcom” Velcom (MDC) BELGIUM Belgacom SA/NV Belgacom (former Proximus) BELGIUM BASE (KPN Orange Belgium) BASE BELGIUM Mobistar S.A. Mobistar BULGARIA Mobiltel M-tel CHINA, PEOPLES REP. China Mobile China Mobile CHINA, PEOPLES REP. China Unicom China Unicom CROATIA Croatian Telecom Inc. Croatian Telecom (former T-Mobile) CYPRUS MTN Cyprus Ltd (Areeba) MTN CYPRUS Cyprus Telecommunications Cytamobile- Vodafone CZECH REPUBLIC Telefónica O2 (EuroTel) Telefónica O2 CZECH REPUBLIC T-Mobile Czech Rep T-mobile CZECH REPUBLIC Vodafone Czech Rep Vodafone DENMARK TDC TDC DENMARK Telenor Denmark Telenor EGYPT Etisalat Misr Etisalat EGYPT Vodafone Egypt Vodafone ESTONIA Elisa Eesti Elisa ESTONIA Estonian Mobile Telephone EMT ESTONIA Tele2 Eesti Tele2 FAROE ISLANDS, THE Faroese Telecom Faroese Telecom FINLAND DNA Finland (fd Networks DNA (Finnet) FINLAND Elisa Finland Elisa FINLAND TeliaSonera Finland TeliaSonera FRANCE Bouygues Telecom Bouygues FRANCE Orange (France Telecom) Orange FRANCE Vivendi SFR Area of Territory – RP126 Page 2 (3) Version D rel01, 2012-11-21 GERMANY E-Plus Mobilfunk E-plus GERMANY Telefonica O2 Germany O2 GERMANY Telekom Deutschland GmbH Telekom (former T-mobile) Deutschland GERMANY Vodafone D2 Vodafone GREECE Vodafone Greece (Panafon) Vodafone GREECE Wind Hellas Wind Telecommunications HUNGARY Pannon GSM Távközlési Pannon HUNGARY Vodafone Hungary Ltd. -

United States Securities and Exchange Commission Form

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F អ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2006 OR អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 1-13758 PORTUGAL TELECOM, SGPS S.A. (Exact name of Registrant as specified in its charter) The Portuguese Republic (Jurisdiction of incorporation or organization) Av. Fontes Pereira de Melo, 40, 1069-300 Lisboa Codex, Portugal (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares, each representing one ordinary share, nominal value A0.03 per share ........ New York Stock Exchange Ordinary shares, nominal value A0.03 each ........... New York Stock Exchange* * Not for trading but only in connection with the registration of American Depositary Shares. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Ordinary shares, nominal value A0.03 per share ........................................ 1,128,856,000 Class A shares, nominal value A0.03 per share ........................................ -

Roaming Rates.Xlsx

ROAMING RATES IN LSL Main TAP Back Country Organisation Code Local Call Home SMS GPRS Price/min Price/min Originated Price/MB Albania ALBEM Eagle Mobile Sh.a. 4.77 27.66 2.28 11.91 Angola AGOUT Unitel 6.22 41.46 2.76 17.97 Anguilla AIACW Cable & Wireless, Anguilla 22.11 36.62 4.15 12.74 Antigua and Barbuda ATGCW Cable & Wireless, Antigua 22.11 36.62 4.15 12.74 Argentina ARGTM Telefonica M�viles Argentina S.A. 8.29 38.69 4.15 13.87 Armenia ARM05 K Telecom CJSC 4.35 26.12 3.45 9.76 Australia AUSTA Telstra 8.93 45.27 5.10 32.64 Bahrain BHRBT Bahrain Telecommunications Co. 11.42 46.28 5.80 18.80 Bahrain BHRST VIVA Bahrain 11.75 49.58 6.61 22.56 Barbados BRBCW Cable & Wireless (Barbados) Limited 22.11 36.62 4.15 12.74 Belgium BELKO KPN GROUP BELGIUM NV/SA 9.77 47.91 2.38 19.23 Belgium BELMO Mobistar S.A. 17.25 46.83 4.12 33.36 Belgium BELTB Belgacom SA/NV 14.37 54.61 4.12 19.23 Bolivia BOLTE Telefonica Celular De Bolivia S.A 8.43 17.96 3.45 7.22 Botswana BWAGA Mascom Wireless 4.40 4.88 3.15 3.14 Botswana BWAVC Orange (Botswana) PTY Limited 3.93 6.29 3.15 13.50 Botswana BWABC beMOBILE BOTSWANA 5.33 14.95 3.81 21.19 Brazil BRACS TIM CELULAR SA (BRACS) 10.78 41.32 4.15 16.56 Brazil BRARN TIM CELULAR SA (BRARN) 10.78 41.32 4.15 16.56 Brazil BRASP TIM CELULAR SA (BRASP) 10.78 41.32 4.15 16.56 Brazil BRATC Vivo MG 9.81 39.11 3.59 16.98 Brazil BRAV1 VIVO (BRAV1) 9.81 39.11 3.59 16.98 Brazil BRAV2 VIVO (BRAV2) 9.81 39.11 3.59 16.98 Brazil BRAV3 VIVO (BRAV3) 9.81 39.11 3.59 16.98 British Virgin Isl VGBCW CABLE & WIRELESS (BVI) 22.11 36.62 4.15 12.74 Bulgaria BGR01 Mobiltel EAD 9.58 47.91 4.79 17.46 Burkina Faso BFATL Telecel Faso 5.84 13.99 2.91 n/a Cambodia KHMGM Camgsm Company Ltd. -

United States Securities and Exchange Commission Form

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F អ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 OR អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR អ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 1-13758 PORTUGAL TELECOM, SGPS, S.A. (Exact name of Registrant as specified in its charter) The Portuguese Republic (Jurisdiction of incorporation or organization) Av. Fontes Pereira de Melo, 40, 1069-300 Lisboa Codex, Portugal (Address of principal executive offices) Nuno Prego, Investor Relations Director, Tel. +351 21 500 1701 Av. Fontes Pereira de Melo, 40, 1069-300 Lisboa Codex, Portugal (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares, each representing one ordinary New York Stock Exchange share, nominal value A0.03 per share .................. Ordinary shares, nominal value A0.03 each ............... New York Stock Exchange* * Not for trading but only in connection with the registration of American Depositary Shares. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. -

Indirect Tax Update

Indirect tax update Edition 21/2020 – 11 June 2020 Court of Justice of the European Union – Vodafone Portugal - Judgment Summary Whether payments received on termination of a contract during a ‘tie-in’ period Welcome to this week’s Indirect Tax Update. were liable to VAT or outside the scope as compensation The Court of Justice has issued its Vodafone Portugal (Vodafone) is the Portuguese subsidiary of the well known judgment in the case of Vodafone telecommunications business. It supplies telecommunication services including mobile Portugal (Vodafone). The case concerns networks, broadband services etc. Under its business model, it enters into contracts with whether VAT is due on amounts customers for the provision of services and will often provide those services at a ‘special’ or received by Vodafone from customers discounted price provided that the customer agrees to be ‘tied-in’ to the contract for a that have terminated their contracts early specified period of time. In some cases, however, a customer will terminate the contract and before the end of the so-called ‘tie- before the end of the tie-in period. In such circumstances, Vodafone will make a charge to the in” period. customer. This charge is calculated in accordance with Portuguese law and cannot exceed the cost to the supplier of making the service available to the customer. The amount received Vodafone had accounted for VAT on the may not necessarily equate to the amount that would have been paid by the customer had income but then lodged an appeal to the the contract not been terminated. The Portuguese law also stipulates that, in light of the right Portuguese courts arguing that the of the supplier to recover some of its costs in this way, the levying of payments by way of amount it received from the customer damages or compensation shall be prohibited. -

NOS: Introducing Pay Per View

Marketing Plan NOS: introducing Pay Per View Pedro Azeredo Pereira Master of Science in Marketing Thesis Supervisor Professor Susana Marques, ISCTE Business School, Marketing, Operations and General Management Department October 2016 Marketing Plan NOS: Introducing Pay Per View Acknowledgements My first thanks goes to my mother because all of this would not be possible without her support, love and pressure to have the project concluded. Her advices have been very important for my life and this time it wasn’t different. In second place, I would like to thank to Professor Susana Marques for your availability, readiness and patience to supervise my thesis, guindance and great advices, and the opportunity to have your name associated to my project. Without you this would not be possible. I also want to thank to NOS Comunicações for the internship. It was a year full of challenges, achievements and results that gave me the experience and information need to develop this project. Another thank goes to my family that, during these years, always supported and adviced me to get where I am now. You are the best family anyone can have and thank you for being so present, woried and united. Also thank you Rita Sousa for dealing with all my stress to get this concluded and for the support, motivation and advices you give me in every situation. I Marketing Plan NOS: Introducing Pay Per View Abstract NOS, NOS Comunicações S.A., is a private telecommunications company of the portuguese market which is proud of being the “best communications and entertainment company in the market”.