2014 Half-Year Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mise En Page 1

WorldReginfo - 8abd55dc-f279-4f41-ad6a-48394863a352 WorldReginfo - 8abd55dc-f279-4f41-ad6a-48394863a352 TABLE OF CONTENTS CHAPTER 1 Kering in 2017 3 CHAPTER 2 Our activities 15 CHAPTER 3 Sustainability 57 CHAPTER 4 Report on corporate governance 139 CHAPTER 5 Financial information 201 CHAPTER 6 Risk management procedures and vigilance plan 363 CHAPTER 7 Additional information 377 This is a free translation into English of the 2017 Reference Document issued in French and is provided solely for the convenience of the English speaking users. WorldReginfo - 8abd55dc-f279-4f41-ad6a-48394863a352 2017 Reference Document ~ Kering 1 WorldReginfo - 8abd55dc-f279-4f41-ad6a-48394863a352 2 Kering ~ 2017 Reference Document CHAPter 1 Kering in 2017 1. History 4 2. Key consolidated figures 6 3. Group strategy 8 4. Kering Group simplified organisational chart as of December 31, 2017 13 WorldReginfo - 8abd55dc-f279-4f41-ad6a-48394863a352 2017 Reference Document ~ Kering 3 1 KERING IN 2017 ~ HISTORY 1. History Kering has continuously transformed itself since its inception 1999 in 1963, guided by an entrepreneurial spirit and a commitment • Acquisition of a 42% stake in Gucci Group NV, marking to constantly seek out growth and create value. the Group’s entry into the Luxury Goods sector. Founded by François Pinault as a lumber and building • First steps towards the creation of a multi- brand Luxury materials business, the Kering group repositioned itself on Goods group, with the acquisition by Gucci Group of the retail market in the 1990s and soon became one of Yves Saint Laurent, YSL Beauté and Sergio Rossi. the leading European players in the sector. -

The Bourse De Commerce: New Site for the Pinault Collection

The Bourse de Commerce: new site for the Pinault Collection Bourse de Conference, May 23, 2018 Commerce Collection Pinault — Paris Annexes Table of contents p.01 From the Halle au Blé to the Bourse de Commerce Pierre-Antoine Gatier p.03 — History of the Pinault Collection — The Pinault Collection in numbers since 2006 p.05 — Palazzo Grassi and Punta della Dogana: Exhibition history — Exhibitions of the Collection outside Venice Biographies p.07 François Pinault p.08 François-Henri Pinault p.09 Jean-Jacques Aillagon p.10 Martin Bethenod Sophie Hovanessian p.11 Daniel Sancho The architectural team p.12 Tadao Ando Architect & Associates (TAAA) Pierre-Antoine Gatier Agency p.13 NeM / Niney et Marca Architectes Setec bâtiment p.14 General contractor Bouygues Construction p.15 Advisory panel From the Halle au Blé to the Bourse de Commerce Pierre-Antoine Gatier, architect in chief of French National Heritage A remarkable historic monument, the Bourse de Commerce embodies four centuries of architectural innovation and technical prowess. It brings together the first freestanding column in Paris, erected during the sixteenth century, with vestiges of a circular Halle au Blé (grain market) built during the eighteenth-century and located at the heart of Paris’s most impor- tant housing development at the time. The site was adapted into a Bourse de Commerce (stock market) in 1889. Because of the exceptional nature of this building, it was soon attributed landmark status: the Medici column in 1862, the entirety of the Bourse in 1975, and the dome in 1986—an indication of the significance of the site. -

Religion and Nationalism in Chinese Societies

RELIGION AND SOCIETY IN ASIA Kuo (ed.) Kuo Religion and Nationalism in Chinese Societies Edited by Cheng-tian Kuo Religion and Nationalism in Chinese Societies Religion and Nationalism in Chinese Societies Religion and Society in Asia The Religion and Society in Asia series presents state-of-the-art cross-disciplinary academic research on colonial, postcolonial and contemporary entanglements between the socio-political and the religious, including the politics of religion, throughout Asian societies. It thus explores how tenets of faith, ritual practices and religious authorities directly and indirectly impact on local moral geographies, identity politics, political parties, civil society organizations, economic interests, and the law. It brings into view how tenets of faith, ritual practices and religious authorities are in turn configured according to socio-political, economic as well as security interests. The series provides brand new comparative material on how notions of self and other as well as justice and the commonweal have been predicated upon ‘the religious’ in Asia since the colonial/imperialist period until today. Series Editors Martin Ramstedt, Max Planck Institute for Social Anthropology, Halle Stefania Travagnin, University of Groningen Religion and Nationalism in Chinese Societies Edited by Cheng-tian Kuo Amsterdam University Press This book is sponsored by the 2017 Chiang Ching-kuo Foundation for International Scholarly Exchange (Taiwan; SP002-D-16) and co-sponsored by the International Institute of Asian Studies (the Netherlands). Cover illustration: Chairman Mao Memorial Hall in Beijing © Cheng-tian Kuo Cover design: Coördesign, Leiden Typesetting: Crius Group, Hulshout Amsterdam University Press English-language titles are distributed in the US and Canada by the University of Chicago Press. -

FRENCH BUSINESS CLIMATE PLEDGE 39 Major French Companies Take Concrete Action to Combat Climate Change

FRENCH BUSINESS CLIMATE PLEDGE 39 major French companies take concrete action to combat climate change Paris, November 26, 2015 – In the lead-up to the Paris climate summit (COP 21), 39 major French companies, employing a total of 4.4 million people worldwide and generating sales of 1,200 billion euros, have made a firm commitment to combat climate change. By signing this climate pledge, they want to contribute to making COP 21 a success and to limiting the warming of the Earth to 2°C. They emphasize their driving role and leadership in the fight for a more sustainable world. Active since many years, these companies are taking concrete steps to reduce their carbon footprint through: − The use of active and passive energy efficiency solutions, − The use of renewable energy, notably hydro, wind or solar energy, − The systematic reduction of greenhouse gas emissions throughout the life cycle of their products, − The development of new low-carbon materials and solutions, − The reduction of food waste and packaging, − The adoption of long-term investment strategies actively promoting the energy transition. From 2016 to 2020, the 39 companies plan to invest at least 45 billion euros in industrial projects and R&D devoted to renewable energy, energy efficiency and other low carbon technologies. Over the same period, they also intend to provide bank and bond financing of at least 80 billion euros for projects contributing to the fight against climate change. In addition, they foresee low carbon investments of 15 billion euros in new nuclear capacities and investments of 30 billion euros in natural gas as energy transition solution, planned over the next five years. -

Journal Officiel De La République Française

o Quarante-troisième année. – N 68 B ISSN 0298-2978 Lundi 6 et mardi 7 avril 2009 BODACCBULLETIN OFFICIEL DES ANNONCES CIVILES ET COMMERCIALES ANNEXÉ AU JOURNAL OFFICIEL DE LA RÉPUBLIQUE FRANÇAISE Standard......................................... 01-40-58-75-00 DIRECTION DES JOURNAUX OFFICIELS Annonces....................................... 01-40-58-77-56 Renseignements documentaires 01-40-58-79-79 26, rue Desaix, 75727 PARIS CEDEX 15 Abonnements................................. 01-40-58-79-20 www.journal-officiel.gouv.fr (8h30à 12h30) Télécopie........................................ 01-40-58-77-57 BODACC “B” Modifications diverses - Radiations Avis aux lecteurs Les autres catégories d’insertions sont publiées dans deux autres éditions séparées selon la répartition suivante Ventes et cessions .......................................... Créations d’établissements ............................ @ Procédures collectives .................................... ! BODACC “A” Procédures de rétablissement personnel .... Avis relatifs aux successions ......................... * Avis de dépôt des comptes des sociétés .... BODACC “C” Avis aux annonceurs Toute insertion incomplète, non conforme aux textes en vigueur ou bien illisible sera rejetée Banque de données BODACC servie par les sociétés : Altares-D&B, EDD, Experian, Optima on Line, Groupe Sévigné-Payelle, Questel, Tessi Informatique, Jurismedia, Pouey International, Scores et Décisions, Les Echos, Creditsafe, Coface services et Cartegie. Conformément à l’article 4 de l’arrêté du 17 mai 1984 relatif à la constitution et à la commercialisation d’une banque de données télématique des informations contenues dans le BODACC, le droit d’accès prévu par la loi no 78-17 du 6 janvier 1978 s’exerce auprès de la Direction des Journaux officiels. Le numéro : 2,50 € Abonnement. − Un an (arrêté du 21 novembre 2008 publié au Journal officiel du 27 novembre 2008) : France : 386,20 €. -

Biodiversity Benchmark Survey Guide Provides Pragmatic Guidance to Help Companies Complete the Survey

Quick Navigation: Biodiversity Benchmark (Beta) Survey Guide BM-P Overview | BM-1 Business Integration | BM-2 Transparency | For support contact: [email protected] BM-3 Materiality | BM-4 Implementation | BM-5 Monitoring and Textile Exchange © 2020 | Page 1 of 75 Evaluation | BM-6 Reporting Version 1 Copyright Textile Exchange December 2020 Acknowledgements The Biodiversity Benchmark and following guidance have been developed by Textile Exchange in partnership with The Biodiversity Consultancy and Dr. Helen Crowley (advisor to Conservation International), during her sabbatical from The Kering Group, and in consultation with Textile Exchange’s Biodiversity Advisory Group. Made possible by the generous support of Sappi Ltd. Quick Navigation: Biodiversity Benchmark (Beta) Survey Guide BM-P Overview | BM-1 Business Integration | BM-2 Transparency | For support contact: [email protected] BM-3 Materiality | BM-4 Implementation | BM-5 Monitoring and Textile Exchange © 2020 | Page 2 of 75 Evaluation | BM-6 Reporting Contents Glossary ............................................................................................................................................................4 Why Biodiversity, Why Now? ............................................................................................................................6 Part I: The Biodiversity Benchmark ..................................................................................................................9 The Biodiversity Benchmark (Beta Version)...................................................................................................10 -

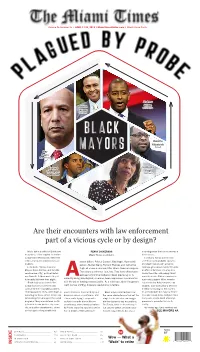

Are Their Encounters with Law Enforcement Part of a Vicious Cycle

Volume 96 Number 35 | APRIL 17-23, 2019 | MiamiTimesOnline.com | Ninety-Three Cents Andrew Gillum Patrick Tallahassee Cannon Charlotte Kwame Kilpatrick Detroit Ray Nagin New Orleans Richard Catherine Thompson Pugh Baltimore Mount Vernon Are their encounters with law enforcement part of a vicious cycle or by design? This is but a shortlist of Black pow- PENNY DICKERSON mounting probe that some say was a er symbols, either toppled or shaken Miami Times Contributor direct cause. during their meteoric rise, white they In January, Florida Commission tried to transform underserved com- ndrew Gillum, Patrick Cannon, Ray Nagin, Kwame Kil- on Ethics found probable cause to munities. patrick, Marion Barry, Richard Thomas and Catherine investigate Gillum, who allegedly In the book, “African-American received gifts valued over $100 while Pugh all share a common title: Black American mayors. Mayors: Race, Politics, and the Afri- in office in the form of a stay at a They share a common fate, too. They have either been can-American City,” political histori- Costa Rica Villa, a Broadway ticket accused of criminal behavior; been previously or is ans David R. Colburn and Jeffrey S. and a boat ride. Ethics commission currently being investigated; or worse, been imprisoned in connection Adler aptly illustrate their plight: A advocate Elizabeth Miller recently “Black mayors assumed office with the job of leading a municipality. At a minimum, when the govern- requested that Administrative Law during economic downturns and ment comes sniffing, it leaves reputations in tatters. Judge E. Gary Early delay a decision confronted the intractable problems in Gillum’s hearing for five months of decaying inner cities, white flight, a power structures dominated by local Black mayors demonstrate how to accommodate the mayor’s former dwindling tax base, violent crime, and business owners or politicians. -

Asian Cultural Objects in Europe. Art Market Expansion and the Illicit Trafficking of Cultural Heritage: an Outline of Legal Issues

JULIA Stepnowska ASIAN cultural OBJECTS IN Europe. Art MARKET expansion AND THE ILLICIT TRAFFICKING OF cultural heritage: AN OUTLINE OF LEGAL ISSUES Introduction Ever since art has been made, there has been a market for it.1 Although the first entries on the history of the art market begin with Egyptian art dealers shipping goods to Crete,2 the 21st century hub of the art world moves further east. Mainland China and Hong Kong have become vibrant art market centres.3 In the face of the growing visibility of those markets and erratic geopolitical times, the issue of Asian art objects found nowadays in Europe is a wide-ranging and promi- nent concern. The aim of this study is to bring attention to the co-relation between the development of the Asian art market along with its visibility in the West and the illicit trafficking of Asian cultural goods paradoxically fostering the improvement of preventive measures. Since the Asian art market is not homogenous, the following study focuses primarily on the context of transactions between Mainland China, Hong Kong, and the Member States of the European Union.4 As the most recurring objects in the context of illicit export and trade of Asian cultural goods are antiques, this study brings forward cases of such practices. Before exploring the case of East- ern heritage in the West, an overview of the actors on the Asian art market needs to be brought forward, since the institutional importance of cultural entities influences the status of cultural objects, both in the country of origin and abroad. -

As of January 21, 2014 Select List of Delegates Boao Forum for Asia Annual Conference 2014 State/Government Leaders Ministers/Se

As of January 21, 2014 Select List of Delegates Boao Forum for Asia Annual Conference 2014 State/Government Leaders 1. FUKUDA Yasuo, Former Prime Minister, Japan 2. ZENG Peiyan, Former Vice Premier, China 3. GOH Chok Tong, Emeritus Senior Minister, Republic of Singapore 4. Jean-Pierre RAFFARIN, Former Prime Minister, France 5. Fidel V. RAMOS, Former President, the Philippines 6. Bob HAWKE, Former Prime Minister of Australia 7. Sergey TERECHSHENKO, Former Prime Minister of Kazakhstan 8. HAN Duck-Soo, Chairman, KITA; Former Prime Minister, Republic of Korea 9. Fransisco PINTO BALSEMAO, Former Prime Minister, Portugal 10. Enrique BARON CRESPO, Former President, European Parliament Ministers/Senior Officials 1. C Y LEUNG, Chief Executive, Hong Kong Special Administrative Region 2. LI Zhaoxing, Former Minister of Foreign Affairs, China 3. ZHAO Qizheng, Former Minister, Information Office, State Council 4. Bill OWENS, Vice Chairman of the New York Stock Exchange (NYSE) for Asia; Chairman of AEA Investors ASIA 5. HUANG Qifan, Mayor, Chongqing 6. XIE Fuzhan, Governor, Henan Province 7. Barbara Hackman FRANKLIN, Former US Secretary of Commerce 8. LONG Yongtu, Former Vice Minister, MOFTEC 9. JIANG Sixian, Member of the Board, Boao Forum for Asia 10. ZHU Mingyang, Mayor, Yangzhou International/Regional Organizations 1. Timothy Perry SHRIVER, Chairman, Special Olympics 2. Axel van TROTSENBURG, Vice President, the World Bank Group 3. Stephen GROFF, Vice President, Asian Development Bank www.boaoforum.org Page 1 / 5 4. ZHOU Wenzhong, Secretary General, Boao Forum for Asia 5. Jusuf WANANDI, Co-Chair, PECC 6. Justin Lin Yifu, Former Senior VP/Chief Economist, World Bank Group 7. YANG Wenchang, President, Chinese People’s Institute of Foreign Affairs 8. -

Insight Issue5 Finally

June 2019 “This month’s cover artwork is from an oil on canvas painting by Samoan artists Malu and Lealofi Siaopo from the Leulumoega School of Fine Arts in the Congregational Christian Church, Samoa - a member church of CWM, . Titled ‘Tsunami’, the painting seeks to portray the agony and suffering of the devastating earthquake and tsunami that claimed nearly 200 lives in September 2009. The two faces were used by the artists to symbolise the vulnerability and helplessness experienced by not just Samoans, but also Pacific Islanders in general. According to a May 2019 report by the European Commission, the Pacific is one of the most disaster-prone regions in the world in terms of the recurrence, severity and scope of natural disasters, with high exposure to cyclones, earthquakes, tsunamis, floods, tidal surges, landslides, droughts, forest fires and volcanic eruptions, in addition to epidemics.” June 2019 2 CONTENTS 3 DEVOTIONAL 5 Foreword 6 Subverting Empire’s Claims To Say What Love Looks Like 9 Subverting Empire’s Claim That Borders Are Sacrosanct, That Migration Is A Crime 11 The Promise Of An Abundant Life 14 AT A GLANCE 18 VIEWPOINTS 19 Empire: How And Where Are We Being Subversive? 23 Healing Relationships: Hope For A New Spirituality 25 My PIM Journey 27 Reflections On ‘2019 Easter Sunday In Sri Lanka’ 29 Religious Diversity, Political Conflict, And The Spirituality Of Liberation 34 The Landing 35 In Conversation With... 37 TAKE A LOOK 38 Book Review 40 SEEN & HEARD 44 YOUR SAY 46 Behind The Scenes: Resistance Rites And Indigenous -

Press Kit Henri Cartier-Bresson. Le Grand Jeu 22/03/2020 – 10/01/2021 New Opening Dates: 11/07/2020 – 20/03/2021 Palazzo Grassi

PRESS KIT HENRI CARTIER-BRESSON. LE GRAND JEU 22/03/2020 – 10/01/2021 NEW OPENING DATES: 11/07/2020 – 20/03/2021 PALAZZO GRASSI 1 The exhibition 2 Excerpts from the catalogue 3 List of works 4 The exhibition catalogue 5 Biography of Henri Cartier-Bresson 6 Biography of the curators a Matthieu Humery b Sylvie Aubenas c Javier Cercas d Annie Leibovitz e François Pinault f Wim Wenders PRESS CONTACTS [email protected] France and international Italy and correspondents Claudine Colin Communication PCM Studio 3, rue de Turbigo Via Farini 70 75001 Paris 20159 Milan Tel : +33 (0) 1 42 72 60 01 Tel: +39 02 3676 9480 Dimitri Besse [email protected] [email protected] Federica Farci Thomas Lozinski Cell: +39 342 0515787 [email protected] [email protected] www.claudinecolin.com www.paolamanfredi.com HENRI CARTIER-BRESSON. LE GRAND JEU 1 THE EXHIBITION Palazzo Grassi presents ‘Henri Cartier-Bresson. Le Grand Jeu’, co-organised with the Bibliothèque nationale de France and in collaboration with the Fondation Henri Cartier-Bresson. The exhibition is a unique project based on the Master Collection created in 1973 by Cartier-Bresson at the re- quest of his art collector friends Dominique and John de Menil, for which the photographer care- fully selected the 385 best images from his contact sheets. Six sets of this extraordinary collec- tion of the photographer’s work were printed and are conserved at the Victoria & Albert Museum in London, the University of Fine Arts in Osaka, the Bibliothèque nationale de France, the Menil Collection in Houston as well as at the Pinault Collection and at the Fondation Henri Cartier-Bresson. -

Press Kit Palazzo Grassi Punta Della Dogana Teatrino

PRESS KIT PALAZZO GRASSI PUNTA DELLA DOGANA TEATRINO 1 Biography of François Pinault 2 Biography of Bruno Racine 3 Pinault Collection 4 A few figures 5 Chronology of the exhibitions of Pinault Collection 6 Teatrino di Palazzo Grassi 7 Educational services and public programmes 8 Membership Card 9 Palazzo Grassi online 10 General information PRESS CONTACTS [email protected] France and international Italy and correspondents Claudine Colin Communication PCM Studio 3, rue de Turbigo Via Farini 70 75001 Paris 20159 Milan Tel : +33 (0) 1 42 72 60 01 Tel: +39 02 3676 9480 Dimitri Besse [email protected] [email protected] Paola C. Manfredi Thomas Lozinski Cell: +39 335 545 5539 [email protected] [email protected] www.claudinecolin.com www.paolamanfredi.com 1 BIOGRAPHY OF FRANÇOIS PINAULT François Pinault was born on August 21, 1936, in Champs-Géraux in Brittany. He established his first wood business in Rennes in 1963. Subsequently, he widened the scope of his activities and in 1988 the group went public on the French stock market. François Pinault decided to refocus the group’s activities on specialised sales before entering the luxury-goods sector worldwide in 1999, when he acquired the Gucci Group (Gucci, Saint Laurent, Bottega Veneta, Boucheron…). In 2003, François Pinault entrusted the group to his son François-Henri Pinault who turned it into a world leader in the luxury goods sector. In 2013 the group is renamed Kering. In 1992, François Pinault created Artémis, a private company entirely owned by the Pinault fami- ly. Artémis owns the auction house Christie’s, the news magazine Le Point, the football club Stade Rennais, the leading cruise ship company Ponant and Artémis Domaine, which includes numerous vineyards in Bordeaux, including Château Latour.