Report & Accounts 2005

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gaseosas Y Bebidas Refrescantes Ismael Díaz Yubero

Alimentos con historia Gaseosas y bebidas refrescantes Ismael Díaz Yubero veces nos com- que no es que lo hiciesen todos plicamos la vida los días pero a veces sí, a llevar buscando tres pies agua en envases, que al no ser al gato, porque es herméticos permitían que se Aevidente que, a poco que se contaminase el agua. Por eso mire, casi todos tienen cuatro. hay referencias de que el rega- Por mucho que nos esforce- liz paliaba los malos sabores, lo mos en inventarnos historias que evitaba tener que prescin- el primer refresco que hubo dir del líquido elemento. no lo inventó nadie, porque El concepto de refresco estuvo sin ninguna duda fue el agua unido durante mucho tiem- y esta existía en todos los luga- po, y todavía lo sigue estando, res de nuestro mundo, mucho al de las aguas carbonatadas, antes de que existiese la huma- que la naturaleza ofrece en di- nidad. versos lugares. Los romanos Lo que se inventó más tarde fue ya conocían fuentes de aguas la sofisticación, aunque tampo- naturalmente carbonatadas y co mucho después, porque es efervescentes, que eran trans- casi seguro que a veces solo se portadas a largas distancias en podía acceder a aguas que te- recipientes sellados para que nían mal sabor y para beberlas, no perdieran la buscada pro- no estaba mal aprovechar algu- piedad. Sólo podían adquirirlas nos de los sabores variadísimos personas muy ricas o las que que están distribuidos por toda vivían cerca de las fuentes, que la naturaleza. Chinos, egipcios, podían disfrutarlas sin ningún griegos, romanos, lapones, ba- costo. -

A Review of Heavy Metal Concentration and Potential Health Implications of Beverages Consumed in Nigeria

toxics Review A Review of Heavy Metal Concentration and Potential Health Implications of Beverages Consumed in Nigeria Sylvester Chibueze Izah *, Iniobong Reuben Inyang, Tariwari C. N. Angaye and Ifeoma Peace Okowa Department of Biological Sciences, Faculty of Science, Niger Delta University, Wilberforce Island, Yenagoa P.M.B. 071, Bayelsa State, Nigeria; [email protected] (I.R.I.); [email protected] (T.C.N.A.); [email protected] (I.P.O.) * Correspondence: [email protected]; Tel.: +234-703-0192-466 Academic Editor: David Bellinger Received: 6 November 2016; Accepted: 18 December 2016; Published: 22 December 2016 Abstract: Beverages are consumed in Nigeria irrespective of age, sex, and socioeconomic status. Beverages may be alcoholic (wine, spirits, and beers) or non-alcoholic (soft drink, energy drinks, candies, chocolates, milks). Notwithstanding, most beverages are packed in cans, bottles, and plastics. This paper reviews the concentration of heavy metals from some commercially-packaged beverages consumed in Nigeria. The study found that heavy metal concentrations, including iron, mercury, tin, antimony, cadmium, zinc, copper, chromium, lead, and manganese, seldom exceed the maximum contaminant level recommended by the Standard Organization of Nigeria (SON) and the World Health Organization (WHO) as applicable to drinking water resources. The occurrence of heavy metals in the beverages could have resulted from the feedstocks and water used in their production. Consumption of beverages high in heavy metal could be toxic and cause adverse effect to human health, depending on the rate of exposure and accumulation dosage. This study concludes by suggesting that heavy metal concentration in the feedstocks and water should be monitored by producers, and its concentration in beverages should also be monitored by appropriate regulatory agencies. -

Cadbury Schweppes Foundation

working better together our corporate and social responsibility report 2004 This is our second Corporate and Social Responsibility (CSR) Report, incorporating for the first time a full Environment, Health and Safety Report. IT COVERS THE PERIOD FROM JANUARY 2002 TO DECEMBER 2003 This report is for all our stakeholders. Shareowners, employees, special interest groups, investment analysts, consumers, customers, suppliers, business partners, governments, members of the communities in which we live and work – we invite you all to take a look at where we are and how we’re doing on our CSR journey. To help each of you find the information you want, we have provided two ways to follow the journey. If you like, you can take the quick route through the main illustrated pages to get the big picture of Cadbury Schweppes and CSR. Along the way, or straightaway, you can get more detailed information on specific issues, policies, key performance indicators and case studies from the booklets inserted in the report. welcome In the following pages we map out our continuing journey in the world of Corporate and Social Responsibility Take a look at our four big challenges; find out why CSR matters to us, what we've achieved and how we’re going about putting it into practice throughout our business. Manufacturing PeterArea Manager Todd Cadbury ANZ content by chapter 1. our commitment the little book of big challenges 2. who we are 3. our value chain 4. what csr means to us our business principles 5. how we make decisions encouraging stakeholder dialogue 6. making it happen key performance indicators 7. -

Exhibit Sales

Exhibit Sales are OPEN! Exhibit at InterBev for access to: • Beverage producers and distributors • Owners and CEOs • Sales/marketing professionals • Packaging and process engineers • Production, distribution and warehousing managers • R&D personnel Specialty Pavilions: • New Beverage Pavilion • Green Pavilion • Organic/Natural Pavilion NEW FOR 2012! “Where the beverage industry does business.” October 16-18, 2012 Owned & Operated by: Sands Expo & Convention Center Las Vegas, Nevada, USA Supported by: www.InterBev.com To learn more, email [email protected] or call 770.618.5884 Soft Drinks Internationa l – July 2012 ConTEnTS 1 news Europe 4 Africa 6 Middle East 8 India 10 The leading English language magazine published in Europe, devoted exclusively to the manufacture, distribution and marketing of soft drinks, fruit juices and bottled water. Asia Pacific 12 Americas 14 Ingredients 16 features Acerola, Baobab And Juices & Juice Drinks 18 Ginseng 28 Waters & Water Plus Drinks 20 Extracts from these plants offer beverage manufacturers the opportunity to enrich Carbonates 22 products in many ways, claims Oliver Sports & Energy 24 Hehn. Adult/Teas 26 Re-design 30 Packaging designed to ‘leave an impres - Packaging sion’ has contributed to impressive 38 growth, according to bottlegreen. Environment 40 People Closure Encounters 30 42 Rather than placing a generic screw top Events 43 onto a container at the very end of the design process, manufacturers need to begin with the closure, writes Peter McGeough. Adding Value To Bottled Water 34 From Silent Salesman 32 In the future, most volume growth in bot - Steve Osborne explores the marketing tled water will come from developing opportunities presented by multi-media markets, so past dynamics are likely to regulars technologies and how these might be continue. -

Bringing the World Moments Of

BRINGING THE WORLD MOMENTS OF ANNUAL REPORT AND FORM 20-F 2001 Contents Page 1 Business Review 2001 1 2 Description of Business 29 3 Operating and Financial Review 39 4 Report of the Directors 59 5 Financial Record 79 6 Financial Statements 87 7 Shareholder Information 141 Glossary 159 Cross reference to Form 20-F 160 Index 162 This is the Annual Report and Form 20-F of Cadbury Schweppes public limited company for the year ended 30 December 2001. It contains the annual report and accounts in accordance with UK generally accepted accounting principles and regulations and, together with the Form 20-F to be filed in April 2002 with the US Securities and Exchange Commission, incorporates the annual report on Form 20-F for the US Securities and Exchange Commission. A Summary Financial Statement for the year ended 30 December 2001 has been sent to all shareholders who have not elected to receive this Annual Report and Form 20-F. The Annual General Meeting will be held on Thursday, 9 May 2002. The Notice of Meeting, details of the business to be transacted and arrangements for the Meeting are contained in the separate Annual General Meeting booklet sent to all shareholders. 1 Business Review 2001 Group Strategy Statement 2 This is Cadbury Schweppes! 4 Corporate and Financial Highlights 6 Moments of Delight – Confectionery 8 1 Chairman’s Statement 10 Moments of Delight – Beverages 12 Chief Executive Officer’s Review 14 A Snapshot of our Industry 20 Chief Operating Officer’s Review 22 Corporate and Social Responsibility 26 Contents Inside Front Cover Glossary 159 Cross reference to Form 20-F 160 Index 162 Annual Report and Form 20-F 2001 Cadbury Schweppes 1 WE ARE passionate ABOUT TO CREATE BRANDS BRANDS THAT BRING THE delight AND A SPLASH 2 Cadbury Schweppes Annual Report and Form 20-F 2001 WORKING TOGETHER THAT PEOPLE love. -

Working Together to Create Brands People Love

working together to create brands people love Fact File 2002/3 our brands Cadbury Sch internationa confectioner loved brands worldwide. H our top sellin hweppes is a major al beverage and ry company, selling much s in over 200 countries Here we show some of ng brands. working together b to create people love brands e Working Together Cadbury Schweppes’ origins go back over 200 a leading brand in the profitable and high growth In the Middle East we sell Cadbury branded years. Jacob Schweppe perfected his process for premium ready-to-drink tea and juice sector of products as well as Bim Bim in Egypt. In Africa we manufacturing mineral water in Geneva in 1783; the beverage market. have operations across the continent, although our John Cadbury first started selling tea and coffee main activity is focused in South Africa where we in 1824 in Birmingham. Cocoa and chocolate, Our Mexico Beverages business, whose major are number one in confectionery as well as owning initially incidental, became Cadbury’s main business brands include the Peñafiel water range and a foods and beverages business, Bromor Foods. within a few years. carbonated soft drinks brands Squirt and Crush, will also join this regional unit from 2004. The two companies – Cadbury and Schweppes – merged in 1969 and since then we have expanded our business worldwide. The acquisition of Dr Pepper/Seven Up in 1995, our biggest step since the merger, transformed our opportunities European in beverages and made the Americas the most profitable region for us. In 2000 we extended americas e our position in this market further through the n bev rages acquisition of Snapple. -

Orangina Schweppes Improves Email Reliability by Migrating from Lotus Domino to Microsoft Exchange

CASE STUDY Orangina Schweppes Improves Email Reliability by Migrating from Lotus Domino to Microsoft Exchange Corporate ”Because we had a complex migration, we appreciated how well the Orangina Schweppes, Neos-SDI, and Binary Tree teams worked Country: Worldwide Industry: Consumer Goods together to ensure everything went smoothly without disruption to more than 2,000 users.” Corporate Profile The Orangina Schweppes Group manages – Fabien Florent, Chief Technical Officer, Orangina Schweppes the marketing, bottling, and distribution of soft drinks in more than 60 countries. Corporate Overview The company has 2,500 employees and is headquartered in Amsterdam. Orangina Schweppes is the number three player in the European soft drinks market. The company markets, Business Situation bottles and distributes a number of soft drinks through Orangina Schweppes wanted to migrate a unique portfolio of leading and iconic brands such as its hosted Lotus Domino messaging Orangina, Schweppes, Oasis, Trina, La Casera, Sunny Delight and Pulco and niche environment to hosted Microsoft Exchange brands such as Champomy, Gini, Vida and Pampryl. The company employs 2,500 2010. The entire process was complicated by a planned move to a new provider for staff. Although Western Europe remains the company’s core market, the company’s outsourced data center services. products are sold in over 60 countries, reaching as far as Eastern Europe, Africa, the Middle East and Asia-Pacific. Solution Orangina Schweppes used Binary Tree’s CMT The Challenge of Migrating Messaging and Data for Exchange for the migration and CMT Centers in Parallel for Coexistence to establish high-fidelity interoperability between Lotus Domino and As part of a corporate decision to use Microsoft platforms, Orangina Schweppes Microsoft Exchange, both during and after wanted to migrate its messaging services from a hosted Lotus Notes 7.5 the migration. -

Tintopia Internationalization Analysis Latin American Market

A WORK PROJECT, PRESENTED AS PART OF THE REQUIREMENTS FOR THE AWARD OF A MASTERS DEGREE IN MANAGEMENT FROM THE NOVA – SCHOOL OF BUSINESS AND ECONOMICS. Tintopia Internationalization Analysis Latin American Market TATIANA HERNÁNDEZ BARANTES 1473 A Project carried out under the supervision of: Emanuel Gomes 1/7/2015 Abstract This project reflects the need to internationalize the Tintopia brand of Navarro López Company, in order to continue fulfilling one of its main pillars, internationalize the company, in order to increase sales and have further diversification of risk. The purpose is to find the best Latin American market for Tinto de Verano. In order to do this, a qualitative analysis of variables for 10 countries in Latin America was performed, yielding the result that the two best options for exporting Tintopia are Peru and Mexico. After a detailed analysis of both countries, Peru has more favorable conditions, especially less competition and higher potential sales. 2 Table of Contents Abstract .............................................................................................................................................. 2 Introduction ........................................................................................................................................ 4 Theoretical background ...................................................................................................................... 5 Methodology ..................................................................................................................................... -

An Evaluation of the Chemical Composition of Soft Drinks in Nigeria: a Principal Component Analysis Approach

Advances in Modelling and Analysis A Vol. 57, No. 1-4, December, 2020, pp. 14-21 Journal homepage: http://iieta.org/journals/ama_a An Evaluation of the Chemical Composition of Soft Drinks in Nigeria: A Principal Component Analysis Approach Samuel Olorunfemi Adams*, Rafiu Olayinka Akano, Rauf Ibrahim Rauf Department of Statistics, University of Abuja, Abuja, Nigeria Corresponding Author Email: [email protected] https://doi.org/10.18280/ama_a.571-403 ABSTRACT Received: 27 August 2020 This study aims to determine the relationship between the chemical compositions of Accepted: 12 October 2020 twenty-five (25) soft drinks sold in Nigeria. Sample concentration of twenty-five (25) soft drinks used in the study was collected from the National Agency for Food and Drug Keywords: Administration and Control (NAFDAC). Principal Component Analysis (PCA) was Carbonated water, colouring, fructose, main employed to explain the relationship between the chemical compositions and determine concentration, soft drink, stabiliser, sucrose the soft drinks' chemical composition distribution. The result has shown that all except acidity and antioxidant has a significantly strong positive relationship among the chemical structures. PCA suggested retaining three components that explained about 82.465 per cent of the data set's total variability. It was observed that carbonated water, fructose, sucrose, main concentration, stabiliser, E412, colouring and gelatin were the major compositions of the soft drinks in Nigeria, Base on the findings in this study, it is recommendations that; Consumers who are allergic to sugar or diabetic should avoid taking any of the soft drinks with high sugar concentration. Soft drinks companies producing drinks with high sugar content should consider their customers who are diabetic and allergic to high sugar levels. -

MSG FDB/Ad 02-002 Yadak Spice

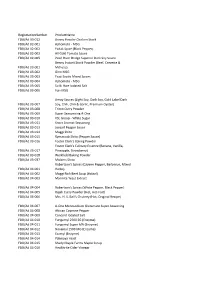

RegistrationNumber ProductName FDB/Ad 00-012 Benny Powder Chicken Stock FDB/Ad 02-001 Ajinomoto - MSG FDB/Ad 02-002 Yadak Spice (Black Pepper) FDB/Ad 02-003 All Gold Tomato Sauce FDB/Ad 02-005 Pearl River Bridge Superior Dark Soy Sauce Benny Instant Stock Powder (Beef, Crevette & FDB/Ad 03-001 Mchuzu) FDB/Ad 03-002 Gino MSG FDB/Ad 03-003 Yaaji Exotic Mixed Spices FDB/Ad 03-004 Ajinomoto - MSG FDB/Ad 03-005 So Bi Hwe Iodated Salt FDB/Ad 03-006 Fun-MSG Amoy Sauces (Light Soy, Dark Soy, Gold Label Dark FDB/Ad 03-007 Soy, Chili, Chili & Garlic, Premium Oyster) FDB/Ad 03-008 Triton Curry Powder FDB/Ad 03-009 Super Seasonoing A-One FDB/Ad 03-010 KSL Group - White Sugar FDB/Ad 03-011 Knorr Aromat Seasoning FDB/Ad 03-013 Joecarl Pepper Sauce FDB/Ad 03-014 Maggi Shito FDB/Ad 03-015 Rymaccob Shito (Pepper Sauce) FDB/Ad 03-016 Foster Clark's Baking Powder Foster Clark's Culinary Essence (Banana, Vanilla, FDB/Ad 03-017 Pineapple, Strawberry) FDB/Ad 03-018 Weikfield Baking Powder FDB/Ad 03-037 Midams Shito Robertson's Spices (Cayene Pepper, Barbecue, Mixed FDB/Ad 04-001 Herbs) FDB/Ad 04-002 Maggi Rich Beef Soup (Halaal) FDB/Ad 04-003 Marmite Yeast Extract FDB/Ad 04-004 Robertson's Spices (White Pepper, Black Pepper) FDB/Ad 04-005 Rajah Curry Powder (Hot, Hot-Fort) FDB/Ad 04-006 Mrs. H. S. Ball's Chutney (Hot, Original Recipe) FDB/Ad 04-007 A-One Monosodium Glutamate Super Seasoning FDB/Ad 04-008 African Cayenne Pepper FDB/Ad 04-009 Concord Iodated Salt FDB/Ad 04-010 Fungamyl 2500 SG (Enzyme) FDB/Ad 04-011 Fungamyl Super MA (Enzyme) FDB/Ad 04-012 Novamyl -

Silvia Isábal Mallén: Historia De Las Fábricas De Bebidas Carbónicas En

HISTORIA DE LAS FÁBRICAS DE BEBIDAS CARBÓNICAS EN LA LITERA SILVIA ISÁBAL MALLÉN RESUMEN La historia de las fábricas de sifones, gaseosas y demás bebidas refrescantes constituye una muestra de la evolución de la vida cotidiana en la España del siglo XX, cuando dichos establecimientos se instalaron por todo el territorio. La Litera no fue ajena a este fenómeno, y a lo largo de su geografía se asentaron varias de estas pequeñas industrias. Este trabajo pretende explicar su historia y analizar su evolución, así como recordar los productos que aquí se elaboraron. PALABRAS CLAVE Sifones, gaseosas, carbónicas, Litera, refrescos RESUM La història de les fàbriques de sifons, gasoses i altres begudes refrescants constitueix una mostra de l’evolució de la vida quotidiana a l’Espanya del segle XX, quan aquests establiments es van instal.lar per tot el territori. La Llitera no va ser aliena a aquest fenomen, i al llarg de la seva geografi a es van establir diverses d’aquestes petites indústries. Aquest treball pretén explicar-ne la història i analitzar-ne l’evolució, així com recordar els productes que s’hi van elaborar. PARAULES CLAU Sifons, gasoses, carbòniques, Llitera, refrescos ABSTRACT The history of factories specialising in soda waters, carbonated beverages and other soft drinks across Spain in the 20th century provides an insight into how daily life was changing. Several of these small businesses were established in La Litera and this paper aims to explain the history of this industry and analyse its development, as well as to recall the drinks it produced. KEYWORDS Soda waters, fi zzy drinks, carbonated beverages, La Litera, soft drinks LITTERA Núm. -

Tanzania Dental Journal Vol. 15 No. 1, May 2008 1 Change in Ph of Nigerian Soft Drinks After Opening

Original Articles Dental Erosion: Immediate pH Changes of Commercial Soft Drinks in Nigeria Bamise CT1, Ogunbodede EO1 1Department of Restorative Dentistry, Faculty of Dentistry, College of Health Sciences at Obafemi Awolowo University, Ile-Ife, Nigeria. Bamise CT, Ogunbodede EO. Dental Erosion: Immediate pH Changes of Commercial Soft Drinks in Nigeria. Tanz Dent J 2008; 15 (1): 1 - 4 Abstract: Aim: To observe the pH changes of commercial soft drinks in the Nigerian market, at different time intervals after opening the can. Material and Methods: Two cola soft drinks, six non-cola soft drinks and two canned or bottled fruit juices were selected based on their popularity. About 250 milliliters of each of the drinks were poured inside a beaker containing the probe of a digital pH meter and the initial pH recorded. The pH readings were then taken at 30 seconds interval for 3 minutes. Results: The pH ranged from 2.74 - 2.76 for cola drinks, 2.68- 4.48 for non-cola drinks and 3.55 - 3.91 for fruit juices. LaCasera®; t0 (on opening) was 2.68, t3 (3 minutes) was 2.72. Seven up®; t0=3.15, t3=3.15. Cocacola®; t0=2.76, t3=2.74. Schweppes®; t0=2.94, t3=2.83. Krest®; t0=4.48, t3=4.54. Pepsicola®; t0=2.74, t3=2.70. Mirinda®; t0=3.04, t3=2.95. Fanta®; t0=3.12, t3=3.01. Fuman®; t0=3.55, t3=3.51. 5-Alive®; t0=3.91, t3=3.91. A tendency to pH increase was observed in LaCasera® and Krest®; no changes observed in Seven up® and 5Alive®; a tendency to decrease in pH was observed in Cocacola®, Schweppes®, Pepsicola®, Mirinda®, Fanta® and Fuman®.