Economic Reform Programme for the Period 2020-2022

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SERBIE G R I E (Plus De 1 100 000 Hab.) O N SZEGED H MAKÓ V

vers BUDAPEST 20° vers BÉKÉSCSABA vers BUDAPEST vers ORADEA 22° 21° vers BUCAREST Capitale d'État SERBIE G R I E (plus de 1 100 000 hab.) O N SZEGED H MAKÓ v. BUDAPEST 19° NADLAC ARAD Plus de 200 000 hab. E PÉCS B Plus de 100 000 hab. ) SÂNNICOLAU MARE Mures U A N Kanjiza A N 46° D U Subotica Novi R LIPOVA Plus de 50 000 hab. D vers CRAIOVA ( nca Knezevac ra A 46° MOHÁCS BAČKA DU NORD K B A N A T r Coka O Plus de 25 000 hab. i B A Č K A v a a ic j Senta t a a D E L ’ O U E S T l D U N O R D Z Plus de 10 000 hab. Bačka Topola Kikinda U BELI MANASTIR Ada (SEVERNI JIMBOLIA vers VARAZDIN Sombor (SEVERNA BAČKA) Autre ville ou localité I I BANAT) I a DRA I g V I Mali Idos TIMISOARA e M E I B I V I e Crvenka ( li I k Nova D i I VOÏVODINE I Pirot Chef-lieu d'okrug (district) R k I Crnja A I a (province autonome) Apatin n Kula s I LUGOS V a I i j A I l I m ) M e i (Z A P A D N A I Becej Novi Becej l T OSIJEK I I I g a I a I I e n A Autoroute a l I I I B k i CRAIOVA B A Č K A) I I I i I I I I Vrbas I I I r I i T ta k k I S s a I I j vers I e n S g Srbobran B A I N A T a A e Route principale I CRUCENI l B Odzaci I BAČKAI DU SUD C R O A T I E GATAIA I Bîrza v a Zitiste N I s i V I u D Temerin ka Backi A Bac m Route secondaire N I C E N T R A L a DETA ( I D Petrovac U I T U B I I N Zabali Boka E I I Secanj VINKOVCI A I I I V Zrenjanin Autre route VUKOVAR I ) Novi Sad I I (SREDNJI BANAT) I I vers ZAGREB I I I I JAMU (JUŽNI BAČKA) I Backa Palanka Plandiste Futog K I MARE Titel a I Voie ferrée n I B a l I o sut Beocin D I u E I 641 vers CRAIOVA n D a -

The PE EPS Environmental Report for 2015

Environmental Protection Electric Power Industry of Serbia 2015 Environmental Report Belgrade, April 2016 PE Electric Power Industry of Serbia Environmental Protection INTRODUCTION .....................................................................................................................................................................................6 1. COAL AND ELECTRICITY PRODUCTION ..................................................................................................................................7 1.1 PE EPS COAL PRODUCTION ...................................................................................................................................................7 1.2 PE EPS ELECTRICITY GENERATION ........................................................................................................................................7 1.3 FUEL CONSUMPTION AND HAZARDOUS AND HARMFUL SUBSTANCES AIR EMISSION FROM PE EPS TPPS ..................................8 1.4 PE EPS WORK INJURIES ......................................................................................................................................................10 1.5 PE EPS HEALTH ..................................................................................................................................................................10 2. KOLUBARA MINING BASIN BRANCH ......................................................................................................................................12 A KOLUBARA MB – OPEN CAST MINES -

Подкласс Exogenia Collin, 1912

Research Article ISSN 2336-9744 (online) | ISSN 2337-0173 (print) The journal is available on line at www.ecol-mne.com Contribution to the knowledge of distribution of Colubrid snakes in Serbia LJILJANA TOMOVIĆ1,2,4*, ALEKSANDAR UROŠEVIĆ2,4, RASTKO AJTIĆ3,4, IMRE KRIZMANIĆ1, ALEKSANDAR SIMOVIĆ4, NENAD LABUS5, DANKO JOVIĆ6, MILIVOJ KRSTIĆ4, SONJA ĐORĐEVIĆ1,4, MARKO ANĐELKOVIĆ2,4, ANA GOLUBOVIĆ1,4 & GEORG DŽUKIĆ2 1 University of Belgrade, Faculty of Biology, Studentski trg 16, 11000 Belgrade, Serbia 2 University of Belgrade, Institute for Biological Research “Siniša Stanković”, Bulevar despota Stefana 142, 11000 Belgrade, Serbia 3 Institute for Nature Conservation of Serbia, Dr Ivana Ribara 91, 11070 Belgrade, Serbia 4 Serbian Herpetological Society “Milutin Radovanović”, Bulevar despota Stefana 142, 11000 Belgrade, Serbia 5 University of Priština, Faculty of Science and Mathematics, Biology Department, Lole Ribara 29, 38220 Kosovska Mitrovica, Serbia 6 Institute for Nature Conservation of Serbia, Vožda Karađorđa 14, 18000 Niš, Serbia *Corresponding author: E-mail: [email protected] Received 28 March 2015 │ Accepted 31 March 2015 │ Published online 6 April 2015. Abstract Detailed distribution pattern of colubrid snakes in Serbia is still inadequately described, despite the long historical study. In this paper, we provide accurate distribution of seven species, with previously published and newly accumulated faunistic records compiled. Comparative analysis of faunas among all Balkan countries showed that Serbian colubrid fauna is among the most distinct (together with faunas of Slovenia and Romania), due to small number of species. Zoogeographic analysis showed high chorotype diversity of Serbian colubrids: seven species belong to six chorotypes. South-eastern Serbia (Pčinja River valley) is characterized by the presence of all colubrid species inhabiting our country, and deserves the highest conservation status at the national level. -

EGEE-III, Regional, and National Grid Infrastructure

Enabling Grids for E-sciencE EGEE-III, Regional, and National Grid Infrastructure Dusan Vudragovic [email protected] Scientific Computing Laboratory Institute of Physics Belgrade, Serbia Nov. 18, 2008 www.eu-egee.org EGEE-III INFSO-RI-222667 EGEE and gLite are registered trademarks AEGIS Enabling Grids for E-sciencE • AEGIS = Academic and Educational Grid Initiative of Serbia • http://www.aegis.rs/ • Founded in April 2005 • Mission: to provide Serbian research and development community with reliable and sustainable grid infrastructure. • Specific goals: . Coordinate efforts o to further develop academic and educational high performance computing facilities o to help integration into AEGIS infrastructure; . Organize dissemination and training activities; . Promote development and deployment of applications on AEGIS infrastructure; . Coordinate fund raising efforts (NIP) to improve AEGIS infrastructure and human resources; . Facilitate wider participation of AEGIS members in FP6, FP7, and other international GRID projects; . Create a national GRID development policy; Lobby for its position within the national research development policy. EGEE-III INFSO-RI-222667 Introduction to Cluster and Grid Computing in Mechanical Engineering 2 AEGIS members Enabling Grids for E-sciencE Coordinating institution: • Faculty of Physics, University of Belgrade • Institute of Physics, Belgrade • Faculty of Technology and Metallurgy, University computer centres: University of Belgrade • AMRES – RCUB - University of Belgrade, • Faculty of Sciences, University -

Toxigenic Fungal and Mycotoxin Contamination of Maize Samples from Different Districts in Serbia

Biotechnology in Animal Husbandry 34 (2), p 239-249, 2018 ISSN 1450-9156 Publisher: Institute for Animal Husbandry, Belgrade-Zemun UDC 632.4:633.15 https://doi.org/10.2298/BAH1802239K TOXIGENIC FUNGAL AND MYCOTOXIN CONTAMINATION OF MAIZE SAMPLES FROM DIFFERENT DISTRICTS IN SERBIA Vesna Krnjaja1, Slavica Stanković2, Miloš Lukić1, Nenad Mićić1, Tanja Petrović3, Zorica Bijelić1, Violeta Mandić1 1Institute for Animal Husbandry, Autoput 16, 11080, Belgrade-Zemun, Serbia 2Maize Research Institute “Zemun Polje“, Slobodana Bajića 1, 11185, Belgrade-Zemun, Serbia 3Institute of Food Technology and Biochemistry, Faculty of Agriculture, University of Belgrade, Nemanjina 6, 11080 Belgrade, Serbia Corresponding author: [email protected] Original scientific paper Abstract: This study was carried out in order to investigate the natural occurrence of toxigenic fungi and levels of zearalenone (ZEA), deoxynivalenol (DON) and aflatoxin B1 (AFB1) in the maize stored immediately after harvesting in 2016 and used for animal feed in Serbia. A total of 22 maize samples were collected from four different districts across the country: City of Belgrade (nine samples), Šumadija (eight samples), Podunavlje (four samples) and Kolubara (one sample). Toxigenic fungi were identified according to the morphological characteristics whereas the mycotoxins contamination were detected using biochemistry enzyme-linked immuno-sorbent (ELISA) assay. The tested samples were mostly infected with Aspergillus, Fusarium and Penicillium spp., except that one sample originated from Kolubara was not contaminated with Aspergillus species. Fusarium graminearum was the most common species in the maize sample from Kolubara district (60%), F. verticillioides in the maize samples from Podunavlje (43.75%) and City of Belgrade (22.4%) districts, and Penicillium spp. -

Emergency Plan of Action (Epoa) Serbia: Floods

P a g e | 1 Emergency Plan of Action (EPoA) Serbia: Floods DREF Operation n° MDRRS014 Glide n°: FF2020-00158-SRB Expected timeframe: 4 months Date of issue: 10 July 2020 Expected end date: 30 November 2020 Category allocated to the of the disaster or crisis: Yellow DREF allocated: CHF 313,953 Total number of people affected: 52,745 Number of people to be 20,256 assisted: Provinces affected: 24 Provinces targeted: 20 Host National Societypresence (n° of volunteers, staff, branches): Red Cross of Serbia (RCS) with 222 volunteers and 83 staff in the branches of Arilje, Blace, Cacak, Despotovac, Doljevac, Gornji Milanovac, Ivanjica, Koceljeva, Kosjeric, Krusevac, Kursumlija, Lucani, Majdanpek, Osecina, Pozega, Prokuplje, Zitoradja, Kraljevo, Ljubovija, Trstenik, Krupanj, Obrenovac, Bajina Basta, Vladimirci. Red Cross Red Crescent Movement partners actively involved in the operation: N/A Other partner organizations actively involved in the operation: Sector for emergency of the Ministry of Interior, members of the Municipal Emergency Response headquarters (municipal emergency services), Serbian Armed Forces, local public companies. A. Situation analysis Description of the disaster For two weeks before the date of the disaster, which occurred on 22-24 June, the Republic of Serbia was affected by heavy rainfalls. The most affected areas are Kolubarski, Moravicki, Raski, Zlatiborski, Rasinski, Toplicki, Jablanicki, and Pomoravski districts. 8 municipalities and cities reported on 22 June that were affected by heavy rain that caused flash floods and floods. It was reported that the municipalities of Osecina, Ljubovija, and Lucani are the most affected by heavy rain (more than 40 litres per square meter in 24 hours) leading to floods in the whole region. -

Chapter 5 Drainage Basin of the Black Sea

165 CHAPTER 5 DRAINAGE BASIN OF THE BLACK SEA This chapter deals with the assessment of transboundary rivers, lakes and groundwa- ters, as well as selected Ramsar Sites and other wetlands of transboundary importance, which are located in the basin of the Black Sea. Assessed transboundary waters in the drainage basin of the Black Sea Transboundary groundwaters Ramsar Sites/wetlands of Basin/sub-basin(s) Recipient Riparian countries Lakes in the basin within the basin transboundary importance Rezovska/Multudere Black Sea BG, TR Danube Black Sea AT, BA, BG, Reservoirs Silurian-Cretaceous (MD, RO, Lower Danube Green Corridor and HR, CZ, DE, Iron Gate I and UA), Q,N1-2,Pg2-3,Cr2 (RO, UA), Delta Wetlands (BG, MD, RO, UA) HU, MD, ME, Iron Gate II, Dobrudja/Dobrogea Neogene- RO, RS, SI, Lake Neusiedl Sarmatian (BG-RO), Dobrudja/ CH, UA Dobrogea Upper Jurassic-Lower Cretaceous (BG-RO), South Western Backa/Dunav aquifer (RS, HR), Northeast Backa/ Danube -Tisza Interfluve or Backa/Danube-Tisza Interfluve aquifer (RS, HU), Podunajska Basin, Zitny Ostrov/Szigetköz, Hanság-Rábca (HU), Komarnanska Vysoka Kryha/Dunántúli – középhegység északi rész (HU) - Lech Danube AT, DE - Inn Danube AT, DE, IT, CH - Morava Danube AT, CZ, SK Floodplains of the Morava- Dyje-Danube Confluence --Dyje Morava AT, CZ - Raab/Rába Danube AT, HU Rába shallow aquifer, Rába porous cold and thermal aquifer, Rába Kőszeg mountain fractured aquifer, Günser Gebirge Umland, Günstal, Hügelland Raab Ost, Hügelland Raab West, Hügelland Rabnitz, Lafnitztal, Pinkatal 1, Pinkatal 2, Raabtal, -

Prostorni Plan Podru^Ja Reis-A Kosova I Metohije

WSEAS TRANSACTIONS on ENVIRONMENT and DEVELOPMENT Slavka Zeković and Tamara Maričić DEVELOPMENT OF NEW ECONOMIC DISTRICTS IN BELGRADE METROPOLITAN AREA Slavka Zeković, PhD, Tamara Maričić, MSc Institute of Architecture and Town & Regional Planning of Serbia, 11000 Belgrade, Bulevar kralja Aleksandra 73/II SERBIA e-mail:[email protected]; www.iaus.org.yu Abstract: Paper discusses new economic districts and spatial structures of the economic activities in metropolitan areas influenced by transitional processes and globalisation. It indicates the impacts of new economic trends and economic districts on creation of metropolitan areas’ spatial organisation. Paper shows mechanisms of the agglomeration of new economic poles and spatial-economic clusters in metropolitan areas. These mechanisms have consequences on economic and spatial changes, on changes of urban, regional and social structures, on environmental degradation, etc. New economic zones in metropolitan areas are result of market pressures, the increase of economic competitiveness and influences of foreign and domestic companies on the territorial capital of those areas and their urban/ spatial structures. There are indications of possible development impacts on creation of new economic districts with the preliminary analyses of Belgrade metropolitan area. Paper concludes that new economic districts – new industrial, commercial, entrepreneurial zones that developed systematically or spontaneously in the suburban areas (along highways) of Belgrade metropolitan area, have a major role in spatial development of economic activities and in the planning of territorial organization of this area. Key words: new economic districts, spatial clusters, business activities, sustainable development, urban policy, urban development 1 Introduction necessary to incorporate European strategic The new economic and social development frameworks, approaches and planning practises policy (based on the Lisbon agenda) founded on [1,2,3,4]. -

The Availability of Data Had to Fields Might Have Been Included, As They Are Part and Parcel of the Sidered, As They Frequently

A SURVE OF BALKAN HOUSES AND FARM BUILDINGS Majda Tharnher INTRODUCTION This study is an analysis of settlement patterns, the construc- tion and form of houses, yards and farm buildings in peasant communities in Yugoslavia, Albania, Bulgaria and Rumania. It might appear more logical to cover the whole of the Balkan Peninsula in which case Greece should have been added and Rumania excluded. How- ever, my main interest is in the Southern Slays of which Greek culture is not a part. Albania, on the other hand, has certain affinities to the culture of Slavic Montenegro., such as in social organization, and the large Albanian element in the population of southwestern Serbia has probably influenced the material culture of that region. In any case the political boundary between Yugoslavia and Albania scarcely reflects the cultural affiliation. The deci- sion to- include Ruania, which cannot be considered a purely Slavic country, rests on historical factors, for Rumania also came under the influence of Turkish rule, sharing the fate of other Balkan countries. The inclusion of Rumania should therefore throw light on the effect of Turkish culture on rural settlements in this region. It was deemed desirable to keep the time factor constant and to choose a period after liberation from Turkish rule and before urban influence had affected rural areas. The availability of data had to be taken into consideration, and, since material on the first half of the 19th century is scarce, most of the research being done with the beginning of the 20th century, the period between 1875 and 1900 was selected. -

Grid Projects and Infrastructures

EGEE Training for Union UniversityEnabling School Grids of for Computing E-sciencE students Institute of Physics Belgrade Grid Projects and Infrastructures Dusan Vudragovic <[email protected]> Scientific Computing Laboratory Institute of Physics Belgrade Serbia nal Gr tio id ca In u it d ia E t i d v n e a o f c i S m e e r d b a i Feb. 19, 2009 c a A www.eu- egee.org A E G I S EGEE-III INFSO-RI-222667 EGEE Training for Union University School of Computing students AEGIS Enabling Grids for E-sciencE • AEGIS = Academic and Educational Grid Initiative of Serbia • http://www.aegis.rs/ • Founded in April 2005 • Mission: to provide Serbian research and development community with reliable and sustainable grid infrastructure. • Specific goals: . Coordinate efforts o to further develop academic and educational high performance computing facilities o to help integration into AEGIS infrastructure; . Organize dissemination and training activities; . Promote development and deployment of applications on AEGIS infrastructure; . Coordinate fund raising efforts (NIP) to improve AEGIS infrastructure and human resources; . Facilitate wider participation of AEGIS members in FP6, FP7, and other international GRID projects; . Create a national GRID development policy; Lobby for its position within the national research development policy. EGEE-III INFSO-RI-222667 EGEE Training for Union University School of Computing students 2 AEGIS Members Enabling Grids for E-sciencE Coordinating institution: • Faculty of Mathematics, University of Belgrade • Institute of -

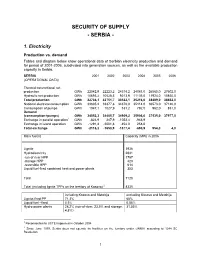

A General Description of the Ongoing Supply-Demand Situation with the Following Indicators Included, Reference Should Be Made

SECURITY OF SUPPLY - SERBIA - 1. Electricity Production vs. demand Tables and diagram below show operational data of Serbian electricity production and demand for period of 2001-2006, subdivided into generation sources, as well as the available production capacity in Serbia. SERBIA 2001 2002 2003 2004 2005 2006 (OPERATIONAL DATA) Thermal conventional net production GWh 22042,9 22223,2 24318,2 24081,0 26565,0 27602,0 Hydraulic net production GWh 10693,2 10528,5 9213,9 11135,0 11924,0 10850,0 Total production GWh 32736,1 32751,7 33532,1 35216,0 38489,0 38452,0 National electrical consumption GWh 33805,2 33377,8 34378,0 35114,0 36573,0 37126,0 Consumption of pumps GWh 1047,1 1027,9 531,2 792,0 962,0 851,0 Demand (consumption+pumps) GWh 34852,3 34405,7 34909,2 35906,0 37535,0 37977,0 Exchange in parallel operation1 GWh -824,9 347,9 -1023,4 -948,9 Exchange in island operation GWh -1291,4 -2001,8 -354,0 258,0 Total exchange GWh -2116,2 -1653,9 -1377,4 -690,9 954,0 4,0 Main fuel(s) Capacity (MW) in 2006 Lignite 3936 Hydroelectricity 2831 -run-of river HPP 1797 -storage HPP 420 -reversible HPP 614 Liquid fuel-fired combined heat and power plants 353 Total 7120 Total (including lignite TPPs on the territory of Kosovo) 2 8335 including Kosovo and Metohija excluding Kosovo and Metohija Lignite-fired PP 71.3% 68% Liquid fuel –fired 0.5% 0.55% Hydro power plants 28.2% (run-of-river: 23.5% and storage: 31.55% 4.8%) 1 Reconnection to UCTE happened in October 2004 2 Since June 1999, Serbia does not operate its facilities on the territory under UNMIK according to 1244 SC Resolution 1 45000,0 40000,0 35000,0 30000,0 25000,0 HPP TPP 20000,0 Exchange Demand 15000,0 10000,0 5000,0 0,0 2001 2002 2003 2004 2005 2006 -5000,0 The Serbian Energy Strategy 2005-2015 envisages the growth rate of electricity consumption from 2.2 % to 1.7 % annually, depending on the economy development scenario, for mentioned period. -

Serbia Exclusive: Bidders for New TPP Kolubara 2 and TENT B3, China Vs Others, Report

Serbia exclusive: Bidders for new TPP Kolubara 2 and TENT B3, China vs others, report The development of electric power system is a key link in the development of the entire electric power system of Serbia and about nine billion EUR should be invested in this area by 2030th, according to the new Energy Development Strategy Draft. It was estimated that the demands for electricity until 2025 would increase by 10.5 percent, and 16.6 percent by 2030th. No power plant was built in Serbia more than twenty years. Electricity production in Serbia meets the domestic market needs, but generally is not sufficient for consumption during average winter, so the electricity must be imported. The potential for the new thermal power plants construction exists, but it is certain that there is not enough money. Investment in the construction of new thermal capacities would be of great importance, as it would solve the problem of kilowatts shortage produced in the country, and at the same time the electricity export would be possible in the Balkan region. To note, coal in Serbia contributes in electricity production even with 64.1 %, hydro energy with 34.5 %, and natural gas with 1.4 %. The situation is such that the country energy stability depends on coal. Coal has a certain future. Provided that it meets all strict measures for the environment protection, the new technologies modernization and introduction, coal will remain the leading energy source, regardless of all “European histories” on renewable energy. Decisions adopted at the recently held Ministerial Council of the Energy Community of Southeast Europe provide an opportunity for the realization of the long-announced investments in the energy sector, such as thermal power plant “Kolubara B” and”Nikola Tesla B3″.