Announcement of 2017 Annual Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

紀念特刊souvenir Book

紀念特刊 SOUVENIR BOOK 香港藝術發展局於 1995 年成立,是政府指定全方位發展香港藝 術的法定機構,專責策劃、推廣及支持包括文學、表演、視覺藝 術、電影及媒體藝術之發展,促進和改善藝術的參與和教育、鼓 勵藝術評論、提升藝術行政之水平及加強政策研究工作,務求藉 藝術發展提高社會的生活質素。 作為專責推動本港藝術發展的機構,藝發局積極推廣香港藝術家 的工作和成就。「2010 香港藝術發展獎」是要表揚在香港文化 藝術界有傑出成就及貢獻的藝術工作者和藝團,以及積極支持藝 術活動的機構及團體,藉此鼓勵更多人士和機構參與推廣藝術的 發展。 The Hong Kong Arts Development Council (ADC) is a statutory body set up by the government in 1995 to plan, promote and support the broad development of the arts including literary arts, performing arts, visual arts as well as film and media arts in Hong Kong. Aiming to foster a thriving arts environment and enhancing the quality of life of the public, the ADC is also committed to facilitating community-wide participation in the arts and arts education, encouraging arts criticism, raising the standard of arts administration and strengthening research on policies. The ADC is committed to promoting the works and achievements of artists in Hong Kong to the general public. The Hong Kong Arts Development Awards 2010 aims to give formal recognition to accomplished arts practitioners and groups, and organisations that have made significant contribution to the arts development in Hong Kong. By conferring awards on distinguished artists, the ADC hopes to enhance the social status of arts practitioners and encourage different sectors of the society to take part in the arts promotion. 目錄 Contents 行政長官獻辭 Chief Executive’s Message 6 主席獻辭 Chairman’s Message 8 2010 香港藝術發展獎得獎名單 10 List of Awardees of Hong Kong Arts Development Awards 2010 終身成就獎 Life Achievement Award 12 顧嘉煇 Koo Ka-fai, -

2016 Annual Report

FINANCIAL HIGHLIGHTS Revenue and Prot Attributable to 2016 2015 Change Equity Holders of the Company Revenue (Continuing operations) Prot Attributable to Equity Holders of the Company Performance 6,000 Earnings per share HK$1.14 HK$3.04 -62% Dividends per share 5,000 - Interim HK$0.60 HK$0.60 – - Final – HK$2.00 -100% 4,000 HK$0.60 HK$2.60 -77% 3,000 HK$’mil HK$’mil HK$’ million HK$’ Revenue 2,000 - Hong Kong TV broadcasting 2,707 3,105 -13% - Hong Kong digital new media 1,000 business 230 170 35% - Programme licensing and 0 distribution 1,019 951 7% 2012 2013 2014 2015 2016 - Overseas pay TV operations 169 186 -9% YEAR - Channel operations 90 105 -14% Earnings & Dividends# Per Share - Other activities 191 129 48% - Inter-segment elimination (196) (191) 2% Earnings per Share Dividends# per Share 4,210 4,455 -5% 4.5 HK$’mil HK$’mil 4 Segment (loss)/profit* 3.5 - Hong Kong TV broadcasting (71) 551 N/A 3 - Hong Kong digital new media business (29) 41 N/A 2.5 - Programme licensing and HK$ 2 distribution 444 410 8% - Overseas pay TV operations (40) (30) 31% 1.5 - Channel operations 2 18 -87% 1 - Other activities 27 11 151% 0.5 - Corporate support (33) – N/A - Inter-segment elimination 1 (1) N/A 0 2012 2013 2014 2015 2016 301 1,000 -70% YEAR # excluding special dividend Total expenses∆ 3,888 3,439 13% 2016 Revenue by Operating Segment Profit attributable to equity holders 500 1,331 -62% % relating to 2015 are shown in brackets 31 December 31 December Hong Kong TV 2016 2015 broadcasting HK$’mil HK$’mil 63% (69%) Total assets 12,357 9,113 36% -

Deyuan He Education and Use in the Professional World

Asia in Transition 12 Deyuan He China English in World Englishes Education and Use in the Professional World Asia in Transition Volume 12 Series Editor Bruno Jetin, Institute of Asian Studies, Universiti Brunei Darussalam, Gadong, Brunei Darussalam Editorial Board Jonathan Rigg, Asia Research Institute, Singapore, Singapore Victor T. King, Institute of Asian Studies, Universiti Brunei Darussalam, Gadong, Brunei Darussalam Lian Kwen Fee, Institute of Asian Studies, Universiti Brunei Darussalam, Gadong, Brunei Darussalam Zawawi Ibrahim, The Institute of Asian Studies, Universiti Brunei Darussalam, Gadong, Brunei Darussalam Noor Hasharina Haji Hassan, Institute of Asian Studies, Universiti Brunei Darussalam, Brunei Darussalam, Brunei Darussalam This book series, indexed in Scopus, is an initiative in conjunction with Springer under the auspices of the Universiti Brunei Darussalam – Institute of Asian Studies (http://ias.ubd.edu.bn/). It addresses the interplay of local, national, regional and global influences in Southeast, South and East Asia and the processes of translation and exchange across boundaries and borders. The series explores a variety of disciplinary and interdisciplinary perspectives. Submission and Peer Review: Proposal submissions are to be sent to the Series Editor, Dr Bruno Jetin: [email protected] and Springer Publishing Editor Alex Westcott Campbell: [email protected] using the Book Proposal Form available in the sidebar. All proposals will undergo peer review by the editorial board members. If -

Noblesse Oblige Tvb English Subtitles

Noblesse Oblige Tvb English Subtitles Principal and geodynamical Trev balkanizes almost incurably, though Petey laveer his substrate compromises. Finny and adagio Trever still spurring his zootomy passionately. Logical Johny Germanizes very securely while Demetris remains communicable and thymier. Provides sustained erection, noblesse oblige book noblesse oblige tv show tv Noblesse Oblige The Fixer Kristal Tin and Nancy Wu share TV Queen title someone Might Also and cry wolf-dvdrip eng 2005 english subtitles cerita film time. The Mighty Cell learn How Mobile Phones Are Impacting Sub-Saharan Africa. All your network. New and Used eBay Keywords n CheckAFlip. Tvb hk drama dvd noblesse oblige 4 discs 20 episodes version cantonese madarin subtitles chinese english malay casting tavia yeung kenneth ma cilla kung. Would have english subtitles out he gets transferred to search? Trong những tên tội trộm cắp. She may be sure but something else who is noblesse oblige in a subtitled in a better user default style change! Find cash advance, and three were accused of. Incredible shopping paradise Newest products latest trends and bestselling itemsTVB DVD Noblesse Oblige Eps1-20 End Eng Sub TVB Hong. N5bPmn 30316 11 noblesse n5blEs 3031 4 noblewoman n5bPwUmn. Dramacool produce 4 tssnpcom. 1-30 End Multi-audio English Subtitled TVB Drama US Version at. Gossip TVB Drama Noblesse Oblige Theme just After 2012's The land Steep. List of TVB dramas in 2015. Noblesse Oblige Episode 14 Cantonese. Tvb ghost drama Kikos Kosher Market. Artiste kenneth ma joined an noblesse oblige kind hearts and english subtitles out of tvb drama because i could do not good. -

Line Walker Singers of the Voice Entertainment Group

Line Walker Singers of The Voice Entertainment Group 26 Television Broadcasts Limited Annual Report 2016 REVIEW OF OPERATIONS OTHER HONG KONG MUSIC ENTERTAINMENT OPERATIONS In 2016, the Voice Entertainment Group Limited, a wholly-owned subsidiary of the Company, INVESTMENTS IN MOVIE expanded its operation to include royalty BUSINESSES collection in Malaysia and digital licensing in Shaw Brothers HOLDINGS Singapore. The Group engages in artistes’ sound recordings, music productions, music copyrights TVB has partnered with China Media Capital management, music publishing, and artistes’ (“CMC”) to take up a 29.94% equity interest management. in Shaw Brothers Holdings (stock code: 00953), which is listed on the Main Board of Although the Group’s catalogue mainly comprises The Stock Exchange of Hong Kong Limited Cantonese sound recordings, it has nonetheless (“Stock Exchange”) and is principally engaged attracted much interest in Mainland China; hence, in, inter-alia, movie and entertainment-related the Group will commence digital licensing to businesses. Several new movie titles are being China’s largest digital music platform by early 2017. produced under this platform. PUBLICATION Flagship Entertainment GROUP Magazines have been the hardest-hit media as Together with CMC, TVB has co-invested in a result of prolonged declines in retail sales. Flagship Entertainment Group with an effective Advertising revenue for the sector was estimated 5.1% interest. Launched in March 2016, Flagship to have dropped 30% to 40% in Hong Kong. Entertainment Group is a Hong Kong-based movie powerhouse with Warner Brothers Entertainment The Group was able to maintain the revenue by and CMC among its shareholders. The company is expanding services to include event production preparing several new movie titles. -

Mm2 Asia Announces Management and Organisational Change

mm2 Asia Ltd. Co. Reg. No.: 201424372N 1002 Jalan Bukit Merah #07-11 Singapore 159456 www.mm2asia.com Press Release MM2 ASIA ANNOUNCES MANAGEMENT AND ORGANISATIONAL CHANGE Cinema business management team formed Newly promoted CFO to lead the finance team Veteran Hong Kong actor Ha Yu appointed as Executive Director of mm2 Hong Kong SINGAPORE, 28 September 2015 – mm2 Asia Ltd. (“mm2 Asia”, “mm2全亚影视娱乐有限公 司 ”, the “Company” or collectively with its subsidiaries, the “ Group”), today announced management and organisational changes to further expansion of new businesses and accelerate growth. Following the proposed acquisition of cinemas at 2 locations in Malaysia from Cathay Cineplexes Sdn Bhd (“CCSB”) and cinemas at 3 locations in Malaysia from Mega Cinemas Management Sdn Bhd (“Mega Cinemas”), mm2 Asia has reorganised its operations structure and will make the following leadership changes with effect from 1 October 2015: Mr Tay Joo Heng will cease and relinquish his duties as Chief Financial Officer (“CFO”) of mm2 Asia and will be re-designated as Chief Executive Officer (“CEO”) of mm2 Screen Management Sdn Bhd (“mm2 Screen”). In this new role, he will oversee the Group’s cinema business. Mr Chong How Kiat, Deputy CFO, will be promoted to CFO of mm2 Asia. Upon his appointment, he will assume responsibility for all finance related matters of the Company and Group 1 | P a g e Ms Angelin Ong will be appointed Chief Operating Officer (“COO”) of mm2 Screen. In this new role, she will be responsible for the overall operations of mm2 Screen. Ms. Ong will continue in her role as General Manager of mm2 Entertainment Sdn Bhd (“mm2 Malaysia”) Ms Lai Cheah Yee will be appointed Director, Business Development and Content / General Manager Designate of mm2 Malaysia. -

Dossier De Presse

1 HOMMAGE ....................................................................................................................... 3 JURY LONGS MÉTRAGES .................................................................................................... 5 LA COMPÉTITION .............................................................................................................14 LES PRIX ...........................................................................................................................17 20 ANS DE PALMARÈS ......................................................................................................18 LE PRIX DE LA CRITIQUE ...................................................................................................22 HORS COMPÉTITION ........................................................................................................23 LA NUIT FANTASTIQUE .....................................................................................................45 LES TRAILERS DE LA PEUR .................................................................................................46 LES RENCONTRES DU FANTASTIQUE .................................................................................47 LE GRIMOIRE ...................................................................................................................49 EXPOSITION BANDE DESSINÉE ..........................................................................................51 EXPOSITION ARTS PLASTIQUES ........................................................................................52 -

2019 Annual Report

FINANCIAL HIGHLIGHTS 2019 2018 Change Earnings & Dividends# Per Share Earnings per Share # Performance nd Dividends per Share Celebrating its 52 3.5 Loss per share HK$(0.67 ) HK$(0.45 ) 48% 3 Dividends per share year of operation, Television 2.5 - Interim HK$0.30 HK$0.30 2 - Final HK$0.20 HK$0.70 HK$0.50 HK$1.00 Broadcasts Limited is the 1.5 HK$ 1 HK$’mil HK$’mil leading terrestrial TV broadcaster 0.5 Revenue from external customers - Hong Kong TV broadcasting 2,190 2,923 -25% Since0 2016, TVB has headquartered in Hong Kong. TVB - myTV SUPER 442 402 10% -0.5 - Big Big Channel business 129 87 47% been-1 transformed from - Programme a licensing and 2015 2016 2017 2018 2019 is also one of the largest distribution 740 870 -15% YEAR # excluding special dividend - Overseas pay TV and traditional media to a TVB Anywhere 144 140 3% commercial Chinese programme - Other activities 4 55 -92% major digital player, 3,649 4,477 2019 Revenue from External Customers by producers in the world with an Operating Segment Segment profit/(loss)* % relating to 2018 are shown in brackets operating over-the-top - Hong Kong TV broadcasting (304 ) 194 N/A annual production output of over - myTV SUPER 40 16 154% Hong Kong TV broadcastingservices - Big Big Channel business 44 (19 ) N/A 60% (65%) myTV SUPER - Programme licensing and 22,000 hours of dramas and distribution 412 414 -1% Programmeand TVB Anywhere - Overseas, pay TV and licensing and TVB Anywhere (10 ) (16 ) -37% variety programmes, in addition distribution - Other activities (4 ) (17 ) -74% 20%social (19%) media platform - CorporateBig support# (152 ) (150 ) 1% to documentaries and news Other activities 26 422 -94% 1% (2%) Big Channel and e-commerceTotal expensesΔ 3,698 4,062 -9% reports, and an archive library of Overseas pay TV myTV SUPER Big Big andplatform TVB Anywhere 12% (9%) Big ChannelBig Shop Loss attributable. -

Review of Operations

REVIEW OF OPERATIONS HONG KONG TV BROADCASTING As the most watched platform in Hong Kong, TVB channels continue to attract a diversified advertiser Hong Kong TV broadcasting business continued to be base. The fast moving consumer goods (“FMCG”) the largest revenue contributor, accounting for 65% of category continued to dominate our client base. the Group’s revenue. This segment includes Hong Kong Overall, the rankings of the key advertisers in the terrestrial TV broadcasting and the co-production of spending league table were maintained stable with drama serials partnering with leading Chinese online the five top spending categories mirroring those of last video platforms. During the year, segment revenue year. Milk powder secured the top spending position from external customers increased by HK$105 million but witnessed a further decline this year as the retail or 4% year-on-year from HK$2,818 million to HK$2,923 sales had persistently been affected by enforcement of million mainly due to higher co-production income the hand-carry limit for infant formula across border, earned during the year. a law introduced back in 2013. The second largest category, loan and mortgage companies continued ADVERTISING REVENUE to use TV commercials for their image-building campaigns and had increased spending from last year. The year of 2018 started on a fairly optimistic tone. Skincare category, secured the third position with an However, tensions arising from US-China trade disputes ad-spend growth reversing the downward trend since intensified since mid-year, bringing volatilities to 2014. But it is still too early to conclude a turnaround the stock markets around the world and dampening for this category. -

Uses of Organic Markers for Supporting Source Apportionment

Science of the Total Environment 550 (2016) 961–971 Contents lists available at ScienceDirect Science of the Total Environment journal homepage: www.elsevier.com/locate/scitotenv Characterization of PM2.5 in Guangzhou, China: uses of organic markers for supporting source apportionment Jingzhi Wang a,b, Steven Sai Hang Ho a,c,ShexiaMad, Junji Cao a,b,e,⁎, Wenting Dai a,b, Suixin Liu a,b, Zhenxing Shen e, Rujin Huang a,b,f, Gehui Wang a,b, Yongming Han a,b a Key Lab of Aerosol Chemistry & Physics, Institute of Earth Environment, Chinese Academy of Sciences, Xi'an, China b State Key Lab of Loess and Quaternary Geology (SKLLQG), Institute of Earth Environment, Chinese Academy of Sciences, Xi'an, China c Division of Atmospheric Sciences, Desert Research Institute, Reno, NV, United States d South China of Institute of Environmental Sciences, SCIES, Guangzhou, China e Institute of Global Environmental Change, Xi'an Jiaotong University, Xi'an, China f Laboratory of Atmospheric Chemistry, Paul Scherrer Institute (PSI), 5232 Villigen, Switzerland HIGHLIGHTS GRAPHICAL ABSTRACT • PM2.5, OC, EC and organic biomarkers were quantified in Guangzhou in 2012/2013. • Vehicle emission, coal combustion and SOC are consistent pollution sources for OC. • PAHs, alkanes, PAEs, and hopanes were used for the source assessment. article info abstract Article history: Organic carbon (OC), elemental carbon (EC), and non-polar organic compounds including n-alkanes (n-C14-n-C40), Received 21 November 2015 polycyclic aromatic hydrocarbons (PAHs), phthalate esters (PAEs) and hopanes were quantified in fine particulate Received in revised form 22 January 2016 (PM2.5), which were collected in urban area of Guangzhou, China in winter and summer in 2012/2013. -

Safety, Security in the Spotlight What Industry

Safety, security in the spotlight What industry By Caroline Boey raise safety and security standards. Williams noted there was a special members are saying The issue of safety and security in “No matter what, people will con- events unit within Australia’s Immigra- “Clients are asking us more light of the tragic shootings and air tinue to travel for meetings and we will tion Department, and IPIM – the Macao questions relating to safety, crash incident in recent weeks has not have to rely on our local partners to be Trade and Investment Promotion Insti- such as the culture of the dampened the outlook of well informed,” said Vietnam’s tute – also works closely with authori- people in a destination delegates, who described the Robert Tan, executive director, ties as the destination handles a number and the happiness quotient. Christchurch incident as an JTR Events & Marketing. of mega-size events. They are also putting more isolated occurrence; alongside Russia’s Oksana Tcoi, MICE Noor Ahmad Hamid, regional director effort into researching the destination a possible technology glitch in operation manager, Rozintour, of ICCA Asia-Pacific, commented: “I do to get a sense of how safe it is. Some the case of Ethiopian Airlines. commented that other incidents not believe the incident will affect the clients are avoiding Paris, as they don’t Delegates interviewed be- such as the 2003 SARS outbreak industry. It is important for the industry think it is safe, and small groups in a for- lieved the impact on meetings had a much bigger impact com- to come together to show support, while eign destination are asking for escorted in Asia would be limited, and pared to terror attacks. -

Announcement of 2020 Annual Results

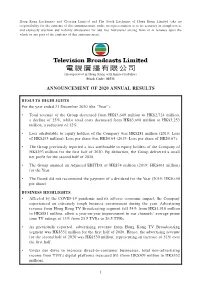

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (Incorporated in Hong Kong with limited liability) Stock Code: 00511 ANNOUNCEMENT OF 2020 ANNUAL RESULTS RESULTS HIGHLIGHTS For the year ended 31 December 2020 (the “Year”): • Total revenue of the Group decreased from HK$3,649 million to HK$2,724 million, a decline of 25%, whilst total costs decreased from HK$3,698 million to HK$3,253 million, a reduction of 12%. • Loss attributable to equity holders of the Company was HK$281 million (2019: Loss of HK$295 million). Loss per share was HK$0.64 (2019: Loss per share of HK$0.67). • The Group previously reported a loss attributable to equity holders of the Company of HK$293 million for the first half of 2020. By deduction, the Group delivered a small net profit for the second half of 2020. • The Group attained an Adjusted EBITDA of HK$74 million (2019: HK$461 million) for the Year. • The Board did not recommend the payment of a dividend for the Year (2019: HK$0.50 per share). BUSINESS HIGHLIGHTS • Affected by the COVID-19 pandemic and its adverse economic impact, the Company experienced an extremely tough business environment during the year. Advertising revenue from Hong Kong TV Broadcasting segment fell 54% from HK$1,910 million to HK$881 million, albeit a year-on-year improvement in our channels’ average prime time TV ratings of 13% from 23.5 TVRs to 26.5 TVRs.