1 the Characteristics of China's Multinationals in the Manufacturing Sector Operating in Indonesia*) Lepi T. Tarmidi, Peter G

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Daftar Perusahaan Yang Menyampaikan Lktp Tahun Buku 2008 ( S/D 18 Mei 2010)

DAFTAR PERUSAHAAN YANG MENYAMPAIKAN LKTP TAHUN BUKU 2008 ( S/D 18 MEI 2010) NO NAMA PERUSAHAAN ALAMAT NO STP LKTP NO TDP 12 3 45 A AND ONE PRECISION Jl. Asoka Lot SD 62 & SD 63, Bintan 1 1866/LKTP-PT/XII/2009 040413201053 ENGINEERING INDONESIA, PT Industrial Estate, Lobam, Bintan Desa Ngerong KM 39, Gempol, 2 A.SCHULMAN PLASTICS, PT 0135/LKTP-PT/V/2009 132613500325 Pasuruan, Jawa Timur Pangkalan I.B. RT.03/RW.03, Desa A.W. FABER CASTELL 3 Bantar Gebang, Bantar Gebang, 1390/LKTP-PT/X/2009 102613600683 INDONESIA, PT. Kabupaten Bekasi Wisma BNI 46, Lt 14, Jl. Jend Sudirman 4 AAPC INDONESIA, PT 0873/LKTP-PT/VIII/2009 090517438893 Kav 1, Jakarta Pusat BII Plaza Tower III Lantai 11, 5 AB SINAR MAS MULTIFINANCE, 1623/LKTP-PT/X/2009 090516533926 Jl.M.H.Thamrin No.51, Jakarta Pusat Gedung Wisma Metropolitan II Lt. 8 dan 6 ABB SAKTI INDUSTRI, PT 9, Jl. Jend. Sudirman Kav. 29-31, karet 2432/LKTP-PT/III/2010 090313151850 Setiabudi, Jakarta Selatan Gedung Wisma Metropolitan II Lt. 8-9, Jl. ABB TRANSMISSION AND 7 Jend. Sudirman Kav. 29-31 Karet 2419/LKTP-PT/II/2010 090313152045 DISTRIBUTION, PT. Setiabudi, Jakarta Selatan Rukan Artha Gading Niaga Blok A No. 32- 8 ABC PRESIDENT INDONESIA, PT 0170/LKTP-PT/V/2009 090111506812 34, Kelapa Gading Barat - Jakarta Utara Ged. Burasa Efek Indonesia, tower II ABN AMRO ASIA SECURITIES 9 lt.10, Jl. Jend. Sudirman Kav 52-53, 1145/LKTP-PT/VIII/2009 09031672466 INDONESIA, PT Jakarta 10 ABN AMRO BANK NV Jl. -

Poland Regional Cities-Comfort-Vehicle-List

Make Model Year Oldsmobile 19 Oldsmobile Alero Oldsmobile Aurora Oldsmobile Bravada Oldsmobile Cutlass Supreme Oldsmobile Intrigue Oldsmobile Silhouette Dodge Attitude Dodge Avenger 2013 Dodge Caliber Dodge Caravan 2015 Dodge Challenger Dodge Charger 2013 Dodge Dakota Dodge Dart 2015 Dodge Durango 2013 Dodge Grand Caravan 2015 Dodge Intrepid Dodge JCUV Dodge Journey 2013 Dodge Magnum 2013 Dodge Neon 2015 Dodge Nitro 2013 Dodge Ram 1500 Dodge Ram 2500 Dodge Ram 3500 Dodge Ram 4500 Dodge Ram 700 Dodge Ram Van 2015 Dodge Sprinter Dodge Stratus 2015 Dodge Stretch Limo Dodge Viper Dodge Vision Dodge i10 Land Rover Defender 2013 Land Rover Discovery 2013 Land Rover Freelander 2013 Land Rover Freelander 2 Land Rover LR2 Land Rover LR3 Land Rover LR4 Land Rover Range Rover 2013 Land Rover Range Rover Evoque 2013 Land Rover Range Rover Sport 2013 Land Rover Range Rover Velar 2013 Land Rover Range Rover Vogue 2013 Chevrolet Agile Chevrolet Astra 2015 Chevrolet Astro Chevrolet Avalanche 2013 Chevrolet Aveo Chevrolet Aveo5 Chevrolet Beat Chevrolet Blazer Chevrolet Bolt Chevrolet CMV Chevrolet Camaro Chevrolet Caprice Chevrolet Captiva 2013 Chevrolet Cavalier Chevrolet Celta Chevrolet Chevy Chevrolet City Express Chevrolet Classic Chevrolet Cobalt 2015 Chevrolet Colorado Chevrolet Corsa Chevrolet Corsa Sedan Chevrolet Corsa Wagon Chevrolet Corvette Chevrolet Corvette ZR1 Chevrolet Cruze 2015 Chevrolet Cruze Sport6 Chevrolet Dmax Chevrolet Enjoy Chevrolet Epica 2013 Chevrolet Equinox 2013 Chevrolet Esteem Chevrolet Evanda 2013 Chevrolet Exclusive Chevrolet -

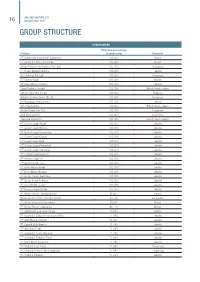

Group Structure

GALLANT VENTURE LTD 16 Annual Report 2019 GROUP STRUCTURE SUBSIDIARIES Effective percentage Entities of ownership Domicile PT Batamindo Investment Cakrawala 100% Batam PT Bintan Inti Industrial Estate 100% Bintan Bintan Resorts International Pte. Ltd. 100% Singapore PT Buana Megawisatama 100% Jakarta BU Holdings Pte Ltd 100% Singapore PT Taman Indah 100% Bintan PT Surya Bangun Pertiwi 100% Jakarta Lagoi Dreams Limited 100% British Virgin Islands Verizon Resorts Limited 100% Malaysia Batamindo Investment (S) Ltd 100% Singapore PT Suakajaya Indowahana 100% Jakarta Win Field Limited 100% British Virgin Islands Bintan Power Pte. Ltd. 100% Singapore Golf View Limited 100% Seychelles Treasure Home Ltd 100% British Virgin Islands PT Gallant Lagoi Abadi 100% Jakarta PT Gallant Lagoi Berjaya 100% Jakarta PT Gallant Lagoi Cemerlang 100% Jakarta PT Gallant Lagoi Damai 100% Jakarta PT Gallant Lagoi Elok 100% Jakarta PT Gallant Lagoi Fenomena 100% Jakarta PT Gallant Lagoi Gemilang 100% Jakarta PT Gallant Lagoi Harmoni 100% Jakarta PT Gallant Lagoi Inti 100% Jakarta PT Gallant Lagoi Jaya 100% Jakarta GV Airport Holdings Pte Ltd 100% Singapore GO Greenhouse Investments Pte Ltd 100% Singapore PT Batam Bintan Telekomunikasi 95% Batam Bintan Resort Ferries Private Limited 90.74% Singapore PT Bintan Resort Cakrawala 86.77% Bintan PT Batamindo Executive Village 77.50% Batam PT Indomobil Sukses Internasional Tbk 71.49% Jakarta PT Auto Euro Indonesia 71.49% Jakarta PT Central Sole Agency 71.49% Jakarta PT IMG Bina Trada 71.49% Jakarta PT Indomobil Trada Nasional -

Daftar Riwayat Hidup

Mr Jusak Kertowidjojo’s Working Experience and Directorships Education : Year Major Name of University 1980 Accounting Parahyangan University, Bandung 1982 Business Administration Parahyangan University, Bandung Work Experience and Directorships : Acting as a member of Board of Directors and/or Board of Commissioners of several companies, as follows: Year Position Name of Corporation 1982 – 1992 Marketing Director PT Indohero Steel Engineering, Co. 1993 – 1998 CEO PT Unicor Prima Motor 1997 – 1999 President Director PT Indomobil Prima Niaga Director PT Master Prima Motorindo 1997 - 2000 President Director PT Indomobil Sumber Baru Director PT Indosentosa Trada 2005 - 2006 President Commissioner PT Wahana Indo Trada Mobilindo 2005 - 2007 Vice President Director II PT Indomobil Sukses Internasional Tbk 2006 - 2007 President Director PT Indomobil Bhupala 2006 - 2011 President Director PT Indobuana Autoraya 2007 - 2011 Vice President Director PT Indomobil Sukses Internasional Tbk Commissioner PT Indosentosa Trada Vice President Director PT Indotruck Utama Vice President PT Indo Traktor Utama Commissioner Commissioner PT Indomobil Trada Nasional Commissioner PT United Indo Surabaya 2008 - 2009 Vice President Director PT Unicor Prima Motor 2009 - 2010 President Director PT Wahana Indo Trada Mobilindo 2009 - 2011 Commissioner PT Auto Euro Indonesia Vice President PT Indomobil Wahana Trada Commissioner 2011 - 2012 President Commissioner PT Indomobil Wahana Trada Since 1999 Vice President Indomobil America, Inc. 1 Year Position Name of Corporation -

Jenis Dan Type Kendaraan Bermotor Roda 4 Produksi Dalam Negeri

DAFTAR ISI Halaman 1. PT. TOYOTA ASTRA MOTOR MANUFACTURING 1 2. PT. HINO MOTOR MANUFACTURING 2 3. PT. HONDA PROSPECT MOTOR 3 4. PT. HYUNDAI INDUSTRI MOTOR 4 5. PT. INDOMOBIL SUZUKI INTERNATIONAL 5 6. PT. K I A INDONESIA MOTOR 6 7. PT. ASTRA NISSAN DIESEL INDONESIA 7 8. PT. DAIMLER CHRYSLER INDONESIA 8 9. PT. PANTJA MOTOR 9 10. PT. ASTRA DAIHATSU MOTOR 10 11. PT. KRAMA YUDHA TIGA BERLIAN 11 12. PT. TJAHJA SAKTI MOTOR 12 13. PT. NISSAN MOTOR INDONESIA 13 14. PT. KORINDO HEAVY INDUSTRY 14 15. PT. UNICOR PRIMA MOTOR 15 Lampiran: Daftar Alamat Perusahaan 1. PT. TOYOTA MOTOR MANUFACTURING INDONESIA NO MEREK KENDARAAN KATEGORI MODEL / TYPE KAPASITAS MESIN TRANSMISI BAHAN BAKAR 1 TOYOTA KIJANG INNOVA Kijang Innova E 2.0 STD M/T Kijang Innova E 2.0 M/T Penumpang Kijang Innova G 2.0 M/T (MPV 4x2) Kijang Innova G 2.0 A/T Kijang Innova G Cruiser 2.0 M/T Kijang Innova G Cruiser 2.0 A/T 1998 cc UNLEADED GASOLINE Kijang Innova V 2.0 M/T Kijang Innova V 2.0 A/T Kijang Innova V X‐tra 2.0 M/T Kijang Innova V X‐tra 2.0 A/T Kijang Innova Lux 2.0 M/T Kijang Innova Lux 2.0 A/T Kijang Innova E 2.5 STD M/T Kijang Innova E 2.5 M/T Kijang Innova G 2.5 M/T Kijang Innova G 2.5 A/T 2494 cc SOLAR Kijang Innova V 2.5 M/T Kijang Innova V 2.5 A/T Kijang Innova V X‐tra 2.5 M/T Kijang Innova V X‐tra 2.5 A/T 2 TOYOTA AVANZA Penumpang Avanza E VVT‐i M/T 1298 cc (MPV 4x2) Avanza G VVT‐i M/T UNLEADED GASOLINE Avanza 1.5 S M/T 1498 cc Avanza 1.5 S A/T 3 TOYOTA FORTUNER Penumpang Fortuner 2.7V 4x4 (SUV 4x4) 2694 cc A/T UNLEADED GASOLINE Penumpang Fortuner 2.7G (SUV 4x2) Fortuner 2.7 G Lux 4 TOYOTA RUSH Penumpang Rush 1.5 G M/T (4x2) Rush 1.5 S 1498 cc UNLEADED GASOLINE Rush 1.5 S A/T 5 TOYOTA DYNA Niaga Dyna 110 ST (4x2) 4009 cc M/T SOLAR Dyna 110 ET 4009 cc M/T SOLAR Dyna 130 LT 4009 cc M/T SOLAR Dyna 130 HT 4009 cc M/T SOLAR 1 2. -

Building Values Building

PURSUING INTEGRATION BUILDING VALUES GALLANT VENTURE LTD ANNUAL REPORT 2015 Gallant Venture Ltd 991A Alexandra Road #02-06/07 Singapore 119969 Tel: (65) 6389 3535 Fax: (65) 6396 7758 www.gallantventure.com TABLE OF CONTENTS 01 OUR PROFILE 03 OUR PRESENCE 04 OUR CORE BUSINESSES • AUTOMOTIVE • PROPERTY DEVELOPMENT • INDUSTRIAL PARKS • UTILITIES • RESORT OPERATIONS 14 LETTER TO SHAREHOLDERS 16 BUSINESS REVIEW 20 FINANCIAL REVIEW 22 GROUP STRUCTURE 24 FINANCIAL HIGHLIGHTS 25 BOARD OF DIRECTORS 28 KEY EXECUTIVES 29 CORPORATE INFORMATION 30 STATEMENT OF CORPORATE GOVERNANCE 45 DIRECTORS’ STATEMENT 49 INDEPENDENT AUDITOR’S REPORT 50 STATEMENTS OF FINANCIAL POSITION 51 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 52 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 53 CONSOLIDATED STATEMENT OF CASH FLOWS 55 NOTES TO THE FINANCIAL STATEMENTS 159 STATISTICS OF SHAREHOLDINGS 161 NOTICE OF ANNUAL GENERAL MEETING PROXY FORM ANNUAL REPORT 2015 GALLANT VENTURE LTD 01 OUR PROFILE Gallant Venture Ltd is an Indonesia focused investment holding company headquartered in Singapore. We are an integrated automotive group with coverage across Indonesia and master planner for industrial parks and resorts in Batam and Bintan. Since our establishment in the 1990s, we have been an important innovator in four key business segments – utilities, industrial parks, resort operations and property development. Our businesses are well-positioned to leverage on the strategic proximity of Singapore and the strategic alliance between the Singapore and Indonesia governments. Our landmark development projects include the Batamindo Industrial Park, the Bintan Industrial Estate and Bintan Resorts, with more prime developments in the pipeline slated for completion in the near future. 02 GALLANT VENTURE LTD ANNUAL REPORT 2015 SINGAPORE BATAM Batamindo Industrial Park ANNUAL REPORT 2015 GALLANT VENTURE LTD 03 OUR PRESENCE GALLANT VENTURE LTD is headquartered in Singapore which aims to maximise shareholders’ value. -

B. Program Studi S1 Pendidikan Teknik Otomotif (S1 Pto)

B. PROGRAM STUDI S1 PENDIDIKAN TEKNIK OTOMOTIF (S1 PTO) 1. Visi, Misi, Tujuan, Area Okupasi, dan Kompetensi Lulusan 1.1 Visi Terwujudnya Program Studi Pendidikan Teknik Otomotif sebagai pusat keunggulan nasio- nal dalam penyelenggaraan pendidikan tenaga kependidikan Teknik otomotif, dan pusat pengembangan serta penerapan ilmu dan teknologi teknik otomotif. 1.2 Misi (1) Menyelenggarakan pendidikan tenaga kependidikan kejuruan teknik otomotif yang unggul; (2) Menyelenggarakan penelitian dan pengembangan ilmu dan teknologi di bidang pendidikan teknik otomotif; dan (3) Memberikan bantuan kepada masyarakat dalam mengembangkan dan meningkatkan kualitas penyelenggaraan pendidikan kejuruan teknik otomotif. 1.3 Tujuan Menghasilkan lulusan sarjana (S1) pendidikan teknik otomotif yang memiliki kompetensi dan kewenangan sebagai guru teknik otomotif pada sekolah menengah kejuruan atau instruktur teknik otomotif pada lembaga kejuruan teknik/industri, dan perancang Program Pelatihan dalam bidang pendidikan dan teknik otomotif. 1.4 Area Okupasi PROGRAM STUDI PENDIDIKAN TEKNIK OTOMOTIF PROFIL LULUSAN: a. Guru pada Sekolah Menengah Kejuruan di bidang Teknik Otomotif. b. Instruktur Diklat pada Lembaga Pendidikan Kejuruan Otomotif. c. Instruktur Diklat pada pusat-pusat Pendidikan dan Latihan di Industri bidang Otomotif. d. Perancang Program Pelatihan dalam bidang pendidikan dan teknik otomotif. SIKAP a. Bertakwa kepada Tuhan Yang Maha Esa dan mampu menunjukkan sikap religius. b. Menjunjung tinggi nilai kemanusiaan dalam menjalankan tugas berdasarkan agama, moral, dan etika. c. Menginternalisasi nilai, norma, dan etika akademik. d. Berperan sebagai warga negara yang bangga dan cinta tanah air, memiliki nasionalisme serta rasa tanggungjawab pada negara dan bangsa. e. Menghargai keanekaragaman budaya, pandangan, agama, dan kepercayaan, serta pendapat atau temuan orisinal orang lain. f. Berkontribusi dalam peningkatan mutu kehidupan bermasyarakat, berbangsa, bernegara, dan kemajuan peradaban berdasarkan pancasila. -

Group Structure

GALLANT VENTURE LTD 16 Annual Report 2017 GROUP STRUCTURE SUBSIDIARIES Effective percentage Entities of ownership Domicile PT Batamindo Investment Cakrawala 100.00% Batam PT Bintan Inti Industrial Estate 100.00% Bintan Bintan Resorts International Pte. Ltd. 100.00% Singapore PT Buana Megawisatama 100.00% Jakarta BU Holdings Pte Ltd 100.00% Singapore PT Taman Indah 100.00% Bintan PT Surya Bangun Pertiwi 100.00% Jakarta Lagoi Dreams Limited 100.00% British Virgin Islands Verizon Resorts Limited 100.00% Malaysia Batamindo Investment (S) Ltd 100.00% Singapore PT Suakajaya Indowahana 100.00% Jakarta Win Field Limited 100.00% British Virgin Islands Bintan Power Pte. Ltd. 100.00% Singapore Golf View Limited 100.00% Seychelles Treasure Home Ltd 100.00% British Virgin Islands PT Gallant Lagoi Abadi 100.00% Jakarta PT Gallant Lagoi Berjaya 100.00% Jakarta PT Gallant Lagoi Cemerlang 100.00% Jakarta PT Gallant Lagoi Damai 100.00% Jakarta PT Gallant Lagoi Elok 100.00% Jakarta PT Gallant Lagoi Fenomena 100.00% Jakarta PT Gallant Lagoi Gemilang 100.00% Jakarta PT Gallant Lagoi Harmoni 100.00% Jakarta PT Gallant Lagoi Inti 100.00% Jakarta PT Gallant Lagoi Jaya 100.00% Jakarta PT Bumi Bintan Abadi 100.00% Jakarta PT Bumi Bintan Berjaya 100.00% Jakarta PT Bintan Damai Sejahtera 100.00% Jakarta PT Bintan Indah Perkasa 100.00% Jakarta PT Citra Bintan Lestari 100.00% Jakarta PT Nuansa Indah Bintan 100.00% Jakarta PT Batam Bintan Telekomunikasi 95.00% Batam Bintan Resort Ferries Private Limited 90.74% Singapore PT Bintan Aviation Investments 90.00% Bintan -

PT Indomobil Sukses Internasional Tbk. Dan Anak Perusahaan/And Subsidiaries

PT Indomobil Sukses Internasional Tbk. dan anak perusahaan/and subsidiaries Laporan keuangan konsolidasi untuk sembilan bulan yang berakhir pada tanggal-tanggal 30 September 2010 dan 2009 (Tidak diaudit)/ Consolidated financial statements nine months ended September 30, 2010 and 2009 (Unaudited) The original consolidated financial statements included herein are in Indonesian language. PT INDOMOBIL SUKSES INTERNASIONAL Tbk. PT INDOMOBIL SUKSES INTERNASIONAL Tbk. DAN ANAK PERUSAHAAN AND SUBSIDIARIES LAPORAN KEUANGAN KONSOLIDASI CONSOLIDATED FINANCIAL STATEMENTS SEMBILAN BULAN YANG BERAKHIR PADA NINE MONTHS ENDED TANGGAL-TANGGAL 30 SEPTEMBER 2010 DAN 2009 SEPTEMBER 30, 2010 AND 2009 Daftar Isi Table of Contents Halaman/ Page Neraca Konsolidasi …………………………………… 1-4 ………………………....Consolidated Balance Sheets Laporan Laba Rugi Konsolidasi …………………….. 5-6 ………………… Consolidated Statements of Income Laporan Perubahan Ekuitas Konsolidasi ………….. 7 ……. Consolidated Statements of Changes in Equity Laporan Arus Kas Konsolidasi ……………………… 8-9 …………….Consolidated Statements of Cash Flows Catatan atas Laporan Keuangan Konsolidasi …….. 10-169 ……Notes to the Consolidated Financial Statements *************************** The original consolidated financial statements included herein are in Indonesian language. PT INDOMOBIL SUKSES INTERNASIONAL Tbk. PT INDOMOBIL SUKSES INTERNASIONAL Tbk. DAN ANAK PERUSAHAAN AND SUBSIDIARIES NERACA KONSOLIDASI CONSOLIDATED BALANCE SHEETS 30 September 2010 dan 2009 September 30, 2010 and 2009 (Disajikan dalam Rupiah, kecuali dinyatakan -

ACCELERATING to the TOP Indomobil Laporan Tahunan 2010 Daftar Isi Table of Contents

PT. IND MOBIL SUKSES INTERNASIONAL Tbk. PT. PT. INDOMOBIL SUKSES INTERNASIONAL Tbk. Annual Report 2010 Annual Report 2010 www.indomobil.com ACCELERATING TO THE TOP Indomobil Laporan Tahunan 2010 Daftar Isi Table of Contents 05. Visi dan Misi 05. Vision and Mission 06. Budaya Kerja Perseroan 06. Corporate Culture 08. Profil Perseroan 08. Company Profile 08. A. Sejarah Singkat Perseroan 08. A. Company In Brief 10. B. Anak-Anak Perusahaan 10. B. Subsidiary Companies 14. C. Informasi Harga Saham 14. C. Stock Price Information 16. D. Lembaga Penunjang Pasar Modal 16. D. Capital Market Supporting Institution 17. E. Struktur Organisasi 17. E. Organization Chart 18. F. Riwayat Singkat Anggota Dewan Komisaris 18. F. Commissioners 20. G. Riwayat Singkat Anggota Direksi 20. G. Directors 24. Pernyataan dan Tanda Tangan 24. Certification & Signatures of the Komisaris dan Direksi Commissioners and Directors 26. Laporan Komisaris Utama 26. Report from the President Commissioner 28. Tata Kelola Perusahaan 28. Good Corporate Governance 34. Laporan Direksi 34. Report from the Directors 34. A. Laporan Direktur Utama 34. A. Report from the President Director 38. B. Analisis Perseroan 38. B. Corporate Analysis 44. C. Peristiwa Penting 44. C. Major Events 50. Penghargaan 50. Award 52. Tanggung Jawab Sosial Perusahaan 52. Corporate Social Responsibility 54. Rencana Kerja Perseroan 2011 54. Corporate Business Plan 2011 56. Laporan Komite Audit 56. Audit Committee’s Report 60. Laporan Auditor Independen 60. Independent Auditor’s Report Direktori Perseroan Company Directory 3 Indomobil Laporan Tahunan 2010 4 Indomobil Laporan Tahunan 2010 Visi dan Misi Vision and Mission Visi Vision Menjadi perusahaan otomotif terhandal dan terpercaya di dalam negeri. -

Integrated Automotive Distribution Platform with a Wide Range of Products and Services

GALLANT VENTURE LTD. Corporate Presentation November 2013 Disclaimer This document is prepared by Gallant Venture Ltd. (“GV” or the “Company”). This document is being presented to you solely for your information and may not be reproduced, redistributed or passed on, directly or indirectly, to any other person (including journalists) or published, in whole or in part, for any purpose. By accepting this document, you agree to keep secret and absolutely confidential the document itself and the information contained herein. This document does not constitute a prospectus, information memorandum or other offering document (an “Offering Document”) in whole or in part. This document does not constitute an offer or invitation to subscribe for or purchase any securities, in the United States, Canada, Japan or otherwise, and nothing contained herein shall form the basis of any contract or commitment whatsoever. This document and the information contained herein is a summary only and has not been audited or independently verified. No representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, reliability, completeness or correctness of the information or opinions contained herein. The information contained in this document may not contain all of the information you may consider material. It is not the intention to provide, and you may not rely on this document as providing, a complete or comprehensive description of the Company's financial or trading position or prospects. The information contained in these materials is provided as at the date of the presentation, should be considered in the context of the circumstances prevailing at the time and has not been, and will not be, updated to reflect material developments which may occur after the date of the presentation. -

Automotive Industrie in ASEAN Region

Eberspächer Exhaust Technology ASEAN Strategy DRIVING THE MOBILITY OF TOMORROW prepared by Babak Niazi © Eberspächer ASEAN Member Countries © Eberspächer Production Forecast Top Ten Countries Global Rank Country Production Vol. Rank Country Production Vol. in 2014 in Mio. in 2020 in Mio. 1 China 23.72 1 China 31.48 2 USA 11.66 2 USA 13.56 3 Japan 9.77 3 Japan 11.84 4 Germany 5.90 4 Germany 6,57 5 Korea 4.52 5 ASEAN 6.08 6 ASEAN 4.47 6 India 5,21 7 India 3.36 7 Korea 5.50 8 Mexico 3.36 8 Mexico 4,92 9 Brazil 3.14 9 Brazil 3.98 10 Spain/Portugal 2.38 10 Spain/Portugal 3,19 ASEAN is currently the 6th largest region, likely to become the 5th largest region! © Eberspächer Automotive industrie in ASEAN region Indonesia, Thailand and Malaysia are the key markets in the ASEAN region, accounting for 90% of the market. Production Volumes has been increased to 200% since 2009 -0,1 % YTD +13,4 % YTD +5,5 % YTD +27,1 % +5,0 % YTD YTD © Eberspächer Japanese players dominate the passenger cars market in Thailand and Indonesia; Local OEMs makes account for 60% in Malaysia ASEAN Automotive Market: Key Players © Eberspächer ASEAN countries however, are not very homogenous. Among top 5 markets, Indonesia is the largest and fastest growing economy • All countries are likely to grow at a CAGR of 6-9% in the next 5 years with the exception of Indonesia at 16%. • Growth in population is averagely staying between 1-2% • Indonesia is predicted to be the fastest growing country in next 5 years with increase GDP per capita are likely to be more than 13% © Eberspächer Key Highlights of 2014 Growth in ASEAN, decline in Thailand • Top 5 ASEAN markets reached 3,5 Million units of total industry volume • Thailand remained the largest market however, saw a steep decline of 8% • Indonesia continued to grow inching closer to ist no.