Business Acquisition Section 67: Notice Seeking Authorisation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

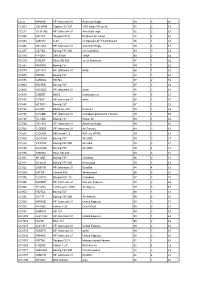

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

Qantas Data Book 2013 Disclaimer

The Transformation Continues QANTAS DATA BOOK 2013 DISCLAIMER The information contained in this investor Data Book is intended to be a general summary of Qantas Airways Limited (Qantas) and its subsidiaries and related bodies corporate (Qantas Group) and their activities as at 16 September 2013 or otherwise as at the date specified in the relevant information and does not purport to be complete in any respect. The information in this document is not advice about shares in Qantas (or any other financial product), nor is it intended to influence, or be relied upon by, any person in making a decision in relation to Qantas shares (or any other financial product). The information in this Data Book does not take into account the objectives, financial situation or needs of any particular individual. Accordingly, you should consider your own objectives, financial situation and needs when considering the information in this document and seek independent investment, legal, tax, accounting or such other advice as you consider appropriate before making any financial or investment decisions. No responsibility is accepted by Qantas or any of its directors, officers, employees, agents or affiliates, nor any other person, for any of the information contained in this document or for any action taken by you on the basis of the information or opinions expressed in this document. The information in this document contains historic information about the performance of Qantas and Qantas securities. That information is historic only, and is not an indication or representation about the future performance of Qantas or Qantas securities (or any other financial product). -

2004/05 Half Year Results ASX Report

QANTAS AIRWAYS LIMITED AND CONTROLLED ENTITIES FINANCIAL REPORT FOR THE HALF-YEAR ENDED 31 DECEMBER 2004 ABN 16 009 661 901 ASX CODE: QAN QANTAS AIRWAYS LIMITED FINANCIAL REPORT ABN 16 009 661 901 HALF-YEAR ENDED 31 DECEMBER 2004 TABLE OF CONTENTS ASX Appendix 4D Results for Announcement to the Market 1 Other Information 2 Directors' Report 3 Financial Report Consolidated Statement of Financial Performance 5 Consolidated Statement of Financial Position 6 Consolidated Statement of Cash Flows 7 Notes to the Financial Statements Basis of Preparation of Half-Year Financial Report 8 Retained Profits 8 Dividends 8 Tax Reconciliation 9 Contingent Liabilities 9 Post Balance Date Events 9 International Financial Reporting Standards 9 Segment Reporting 13 Business Segment Reporting 14 Geographical Segment Reporting 15 Auditor's Independence Declaration 16 Directors' Declaration 17 Independent Review Report to the Members of Qantas Airways 18 Limited QANTAS AIRWAYS LIMITED ASX APPENDIX 4D ABN 16 009 661 901 HALF-YEAR ENDED 31 DECEMBER 2004 RESULTS FOR ANNOUNCEMENT TO THE MARKET 31 Dec 2004 31 Dec 2003 Change Change $m $m $m % Revenue from ordinary activities 6,431.0 5,801.8 629.2 up 10.8% Profit from ordinary activites after tax attributable to members 458.4 357.8 100.6 up 28.1% Net profit for the period attributable to members 458.4 357.8 100.6 up 28.1% DIVIDENDS 31 December 2004 interim dividend - to be paid 6 April 2005 Amount per security (cents) 10.0 Franked amount per security at 30% tax 10.0 Record date for determining entitlements to the dividend 9 March 2005 Date the dividend is payable 6 April 2005 Total dividend declared ($m) 186.8 Qantas operates a Dividend Reinvestment Plan (DRP) under which shareholders can reinvest the dividends payable on participating shares in newly issued Qantas shares. -

Annual Report 2005 Annual Report 2005 > Our Customers Our Future Our Brand Our Business Our Priority X Spirit of Australia Qantas Annual Report 2005

Qantas Annual Report 2005 Report Annual > Our Customers Our Brand Our Priority Spirit of Australiax Our Future Our Business Qantas AnnualReport2005 Qantas Annual Report 2005 ~Corporate Directory~ REGISTERED OFFICE QANTAS SHARE REGISTRY STOCK EXCHANGE Qantas Airways Limited Level 8 Australian Stock Exchange ABN 16 009 661 901 580 George Street 20 Bridge Street Sydney NSW 2000 Sydney NSW 2000 Qantas Centre Australia Australia Level 9, Building A 203 Coward Street or DEPOSITARY FOR AMERICAN Mascot NSW 2020 Locked Bag A14 Australia Sydney South NSW 1235 DEPOSITARY RECEIPTS Australia The Bank of New York Telephone 61 2 9691 3636 ADR Division Facsimile 61 2 9691 3339 Freecall 1800 177 747 101 Barclay Street Website www.qantas.com International 61 2 8280 7390 New York NY USA Our Brand Priority Our Our Facsimile 61 2 9287 0303 Telephone 1 212 815 2218 Email [email protected] Facsimile 1 212 571 3050 Website www.qantas.com GENERAL COUNSEL & Our Customers COMPANY SECRETARY > Our Future Our Business Brett Johnson Designed and produced by Armstrong Miller+McLaren – www.amm.com.au Photography by Bob Armstrong and Mike Armstrong Qantas Annual Report 2005 ~Our Customers~ 1~ Customers are at the centre of everything we dox This year, we carried more than 32 million people to We know that different travellers have different 145 destinations in 40 countries around the world. needs, which is why we offer different experiences for the business traveller, the leisure traveller, the Our goal is to give each customer the best possible regional flyer and, with Jetstar, a whole new group travel experience, from the time they choose to of customers who are first-time flyers. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Airline Schedules

Airline Schedules This finding aid was produced using ArchivesSpace on January 08, 2019. English (eng) Describing Archives: A Content Standard Special Collections and Archives Division, History of Aviation Archives. 3020 Waterview Pkwy SP2 Suite 11.206 Richardson, Texas 75080 [email protected]. URL: https://www.utdallas.edu/library/special-collections-and-archives/ Airline Schedules Table of Contents Summary Information .................................................................................................................................... 3 Scope and Content ......................................................................................................................................... 3 Series Description .......................................................................................................................................... 4 Administrative Information ............................................................................................................................ 4 Related Materials ........................................................................................................................................... 5 Controlled Access Headings .......................................................................................................................... 5 Collection Inventory ....................................................................................................................................... 6 - Page 2 - Airline Schedules Summary Information Repository: -

Qantaslink Timetable

Terms of Use All data shown in this service is a property of Qantas, is for information only and is subject to change at any time. Given the flexible nature of Qantas schedules, our PDF Timetable may not reflect the latest information. By accessing the information, the user acknowledges that Qantas will not be responsible or liable to the user, or any other party, for any direct or indirect damages or costs resulting from any use of this information, including without limitation any discrepancies, in the actual timings of flights and timings started in this product. Qantas is under no obligation to maintain or support the service and to the extent permitted by applicable law excludes liability for direct or indirect damages in connection with the use of the service or of any data contained in this product. How to use the PDF Timetable The timetable has two sections, the bookmark or navigation area on the left-hand side and timetable on the right hand side. Bookmarks The bookmarks are your navigation for the timetable. All departure cities are listed alphabetically and are indicated by the word ©From©. If you click on one of these links it will take you directly to the part of the timetable that shows flights from the city selected. All the from cities have a + mark next to them. If you click on the + mark it will show you a list of destinations you can go to from that departure city. They are indicated by the word ©To©. If you click on one of these links it will take you directly to the part of the timetable that shows flights to the city selected. -

The Undisputed Leader in World Travel CONTENTS

Report & Accounts 1996-97 ...the undisputed leader in world travel CONTENTS Highlights of the year 1 Chairman’s Statement 2 THE NEXT Chief Executive’s Statement 5 Board Members 8 The Board and Board Committees DECADEIN FEBRUARY 1997 and the Report of the Remuneration Committee 10 British Airways celebrated 10 years of privatisation, with a Directors’ Report 14 renewed commitment to stay at the forefront of the industry. Report of the Auditors on Corporate Governance matters 17 Progress during the last decade has been dazzling as the airline Operating and Financial established itself as one of the most profitable in the world. Review of the year 18 Statement of Directors’ responsibilities 25 Report of the Auditors 25 Success has been built on a firm commitment to customer service, cost control and Group profit and loss account 26 the Company’s ability to change with the times and new demands. Balance sheets 27 As the year 2000 approaches, the nature of the industry and Group cash flow statement 28 competition has changed. The aim now is to create a new Statement of total recognised British Airways for the new millennium, to become the undisputed gains and losses 29 leader in world travel. Reconciliation of movements in shareholders’ funds 29 This involves setting a new direction for the Company with a Notes to the accounts 30 new Mission, Values and Goals; introducing new services and Principal investments 54 products; new ways of working; US GAAP information 55 new behaviours; a new approach to The launch of privatisation spelt a Five year summaries 58 service style and a brand new look. -

Bombardier Business Aircraft and Are Not Added to This Report

BACKGROUNDER June 30, 2015 Program Status Report - CRJ Series aircraft Deliveries Total Total Current Apr - Jun FYTD 1 Orders Delivered Backlog 2015 CRJ100 226 226 0 0 0 CRJ200 709 709 0 0 0 CRJ440 86 86 0 0 0 CRJ700 Series 701 2 334 326 8 1 2 CRJ700 Series 705 16 16 0 0 0 CRJ900 391 351 40 11 24 CRJ1000 68 40 28 0 1 Challenger 800 3 33 33 0 0 0 Total 1863 1787 76 12 27 June 30, 2015 Page 1 of 3 Program Status Report - CRJ Series aircraft CRJ700 CRJ700 CRJ700 CRJ700 Customer Total Total CRJ100 CRJ100 CRJ200 CRJ200 CRJ440 CRJ440 Series 701 Series 701 Series 705 Series 705 CRJ900 CRJ900 CRJ1000 CRJ1000 Orders Delivered Backlog Ordered Delivered Ordered Delivered Ordered Delivered Ordered Delivered Ordered Delivered Ordered Delivered Ordered Delivered Adria Airways 12 11 1 0 0 5 5 0 0 0 0 0 0 7 6 0 0 AeroLineas MesoAmericanas 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Air Canada 56 56 0 24 24 17 17 0 0 0 0 15 15 0 0 0 0 Air Dolimiti 5 5 0 0 0 5 5 0 0 0 0 0 0 0 0 0 0 Air Littoral 19 19 0 19 19 0 0 0 0 0 0 0 0 0 0 0 0 Air Nostrum 81 56 25 0 0 35 35 0 0 0 0 0 0 11 11 35 10 Air One 10 10 0 0 0 0 0 0 0 0 0 0 0 10 10 0 0 Air Wisconsin 64 64 0 0 0 64 64 0 0 0 0 0 0 0 0 0 0 American Airlines 54 30 24 0 0 0 0 0 0 0 0 0 0 54 30 0 0 American Eagle 47 47 0 0 0 0 0 0 0 47 47 0 0 0 0 0 0 Arik Air 7 5 2 0 0 0 0 0 0 0 0 0 0 4 4 3 1 Atlantic Southeast (ASA) 57 57 0 0 0 45 45 0 0 12 12 0 0 0 0 0 0 Atlasjet 3 3 0 0 0 0 0 0 0 0 0 0 0 3 3 0 0 Austrian arrows 4 13 13 0 0 0 13 13 0 0 0 0 0 0 0 0 0 0 BRIT AIR 49 49 0 20 20 0 0 0 0 15 15 0 0 0 0 14 14 British European 4 4 0 0 0 4 4 0 0 0 0 0 0 0 0 0 0 China Eastern Yunnan 6 6 0 0 0 6 6 0 0 0 0 0 0 0 0 0 0 China Express 28 18 10 0 0 0 0 0 0 0 0 0 0 28 18 0 0 Cimber Air 2 2 0 0 0 2 2 0 0 0 0 0 0 0 0 0 0 COMAIR 130 130 0 110 110 0 0 0 0 20 20 0 0 0 0 0 0 DAC AIR 2 2 0 0 0 2 2 0 0 0 0 0 0 0 0 0 0 Delta Connection 168 168 0 0 0 94 94 0 0 30 30 0 0 44 44 0 0 Delta Air Lines 40 40 0 0 0 0 0 0 0 0 0 0 0 40 40 0 0 Estonian Air 3 3 0 0 0 0 0 0 0 0 0 0 0 3 3 0 0 The Fair Inc. -

2007 Annual Report

A New Era Annual Report 2007 1944 1947 1968 1984 2007 The original kangaroo The winged kangaroo The flying kangaroo The flying kangaroo was A new interpretation symbol, which appeared symbol first appeared was placed in a circle refined to a more slender, of the logo was revealed. on Qantas aircraft in 1947 to coincide and the aircraft livery stylised presentation. The modern kangaroo was adapted from the with Qantas’ introduction was modified on the The wings on the was designed to reflect Australian one penny coin. of Lockheed L749 Boeing 707 V-jets. The kangaroo were removed the changing structure Constellations. words “Overseas Airline” to help strengthen of the A380 and other were removed from the the design and the new generation aircraft, fuselage, leaving the typeface for the airline’s and keeping with the words ”Australia” and name was changed airline’s increasing focus “Qantas.” The Australian from hand-drawn to on contemporary design flag was moved from a standard typeface. for its inflight and on-the- the rear of the aircraft, ground products. to sit in between these two words. Contents 01 About Qantas 49 Performance Summary 02 Our Key Objectives 50 Discussion and Analysis 04 Financial Highlights of Performance Summary 05 Operational Highlights 54 Directors‘ Report 06 Report from the Chairman 72 Financial Statements & the Chief Executive and Notes Officer 134 Shareholder Information 10 Qantas 135 Qantas Group Five Year 18 Jetstar Summary 22 Portfolio Businesses 136 Sustainability Information 30 Sustainability 141 Financial Calendar 40 Board of Directors 44 2007 Corporate Governance Statement About Qantas Tenacity and the ability to survive adverse conditions have characterised the history of Qantas since its first tentative flights across outback Queensland in the early 1920s. -

7 Regional Airports and Opportunities for Low-Cost Carriers in Australia

7 Regional airports and opportunities for low-cost carriers in Australia A. Collins, D. A. Hensher & Z. Li The University of Sydney, Australia Abstract Australia is vitally dependent on aviation services for delivering passenger accessibility to many rural and remote locations. The majority of airports in Australia are regional airports. There are real opportunities for a number of regional airports to improve their services for the region through the introduction of low-cost carriers (LCCs). The aim of this paper is to investigate this potential, through a formal model system of the entire aviation network in Australia, focusing on identifying influences on passenger demand and flights offered, and the role of air fares and number of competitors on each route. Keywords: regional airports; low-cost carriers; regular passenger transport; structural equation system; three stage least squares (3SLS) 1 Introduction Australia is vitally dependent on aviation services for delivering passenger accessibility to many rural and remote locations. In 2005–06, over 40.93 billion passenger kilometres or 11.47% of the total domestic passenger transport task (including metropolitan travel) was serviced by aviation [1]. Conservatively this represents over 46% of all intra- and inter-state aircraft movements and 13% of revenue passenger activity. As the Australian population progressively, albeit slowly, migrates away from the capital cities along the coast and inland, a number of towns that were once small centres servicing a hinterland have grown to become sizeable hubs for substantial regional activity. The role of aviation has grown in response to the need for improved accessibility to these regional hubs. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L.