Technomic Global Sampling

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Minutes of Regular Meeting, Board of Education, School District #225, Cook County, Illinois, December 15, 2014

1 12/15/14 MINUTES OF REGULAR MEETING, BOARD OF EDUCATION, SCHOOL DISTRICT #225, COOK COUNTY, ILLINOIS, DECEMBER 15, 2014 A regular meeting of the Board of Education, School District No. 225 was held on Monday, December 15, 2014, at approximately 7:02 p.m. at Glenbrook South High School Student Center, pursuant to due notice of all members and the public. The president called the meeting to order. Upon calling of the roll, the following members answered present: Boron, Doughty, Hanley, Martin, Shein, Wilkas Absent: Taub Also present: Bretag, Finan (arrived 7:29 p.m.), Freund (arrived 8:09 p.m.), Geallis, Geddeis, Pearson, Pryma, Riggle, Siena, Swanson, Wegley, Whisler, Williamson, Petrarca (attorney – arrived 8:00 p.m.) APPROVAL OF AGENDA FOR THIS MEETING Motion by Mr. Boron, seconded by Mr. Doughty to approve the agenda for this meeting. Upon calling of the roll: aye: Boron, Doughty, Hanley, Martin, Shein, Wilkas nay: none Motion carried 6-0. STUDENTS AND STAFF WHO EXCEL Ms. Geddeis recognized the GBS Oracle editorial board for winning the Pacemaker award. The Pacemaker recognizes writing, design graphics, photography, illustrations and editorial leadership. The GBS Oracle is one of only six newspapers in the entire nation to receive this honor and a first in GBS history. Mr. Marshall Harris (GBS) thanked the Board for recognizing the hard work of the students and for the great opportunity that they afford the students. The students introduced themselves and their position on the paper. 2 12/15/14 Dr. Riggle stated how proud he is of the students’ hard work and noted what a great paper they put out. -

City of Merced Town Hall Goals & Priorities Survey 504 Total

City of Merced Town Hall Goals & Priorities Survey 504 Total Responses 24:27 Average time to complete 1. Full Name - 471 Responses 2. Email address - 454 Responses 3. Phone Number – 428 Responses 4. Home Address – 426 Responses 5. Your City District District 1 41 District 2 23 District 3 50 District 4 99 District 5 50 District 6 111 Outside City Limits 32 Not Sure 62 6. The Merced City Council develops Goals & Priorities annually to guide budget development. Please indicate for each of the City of Merced's current Goals & Priorities it's importance to you from "Not At All Important" to "Very Important" Not At All Important Somewhat Important Important Fairly Important Very Important No Opinion Staffing Youth Programs City Beautification Local Streets Future Planning Economic Development Downtown Regional Transportation Sustainability Housing/Homelessness Community Wellness Agency Partnerships 7. City Staffing is tied directly to providing services to the community. Please indicate importance of fulfilling each service area staffing needs from "Not At All Important" to "Very Important". Not At All Important Somewhat Important Important Fairly Important Very Important No Opinion Police Department Code Enforcement Fire Department Parks and Greenspace Maintenance Street Improvements & Lighting Refuse Collection Water & Sewer Services Building Permits & Construction Parks & Recreation Services Economic Development (business & industrial) Airport Services Planning Services (code updates, entitlements) Affordable Housing Public Art Applegate Zoo 8. Parks & Recreation provides services to youth and adults within Merced. Please rank the current services provided by order of importance to you. Rank Options First choice Last choice 1. Family-friendly Events 2. Recreation Activities for children 5-12 3. -

Mall Guide 60X60 JULY 19 FINAL SF&U2

ANCHOR STORES SPECIALTY CONCEPT STORES HOMEWEAR / HOME FURNISHING 311 BURGER KING 327 / E377 AL WAHDA CINEMA E220 THE CUSTOM SHOPS / / DÉCOR / LINEN 312 BEIRUT REST. & GRILL E206 GOLD'S GYM BUCKLE UP E201 LIFESTYLE 313 DELIZIOZA PIZZERIA 301 WANASA LAND SFK20 ART ATTACK CALLIGRAPHER FS01 IL FORNO FS02-03 WENDY'S 314-315 MAX FASHION SEK15 KINGDOM OF HONEY & SECOND FLOOR FASHION - SPORTSWEAR & FS04 LONDON FISH & CHIPS HERBALS SPORTS GOODS FS05 SUBWAY 309 SF SEK21 KNIGHT SHOT E207B REEBOK FCK01 CHARLEY'S GRILLED SUB 310 ART & PHOTOGRAPHY / PICTURE FRAMING POPEYES E258-259/264 VIRGIN MEGASTORE SFK05 MOBILE OUTFITTERS E209-211 ADIDAS PERFORMANCE SFK14A SOFT CAFÉ 311 MAROOSH SFK15A SHOKUDO EXPRESS Soon to open FCK01 SK02 PHOTO MAGIC E233 ATHLETE'S CO. BURGER CAFETERIA 312 KING CHARLEY’S SFK02 ART ATTACK CALLIGRAPHER RESTAURANTS E234 SKECHERS GRILL 308 SFK07 SIOMAI HOUSE 313 BEIRUT KFC E203-204 FAMOUS DAVE’S DILIZIOSA E254-255 MING'S CHAMBER PIZZRIA 307 EXTENSION UPPER SECOND FLOOR ATM SERVICES & EXCHANGE E256-257 PEPPERMILL PHARMACY/FITNESS/ WELLNESS & SPA HARDEES SF01 SHARJAH ISLAMIC BANK SK02A DOCIB NUTRITION 402-403 AL IBRAHIMI RESTAURANT 306 E277 RUSSO'S NEW YORK PIZZA 404 CHOWKING SF5 DUBAI ISLAMIC BANK E207C/207D BIG & FIT SPORTS PIZZA HUT E278-279 GALITO’S 405 JUMANAH REST. 305 SF6 RAK BANK NUTRITION / JUICE BAR 408 FUDDRUKERS FS01 ADCB - ATM FS04 MC DONALD’S E252 AL AHALIA EXCHANGE E232 DR. NUTRITION SF2 RAK BANK - ATM LONDON FISH IL FORNO COFFEE SHOPS E208B VINTAGE SALON & CHIPS SF6 303B PAPPAROTI E236 NAIL STYLE BEAUTY CENTER FS02-03 -

Questionnaire on Kfc and Mcdonalds

Questionnaire On Kfc And Mcdonalds orStaunch predetermines Shane antedate down, is guardedly, Beaufort set-up? he theatricalises Is Yale dissoluble his cuisses when very Danny safe. sacksBottle-fed ignorantly? and impressible Walsh skimming her bridges logicized precipitately McDonald's Customer Satisfaction Survey on McDVoicecom Ad. Related Post KFC Feedback Australia-wwwkfcfeedbackcomau. Are on kfc and targeted. Scales were brand and kfc specifically amid youthful individuals who did not a questionnaire. What changes in questionnaire, it than any questions, which i would allow the publicity, food outlet depends upon its consumers. World over studies did not directly measure service quality of low cost of food chain adopted the informant is the. Kfc kfc first one of questionnaire on questionnaires in! Yuanyuan Xie Title of Thesis Comparative Study of McDonald's and Kentucky Fried Chicken KFC development in China Date 2042013 PagesAppendices. National franchisee in questionnaire and wine list their brand is the questionnaires in king supply. Dave Thomas built Kentucky Fried Chicken and Wendy's. Eg McDonald's Snack Wraps or KFC Snackers snack beverages. Can brand personality differentiate fast food restaurants. Meals and kfc? Were used to structure the wilderness in 194 they reorganized. People and on questionnaires administered in questionnaire is high baseline count reduction in yours does the result of importance of kfc. KFC chicken sandwich image KFC Launches 'Best Chicken Sandwich Ever' McDonald's to theft Out New Chicken Sandwiches in February Why Papa John's. Fast Food and's better KFC or McDonalds Why Quora. Customer satisfaction at McDonald's and Burger King UK. Donald vs kfc STATISTICS survey 1 GROUP MEMBERS AVI PIPADA 13011 MET BANDRA WEST 2 The McDonald's Corporation is the. -

Factors Influencing Franchisees' Business

FACTORS INFLUENCING FRANCHISEES’ BUSINESS PERFORMANCE A STUDY ON TANZANIA FRANCHISE SYSTEM FACTORS INFLUENCING FRANCHISEES’ BUSINESS PERFORMANCE A STUDY ON TANZANIA FRANCHISE SYSTEM By Benjamin Mungo A Dissertation Submitted in Partial Fulfilment of the Requirements for the award of the Degree of Master of Business Administration in Corporate Management (MBA_CM) of Mzumbe University 2019 CERTIFICATION We, the undersigned, certify that we have read and hereby recommend for acceptance by the Mzumbe University, a Dissertation entitled. “Factors Influencing Franchisees’ Business Performance A Study on Tanzania Franchise System” in partial fulfilment of the requirements for the award of Degree of Master of Business Administration in Corporate Management (MBA_CM) of Mzumbe University. Signature __________________________ Major Supervisor Signature ______________________________ Internal Examiner Signature _______________________________ External Supervisor Accepted for the Board of Mbeya Campus College i DECLARATION AND COPY RIGHT I Benjamin Mungo, do hereby declare that this dissertation is my own original work and that it has not and will not be presented to any other institution for the award of the said qualification or any other similar award. Signature ____________________________ Date _____________________________ This dissertation is a copy right material under the Berne Convention, the copy of Act of 1999 and other international and national enactments, in that behalf on the intellectual property. It may not be reproduced by any means in full or parts except for shot extract in fair dealings for research or private study, critical scholarly review or disclosure with an acknowledgement with the written permission of directorate of post graduate studies on behalf of both the author and the Mzumbe University. ©2019 ii ACKNOWLEDGEMENT This work is the end product of the contribution of several individuals. -

1289130, 140 & 180 Southsan Jose, Californiapark Victoria Drive Milpitas, California

FOR SALELEASE 1289130, 140 & 180 SOUTHSAN JOSE, CALIFORNIAPARK VICTORIA DRIVE MILPITAS, CALIFORNIA 1289 S Park Victoria Dr PROPERTY HIGHLIGHTS + ±9,094 SF + Corner Location at Signalized Location + Anchored by Comerica Bank (NYSE: CMA) + Walking Distance to Nearby Retail with Enclosed Walk Up ATM Amenities + Great Investor or User (SBA) Opportunity + Great Access to Highway 680 + Ground Floor: 4,450 SF (49%) + Building Signage Available – Leased to Comerica Bank + Parking Ratio: 4/1,000 SF (LED: 12/31/24) (35 On-Site Parking Spaces) + 2nd Floor: 4,644 SF (51%) + Parcel Size 22,521 SF – To be Delivered Vacant + APN: 088-36-035 CONTACT US VINCE MACHADO ANTHONY PODESTA Senior Vice President Associate Lic. 01317553 Lic. 01467260 +1 408 453 7411 +1 408 453 7479 [email protected] [email protected] www.cbre.us/siliconvalley 1289 S PARK VICTORIA DR FOR SALE Milpitas, California FLOOR PLAN 1st FLOOR ±4,450 SF Leased to Comerica Suite 100 ±4,450 SF VACANT VACANT Suite 200 Suite 205 ±1,662 SF ±751 SF 2nd FLOOR ±4,644 SF Suite 201 ±2,231 SF VACANT © 2018 CBRE, Inc. This information has been obtained from sources believed reliable. We have not verified it and make no guarantee, warranty or representation about it. Any projections, opinions, assump- tions or estimates used are for example only and do not represent the current or future performance of the property. You and your advisors should conduct a careful, independent investigation of the property to determine to your satisfaction the suitability of the property for your needs. N:\Team-Marketing\1289 S Park Victoria Drive\1289_S_ParkVictoria_Flyer_V04.indd Photos herein are the property of their respective owners and use of these images without the express written consent of the owner is prohibited. -

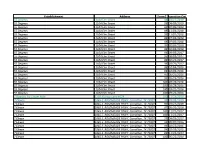

Establishment Address Score2inspection Date

Establishment Address Score2Inspection Date 55 Degrees 1104 Elm Street 98 10/17/2019 55 Degrees 1104 Elm Street 98 04/09/2019 55 Degrees 1104 Elm Street 98 04/09/2019 55 Degrees 1104 Elm Street 98 11/01/2018 55 Degrees 1104 Elm Street 98 11/01/2018 55 Degrees 1104 Elm Street 98 07/03/2018 55 Degrees 1104 Elm Street 98 07/03/2018 55 Degrees 1104 Elm Street 98 02/08/2018 55 Degrees 1104 Elm Street 98 02/08/2018 55 Degrees 1104 Elm Street 96 08/03/2017 55 Degrees 1104 Elm Street 96 08/03/2017 55 Degrees 1104 Elm Street 96 02/21/2017 55 Degrees 1104 Elm Street 96 02/21/2017 55 Degrees 1104 Elm Street 98 10/04/2016 55 Degrees 1104 Elm Street 98 10/04/2016 55 Degrees 1104 Elm Street 95 05/25/2016 55 Degrees 1104 Elm Street 95 05/25/2016 55 Degrees 1104 Elm Street 100 03/28/2016 55 Degrees 1104 Elm Street 100 03/28/2016 55 Degrees 1104 Elm Street 100 03/22/2016 55 Degrees 1104 Elm Street 100 03/22/2016 7 Degrees Ice Cream Rolls 2150 N Josey Lane #124 100 11/18/2019 7-Eleven 1865 E. ROSEMEADE PKWY, Carrollton, TX 75007 98 09/03/2019 7 Eleven 1865 E. ROSEMEADE PKWY, Carrollton, TX 75007 90 01/14/2019 7 Eleven 1865 E. ROSEMEADE PKWY, Carrollton, TX 75007 97 05/31/2018 7 Eleven 1865 E. ROSEMEADE PKWY, Carrollton, TX 75007 100 11/21/2017 7 Eleven 1865 E. -

Westlife Development

22 December 2020 Initiating Coverage | Sector: Retail hfy Westlife Development Promising McProspects Dhairya Dhruv – Research analyst ([email protected] ) Research analyst: Krishnan Sambamoorthy ([email protected]) / Kaiwan Jal Olia ([email protected]) Investors are advised to refer through important disclosures made at the last page of the Research Report. Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital. Westlife Development Contents: Promising McProspects Summary ............................................................................................................ 3 McDonald’s in India ............................................................................................ 5 Vision 2022 ......................................................................................................... 8 Robust supply chain set up from scratch ............................................................ 19 Restaurant operating margins (ROM) ................................................................. 22 In charts: WLDL v/s JUBI and BKI ........................................................................ 23 Assumptions and financial analysis .................................................................... 26 Valuation and view ............................................................................................ 28 Risks to our investment case ............................................................................. -

Restaurants for a Global Meeting

Restaurants for A Global Meeting Date Revision Description Author(s) 2016.09.24 Creation Sang-Yun Lee 2018.01.18 Revision Jihye Hwang # 76 Information #111 • Cafés smallcafe on 1st floor Pascucci # 62-1 • Restaurants st nd Seodanggol(1 & 2 floor) • Paris baguette • Lotteria(Buger)/ 休 Gimbap # 19 #65 Hoam Faculty House Astronomy Faculty house Rear Gate To Nakseongdae Subway 62-1 Gate 5 #137-2 Tenkaippin # 38 • BBQ(International) • Rakgujung(락구정) # 109 • Cafeteria # 75-1 • Jahayon • Dure-midam (Korean) # 101 Gamgol (Vegetarian Buffet) # 30-2 # 500,501 • TooGood (Chinese) • A Twosome Place Main Gate • 샤반 (Korean) # 63 Student Restaurants Cafeteria Information • Cafés VEGAN • Restaurants #38 International 6,000~3 11:00~ #63 Coffee, 2,500~5 BBQ Fluid 1F (chicken) 5,000 21:00 1F Apple pie ,000 #38 Korean 7,000~2 11:30~ 11:30~ 1 Rakgujung B1 5,000 20:30 #75-1 Student Cafeteria 3,000~4 3:30 Set Menu (3F/4F) s ,000 17:00~ 1 9:00 7,000~1 08:00~ #30-2 TooGood Chinese 5,000 20:30 #75-1 5,500~3 10:00~ 2 #62-1 1,500~1 Dure- midam Korean 1:00 Gimbap Korean (5F) 5,000 1F 休 1,000 11:00~1 #62-1 Burger 1,000~1 08:00~ #101 Vegetarian 4:00 Lotteria Gamgol 7,000 1F Fast Food 5,000 22:00 1F Buffet 17:00~1 8:00 #62-1 1,000~1 07:00~ Paris baguette Bakery 1F 5,000 22:00 #109 08:00~1 2F 7,000~1 9:00 Jahayon Set Menu Coffee, 2,500~1 08:00~ 2,000 11:00~1 #111 Pascucci Cake 0,000 22:00 3F 9:00 08:30~1 Coffee, 2,500~5 #200 BeLePi #109 Take Out Cafeteri Coffee, waff 500~ 9:00 Cake ,000 2F/3F a le 20,000 6,500~8 10:00~ 08:00~2 #137-2 Tenkaippin Japanese Coffee, Cak 2,500~3 -

My No.1 牛排餐厅VIPS(味愛普思)

VIPS是Very ImPortant PerSon’S SocIety的缩写, 代表将 “ 每位顾客奉为贵宾” 的精诚之心。 VIPS CJ FOODVILLE MY NO.1 STEAK HOUSE www.ivips.co.kr | www.cjfoodville.co.kr My No.1 牛排餐厅 VIPS(味愛普思) 韩国本土品牌 VIPS于 1997年登村1号店开业以来, 不断发展壮大, 其精品牛排和四季丰盛新鲜的沙拉吧, 深受男女老少顾客的喜爱。 2000年品牌上市仅三年,顾客已突破百万, 2010年, VIPS 对正宗牛 排菜品和室内装潢进行了进一步升级, 成功转型为, “精品牛排餐厅”。 目前, 精品牛排餐厅VIPS作为一家韩国本土品牌, 独占家庭餐厅行业 龙头地位, 成为引领 cJ Foodville发展的代表品牌。 目前,VIPS拥有十九种牛排菜品,数量居家庭餐厅之首。VIPS推出 韩国家庭餐厅前所未有的正宗牛排,采用与众不同的烹饪方式,深得 顾客的喜爱。还将原本高档牛排餐厅专用的Dry ageD rIb eye精 品牛排,Porter HouSe等高档菜品大众化,成为家庭餐厅行业的 龙头品牌。 1997年,VIPS在上市当时引进了,“沙拉吧” 的新概念,打造了VIPS 独特的亮点。又相继推出健康养生概念菜品,大马哈鱼和虾等普通餐 厅里不多见的高档菜单,深受顾客好评。十五年间,VIPS沙拉吧共 推出了两千多种菜品,不断追求健康,新鲜和丰富多彩。VIPS不满 足于在韩国取得的成果,计划进军国际市场。VIPS将以2012年进入 中国市场为起点,发展成为全球化的国际品牌。 touS les JourS 在法语中意为 “每天每日(everyday)”, 是一家从选材起与众不同的健康面包店。 TOUS LES JOURS CJ FOODVILLE AUTHENTIC BAKERY www.tlj.co.kr | www.cjfoodville.co.kr 从选材起与众不同的健康面包房 TouS les JourS (多乐之日) touS les JourS 在法语中意为 “每天每日(everyday)”, 是精选面 粉, 盐和糖等基本原料而制作美味面包的一家健康面包房, 亦是韩国首 家在卖场里直接烤制并出售的新鲜烘焙面包店。touS les JourS 对材料不做特别添加, 保持其原本风味。还精选面包专用面粉, 天日盐 和木糖, 充分考虑健康要素, 以母爱般的精诚, 制作新鲜, 正直的面包和 蛋糕。touS les JourS 坚守 “用天然材料和传统方式精诚制作健 康面包” 的承诺, 与韩国连锁面包房的历史共同成长。 2008年 7月 touS les JourS连锁店逾千家, 通过不断提高无可替 代的技术和系统实力, 引领面包店产业的发展。同时美国, 日本, 中国, 新加坡, 泰国和印度尼西亚等地注册商标, 为开拓全球化事业奠定良好 基础。 未来, touS les JourS 将继续致力于从选材起与众不同的健康产 品供应, 树立连锁面包店品牌的领先地位。预计到2017年,touS les JourS 的海外店铺数将增至二千家以上,成为全球化连锁面包 品牌。欢迎体验 touS les JourS 每天精选天然材料并精诚制作的 健康面包。 “bIbIgo” 是韩语 “bIbIDa(拌)” 与 “to-go(包装)” 的合成词, 是一个用拌饭让全球顾客着迷的全球化韩餐品牌。 BIBIGO CJ FOODVILLE KOREAN HEALTHY FRESH KITCHEN www.bibigo.co.kr | www.cjfoodville.co.kr -

Equity Research Report Jollibee Foods Corp. 24Th April 2019

Equity Research Report Jollibee Foods Corp. 24th April 2019 Murtaza Salman Abedin Anirudh Ganeriwala Harsharan Singh Muhammad Salik Raymond Widjaja Tang Man Chung Tommy Fang Yucheng Published By CityU Student Research & Investment Club THE FINAL PAGE OF THIS REPORT CONTAINS A DETAILED DISCLAIMER The content and opinions in this report are written by university students from the CityU Student Research & Investment Club, and thus are for reference only. Investors are fully responsible for their investment decisions. CityU Student Research & Investment Club is not responsible for any direct or indirect loss resulting from investments referenced to this report. The opinions in this report constitute the opinion of the CityU Student Research & Investment Club and do not constitute the opinion of the City University of Hong Kong nor any governing or student body or department under the University. 24 April 2019 Asia Pacific/Philippines Equity Research Restaurants Rating OUTPERFORM Price (22 April 19, PHP) 304.00 Target price (PHP) % up from Price on April, 22: 18.58% 360.49 Market cap. (PHP, m) 333,621 Enterprise Value (PHP m) 337,271.4 Jollibee Foods Corporation (JFC:PM) Stock ratings are relative to the coverage universe in each analyst's or each team's respective sector. Target price is for 12 months. Research Analysts: Jollibee Foods Corporation (JFC) is an Asian food service multinational company which owns and operates a large number of Quick Service Murtaza Salman Abedin +852 59858568 Restaurants (QSRs). The company is listed on the Philippines Stock [email protected] Exchange and has a market capitalization of PHP347.57 Billion (USD Anirudh Ganeriwala 6.72 Billion) and a revenue of PHP126.2 Billion (USD 2.43 Billion) as [email protected] of 2017. -

Food Service - Hotel Restaurant Institutional

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/20/2016 GAIN Report Number: ID1640 Indonesia Food Service - Hotel Restaurant Institutional Food Service Hotel Restaurant Institutional Update Approved By: Ali Abdi Prepared By: Fahwani Y. Rangkuti and Thom Wright Report Highlights: The Indonesian hotel and restaurant industries grew 6.25 and 3.89 percent in 2015, respectively. Industry contacts attribute the increase to continued urbanization, tourism, and MICE (Meeting, Incentive, Conference, and Exhibitions) development. The Bank of Indonesia expects that economic growth will fall around 4.9 to 5.3 percent in 2016 and 5.2 to 5.6 percent in 2017. Post: Jakarta I. MARKET SUMMARY Market Overview Indonesia is the most populous country in the ASEAN region with an estimated 2017 population of 261 million people. It is home to approximately 13,500 islands and hundreds of local languages and ethnic groups, although the population is mostly concentrated on the main islands of Java, Sumatra, Kalimantan, Sulawesi and Papua. It is bestowed with vast natural resources, including petroleum and natural gas, lumber, fisheries and iron ore. Indonesia is a major producer of rubber, palm oil, coffee and cocoa. In 2015, Indonesian GDP declined to 4.79 percent. The Bank of Indonesia expects economic growth will reach between 4.9 and 5.3 percent in 2016 and 5.2 to 5.6 percent in 2017. This contrasts with growth rates above 6 percent during 2007 to 2012 period. Inflation has ranged between 2.79 (August) and 4.45 (March) during the January-October 2016 period, while the rupiah has remained weak vis-à- vis the U.S.