Ngo Documents 2018-11-07 00:00:00 Still Undermining Our Future?!

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Crystalline Silicon Photovoltaic Cells, Whether Or Not Assembled Into Modules, from the People's Republic of China

ACCESS C-570-980 Administrative Review POR: 01/01/2017-12/31/2017 Public Document E&C/OVII: GHC January 31, 2020 MEMORANDUM TO: Jeffrey I. Kessler Assistant Secretary for Enforcement and Compliance FROM: James Maeder Deputy Assistant Secretary for Antidumping and Countervailing Duty Operations SUBJECT: Decision Memorandum for the Preliminary Results of the Administrative Review of the Countervailing Duty Order on Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled Into Modules, from the People’s Republic of China; 2017 ______________________________________________________________________________ I. SUMMARY The Department of Commerce is conducting an administrative review of the countervailing duty (CVD) order on crystalline silicon photovoltaic cells, whether or not assembled into modules (solar cells) from the People’s Republic of China (China), covering the period of review (POR) January 1, 2017 through December 31, 2017. The mandatory respondents are JA Solar Technology Yangzhou Co., Ltd. (JA Solar) and Risen Energy Co., Ltd. (Risen Energy). This is the sixth administrative review of the CVD order on solar cells from China. We preliminarily find that JA Solar and Risen Energy received countervailable subsidies during the POR. If these preliminary results are adopted in the final results of this review, we will instruct U.S. Customs and Border Protection (CBP) to assess countervailing duties on all appropriate entries of subject merchandise during the POR. Interested parties are invited to comment on these preliminary results. Unless the deadline is extended pursuant to section 751(a)(3)(A) of the Tariff Act of 1930, as amended (the Act), we will issue the final results of this review by no later than 120 days after the publication of these preliminary results in the Federal Register. -

Annual Report Annual Report 2020

2020 Annual Report Annual Report 2020 For further details about information disclosure, please visit the website of Yanzhou Coal Mining Company Limited at Important Notice The Board, Supervisory Committee and the Directors, Supervisors and senior management of the Company warrant the authenticity, accuracy and completeness of the information contained in the annual report and there are no misrepresentations, misleading statements contained in or material omissions from the annual report for which they shall assume joint and several responsibilities. The 2020 Annual Report of Yanzhou Coal Mining Company Limited has been approved by the eleventh meeting of the eighth session of the Board. All ten Directors of quorum attended the meeting. SHINEWING (HK) CPA Limited issued the standard independent auditor report with clean opinion for the Company. Mr. Li Xiyong, Chairman of the Board, Mr. Zhao Qingchun, Chief Financial Officer, and Mr. Xu Jian, head of Finance Management Department, hereby warrant the authenticity, accuracy and completeness of the financial statements contained in this annual report. The Board of the Company proposed to distribute a cash dividend of RMB10.00 per ten shares (tax inclusive) for the year of 2020 based on the number of shares on the record date of the dividend and equity distribution. The forward-looking statements contained in this annual report regarding the Company’s future plans do not constitute any substantive commitment to investors and investors are reminded of the investment risks. There was no appropriation of funds of the Company by the Controlling Shareholder or its related parties for non-operational activities. There were no guarantees granted to external parties by the Company without complying with the prescribed decision-making procedures. -

Coal Mine Methane Country Profiles, June 2015

Disclaimer The U.S. Environmental Protection Agency does not: a) Make any warranty or representation, expressed or implied, with respect to the accuracy, completeness, or usefulness of the information contained in this report, or that the use of any apparatus, method, or process disclosed in this report may not infringe upon privately owned rights; or b) Assume any liability with respect to the use of, or damages resulting from the use of, any information, apparatus, method, or process disclosed in this report. CMM Country Profiles CONTENTS Units of Conversions .............................................................................................................................................. i Executive Summary .............................................................................................................................................. ii Global Overview at a Glance ................................................................................................................................. ii Introduction ............................................................................................................................................................ 1 Purpose of the Report ............................................................................................................................................. 2 Organization of the Report ................................................................................................................................... 2 1 Argentina ...................................................................................................................................................... -

OIL COUNCIL Exploration Director, WORLD ASSEMBLY Tullow Oil

Oil & Gas Company Executives Register Today for only £1,995! Special Industry Delegation Discounts Also Available! 70 renowed speakers including: Angus McCoss OIL COUNCIL Exploration Director, WORLD ASSEMBLY Tullow Oil The World’s Premier Meeting Ashley Heppenstall President and CEO, Point for Energy, Finance Lundin Petroleum and Investment Charles ‘Chuck’ Davidson Chairman and CEO, Noble Energy John Knight EVP, Global Strategy and Business Development, Statoil Dr Mike Watts Deputy CEO, 26 – 27 November 2012 Cairn Energy Old Billingsgate, London, UK Ian Henderson Senior Advisor, J.P Morgan Asset Management • Europe’s largest O&G business meeting with 1,200 senior executives • Global participation from international O&G companies, investors and financiers • Delegations attending from NOCs, IOCs, small-cap, mid-cap and large cap independents • Direct access to energy focussed debt providers, equity capital, private equity Ian Taylor and strategic investors President and CEO, • Focuses on E&P funding, corporate development strategies, joint ventures, Vitol Group deepwater, the future of the North Sea and NCS, the new MENA landscape and the new regulatory environment Julian Metherell Lead Partners: CFO, Genel Energy Ronald Pantin CEO, Pacific Rubiales Partners: PR OG RE SS IV E Toronto Stock TSX Venture Toronto Stock TSX Venture Toronto Stock TSX Venture Exchange Exchange Exchange Exchange Exchange Exchange Bourse de Bourse de Bourse de Bourse de Bourse de Bourse de www.oilcouncil.com/event/wecaToronto Croissance TSX Toronto Croissance TSX -

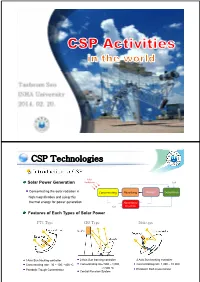

CSP Technologies

CSP Technologies Solar Solar Power Generation Radiation fuel Concentrating the solar radiation in Concentrating Absorbing Storage Generation high magnification and using this thermal energy for power generation Absorbing/ fuel Reaction Features of Each Types of Solar Power PTC Type CRS Type Dish type 1Axis Sun tracking controller 2 Axis Sun tracking controller 2 Axis Sun tracking controller Concentrating rate : 30 ~ 100, ~400 oC Concentrating rate: 500 ~ 1,000, Concentrating rate: 1,000 ~ 10,000 ~1,500 oC Parabolic Trough Concentrator Parabolic Dish Concentrator Central Receiver System CSP Technologies PTC CRS Dish commercialized in large scale various types (from 1 to 20MW ) Stirling type in ~25kW size (more than 50MW ) developing the technology, partially completing the development technology development is already commercialized efficiency ~30% reached proper level, diffusion level efficiency ~16% efficiency ~12% CSP Test Facilities Worldwide Parabolic Trough Concentrator In 1994, the first research on high temperature solar technology started PTC technology for steam generation and solar detoxification Parabolic reflector and solar tracking system were developed <The First PTC System Installed in KIER(left) and Second PTC developed by KIER(right)> Dish Concentrator 1st Prototype: 15 circular mirror facets/ 2.2m focal length/ 11.7㎡ reflection area 2nd Prototype: 8.2m diameter/ 4.8m focal length/ 36㎡ reflection area <The First(left) and Second(right) KIER’s Prototype Dish Concentrator> Dish Concentrator Two demonstration projects for 10kW dish-stirling solar power system Increased reflection area(9m dia. 42㎡) and newly designed mirror facets Running with Solo V161 Stirling engine, 19.2% efficiency (solar to electricity) <KIER’s 10kW Dish-Stirling System in Jinhae City> Dish Concentrator 25 20 15 (%) 10 발전 효율 5 Peak. -

Boards Fall Behind in the Drive to Appoint Women Alex Spence: the Times February 6 2012

Boards fall behind in the drive to appoint women Alex Spence: The Times February 6 2012 Britain's biggest companies will miss a deadline to have a quarter of their boardroom positions filled by women unless more is done to move talented female executives up the corporate ladder, recruiters have warned. As things stand, the target of having 25 per cent of FTSE 100 directorships held by women will be met two years late, in 2017, the search firm Norman Broadbent said. Although the female composition of FTSE 100 boards has risen from 13.6 per cent at the start of last year to almost 15 per cent, the supply of women executives and senior managers remained limited, it said. According to Neil Holmes, a consultant at Norman Broadbent: "Women are appearing on short-lists but the supply on the executive side is still lower than it should be and this requires companies to invest in long-term cultural changes." In a report last year, Lord Davies of Abersoch challenged corporate leaders to cast the net wider in the search for directors and to break their dominance of their boardrooms. Twenty-six per cent of the non-executive directors appointed to FTSE 100 boards last year were women, with 24 per cent in the FTSE 250 and 17 per cent in smaller listed companies. Women still lagged well behind their male counterparts in the top executive jobs at the biggest companies, accounting for 9 per cent of FTSE 100 executive positions last year, Norman Broadbent said. There was also a vast disparity between different industries, with women making up 17 per cent of boards in the health sector at the end of the year. -

Sonnedix Scholars

SONNEDIX SCHOLARS Sonnedix is an independent power producer sustainable world. Each year, Sonnedix will invite (IPP), committed to harnessing the power of one student in Puerto Rico to become a Sonnedix the sun to build a bright future. At Sonnedix, Scholar. we work together as One Team to achieve our The successful applicant will receive a stipend of purpose, proactively driving forward the growth $1,450 to be used in support of their studies, along of our global, scalable solar platform. with the valuable opportunity of work experience Now, Sonnedix is looking to develop the next through a part-time paid internship from September generation of solar innovators. That’s why we’re to December 2020 (a stipend of $3,500 for the offering a two-year scholarship programme to an internship period along with $1,450 financial individual who shares our values – taking ownership support towards accommodation), a mentor within of tasks, acting ethically and driving forward positively the company, networking opportunities, CV and to achieve the best outcomes for sustainable growth interview skills coaching, a global experience at one - and our vision for a more of our offices in a different country and access to our alumni network as it grows over time. PROGRAMME COMPONENTS FINANCIAL SUPPORT PAID INTERNSHIP ALUMNI NETWORK GIVE BACK Stipend to support Part-time role with Access to our Deliver two educational recipient's education competitive stipend network of alumni presentations during and living expenses the scholarship MENTORING SKILL BUILDING SPECIAL PROJECTS Dedicated mentoring Support on building Recipients will work support from a a CV and interview to design renewable Sonnedix employee preparation curriculum for students HOW TO APPLY Sonnedix Scholars are the solar innovators of the future; when they see problems, they are driven to find solutions. -

Trade Remedies, Targeting the Renewable Energy Sector

Green Economy and Trade. Ad hoc Expert Group 2: Trade Remedies in Green Sectors: the Case of Renewables 3−4 April 2014 Salle XXVI, Palais des Nations Geneva Trade Remedies Targeting the Renewable Energy Sector Report by 1 Cathleen Cimino & Gary Hufbauer 1 Cathleen Cimino is a Research Analyst at the Peterson Institute for International Economics and Gary Hufbauer is the Reginald Jones Senior Fellow. The views expressed are their own. Table of Contents I. Introduction .............................................................................................................................. 3 Clash between trade remedies and environmental goals ....................................................... 3 Outline of the report ............................................................................................................ 4 II. Overview of trade remedies ...................................................................................................... 5 III. Trade in renewable energy products affected by AD/CVD cases ............................................... 8 Methodology for the trade remedy survey ............................................................................ 9 Findings from the surveyt .................................................................................................. 10 IV. Renewable energy costs .......................................................................................................... 17 V. WTO disputes relating to renewable energy ........................................................................... -

Coal Mine Methane Country Profiles, Chapter 7, June 2015

7 China 7.1 Summary of Coal Industry 7.1.1 ROLE OF COAL IN CHINA Coal accounts for 69 percent of total national energy consumption in China (EIA, 2014a). Ranking first in the world in production of coal, China exported 16.5 million tonnes (Mmt) of coal in 2011; a sharp decline from a peak of 108.8 Mmt in 2003 (EIA, 2014b). Historically, a net coal exporter, China became a net coal importer in 2009 for the first time in more than two decades (EIA, 2014a). Table 7-1 provides recoverable reserve and recent coal production data for China. Table 7-1. China’s Coal Reserves and Production Sub- Anthracite & Total bituminous & Global Rank Indicator Bituminous (million Lignite (# and %) (million tonnes) tonnes) (million tonnes) Estimated Proved Coal Reserves 62,200 52,300 114,500 3 (12.9%) (2011) Annual Coal Production (2012) 3,510.2 141.5 3,651.8 1 (46.3%) Note: Numbers may not add due to rounding Source: EIA (2014b) As shown in Figure 7-1, the following major coal basins are located in four regions of China (USEPA, 1996): . Sanjuang-Mulinghe, Songliao, Donhua-Fushun, and Hongyang-Hunjiang basins in the Northeast; . Taixing-Shandou, Qinshui, Daning, Ordos, Hedong, Yuxi, Xuhuai, and Huainan basins in the North; . Chuannon-Qianbei, Huayingshan-Yongrong, and Liapanshui basins in the South; and . Tarim, Qaidam, and Junggar basins in the Northwest. CMM Country Profiles 63 CHINA Figure 7-1. China’s Coal Fields Source: Liu (2006) 7.1.2 STAKEHOLDERS Table 7-2 identifies some of the key stakeholders for coal mine methane (CMM) project development in China. -

The Mineral Industry of China in 2016

2016 Minerals Yearbook CHINA [ADVANCE RELEASE] U.S. Department of the Interior December 2018 U.S. Geological Survey The Mineral Industry of China By Sean Xun In China, unprecedented economic growth since the late of the country’s total nonagricultural employment. In 2016, 20th century had resulted in large increases in the country’s the total investment in fixed assets (excluding that by rural production of and demand for mineral commodities. These households; see reference at the end of the paragraph for a changes were dominating factors in the development of the detailed definition) was $8.78 trillion, of which $2.72 trillion global mineral industry during the past two decades. In more was invested in the manufacturing sector and $149 billion was recent years, owing to the country’s economic slowdown invested in the mining sector (National Bureau of Statistics of and to stricter environmental regulations in place by the China, 2017b, sec. 3–1, 3–3, 3–6, 4–5, 10–6). Government since late 2012, the mineral industry in China had In 2016, the foreign direct investment (FDI) actually used faced some challenges, such as underutilization of production in China was $126 billion, which was the same as in 2015. capacity, slow demand growth, and low profitability. To In 2016, about 0.08% of the FDI was directed to the mining address these challenges, the Government had implemented sector compared with 0.2% in 2015, and 27% was directed to policies of capacity control (to restrict the addition of new the manufacturing sector compared with 31% in 2015. -

Chinacoalchem

ChinaCoalChem Monthly Report Issue May. 2019 Copyright 2019 All Rights Reserved. ChinaCoalChem Issue May. 2019 Table of Contents Insight China ................................................................................................................... 4 To analyze the competitive advantages of various material routes for fuel ethanol from six dimensions .............................................................................................................. 4 Could fuel ethanol meet the demand of 10MT in 2020? 6MTA total capacity is closely promoted ....................................................................................................................... 6 Development of China's polybutene industry ............................................................... 7 Policies & Markets ......................................................................................................... 9 Comprehensive Analysis of the Latest Policy Trends in Fuel Ethanol and Ethanol Gasoline ........................................................................................................................ 9 Companies & Projects ................................................................................................... 9 Baofeng Energy Succeeded in SEC A-Stock Listing ................................................... 9 BG Ordos Started Field Construction of 4bnm3/a SNG Project ................................ 10 Datang Duolun Project Created New Monthly Methanol Output Record in Apr ........ 10 Danhua to Acquire & -

REIPPP Projects

REIPPP Projects Window 1 Projects Net capacity Technology Project Location Technology Developer Contractor Status MW supplier Klipheuwel – Dassiefontein Group 5, Dassiesklip Wind Energy Facility Caledon, WC Wind 26,2 Sinovel Operational Wind Energy fFcility Iberdrola MetroWind Van Stadens Wind Port Elizabeth, EC Wind 26,2 MetroWind Sinovel Basil Read Operational Farm Hopefield Wind Farm Hopefield, WC Wind 65,4 Umoya Energy Vestas Vestas Operational Noblesfontein Noblesfontein, NC Wind 72,8 Coria (PKF) Investments 28 Vestas Vestas Operational Red Cap Kouga Wind Farm – Port Elizabeth, EC Wind 77,6 Red Cap Kouga Wind Farm Nordex Nordex Operational Oyster Bay Dorper Wind Farm Stormberg, EC Wind 97,0 Dorper Wind Farm Nordex Nordex Operational South Africa Mainstream Jeffreys Bay Jeffereys Bay, EC Wind 133,9 Siemens Siemens Operational Renewable Power Jeffreys Bay African Clean Energy Cookhouse Wind Farm Cookhouse, EC Wind 135,0 Suzlon Suzlon Operational Developments Khi Solar One Upington, NC Solar CSP 50,0 Khi Dolar One Consortium Abengoa Abengoa Construction KaXu Solar One Pofadder, NC Solar CSP 100,0 KaXu Solar One Consortium Abengoa Abengoa Operational SlimSun Swartland Solar Park Swartland, WC Solar PV 5,0 SlimSun BYD Solar Juwi, Hatch Operational RustMo1 Solar Farm Rustenburg, NWP Solar PV 6,8 RustMo1 Solar Farm BYD Solar Juwi Operational Mulilo Renewable Energy Solar De Aar, NC Solar PV 9,7 Gestamp Mulilo Consortium Trina Solar Gestamp, ABB Operational PV De Aar Konkoonsies Solar Pofadder, NC Solar PV 9,7 Limarco 77 BYD Solar Juwi Operational