Financial and Investment Market Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2013

NATIONAL INVESTMENT BANK 2013 Annual Report Your Business is Our Business National Investment Bank Limited | 2013 Annual Report [email protected] 2 www.nib-ghana.com National Investment Bank Limited | 2013 Annual Report CONTENTS Notice and Agenda of Annual General Meeting 04 Corporate Information 05 Chairman’s Statement 07 Managing Director’s Statement 10 Prole of Board of Directors 12 Report of Directors 16 Financial Highlights 17 Independent Auditor’s Report 25 Statement of Comprehensive Income 27 Statement of Financial Position 29 Statement of Changes in Equity 30 Statement of Cash Flows 31 Notes to Financial Statements 63 Proxy Form 99 Head Oce and Branches 102 List of Correspondent Banks 104 Your business is Our Business 3 National Investment Bank Limited | 2013 Annual Report NOTICE AND AGENDA OF ANNUAL GENERAL MEETING NOTICE IS HEREBY GIVEN that the 45th Annual General Meeting of the National Investment Bank Limited will be held at the La-Palm Royal Beach Hotel, Accra at 10:00 a.m. on Thursday, 12th June, 2014 to transact the following business: 1. To receive and consider the Financial Statements for the year ended 31st December, 2013, together with the Reports of the Directors and Auditors thereon. 2. To elect / re-elect Directors 3. To approve Directors‘ Fees 4. To authorize the Directors to determine the remuneration of the Auditors. Dated this 12th Day of May, 2014. BY ORDER OF THE BOARD. Frank S. Aidoo Board Secretary NOTE: A member entitled to attend and vote may appoint a proxy who need not be a member of the Bank. -

The Determinants of Bank's Profitability in Ghana, The

The Determinants of Bank’s Profitability in Ghana, The Case of Merchant Bank Ghana Limited (MBG) and Ghana Commercial Bank (GCB) By Anthony Kofi Krakah & Aaron Ameyaw Henrik Sällberg (Supervisor) Master’s Thesis in Business Administration, MBA programme 2010 Table of Contents Table of Contents ............................................................................................................................................ i ABSTRACT ...................................................................................................................................................... v ACKNOWLEDGEMENT ........................................................................................................................................ vi CHAPTER ONE ............................................................................................................................................... 1 1.0 INTRODUCTION ...................................................................................................................................... 1 An overview of the banking industry in Ghana ..................................................................................................... 3 1.2 Background of the banks ......................................................................................................................... 6 Global Banking Industry .................................................................................................................. 12 Statement of the problem .......................................................................................................................... -

Sector Profile of Ghana's Financial Services Industry

SECTOR PROFILE OF GHANA’S FINANCIAL SERVICES INDUSTRY Table of Contents LIST OF ABBREVIATIONS AND ACRONYMS .....................................................................4 EXECUTIVE SUMMARY ...............................................................................................................5 1. 0 OVERVIEW OF THE INDUSTRY ......................................................................................8 1.1 Introduction ............................................................................................................................................................8 1.2 Government Policy and Regulatory Environment for the Industry .............................................9 1.2.1 Regulation and Supervision of Financial Markets..................................................... 9 1.2.2 Banking and NBFI (Non-Bank Financial Institution) Regulation and Supervision ... 10 1.2.3 Insurance Regulation and Supervision.................................................................... 10 1.2.4 Strengthening of Capital Markets ........................................................................... 10 1.2.5 Pension Sector Development................................................................................... 11 1.2.6 Access to Finance and Financial Sector Governance............................................... 11 1.2.7 Regulatory Environment.......................................................................................... 11 1.2.8 Bank of Ghana ........................................................................................................ -

World Bank Document

69450 Public Disclosure Authorized The Role of Postal Networks in Expanding Access to Financial Services Country Case: Egypt’s Postal Finance Services Public Disclosure Authorized The World Bank Group Global Information and Communication Technology Postbank Advisory, ING Bank Postal Policy Public Disclosure Authorized Public Disclosure Authorized Author’s Note This paper discusses the role of the postal network in expanding access to financial services in Egypt. It reviews the public postal operator within the postal sector and within the broader context of the communications sector. The roles of the postal network and state and privately-owned banks are also reviewed from the perspective of the financial sector development, with particular focus on payments systems development and microfinance. This paper was prepared with desk research in 2004. Field visits were not scheduled. While this country case on Egypt can stand alone, it is an integral part of this large study of the potential of postal networks to coordinate with financial service providers in 7 countries (Egypt, Kazahkstan, Namibia, Romania, Sri Lanka, Uganda, and Vietnam) and 5 regions (Africa, Asia, Eastern Europe and Central Asia, Latin America and the Caribbean, and the Middle East and Northern Africa). Glossary of Abbreviations and Acronyms ATM automated teller machine BdC Banque du Caire CIDA Canadian International Development Agency EFT POS electronic fund transfer at point of sale EGP Egyptian pound ENPO Egypt national post office FFI formal financial institution GDP -

Egypt Financial Policy for Adjustment and Growth Volume 11 Financialintermediaries September20, 1993

Egypt Financial Policy for Adjustment and Growth Volume 11 FinancialIntermediaries September20, 1993 CountryDepartment 11 (MN2) CountryOperations Public Disclosure Authorized Middle Eastand North Africa Region FOR OFFICIAL USE ONLY 00 Public Disclosure Authorized in D ... f oi Public Disclosure Authorized - I . ) C * I2 S1 'isclosed without World Rank authcgization Public Disclosure Authorized CURRENCY EOUIVALENTS Currency Unit - Egyptian Pound (LE) LE per US Dollar (average) 1991 3.009 1992 3.323 August 1993 3.348 (actual) FISg& YEAR July 1 - June 30 LIST OF ABBREVIATIONS BCCI Bank of Credit and Commerce International BCCM Bank of Credit and Commerce Misr ChO Central Audit Organization CAPMAS Central Authority for Public Mobilization and Statistics (Central Government's Bureau of Statistics) CBE Central Bank of Egypt CLG Central and Local Government CMA Capital Market Authority CML Capital Markets Law CSI Contractual Savings Institution Da Defined Benefit DC Defined Contribu:ion DDSR Debt Debt Service Relief DFI Direct Foreign Investment ECAs Export Credit Agencies EGPC Egypt General Petroleum Corporation EIAA Egyptian Institute of Accountants and Auditors EISA Egyptian Insurance Supervisory Authority EPF Employees Provident Fund ERs Executive Regulations ERSAP Economic Reform and Structural Adjustment Program FRBNY Federal Reserve Bank of New York GAFI Investment Authority GASC General Authority Supply Companv GASI General Authority for Social Insurance GCFCG Gulf Crisis Financial Coordination Group HCs Holding Ccmr,any HDB Housing -

Summary of Status Report February 2020

SUMMARY OF STATUS REPORT FEBRUARY 2020 1 MEMBERSHIP GFIM as at the end of February 2020 has 38 registered members categorized as follows: LICENSED DEALING MEMBERS PRIMARY DEALER BANKS 1. African Alliance Securities Limited 1. Access Bank Ghana Limited 2. Black Star Brokerage Limited 2. ARB Apex Bank 3. Bullion Securities Limited 3. ABSA Bank Ghana Limited 4. Databank Brokerage Limited 4. Cal Bank Ghana Limited 5. EDC Stockbrokers Limited 5. Consolidated Bank Ghana Limited 6. Teak Tree Brokerage Limited 6. Ecobank Ghana Limited 7. Republic Securities Ghana Limited 7. Fidelity Bank Ghana Limited 8. IC Securities Limited 8. GCB Bank Limited 9. NTHC Securities Ltd 9. Guaranty Trust Bank Ghana Limited 10. Prudential Stockbrokers Limited 10. Societe Generale Ghana Limited 11. SBG Securities Ghana Limited 11. Stanbic Bank Limited 12. SIC Brokerage Limited 12. Standard Chartered Bank Limited 13. Strategic African Securities Limited 13. Universal Merchant Bank 14. UMB Stock Brokers Ltd NON - PRIMARY DEALER BANKS 1. Agricultural Development Bank 2. Bank of Africa Ghana Ltd 3. First Atlantic Bank Ghana Ltd 4. First National Bank Limited 5. FBN Bank Ghana Ltd 6. National Investment Bank 7. Prudential Bank Limited 8. Republic Bank Ghana Limited 9. Sahel Sahara Bank Ghana Limited 10. UBA Ghana Limited 11. Zenith Bank Ghana Ltd 2 SUMMARY OF SECURITIES • Benchmark Securities: 8 5yr Government bond- 5 7yr Government bond- 1 10yr Government bond- 1 15yr Government bond- 1 • Non-Benchmark Securities: 28 3yr Government bond-14 5yr Government bond- 6 6yr Government bond- 1 7yr Government bond- 3 10yr Government bond-2 15yr Government bond-1 20yr Government bond-1 • Treasury Notes: 14 1yr Government note- 1 2yr Government note- 13 • Treasury Bills:80 364 day bill- 28 182 day bill- 26 91 day bill- 13 182-day Cocoa Bill- 13 ❖ Local US dollar 3-year bond-1 ❖ Eurobond-9 ❖ Corporate Bonds AFB Ghana Plc 18 Bayport Financial Services (Ghana) 9 Edendale Properties 2 Izwe Loans Ghana 6 E.S.L.A. -

Ghana Securities Industry Association

Ghana Securities Industry Association 6th Floor Cedi House, Liberia Road, Accra Tel: 233 - 050 1418845, 050 1418846 MEMBERS IN GOOD STANDING 2015 BROKER-DEALERS INVESTMENT ADVISORS 1 African Alliance Securities Limited 1 Abraaj Ghana Advisers Limited 2 Bullion Securities Limited 2 All-Time Capital Limited 3 CAL Brokers Limited 3 ASN Investments Limited 4 CDH Securities Limited 4 Black Star Advisors Limited 5 Databank Brokerage Limited 5 Bora Capital Advisors Limited 6 EDC Stockbrokers Limited 6 Boulders Advisors Limited 7 First Atlantic Brokers Limited 7 Brooks Asset Management Limited 8 Firstbanc Brokerage Services Limited 8 Bullion Financial Advisors Limited 9 GFX Brokers Limited 9 CAL Asset Management Limited 10 GN Investments Limited 10 Capstone Capital Limited 11 HFC Brokerage Services Limited 11 CDH Asset Management Limited 12 Liberty Securities Limited 12 Cidan Investment Advisor’s Limited 13 New World Securities Limited 13 Cornerstone Capital Advisors Limited 14 NTHC Securities Limited 14 Dalex Capital Management Limited 15 SBG Securities Ghana Limited 15 Databank Asset Management Services Limited 16 SIC Brokerage Services Limited 16 Delta Capital Limited 17 Strategic African Securities Limited 17 Ecobank Capital Advisors Limited 18 EDC Investments Limited CUSTODIANS 19 EM Capital Partners Limited 1 Access Bank Ghana Limited 20 Fidelity Securities Limited 2 CAL Bank Custody Services Limited 21 First Atlantic Asset Management Company Limited 3 Guaranty Trust Bank Ghana Limited 22 Firstbanc Financial Services Limited 4 National -

Practices at National Investment Bank (NIB) Ghana Limited: (A Study of the Cape Coast Branch)

ISSN: 2278-3369 International Journal of Advances in Management and Economics Available online at www.managementjournal.info RESEARCH ARTICLE Assessing Customer Relationship Management (CRM) Practices at National Investment Bank (NIB) Ghana Limited: (A Study of the Cape Coast Branch) Nyarku, Kwamena M* Department of Management Studies, School of Business, University of Cape Coast, Cape Coast, Ghana. *Corresponding Author: E-mail: [email protected] Abstract In today’s competitive business world and challenging economy, retaining a customer base is vital to the success of a business as the sole reason for any organisation to exist is to satisfy the current and potential buyers of its market offerings. What customers think and feel about a company and/or its offerings are key aspects of its success. The Ghanaian banking industry has become highly competitive, with banks not only competing among each other; but also with non-banks and other financial institutions to gain greater market share. If customers are not given good reasons to stay, competitors will give them a reason to leave. Many banks are constantly formulating strategies to increase their share of the market by getting, keeping and growing its customer base through the provision of quality services, good customer care and creating customer value. The National Investment Bank (NIB) Limited, a reputable state bank is losing its customers to other competitors in the industry.This study seeks to assess the Customer Relationship Management (CRM) practices at National Investment Bank (NIB) and also recommend win- back and/or retention strategies to meet the needs of customers in a highly customised and responsive manner. -

Survey of Bank Charges Second Quarter, 2019

Survey of Bank Charges Second Quarter, 2019 Financial Stability Department Contents Abbreviations ............................................................................................................................................................................................................................................. 3 DOMESTIC BANKING PRODUCTS AND SERVICES ....................................................................................................................................................................... 5 Savings account: E-banking Product and Services Fees ............................................................................................................................................................... 6 Initial Deposit Required for Savings Accounts ................................................................................................................................................................................. 7 Minimum Operating Balance Required for Saving Accounts ......................................................................................................................................................... 8 Current Account: Initial Deposit Required (IDR) and Minimum Operating Balance (MOB) ...................................................................................................... 9 Current Account Charges: Commission on Turnover (COT) ...................................................................................................................................................... -

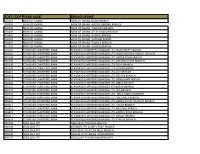

Sort Code Bank Name Branch Name

SORT CODE BANK NAME BRANCH NAME 010101 BANK OF GHANA BANK OF GHANA ACCRA BRANCH 010303 BANK OF GHANA BANK OF GHANA -AGONA SWEDRU BRANCH 010401 BANK OF GHANA BANK OF GHANA -TAKORADI BRANCH 010402 BANK OF GHANA BANK OF GHANA -SEFWI BOAKO BRANCH 010601 BANK OF GHANA BANK OF GHANA -KUMASI BRANCH 010701 BANK OF GHANA BANK OF GHANA -SUNYANI BRANCH 010801 BANK OF GHANA BANK OF GHANA -TAMALE BRANCH 011101 BANK OF GHANA BANK OF GHANA - HOHOE BRANCH 020101 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-HIGH STREET BRANCH 020102 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- INDEPENDENCE AVENUE BRANCH 020104 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-LIBERIA ROAD BRANCH 020105 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-OPEIBEA HOUSE BRANCH 020106 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-TEMA BRANCH 020108 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-LEGON BRANCH 020112 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-OSU BRANCH 020118 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-SPINTEX BRANCH 020121 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-DANSOMAN BRANCH 020126 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-ABEKA BRANCH 020127 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH)-ACHIMOTA BRANCH 020129 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- NIA BRANCH 020132 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- TEMA HABOUR BRANCH 020133 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- WESTHILLS BRANCH 020436 -

“Internet Banking: an Initial Look at Ghanaian Bank Consumer Perceptions”

“Internet banking: an initial look at Ghanaian Bank Consumer Perceptions” Atsede Woldie AUTHORS Robert Hinson Habib Iddrisu Richard Boateng Atsede Woldie, Robert Hinson, Habib Iddrisu and Richard Boateng (2008). ARTICLE INFO Internet banking: an initial look at Ghanaian Bank Consumer Perceptions. Banks and Bank Systems, 3(3) RELEASED ON Thursday, 27 November 2008 JOURNAL "Banks and Bank Systems" FOUNDER LLC “Consulting Publishing Company “Business Perspectives” NUMBER OF REFERENCES NUMBER OF FIGURES NUMBER OF TABLES 0 0 0 © The author(s) 2021. This publication is an open access article. businessperspectives.org Banks and Bank Systems, Volume 3, Issue 3, 2008 Atsede Woldie (United Kingdom), Robert Hinson (Ghana), Habib Iddrisu (United Kingdom), Richard Boateng (United Kingdom) Internet banking: an initial look at Ghanaian bank consumer perceptions Abstract Internet banking is a tool in the service delivery arsenal for banks. This study focuses on client-bank relationship and on how Internet adoption may improve the qualitative relationship between banks and firms in Ghana and the business they serve. The study adopted a triangulation approach in meeting its objectives. A sample of 180 companies was sampled from the manufacturing, commerce, and services sectors of the economy. The findings of the study were mainly reported by means of descriptive statistics. The research findings indicate that Internet banking services are at their infant stage. Of the respondents, 68% had heard about Internet banking while 33% have never heard about it. 55% of the respondents said security concerns were the major barrier to the adoption of Internet banking. 55.6% of the firms that responded were not connected to the Internet whiles 44.4% were. -

First National Bank Ghana

First National Bank Online Banking Enterprise™ - Payment Cut-Off Times Direct Payment Express Payment Instant Payment Service Service Service Service Anytime during the day Monday - Friday Anytime (including Saturdays, Sundays within the allowed cut-off and Public Holidays) processing times. In accordance with the cut-off Submission times below. Payments submitted after the cut-off times below will be processed on the next business day. Monday to Friday To First National Bank: To Participating Banks n/a No cut-off time between 09h15 and 11h35 Cut-off To other banks: 09h00 - Times 18h00 Saturdays, Sundays and Public Holidays Payments to both First National Bank and to other banks will n/a only be submitted for processing on the next business day. Any payment processed to a Any payment processed to a Participating Any payment authorised Bank through the Instant Payment service and fully processed to a Participating Bank through the Express service type within the type will be cleared within 1 minute of it Participating Bank being authorised and fully processed on Clearing allowed cut-off processing through the Direct the same day. Times: Payment service type times will be cleared within 6 within the allowed cut-off hours of it being authorised and processing times will be fully processed on the same cleared on the next day. business day. Express payments are Instant payments are posted to the posted to the recipient’s recipient’s account on the same business All payments are posted account on the same day. to the recipient’s account business day. on the next business day.