Scoping Comments for the Resolution Copper Mine DEIS Earthworks, A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strategy Delivery Growth

Rio Tinto 2009 Annual report Rio Tinto Financial calendar Strategy 2010 14 January Fourth quarter 2009 operations review 11 February Announcement of results for 2009 24 February Rio Tinto plc and Rio Tinto Limited shares and Rio Tinto plc ADRs quoted “ex-dividend” for 2009 fi nal dividend Delivery 26 February Record date for 2009 fi nal dividend for Rio Tinto plc shares and ADRs 2 March Record date for 2009 fi nal dividend for Rio Tinto Limited shares 11 March Plan notice date for election under the dividend reinvestment plan for the 2009 fi nal dividend 1 April Payment date for 2009 fi nal dividend to holders of Ordinary shares and ADRs Growth 15 April Annual general meeting for Rio Tinto plc 15 April First quarter 2010 operations review 22 April Annual general meeting for Rio Tinto Limited A focused and 14 July Second quarter 2010 operations review 5 August Announcement of half year results for 2010 integrated strategy 11 August Rio Tinto plc and Rio Tinto Limited shares and Rio Tinto plc ADRs quoted “ex-dividend” for 2010 interim dividend 13 August Record date for 2010 interim dividend for Rio Tinto plc shares and ADRs 17 August Record date for 2010 interim dividend for Rio Tinto Limited shares Excellence in 18 August Plan notice date for election under the dividend reinvestment plan for the 2010 interim dividend 9 September Payment date for 2010 interim dividend to holders of Ordinary shares and ADRs operational delivery 14 October Third quarter 2010 operations review 2011 Positioned for growth January Fourth quarter 2010 operations review February Announcement of results for 2010 Useful information and contacts Registered offi ces Investor Centre Rio Tinto Limited Rio Tinto plc To fi nd out more about Investor Centre, go to Computershare Investor Services Pty Limited 2 Eastbourne Terrace www.investorcentre.co.uk/riotinto GPO Box 2975 London Holders of Rio Tinto American Melbourne W2 6LG Depositary Receipts (ADRs) Victoria 3001 Registered in England No. -

BHP: Fine Words, Foul Play 23 September 2020 Introduction

BHP: fine words, foul play 23 September 2020 Introduction BHP presents itself, and is often considered by investors, as the very model of a modern mining company. Not only does it present itself as socially and environmentally responsible but now as indispensable in the efforts to save the world from climate catastrophe. Given the impacts and potential impacts of its Australian operations on Aboriginal sites and the furore over Rio Tinto’s destruction of the Juukan Gorge site earlier this year, perhaps BHP will begin to tread more carefully. It certainly needs to. This briefing summarises concerns around current and planned operations in which BHP is involved in Brazil, Chile, Colombia, Peru and the USA. LMN and our member groups work with communities or partner organisations in these five countries. Concerns include ecological and social impacts, violation of indigenous rights, mining waste disposal and the financing of clean- up. Other matters of current concern are briefly noted. At the end of the briefing are reports on three legacy cases - in Papua New Guinea, Indonesia and Colombia - where BHP pulled out, leaving others to deal with the environmental destruction and social dislocation caused by its operations. LMN exists to work in solidarity with communities harmed by companies linked to London, including BHP, the world’s largest mining corporation. This briefing is intended to encourage those who finance the company to use that finance to force change, and members of the public to join us in support of communities in the frontline of the struggle to defend their rights and the integrity of the planet’s ecosystems. -

The Resolution Copper Deposit, a Deep, High-Grade Porphyry Copper Deposit in the Superior District, Arizona

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/283908508 THE RESOLUTION COPPER DEPOSIT, A DEEP, HIGH-GRADE PORPHYRY COPPER DEPOSIT IN THE SUPERIOR DISTRICT, ARIZONA Conference Paper · April 2003 CITATIONS READS 2 767 6 authors, including: Ken Krahulec Utah Geological Survey 20 PUBLICATIONS 15 CITATIONS SEE PROFILE All content following this page was uploaded by Ken Krahulec on 16 November 2015. SCAT001570 The user has requested enhancement of the downloaded file. THE RESOLUTION COPPER DEPOSIT, A DEEP, HIGH-GRADE PORPHYRY COPPER DEPOSIT IN THE SUPERIOR DISTRICT, ARIZONA Geoff Ballantyne, Tim Marsh, Carl Hehnke, Dave Andrews, Amy Eichenlaub & Ken Krahulec Kennecott Exploration Company THIS PAPER WAS PRESENTED AT THE MARCO T. EINAUDI SYMPOSIUM, SOCIETY OF ECONOMIC GEOLOGISTS STUDENT CHAPTER, COLORADO SCHOOL OF MINES, GOLDEN, CO; A CONFERENCE (MARCOFEST) HELD AT THE COLORADO SCHOOL OF MINES ON APRIL 3 AND 4, 2003. INTRODUCTION Manske and Paul (2002) described a recently discovered, deep, high-grade porphyry copper deposit in the Superior (Pioneer) district of Arizona. Their description, written after just five core holes had intersected an apparently coherent zone of >1% Cu mineralization, provides a remarkably complete picture of the upper parts of the mineralized system. Following initial drilling, which was carried out by Magma Copper Company and by BHP, Kennecott secured an option to earn a 55% interest in the copper deposit through further exploration expenditures. The deposit was named the Resolution deposit and a program of deep surface drilling commenced in July 2001. Since that time 17 additional deep core holes have been completed, most of them to depths of more than 2000m. -

ALL the QUEEN's AGENTS & CORPORATIONS the Queen's

ALL THE QUEEN’S AGENTS & CORPORATIONS The Queen’s Prerogative English law prohibits questioning the Monarchy about their personal holdings and business. This is true of most of Europe’s royalty, whether enthroned or not. The wealth of the Monarchies is held outside of the countries that made the wealth. The British Crown’s offshore banks hold the greatest personal wealth in the world estimated at $35 trillion. Perhaps the British Crown still owns and controls its Commonwealth Nations, including the American “colonies.” Monarchies are not supposed to be warlord bankers who create conflict and chaos to turn a profit or destabilize an economy for personal gain. But they have been for some time now, and history is a string of immoral wars caused by monarchies, the Vatican and other religions. Untold millions have died while kings and popes lived on to grab the wealth through well-established institutions that were created to control the people of the Earth. The Commonwealth of Nations, headed by Queen Elizabeth II, is made up of 53 nations, spanning the globe, accounting for one-fifth of the land mass of the Earth, and a very high percentage of its strategic resources and population. The Queen is a Knight of Malta and has vowed allegiance to the Pope through the largest insider trading club on the planet. The British Crown Agents are, in fact, also agents of the Vatican’s Knights of Malta. The Queen is a Knight of Malta The Sovereign Military Order of Malta (SMOM) took control of the power and wealth of the Poor Fellow-Soldiers of Christ and of the Temple of Solomon from within the Roman system. -

Projected Consumption of Electricity and Water by the Proposed Resolution Copper Mine, Arizona Dr. Steven H. Emerman, Malach

Projected Consumption of Electricity and Water by the Proposed Resolution Copper Mine, Arizona Dr. Steven H. Emerman, Malach Consulting, LLC, 785 N 200 W, Spanish Fork, Utah 84660, USA, E-mail: [email protected], Tel: 801-921-1228 Report to Arizona Mining Reform Coalition, submitted March 11, 2019 Revision submitted March 31, 2019 LIGHTNING SUMMARY Rio Tinto has provided no estimate of the electricity consumption of the proposed Resolution Copper Mine, Arizona, but it can be shown to be 3% and 22% of the peak power capacity of the Salt River Project under the best-case and worst-case scenarios, respectively. Rio Tinto has estimated water consumption of only 15,700 acre-feet per year (about one-third of industry standards) while using conventional technologies for water efficiency. ABSTRACT The underground Resolution Copper Mine that is being proposed by Rio Tinto in Arizona would process 150,000 metric tons of ore per day from an ore body at a depth of 5000-7000 feet with a grade of 1.47%. The objective of this study was to evaluate the projected consumption of electricity and water by the proposed mine. Rio Tinto has provided no information about electricity consumption, except that power would be supplied by the local grid of the Salt River Project. Based on the depth, grade, and production rate, the projected electricity consumption would be 236 MW. However, the discovery of geothermal water while drilling the primary access shaft could result in additional electricity consumption of 24 MW solely for mine dewatering and refrigeration under the best-case scenario and 1650 MW under the worst-case scenario, corresponding to total electricity consumption of 260 MW and 1900 MW, which are 3% and 22%, respectively, of the peak power capacity of the Salt River Project. -

Human Rights and Australian Listed Companies

Human rights and Australian listed companies OCTOBER 2017 Part 1 of this report was researched and written by Howard Pender, Research Director, and Brynn O’Brien, Executive Director, of ACCR. Part 2 was researched and written by Nina Haysler, Research Project Manager, and Julia Leske, CEO, of CAER on behalf of ACCR. ACCR acknowledges the work of Emma Batchelor and Veda FitzSimons on this report. ACCR extends its gratitude to the Corporate Human Rights Benchmark Ltd. (CHRB) for their agreement to license the use of the CHRB methodology as a basis for this research and for their contribution and cooperation. Any errors or oversights are the responsibility of ACCR, and not of CHRB. CONTENTS Human rights and Australian listed companies ......................................................................................... 1 CONTENTS .............................................................................................................................................. 3 ABOUT THE AUTHORS ........................................................................................................................ 5 ACCR .................................................................................................................................................... 5 CAER .................................................................................................................................................... 5 EXECUTIVE SUMMARY ..................................................................................................................... -

Bhp Results for the Half Year Ended 31 December 2020

BHP Group Plc Registration number 3196209 Registered in England and Wales Share code: BHP ISIN: GB00BH0P3Z91 Release Time IMMEDIATE Date 16 February 2021 Number 02/21 BHP RESULTS FOR THE HALF YEAR ENDED 31 DECEMBER 2020 Note: All guidance is subject to further potential impacts from COVID-19 during the 2021 financial year. Keeping our people and communities safe There were no fatalities at our operated assets over the last two years. Our focus on safety, health and wellbeing has enabled us to deliver strong safety and operational performance. Maximise cash flow: Strong operational performance and free cash flow generation, with a margin of 59% Strong underlying operational performance, with record production achieved at Western Australia Iron Ore (WAIO) and record average concentrator throughput delivered at Escondida. Profit from operations of US$9.8 billion, up 17%. Underlying EBITDA(i) of US$14.7 billion at a margin(i) of 59%, with full year unit cost guidance unchanged for our major assets (at guidance exchange rates(ii)). Attributable profit of US$3.9 billion (includes an exceptional loss of US$2.2 billion predominantly related to the impairments of New South Wales Energy Coal (NSWEC) and associated deferred tax assets, and Cerrejón). Underlying attributable profit(i) of US$6.0 billion up 16% from the prior period. Net operating cash flow of US$9.4 billion and free cash flow(i) of US$5.2 billion reflects higher iron ore and copper prices and strong operational performance. Capital discipline: Spence Growth Option delivered on time and budget, and our balance sheet remains strong Capital and exploration expenditure(i) of US$3.6 billion. -

OPERATIONAL REVIEW for the HALF YEAR ENDED 31 DECEMBER 2020 Note: All Guidance Is Subject to Further Potential Impacts from COVID-19 During the 2021 Financial Year

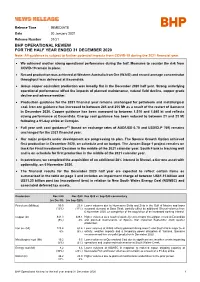

Release Time IMMEDIATE Date 20 January 2021 Release Number 01/21 BHP OPERATIONAL REVIEW FOR THE HALF YEAR ENDED 31 DECEMBER 2020 Note: All guidance is subject to further potential impacts from COVID-19 during the 2021 financial year. We achieved another strong operational performance during the half. Measures to counter the risk from COVID-19 remain in place. Record production was achieved at Western Australia Iron Ore (WAIO) and record average concentrator throughput was delivered at Escondida. Group copper equivalent production was broadly flat in the December 2020 half year. Strong underlying operational performance offset the impacts of planned maintenance, natural field decline, copper grade decline and adverse weather. Production guidance for the 2021 financial year remains unchanged for petroleum and metallurgical coal. Iron ore guidance has increased to between 245 and 255 Mt as a result of the restart of Samarco in December 2020. Copper guidance has been narrowed to between 1,510 and 1,645 kt and reflects strong performance at Escondida. Energy coal guidance has been reduced to between 21 and 23 Mt following a 91-day strike at Cerrejón. Full year unit cost guidance(1) (based on exchange rates of AUD/USD 0.70 and USD/CLP 769) remains unchanged for the 2021 financial year. Our major projects under development are progressing to plan. The Spence Growth Option achieved first production in December 2020, on schedule and on budget. The Jansen Stage 1 project remains on track for Final Investment Decision in the middle of the 2021 calendar year. South Flank is tracking well and is on schedule for first production in the middle of the 2021 calendar year. -

Evaluation of the Maximum Design Earthquake for the Tailings Storage Facilities for the Proposed Resolution Copper Mine, Arizona

Evaluation of the Maximum Design Earthquake for the Tailings Storage Facilities for the Proposed Resolution Copper Mine, Arizona Dr. Steven H. Emerman, Malach Consulting, LLC, 785 N 200 W, Spanish Fork, Utah 84660, USA, E-mail: [email protected], Tel: 801-921-1228 Report to Arizona Mining Reform Coalition, submitted March 27, 2019 Revision submitted April 1, 2019 LIGHTNING SUMMARY The U.S. Forest Service has put forward five alternatives for the tailings storage facilities for the proposed Resolution Copper Mine, Arizona, all of which would be designed to withstand the 5000-year earthquake. However, since the failures of the alternatives would endanger the towns of Superior (population 2837), Queen Valley (population 820), Florence (population 26,074), and Dripping Springs (population 235), according to dam safety standards, they should be designed to withstand the Maximum Credible Earthquake, the largest earthquake that is theoretically possible within a particular seismotectonic setting. ABSTRACT The U.S. Forest Service has put forward five alternatives for the tailings storage facilities for the proposed Resolution Copper Mine, Arizona, all of which would be designed to withstand the 5000-year earthquake. Four of the alternatives (Peg Leg site, Skunk Camp site, and two at the Near West site) involve the storage of thickened tailings (50-70% solids), while one alternative (Silver King site) involves the storage of filtered tailings (86-89% solids). According to a wide range of dam safety standards, a dam for which the failure would result in the loss of human life should be designed to withstand the Maximum Credible Earthquake (MCE), the largest earthquake that is theoretically possible within a particular seismotectonic setting. -

Transforming Onesteel

OneS OneSteel limited level 40 259 George Street Sydney T nSW 2000 Australia eel t.+61 2 9239 6666 l F. +61 2 9251 3042 imi Transforming T www.onesteel.com ed Annu OneSteel A l rep O rt 2008 OneSTeel limiTed AnnuAl repOrt 2008 OneSteel limited Share reGistRY FinAnciAl cAlendAr ABN 63 004 410 833 corporate OneSteel Share registry (subject to change) OneSteel was listed on the Australian Computershare Investor Services 19 August 2008 Securities Exchange on 23 October 2000. pty limited Annual results and final dividend announced directory GpO Box 242, Melbourne VIC 3001 8 September 2008 AnnuAl GenerAl meeTinG telephone: 1300 364 787 ex–dividend share trading commenced OneSteel’s Annual General Meeting or +61 3 9415 4026 will be held at City Recital Hall, 12 September 2008 Facsimile: +61 3 9473 2500 record date for final dividend Angel Place Auditorium, Sydney, Internet: www.computershare.com NSW 2000 commencing at 2:30pm directorS 16 October 2008 on Monday 17 November 2008. peter J Smedley, Chairman Auditor Final dividend paid Geoffrey J plummer, Managing Director KpMG laurie G Cox, AO 16 October 2008 Photo: Grinding media manufacturing at SecuriTieS exchanGe listinG Annual report mailed to shareholders OneSteel’s Waratah Steel Mill in Newcastle r Bryan Davis (NSW). Grinding media is used to assist in eileen J Doyle OneSteel limited shares are quoted 17 November 2008 the extraction process for many metals such Colin r Galbraith, AM on the Australian Securities exchange Annual General Meeting for 2008 as gold, copper, lead, zinc, iron, nickel, tin and peter G nankervis silver. -

Executive Summary

Resolution Copper Project and Land Exchange Draft Environmental Impact Statement Pinal County, Arizona August 2019 Lead Agency: USDA Forest Service Cooperating Arizona Department of Environmental Quality, Arizona Department of Water Resources, Agencies: Arizona Game and Fish Department, Arizona State Land Department, Arizona State Mine Inspector, Bureau of Land Management, Pinal County Air Quality Control District, U.S. Army Corps of Engineers, U.S. Environmental Protection Agency Responsible Neil Bosworth, Forest Supervisor Official: 2324 East McDowell Road, Phoenix, AZ 85006 For Information, John Scaggs, Public Affairs Specialist Contact: 2324 East McDowell Road, Phoenix, AZ 85006 Draft EIS for Resolution Copper Project and Land Exchange Abstract: The purpose of and need for the environmental including names and addresses of those who comment, will be impact statement includes evaluating the impacts part of the public record for this proposed action. Comments associated with approval of a mine plan, and submitted anonymously will be accepted and considered; however, considering the effects of the exchange of lands anonymous comments will not provide the respondent with standing between Resolution Copper Mining, LLC, to participate in subsequent administrative or judicial reviews. and the United States as directed by Section 3003 of the Carl Levin and Howard P. ‘Buck’ McKeon National Defense Authorization Send Comments To: Resolution Copper EIS Act for Fiscal Year 2015 (NDAA). P.O. Box 34468 The analysis includes six alternatives: the -

Testimony of David Salisbury President, Resolution Copper Mining, LLC Before the U.S

102 Magma Heights – P.O. Box 1944 Superior, AZ 85273 Tel.: (520) 689-9374 - Fax: (520) 689-9304 Testimony of David Salisbury President, Resolution Copper Mining, LLC before the U.S. Senate Committee on Forests and Public Lands concerning S. 3157, Southeast Arizona Land Exchange and Conservation Act of 2008 July 9, 2008 Mr. Chairman and Members of the Subcommittee: My name is David Salisbury. I am the President of the Resolution Copper Mining LLC (“Resolution Copper”), which is a company headquartered in Superior, Arizona and owned by subsidiaries of Rio Tinto plc and BHP-Billiton plc. I am here in support of S. 3157, and to briefly describe the efforts we have made to address various issues since this Subcommittee held a hearing on similar legislation two years ago. The Southeast Arizona Land Exchange and Conservation Act of 2008, S. 3157, represents an important step toward the development of a large, underground copper mine in a historic mining district. This legislation would allow us to acquire sufficient acreage of National Forest land, known as the Oak Flat parcel, where much of our new underground mine will be located. Most of the land needed is already blanketed by unpatented mining claims which we or our predecessors have owned and maintained for decades. As you can see from the map attached to my testimony, the Oak Flat parcel abuts, or is intermingled with, private land we already own. That private land was the site of the Magma underground copper mine, which operated from 1912 to 1996, and produced 25 million tons of copper ore.