1981 0101 DTCAR.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 1980

Annual Report 1980 The Depository• Trust Company The ability of Depository Trust to conduct its activities rests largely on modern computer technology, reflecting a long chain of developments in several disciplines. Automated calculating and recordkeeping are the essence of DTC's book-entry capability. Telecommunications devices facilitate the flow of information among Participants, transfer agents, and others throughout the financial community. The ability to utilize minute intervals of time permits computers to operate in billionths of a second. The illustrations in this report depict historical developments in each of these disciplines. The graphic theme and appearance of this Annual Report were conceived by David S. Jobrack, Executive Assistant to the Chairman, who also acted as Creative Director throughout the production process, and wrote, edited and/or compiled the text, illustrations and captions. 1980 Annual Report Highlights. 2 Computer Communications A Message from Management. ..... 3 Facility (CCF) . 28 History, Ownership and Policies. ....... 4 Other Automation Developments .... 28 Growth in 1980 .... 6 Interfaces in a National Clearance and Settlement System .. ....... 30 Eligible Issues. .8 Municipal Bond Program ..... 8 Protection for Participants' Securities ..... 32 Outlook for Institutional Use. 10 Officers and Directors of The Institutional Delivery (ID) Depository Trust Company.. 38 System. 14 1980 in Retrospect . .40 Basic Services 16 Financial Statements. ............ 46 Fast Automated Securities Participants. 54 Transfer (FAST) .' 17 Stockholders. ........ 56 Ancillary Services. 20 Depository Facilities ... 56 ...... 20 Dividends Pledgees .............. 57 Voting Rights. 21 Banks Reported to be Participating in Other Ancillary Services. 22 the Depository on an Indirect Basis 57 The Automation of Depository Services. 26 Investment Companies Reported Participant Terminal System (PTS). -

US Accounts in 24 Hours

U.S. Accounts In 24 Hours - eBook Thank you for purchasing our featured "U.S. Accounts In 24 Hours" eBook / Online Information Packet offered at our web site, U.S. Account Setup.com Within our featured online information packet, you will find all of the resources, tools, information, and contacts you'll need to quickly & easily open a NON-U.S. Resident Bank Account within 24 hours. You'll find lists of U.S. Banks, Account Application Forms, Information on how to obtain a U.S. Mailing Address, plus so much more. Just point and click your way through our Online Information Packet using the links above. If you should have any questions or experience any difficulties in opening your Non-U.S. Resident Account, please feel free to email us at any time, and one of our representatives will get back with you promptly. For Support, Email: [email protected] Homepage: www.usaccountsetup.com Application Forms UPDATE - E-TRADE'S NEW ACCOUNT OPENING POLICIES Etrade is changed the rules in which they open International Banking/ Brokerage accounts for foreigners. They now require all new applications be submitted to the local branch office in your region. Once account is opened, you will be able to use it as a U.S. Bank/Brokerage Account out of your home country. Below, you will find a list of International Etrade Phone Numbers & Addresses. Contact the etrade office that best reflects where you reside or would like your account based out of and where you would like to receive your debit card. U.S. -

During the Past Two Decades, the U.S. Housing Finance System Experienced Changes of a Magnitude Unseen Since the New Deal Era

FOREWORD During the past two decades, the U.S. housing finance system experienced changes of a magnitude unseen since the New Deal era. In the 1980s, the primary mortgage market restructured and consolidated as a result of the savings and loan crisis, adjustable-rate mortgages became widely available, and the secondary mortgage market grew rapidly. The 1990s saw continued industry consolidation, as well as significant technological de- velopments in mortgage finance. In addition, the past decade was a time of considerable innovation in affordable mortgage lending, part of a growing movement to connect his- torically underserved households and communities to the mainstream housing finance system. This volume examines this movement through case studies of organizations recognized by their peers as leaders in expanding homeownership opportunities. In an extension of their earlier research for the U.S. Department of Housing and Urban Development, the authors describe the efforts of a broad cross section of industry participants, including small and large lenders, nonprofit community-based organizations (CBOs), and lending consortia. They document a wide range of strategies—in the areas of management, out- reach, borrower qualification, and homeowner retention—designed to expand and sus- tain homeownership among lower-income and minority households. The case studies illustrate three notable aspects of recent efforts to extend the reach of homeownership. First, they demonstrate that leaders in the mortgage finance industry view historically underserved populations and communities as viable business markets rather than regulatory burdens, and back this perspective with action. Second, the stud- ies show the vital role that partnership plays in expanding opportunity. -

1985 0101 NSCCAR.Pdf

National Securities Clearing Corporation Corporate Office 55 Water Street New York, New York 10041 (212) 510-0400 Boston One Boston Place Boston, Massachusetts 02108 Chicago 135 South LaSalle Street Chicago, Illinois 60603 Cleveland 900 Euclid Avenue Cleveland, Ohio 44101 Dallas Plaza of the Americas TCBTower Dallas, Texas 75201 Denver Dominion Plaza Table of Contents 600 17th Street Denver, Colorado 80202 To NSCC Participants 2 Detroit NSCC Board of Directors 4 3153 Penobscot Building Detroit, Michigan 48226 NSCC Officers 8 Jersey City Introduction 9 One Exchange Place Jersey City, New Jersey 07302 The Year in Review 10 Los Angeles Municipal Bond Program 12 615 South Flower Street Los Angeles, California 9001.7 Fund/SERV 14 Milwaukee Automated Customer Account Transfer Service 16 777 East Wisconsin Avenue Milwaukee, Wisconsin 53202 International Securities Clearing Corporation 18 Minneapolis Audited Financial Statements 20 IDS Center 80 South 8th Street Participating Organizations 26 Minneapolis, Minnesota 55402 New York 55 Water Street New York, New York 10041 St. Louis One Mercantile Tower Cover: 1985 was a year during which NSCC anticipated and St. Louis, Missouri 63101 responded to the expanding needs of the financial services San Francisco industry ... 50 California Street • As marketplace self-regulatory organizations, represented San Francisco, California 94111 here by a New York Stock Exchange Guide/Constitution Toronto and Rules, proposed new rules on broker-dealers' transfer Two First Canadian Place of client accounts, NSCC implemented the Automated Toronto, Ontario, Canada M5X lA9 Customer Account Transfer Service. • While continuing to serve its traditional equity, corporate bond and municipal bond marketplaces, represented by volume charts on the computer screen, NSCC expanded its comparison services to include municipal bond syndi cates, when-issued and extended-settlement trades. -

Decade of Holding Company Regulation in Florida

July 1970 A Decade of Holding Com pany Regulation in Florida The Bank Holding Company Act of 1956 placed was often met through the chartering of new sub multibank holding company formation and ex urban banks by the stockholders of the com pansion within the jurisdiction of the Board of munity’s existing banks. Governors of the Federal Reserve System. By Since 1959 when the Board rendered its first the end of 1969, the Board had handed down 294 decision on a Florida holding company applica decisions. These Board decisions did not, however, tion, the holding company form of group bank fall evenly throughout the nation. They affected ing has become an important part of the struc prim arily those states having unit- or limited tural change in Florida banking. The composi branch-banking legislation that typically encour tion of Florida banking, therefore, has been ages holding company expansion. Florida is one molded to some extent by the provisions of the of these unit-banking states, and 52 of the Board’s Bank Holding Company Act of 1956 and by decisions affected Florida banks. Only Wisconsin the decisions the Board has made on individual witnessed as much holding company activity dur applications under the Act. This article reviews ing the same period. the pattern that has developed during the first ten The holding company is simply one form of years of experience. control over several separately chartered banks. Other forms of control over such a group of Genesis of Florida Holding Companies banks might be maintained through ownership by an individual, a partnership, or by common When Congress passed the Bank Holding Com m ajority stockholders. -

School of Economics & Business Administration Master of Science in Management “MERGERS and ACQUISITIONS in the GREEK BANKI

School of Economics & Business Administration Master of Science in Management “MERGERS AND ACQUISITIONS IN THE GREEK BANKING SECTOR.” Panolis Dimitrios 1102100134 Teti Kondyliana Iliana 1102100002 30th September 2010 Acknowledgements We would like to thank our families for their continuous economic and psychological support and our colleagues in EFG Eurobank Ergasias Bank and Marfin Egnatia Bank for their noteworthy contribution to our research. Last but not least, we would like to thank our academic advisor Dr. Lida Kyrgidou, for her significant assistance and contribution. Panolis Dimitrios Teti Kondyliana Iliana ii Abstract M&As is a phenomenon that first appeared in the beginning of the 20th century, increased during the first decade of the 21st century and is expected to expand in the foreseeable future. The current global crisis is one of the most determining factors affecting M&As‟ expansion. The scope of this dissertation is to examine the M&As that occurred in the Greek banking context, focusing primarily on the managerial dimension associated with the phenomenon, taking employees‟ perspective with regard to M&As into consideration. Two of the largest banks in Greece, EFG EUROBANK ERGASIAS and MARFIN EGNATIA BANK, which have both experienced M&As, serve as the platform for the current study. Our results generate important theoretical and managerial implications and contribute to the applicability of the phenomenon, while providing insight with regard to M&As‟ future within the next years. Keywords: Mergers &Acquisitions, Greek banking sector iii Contents 1. Introduction ................................................................................................................ 1 2. Literature Review .......................................................................................................... 4 2.1 Streams of Research in M&As ................................................................................ 4 2.1.1 The Effect of M&As on banks‟ performance .................................................. -

Staff Study 174

Board of Governors of the Federal Reserve System Staff Study 174 Bank Mergers and Banking Structure in the United States, 1980–98 Stephen A. Rhoades August 2000 The following list includes all the staff studies published 171. The Cost of Bank Regulation: A Review of the Evidence, since November 1995. Single copies are available free of by Gregory Elliehausen. April 1998. 35 pp. charge from Publications Services, Board of Governors of 172. Using Subordinated Debt as an Instrument of Market the Federal Reserve System, Washington, DC 20551. To be Discipline, by Federal Reserve System Study Group on added to the mailing list or to obtain a list of earlier staff Subordinated Notes and Debentures. December 1999. studies, please contact Publications Services. 69 pp. 168. The Economics of the Private Equity Market, by 173. Improving Public Disclosure in Banking, by Federal George W. Fenn, Nellie Liang, and Stephen Prowse. Reserve System Study Group on Disclosure. November 1995. 69 pp. March 2000. 35 pp. 169. Bank Mergers and Industrywide Structure, 1980–94, 174. Bank Mergers and Banking Structure in the United States, by Stephen A. Rhoades. January 1996. 29 pp. 1980–98, by Stephen A. Rhoades. August 2000. 33 pp. 170. The Cost of Implementing Consumer Financial Regula- tions: An Analysis of Experience with the Truth in Savings Act, by Gregory Elliehausen and Barbara R. Lowrey. December 1997. 17 pp. The staff members of the Board of Governors of the The following paper is summarized in the Bulletin Federal Reserve System and of the Federal Reserve Banks for September 2000. The analyses and conclusions set forth undertake studies that cover a wide range of economic and are those of the author and do not necessarily indicate financial subjects. -

Behind Miami's Surge in International Banking

April 1981 Behind Miami's Surge in International Banking Miami's international banking activity has expanded substantially since 1969. Regulatory changes have made the Edge Act corporation a more viable entity. Florida's legal and tax structure has become more accommodating to international financial development. And banking activity with Latin American individuals and nonfinancial firms has surged. In the past two decades, Miami has emerged Edge Act Corporations as one of the new international banking cen- » ters. The move to Miami by major U. S. and foreign banks has been stimulated by both It was not until 1969 that a non-Florida regulatory changes and economic factors. U. S. bank entered the Miami international banking market. In that year, the Georgia- International Banking from Miami: based Citizens and Southern National Bank The Cast of Participants opened the first Edge Act corporation in Miami. Edge Act corporations are restricted to International banking from Miami consists international transactions. Since 1969, 21 of locally based commercial banks, Edge Act more banks have entered Miami's banking corporations set up by out-of-state and market as Edge Act corporations; another 11 foreign banks, and foreign bank agencies and have applications approved or pending (see representative offices. Using June 1980 data, Table 3). transactions with the Caribbean Basin and the rest of Latin America constituted at least half, All New York banks with banking Edges and regularly 80 to 90 percent, of Miami's have or have applied for Miami presence. commercial bank, Edge, and agency activity Four of the six California banks and three of with foreigners. -

The Preservation and Adaptation of a Financial Architectural Heritage

University of Pennsylvania ScholarlyCommons Theses (Historic Preservation) Graduate Program in Historic Preservation 1998 The Preservation and Adaptation of a Financial Architectural Heritage William Brenner University of Pennsylvania Follow this and additional works at: https://repository.upenn.edu/hp_theses Part of the Historic Preservation and Conservation Commons Brenner, William, "The Preservation and Adaptation of a Financial Architectural Heritage" (1998). Theses (Historic Preservation). 488. https://repository.upenn.edu/hp_theses/488 Copyright note: Penn School of Design permits distribution and display of this student work by University of Pennsylvania Libraries. Suggested Citation: Brenner, William (1998). The Preservation and Adaptation of a Financial Architectural Heritage. (Masters Thesis). University of Pennsylvania, Philadelphia, PA. This paper is posted at ScholarlyCommons. https://repository.upenn.edu/hp_theses/488 For more information, please contact [email protected]. The Preservation and Adaptation of a Financial Architectural Heritage Disciplines Historic Preservation and Conservation Comments Copyright note: Penn School of Design permits distribution and display of this student work by University of Pennsylvania Libraries. Suggested Citation: Brenner, William (1998). The Preservation and Adaptation of a Financial Architectural Heritage. (Masters Thesis). University of Pennsylvania, Philadelphia, PA. This thesis or dissertation is available at ScholarlyCommons: https://repository.upenn.edu/hp_theses/488 UNIVERSITY^ PENN5YLV^NIA. UBKARIE5 The Preservation and Adaptation of a Financial Architectural Heritage William Brenner A THESIS in Historic Preservation Presented to the Faculties of the University of Pennsylvania in Partial Fulfillment of the Requirements for the Degree of MASTER OF SCIENCE 1998 George E. 'Thomas, Advisor Eric Wm. Allison, Reader Lecturer in Historic Preservation President, Historic District ouncil University of Pennsylvania New York City iuatg) Group Chair Frank G. -

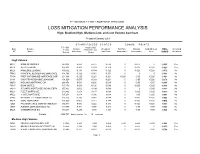

LOSS MITIGATION PERFORMANCE ANALYSIS High, Medium-High, Medium-Low, and Low Volume Servicers

FY 2000 SINGLE FAMILY MORTGAGE SERVICING LOSS MITIGATION PERFORMANCE ANALYSIS High, Medium-High, Medium-Low, and Low Volume Servicers Prepared January 2001 S T A N D A R D I Z E D S C O R E S B O N U S P O I N T S FY 1999 Actual Loss/ Svcr Servicer Loans Default Potential Loss Weighted FirstTime Minority UnderServed FINAL Increased ID * Name Scored Rate Score Score Total Score Homeowner Homeowner Area SCORE Incentives High Volume MUL1 BANK OF AMERICA 240,318 0.059 -0.727 -0.530 0 -0.025 0 -0.555 Yes MUL6 WELLS FARGO 656,303 -0.005 -0.503 -0.379 0 -0.025 -0.025 -0.429 Yes MUL5 HOMESIDE LENDING 439,502 -0.136 -0.384 -0.322 0 -0.025 -0.025 -0.372 No 75640 PRINCIPAL RESIDENTIAL MORTGAGE 191,398 -0.122 -0.361 -0.301 0 0 0 -0.301 No 77396 FIRST NATIONWIDE MORTGAGE COR 211,449 -0.125 -0.227 -0.201 -0.025 -0.05 -0.025 -0.301 No 64141 COUNTRYWIDE HOME LOANS INC 491,029 -0.075 -0.243 -0.201 0 -0.05 -0.025 -0.276 No 39276 MIDLAND MORTGAGE CO 266,458 0.521 -0.286 -0.085 0 -0.05 -0.05 -0.185 No 73815 BANK UNITED 117,179 0.039 -0.120 -0.080 0 -0.025 -0.025 -0.130 No 68013 ATLANTIC MORTGAGE AND INVESTM 155,832 -0.032 -0.104 -0.086 0 0 -0.025 -0.111 No MUL3 FLEET MORTGAGE 319,862 -0.258 0.137 0.038 0 -0.025 -0.025 -0.012 No MUL2 CHASE MORTGAGE 597,276 -0.018 0.096 0.068 0 -0.05 -0.025 -0.007 No 38092 NATIONAL CITY MORTGAGE CO 105,256 -0.236 0.142 0.048 0 -0.025 -0.025 -0.002 No MUL4 GMAC MORTGAGE 136,099 -0.057 0.211 0.144 0 -0.025 -0.025 0.094 No 12621 PNC MORTGAGE CORP OF AMERICA 102,937 0.082 0.222 0.187 0 -0.025 -0.025 0.137 No 10757 AURORA LOAN -

Download (Pdf)

THIS COMPILATION IS DERIVED LARGELY FROM SECONDARY SOURCES. NOT AN OFFICIAL REPORT OF CHANGES IN THE BANKING STRUCTURE.' NOT FOR PUBLICATION BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM L. 4.5 October 22, 1962 CHANGES IN STATUS OF BANKS AND BRANCHES DURING SEPTEMBER 1962 Class Date of MAP ? ae and location of banks and branches of bank change New Banks (Except successions and conversions) First State Bank Lake Village, Ark. Ins. non. 9-19-62 Chicot County First National Bank Fresno, Calif. National 9-14-62 Fresno County- Colfax National Bank Denver, Colo. National 9-24-62 Denver County Republic National Bank Pueblo, Colo. National 9- 4-62 Pueblo County Bank of Commerce Fort Lauderdale, Fla. Ins. non. 9-11-62 Broward County First National Bank of North Broward County- Lighthouse Point, Fla. National 9- 4-62 Broward County Trail National Bank P. 0. Sarasota, Fla. National 9-26-62 Manatee County Hampshire National Bank South Hadley, Mass. National 9- 4-62 Hampshire County Troy National Bank Troy, Mich. National 9-20-62 Oakland County Grant Square Bank & Trust Co. Oklahoma City, Okla. Ins. non. 9-24-62 Oklahoma County First National Bank Owasso, Okla. National 9- 8-62 Tulsa County Bassett National Bank El Paso, Tex. National 9-27-62 El Paso County Coronado State Bank El Paso, Tex. Ins. non. 9- 4-62 El Paso County Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Class Date of Name and location of banks and "branches of bank change New Banks (Cont'd) ' (Except successions and conversions) Wolfforth State Bank Wolfforth, Tex. -

Download (Pdf)

STATISTICAL SUPPLEMENT to the 1966 Annual Report The Administrator of National Banks William B. Camp Comptroller of the Currency THE UNITED STATES TREASURY, WASHINGTON Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis U.S. GOVERNMENT PRINTING OFFICE WASHINGTON : 1967 For sale by the Superintendent of Documents, U.S. Government Printing Office, Washington, D.C. 20402 - Price $1.25 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis TREASURY DEPARTMENT, OFFICE OF THE COMPTROLLER OF THE CURRENCY, Washington, D.C., September 1,1967. SIRS: I am pleased to submit the Statistical Supplement to the 1966 Annual Report of the Comptroller of the Currency. Respectfully, WILLIAM B. CAMP, Comptroller of the Currency. THE PRESIDENT OF THE SENATE THE SPEAKER OF THE HOUSE OF REPRESENTATIVES Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis Contents Title of Section Page I. The National Banking System in 1966 2 A. Assets, Liabilities, and Capital Accounts 3 B. Income and Expenses of National Banks 3 C. Structural Changes in the National Banking System 4 II. Financial Operations of the Office of the Comptroller of the Currency, 1966 16 Appendices A. Merger Decisions, 1966 22 B. Statistical Tables 116 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis I. The National Banking System In 1966 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis INDEX Statistical Tables Table No. Title Page Table No. Title Page 1 Assets, liabilities, and capital of National banks, 1965 6 Branches of National banks: in operation December and 1966.