Case 20-50629-BLS Doc 1 Filed 06/22/20 Page 1 of 17

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![1 [4910-13] DEPARTMENT of TRANSPORTATION Federal](https://docslib.b-cdn.net/cover/8652/1-4910-13-department-of-transportation-federal-48652.webp)

1 [4910-13] DEPARTMENT of TRANSPORTATION Federal

This document is scheduled to be published in the Federal Register on 08/28/2018 and available online at https://federalregister.gov/d/2018-18642, and on govinfo.gov [4910-13] DEPARTMENT OF TRANSPORTATION Federal Aviation Administration Public Notice for Intent to Release Airport Property AGENCY: Federal Aviation Administration (FAA), DOT ACTION: Notice of intent to rule on request to release airport property; Nome Airport (OME), Nome, Alaska SUMMARY: The FAA proposes to rule and invites public comment on the release of land at the Nome Airport, Nome, Alaska. DATES: Comments must be received on or before [INSERT DATE 30 DAYS AFTER THE DATE OF PUBLICATION IN THE FEDERAL REGISTER]. ADDRESSES: Documents are available for review by appointment at the FAA Anchorage Airports Regional Office, Molly Lamrouex, Compliance Manager, 222 W. 7th Avenue, Anchorage, AK. Telephone: (907) 271-5439/Fax: (907) 271- 2851 and the State of Alaska Department of Transportation and Public Facilities, Fairbanks Office, 2301 Peger Road, Fairbanks, AK. Telephone: (907) 451-5226. Written comments on the Sponsor’s request must be delivered or mailed to: Molly Lamrouex, Compliance Manager, Federal Aviation Administration, Airports Anchorage Regional 1 Office, 222 W. 7th Avenue, Anchorage AK 99513, Telephone Number: (907) 271-5439/FAX Number: (907) 271-2851. FOR FURTHER INFORMATION CONTACT: Molly Lamrouex, Compliance Manager, Federal Aviation Administration, Alaskan Region Airports District Office, 222 W. 7th Avenue, Anchorage, AK 99513. Telephone Number: (907) 271-5439/FAX Number: (907) 271-2851. SUPPLEMENTARY INFORMATION: The FAA invites public comment on the request to release approximately 2.15 acres of airport property (lots 2 and 2B) at the Nome Airport (OME) under the provisions of 49 U.S.C. -

CFIT, World Airways, Inc., DC-8-63F, N802WA, King Cove, Alaska, September 8, 1973

CFIT, World Airways, Inc., DC-8-63F, N802WA, King Cove, Alaska, September 8, 1973 Micro-summary: This DC-8-63F flew into mountainous terrain. Event Date: 1973-09-08 at 0542 ADT Investigative Body: National Transportation Safety Board (NTSB), USA Investigative Body's Web Site: http://www.ntsb.gov/ Cautions: 1. Accident reports can be and sometimes are revised. Be sure to consult the investigative agency for the latest version before basing anything significant on content (e.g., thesis, research, etc). 2. Readers are advised that each report is a glimpse of events at specific points in time. While broad themes permeate the causal events leading up to crashes, and we can learn from those, the specific regulatory and technological environments can and do change. Your company's flight operations manual is the final authority as to the safe operation of your aircraft! 3. Reports may or may not represent reality. Many many non-scientific factors go into an investigation, including the magnitude of the event, the experience of the investigator, the political climate, relationship with the regulatory authority, technological and recovery capabilities, etc. It is recommended that the reader review all reports analytically. Even a "bad" report can be a very useful launching point for learning. 4. Contact us before reproducing or redistributing a report from this anthology. Individual countries have very differing views on copyright! We can advise you on the steps to follow. Aircraft Accident Reports on DVD, Copyright © 2006 by Flight Simulation Systems, LLC All rights reserved. www.fss.aero File No. 1-0018 AIRCRAFT ACCIDENT REPORT WORLD AIRWAYS, INC. -

4910-13 DEPARTMENT of TRANSPORTATION Federal

This document is scheduled to be published in the Federal Register on 09/21/2020 and available online at federalregister.gov/d/2020-20567, and on govinfo.gov 4910-13 DEPARTMENT OF TRANSPORTATION Federal Aviation Administration 14 CFR Part 71 [Docket No. FAA-2020-0823; Airspace Docket No. 20-AAL-49] RIN 2120-AA66 Proposed Technical Amendment to Separate Terminal Airspace Areas from Norton Sound Low, Woody Island Low, Control 1234L, and Control 1487L Offshore Airspace Areas; Alaska AGENCY: Federal Aviation Administration (FAA), DOT. ACTION: Notice of proposed rulemaking (NPRM). SUMMARY: This action proposes to amend the following Offshore Airspace Areas in Alaska: Norton Sound Low, Woody Island Low, Control 1234L, and Control 1487L. The FAA found an error with the Offshore Airspace Legal Descriptions containing airspace descriptions not related to the need to apply IFR en route Air Traffic Control services in international airspace. This action would correct that error by removing terminal airspace, airspace associated with geographic coordinates, and airspace associated with NAVAIDs from the Offshore Airspace legal descriptions. DATES: Comments must be received on or before [INSERT DATE 45 DAYS AFTER DATE OF PUBLICATION IN THE FEDERAL REGISTER]. ADDRESSES: Send comments on this proposal to the U.S. Department of Transportation, Docket Operations, 1200 New Jersey Avenue SE, West Building Ground Floor, Room W12-140, Washington, D.C. 20590; telephone: 1(800) 647-5527, or (202) 366-9826. You must identify FAA Docket No. FAA-2020-0823; Airspace Docket No. 20-AAL-49 at the beginning of your comments. You may also submit comments through the Internet at https://www.regulations.gov. -

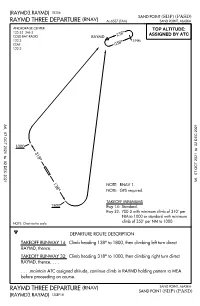

PASD Procedures

(RAYMD3.RAYMD)18256 SAND POINT (SDP) (PASD) RAYMD THREE DEPARTURE(RNAV) AL-6537 (FAA) SAND POINT, ALASKA ANCHORAGE CENTER TOP ALTITUDE: 125.35 346.3 ° 238 ASSIGNED BY ATC COLD BAY RADIO RAYMD 122.3 5 NM 8° CTAF 05 122.3 AK, 07 OCT 2021 to 02 DEC 1000 318 ° 138 AK, 07 OCT 2021 to 02 DEC NOTE:RNAV 1. ° NOTE:GPS required. TAKEOFF MINIMUMS 1800 Rwy 14:Standard. Rwy 32:700-3 with minimum climb of 310' per NM to 1000 or standard with minimum climb of 350' per NM to 1000. NOTE: Chart not to scale. T DEPARTURE ROUTE DESCRIPTION TAKEOFF RUNWAY 14: Climb heading 138° to 1800, then climbing left turn direct RAYMD, thence. TAKEOFF RUNWAY 32: Climb heading 318° to 1000, then climbing right turn direct RAYMD, thence. .maintain ATC assigned altitude, continue climb in RAYMD holding pattern to MEA before proceeding on course. RAYMD THREE DEPARTURE(RNAV) SAND POINT, ALASKA SAND POINT(SDP) (PASD) (RAYMD3.RAYMD)13SEP18 SAND POINT, ALASKA AL-6537 (FAA) 19115 NDB/DME HBT Rwy Idg 4099 APP CRS NDB RWY 14 390 TDZE 23 126° Chan79 (113.2) Apt Elev 24 SAND POINT(SDP)(PASD) T Circling NA northeast of Rwy 14-32. MISSED APPROACH: Climb to 2300 then climbing left turn to A 3 Helicopter visibility reduction below 4 SM NA. 3500 direct HBT NDB and hold, continue climb-in-hold to 3500. AWOS-3P ANCHORAGE CENTER CLNC DEL UNICOM 134.85 125.35 346.3 122.3(CTAF)L 122.8 RAYMD HBT 20 2182 2000 ° ) 4100 201 20 ( 0 100 2100 CUBPA HBT 20 1310 SAFKO 4100° ° 6200 227) 20 171 ( 108 306 ° (58 ° ° .8 351 AK, 07 OCT 2021 to 02 DEC ) 1207 IAF 1808 BORLAND Procedure NA for arrival at SAFKO 390 HBTBH 126 T on G10-G8 southwest bound. -

Overview of Environmental and Hydrogeologic Conditions at Sand Point, Alaska

Overview of Environmental and Hydrogeologic Conditions at Sand Point, Alaska U.S. GEOLOGICAL SURVEY Open-File Report 95-408 Prepared in cooperation with the FEDERAL AVIATION ADMINISTRATION U.S. DEPARTMENT OF THE INTERIOR BRUCE BABBITT, Secretary U.S. GEOLOGICAL SURVEY Gordon P. Eaton, Director For additional information write to: Copies of this report may be purchased from: District Chief U.S. Geological Survey U.S. Geological Survey Earth Science Information Center 4230 University Drive, Suite 201 Open-File Reports Section Anchorage, AK 99508-4664 Box 25286, MS 517 Federal Center Denver, CO 80225-0425 CONVERSION FACTORS AND VERTICAL DATUM Multiply By To obtain millimeter (mm) 0.03937 inch meter (m) 3.281 foot kilometer (km) 0.6214 mile square kilometer (km2) 0.3861 square mile kilometer per hour (km/hr) 0.6214 mile per hour cubic meter per second (m3/s) 35.31 cubic foot per second cubic meter per second per square kilometer 91.4 cubic foot per second per square [(m3/s)/(km2)] mile In this report, temperature is reported in degrees Celsius (°C), which can be converted to degrees Fahrenheit (°F) by the following equation: °F=1.8(°C) + 32 Sea level: In this report, "sea level" refers to the National Geodetic Vertical Datum of 1929 A geodetic datum derived from a general adjustment of the first-order level nets of the United States and Canada, formerly called Sea Level Datum of 1929. II Contents Overview of Environmental and Hydrogeologic Conditions at Sand Point, Alaska By James R. Cowan U.S. GEOLOGICAL SURVEY Open-File Report 95-408 Prepared in cooperation with the FEDERAL AVIATION ADMINISTRATION Anchorage, Alaska 1995 Overview of Environmental and Hydrogeologic Conditions at Sand Point, Alaska By James R. -

Notice of Adjustments to Service Obligations

Served: May 12, 2020 UNITED STATES OF AMERICA DEPARTMENT OF TRANSPORTATION OFFICE OF THE SECRETARY WASHINGTON, D.C. CONTINUATION OF CERTAIN AIR SERVICE PURSUANT TO PUBLIC LAW NO. 116-136 §§ 4005 AND 4114(b) Docket DOT-OST-2020-0037 NOTICE OF ADJUSTMENTS TO SERVICE OBLIGATIONS Summary By this notice, the U.S. Department of Transportation (the Department) announces an opportunity for incremental adjustments to service obligations under Order 2020-4-2, issued April 7, 2020, in light of ongoing challenges faced by U.S. airlines due to the Coronavirus (COVID-19) public health emergency. With this notice as the initial step, the Department will use a systematic process to allow covered carriers1 to reduce the number of points they must serve as a proportion of their total service obligation, subject to certain restrictions explained below.2 Covered carriers must submit prioritized lists of points to which they wish to suspend service no later than 5:00 PM (EDT), May 18, 2020. DOT will adjudicate these requests simultaneously and publish its tentative decisions for public comment before finalizing the point exemptions. As explained further below, every community that was served by a covered carrier prior to March 1, 2020, will continue to receive service from at least one covered carrier. The exemption process in Order 2020-4-2 will continue to be available to air carriers to address other facts and circumstances. Background On March 27, 2020, the President signed the Coronavirus Aid, Recovery, and Economic Security Act (the CARES Act) into law. Sections 4005 and 4114(b) of the CARES Act authorize the Secretary to require, “to the extent reasonable and practicable,” an air carrier receiving financial assistance under the Act to maintain scheduled air transportation service as the Secretary deems necessary to ensure services to any point served by that air carrier before March 1, 2020. -

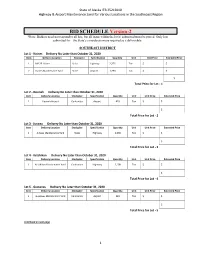

BID SCHEDULE Version-2 *Note: Bidders Need Not Respond to All Lots, but All Items Within the Lot(S) Submitted Must Be Priced

State of Alaska ITB 2521S010 Highway & Airport Maintenance Sand for Various Locations in the Southcoast Region BID SCHEDULE Version-2 *Note: Bidders need not respond to all lots, but all items within the lot(s) submitted must be priced. Only lots submitted for the State’s consideration are required as a deliverable. SOUTHEAST DISTRICT Lot 1 - Haines Delivery No Later than October 31, 2020 Item Delivery Location Stockpiler Specification Quantity Unit Unit Price Extended Price 1 MP 25 Haines State Highway 2,275 Ton $ $ 2 Haines Maintenance Yard State Airport 1,750 Ton $ $ $ Total Price for Lot - 1 Lot 2 - Hoonah Delivery No Later than October 31, 2020 Item Delivery Location Stockpiler Specification Quantity Unit Unit Price Extended Price 1 Hoonah Airport Contractor Airport 420 Ton $ $ $ Total Price for Lot - 2 Lot 3 - Juneau Delivery No Later than October 31, 2020 Item Delivery Location Stockpiler Specification Quantity Unit Unit Price Extended Price 1 Juneau Maintenance Yard State Highway 2,000 Ton $ $ $ Total Price for Lot - 3 Lot 4 - Ketchikan Delivery No Later than October 31, 2020 Item Delivery Location Stockpiler Specification Quantity Unit Unit Price Extended Price 1 Ketchikan Maintenance Yard Contractor Highway 2,100 Ton $ $ $ Total Price for Lot - 4 Lot 5 - Gustavus Delivery No Later than October 31, 2020 Item Delivery Location Stockpiler Specification Quantity Unit Unit Price Extended Price 1 Gustavus Maintenance Yard Contractor Airport 420 Ton $ $ $ Total Price for Lot - 5 Continued on next page 1 State of Alaska ITB 2521S010 Highway & Airport Maintenance Sand for Various Locations in the Southcoast Region Lot 6 - Hoonah Delivery No Later than October 31, 2020 Item Delivery Location Stockpiler Specification Quantity Unit Unit Price Extended Price 1 Klawock Maintenance Yard Contractor Highway 5,600 Ton $ $ $ Total Price for Lot - 6 Lot 7 - Petersburg Delivery No Later than October 31, 2020 Item Delivery Location Stockpiler Specification Quantity Unit Unit Price Extended Price 1 Petersburg Scow Bay, 288 Contractor Highway 1,176 Ton $ $ Mitkoff Hwy. -

Overview of Environmental and Hydrogeologic Conditions at Bethel, Alaska

Overview of Environmental and Hydrogeologic Conditions at Bethel, Alaska By Joseph M. Dorava and Eppie V. Hogan U.S. GEOLOGICAL SURVEY Open-File Report 95-173 Prepared in cooperation with the FEDERAL AVIATION ADMINISTRATION Anchorage, Alaska 1995 U.S. DEPARTMENT OF THE INTERIOR BRUCE BABBITT, Secretary U.S. GEOLOGICAL SURVEY Gordon P. Eaton, Director For additional information write to: Copies of this report may be purchased from: District Chief U.S. Geological Survey U.S. Geological Survey Earth Science Information Center 4230 University Drive, Suite 201 Open-File Reports Section Anchorage, AK 99508-4664 Box25286, MS 517 Federal Center Denver, CO 80225-0425 CONTENTS Abstract ................................................................. 1 Introduction............................................................... 1 Background............................................................... 1 Location.............................................................. 1 History and socioeconomics .............................................. 3 Physical setting ............................................................ 3 Climate .............................................................. 3 Vegetation............................................................ 5 Bedrock geology ....................................................... 5 Surficial geology and soils ............................................... 5 Hydrology ................................................................ 8 Surface water ........................................................ -

LEGISLATIVE BUDGET and AUDIT COMMITTEE Division of Legislative Audit

LEGISLATIVE BUDGET AND AUDIT COMMITTEE Division of Legislative Audit P.O. Box 113300 Juneau, AK 99811-3300 (907) 465-3830 FAX (907) 465-2347 [email protected] SUMMARY OF: A Special Report on the Department of Environmental Conservation, Division of Spill Prevention and Response, Oil and Hazardous Substance Release Prevention and Response Fund, March 18, 2008. PURPOSE OF THE REPORT In accordance with Title 24 of the Alaska Statutes and a special request by the Legislative Budget and Audit Committee, we have conducted a performance audit of the Department of Environmental Conservation (DEC), Division of Spill Prevention and Response (Division). Specifically, we were asked to review the expenditures and cost recovery revenues from the Oil and Hazardous Substance Release Prevention and Response Fund (Fund). REPORT CONCLUSIONS The conclusions are as follows: all expenditures are not recorded according to activities compliance with statutory cost recovery requirements is unclear Division is not efficiently and effectively recovering costs most expenditures were appropriate legal costs need an improved budgeting process certain contractual oversight practices are weak detailed information on the Fund’s financial activities is incomplete During the audit we reviewed a $9 million reimbursable services agreement between the Division and the Department of Law for legal services related to two transit pipeline spills on the North Slope. The contract was funded by the Response Account without specific legislative appropriation. It would have been more prudent to follow the established legislative budget process, especially for long-term legal activities. FINDINGS AND RECOMMENDATIONS 1. The Division Director should improve the accountability for the Division’s activities and reporting of Fund expenditures. -

Executive Summary

Yukon Kuskokwim Delta YKTPTRANSPORTATION PLAN Executive Summary March 2018 EXECUTIVE SUMMARY Purpose I The purpose of the Yukon-Kuskokwim Delta Transportation Plan (Plan) is to inventory transportation facilities and issues, and document transportation needs. The Plan identifies, prioritizes, and recommends the top five regionally significant projects1 for each mode of transportation (aviation, marine, and surface) in the Yukon-Kuskokwim Delta (Y-K Delta). The Y-K Delta is in critical Yukon Kuskokwim Delta need of basic infrastructure necessary for daily life activitiesYKTP including TRANSPORTATION PLAN transportation, facilities, housing, water and sewer, and utilities. The Plan is a 20-year, multimodal, regional transportation plan including various vehicle fleets (e.g. planes, all-terrain vehicles [ATVs], snow machines, barges, skiffs, and automobiles), and modes (e.g. aviation, surface, and marine) of transportation. The Plan is one of six area transportation plans being incorporated into the Alaska Statewide Long-Range Transportation Plan (LRTP). This is an update to the original Y-K Delta Transportation Plan (2002 YKTP). The Plan is not a programing document. Communities, tribal and city governments, and funding agencies should use this plan as a tool to secure funding for projects from multiple funding sources. The vision for the Plan is: Yukon Kuskokwim Delta Transportation Plan VISION STATEMENT The Yukon-Kuskokwim Delta Transportation Plan will guide transportation decisions in the Yukon- Kuskokwim region by promoting safety, livability, economic development, and intermodal connectivity throughout the transportation system. 1 A regionally significant project is one that provides connection between two or more communities; provides access to public facilities such as hospitals, schools, jobs etc.; or March 2018 provides access to alternative modes of transportation. -

Election District Report

Fiscal Year 1992 Election District Report Legislative Finance Division P.O. BoxWF Juneau, Alaska 99811 (907) 465-3795 TABLE OF CONTENTS ELECTION DISTRICT PAGE NUMBER Summaries ........................................................... III - VI 01 Ketchikan - Wrangell - Petersburg. 1 02 Inside Passage . .. 7 03 Baranof - Chichagof. .. 11 04 Juneau. .. 15 05 Kenai - Cook Inlet . .. 21 06 Prince William Sound . .. 25 07 - 15 Anchorage .............................................................. 31 16 Matanuska - Susitna . .. 61 17 Interior Highways. .. 67 18 Southeast North Star Borough. .. 71 19 - 21 Fairbanks . .. 73 22 North Slope ~- Kotzebue ..................................................... 79 23 Norton Sound ........................................................... 83 24 Interior Rivers . 89 25 Lower Kuskokwim ......... ~.............................................. 93 26 Bristol Bay - Aleutian Islands . 97 27 Kodiak - East Alaska Peninsula ... .. 101 99 Statewide & Totals. .. 107 I II FY92 CAPITAL BUDGET /REAPPROPRIATIONS (CH 96, SLA 91) - AFTER VETOES ELECTION CAPITAL CAPITAL REAPPROP REAPPROP DISTRICT GENFUNDS TOTAL FUNDS GENFUNDS TOTAL FUNDS TOTALS 1 21,750.1 35,266.3 0.0 0.0 35,266.3 2 8,223.8 15,195.6 0.0 0.0 15,195.6 3 3,524.8 6,446.1 0.0 0.0 6,446.1 4 8,397.2 19,387.0 1,360.0 1,360.0 20,747.0 5 11,885.0 16,083.9 0.0 0.0 16,083.9 6 5,315.0 14,371.1 0.0 0.0 14,371.1 7 - 15 73,022.9 99,167.9 -95.3 -95.3 99,072.6 16 13,383.0 66,817.2 -20.0 -20.0 66,797.2 17 6,968.5 39,775.5 0.0 0.0 39,775.5 18 2,103.6 2,753.6 0.0 0.0 2,753.6 -

TABLE of CONTENTS Page

Alaska Aviation System Plan Update Yukon-Kuskokwim Region Air Versus Roads Access Construction and Maintenance Baseline Cost Comparison January 2013 YUKON-KUSKOKWIM REGION AIR VERSUS ROADS ACCESS CONSTRUCTION AND MAINTENANCE BASELINE COST COMPARISON ALASKA AVIATION SYSTEM PLAN UPDATE Prepared for: State of Alaska Department of Transportation and Public Facilities Division of Statewide Aviation 4111 Aviation Drive Anchorage, Alaska 99502 Prepared by: DOWL HKM 4041 B Street Anchorage, Alaska 99503 (907) 562-2000 W.O. 59825.10 January 2013 Yukon-Kuskokwim Region Air Versus Roads Access Alaska Aviation System Plan Update Construction and Maintenance Baseline Cost Comparison January 2013 TABLE OF CONTENTS Page 1.0 INTRODUCTION ...............................................................................................................1 2.0 ROADS COST ESTIMATE ................................................................................................4 2.1 Design Criteria ..................................................................................................................5 2.2 Roadway Unit Costs and Assumptions .............................................................................6 2.2.1 Roadway Unit Costs ...................................................................................................6 2.2.2 Roadway Cost Assumptions .......................................................................................7 2.2.3 Drainage Unit Costs and Assumptions .......................................................................8