STV (Response to Call for Evidence on UK Production Sector)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tv Uk Freesat

Tv uk freesat loading Skip to content Freesat Logo TV Guide Menu. What is Freesat · Channels · Get Freesat · THE APP · WHAT'S ON · Help. Login / Register. My Freesat ID. With over channels - and 13 in high definition - it's not hard to find unbelievably good TV. With Freesat's smart TV Recorders you can watch BBC iPlayer, ITV Hub*, All 4, Demand 5 and YouTube on your TV. Tune into our stellar line-up of digital radio channels and get up to date Get Freesat · What's on · Sport. If you're getting a new TV, choose one with Freesat built in and you can connect directly to your satellite dish with no need for a separate box. You can now even. With a Freesat Smart TV Recorder you can enjoy the UK's favourite Catch Up services: BBC iPlayer, ITV Hub*, All 4 & Demand 5, plus videos on YouTube. Freesat TV Listings. What's on TV now and next. Full grid view can be viewed at Freesat is a free-to-air digital satellite television joint venture between the BBC and ITV plc, . 4oD launched on Freesat's Freetime receivers on 27 June , making Freesat the first UK TV platform to host the HTML5 version of 4oD. Demand Owner: BBC and ITV plc. Freesat, the satellite TV service from the BBC and ITV, offers hundreds of TV and radio channels to watch Lifestyle: Food Network UK, Showcase TV, FilmOn. FREESAT CHANNEL LIST - TV. The UK IPTV receiver now works on both wired internet and WiFi which , BET Black Entertainment TV, Entertainment. -

Scotland's Digital Media Company

Annual Report and Accounts 2010 Annual Report and Accounts Scotland’s digital media company 2010 STV Group plc STV Group plc In producing this report we have chosen production Pacific Quay methods which aim to minimise the impact on our Glasgow G51 1PQ environment. The papers chosen – Revive 50:50 Gloss and Revive 100 Uncoated contain 50% and 100% recycled Tel: 0141 300 3000 fibre respectively and are certified in accordance with the www.stv.tv FSC (Forest stewardship Council). Both the paper mill and printer involved in this production are environmentally Company Registration Number SC203873 accredited with ISO 14001. Directors’ Report Business Review 02 Highlights of 2010 04 Chairman’s Statement 06 A conversation with Rob Woodward by journalist and media commentator Ray Snoddy 09 Chief Executive’s Review – Scotland’s Digital Media Company 10 – Broadcasting 14 – Content 18 – Ventures 22 KPIs 2010-2012 24 Performance Review 27 Principal Risks and Uncertainties 29 Corporate Social Responsibility Corporate Governance 34 Board of Directors 36 Corporate Governance Report 44 Remuneration Committee Report Accounts 56 STV Group plc Consolidated Financial Statements – Independent Auditors’ Report 58 Consolidated Income Statement 58 Consolidated Statement of Comprehensive Income 59 Consolidated Balance Sheet 60 Consolidated Statement of Changes in Equity 61 Consolidated Statement of Cash Flows 62 Notes to the Financial Statements 90 STV Group plc Company Financial Statements – Independent Auditors’ Report 92 Company Balance Sheet 93 Statement -

ITV Plc Corporate Responsibility Report 04 ITV Plc Corporate Responsibility Report 04 Corporate Responsibility and ITV

One ITV ITV plc Corporate responsibility report 04 ITV plc Corporate responsibility report 04 Corporate responsibility and ITV ITV’s role in society is defined ITV is a commercial public service by the programmes we make broadcaster. That means we and broadcast. The highest produce programmes appealing ethical standards are essential to to a mass audience alongside maintaining the trust and approval programmes that fulfil a public of our audience. Detailed rules service function. ITV has three core apply to the editorial decisions public service priorities: national we take every day in making and international news, regional programmes and news bulletins news and an investment in and in this report we outline the high-quality UK-originated rules and the procedures in place programming. for delivering them. In 2004, we strengthened our longstanding commitment to ITV News by a major investment in the presentation style. Known as a Theatre of News the new format has won many plaudits and helped us to increase our audience. Researched and presented by some of the finest journalists in the world, the role of ITV News in providing accurate, impartial news to a mass audience is an important social function and one of which I am proud. Our regional news programmes apply the same editorial standards to regional news stories, helping communities to engage with local issues and reinforcing their sense of identity. Contents 02 Corporate responsibility management 04 On air – responsible programming – independent reporting – reflecting society – supporting communities – responsible advertising 14 Behind the scenes – encouraging creativity – our people – protecting the environment 24 About ITV – contacts and feedback Cover Image: 2004 saw the colourful celebration of a Hindu Wedding on Coronation Street, as Dev and Sunita got married. -

FTSE Factsheet

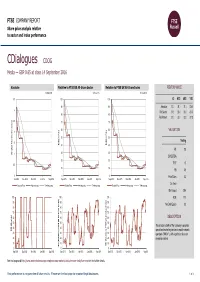

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 14 September 2016 CDialogues CDOG Media — GBP 0.65 at close 14 September 2016 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-Sep-2016 14-Sep-2016 14-Sep-2016 3.5 100 100 1D WTD MTD YTD 90 90 Absolute 31.3 31.3 31.3 -23.5 3 Rel.Sector 31.5 33.0 33.2 -24.0 80 80 Rel.Market 31.2 33.3 33.2 -27.8 2.5 70 70 60 60 VALUATION 2 (local currency) (local 50 50 Trailing 1.5 Relative Price 40 Relative Price 40 PE 2.8 30 30 Absolute Price Price Absolute 1 EV/EBITDA - 20 20 0.5 PCF 1.0 10 10 PB 0.5 0 0 0 Price/Sales 0.3 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Div Yield - Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout 29.4 100 100 100 ROE 17.7 90 90 90 Net Debt/Equity 0.0 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is provides 40 40 40 RSI (Absolute) RSI specialised marketing services to mobile network 30 30 30 operators ("MNOs" ), with a particular focus on 20 20 20 emerging markets. -

Anticipated Acquisition by ITV Plc of SDN Limited

Anticipated acquisition by ITV plc of SDN Limited The OFT’s decision on reference under section 22(1) given on 15 August 2005. Full text of decision published 24 August 2005. PARTIES 1. ITV plc (ITV) is a vertically integrated broadcaster active in the acquisition and production of broadcasting content, the packaging of that content into channels (ITV1, ITV2, ITV3, ITV News, and Men and Motors) and the distribution of those channels on analogue and the Digital Terrestrial Television (DTT) platform. It has 48.5 per cent share ownership on Digital 3and4 limited, which holds the licence for Multiplex 2.1 2. SDN Limited (SDN) holds the licence for and operates Multiplex A, part of the DTT transmission system. It was jointly controlled by S4C, United Business Media and NTL. In the year ending 31 December 2003 it had a turnover of £7.76 million in the UK. TRANSACTION 3. On 27 April ITV acquired the entire shareholding in SDN, following the shareholders’ triggering of a buy out option. 4. The statutory deadline is 26 August. The administrative deadline has expired. JURISDICTION 5. As a result of this transaction ITV and SDN have ceased to be distinct. The parties overlap in the ownership of DTT multiplex licences and in the supply of multiplex capacity for pay-TV and commercial TV. The share of supply test in section 23 of the Enterprise Act 2002 (the Act) is met as they have 33 per cent of multiplex licences and at least 25 per cent of capacity available for both pay-TV and commercial TV in the UK. -

ITV Plc (ITV:LN)

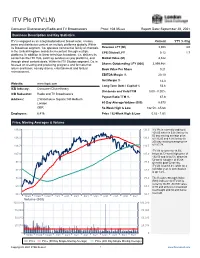

ITV Plc (ITV:LN) Consumer Discretionary/Radio and TV Broadcasters Price: 108.05 GBX Report Date: September 28, 2021 Business Description and Key Statistics ITV is engaged as an integrated producer broadcaster, creates, Current YTY % Chg owns and distributes content on multiple platforms globally. Within its Broadcast segment, Co. operates commercial family of channels Revenue LFY (M) 3,308 3.0 in the United Kingdom and delivers content through multiple EPS Diluted LFY 0.12 1.7 platforms. In addition to linear television broadcast, Co. delivers its content on the ITV Hub, catch up services on pay platforms, and Market Value (M) 4,322 through direct content deals. Within its ITV Studios segment, Co. is focused on creating and producing programs and formats that Shares Outstanding LFY (000) 3,999,984 return and travel, namely drama, entertainment and factual Book Value Per Share 0.21 entertainment. EBITDA Margin % 20.10 Net Margin % 14.3 Website: www.itvplc.com Long-Term Debt / Capital % 53.6 ICB Industry: Consumer Discretionary Dividends and Yield TTM 0.00 - 0.00% ICB Subsector: Radio and TV Broadcasters Payout Ratio TTM % 67.8 Address: 2 Waterhouse Square;140 Holborn London 60-Day Average Volume (000) 8,573 GBR 52-Week High & Low 132.50 - 65.68 Employees: 6,416 Price / 52-Week High & Low 0.82 - 1.65 Price, Moving Averages & Volume 136.0 136.0 ITV Plc is currently trading at 108.05 which is 6.0% below its 50 day moving average price 126.3 126.3 of 115.00 and 8.3% below its 200 day moving average price 116.7 116.7 of 117.78. -

Sci-Fi Sisters with Attitude Television September 2013 1 LOVE TV? SO DO WE!

April 2021 Sky’s Intergalactic: Sci-fi sisters with attitude Television www.rts.org.uk September 2013 1 LOVE TV? SO DO WE! R o y a l T e l e v i s i o n S o c i e t y b u r s a r i e s o f f e r f i n a n c i a l s u p p o r t a n d m e n t o r i n g t o p e o p l e s t u d y i n g : TTEELLEEVVIISSIIOONN PPRROODDUUCCTTIIOONN JJOOUURRNNAALLIISSMM EENNGGIINNEEEERRIINNGG CCOOMMPPUUTTEERR SSCCIIEENNCCEE PPHHYYSSIICCSS MMAATTHHSS F i r s t y e a r a n d s o o n - t o - b e s t u d e n t s s t u d y i n g r e l e v a n t u n d e r g r a d u a t e a n d H N D c o u r s e s a t L e v e l 5 o r 6 a r e e n c o u r a g e d t o a p p l y . F i n d o u t m o r e a t r t s . o r g . u k / b u r s a r i e s # R T S B u r s a r i e s Journal of The Royal Television Society April 2021 l Volume 58/4 From the CEO It’s been all systems winners were “an incredibly diverse” Finally, I am delighted to announce go this past month selection. -

![Statement 2011 [FINAL]](https://docslib.b-cdn.net/cover/9394/statement-2011-final-1129394.webp)

Statement 2011 [FINAL]

Statement 2011 Overall strategy / major themes for the year STV continues to thrive as Scotland’s most popular peak time TV station and holds the broadcast licences for central and north Scotland, attracting more than 4 million viewers each month. With a strong, recognisable brand and a flourishing production arm we enter 2011 in the best position possible to create and deliver and unique, rich and relevant schedule for our viewers. 2011 will see Scotland complete its digital switchover process which has already been achieved successfully in the STV north region. This brings increased choice to all viewers including a DTT HD version of STV, the result of new investment in order to offer Scotland’s most popular peaktime service at the highest resolution. The digital business has been a huge success for STV over the past 12 months and we are looking forward to bolstering this throughout 2011 and further cementing STV’s reputation as Scotland’s digital media company. Remaining at the core of STV’s strategy is our ongoing commitment to our quality content and making that content available to our audiences whenever, wherever and however they want it through our STV Anywhere program. We offer Scottish viewers a service that is both relevant and unique to Scotland and increasingly available on multi platforms including DTT, DSAT & DCAB and HD. To complement our on air transmissions, we are developing new access for viewers via online websites such as the STV Player and YouTube and serving content to mobile and connected devices starting with iPhone apps and PS3 consoles. -

Cteea/S5/20/C19/C015

CTEEA/S5/20/C19/C015 CULTURE, TOURISM, EUROPE AND EXTERNAL AFFAIRS COMMITTEE CALL FOR VIEWS ON THE IMPACT OF COVID-19 ON SCOTLAND’S CULTURE AND TOURISM SECTORS SUBMISSION FROM STV GROUP PLC STV Group plc (“STV”) is pleased to take this opportunity to respond to the Culture, Tourism, Europe And External Affairs Committee inquiry on the impact of Covid-19. STV holds the Channel 3 licences for central and north Scotland, broadcasting both the network schedule of drama, entertainment and events alongside regional content which is primarily news and current affairs. We reach over 85% of the population in our regions every month and our STV News at Six programme is Scotland’s most watched bulletin. STV is also Scotland’s largest commercial producer of television programmes in a range of genres including drama (The Victim and Elizabeth is Missing) - and entertainment (Catchphrase), working with all the major UK networks. In digital, the STV Player has enjoyed significant growth over the past year, with availability on more platforms and an increasing range of new content and channels in addition to our 30 day catchup service. STV is a proud commercial partner for Scottish business including many SMEs. Our Growth Fund initiative enables many businesses to access television advertising for the first time. We have committed £20m to the Growth Fund and worked with nearly 200 businesses already. We are pleased to attach below two documents for the Committee as they examine the impact of Covid-19. Both are forward looking as we consider the challenge of doing business post-lockdown. -

Sustaining the Public Value of ITV News in a Changing World

Robert Kenny Sustaining the public value of ITV News in a changing world October 2020 About the Author Rob Kenny is a founder of Communications Chambers. He has extensive experience on issues of TMT policy and regulation, and PSB and news in particular. He has worked on PSB issues for clients such as the BBC, ITV, RTÉ, Virgin Media, COBA, the Broadcasting Authority of Ireland and the Belgian government, addressing funding, public value, market impact, distribution strategy, and many other topics. He has also worked widely on news issues, including plurality, the business of news, and interventions to support news. Relevant clients have included the BBC, Sky, 21st Century Fox, News Corp, GMG, the Broadcasting Authority of Ireland and the Australian Competition & Consumer Commission. Previously Rob headed strategic planning and corporate development for Hongkong Telecom, and corporate development for Level 3. Disclaimer This is an independent report prepared for ITV. The opinions offered herein are purely those of the author. They do not necessarily represent the views of ITV, nor the views of all Communications Chambers members. [0] Contents 1. Executive Summary .................................................................................................................................. 2 2. Introduction ................................................................................................................................................. 6 3. A rapidly changing news market ........................................................................................................ 7 3.1. Shifting platform preference 7 3.2. News economics 10 3.3. The nature of news 12 4. A news service for everyone: the current role of ITV News ............................................... 15 4.1. ITV’s news offering 15 4.2. ITV’s investment in news 19 4.3. Consumption of ITV News 21 4.4. Trust in ITV News 25 4.5. ITV News during COVID-19 25 4.6. -

ITV Diversity Acceleration Plan

DIVERSITY ACCELERATION PLAN REPORT 2021 WELCOME CAROLYN MCCALL, CEO ITV Welcome to our report. A year ago, we committed to increasing investment, including appointing a new Diversity & Inclusion team, in order to accelerate the speed of change and increase representation on-screen, in our production teams and within our own workforce. Attracting the best talent from a wide range of backgrounds, creating an inclusive culture where all colleagues can flourish, and making programmes that appeal to wide and diverse audiences are all hugely important priorities to our business. I feel incredibly proud to work for ITV and this has been an extraordinary year. I would like to acknowledge the passion and commitment ITV colleagues have displayed to drive this agenda forward and particularly the hard work of and the important role that our colleague Network Groups have played. Lockdown made things harder to deliver on many fronts including some elements of this plan and there are further steps to reach all our targets. There is no doubting our commitment – we are also committed to measuring our progress and reporting publicly each year because we know that we will rightly be judged by actions rather than words. 2 INTRODUCTION ADE RAWCLIFFE, GROUP DIRECTOR DIVERSITY AND INCLUSION, ITV As a senior leader at ITV I know how essential it is for us to use our position in society to shape Britain’s culture whilst reflecting who we are; it’s a position of privilege and responsibility. ITV has a duty to remain relevant, successful and profitable. As custodians of an organisation which millions of British people have a close relationship and affinity with, we understand the importance of ensuring that ITV consistently lives up to their expectations. -

Small Screen: Big Debate – Consultation Itv Plc Response

SMALL SCREEN: BIG DEBATE – CONSULTATION ITV PLC RESPONSE March 2021 [Redacted for publication] 1. EXECUTIVE SUMMARY 2021 is a critical year for Public Service Media and the UK’s wider TV ecology and creative economy The decisions we take this year about public service media will determine the extent to which the UK will continue to have a thriving national TV market serving all citizens, with public service media at its heart, alongside and participating in a thriving global market. The huge value people in Britain see in what Ofcom rightly calls Public Service Media (or ‘PSM’, which we adopt where appropriate in this submission) was strikingly set out in Ofcom’s consultation. The evidence amassed by Ofcom illustrated particularly the enduring importance of free-to-air, mass reach television from the existing PSB institutions in bringing people together right across the UK, regardless of ability to pay, supporting our culture, democracy and creative economy. PSM promotes and develops our shared values, national resilience, furthers the Creative Industries and nurtures Britain’s soft power abroad. Indeed, so compelling was Ofcom’s description of the benefits PSM brings to the UK and its citizens, we should now move on from the endless debate about the purposes or value of PSM and instead shift attention to the development of a plan to sustain it for the long term. But even as a consensus around the importance of PSM and the need for reform grows, so at the same time the commercial PSBs are faced with the immediate and serious impact of the proposed ban on HFSS food and drink advertising on TV before 9pm.