2020 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Liquefied Natural Gas (LNG) Regulation in British Columbia February 2017

Liquefied Natural Gas (LNG) Regulation in British Columbia February 2017 McCarthy Tétrault LLP mccarthy.ca i McCarthy Tétrault LLP mccarthy.ca This publication is intended as an overview of liquefied natural gas (LNG) regulation in British Columbia. Specific advice should be sought in respect of particular projects. For more information on this overview, please contact Monika Sawicka (editor), Paul Cassidy, Selina Lee-Andersen or Robin Sirett at (604) 643-7100. The laws, regulations and policies discussed in this overview are stated as of January 31, 2017. © 2017 McCarthy Tétrault LLP/S.E.N.C.R.L., s.r.l. ii McCarthy Tétrault LLP mccarthy.ca CONTENTS Page CONTENTS ................................................................................................................................II I. DEFINITIONS..................................................................................................................5 II. INTRODUCTION.............................................................................................................7 III. CURRENT POLICY SETTING ........................................................................................8 IV. PERMITS AND APPROVALS.......................................................................................10 A. EXPLORATION, DEVELOPMENT AND PRODUCTION...................................10 1. Provincial .............................................................................................................10 a. Petroleum and Natural Gas Tenure.........................................................10 -

The Canadian LNG Export Industry Progress and Prospects

The Canadian LNG Export Industry Progress and Prospects ABA Section of International Law 2016 Fall Meeting Tokyo, Japan Al Hudec, Farris LLP, Vancouver Don Bell, Torys LLP, New York John Mackay, Latham & Watkins LLP, Singapore Karen Ogen, First Nations LNG Alliance, Wet’suwet’en First Nation 2 Introduction • Canada began to develop a legal regulatory and fiscal regime for LNG exports in 2012 • This regime is now largely in place and 3 large projects and one smaller project now have full regulatory approval • If built, these proposed Canadian LNG liquefaction facilities will be among the largest and costliest energy projects ever built 3 Driving forces behind the Canadian industry • The ‘shale gas’ revolution has made the U.S. self sufficient in oil and gas and has shut in abundant Canadian supplies • The obvious solution is for Western Canada to replace its U.S. and Eastern Canadian markets with Asian exports • This requires a return to JCC oil index based pricing – B.C. announced an LNG strategy in 2012 when price was U.S.$18.11 – Price now U.S.$6.32 – Break even for the Canadian projects is about U.S.$10.30 The view from Asia • Asia is the principal market for Canadian LNG LNG Importers (2013) OTHER ASIA 15% EUROPE 15% Belgium, France, Greece, Italy, India, Indonesia, Malaysia, Lithuania, Netherlands, Portugal, Pakistan, Singapore, Taiwan, Spain, Sweden, Turkey, Thailand MIDDLE EAST 4% U.K. SOUTH KOREA 14% AMERICAS 9% Argentina, Brazil, Chile, Dominican Rep, Mexico, Puerto Rico, Canada, USA CHINA 8% JAPAN 35% Source: International Group -

Management's Discussion and Analysis

Management’s discussion and analysis February 12, 2015 This management’s discussion and analysis (MD&A) contains information to help the reader make investment decisions about TransCanada PipeLines Limited. It discusses our business, operations, financial position, risks and other factors for the year ended December 31, 2014. This MD&A should be read with our accompanying December 31, 2014 audited comparative consolidated financial statements and notes for the same period, which have been prepared in accordance with U.S. generally accepted accounting principles (GAAP). Contents ABOUT THIS DOCUMENT ............................... 2 ABOUT OUR BUSINESS ................................. 5 • Three core businesses ................................. 5 • Our strategy ....................................... 6 • Capital program ..................................... 7 • 2014 financial highlights .............................. 8 • Outlook ........................................... 13 NATURAL GAS PIPELINES ............................... 15 LIQUIDS PIPELINES .................................... 33 ENERGY ............................................. 43 CORPORATE .......................................... 63 FINANCIAL CONDITION ................................. 65 OTHER INFORMATION ................................. 75 • Risks and risk management ............................ 75 • Controls and procedures .............................. 81 • CEO and CFO certifications ............................ 82 • Critical accounting estimates .......................... -

TC Energy 2021 Management Information Circular

Management information circular March 4, 2021 Notice of annual meeting of shareholders to be held May 7, 2021 24668 TC_ENGLISH Circular cover spread.pdf - p1 (March 6, 2021 00:22:29) DT Letter to shareholders ........................................... 1 Notice of 2021 annual meeting ................................ 2 About Management information circular ............................3 TC Energy Summary ....................................................................4 About the shareholder meeting ...............................6 Delivering the energy people need, every day. Safely. Delivery of meeting materials ........................................7 Responsibly. Collaboratively. With integrity. Attending and participating in the meeting .....................8 We are a vital part of everyday life — delivering the energy millions of people rely on to power their lives in a Voting ...................................................................... 10 sustainable way. Thanks to a safe, reliable network of natural gas and crude oil pipelines, along with power generation Business of the meeting .............................................. 14 and storage facilities, wherever life happens — we’re there. Guided by our core values of safety, responsibility, Governance ........................................................33 collaboration and integrity, our 7,500 people make a positive difference in the communities where we operate across About our governance practices ...................................33 Canada, the U.S. and Mexico. -

Annual Information Form

TC Energy Corporation 2019 Annual information form February 12, 2020 TED Contents PRESENTATION OF INFORMATION . 2 FORWARD-LOOKING INFORMATION . 2 TC ENERGY CORPORATION . 4 Corporate structure . 4 Intercorporate relationships . 4 GENERAL DEVELOPMENT OF THE BUSINESS . 5 Natural Gas Pipelines . 5 Liquids Pipelines . 12 Power and Storage . 14 BUSINESS OF TC ENERGY . 15 Natural Gas Pipelines . 15 Liquids Pipelines . 15 Regulation of Natural Gas Pipelines and Liquids Pipelines . 16 Power and Storage . 17 GENERAL . 18 Employees . 18 Health, safety, sustainability and environmental protection and social policies . 18 RISK FACTORS . 20 DIVIDENDS . 21 DESCRIPTION OF CAPITAL STRUCTURE . 21 Share capital . 21 CREDIT RATINGS . 24 Moody's . 25 S&P . 25 Fitch . 25 DBRS . 26 MARKET FOR SECURITIES . 27 Common shares . 27 Preferred shares . 28 DIRECTORS AND OFFICERS . 29 Directors . 29 Board committees . 31 Officers . 32 Conflicts of interest . 33 CORPORATE GOVERNANCE . 34 AUDIT COMMITTEE . 35 Relevant education and experience of members . 35 Pre-approval policies and procedures . 37 External auditor service fees . 37 LEGAL PROCEEDINGS AND REGULATORY ACTIONS . 38 TRANSFER AGENT AND REGISTRAR . 38 MATERIAL CONTRACTS . 38 INTEREST OF EXPERTS . 38 ADDITIONAL INFORMATION . 38 GLOSSARY . 39 SCHEDULE A . .. -

Electric/Gas Operations Committee Meeting No

ISO New England Final Minutes Electric/Gas Operations Committee Meeting No. 65 March 25, 2020 2:00 – 2:25 PM EDT Teleconference Attendees Representing M. Babula ISO New England (ISO-NE) E. Cahill Constellation / Everett LNG J. Carroll Energir J. Daul National Fuel Gas Supply M. Dirrane Enbridge J. Esposito Iroquois Gas Transmission (IGT) C. Fasca ISO New England T. Gwilliam Iroquois Gas Transmission M. Holt NG Advantage K. Iampen Repsol / Canaport LNG E. Karanian Eversource Energy A. Klaube Northeast Power Coordinating Council (NPCC) M. Knowland ISO-NE S. Leahy Northeast Gas Association (NGA) M. Lombardi NPCC A. Oks NPCC W. Page Enbridge D. Raval Columbia Gas of MA/NiSource G. Ritter Excelerate Energy L. Reno Eversource Energy C. Sculley Tennessee Gas Pipeline (TGP) N. Sproehnle ISO New England J. Stevenson New York ISO (NYISO) G. Venkateshan Tennessee Gas Pipeline TGP) T. White Iroquois Gas Transmission M. Whitten Daymark Energy Advisors M. Zampano Sprague Energy Introductions Mr. Babula welcomed everyone to the sixty-fifth meeting of the Electric/Gas Operations Committee (EGOC). Introductions were made. This meeting’s agenda focused on identifying the current conditions for the regional electric, natural gas and liquid fuel sectors during the COVID-19 pandemic. This was the second meeting of the EGOC in a series of regularly weekly conference calls scheduled during the ongoing pandemic. ISO New England / NGA Page 1 April 10, 2020 ISO New England Final Minutes 1.0 Administrative Matters 1.1 ISO New England’s (ISO-NE) Information Policy and the Northeast Gas Association’s (NGA) Antitrust Compliance Procedure Mr. -

March 30, 2020 OPEN LETTER: Coastal Gaslink Pipeline Project

March 30, 2020 Prime Minister Justin Trudeau Honourable Patty Hajdu Office of the Prime Minister Minister of Health 80 Wellington Street Confederation Building, 278 House of Commons Ottawa, ON K1A 0A2 Ottawa, Ontario K1A 0A6 Via Email Only: [email protected] Via Email Only: [email protected] Honourable John Horgan Honourable Adrian Dix Premier of Executive Council Minster of Health Parliament Buildings Parliament Buildings Victoria, British Columbia V8V 1X4 Victoria, British Columbia V8V 1X4 Via Email Only: [email protected] Via Email Only: [email protected] OPEN LETTER: Coastal GasLink Pipeline Project Must be Halted Due to the COVID-19 Outbreak Dear Prime Minister Trudeau, Minister Hajdu, Premier Horgan, and Minister Dix, We urge you to act swiftly to protect the public’s health from the heightened risks of COVID-19 transmission posed by ongoing construction of the Coastal GasLink Pipeline Project. Most vulnerable to the spread will be frontline healthcare workers, project workers, and local Indigenous and non-Indigenous communities forced to shoulder the consequences for any disregard for health and safety. Directed by Resolution 2019-07, the Union of BC Indian Chiefs has called on Canada and B.C. to honour Wet’suwet’en Title and Rights that have never been extinguished and are confirmed by the S.C.C. in Delgamuukw. Under the standards enshrined in the United Nations Declaration on the Rights of Indigenous Peoples, legislated in BC and affirmed by Canada, free, prior, and informed consent of proper Title and Rights holders impacted must be achieved before any approval of any project affecting their land, territories, and other resources. -

United States Mexico Canada

4 5 93 3 8 7 CANADA 6 CALGARY TORONTO 1 UNITED STATES CHARLESTON 2 HOUSTON MEXICO MEXICO CITY TC Energy – Liquids pipelines As of June 30, 2021 Liquids pipelines We are the operator and developer of the following pipelines and properties. Length Description Ownership Liquids Pipelines Transports crude oil from Hardisty, Alberta to U.S. markets at 4,324 km 1 Keystone Pipeline System Wood River and Patoka, Illinois, Cushing, Oklahoma, and the U.S. 100% (2,687 miles) Gulf Coast. Transports crude oil from Cushing, Oklahoma to the U.S. Gulf Coast on 2 Marketlink 100% facilities that form part of the Keystone Pipeline System. Transports crude oil from the producing area northwest of Fort 460 km 3 Grand Rapids McMurray, Alberta to the Edmonton/Heartland, Alberta market 50% (287 miles) region. 72 km Transports crude oil from Canadian Natural Resources Limited’s 4 White Spruce 100% (45 miles) Horizon facility in northeast Alberta to the Grand Rapids pipeline. 90 km Transports bitumen and diluent between the Fort Hills mine site and 5 Northern Courier 15% (56 miles) Suncor Energy’s terminal located north of Fort McMurray, Alberta. In development 6 Keystone Hardisty Terminal1 Crude oil terminal located at Hardisty, Alberta. 100% 200 km 7 Heartland Pipeline and Terminal and pipeline facilities to transport crude oil from the (125 miles) 100% 8 TC Terminals Edmonton/Heartland, Alberta region to Hardisty, Alberta. Expansion of Grand Rapids to transport additional crude oil from 460 km 9 Grand Rapids Phase II the producing area northwest of Fort McMurray, Alberta to the 50% (287 miles) Edmonton/Heartland, Alberta market region. -

Coastal Gaslink Pipeline Ltd

Coastal GasLink Pipeline Ltd. NEB 1.1 Jurisdiction over the Coastal GasLink Pipeline Response to Information Request Project MH-053-2018 IR Number: NEB 1.1 Category: Economic Matters Topic: Corporate Structure Reference: i) A97628-1, Coastal GasLink Pipeline Ltd., Additional Written Evidence, PDF Page 8 of 18 ii) A97628-1, Coastal GasLink Pipeline Ltd., Additional Written Evidence, PDF Page 11 of 18 iii) A93296-1, Sawyer Application, PDF Pages 16-17 of 19 iv) A97628-1, Coastal GasLink Pipeline Ltd., Additional Written Evidence, PDF Page 5 of 18 Preamble: In reference i), Coastal GasLink Pipeline Ltd. (CGL) states that it is directed separately from other TransCanada Corporation (TCC) subsidiaries. Reference ii) states that CGL is a wholly-owned subsidiary of TCC. CGL is the general partner of the Coastal GasLink Pipeline Limited Partnership (CGL LP). CGL LP is the partnership through which the Coastal GasLink Pipeline (CGL Pipeline) is being constructed. Reference iii) is a table filed by Mr. Sawyer entitled "Directors and Officers of Coastal GasLink Ltd. and Positions with TransCanada.” Reference iii) also includes a table entitled “Coastal GasLink Ltd. Senior Staff and TCPL Positions.” Reference iv) states that CGL is a wholly-owned subsidiary of TransCanada PipeLines Limited (TCPL), which in turn is a wholly- owned subsidiary of TCC. Request: a) Provide a chart reflecting the corporate structure of each of TCC, TCPL, NOVA Gas Transmission Ltd. (NGTL), as well as CGL, CGL LP and all other corporate entities that own or may operate CGL Pipeline. Include a description summarizing the ownership of each entity and the operating relationships with each other. -

Cedar LNG Liquefaction and Export Terminal

Project Description Summary Cedar LNG Liquefaction and Export Terminal Prepared by: Prepared for: Stantec Consulting Ltd. Cedar LNG 1232210301 Revision 0 August 30, 2019 PROJECT DESCRIPTION SUMMARY CEDAR LNG PROJECT—LIQUEFACTION AND EXPORT TERMINAL List of Abbreviations BC British Columbia BCEAA British Columbia Environmental Assessment Act CEA Agency Canadian Environmental Assessment Agency CRA commercial, recreational or Aboriginal CWH Coastal Western Hemlock EA environmental assessment EAC environmental assessment certificate EAO BC Environmental Assessment Office FEED front end engineering and design IAA Impact Assessment Act LNG liquefied natural gas mm millimetre MNBC Métis Nation British Columbia MOTI Ministry of Transportation and Infrastructure MTPA million tonnes per annum MW megawatt NAICS North American Industry Classification System PJ petajoule RDKS Regional District of Kitimat-Stikine ROW right of way i Rev 0 (30-08-19) PROJECT DESCRIPTION SUMMARY CEDAR LNG PROJECT—LIQUEFACTION AND EXPORT TERMINAL Table of Contents List of Abbreviations ................................................................................................................................... i 1.0 General Information and Contact(s) .................................................................................................... 1 2.0 Project Information ............................................................................................................................... 2 2.1 Project Overview ............................................................................................................................... -

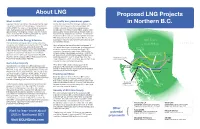

Proposed LNG Projects in Northern B.C. About

About LNG Proposed LNG Projects What is LNG? Air quality and greenhouse gases in Northern B.C. Liquefied Natural Gas (LNG) is natural gas that has been Kitimat has one of the most confined airsheds in the converted to a liquid form for storage or transportation. world and an increase in pollution associated with LNG is 1/600th the volume of natural gas in its gaseous multiple industrial development proposals poses state. Natural gas is converted to LNG by cooling to considerable risk. Nitrogen oxide (NOx), sulphur oxide approximately -162 degrees Celsius. Once it is in liquid (SOx), sulphur dioxide (SO2) and particulate matter are form it is transported on specially designed LNG carrier emitted during the liquefaction process. The life-cycle ships, and then re-gasified at destination. emissions of NOx from LNG could be greater than coal. With 3 liquefaction plants proposed for Kitimat, these LNG Plants Are Energy Intensive associated emissions raise human heath concerns such as respiratory disease. BRITISH LNG production and transportation is one of the most ALBERTA energy intensive industrial processes known. The cooling Much of the gas that would be used in proposed BC COLUMBIA process requires enormous amounts of power. For LNG plants will come from shale gas, an unconventional WEST COAST example, the proposed LNG Canada Gas facility (Shell) extraction process that produces significant GHG CONNECTOR in Kitimat will require approximately 1,200 megawatts emissions. If powered by natural gas, LNG facilities of power. In comparison the rebuilt Rio Tinto/Alcan will also produce considerable emissions. In 2012, the Stewart PRINCE RUPERT GAS aluminum smelter will require approximately 900 MW BC Government exempted LNG export facilities and TRANSMISSION PROJECT Fort St. -

NSR00961-LNG Infocus August 2017 Awv4.Indd

Message from the CEO Opportunity for British Columbia LNG Canada in the community Preparing the site for construction Supporting the community INFOCUS LNG Canada’s community newsletter July 2018 Opportunity for British Columbia and Canada, Energy for the World 2 Message from the CEO Message from Andy Calitz, CEO of LNG Canada “Talent wins games, but Bringing natural gas to Kitimat TransCanada Pipeline – with its track record for teamwork and intelligence safe, stable gas transmission networks – will wins championships.” build the 670-km Coastal GasLink pipeline. LNG Canada’s estimate for construction Green Power of the project along the full value chain – BC Hydro is providing green power to help us upstream gas development, the CGL pipeline, achieve among the lowest carbon emissions the two train LNG plant, the port of Kitimat intensity of any large LNG plant in the world. and LNG ships is significantly higher, placing us in a mega-project category of one. Community Support And we could not have done this on our We will be located on the traditional territory own. Here’s just a sample of who has of the Haisla Nation, who has welcomed our been helping us get this far. project to their community. Rio Tinto provided options for land for our project and the Safety during Construction District of Kitimat Stikine and Terrace has also It takes a village… WorkSafeBC is helping us to live up to our welcomed us with open arms. Seaspan’s joint to build a mega project aspiration of being the Safest Project on Earth. venture with Haisla, HaiSea, could competitively power our escort and harbor tugs, and Michael Jordan said it best.