Part 3 Outreach

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

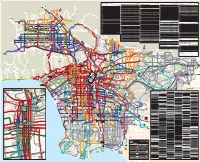

Metro Bus and Metro Rail System

Approximate frequency in minutes Approximate frequency in minutes Approximate frequency in minutes Approximate frequency in minutes Metro Bus Lines East/West Local Service in other areas Weekdays Saturdays Sundays North/South Local Service in other areas Weekdays Saturdays Sundays Limited Stop Service Weekdays Saturdays Sundays Special Service Weekdays Saturdays Sundays Approximate frequency in minutes Line Route Name Peaks Day Eve Day Eve Day Eve Line Route Name Peaks Day Eve Day Eve Day Eve Line Route Name Peaks Day Eve Day Eve Day Eve Line Route Name Peaks Day Eve Day Eve Day Eve Weekdays Saturdays Sundays 102 Walnut Park-Florence-East Jefferson Bl- 200 Alvarado St 5-8 11 12-30 10 12-30 12 12-30 302 Sunset Bl Limited 6-20—————— 603 Rampart Bl-Hoover St-Allesandro St- Local Service To/From Downtown LA 29-4038-4531-4545454545 10-12123020-303020-3030 Exposition Bl-Coliseum St 201 Silverlake Bl-Atwater-Glendale 40 40 40 60 60a 60 60a 305 Crosstown Bus:UCLA/Westwood- Colorado St Line Route Name Peaks Day Eve Day Eve Day Eve 3045-60————— NEWHALL 105 202 Imperial/Wilmington Station Limited 605 SANTA CLARITA 2 Sunset Bl 3-8 9-10 15-30 12-14 15-30 15-25 20-30 Vernon Av-La Cienega Bl 15-18 18-20 20-60 15 20-60 20 40-60 Willowbrook-Compton-Wilmington 30-60 — 60* — 60* — —60* Grande Vista Av-Boyle Heights- 5 10 15-20 30a 30 30a 30 30a PRINCESSA 4 Santa Monica Bl 7-14 8-14 15-18 12-18 12-15 15-30 15 108 Marina del Rey-Slauson Av-Pico Rivera 4-8 15 18-60 14-17 18-60 15-20 25-60 204 Vermont Av 6-10 10-15 20-30 15-20 15-30 12-15 15-30 312 La Brea -

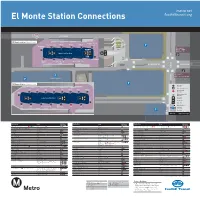

El Monte Station Connections Foothilltransit.Org

metro.net El Monte Station Connections foothilltransit.org BUSWAY 10 Greyhound Foothill Transit El Monte Station Upper Level FT Silver Streak Discharge Only FT486 FT488 FT492 Eastbound Metro ExpressLanes Walk-in Center Discharge 24 25 26 27 28 Only Bus stop for: 23 EMT Red, EMT Green EMS Civic Ctr Main Entrance Upper Level Bus Bays for All Service B 29 22 21 20 19 18 Greyhound FT481 FT Silver Streak Metro Silver Line Metro Bike Hub FT494 Westbound RAMONA BL RAMONA BL A Bus stop for: EMS Flair Park (am/pm) Metro Parking Structure Division 9 Building SANTA ANITA AV El Monte Station Lower Level 1 Bus Bay A Bus Stop (on street) 267 268 487 190 194 FT178 FT269 FT282 2 Metro Rapid 9 10 11 12 13 14 15 16 Bus Bay 577X Metro Silver Line 8 18 Bus Bay Lower Level Bus Bays Elevator 76 Escalator 17 Bike Rail 7 6 5 4 3 2 1 EMS Bike Parking 270 176 Discharge Only Commuter 770 70 Connection Parking Building 13-0879 ©2012 LACMTA DEC 2012 Subject to Change Destinations Lines Bus Bay or Destinations Lines Bus Bay or Destinations Lines Bus Bay or Street Stop Street Stop Street Stop 7th St/Metro Center Rail Station Metro Silver Line 18 19 Hacienda Heights FT282 16 Pershing Square Metro Rail Station Metro Silver Line , 70, 76, 770, 1 2 17 18 37th St/USC Transitway Station Metro Silver Line 18 19 FT Silver Streak 19 20 21 Harbor Fwy Metro Rail Station Metro Silver Line 18 19 Pomona TransCenter ÅÍ FT Silver Streak 28 Alhambra 76, 176 6 17 Highland Park 176 6 Altadena 267, 268 9 10 Puente Hills Mall FT178, FT282 14 16 Industry Å 194, FT282 13 16 Arcadia 268, -

Transit Service Plan

Attachment A 1 Core Network Key spines in the network Highest investment in customer and operations infrastructure 53% of today’s bus riders use one of these top 25 corridors 2 81% of Metro’s bus riders use a Tier 1 or 2 Convenience corridor Network Completes the spontaneous-use network Focuses on network continuity High investment in customer and operations infrastructure 28% of today’s bus riders use one of the 19 Tier 2 corridors 3 Connectivity Network Completes the frequent network Moderate investment in customer and operations infrastructure 4 Community Network Focuses on community travel in areas with lower demand; also includes Expresses Minimal investment in customer and operations infrastructure 5 Full Network The full network complements Muni lines, Metro Rail, & Metrolink services 6 Attachment A NextGen Transit First Service Change Proposals by Line Existing Weekday Frequency Proposed Weekday Frequency Existing Saturday Frequency Proposed Saturday Frequency Existing Sunday Frequency Proposed Sunday Frequency Service Change ProposalLine AM PM Late AM PM Late AM PM Late AM PM Late AM PM Late AM PM Late Peak Midday Peak Evening Night Owl Peak Midday Peak Evening Night Owl Peak Midday Peak Evening Night Owl Peak Midday Peak Evening Night Owl Peak Midday Peak Evening Night Owl Peak Midday Peak Evening Night Owl R2New Line 2: Merge Lines 2 and 302 on Sunset Bl with Line 200 (Alvarado/Hoover): 15 15 15 20 30 60 7.5 12 7.5 15 30 60 12 15 15 20 30 60 12 12 12 15 30 60 20 20 20 30 30 60 12 12 12 15 30 60 •E Ğǁ >ŝŶĞϮǁ ŽƵůĚĨŽůůŽǁ ĞdžŝƐƟŶŐ>ŝŶĞƐϮΘϯϬϮƌŽƵƚĞƐŽŶ^ƵŶƐĞƚůďĞƚǁ -

Tour 1: Wilshire BRT / Metro Orange Line Technical Tour – Limit 100

Tour 1: Wilshire BRT / Metro Orange Line Technical Tour – Limit 100 Wilshire Boulevard is the most heavily used bus corridor in the County of Los Angeles. In addition to being the most heavily used transit corridor in the County, Wilshire Boulevard has the distinction of having some of the highest average daily traffic (ADT) volumes in the City of Los Angeles. The Wilshire BRT Project, completed in November 2015, added 7.7 miles of dedicated peak period curbside bus lanes, as well as other street, signal improvements and further enhancements to the existing transit signal priority system. The tour will include a short trip along this busy corridor with a brief stop at the Wilshire/Vermont Metro Red/Purple Line station. There you will be able to observe and hear about one of Metro’s successful joint development projects sitting on 5.64 acres or one entire City block. The project, completed in August 2007, consists of 3.24 acres of Metro-owned property ground leased to the developer, 449 apartments (20% affordable), 35,000 square feet of ground floor retail, new subway portal and elevator access. Another 2.4 acres was sold to the Los Angeles Unified School District to construct an 800-student middle school completed in October 2008 and opened in Fall 2009. Also, a new bus layover facility sitting on an adjacent 1.02 acre parcel was also constructed. From there, the tour will continue on to the North Hollywood Metro Orange/Red Line Station where the group will take a short trip on the Metro Orange Line. -

Metro Public Hearing Pamphlet

Proposed Service Changes Metro will hold a series of six virtual on proposed major service changes to public hearings beginning Wednesday, Metro’s bus service. Approved changes August 19 through Thursday, August 27, will become effective December 2020 2020 to receive community input or later. How to Participate By Phone: Other Ways to Comment: Members of the public can call Comments sent via U.S Mail should be addressed to: 877.422.8614 Metro Service Planning & Development and enter the corresponding extension to listen Attn: NextGen Bus Plan Proposed to the proceedings or to submit comments by phone in their preferred language (from the time Service Changes each hearing starts until it concludes). Audio and 1 Gateway Plaza, 99-7-1 comment lines with live translations in Mandarin, Los Angeles, CA 90012-2932 Spanish, and Russian will be available as listed. Callers to the comment line will be able to listen Comments must be postmarked by midnight, to the proceedings while they wait for their turn Thursday, August 27, 2020. Only comments to submit comments via phone. Audio lines received via the comment links in the agendas are available to listen to the hearings without will be read during each hearing. being called on to provide live public comment Comments via e-mail should be addressed to: via phone. [email protected] Online: Attn: “NextGen Bus Plan Submit your comments online via the Public Proposed Service Changes” Hearing Agendas. Agendas will be posted at metro.net/about/board/agenda Facsimiles should be addressed as above and sent to: at least 72 hours in advance of each hearing. -

Fiscal Year 2019-20 Proposed Budget

SOUTHERN CALIFORNIA REGIONAL RAIL AUTHORITY FISCAL YEAR 2019-20 PROPOSED BUDGET Including Forecast for FY2020-21 thru FY2023-24 For Board Consideration & Public Comment Final Adopted Budget will be available 60 days after Board Adoption Los Angeles County Metropolitan Transportation Authority Orange County Transportation Authority Riverside County Transportation Commission San Bernardino County Transportation Authority Ventura County Transportation Commission June 28, 2019 1 This page intentionally left blank June 28, 2019 2 SOUTHERN CALIFORNIA REGIONAL RAIL AUTHORITY FY2019-20 BUDGET TABLE OF CONTENTS SECTION 1: Executive Summary ....................................................................... 11 1.1 A Message from the Chief Executive Officer – To be added ............ 11 1.2 Introduction – To be added .............................................................. 11 1.3 Metrolink in Perspective – To be added ........................................... 11 1.4 Metrolink in Comparison – To be added .......................................... 11 1.5 Accomplishments in FY2018-19 – To be added ............................... 11 1.6 Objectives for FY2019-20 ................................................................ 11 1.7 FY2019-20 Budget in Brief ............................................................... 12 1.8 Key FY2019-20Budget Information .................................................. 12 1.9 The FY2019-20 Operational Budget Statistics ................................. 13 1.10 Administrative Requirements .......................................................... -

Appendix E Detailed Case Studies

Guidelines for Providing Access to Public Transportation Stations APPENDIX E DETAILED CASE STUDIES Revised Final Report 2011 Page E-1 Detailed Case Studies Guidelines for Providing Access to Public Transportation Stations TABLE OF CONTENTS Case Study Summary ............................................................................................................................... E-3 Bay Area Rapid Transit (BART) .............................................................................................................. E-7 Los Angeles County Metropolitan Transportation Authority (Metro) ........................................... E-21 Metropolitan Atlanta Rapid Transit Authority (MARTA) ................................................................ E-33 Massachusetts Bay Transportation Authority (MBTA) ..................................................................... E-41 Metro-North Railroad ............................................................................................................................. E-57 New Jersey Transit (NJT) ....................................................................................................................... E-67 OC Transpo .............................................................................................................................................. E-81 Regional Transit District Denver (RTD) ............................................................................................... E-93 Sound Transit ........................................................................................................................................ -

Union Station Area Connections

metro.net Union Station Area Connections 1 Destinations Lines Stops Scale One Unit: /4 Mile Chinese Historical Lincoln/Cypress Station Society Chinatown Alhambra 76, 78, 79, 378, 485 B CL 5 8 7 BE Heritage and Altadena via Lake 485 7 A 1 Metro Local Stop RN Visitors Center Arcadia 78, 79, 378 B C AR T Metro Local and D S Artesia Transit Center n Metro Silver Line n J 1 S A RapidL Stop Y T G Baldwin Park Metro Silver Line n to 190 N Å K A W I ST I Chung King Chinese R E Beverly Hills Metro Purple Line o to 20, 720; 704 5 Metro Rapid Line UM Bamboo R Los Angeles S N I Cultural P EY T D Road Art Plaza State S W S Bob Hope Airport (BUR) ÅÍ 94, 794, Metrolink Å, Amtrak Í W 2 N A BA T C Center D Galleries HU M N Metro Silver Line Stop S NG B Historical 110 D K o E I O A U Boyle Heights Metro Gold Line , 30, 68, 770 B R N CP T G C O G T L A N T S I N Park N A Mandarin K G 5 7 I N Broadway 30, 40, 42, 730, 740, 745 A O N FIN G L E IN L N N Metro Silver Line G W N B U Y Plaza P R H E Burbank Å 94, 96, 794 W 2 O C I E E Paci>c L L N C Y D T T E Cal Poly Pomona Metro Silver Line n to 190, 194 K Metro Rail StationT A S M E JU L S W Alliance N Y U G J R Y I W F N and Entrance G L n S W W Y Carson Metro Silver Line to 246 J Medical Y N G U R B O N E T M A I R O L N P A N I 5 6 O E T Center U L Y Century City 704, 728, CE534 E 3 O W R E D S D S M L A E E W I T Metro Red LineA C M U S E IN O O W G A N Y U S City Terrace 70, 71 E B C I P L V O F LE L T n N M Covina Å Metro Silver Line to 190 K Metro Purple Line G L IN E A S Crenshaw District 40, 42, 740 -

Passenger Rail

TRANSPORTATION SYSTEM PASSENGER RAIL SOUTHERN CALIFORNIA ASSOCIATION OF GOVERNMENTS TECHNICAL REPORT DRAFT FOR PUBLIC REVIEW AND COMMENT EXECUTIVE SUMMARY 1 INTRODUCTION 2 REGIONAL SIGNIFICANCE 2 REGULATORY FRAMEWORK 3 ANALYTICAL APPROACH 5 EXISTING CONDITIONS 6 STRATEGIES 27 NEXT STEPS 44 CONCLUSION 45 TECHNICAL REPORT PASSENGER RAIL DRAFT FOR PUBLIC REVIEW AND COMMENT connectsocal.org EXECUTIVE SUMMARY TRANSPORTATION SYSTEM This Connect SoCal Passenger Rail report lays out a vision of passenger rail services for the SCAG Region for the next three decades. It demonstrates Passenger Rail the progress that has been made over the last two decades in terms of growing ridership, new rail services, capital improvements and new funding opportunities. It demonstrates the regional importance and significance of passenger rail in the SCAG region, and why growing rail services by increasing frequencies in underserved corridors, as well as establishing service in unserved markets, is crucial to the future mobility and sustainability of our region. The report highlights recent success in establishing new funding opportunities for passenger rail, including the Transit and Intercity Rail Capital Program (TIRCP) and Senate Bill (SB) 1. Amtrak’s Pacific Surfliner intercity rail service is benefiting from these new funding opportunities as well as recent institutional arrangements that establish local control for the service. The Southern California Regional Rail Authority’s (SCRRA) Southern California Optimized Rail Expansion (SCORE) program is an ambitious -

Master List of Mta Divisions Locations Stations 073009

METRO DIVISIONS, LOCATIONS, TERMINALS FACILITY CODE NAME Address City State Zip DIVISIONS - LOCATIONS - TERMINALS DIVISION 0001 ACTIVE BUS OPERATING DIVISION 1130 E. 6TH ST LOS ANGELES CA 90021 DIVISION 0002 ACTIVE BUS OPERATING DIVISION 720 E. 15TH ST. LOS ANGELES CA 90021 DIVISION 0003 ACTIVE BUS OPERATING DIVISION 630 W. AVENUE 28 LOS ANGELES CA 90065 DIVISION 0004 NON-REVENUE VEHICLE DIVISION 7878 TELEGRAPH RD. DOWNEY CA 90240 DIVISION 0005 ACTIVE BUS OPERATING DIVISION 5425 VAN NESS AVE. LOS ANGELES CA 90062 DIVISION 0006 ACTIVE BUS OPERATING DIVISION 100 SUNSET AVE. VENICE CA 90291 DIVISION 0007 ACTIVE BUS OPERATING DIVISION 8800 SANTA MONICA BLVD. LOS ANGELES CA 90069 DIVISION 0008 ACTIVE BUS OPERATING DIVISION 9201 CANOGA AVE. CHATSWORTH CA 91311 DIVISION 0009 ACTIVE BUS OPERATING DIVISION 3449 SANTA ANITA AVE. EL MONTE CA 91731 DIVISION 0010 ACTIVE BUS OPERATING DIVISION 742 N. MISSION RD. LOS ANGELES CA 90033 DIVISION 0011 BLUE LINE MAIN YARD 4350 E. 208th ST. LONG BEACH CA 90810 DIVISION 0012 INACTIVE BUS OPERATING DIVISION 970 W. CHESTER PL. LONG BEACH CA 90813 LOCATION 0014 SOUTH PARK SHOPS 5413 AVALON BLVD. LOS ANGELES CA 90011 DIVISION 0015 ACTIVE BUS OPERATING DIVISION 11900 BRANFORD ST. SUN VALLEY CA 91352 TERMINAL 0017 MAPLE LOT - BUS LAYOVER 632 MAPLE AVE. LOS ANGELES CA 90014 DIVISION 0018 ACTIVE BUS OPERATING DIVISION 450 W. GRIFFITH ST. GARDENA CA 90248 TERMINAL 0019 EL MONTE STATION 3501 SANTA ANITA AVE. EL MONTE CA 91731 DIVISION 0020 RED LINE MAIN YARD 320 SO. SANTA FE AVE. LOS ANGELES CA 90013 DIVISION 0021 PASADENA GOLD LINE YARD(MIDWAY) 1800 BAKER ST. -

Passenger Rail

TRANSPORTATION SYSTEM PASSENGER RAIL SOUTHERN CALIFORNIA ASSOCIATION OF GOVERNMENTS TECHNICAL REPORT ADOPTED ON SEPTEMBER 3, 2020 EXECUTIVE SUMMARY 1 INTRODUCTION 2 REGIONAL SIGNIFICANCE 2 REGULATORY FRAMEWORK 3 ANALYTICAL APPROACH 5 EXISTING CONDITIONS 7 STRATEGIES 28 NEXT STEPS 45 CONCLUSION 46 TECHNICAL REPORT PASSENGER RAIL ADOPTED ON SEPTEMBER 3, 2020 connectsocal.org EXECUTIVE SUMMARY TRANSPORTATION SYSTEM This Connect SoCal Passenger Rail report lays out a vision of passenger rail services for the SCAG Region for the next three decades. It demonstrates Passenger Rail the progress that has been made over the last two decades in terms of growing ridership, new rail services, capital improvements and new funding opportunities. It demonstrates the regional importance and significance of passenger rail in the SCAG region, and why growing rail services by increasing frequencies in underserved corridors, as well as establishing service in unserved markets, is crucial to the future mobility and sustainability of our region. The report highlights recent success in establishing new funding opportunities for passenger rail, including the Transit and Intercity Rail Capital Program (TIRCP) and Senate Bill (SB) 1. Amtrak’s Pacific Surfliner intercity rail service is benefiting from these new funding opportunities as well as recent institutional arrangements that establish local control for the service. The Southern California Regional Rail Authority’s (SCRRA) Southern California Optimized Rail Expansion (SCORE) program is an ambitious long-term capital improvement program to increase service on most of its lines to 15- and 30-minute frequencies, and SCRRA was recently awarded nearly one billion dollars in TIRCP funds for initial improvements. Finally, the report takes a look at existing conditions; a needs assessment which discusses, among other things, capacity constraints and opportunities for improved connectivity, including rail access to the region’s airports; and rail projects in the pipeline, both under construction and unfunded strategic long-term projects. -

Silver Line (910/950) GATEWAY Line 950 Only College, OC701, SC794, USC Shuttle; CARSON 37Th St/USC Station 110 E

Monday through Friday Effective Jun 27 2021 J Line (Silver)910/950 Northbound to El Monte (Approximate Times) Southbound to San Pedro (ApproximateTimes) SAN HARBOR LOS DOWNTOWN LOS EL EL DOWNTOWN LOS LOS HARBOR SAN PEDRO GATEWAY ANGELES ANGELES MONTE MONTE ANGELES ANGELES GATEWAY PEDRO 8 7 6 5 4 2 1 1 2 3 5 6 7 8 ) ) A A B ) ) A A (See Note (See Note El Monte Bus Station Route & 21st Pacific Harbor Beacon Lot Park/Ride Harbor Gateway Center Transit Harbor Freeway Station C Line (Green) (See Note & 7th Figueroa UNION STATION Plz (Patsarouas Bwy Sta Flower & 7th Flower Harbor Freeway Station C Line (Green) (See Note Harbor Gateway Center Transit Harbor Beacon Lot Park/Ride & 21st Pacific Route El Monte Bus Station UNION STATION Plz (Patsarouas Bwy Sta 910 — — 4:40A 4:47A 5:06A 5:16A 5:31A 910 3:30A 3:44A 3:55A 4:12A 4:19A — — 950 4:28A 4:39A 4:56 5:03 5:22 5:32 5:47 950 4:00 4:14 4:25 4:42 4:49 5:05A 5:13A 910 — — 5:12 5:19 5:38 5:48 6:03 910 4:18 4:32 4:43 5:00 5:07 — — 910 — — 5:25 5:32 5:52 6:02 6:17 950 4:36 4:50 5:01 5:18 5:25 5:41 5:49 950 5:05 5:17 5:35 5:42 6:02 6:13 6:28 910 4:50 5:04 5:15 5:32 5:39 — — 910 — — 5:44 5:51 6:12 6:23 6:38 950 5:00 5:14 5:25 5:42 5:49 6:05 6:13 910 — — 5:52 5:59 6:20 6:31 6:46 910 5:10 5:24 5:35 5:52 5:59 — — 950 5:30 5:42 6:00 6:07 6:28 6:39 6:54 950 5:20 5:34 5:45 6:02 6:09 6:25 6:33 910 — — 6:08 6:15 6:36 6:47 7:02 910 5:30 5:44 5:55 6:13 6:20 — — 910 — — 6:15 6:22 6:43 6:54 7:09 910 5:40 5:54 6:05 6:23 6:30 — — 950 5:53 6:05 6:23 6:30 6:51 7:02 7:17 950 5:48 6:02 6:13 6:31 6:38 6:54 7:02 910 — —