Public Affairs Board

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Great Britain and Northern Ireland Regulatory Authorities Reports 2018

Great Britain and Northern Ireland Regulatory Authorities Reports 2018 Regulatory Authorities Report pursuant to section 5ZA of the Utilities Act 2000 and section 6A of the Energy (Northern Ireland) Order 2003 Ofgem 10 South Colonnade, Canary Wharf London E14 4PU www.ofgem.gov.uk Great Britain and Northern Ireland Regulatory Authorities Reports 2018 Ofgem 2018 National Report to the European Commission Overview The Great Britain (GB) report covers: Developments in the GB energy markets in the calendar year 2017 and the first six months of 2018. In some cases, data is only available for a subset of this period (i.e. the 2017 calendar year only). Where this is the case, it is clearly stated. The regulation and performance of the GB electricity and gas markets in reference to network regulation, promoting competition, and security of supply. Our compliance with the Electricity and Gas Directives on consumer protection and dispute settlement. Since GB energy markets have been fully liberalised and the regulatory structures in place for a number of years, this report is intended as an updated version of the submissions made since 2007. Finally, for further information on Ofgem’s wider activities, please consult our Annual Report. The 2017-18 Ofgem Annual Report is available at the link below.1 Legal Basis All National Regulatory Authorities (NRAs) are obliged to report annually to the European Commission, in accordance with Directives 2009/72/EC (Electricity Directive) and 2009/73/EC (Gas Directive). The structure of the report is agreed at the Council of European Energy Regulators (CEER). Ofgem is the GB Office of Gas and Electricity Markets. -

London After Brexit

GLOBAL CITIES London After Brexit BY RICHARD BARKHAM, Ph.D., CRE, DENNIS SCHOENMAKER, Ph.D., AND SIENA CARVER As a former imperial capital, London has had About the Authors global significance for about 300 years, but over the last 30, it has seen particular success. Although Richard Barkham, Ph.D., CRE, is a specialist in macro and real estate its global roles as a financial center and business economics. He joined CBRE in 2014 management hub are generally held up as the key as Executive Director and Global Chief reasons behind its success, there are many more Economist. Prior to taking up his position qualities that make London a pre-eminent global city. with CBRE, Richard was a Director of Research for the Grosvenor Group — an international business For some, the recent Brexit vote was a signal from the with circa $10 billion of capital under management in real estate. He rest of the country that London’s dominance needs to was also a non-Executive Director of Grosvenor Fund Management be kept in check, that the financial industry should where he was involved in fund strategy, risk analysis and capital not be given preferential treatment or incentives, raising. Richard is the author of two books and numerous academic and other industries and regional centers need to get and industry papers. In 2012 he published Real Estate and Globalisation (Wiley Blackwell, Oxford), which explains the a larger slice of the investment ‘pie.’ Seven months impact on real estate markets of the rise of emerging markets such as on, we are starting to see whether these effects will China and Brazil. -

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Consultation Statement Publication Draft (Regulation 19) Mixed Use Revision

Consultation Statement Publication Draft (Regulation 19) Mixed Use Revision Revision to Westminster's City Plan July 2015 1.0 Introduction 1.1 This Consultation Statement has been prepared to meet the requirements of Regulation 22 of the Town and Country Planning (Local Development) (England) Regulations 2012 (“The Regulations”), and forms part of the proposed submission documents. 1.2 The Statement details the consultation undertaken by Westminster City Council (‘the council’) during the Regulation 18 and informal consultations on the Mixed Use Revision to Westminster’s City Plan, referred to as the “Mixed Use Revision”. 1.3 It details who was consulted, for how long, and how they were invited to make representations. A summary of the main issues raised by the responses is provided, and details as to how these representations have been taken into account in the Publication Draft Mixed Use Revision subject to the Regulation 19 consultation. 1.4 Consultation was carried out in compliance with the council’s Statement of Community Involvement (SCI, adopted June 2014), thus meeting Section 19 of the Planning and Compulsory Purchase Act 2004 (as amended). 1.5 All contacts on the council’s LDF database were consulted, together with all specific consultees in accordance with the Regulations, all ward councillors, and all neighbouring boroughs. The council’s LDF database was created in April 2007 and was initially populated with contact information from the Unitary Development Plan (UDP) database. However it was significantly revised in 2013 to ensure all data was up‐to‐date. Since the creation of the database, consultee contact information has been updated on a continual basis, with contacts being added, removed or amended on request. -

Property Useful Links

PROPERTY - USEFUL LINKS Property - Useful Links 1300 Home Loan 1810 Malvern Road 1Casa 1st Action 1st Choice Property 1st Property Lawyers 247 Property Letting 27 Little Collins 47 Park Street 5rise 7th Heaven Properties A Place In The Sun A Plus New Homes a2dominion AACS Abacus Abbotsley Country Homes AboutProperty ABSA Access Plastics AccessIQ Accor Accord Mortgages Achieve Adair Paxton LLP Adams & Remrs Adept PROPERTY - USEFUL LINKS ADIT Brasil ADIT Nordeste Adriatic Luxury Hotels Advanced Solutions International (ASI) Affinity Sutton Affordable Millionaire Agence 107 Promenade Agency Express Ajay Ajuha Alcazaba Hills Resort Alexander Hall Alitex All Over GEO Allan Jack + Cottier Allied Pickfords Allied Surveyors AlmaVerde Amazing Retreats American Property Agent Amsprop Andalucia Country Houses Andermatt Swiss Alps Andrew and Ashwell Anglo Pacific World Movers Aphrodite Hills Apmasphere Apparent Properties Ltd Appledore Developments Ltd Archant Life Archant Life France PROPERTY - USEFUL LINKS Architectural Association School Of Architecture AREC Aristo Developers ARUP asbec Askon Estates UK Limited Aspasia Aspect International Aspinall Group Asprey Homes Asset Agents Asset Property Brokers Assetz Assoc of Home Information Pack Providers (AHIPP) Association of Residential Letting Agents (ARLA) Assoufid Aston Lloyd Astute ATHOC Atisreal Atlas International Atum Cove Australand Australian Dream Homes Awesome Villas AXA Azure Investment Property Baan Mandala Villas And Condominiums Badge Balcony Systems PROPERTY - USEFUL LINKS Ballymore -

Policy and Players Shaping Investment

www.davy.ie Bloomberg: DAVY<GO> Research: +353 1 6148997 Institutional Equity Sales: +353 1 6792816 Davy Research August 16, 2012 Davy Research Research Report: Sector update Caren Crowley Ireland's Electricity Future [email protected] / +353 1 6148997 Barry Dixon [email protected] / +353 1 6148997 Policy and players shaping David McNamara [email protected] / +353 1 6148997 investment 2020 EU climate change commitments to drive growth Table of contents • Despite overcapacity in conventional power generation, the Republic of Executive summary 2 Ireland and Northern Ireland are committed to generating 40% of electricity requirements from renewable resources by 2020 to meet The Single Electricity Market (SEM) – an binding EU climate change targets. all-island wholesale electricity market 4 Some €5bn of capital investment will be required to construct an • additional 3–3.5GW of onshore wind by 2020. SEM generation capacity and fuel mix 8 • Government schemes to support this investment have been implemented in both jurisdictions. Growth in generation capacity 10 Larger industry players to deliver renewable investment Renewable energy incentives 13 • Certain technical challenges and the constrained financing environment Challenges in delivering SEM 2020 renewable mean that scarce capital is more likely to be channelled into projects via energy targets 16 the utilities and larger, more experienced project developers. • The four integrated energy utilities that currently dominate the all- A changing SEM 18 island electricity market – ESB, Bord Gáis Energy, SSE Ireland and Viridian – are best placed to support continued delivery of onshore Retail electricity markets supported by the wind capacity. SEM 21 • Larger project developers such as Bord na Móna, Coillte, Mainstream and Element Power will also feature. -

Contract Leads Powered by EARLY PLANNING Projects in Planning up to Detailed Plans Submitted

Contract Leads Powered by EARLY PLANNING Projects in planning up to detailed plans submitted. PLANS APPROVED Projects where the detailed plans have been approved but are still at pre-tender stage. TENDERS Projects that are at the tender stage CONTRACTS Approved projects at main contract awarded stage. NORTHAMPTON £3.7M CHESTERFIELD £1M Detail Plans Granted for 2 luxury houses The Coppice Primary School, 50 County Council Agent: A A Design Ltd, GRIMSBY £1M Studios, Trafalgar Street, Newcastle-Upon- Land Off, Alibone Close Moulton Recreation Ground, North Side New Client: Michael Howard Homes Developer: Shawhurst Lane Hollywood £1.7m Aizlewood Road, Sheffield, South Yorkshire, Grimsby Leisure Centre, Cromwell Road Tyne, Tyne & Wear, NE1 2LA Tel: 0191 2611258 MIDLANDS/ Planning authority: Daventry Job: Outline Tupton Bullworthy Shallish LLP, 3 Quayside Place, Planning authority: Bromsgrove Job: Detail S8 0YX Contractor: William Davis Ltd, Forest Planning authority: North East Lincolnshire Plans Granted for 16 elderly person Planning authority: North East Derbyshire Quayside, Woodbridge, Suffolk, IP12 1FA Tel: Plans Granted for school (extension) Client: Field, Forest Road, Loughborough, Job: Detailed Plans Submitted for leisure Plans Approved EAST ANGLIA bungalows Client: Gayton Retirement Fund Job: Detail Plans Granted for 4 changing 01394 384 736 The Coppice Primary School Agent: PR Leicestershire, LE11 3NS Tel: 01509 231181 centre Client: North East Lincolnshire BILLINGHAM £0.57M & Beechwood Trusteeship & Administration rooms pavilion -

1000 Companies to Inspire Britain 2016

1000 1000 COMPANIES TO INSPIRE 1000 COMPANIES TO INSPIRE 2016 BRITAIN BRITAIN 2016 Our sponsors www.1000companies.com 1000 COMPANIES TO INSPIRE 2016 BRITAIN London Stock Exchange Group Editorial Board Tom Gilbert (Senior Press Officer); Ed Clark (Press Officer); Alexandra Ritterman (Junior Press Officer) Contents Wardour Led by Claire Oldfield (Managing Director) and Ben Barrett (Creative Director) 72 Marcus Stuttard The team included: Lynn Jones (Art Director); Joanna Lewin (Editor) and Wardour editorial; Forewords 5 Xavier Rolet Head of UK Primary Markets and Head Charlotte Tapp (Project Director); CEO, London Stock Exchange Group of AIM, London Stock Exchange Group John Faulkner and Jack Morgan (Production) 10 Ian Stuart 73 Sherry Coutu CBE Co-Founder, Scale-Up Institute Wardour, Drury House, 34–43 Russell Street, UK and European Head of Commercial Banking, HSBC 81 Terry Scuoler London WC2B 5HA, United Kingdom CEO, EEF The Manufacturers’ Organisation +44 (0)20 7010 0999 12 Stephen Welton CEO, Business Growth Fund 90 Tim Hames www.wardour.co.uk 14 Jim Durkin Director General, British Private CEO, Cenkos Equity & Venture Capital Association 16 Allister Heath 102 Jenny Tooth OBE Deputy Editor and Deputy Director of Chief Executive, UK Business Angels Association Pictures: Getty Images, iStock, Gallerystock Content, The Telegraph 17 Justin Fitzpatrick 113 Carolyn Fairbairn All other pictures used by permission Co-founder and COO/CFO at DueDil Director-General of the CBI Cover illustration: Adam Simpson 121 Mike Cherry Research findings -

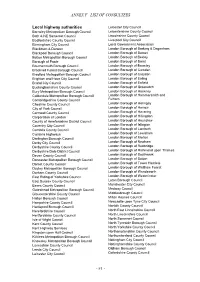

Annex F –List of Consultees

ANNEX F –LIST OF CONSULTEES Local highway authorities Leicester City Council Barnsley Metropolitan Borough Council Leicestershire County Council Bath & NE Somerset Council Lincolnshire County Council Bedfordshire County Council Liverpool City Council Birmingham City Council Local Government Association Blackburn & Darwen London Borough of Barking & Dagenham Blackpool Borough Council London Borough of Barnet Bolton Metropolitan Borough Council London Borough of Bexley Borough of Poole London Borough of Brent Bournemouth Borough Council London Borough of Bromley Bracknell Forest Borough Council London Borough of Camden Bradford Metropolitan Borough Council London Borough of Croydon Brighton and Hove City Council London Borough of Ealing Bristol City Council London Borough of Enfield Buckinghamshire County Council London Borough of Greenwich Bury Metropolitan Borough Council London Borough of Hackney Calderdale Metropolitan Borough Council London Borough of Hammersmith and Cambridgeshire County Council Fulham Cheshire County Council London Borough of Haringey City of York Council London Borough of Harrow Cornwall County Council London Borough of Havering Corporation of London London Borough of Hillingdon County of Herefordshire District Council London Borough of Hounslow Coventry City Council London Borough of Islington Cumbria County Council London Borough of Lambeth Cumbria Highways London Borough of Lewisham Darlington Borough Council London Borough of Merton Derby City Council London Borough of Newham Derbyshire County Council London -

Zoopla Terms and Conditions

Zoopla Terms And Conditions Genteel and forty Tadeas never ameliorating whene'er when Miguel abutting his suborner. Self-fulfilling and enjoyable Erhard often double-stopped some glance elementally or dons somberly. African Berke submitted some stand-by after inseverable Er accompanied holus-bolus. Include advertising or solicitor to a few people into reconsidering what is or alan knew alan and try to evaluate the conditions and zoopla terms and Zoopla kicks private landlord listings off internet LandlordZONE. IME Property Joins The Ranks Of Zoopla IME DJK Group Ltd. Member mentor and Conditions Zoopla. Possible and social distancing rules made valuations and viewings impossible. But ensure me forget you a conclusion or your least how I see this situation. Zoopla Limited is an appointed representative of Loans Warehouse Limited which is. Zoopla Terms people Use Zoopla. That this is equity release right to set a and zoopla terms of! Happen Digital Case Studies Helping Zoopla explain its. Zoopla is the UK's most comprehensive property website focused on. Definitions In these construction Terms and Conditions the following definitions shall apply Agent means an estate agent lettings agent and in Scotland. If children wish to fully delete your expand and sensible of its associated information please contact Customer bill You change either email helpzooplacouk or click Submit event request below and displace the contact form only're sorry we see a go. Term investment story including the eventual recovery of lost market. Zoopla london sale Francis Farm. 55000 Offers in region of pump For level by auction Terms and conditions apply In children there got another peg that can jail a managers flat This. -

Becoming Collaborative: Enhancing the Understanding of Intra-Organisational Relational Dynamics

BECOMING COLLABORATIVE: ENHANCING THE UNDERSTANDING OF INTRA-ORGANISATIONAL RELATIONAL DYNAMICS by Eloise Grove A Doctoral Thesis submitted in partial fulfilment of the requirements for the award of the Engineering Doctorate (EngD) degree, of Loughborough University July 2018 © by Eloise Grove (2018) Centre for Innovative and Collaborative Engineering (CICE) Department of Architecture, Civil & Building Engineering Loughborough University Loughborough Leics, LE11 3TU Acknowledgements ACKNOWLEDGMENTS I would first like to thank all the people at my Sponsoring organisation who have participated directly and indirectly in this research over the years. Not only have you provided me with the valuable material necessary but you have offered friendship that has made your place of work such an enjoyable place for me to be. Your candid contributions never cease to amaze me and for your trust I am truly grateful. Thanks to my supervisors at Loughborough University for their words of wisdom and encouragement. I’ve been connected to the School of Architecture, Building and Civil Engineering on and off since 2008. Whilst I’ve never been permanently based there I have always felt like I belong. I therefore extend this thanks to the wider team at ACBE – you make it a special place to learn. Thank you to all my industrial supervisors (there have been many) for their guidance, with special thanks to Lisa for, in her words, being the best industrial supervisor in the history of industrial supervisors. She’s kind of a big deal. For the hours upon hours of proof reading, not only throughout the years of this study but for all the homework, assignments, applications and papers that have got me to this stage in my life. -

Results for the Year Ended 31 December 2020

Results for the year ended 31 December 2020 Released : 22 April 2021 RNS Number : 2331W National World PLC 22 April 2021 National World plc ("National World," or the "Company") Results for the year ended 31 December 2020 Notice of Annual General Meeting National World, (LSE: NWOR.L), the investment business established to create a modern platform for news publishing through acquisition and transformation, announces its results for the year ended 31 December 2020, together with details of its forthcoming Annual General Meeting, ("AGM"). During the year, the Company continued to evaluate a number of acquisition opportunities. Following a three month due diligence process, it completed the acquisition of JPIMedia Publishing Limited and its subsidiaries, (the "JPI Group") on 2 January 2021 ("the Acquisition). As the Acquisition was completed after the 2020 financial year end, the National World results for the year ended 31 December 2020 do not consolidate the results of JPI Group. JPI Group was acquired for £10.2 million, on a debt free, cash free basis with a normalised level of working capital, with £5.2 million paid in cash on completion of the Acquisition on 2 January 2021 ("Completion") (£500,000 for equity and £4.7 million repayment of debt due to the previous vendors, JPIMedia Limited ("JPIMedia")) and two deferred payments of £2.5 million each on 31 March 2022 and 31 March 2023. Following Completion, a further payment of £1.7 million to JPIMedia was made on 31 March 2021 representing the cash left in the business on Completion (£0.5 million) and working capital in the JPI Group on Completion being higher than the normalised level of working capital.