Graphic Explanation for Welfare Economic Foundation of Hoarding Loss

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Welfare Economic Foundation of Hoarding Loss by Money Circulation Optimization

Munich Personal RePEc Archive Welfare economic foundation of hoarding loss by money circulation optimization Miura, Shinji Independent 13 August 2018 Online at https://mpra.ub.uni-muenchen.de/88443/ MPRA Paper No. 88443, posted 20 Aug 2018 10:07 UTC Welfare economic foundation of hoarding loss by money circulation optimization Shinji Miura (Independent. Gifu, Japan) Abstract Saving brings an economic loss. This is one of the basic propositions of the under-consumption theory. This paper aims to give a welfare economic foundation of this proposition through an optimization method considering money circulation in the case where a type of saving is limited to hoarding. If price is fixed, a non-hoarding state is a necessary condition for Pareto efficiency. However, individual agents who prefer future expenditure hoard money, thus individual rational behavior brings about a Pareto inefficient state. This irrationality of rationality occurs because of a qualitative difference of the budget constraint between the whole society and an individual agent. The former’s constraint incorporates a truth that hoarding decreases other’s revenue, whereas the latter’s does not. Selfish individual agents make a decision with an ignorance of this relational truth because their interest is limited to their private range. As a result, agents fall into an irrational situation despite their rational judgment. Keywords: Money Circulation, Welfare Economics, Under-Consumption, Paradox of Thrift, Intertemporal Choice. 1. Introduction Saving brings an economic loss even though it is often regarded as a virtue. This proposition, known as the paradox of thrift, is one of main elements of the under-consumption theory. -

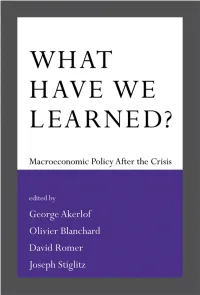

What Have We Learned? Macroeconomic Policy After the Crisis

What Have We Learned? What Have We Learned? Macroeconomic Policy after the Crisis edited by George Akerlof, Olivier Blanchard, David Romer, and Joseph Stiglitz The MIT Press Cambridge, Massachusetts London, England © 2014 International Monetary Fund and Massachusetts Institute of Technology All rights reserved. No part of this book may be reproduced in any form by any elec- tronic or mechanical means (including photocopying, recording, or information storage and retrieval) without permission in writing from the publisher. Nothing contained in this book should be reported as representing the views of the IMF, its Executive Board, member governments, or any other entity mentioned herein. The views expressed in this book belong solely to the authors. MIT Press books may be purchased at special quantity discounts for business or sales promotional use. For information, please email [email protected]. This book was set in Sabon by Toppan Best-set Premedia Limited, Hong Kong. Printed and bound in the United States of America. Library of Congress Cataloging-in-Publication Data What have we learned ? : macroeconomic policy after the crisis / edited by George Akerlof, Olivier Blanchard, David Romer, and Joseph Stiglitz. pages cm Includes bibliographical references and index. ISBN 978-0-262-02734-2 (hardcover : alk. paper) 1. Monetary policy. 2. Fiscal policy. 3. Financial crises — Government policy. 4. Economic policy. 5. Macroeconomics. I. Akerlof, George A., 1940 – HG230.3.W49 2014 339.5 — dc23 2013037345 10 9 8 7 6 5 4 3 2 1 Contents Introduction: Rethinking Macro Policy II — Getting Granular 1 Olivier Blanchard, Giovanni Dell ’ Ariccia, and Paolo Mauro Part I: Monetary Policy 1 Many Targets, Many Instruments: Where Do We Stand? 31 Janet L. -

The Paradox of Thrift

ECONOMICS PAGE ONE NEWSLETTER the back story on front page economics May I 2012 Wait, Is Saving Good or Bad? The Paradox of Thrift E. Katarina Vermann, Research Associate “[Saving] is a paradox because in kindergarten we are all taught that thrift is always a good thing.”1 —Paul A. Samuelson, first American to win the Nobel Prize in Economics (1970) People save for various reasons. Some save with a specific purchase in mind, such as cos- metic surgery or a Porsche, while others save just to have more money. Economists say that individuals save to buy durable goods and/or accumulate wealth to maintain a certain lifestyle during retirement or in times of financial uncertainty. These reasons all confer benefits to a saver. In the near term, the saver can finally buy the latest and greatest gadget, and in the long term, the saver can be more financially secure during retirement or unplanned unemployment. Normally, personal saving declines during recessions because people want to maintain their existing level of consumption. During the Great Recession, though, saving increased. The chart shows the personal saving rate, the year-over-year growth rate of gross domestic prod- uct (GDP), and recession periods from 2000 to 2011. Before the Great Recession, the average saving rate for the typical American household was 2.9 percent. Since the recession started in 2007, the average saving rate has risen to 5.0 percent. This increase was largely driven by uncer- Source: Bureau of Economic Analysis, Naonal Bureau of Economic Research, and FRED. Recession Average Saving Rate GDP Growth Personal Saving Rate 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2011 -6 -4 -2 0 Percent 2 4 6 Great Recession 8 U.S. -

The New Paradox of Thrift: Financialisation, Retirement Protection, and Income Polarisation in Hong Kong

China Perspectives 2014/1 | 2014 Post-1997 Hong Kong The New Paradox of Thrift: Financialisation, retirement protection, and income polarisation in Hong Kong Kim Ming Lee, Benny Ho-pong To and Kar Ming Yu Electronic version URL: http://journals.openedition.org/chinaperspectives/6363 DOI: 10.4000/chinaperspectives.6363 ISSN: 1996-4617 Publisher Centre d'étude français sur la Chine contemporaine Printed version Date of publication: 1 March 2014 Number of pages: 5-14 ISSN: 2070-3449 Electronic reference Kim Ming Lee, Benny Ho-pong To and Kar Ming Yu, « The New Paradox of Thrift: », China Perspectives [Online], 2014/1 | 2014, Online since 01 January 2017, connection on 28 October 2019. URL : http:// journals.openedition.org/chinaperspectives/6363 ; DOI : 10.4000/chinaperspectives.6363 © All rights reserved Special feature China perspectives The New Paradox of Thrift Financialisation, retirement protection, and income polarisation in Hong Kong KIM MING LEE, BENNY HO-PONG TO, AND KAR MING YU ABSTRACT: The Hong Kong SAR government has always been proud of the fact that Hong Kong retains its top ranking in terms of “mar - ket freedom” according to most international rating agencies and think tanks. What the government has been much more reluctant to recognise is that, more than 15 years after the handover, Hong Kong now also tops other developed economies in terms of income ine - quality. The growing inequality is caused, among other things, by worsening poverty among the aged. This paper attempts to provide an updated analysis of income and wealth polarisation in Hong Kong, with a particular focus on the retirement protection policy and old-age poverty. -

Paradoxes Situations That Seems to Defy Intuition

Paradoxes Situations that seems to defy intuition PDF generated using the open source mwlib toolkit. See http://code.pediapress.com/ for more information. PDF generated at: Tue, 08 Jul 2014 07:26:17 UTC Contents Articles Introduction 1 Paradox 1 List of paradoxes 4 Paradoxical laughter 16 Decision theory 17 Abilene paradox 17 Chainstore paradox 19 Exchange paradox 22 Kavka's toxin puzzle 34 Necktie paradox 36 Economy 38 Allais paradox 38 Arrow's impossibility theorem 41 Bertrand paradox 52 Demographic-economic paradox 53 Dollar auction 56 Downs–Thomson paradox 57 Easterlin paradox 58 Ellsberg paradox 59 Green paradox 62 Icarus paradox 65 Jevons paradox 65 Leontief paradox 70 Lucas paradox 71 Metzler paradox 72 Paradox of thrift 73 Paradox of value 77 Productivity paradox 80 St. Petersburg paradox 85 Logic 92 All horses are the same color 92 Barbershop paradox 93 Carroll's paradox 96 Crocodile Dilemma 97 Drinker paradox 98 Infinite regress 101 Lottery paradox 102 Paradoxes of material implication 104 Raven paradox 107 Unexpected hanging paradox 119 What the Tortoise Said to Achilles 123 Mathematics 127 Accuracy paradox 127 Apportionment paradox 129 Banach–Tarski paradox 131 Berkson's paradox 139 Bertrand's box paradox 141 Bertrand paradox 146 Birthday problem 149 Borel–Kolmogorov paradox 163 Boy or Girl paradox 166 Burali-Forti paradox 172 Cantor's paradox 173 Coastline paradox 174 Cramer's paradox 178 Elevator paradox 179 False positive paradox 181 Gabriel's Horn 184 Galileo's paradox 187 Gambler's fallacy 188 Gödel's incompleteness theorems -

Educational Directory 1°30

UNITED STATESDEPARTMENT OF THE INTERIOR RAY LYMAN WILBUR. Secretary s. OFFICE OF EDUCATION WILLIAM JOHN COOPER. Commissioner BULLETIN, 1930, No. 1 EDUCATIONAL DIRECTORY 1°30 1 --"16. ,0 DANIA el 9-111911,- , Al.. s."2:1,_ 111 %. a a. Al. UNITED STATES GOVEANNIENT PRINTING OFFICE WASHINGTON:1930 - bes oh by the Swerintendept ofDocuments, Yashington, D. C. e . Price 30 casts o ) ..:41 1\1 456391 g. JUrl-71118 AC4 1,69 \ '30 ,1101141117111.... swim r-" R :7) - - -.40- - t .1.111= CONTENTS I 1 Page I. United StatesOffice ofEducation___ _ _ 1 II. PrincipalState schoolofficers .. ______ .. ... s .;2 III. Countyand other localsuperintendents of schools'_ _...... _ .............. 16 Iv. Superintendentsof public schoolsin cities andtowns 40 I V. Public-schoolbusiness managers_______- ____---.--..... --- 57, VI. Presidentsof tiniversitiesand colleges 58 VII. Presidents of juniorcolleges _ , 65 VIII. Headsof departmentsof education_ 68 "P r Ix. Presidentsor WM OW .N. deans of sehoolsof theology__ m =0 MMM .. ../ Mt o. w l0 X. Presidentsordeans of schools oflaw _ 78 XI. Presidentsor deans of schools of medicinP M Mo". wt. MP OM mm .. 80 XII. Presidentsordeans of schoolsof dentistry__.---- ___--- - 82 XIII. Prusidentsordeans of dchoolsof pharmacy_____ .. 82 XIV. PNsidentsofrschools ofosteopathy : 84 XV. Deansof schools ofveterinary medicine . 84 XVI. Deansof collegiateschools ofcommerce 84 XVII. Schools, colleges,ordepartments ofengineering _ 86 XVIII. Presidents,etc., of institutions forthetraini;igof teachers: , (1) Presidents ofteachers colleges__:__aft do am IND . _ . _ 89 (2) Principals of Statenormal schools_______ _ N.M4, 91 (3) Principals ofcity public normalschools___ __ _ 92 (4) Principals ofprivate physicaltraining schoolss.,__ _ 92 (5) Prinoipals ofprivatenursery,kindergarten, andprimary training schools 93 (6) Principals of privategeneral training schools 93 XIX. -

The Fiscal Revolution and Taxation: the Rise of Compensatory Taxation, 1929–1938

THORNDIKE 9/4/2010 11:15:04 AM THE FISCAL REVOLUTION AND TAXATION: THE RISE OF COMPENSATORY TAXATION, 1929–1938 JOSEPH J. THORNDIKE* I INTRODUCTION In his classic study of federal economic policy, The Fiscal Revolution in America,1 Herbert Stein offered a telling comparison. In 1931, faced with rising unemployment and a growing budget deficit, President Herbert Hoover proposed a tax increase. In 1962, faced with similar (if less acute) conditions, President John F. Kennedy proposed a tax reduction. This contrast reveals a sea change in American political economy. Between the late 1920s and the early 1960s, economists and political leaders changed the way they thought about taxes, spending, and the impact of each on the national economy. As a group, they embraced “domesticated Keynesianism,” a particular type of compensatory fiscal policy designed to regulate the business cycle.2 As the name implies, domesticated Keynesianism drew its inspiration from the work of John Maynard Keynes, especially his 1936 treatise, The General Theory of Employment, Interest and Money.3 But it represented a distinctly American interpretation of the Keynesian canon. Domesticated Keynesianism emphasized the use of automatic stabilizers (like a relatively stable tax system), rather than active manipulation of revenue and spending decisions. In addition, domesticated Keynesianism paid homage (more symbolic than substantive) to the political shibboleth of a “balanced budget,” albeit one balanced at a Copyright © 2009 by Joseph J. Thorndike. This article is also available at http://law.duke.edu/journals/lcp. * Director of the Tax History Project at Tax Analysts and Visiting Scholar in History, University of Virginia. -

List of Paradoxes 1 List of Paradoxes

List of paradoxes 1 List of paradoxes This is a list of paradoxes, grouped thematically. The grouping is approximate: Paradoxes may fit into more than one category. Because of varying definitions of the term paradox, some of the following are not considered to be paradoxes by everyone. This list collects only those instances that have been termed paradox by at least one source and which have their own article. Although considered paradoxes, some of these are based on fallacious reasoning, or incomplete/faulty analysis. Logic • Barbershop paradox: The supposition that if one of two simultaneous assumptions leads to a contradiction, the other assumption is also disproved leads to paradoxical consequences. • What the Tortoise Said to Achilles "Whatever Logic is good enough to tell me is worth writing down...," also known as Carroll's paradox, not to be confused with the physical paradox of the same name. • Crocodile Dilemma: If a crocodile steals a child and promises its return if the father can correctly guess what the crocodile will do, how should the crocodile respond in the case that the father guesses that the child will not be returned? • Catch-22 (logic): In need of something which can only be had by not being in need of it. • Drinker paradox: In any pub there is a customer such that, if he or she drinks, everybody in the pub drinks. • Paradox of entailment: Inconsistent premises always make an argument valid. • Horse paradox: All horses are the same color. • Lottery paradox: There is one winning ticket in a large lottery. It is reasonable to believe of a particular lottery ticket that it is not the winning ticket, since the probability that it is the winner is so very small, but it is not reasonable to believe that no lottery ticket will win. -

Of the Paradoxes of Thrift and Costs in the Long Run? L´Idia Brochier

A Supermultiplier Stock-Flow Consistent model: the \return" of the paradoxes of thrift and costs in the long run? L´ıdiaBrochier? Abstract Supermultiplier models have been recently brought to the post-Keynesian debate. Yet these models still rely on quite simple economic assumptions, being mostly flow models which omit the financial determinants of autonomous expenditures. Since the output growth rate converges in the long run to the exogenously given growth rate of the \non-capacity creating" autonomous expenditure and the utilization rate moves towards the normal utilization rate, the paradoxes of thrift and costs remain valid only in terms of level effects (average growth rates). The aim of this paper is to investigate whether the core conclusions of supermultiplier models hold in a more complex economic framework. It thus presents a supermultiplier SFC model, in which private business investment is assumed to be completely induced by income while the autonomous expenditure component - in this case consumption out of wealth - becomes endogenous. The results of the numerical simulation experiments suggest that the paradox of thrift can remain valid in terms of growth effects and that a lower profit share can also be associated to a higher accumulation rate, though with a lower profit rate. Keywords: Supermultiplier; SFC model; autonomous expenditures; paradoxes of thrift and costs; growth theories. JEL classification codes: B59, E11, E12, E25, O41. 1 Introduction Supermultiplier models, as originally conceived by Sraffian authors (Serrano, 1995a; Bortis, 1997), keep the Keynesian hypothesis, emphasizing the idea that growth can be demand-led even in the long run. This is made possible through the introduction of a \non capacity creating" autonomous expenditure which grows at an exogenously given rate and towards which capital accumulation rate will converge in the long run, as business invest- ment is completely induced by income. -

Engineering a Paradox of Thrift Recession∗

Engineering a Paradox of Thrift Recession∗ Zhen Huo José-Víctor Ríos-Rull University of Minnesota University of Minnesota Federal Reserve Bank of Minneapolis Federal Reserve Bank of Minneapolis CAERP, CEPR, NBER December 2012 Abstract We build a variation of the neoclassical growth model in which financial shocks to house- holds or wealth shocks (in the sense of wealth destruction) generate recessions. Two standard ingredients that are necessary are (1) the existence of adjustment costs that make the ex- pansion of the tradable goods sector difficult and (2) the existence of some frictions in the labor market that prevent enormous reductions in real wages (Nash bargaining in Mortensen- Pissarides labor markets is enough). We pose a new ingredient that greatly magnifies the recession: a reduction in consumption expenditures reduces measured productivity, while technology is unchanged due to reduced utilization of production capacity. Our model pro- vides a novel, quantitative theory of the current recessions in southern Europe. Keywords: Great Recession, Paradox of thrift, Endogenous productivity JEL classifications: E20, E32, F44 ∗Ríos-Rull thanks the National Science Foundation for Grant SES-1156228. We are thankful for discussions with Yan Bai, Kjetil Storesletten, and Nir Jaimovich and the comments of Joan Gieseke and of the attendants at the many seminars where this paper was presented. The views expressed herein are those of the authors and not necessarily those of the Federal Reserve Bank of Minneapolis or the Federal Reserve System. 1 Introduction We develop a model in which recessions are triggered by the desire of households to save more (i.e., because of insufficient demand), and we map our model to a standard modern economy. -

Chapter 21 the IS-LM Model

Chapter 21 The IS-LM model After more basic reflections in the previous two chapters about short-run analysis, this chapter revisits what became known as the IS-LM model. This model is based on John R. Hicks’ summary of the analytical core of Keynes’ General Theory of Employment, Interest and Money (Hicks, 1937). The distinguishing element of the IS-LM model compared with both the World’s Smallest Macroeconomic Model of Chapter 19 and the Blanchard-Kiyotaki model of Chapter 20 is that an interest-bearing asset is added so that money holding is motivated primarily by its liquidity services rather than its role as a store of value. The version of the IS-LM model presented here is in one respect different from the presentation in many introductory and intermediate textbooks. The tradition is to see the IS-LM model as just one building block of a more involved aggregate supply-aggregate demand (AD-AS) framework where only the wage level is predetermined while the output price is flexible and adjusts in response to shifts in aggregate demand, triggered by changes in the exogenous variables. We interpret the IS-LM model differently, namely as an independent short-run model in its own right, based on the approximation that both wages and prices are set in advance by agents operating in imperfectly competitive markets and being hesitant regarding frequent or large price changes. The model is quasi-static and deals with mechanisms supposed to be operative within a “short period”. We may think of the period length to be a month, a year, or something in between. -

The New Road to Serfdom: the Curse of Bigness and the Failure of Antitrust

University of Michigan Journal of Law Reform Volume 49 2015 The New Road to Serfdom: The Curse of Bigness and the Failure of Antitrust Carl T. Bogus Roger Williams University Follow this and additional works at: https://repository.law.umich.edu/mjlr Part of the Antitrust and Trade Regulation Commons, Banking and Finance Law Commons, and the Business Organizations Law Commons Recommended Citation Carl T. Bogus, The New Road to Serfdom: The Curse of Bigness and the Failure of Antitrust, 49 U. MICH. J. L. REFORM 1 (2015). Available at: https://repository.law.umich.edu/mjlr/vol49/iss1/1 This Article is brought to you for free and open access by the University of Michigan Journal of Law Reform at University of Michigan Law School Scholarship Repository. It has been accepted for inclusion in University of Michigan Journal of Law Reform by an authorized editor of University of Michigan Law School Scholarship Repository. For more information, please contact [email protected]. THE NEW ROAD TO SERFDOM: THE CURSE OF BIGNESS AND THE FAILURE OF ANTITRUST Carl T. Bogus* This Article argues for a paradigm shift in modern antitrust policy. Rather than being concerned exclusively with consumer welfare, antitrust law should also be concerned with consolidated corporate power. Regulators and courts should con- sider the social and political, as well as the economic, consequences of corporate mergers. The vision that antitrust must be a key tool for limiting consolidated cor- porate power has a venerable legacy, extending back to the origins of antitrust law in early seventeenth century England, running throughout American history, and influencing the enactment of U.S.