Running Head: E-COMMERCE at YUNNAN LUCKY AIR 1 E

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pilot Movers Westair

PILOTMOVERS IS DELIGHTED TO BE RECRUITING FOR A320 CAPTAINS ON BEHALF OF WEST AIR WEST AIR West Air is member of Hainan Group of airlines, the largest non-Stated owned airline group in China. It operates a scheduled passenger network to 18 domestic destinations out of Chongqing Jiangbei International Airport. The company was established in March 2006 by its parent company Hainan Airlines with the launch of scheduled services on 14 July 2010. There has been a consistent increase in West Air fleet size of A320 family aircraft since starting operations. They currently operate 27 x A320 series aircraft and plan to have a severe fleet expansion in the coming years. West Air is member of Hainan Group of airlines, the largest non-Stated owned airline group in China. PILOTMOVERS IN CHINA PilotMovers was set up by pilots with over 25 years experience in the industry. We have inside expertise and we are currently flying in China, that is why we can offer on site and on-line support. PilotMovers is the only agency that has his own in-house specialist for Insurance and loss of licence solutions. We have very attractive deals on these packages as we adhere to group discount rates Our pilots receive personalised attention, customised FLY4FREEDOM preparation packages and unique know-how of several Chinese airlines. We know what pilots expect and pilot to pilot communication is one of our main assets. We can provide you with significant increase of your success probabilities in order to achieve your goal: Get one of the top paid pilot jobs in the world. -

Airline On-Time Arrival Performance (Sep 2018, by Variflight) SC Tops

Airline On-time Arrival Performance (Sep 2018, by VariFlight) SC Tops China’s Major Airlines in APAC OTP Chart MF Shows the Most Rapid YoY Growth Powered by VariFlight incomparable aviation database, the monthly report of Airline On-time Arrival Performance provides an overview of how global airlines perform in September, 2018. In September, Aeroflot-Russian Airlines tops the global OTP chart again. A total of 381,000 aircraft movements were handled by Chinese airlines, showing an increase of 4.6 percent year-over-year. Aeroflot-Russian Airlines takes the top spot in the global OTP chart for three consecutive months. Shandong Airlines moves into the first place for punctuality among Chinese airlines in APAC with an on-time arrival rate of 89.22 percent. Among ten major Chinese airlines, Shandong Airlines surpasses Tianjin Airlines to top the OTP list; Xiamen Airlines shows the most rapid YoY growth in OTP. Taking a look at the TOP10 domestic popular routes, SHA-CAN route demonstrates the fastest growth, improving 23.14 percent compared with that in August. Global Big Airlines SU Tops Global Big Airlines Aeroflot-Russian Airlines tops the global big airlines chart in September with an on-time arrival rate of 96.28 percent and 5.06 minutes of average arrival delay, followed by All Nippon Airways and Japan Airlines. IATA Flight On-time Arrival Average Arrival Ranking Airlines Country Code Arrivals Performance Delay (minutes) Aeroflot-Russian 1 SU RU 30826 96.28% 5.06 Airlines 2 NH All Nippon Airways JP 34965 96.20% 5.60 3 JL Japan Airlines JP 23778 96.09% 6.58 4 EK Emirates Airlines AE 16042 95.90% 5.68 Page 1 of 6 © 2018 VariFlight. -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

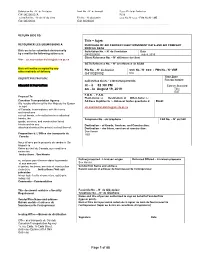

G410020002/A N/A Client Ref

Solicitation No. - N° de l'invitation Amd. No. - N° de la modif. Buyer ID - Id de l'acheteur G410020002/A N/A Client Ref. No. - N° de réf. du client File No. - N° du dossier CCC No./N° CCC - FMS No./N° VME G410020002 G410020002 RETURN BIDS TO: Title – Sujet: RETOURNER LES SOUMISSIONS À: PURCHASE OF AIR CARRIER FLIGHT MOVEMENT DATA AND AIR COMPANY PROFILE DATA Bids are to be submitted electronically Solicitation No. – N° de l’invitation Date by e-mail to the following addresses: G410020002 July 8, 2019 Client Reference No. – N° référence du client Attn : [email protected] GETS Reference No. – N° de reference de SEAG Bids will not be accepted by any File No. – N° de dossier CCC No. / N° CCC - FMS No. / N° VME other methods of delivery. G410020002 N/A Time Zone REQUEST FOR PROPOSAL Sollicitation Closes – L’invitation prend fin Fuseau horaire DEMANDE DE PROPOSITION at – à 02 :00 PM Eastern Standard on – le August 19, 2019 Time EST F.O.B. - F.A.B. Proposal To: Plant-Usine: Destination: Other-Autre: Canadian Transportation Agency Address Inquiries to : - Adresser toutes questions à: Email: We hereby offer to sell to Her Majesty the Queen in right [email protected] of Canada, in accordance with the terms and conditions set out herein, referred to herein or attached hereto, the Telephone No. –de téléphone : FAX No. – N° de FAX goods, services, and construction listed herein and on any Destination – of Goods, Services, and Construction: attached sheets at the price(s) set out thereof. -

COVID-19) on Civil Aviation: Economic Impact Analysis

Effects of Novel Coronavirus (COVID-19) on Civil Aviation: Economic Impact Analysis Montréal, Canada 11 March 2020 Contents • Introduction and Background • Scenario Analysis: Mainland China • Scenario Analysis: Hong Kong SAR of China and Macao SAR of China • Summary of Scenario Analysis and Additional Estimates: China • Scenario Analysis: Republic of Korea • Scenario Analysis: Italy • Scenario Analysis: Iran (Islamic Republic of) • Preliminary Analysis: Japan and Singapore 2 Estimated impact on 4 States with the highest number of confirmed cases* Estimated impact of COVID-19 outbreak on scheduled international passenger traffic during 1Q 2020 compared to originally-planned: • China (including Hong Kong/Macao SARs): 42 to 43% seat capacity reduction, 24.8 to 28.1 million passenger reduction, USD 6.0 to 6.9 billion loss of gross operating revenues of airlines • Republic of Korea: 27% seat capacity reduction, 6.1 to 6.6 million passenger reduction, USD 1.3 to 1.4 billion loss of gross operating revenues of airlines • Italy: 19% seat capacity reduction, 4.8 to 5.4 million passenger reduction, USD 0.6 to 0.7 billion loss of gross operating revenues of airlines • Iran (Islamic Republic of): 25% seat capacity reduction, 580,000 to 630,000 passenger reduction, USD 92 to 100 million loss of gross operating revenues of airlines * Coronavirus Disease 2019 (COVID-19) Situation Report by WHO 3 Global capacity share of 4 States dropped from 23% in January to 9% in March 2020 • Number of seats offer by airlines for scheduled international passenger traffic; -

An Overview of China's Recent Domestic and International Air

An overview of China’s recent domestic and international air transport policy Abstract This chapter reviews China’s domestic and international air transport policy. The introduction of private and low-cost carriers, together with the emergence of HSR, put much competitive pressure on the Chinese state-owned carriers and create momentum for further reforms in China’s air transport sector. In the last two decades, relatively liberal air services arrangements have been made with some major markets including the US, ASEAN, Korea, Japan etc. These open and liberal arraignments have given the Chinese carriers the room to grow and the chance to become stronger. They in turn call for further liberalisation moves to allow for their deeper participation in and engagement with international air transport service provisions. 1. Overview of China’s economic growth and air transport industry Air travel and economic growth have an intertwined relationship. On the one hand, the demand for air travel depends heavily on economic conditions, resulting in the fact that the air transport industry is extremely cyclical in demand. On the other hand, it is a widely held view that as an input into many economic activities including tourism, trade and investment, air transport has been an important component in achieving economic development and welfare enhancement (Zhang and Findlay 2014). Air transport is particularly important to distant and remote regions where there is no close substitute for this transport mode due to the tyranny of distance. In some parts of the world, air transport is the only viable means of transportation for both goods and people due to geographic or climate constraints (Pagliari 2010). -

A Famous Chinese Brand and Fleets

ASCEND I PROFILE y most accounts, the first double-digit passenger traffic growth from decade of the 21st century 2004 through 2010, according to the Civil presented unprecedented chal- Aviation Administration of China (CAAC). While lenges for the global airline that growth has slowed during the last two industry worldwide. In fact, years, it is still the highest in the world. Total manyB industry analysts have labeled the first profits for China’s airline industry in 2011 alone 10 years of this century as the “lost decade,” are an estimated US$7.2 billion, accounting citing: for more than half the profits of the entire Massive layoffs, worldwide airline industry. Staggering financial losses, Leading the way are China’s “big three” Record numbers of bankruptcies and con- carriers — Air China, China Southern Airlines solidations, and China Eastern Airlines, followed by a Skyrocketing fuel prices, strengthening number of second-tier carriers. Declining consumer confidence, While expansion has been a major focus Widespread service disruptions attributed to of China’s aviation industry during the first pandemics, volcanic ash and wild weather decade, flexibility — the ability to adapt quickly patterns. to the volatile marketplace — continues to be Along with the challenges, the decade also a priority. brought myriad opportunities for the industry. China Eastern was the first Chinese civil The tragic events of Sept. 11, 2001, in the aviation company to be listed simultaneously United States, it appears, were the first of on the Hong Kong, New York and Shanghai many catalysts that drove airlines worldwide stock exchanges. It has carefully and success- to evaluate and fundamentally restructure the fully navigated the industry’s last few turbulent way they do business. -

Attachment F – Participants in the Agreement

Revenue Accounting Manual B16 ATTACHMENT F – PARTICIPANTS IN THE AGREEMENT 1. TABULATION OF PARTICIPANTS 0B 475 BLUE AIR AIRLINE MANAGEMENT SOLUTIONS S.R.L. 1A A79 AMADEUS IT GROUP SA 1B A76 SABRE ASIA PACIFIC PTE. LTD. 1G A73 Travelport International Operations Limited 1S A01 SABRE INC. 2D 54 EASTERN AIRLINES, LLC 2I 156 STAR UP S.A. 2I 681 21 AIR LLC 2J 226 AIR BURKINA 2K 547 AEROLINEAS GALAPAGOS S.A. AEROGAL 2T 212 TIMBIS AIR SERVICES 2V 554 AMTRAK 3B 383 Transportes Interilhas de Cabo Verde, Sociedade Unipessoal, SA 3E 122 MULTI-AERO, INC. DBA AIR CHOICE ONE 3J 535 Jubba Airways Limited 3K 375 JETSTAR ASIA AIRWAYS PTE LTD 3L 049 AIR ARABIA ABDU DHABI 3M 449 SILVER AIRWAYS CORP. 3S 875 CAIRE DBA AIR ANTILLES EXPRESS 3U 876 SICHUAN AIRLINES CO. LTD. 3V 756 TNT AIRWAYS S.A. 3X 435 PREMIER TRANS AIRE INC. 4B 184 BOUTIQUE AIR, INC. 4C 035 AEROVIAS DE INTEGRACION REGIONAL 4L 174 LINEAS AEREAS SURAMERICANAS S.A. 4M 469 LAN ARGENTINA S.A. 4N 287 AIR NORTH CHARTER AND TRAINING LTD. 4O 837 ABC AEROLINEAS S.A. DE C.V. 4S 644 SOLAR CARGO, C.A. 4U 051 GERMANWINGS GMBH 4X 805 MERCURY AIR CARGO, INC. 4Z 749 SA AIRLINK 5C 700 C.A.L. CARGO AIRLINES LTD. 5J 203 CEBU PACIFIC AIR 5N 316 JOINT-STOCK COMPANY NORDAVIA - REGIONAL AIRLINES 5O 558 ASL AIRLINES FRANCE 5T 518 CANADIAN NORTH INC. 5U 911 TRANSPORTES AEREOS GUATEMALTECOS S.A. 5X 406 UPS 5Y 369 ATLAS AIR, INC. 50 Standard Agreement For SIS Participation – B16 5Z 225 CEMAIR (PTY) LTD. -

Spring Airlines to Launch Narita - Shanghai Pudong Service on 27 October

25 October 2019 Spring Airlines to Launch Narita - Shanghai Pudong Service on 27 October Spring Airlines (IATA code: 9C) will launch a new service between Narita and Shanghai Pudong Airport on 27 October 2019. Spring Airlines, based in Shanghai, is China's largest low cost carrier (LCC) and has a tie up with the Japanese carrier, Spring Japan, which operates at Narita Airport. This is Spring Airlines first scheduled service to Narita Airport. Shanghai is a bustling business city with row upon row of high-rise buildings but also has a traditional streetscape. Xintiandi with its reconstituted traditional "shikumen" stone houses is popular with foreigners and young people. The tree-lined streets are full of stylish cafes with photogenic outdoor seating as well as authentic jazz bars in a pleasant setting where the old and new exist side by side. Narita Airport remains committed to expanding its network of destinations so that we can offer a greater level of convenience for our customers. Take advantage of Narita Airport's extensive network, now bigger and better with Spring Airlines' new Shanghai-Pudong Service. <City of Shanghai> <Photos: Courtesy of Spring Airlines> ■ Launch date : Sunday, 27 October 2019 ■ Route : Narita - Shanghai Pudong (China) ■ Operating terminal : Terminal 3 ■ Aircraft : A320 (Seat capacity: 186 seats) ■ Flight schedule : Daily Flight No. Origin Departure Time Destination Arrival Time Tokyo/Narita Shanghai Pudong 9C6218 20:40 22:50 (NRT) (PVG) Shanghai Pudong Tokyo/Narita 9C6217 15:50 19:40 (PVG) (NRT) * All times are local times. * Conditional upon government approval. * Please note that schedules are subject to change without notice. -

Foram Encontrados 367 Parceiros. Verifique Se Está Disponível No Seu Mercado

Foram encontrados 367 parceiros. Verifique se está disponível no seu mercado. Por favor use sempre o Quick Check em www.hahnair.com/quickcheck antes de emitir um bilhete. P4 Air Peace BG Biman Bangladesh Airl… T3 Eastern Airways 7C Jeju Air HR-169 HC Air Senegal NT Binter Canarias MS Egypt Air JQ Jetstar Airways A3 Aegean Airlines JU Air Serbia 0B Blue Air LY EL AL Israel Airlines 3K Jetstar Asia EI Aer Lingus HM Air Seychelles BV Blue Panorama Airlines EK Emirates GK Jetstar Japan AR Aerolineas Argentinas VT Air Tahiti OB Boliviana de Aviación E7 Equaflight BL Jetstar Pacific Airlines VW Aeromar TN Air Tahiti Nui TF Braathens Regional Av… ET Ethiopian Airlines 3J Jubba Airways AM Aeromexico NF Air Vanuatu 1X Branson AirExpress EY Etihad Airways HO Juneyao Airlines AW Africa World Airlines UM Air Zimbabwe SN Brussels Airlines 9F Eurostar RQ Kam Air 8U Afriqiyah Airways SB Aircalin FB Bulgaria Air BR EVA Air KQ Kenya Airways AH Air Algerie TL Airnorth VR Cabo Verde Airlines FN fastjet KE Korean Air 3S Air Antilles AS Alaska Airlines MO Calm Air FJ Fiji Airways KU Kuwait Airways KC Air Astana AZ Alitalia QC Camair-Co AY Finnair B0 La Compagnie UU Air Austral NH All Nippon Airways KR Cambodia Airways FZ flydubai LQ Lanmei Airlines BT Air Baltic Corporation Z8 Amaszonas K6 Cambodia Angkor Air XY flynas QV Lao Airlines KF Air Belgium Z7 Amaszonas Uruguay 9K Cape Air 5F FlyOne LA LATAM Airlines BP Air Botswana IZ Arkia Israel Airlines BW Caribbean Airlines FA FlySafair JJ LATAM Airlines Brasil 2J Air Burkina OZ Asiana Airlines KA Cathay Dragon -

There Are 2 Direct Flights Between Lhasa and Kathmandu, Run by Sichuan Airline and Air China Separately, While the Sichuan Airline Departs Every Other Day

Flights from Kathmandu to Lhasa and Lhasa to Kathmandu Until today (May 2, 2016), there are 2 direct flights between Lhasa and Kathmandu, run by Sichuan Airline and Air China separately, while the Sichuan Airline departs every other day. Besides, there are also a few connecting flights between Lhasa and Kathmandu, stopover in Chongqing, Kunming and Chengdu. Air China: Lhasa and Kathmandu Flight Schedule Flight Route Flight Code Airlines Dep. Arr. Type Schedule Air Lhasa to Kathmandu CA407 12:10 11:10 319 every day China Air Kathmandu to Lhasa CA408 12:10 16:00 319 every day China Sichuan Airline: Lhasa and Kathmandu Flight Shcedule Flight Route Flight Code Airlines Dep. Arr. Type Schedule Lhasa to Kathmandu 3U8719 Sichuan Airline 11:15 10:10 319 every other day Kathmandu to Lhasa 3U8720 Sichuan Airline 11:10 14:50 319 every other day Flights from Shanghai to Lhasa and Lhasa to Shanghai Currently, there are three direct flights which go via Chengdu or Xi'an between Lhasa and Shanghai, operated by China Eastern Airline, Tibet Airline and Air China. It takes about 7 hours for the flight in which about 1 hour is for stopover. In addition, a few of connecting flights stop at Chengdu, Chongqing and Kunming airport, then you can transfer flights to Lhasa. Air China: Lhasa and Shanghai Flight Schedule Flight Route Flight Code Airlines Dep. Arr. Type Stopover Schedule Air Lhasa to Shanghai CA3981 07:40 13:30 319 Chengdu every day China Air Shanghai to Lhasa CA3982 14:45 21:45 319 Chengdu every day China China Eastern Airline: Lhasa and Shanghai Flight Schedule Flight Route Flight Code Airlines Dep. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L.