Response to the Peer Review Report EPA Base Case Version 5.13 Using IPM U.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Transmission Benefits of Co-Locating Concentrating Solar Power and Wind Ramteen Sioshansi the Ohio State University Paul Denholm National Renewable Energy Laboratory

Transmission Benefits of Co-Locating Concentrating Solar Power and Wind Ramteen Sioshansi The Ohio State University Paul Denholm National Renewable Energy Laboratory NREL is a national laboratory of the U.S. Department of Energy, Office of Energy Efficiency & Renewable Energy, operated by the Alliance for Sustainable Energy, LLC. Technical Report NREL/TP-6A20-53291 March 2012 Contract No. DE-AC36-08GO28308 Transmission Benefits of Co-Locating Concentrating Solar Power and Wind Ramteen Sioshansi The Ohio State University Paul Denholm National Renewable Energy Laboratory Prepared under Task No. SS12.2721 NREL is a national laboratory of the U.S. Department of Energy, Office of Energy Efficiency & Renewable Energy, operated by the Alliance for Sustainable Energy, LLC. National Renewable Energy Laboratory Technical Report 1617 Cole Boulevard NREL/TP-6A20-53291 Golden, Colorado 80401 March 2012 303-275-3000 • www.nrel.gov Contract No. DE-AC36-08GO28308 NOTICE This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. Reference herein to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply its endorsement, recommendation, or favoring by the United States government or any agency thereof. The views and opinions of authors expressed herein do not necessarily state or reflect those of the United States government or any agency thereof. -

A RESOLUTION Urging the President and Congress to Advance on the Retired List 2 the Late Rear Admiral Husband E

UNOFFICIAL COPY 17 RS BR 1793 1 A RESOLUTION urging the President and Congress to advance on the retired list 2 the late Rear Admiral Husband E. Kimmel and the late Major General Walter C. Short to 3 their highest held ranks, as was done for all other senior officers who served in positions 4 of command during World War II. 5 WHEREAS, Rear Admiral Husband E. Kimmel, formerly the Commander in Chief 6 of the United States Fleet and the Commander in Chief, United States Pacific Fleet, had 7 an excellent and unassailable record throughout his career in the United States Navy prior 8 to the December 7, 1941, attack on Pearl Harbor; and 9 WHEREAS, Major General Walter C. Short, formerly the Commander of the 10 United States Army Hawaiian Department, had an excellent and unassailable record 11 throughout his career in the United States Army prior to the December 7, 1941, attack on 12 Pearl Harbor; and 13 WHEREAS, numerous investigations following the attack on Pearl Harbor have 14 documented that Admiral Kimmel and Lieutenant General Short were not provided 15 necessary and critical intelligence that was available, that foretold of war with Japan, that 16 warned of imminent attack, and that would have alerted them to prepare for the attack, 17 including such essential communiques as the Japanese Pearl Harbor Bomb Plot message 18 of September 24, 1941, and the message sent from the Imperial Japanese Foreign 19 Ministry to the Japanese Ambassador in the United States from December 6–7, 1941, 20 known as the Fourteen-Part Message; and 21 WHEREAS, -

7 Mahana Series Soils Are Described As Follows: This Series Consists of Well-Drained Soils on Uplands on the Islands of Kauai An

Cultural Surveys Hawai‘i Job Code: HONOULIULI 172 Introduction Mahana series soils are described as follows: This series consists of well-drained soils on uplands on the islands of Kauai and Oahu. These soils developed in volcanic ash. They are gently sloping to very steep. Elevations range from 1,000 to 3,000 feet. The annual rainfall amounts to 30 to 45 inches. […] These soils are used for pasture, woodland, wildlife habitat, irrigated sugarcane, and water supply. The natural vegetation consists of puakeawe, aalii, ricegrass, molassesgrass, silver oak, yellow foxtail, lantana, joee, Japanese tea, passion flower, and associated plants. [Foote et al. 1972:85] Mahana silty clay loam, 6 to 12% slopes, eroded (McC2) soils are described as follows: This soil occurs on ridgetops and moderately sloping uplands […] Permeability is moderately rapid. Runoff is slow, and the erosion hazard is slight. […] In places roots penetrate to a depth of 5 feet or more. […] This soil is used for pasture, woodland, wildlife habitat, pineapple, and sugarcane. [Foote et al. 1972:85–86] Mahana silty clay loam, 12 to 20% slopes, eroded (McD2) soils, are described as having medium runoff and a moderate erosion hazard, used for pasture, woodland, wildlife habitat, and sugarcane (Foote et al. 1972). Mahana silty clay loam, 20 to 35% slopes, eroded (McE2) soils are further described as follows: Most of the surface layer has been removed by erosion. Runoff is very rapid, and the erosion hazard is very severe. Included in mapping were areas where all of the surface layer and part of the subsoil have been removed by erosion. -

The Imposition of Martial Law in the United States

THE IMPOSITION OF MARTIAL LAW IN THE UNITED STATES MAJOR KIRK L. DAVIES WTC QUALTPy m^CT^^ A 20000112 078 Form Approved REPORT DOCUMENTATION PAGE OMB No. 0704-0188 Public reDOrtino burden for this collection of information is estimated to average 1 hour per response, including the time for reviewing instructions, searching existing data sources, a^^r^6<^mim\ngxh^a^BäJ, and completing and reviewing the collection of information Send comments regarding this burden estimate or any^othe aspect of this collection of information, including suggestions for reducing this burden, to Washington Headquarters Services, Directorate for Inforrnatior.Ope.rations and Reporte, 1215 Jefferson Davfei wShwa? Suit? 1:204 Arlington: VA 22202-4302, and to the Office of Management and Budget, Paperwork Reduction Pro]ect (0704-01881, Washington, DC 20503. 1. AGENCY USE ONLY (Leave blank) 2. REPORT DATE REPORT TYPE AND DATES COVERED 3Jan.OO MAJOR REPORT 4. TITLE AND SUBTITLE 5. FUNDING NUMBERS THE IMPOSITION OF MARTIAL LAW IN UNITED STATES 6. AUTHOR(S) MAJ DAVIES KIRK L 7. PERFORMING ORGANIZATION NAME(S) AND ADDRESS(ES) 8. PERFORMING ORGANIZATION REPORT NUMBER JA GENERAL SCHOOL ARMY 9. SPONSORING/MONITORING AGENCY NAME(S) AND ADDRESS(ES) 10. SPONSORING/MONITORING AGENCY REPORT NUMBER THE DEPARTMENT OF THE AIR FORCE AFIT/CIA, BLDG 125 FY99-603 2950 P STREET WPAFB OH 45433 11. SUPPLEMENTARY NOTES 12a. DISTRIBUTION AVAILABILITY STATEMENT 12b. DISTRIBUTION CODE Unlimited distribution In Accordance With AFI 35-205/AFIT Sup 1 13. ABSTRACT tMaximum 200 words) DISTRIBUTION STATEMENT A Approved for Public Release Distribution Unlimited 14. SUBJECT TERMS 15. NUMBER OF PAGES 61 16. -

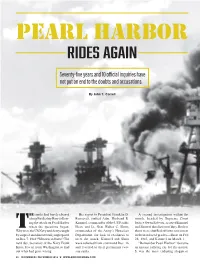

Attack on Pearl Harbor

Attack on Pearl Harbor From Wikipedia, the free encyclopedia Attack on Pearl Harbor Part of the Pacific Theater of World War II Photograph from a Japanese plane of Battleship Row at the beginning of the attack. The explosion in the center is a torpedo strike on the USS Oklahoma. Two attacking Japanese planes can be seen: one over the USS Neosho and one over the Naval Yard. Date December 7, 1941 Primarily Pearl Harbor, Hawaii Location Territory, U.S. Japanese major tactical victory U.S. declaration of war on the Result Empire of Japan. Germany and Italy declare war on the United States. Belligerents United States Empire of Japan Commanders and leaders Husband Kimmel Chuichi Nagumo Walter Short Isoroku Yamamoto Strength Mobile Unit: 8 battleships 6 aircraft carriers 8 cruisers 2 battleships 30 destroyers 2 heavy cruisers 4 submarines 1 light cruiser 1 USCG Cutter[nb 1] 9 destroyers 49 other ships[1] 8 tankers ~390 aircraft 23 fleet submarines 5 midget submarines 414 aircraft Casualties and losses 4 battleships sunk 3 battleships damaged 1 battleship grounded 4 midget submarines sunk 2 other ships sunk[nb 2] 1 midget submarine 3 cruisers damaged[nb 3] grounded 3 destroyers damaged 29 aircraft destroyed 3 other ships damaged 64 killed 188 aircraft destroyed 1 captured[6] 159[3] aircraft damaged 2,402 killed 1,247 wounded[4][5] Civilian casualties Between 48 - 68 killed[7][8] 35 wounded[4] [show] v t e Hawaiian Islands Campaign [show] v t e Pacific War The attack on Pearl Harbor[nb 4] was a surprise military strike conducted by the Imperial Japanese Navy against the United States naval base at Pearl Harbor, Hawaii, on the morning of December 7, 1941 (December 8 in Japan). -

The Battle Over Pearl Harbor: the Controversy Surrounding the Japanese Attack, 1941-1994

W&M ScholarWorks Dissertations, Theses, and Masters Projects Theses, Dissertations, & Master Projects 1995 The Battle Over Pearl Harbor: The Controversy Surrounding the Japanese Attack, 1941-1994 Robert Seifert Hamblet College of William & Mary - Arts & Sciences Follow this and additional works at: https://scholarworks.wm.edu/etd Part of the United States History Commons Recommended Citation Hamblet, Robert Seifert, "The Battle Over Pearl Harbor: The Controversy Surrounding the Japanese Attack, 1941-1994" (1995). Dissertations, Theses, and Masters Projects. Paper 1539625993. https://dx.doi.org/doi:10.21220/s2-5zq1-1y76 This Thesis is brought to you for free and open access by the Theses, Dissertations, & Master Projects at W&M ScholarWorks. It has been accepted for inclusion in Dissertations, Theses, and Masters Projects by an authorized administrator of W&M ScholarWorks. For more information, please contact [email protected]. THE BATTLE OVER PEARL HARBOR The Controversy Surrounding the Japanese Attack, 1941-1994 A Thesis Presented to The Faculty of the Department of History The College of William and Mary in Virginia In Partial Fulfillment Of the Requirements for the Degree of Master of Arts by Robert S. Hamblet 1995 APPROVAL SHEET This thesis is submitted in partial fulfillment of the requirements for the degree of Master of Arts '-{H JxijsJr 1. Author Approved, November 1995 d(P — -> Edward P. CrapoII Edward E. Pratt TABLE OF CONTENTS Page ACKNOWLEDGEMENTS......................................................................iv ABSTRACT..............................................................................................v -

DENSHO PUBLICATIONS Articles by Kelli Y

DENSHO PUBLICATIONS Articles by Kelli Y. Nakamura Kapiʻolani Community College Spring 2016 Byodo-In by Rocky A / CC BY-NC-SA 2.0 The articles, by Nakamura, Kelli Y., are licensed under CC BY-NC-SA 3.0 by rights owner Densho Table of Contents 298th/299th Infantry ..................................................................................................................................... 1 Alien Enemies Act of 1798 ........................................................................................................................... 3 Americans of Japanese Ancestry: A Study of Assimilation in the American Community (book) ................. 6 By: Kelli Y. Nakamura ................................................................................................................................. 6 Cecil Coggins ................................................................................................................................................ 9 Charles F. Loomis ....................................................................................................................................... 11 Charles H. Bonesteel ................................................................................................................................... 13 Charles Hemenway ..................................................................................................................................... 15 Dan Aoki .................................................................................................................................................... -

Renewable Energy and Efficiency Modeling Analysis Partnership REMI Regional Economic Models Inc

Technical Report Renewable Energy and Efficiency NREL/TP-6A2-45656 Modeling Analysis Partnership (REMAP): September 2009 An Analysis of How Different Energy Models Addressed a Common High Renewable Energy Penetration Scenario in 2025 Nate Blair, Thomas Jenkin, James Milford, Walter Short, Patrick Sullivan National Renewable Energy Laboratory David Evans, Elliot Lieberman Environmental Protection Agency Gary Goldstein, Evelyn Wright International Resources Group Kamala R. Jayaraman, Boddu Venkatesh ICF International Gary Kleiman Northeast States for Coordinated Air Use Management Christopher Namovicz, Bob Smith Energy Information Administration Karen Palmer Resources for the Future Ryan Wiser Lawrence Berkeley National Laboratory Frances Wood OnLocation Technical Report Renewable Energy and Efficiency NREL/TP-6A2-45656 Modeling Analysis Partnership (REMAP): September 2009 An Analysis of How Different Energy Models Addressed a Common High Renewable Energy Penetration Scenario in 2025 Nate Blair, Thomas Jenkin, James Milford, Walter Short, Patrick Sullivan National Renewable Energy Laboratory David Evans, Elliot Lieberman Environmental Protection Agency Gary Goldstein, Evelyn Wright International Resources Group Kamala R. Jayaraman, Boddu Venkatesh ICF International Gary Kleiman Northeast States for Coordinated Air Use Management Christopher Namovicz, Bob Smith Energy Information Administration Karen Palmer Resources for the Future Ryan Wiser Lawrence Berkeley National Laboratory Frances Wood OnLocation Prepared under Task No. SAO1.1005 National Renewable Energy Laboratory 1617 Cole Boulevard, Golden, Colorado 80401-3393 303-275-3000 • www.nrel.gov NREL is a national laboratory of the U.S. Department of Energy Office of Energy Efficiency and Renewable Energy Operated by the Alliance for Sustainable Energy, LLC Contract No. DE-AC36-08-GO28308 NOTICE This report was prepared as an account of work sponsored by an agency of the United States government. -

Juliana, Et Al. V. United States of America, Et Al. Expert Report Of

Case 6:15-cv-01517-TC Document 338-4 Filed 08/24/18 Page 1 of 129 Expert Report of Professor James L. Sweeney Submitted August 13, 2018 Kelsey Cascadia Rose Juliana; Xiuhtezcatl Tonatiuh M., through his Guardian Tamara Roske-Martinez; et al., Plaintiffs, v. The United States of America; Donald Trump, in his official capacity as President of the United States; et al., Defendants. IN THE UNITED STATES DISTRICT COURT DISTRICT OF OREGON (Case No.: 6:15-cv-01517-TC) Case 6:15-cv-01517-TC Document 338-4 Filed 08/24/18 Page 2 of 129 Contents I. Qualifications ...................................................................................................................... 1 II. Background and Assignment .............................................................................................. 3 III. Summary of Opinions ......................................................................................................... 6 IV. Climate Change Is a Real, Global Problem ........................................................................ 9 A. Global Climate Change Resulting from Greenhouse Gas Emissions ..................... 9 B. The U.S. Alone Cannot Ensure That Atmospheric CO2 Is No More Concentrated than 350 ppm by 2100....................................................................................................... 12 V. Energy Policy in the U.S. Requires Trade-Offs among Economic, Security, and Environmental Objectives ................................................................................................. 14 A. -

The Smoke Had Barely Cleared Along Battleship Row Follow- Ing the Attack on Pearl Harbor When the Questions Began. Why Were

Pearl Harbor By John T. Correll he smoke had barely cleared His report to President Franklin D. A second investigation within the along Battleship Row follow- Roosevelt faulted Adm. Husband E. month, headed by Supreme Court ing the attack on Pearl Harbor Kimmel, commander of the US Pacific Justice Owen Roberts, accused Kimmel when the questions began. Fleet, and Lt. Gen. Walter C. Short, and Short of dereliction of duty. Both of TWhy were the US Navy and Army caught commander of the Army’s Hawaiian them were shuffled off into retirement by surprise and almost totally unprepared Department, for lack of readiness to in their reduced grades—Short on Feb on Dec. 7, 1941? Who was to blame? The meet the attack. Kimmel and Short 28, 1942, and Kimmel on March 1. next day, Secretary of the Navy Frank were relieved from command Dec. 16 “Remember Pearl Harbor!” became Knox flew in from Washington to find and reverted to their permanent two- an instant rallying cry for the nation. out what had gone wrong. star ranks. It was the most enduring slogan of 22 NOVEMBER / DECEMBER 2016 H WWW.AIRFORCEMAG.COM Battleship Row on Dec. 7, 1941. USS Arizona is in the center, burning after an explosion that killed more than 1,100 sea- men. To the left are USS Tennessee and USS West Virginia. Tennessee survived the attack. West Virginia was sunk but later salvaged and repaired. US Naval History and Heritage Command photo World War II and a fixture in the popu- ian islands were on a relaxed weekend Fourteen US pilots, acting on their lar culture for many years. -

John Weyant Professor (Research) of Management Science and Engineering and Senior Fellow at the Precourt Institute for Energy

John Weyant Professor (Research) of Management Science and Engineering and Senior Fellow at the Precourt Institute for Energy Bio BIO John P. Weyant is Professor of Management Science and Engineering and Director of the Energy Modeling Forum (EMF) at Stanford University. He is also a Senior Fellow of the Precourt Institute for Energy and an an affiliated faculty member of the Stanford School of Earth, Environment and Energy Sciences, the Woods Institute for the Environment, and the Freeman-Spogli Institute for International Studies at Stanford. His current research focuses on analysis of multi-sector, multi-region coupled human and earth systems dynamics, global change systems analysis, energy technology assessment, and models for strategic planning. Weyant was a founder and serves as chairman of the Integrated Assessment Modeling Consortium (IAMC), a fourteen-year old collaboration among over 60 member institutions from around the world. He has been an active adviser to the United Nations, the European Commission, U.S.Department of Energy, the U.S. Department of State, and the Environmental Protection Agency. In California, he has been and adviser to the California Air Resources, the California Energy Commission and the California Public Utilities Commission.. Weyant was awarded the US Association for Energy Economics’ 2008 Adelmann-Frankel award for unique and innovative contributions to the field of energy economics and the award for outstanding lifetime contributions to the Profession for 2017 from the International Association for Energy Economics, and a Life Time Achievement award from the Integrated Assessment Modeling Consortium in 2018. Weyant was honored in 2007 as a major contributor to the Nobel Peace prize awarded to the Intergovernmental Panel on Climate Change and in 2008 by Chairman Mary Nichols for contributions to the to the California Air Resources Board's Economic and Technology Advancement Advisory Committee on AB 32. -

RCPP Panelreport March31

INTERGOVERNMENTAL PANEL ON CLIMATE CHANGE WMO UNEP _______________________________________________________________________________________________________________________ INTERGOVERNMENTAL PANEL IPCC-XXX/INF.6 ON CLIMATE CHANGE (15.IV.2009) THIRTIETH SESSION Agenda item: 3 Antalya, 21-23 April 2009 ENGLISH ONLY FUTURE IPCC ACTIVITIES – NEW SCENARIOS Report of 2.6 Versus 2.9 Watts/m2 RCPP Evaluation Panel John Weyant, Christian Azar, Mikiko Kainuma, Jiang Kejun, Nebojsa Nakicenovic, P.R. Shukla, Emilio La Rovere and Gary Yohe (Submitted by Richard Moss and Ismail Elgizouli on behalf of the Steering Committee for the Expert Meeting on New Scenarios) _______________________________________________________________________________________________________________________ IPCC Secretariat, c/o WMO, 7bis, Avenue de la Paix, C.P. N° 2300, 1211 Geneva 2, SWITZERLAND Phone: +41 22 730 8208/8254/8284 Fax: +41 22 730 8025/8013 E-mail: [email protected] Website: http://www.ipcc.ch Report of 2.6 Versus 2.9 Watts/m2 RCPP Evaluation Panel John Weyant, Christian Azar, Mikiko Kainuma, Jiang Kejun, Nebojsa Nakicenovic, P.R. Shukla, Emilio La Rovere and Gary Yohe March 31, 2009 INTRODUCTION An IPCC expert meeting on developing new community greenhouse gas emission scenarios was held in Noordwijkerhout, the Netherlands, in September 2007. As requested by the steering committee for that meeting, the Integrated Assessment Modeling Consortium (IAMC) identified a set of “Representative Concentration Pathways” (RCP’s) from the published literature. These pathways