IE Business School Working Paper EC8-115-I 10-07-2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bom Madrid 2016 Travel Guide

madrid 26/27/28 FEBRUARY EUROPEAN BOM TOUR 2016 2 TABLE OF CONTENTS 1. INTRODUCTION WELCOME TO MADRID LANGUAGE GENERAL TIPS 2. EASIEST WAY TO ARRIVE TO MADRID BY PLANE - ADOLFO SUÁREZ MADRID-BARAJAS AIRPORT (MAD) BY TRAIN BY BUS BY CAR 3. VENUE DESCRIPTION OF THE VENUE HOW TO GET TO THE VENUE 4. PUBLIC TRANSPORTATION SYSTEM UNDERGROUND METRO BUS TRAIN “CERCANÌAS TURISTIC TICKET 5. HOTELS 01. 6. SIGHTSEEING WELCOME TO MADRID TURISTIC CARD MONUMENTS MUSEUMS Madrid is the capital city of Spain and with a population of over 3,2 million people it is also the largest in Spain and third in the European Union! Located roughly at the center of the Iberian GARDENS AND PARKS Peninsula it has historically been a strategic location and home for the Spanish monarchy. Even today, it hosts mayor international regulators of the Spanish language and culture, such 7. LESS KNOWN PLACES as the Royal Spanish Academy and the Cervantes Institute. While Madrid has a modern infrastructure it has preserved the look and feel of its vast history including numerous landmarks and a large number of National 8. OTHERS CITIES AROUND MADRID Museums. 9. FOOD AND DRINK 10. NIGHTLIFE 11. LOCAL GAME STORES 12. CREDITS MADRID 4 LAN- GUAGE GENERAL TIPS The official language is Spanish and sadly a lot of people will have trouble communicating INTERNATIONAL PHONE CODE +34 in English. Simple but Useful Spanish (real and Magic life): TIME ZONE GMT +1 These words and phrases will certainly be helpful. They are pronounced exactly as written with the exception of letter “H”, which isn’t pronounced at all. -

Public-Private Partnerships in Roads: Economic and Policy Analyses

Public-Private Partnerships in Roads: Economic and Policy Analyses Paula Bel-Piñana ADVERTIMENT. La consulta d’aquesta tesi queda condicionada a l’acceptació de les següents condicions d'ús: La difusió d’aquesta tesi per mitjà del servei TDX (www.tdx.cat) i a través del Dipòsit Digital de la UB (diposit.ub.edu) ha estat autoritzada pels titulars dels drets de propietat intel·lectual únicament per a usos privats emmarcats en activitats d’investigació i docència. No s’autoritza la seva reproducció amb finalitats de lucre ni la seva difusió i posada a disposició des d’un lloc aliè al servei TDX ni al Dipòsit Digital de la UB. No s’autoritza la presentació del seu contingut en una finestra o marc aliè a TDX o al Dipòsit Digital de la UB (framing). Aquesta reserva de drets afecta tant al resum de presentació de la tesi com als seus continguts. En la utilització o cita de parts de la tesi és obligat indicar el nom de la persona autora. ADVERTENCIA. La consulta de esta tesis queda condicionada a la aceptación de las siguientes condiciones de uso: La difusión de esta tesis por medio del servicio TDR (www.tdx.cat) y a través del Repositorio Digital de la UB (diposit.ub.edu) ha sido autorizada por los titulares de los derechos de propiedad intelectual únicamente para usos privados enmarcados en actividades de investigación y docencia. No se autoriza su reproducción con finalidades de lucro ni su difusión y puesta a disposición desde un sitio ajeno al servicio TDR o al Repositorio Digital de la UB. -

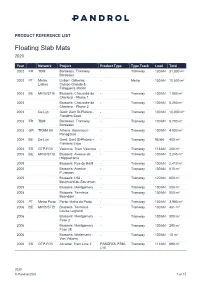

Floating Slab Mats 2020

PRODUCT REFERENCE LIST Floating Slab Mats 2020 Year Network Project Product Type Type Track Load Total 2002 FR TBM Bordeaux: Tramway - Tramway 100 kN 31,000 m² Bordeaux 2002 PT Metro Lisbon: Odivelas, - Metro 100 kN 10,000 m² Lisboa Campo Grande & Falagueira station 2003 BE MIVB/STIB Brussels: Chaussée de - Tramway 100 kN 1,800 m² Charleroi - Phase 1 2003 Brussels: Chaussée de - Tramway 100 kN 5,250 m² Charleroi - Phase 2 2003 De Lijn Gent: Gent St-Pieters - - Tramway 100 kN 10,000 m² Flanders Expo 2003 FR TBM Bordeaux: Tramway - Tramway 130 kN 9,700 m² Bordeaux 2003 GR TRAM SA Athens: Kasamouli - - Tramway 100 kN 4,000 m² Panagitsas 2004 BE De Lijn Gent: Gent St-Pieters - - Tramway 95 kN 400 m² Flanders Expo 2004 ES GTP-FGV Valencia: Tram Valencia - Tramway 113 kN 200 m² 2005 BE MIVB/STIB Brussels: Avenue de - Tramway 100 kN 2,245 m² l'Hippodrome 2005 Brussels: Rue du Bailli - Tramway 100 kN 2,410 m² 2005 Brussels: Avenue - Tramway 100 kN 610 m² P.Janson 2005 Brussels: L94 - - Tramway 120 kN 600 m² Boulevard du Souverain 2005 Brussels: Montgomery - Tramway 100 kN 250 m² 2005 Brussels: Terminus - Tramway 100 kN 550 m² Boondael 2005 PT Metro Porto Porto: Metro do Porto - Tramway 100 kN 3,900 m² 2006 BE MIVB/STIB Brussels: Terminus - Tramway 130 kN 481 m² Louise Legrand 2006 Brussels: Montgomery - Tramway 100 kN 300 m² Fase 2 2006 Brussels: Montgomery - Tramway 100 kN 290 m² Fase 2E 2006 Brussels: Wielemans - - Tramway 100 kN 15 m² Van Volxem 2006 ES GTP-FGV Alicante: Tram Line 2 PANDROL FSM- Tramway 113 kN 690 m² L10 2020 © Pandrol 2020 -

Diseño Del Tabique Que Separa La Cabina Del Conductor Del Resto Del Vagón En Trenes Y Trenes-Tranvía

UNIVERSIDAD DE VALLADOLID ESCUELA DE INGENIERIAS INDUSTRIALES Grado en Ingeniería en Diseño Industrial y Desarrollo del Producto “Ledway”: Diseño del tabique que separa la cabina del conductor del resto del vagón en trenes y trenes-tranvía Autor: Santos Villaverde, Celia Responsable de Intercambio en la UVa Sánchez Bascones, María Isabel Universidad de destino Universidad Politécnica de Valencia, ETSID Valladolid, septiembre 2017. TFG REALIZADO EN PROGRAMA DE INTERCAMBIO TÍTULO: “Ledway”: Diseño del tabique que separa la cabina del conductor del resto del vagón en tranvías y trenes-tranvía ALUMNO: Celia Santos Villaverde FECHA: 18 septiembre 2017 CENTRO: ETSID, Universidad Politécnica de Valencia TUTOR: Marina Puyuelo Cazorla RESUMEN Y PALABRAS CLAVE RESUMEN: El proyecto de ingeniería que se presenta en las siguientes páginas y que pretende abarcar todo el proceso del proyecto, desde la conceptualización de la idea hasta la fabricación del producto, responde a la propuesta para el diseño y desarrollo del tabique que separa la cabina del conductor del resto del vagón de tranvías y tren-tranvías. Se busca como objeBvo principal la convergencia de la ergonomía y simplificar la transmisión de información entre la empresa y los usuarios, sin dejar de lado la uBlidad, tanto para el maquinista como para el pasajero. Se han idenBficado y uBlizado elementos representaBvos del Metro de Valencia como el recorrido y colores plasmados en el mapa oficial de la red de tranvías para conseguir uniformidad y simplicidad de cara al usuario. PALABRAS CLAVE: -

Tranvías Y Otros Sistemas De Transporte Urbano

Informe especial - Febrero 2015 Tranvías y otros sistemas de transporte urbano Despilfarros y aciertos Tras un primer estudio llevado a cabo en 2012, Carril Bus en colaboración con la consultora Solutrans, vuelve a analizar la situación de las infraestructuras de transporte puestas en funcionamiento en las últimas décadas en España, especialmente de los tranvías. El siguiente artículo se centra en su utilidad, justificación y en la mejora para la vida cotidiana que aportan a los ciudadanos Según afirma el autor del texto, Gregory Carmona, “parece que en ocasiones hubiesen sido proyectos utilizados más allá de su fin como medios de transporte, para generar actividad local u otras operaciones con dudosos fines, elevando la inversión inicial realmente necesaria”. Y la realidad es que estas inversiones siguen siendo en la actualidad objeto de críticas. ¿Será que dichas críticas a estos proyectos de tranvías y metros ligeros están justificadas? Es lo que Gregory Carmona, experto en transportes y autor del informe, vuelve a analizar en detalle desde un punto de vista técnico y socio económico. Un estUdio realizado con criterio referencias el autor del estudio, Gregory carmona, lleva más de 15 años en el mundo del transporte de viajeros, ha trabajado en planificación, operación y gestión de transporte urbano / interurbano de autobuses y participado en proyectos de tranvías. títulos se formó como técnico superior de transporte en lyon antes de entrar en la escuela de dirección de transporte y logística en Paris. luego, se graduó Master en transporte, Urbanismo, Medio ambiente por la universidad de cergy Pontoise (Versailles) antes de especializarse en transporte terrestre en la UPM. -

Seeking Factors to Increase the Public's Acceptability of Road

Seeking Factors to Increase the Public’s Acceptability of Road-Pricing Schemes Case Study of Spain Paola Carolina Bueno, Juan Gomez, and Jose Manuel Vassallo User acceptability has become a critical issue for the successful imple- One of the major obstacles to the widespread implementation mentation of transport pricing measures and policies. Although several of road charging is its still scarce public acceptability (1). Previous studies have addressed the public acceptability of road pricing, little research has clearly shown that public acceptability of such measures evidence can be found of the effects of pricing strategies. The accept- is low, with considerable public resistance to road pricing in Europe ability of alternative schemes for a toll network already in operation is and beyond, as was evidenced by Link and Polak (2). Nevertheless, an issue to be tackled. This paper contributes to the limited literature in public opposition to charging policies is not inevitable, as was pointed this field by exploring perceptions toward road-pricing schemes among out by Jaensirisak et al. (3). For instance, spending road revenues on toll road users. On the basis of a nationwide survey of toll road users public transport or setting an understandable and reasonable pricing in Spain, the study developed several binomial logit models to analyze purpose may contribute to minimizing opposition to road charges user acceptability of three approaches: express toll lanes, a time-based and increasing their political acceptability. pricing approach, and a flat fee (vignette) system. The results show Acceptability of road-pricing schemes is determined by several notable differences in user acceptability by the type of charging scheme factors, which can be broadly classified into three main categories. -

Trams Der Welt / Trams of the World 2020 Daten / Data © 2020 Peter Sohns Seite/Page 1 Algeria

www.blickpunktstrab.net – Trams der Welt / Trams of the World 2020 Daten / Data © 2020 Peter Sohns Seite/Page 1 Algeria … Alger (Algier) … Metro … 1435 mm Algeria … Alger (Algier) … Tram (Electric) … 1435 mm Algeria … Constantine … Tram (Electric) … 1435 mm Algeria … Oran … Tram (Electric) … 1435 mm Algeria … Ouragla … Tram (Electric) … 1435 mm Algeria … Sétif … Tram (Electric) … 1435 mm Algeria … Sidi Bel Abbès … Tram (Electric) … 1435 mm Argentina … Buenos Aires, DF … Metro … 1435 mm Argentina … Buenos Aires, DF - Caballito … Heritage-Tram (Electric) … 1435 mm Argentina … Buenos Aires, DF - Lacroze (General Urquiza) … Interurban (Electric) … 1435 mm Argentina … Buenos Aires, DF - Premetro E … Tram (Electric) … 1435 mm Argentina … Buenos Aires, DF - Tren de la Costa … Tram (Electric) … 1435 mm Argentina … Córdoba, Córdoba … Trolleybus … Argentina … Mar del Plata, BA … Heritage-Tram (Electric) … 900 mm Argentina … Mendoza, Mendoza … Tram (Electric) … 1435 mm Argentina … Mendoza, Mendoza … Trolleybus … Argentina … Rosario, Santa Fé … Heritage-Tram (Electric) … 1435 mm Argentina … Rosario, Santa Fé … Trolleybus … Argentina … Valle Hermoso, Córdoba … Tram-Museum (Electric) … 600 mm Armenia … Yerevan … Metro … 1524 mm Armenia … Yerevan … Trolleybus … Australia … Adelaide, SA - Glenelg … Tram (Electric) … 1435 mm Australia … Ballarat, VIC … Heritage-Tram (Electric) … 1435 mm Australia … Bendigo, VIC … Heritage-Tram (Electric) … 1435 mm www.blickpunktstrab.net – Trams der Welt / Trams of the World 2020 Daten / Data © 2020 Peter Sohns Seite/Page -

Influence of Wider Longitudinal Road Markings on Vehicle Speeds in Two

sustainability Article Influence of Wider Longitudinal Road Markings on Vehicle Speeds in Two-Lane Rural Highways Francisco Calvo-Poyo * , Juan de Oña , Laura Garach Morcillo and José Navarro-Moreno TRYSE Research Group, Department of Civil Engineering, University of Granada, 18071 Granada, Spain; [email protected] (J.d.O.); [email protected] (L.G.M.); [email protected] (J.N.-M.) * Correspondence: [email protected]; Tel.: +34-958-249-452 Received: 14 September 2020; Accepted: 3 October 2020; Published: 9 October 2020 Abstract: Longitudinal road markings are a valuable aid in driving guidance. An increase in their width may influence driving and, therefore, road safety. Wider road markings generate a perception of a narrowing lane, which may induct drivers to reduce speed. The present study tries to verify if an increased width of longitudinal road markings actually helps one to drive more slowly, and consequently leads to enhanced road safety. For this purpose, three curves with reduced visibility were selected and driving speed was measured with normal and modified (wider) longitudinal road markings. The results showed a speed reduction effect of around 3.1% with wide road markings. The speed-reducing effect of wide marks was greater during weekends and with more intense traffic volume, while it was slightly attenuated by night. Finally, the calculation of some standard cases on a working day, and considering average traffic volume, gave the following speed reductions during the day and at night, respectively: for light vehicles, 2.24% and 1.96%; for heavy vehicles, 2.46% and 2.15%. In view of the results obtained, it may be said that using wide road markings can help reduce vehicle speed, thereby contributing to reduced traffic accidents and making road transport more sustainable. -

Innovative Applications of the Highway Capacity Manual 2010

TRANSPORTATION RESEARCH Number E-C190 December 2014 Innovative Applications of the Highway Capacity Manual 2010 January 13, 2014 Washington, D.C. TRANSPORTATION RESEARCH BOARD 2014 EXECUTIVE COMMITTEE OFFICERS Chair: Kirk T. Steudle, Director, Michigan Department of Transportation, Lansing Vice Chair: Daniel Sperling, Professor of Civil Engineering and Environmental Science and Policy; Director, Institute of Transportation Studies, University of California, Davis Division Chair for NRC Oversight: Susan Hanson, Distinguished University Professor Emerita, School of Geography, Clark University, Worcester, Massachusetts Executive Director: Robert E. Skinner, Jr., Transportation Research Board TRANSPORTATION RESEARCH BOARD 2014–2015 TECHNICAL ACTIVITIES COUNCIL Chair: Daniel S. Turner, Emeritus Professor of Civil Engineering, University of Alabama, Tuscaloosa Technical Activities Director: Mark R. Norman, Transportation Research Board Peter M. Briglia, Jr., Consultant, Seattle, Washington, Operations and Preservation Group Chair Alison Jane Conway, Assistant Professor, Department of Civil Engineering, City College of New York, New York, Young Members Council Chair Mary Ellen Eagan, President and CEO, Harris Miller Miller and Hanson, Inc., Burlington, Massachusetts, Aviation Group Chair Barbara A. Ivanov, Director, Freight Systems, Washington State Department of Transportation, Olympia, Freight Systems Group Chair Paul P. Jovanis, Professor, Pennsylvania State University, University Park, Safety and Systems Users Group Chair Thomas J. Kazmierowski, Senior Consultant, Golder Associates, Inc., Mississauga, Ontario, Canada, Design and Construction Group Chair Mark S. Kross, Consultant, Jefferson City, Missouri, Planning and Environment Group Chair Hyun-A C. Park, President, Spy Pond Partners, LLC, Arlington, Massachusetts, Policy and Organization Group Chair Harold R. (Skip) Paul, Director, Louisiana Transportation Research Center, Louisiana Department of Transportation and Development, Baton Rouge, State DOT Representative Stephen M. -

Manual De Criterios

INVENTARIO DE CARACTERÍSTICAS GEOMÉTRICAS Y DE EQUIPAMIENTO MANUAL DE CRITERIOS Peticionario : MINISTERIO DE FOMENTO RIO DE FOMENTO ICIEMBRE DE 2 MDiciembre de 2009 Inventario de Características Geométricas y de Equipamiento. MANUAL DE CRITERIOS ÍNDICE 0.- INTRODUCCIÓN………………………………………………………………………………..…6 1.- OBJETIVOS Y CONTENIDO DEL INVENTARIO…………………………………………...….7 2.- TRAMIFICACIÓN DE LA RED………………………………………………............................8 2.1.- Criterios de tramificación. Nudos………………………………………………………..8 2.1.1.- Definición de nudos………………………………………………………….……8 2.1.2.- Ubicación de los nudos………………………………………………………….10 2.2.- Criterios de denominación de los tramos……………………………………………..10 3.- REFERENCIACIÓN………………………………………………………………………………...14 4.- RED A INVENTARIAR………………………………………………………………………….16 5.- TOMA DE DATOS Y VALIDACIÓN EN GABINETE.……………………………………….17 5.1.- Introducción…...…………………………………………………………………………17 5.2.- Toma de datos en campo……………………………………………………………….17 5.3.- Cálculo, complementación y validación de los datos en gabinete……...…………20 6. – VARIABLES A INVENTARIAR, ERRORES Y PRECISIONES.…………………………21 6.1. – Introducción………………………………………………………………………...21 6.2. – Geometría y visibilidad……………………………………………………………..…...21 6.2.1. – Sección de la carretera…………………………………………………………….23 6.2.2. – Plataforma…………………………………………………………………………..26 6.2.3. – Calzada……………………………………………………………………………...27 6.2.4. – Nº de carriles………………………………………………………………………..33 Inventario de Características Geométricas y de Equipamiento. MANUAL DE CRITERIOS 6.2.5. – Ancho de carriles adicionales……………………………………………………..34 -

A NEW APPROACH to MEASURE the IMPACT of HIGHWAYS on BUSINESS LOCATION with an APPLICATION to SPAIN Teresa Garcia-Milà Universit

A NEW APPROACH TO MEASURE THE IMPACT OF HIGHWAYS ON BUSINESS LOCATION WITH AN APPLICATION TO SPAIN* Teresa Garcia-Milà Universitat Pompeu Fabra and Barcelona GSE José G. Montalvo Universitat Pompeu Fabra, Barcelona GSE and IVIE June 2013 In this paper we present a new approach to measure the effect of infrastructures on firms’ location. We use fixed size rectangles around the roads as the unit of analysis instead of the traditional approach based on regions or municipalities. We apply this approach to Spain, which is an interesting case since during the period 1984- 2000 there was a very active process of increasing the capacity of roads by transforming national roads into highways/dual carriageways. The results show that the transformation of national roads into high capacity roads did not increase the number of firms in the catchment area relative to the non-treated group. JEL classification numbers: R4; O4; R58 Keywords: firms’ location, infrastructure, geographic information system. * Corresponding author: José G. Montalvo, email: [email protected]. The paper has benefited from the comments of participants on many conferences and seminars. The authors acknowledge the financial support of the Ministerio de Ciencia e Innovación (SEJ2007-64340). This research is not the result of a for-pay consulting relationship. We thank Xavier Vinyals, Sandro Shelegia and Cristina Vila for their excellent research assistance. We are grateful to the Institute of Geographic Studies and, in particular, Jordi Martín, for his collaboration in the construction and transformation of the data in several stages of the paper. 1. Introduction Credible and sensitive methods to evaluate the effect of public infrastructures on economic development are critical to understand the economic relevance of these programs. -

Presupuestos Generales Del Estado Estado Ejercicio Presupuestario

PRESUPUESTOS GENERALES DEL ESTADO ESTADO EJERCICIO PRESUPUESTARIO 2005 Sección: 17 MINISTERIO DE FOMENTO Servicio: 38 DIRECCIÓN GENERAL DE CARRETERAS Programa: 453B Creación de infraestructura de carreteras (Miles de euros) Prog. Ar. Proyec. Superproyec. Denominación Año ini. Año fin Com. Prov. Tipo Ley 2005 453B Creación de infraestructura de carreteras 2.385.764,36 60 Inv. nueva en infraestr. y bienes destinados al uso general 1.896.888,84 Superproyectos 1.835.947,22 1993 17 38 9006 ACTUACIONES EN MEDIO URBANO Y ACCESOS A PUERTOS Y AEROPUERTO S 1980 2007 93 93 O 177.224,60 1996 17 38 0260 ACCESO AL PUERTO DE MALAGA. (O) (2,7 Km.) 1997 2004 04 29 Q 1996 17 38 0325 N-II. LLEIDA-ELS ALAMUS. (O) (8,1 km.) 1997 2006 02 25 O 1.221,67 1996 17 38 0330 N-420 CON CIRCUNVALACION DE CUENCA. (O) (2,2 km.) 1997 2004 11 16 Q 1996 17 38 4130 CUARTO CINTURON DE ZARAGOZA. RONDA SUR. (O) (13,2 Km.) 1996 2004 10 50 Y 1996 17 38 4310 VARIANTE DE CERVELLO. (O) (6,3 Km.) 1996 2005 02 08 Q 864,64 1998 17 38 0440 CONEXION A-66 Y ACCESO VENTANIELLES Y RUBIN. (O) (0,8 K m.) 1999 2005 05 33 O 271,62 1998 17 38 3100 N-240 ACONDICIONAMIENTO TARRAGONA (A-7)-VALLS.(PC) 1998 2006 02 43 O 446,00 1998 17 38 4370 CONEXION N-230/N-240. AVENIDA DE PINYANA (LLEIDA).(O) (1,1 K m.) 1998 2005 02 25 O 306,01 1998 17 38 4380 SEGUNDO CINTURON DE CIRCUNVALACION DE VIGO (CONVE-NIO).