Ford Grows Third Quarter Sales in Europe, Driven by Popularity Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ford Going Further at Shanghai with Escort Concept – a Distinctive, Desirable Car Designed for Chinese Customers

NEWS www.facebook.com/ford www.twitter.com/ford Ford Going Further at Shanghai with Escort Concept – a Distinctive, Desirable Car Designed for Chinese Customers • Ford Escort Concept blends design that is distinctive and desirable with functionality, quality, roominess, fuel economy and safety • Ford Escort Concept shows the future vision for how Ford could expand its global compact car platform in China • Ford Escort Concept is designed to meet the demands of Chinese consumers within a specific subsegment of China’s largest and fastest-growing segments, compact cars SHANGHAI, China, April 20, 2013 – Ford’s commitment to Chinese automotive customers took a giant leap forward today at Auto Shanghai 2013 with the unveiling of the Ford Escort Concept – the latest example of how the company’s global DNA continues to evolve and cater to a growing and diverse mix of customers. The Ford Escort Concept showcases Ford’s vision for how the company could serve additional customers in China’s compact car segment – a segment that accounts for over 25 percent of the country’s total vehicle industry and includes the Ford Focus, the best-selling nameplate in China last year as well as the best-selling nameplate worldwide. Building on the success of the Focus, the Ford Escort Concept is a new kind of compact car, designed for a very different customer. Both Focus and Escort Concept deliver high quality, safety and fuel economy. While Focus successfully meets the needs of those seeking a fun driving experience and high level of technology, the Escort Concept is for those customers who value exceptional roominess, uncompromised functionality and sophisticated design. -

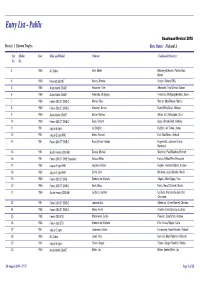

REV Entry List

Entry List - Public Goodwood Revival 2018 Race(s): 1 Kinrara Trophy - Race Status: National A Car Shelter Year Make and Model Entrant Confirmed Driver(s) No. No. 3 1963 AC Cobra Hunt, Martin Blakeney-Edwards, Patrick/Hunt, Martin 4 1960 Maserati 3500GT Rosina, Stefano Rosina, Stefano/TBC, 5 1960 Aston Martin DB4GT Alexander, Tom Alexander, Tom/Wilmott, Adrian 6 1960 Aston Martin DB4GT Friedrichs, Wolfgang Friedrichs, Wolfgang/Hadfield, Simon 7 1960 Ferrari 250 GT SWB/C Werner, Max Werner, Max/Werner, Moritz 8 1960 Ferrari 250 GT SWB/C Allemann, Benno Dowd, Mike/Gnani, Michael 9 1960 Aston Martin DB4GT Mosler, Mathias Gillian, G.C./Woodgate, Chris 10 1960 Ferrari 250 GT SWB/C Gaye, Vincent Gaye, Vincent/Reid, Anthony 11 1961 Jaguar E-type Ian Dalglish Dalglish, Ian/Turner, James 12 1961 Jaguar E-type FHC Meins, Richard Huff, Rob/Meins, Richard 14 1961 Ferrari 250 GT SWB/C Racing Team Holland Hugenholtz, John/van Oranje, Bernhard 15 1961 Austin Healey 3000 Mk1 Darcey, Michael Woolmer, Paul/Woolmer, Richard 16 1961 Ferrari 250 GT SWB 'Breadvan' Halusa, Niklas Halusa, Niklas/Pirro, Emanuele 17 1962 Jaguar E-type FHC Hayden, Andrew Hayden, Andrew/Hibberd, Andrew 18 1962 Jaguar E-type FHC Corrie, John Minshaw, Jason/Stretton, Martin 19 1960 Ferrari 250 GT SWB Scuderia del Viadotto Vögele, Alain/Vögele, Yves 20 1960 Ferrari 250 GT SWB/C Devis, Marc Devis, Marc/O'Connell, Martin 21 1960 Austin Healey 3000 Mk1 Le Blanc, Karsten Le Blanc, Karsten/van Lanschot, Christiaen 23 1961 Ferrari 250 GT SWB/C Lanzante Ltd. Ellerbrock, Olivier/Glaesel, Christian -

2002 Ford Motor Company Annual Report

2228.FordAnnualCovers 4/26/03 2:31 PM Page 1 Ford Motor Company Ford 2002 ANNUAL REPORT STARTING OUR SECOND CENTURY STARTING “I will build a motorcar for the great multitude.” Henry Ford 2002 Annual Report STARTING OUR SECOND CENTURY www.ford.com Ford Motor Company G One American Road G Dearborn, Michigan 48126 2228.FordAnnualCovers 4/26/03 2:31 PM Page 2 Information for Shareholders n the 20th century, no company had a greater impact on the lives of everyday people than Shareholder Services I Ford. Ford Motor Company put the world on wheels with such great products as the Model T, Ford Shareholder Services Group Telephone: and brought freedom and prosperity to millions with innovations that included the moving EquiServe Trust Company, N.A. Within the U.S. and Canada: (800) 279-1237 P.O. Box 43087 Outside the U.S. and Canada: (781) 575-2692 assembly line and the “$5 day.” In this, our centennial year, we honor our past, but embrace Providence, Rhode Island 02940-3087 E-mail: [email protected] EquiServe Trust Company N.A. offers the DirectSERVICE™ Investment and Stock Purchase Program. This shareholder- paid program provides a low-cost alternative to traditional retail brokerage methods of purchasing, holding and selling Ford Common Stock. Company Information The URL to our online Investor Center is www.shareholder.ford.com. Alternatively, individual investors may contact: Ford Motor Company Telephone: Shareholder Relations Within the U.S. and Canada: (800) 555-5259 One American Road Outside the U.S. and Canada: (313) 845-8540 Dearborn, Michigan 48126-2798 Facsimile: (313) 845-6073 E-mail: [email protected] Security analysts and institutional investors may contact: Ford Motor Company Telephone: (313) 323-8221 or (313) 390-4563 Investor Relations Facsimile: (313) 845-6073 One American Road Dearborn, Michigan 48126-2798 E-mail: [email protected] To view the Ford Motor Company Fund and the Ford Corporate Citizenship annual reports, go to www.ford.com. -

Ford Accessories Wheels

FORD ACCESSORIES WHEELS www.ford.co.uk K42394_Ford-Alloy-Wheel_Brochure_fixe Seiten_190615_RZ.indd 36-1 19.06.15 17:49 Spice up your Ford 4-5 6-7 Ford Ka 8-9 Ford Fiesta 10-11 Ford B-MAX 12-15 Ford Focus & Ford C-MAX 16-17 Ford Kuga 18-21 Ford Mondeo 22-25 Ford S-MAX & Ford Galaxy 26-27 Ford Ranger 28-29 Ford Transit Courier 30-31 Ford Transit Connect & Ford Tourneo Connect 32-33 Ford Transit Custom & Ford Tourneo Custom 34-35 Accessories online 2 3 K42394_Ford-Alloy-Wheel_Brochure_fixe Seiten_190615_RZ.indd 2-3 19.06.15 17:49 Love the wheels. We don’t compromise. Enjoy the drive. Neither should you. Alloy wheels add an extra dimension to your Ford, and extra pleasure to your driving. We design, build and test our alloy wheels to be the best choice for you and your Ford – with Because you know your Ford looks even better than before, with wheels designed to no compromise. With each new wheel created for a particular Ford model, every design is complement its design from every angle. tested against all body styles for quality, safety and – of course – great looks. We build prototypes for a thoroughly static testing and durability resistance, and only then do we at the Made only for Ford Ford Proving Ground. Ford alloy wheels are made only for Ford cars – never for anyone else. That means no compromises, and no “one style fits all” attitude. Just wheels perfectly matched to your Ford’s style and high standards. Going further All-round testing. -

Notice of Annual Meeting Management Information Circular/Proxy Statement

Notice of Annual Meeting Management Information Circular/Proxy Statement Annual Meeting May 4, 2011 BODY & CHASSIS SYSTEMS | POWERTRAIN SYSTEMS | EXTERIOR SYSTEMS www.magna.com SEATING SYSTEMS | INTERIOR SYSTEMS | VISION SYSTEMS | CLOSURE SYSTEMS | ROOF SYSTEMS | ELECTRONIC SYSTEMS | HYBRID & ELECTRIC VEHICLES/SYSTEMS | VEHICLE ENGINEERING & CONTRACT ASSEMBLY 24MAR201113335785 Magna International Inc. 337 Magna Drive 24MAR200901113112 Aurora, Ontario, Canada L4G 7K1 Telephone: (905) 726-2462 Legal Fax: (905) 726-7164 March 30, 2011 Dear Shareholder, I am pleased to invite you to attend Magna’s 2011 Annual Meeting of Shareholders on May 4, 2011 at 10:00 a.m. (Toronto time) at the Hilton Suites Toronto/Markham Conference Centre, 8500 Warden Avenue, Markham, Ontario, Canada. The business items which will be addressed at the annual meeting are set out in the notice of annual meeting and the accompanying proxy circular. We encourage you to vote your shares in person, or by phone, fax or internet, as described in the proxy circular. As in prior years, those not attending the annual meeting in person can access a simultaneous webcast through Magna’s website (www.magna.com). As you are aware, 2010 was a year of significant change for Magna. In August 2010, Magna completed the plan of arrangement and related transactions (the ‘‘Arrangement’’) announced in May 2010. The Arrangement, which was approved by over 75% of Magna’s disinterested shareholders, represented an historic milestone for Magna as it collapsed the dual-class share structure which had been in place since 1978. In conjunction with the Arrangement, the consulting, business development and business services agreements through which Frank Stronach has provided his knowledge and expertise to Magna and its divisions were amended to extend the expiry date of each agreement to December 31, 2014, after which they will automatically terminate. -

New Ford Fiesta: Safety and Driver Assistance

New Ford Fiesta: Safety and Driver Assistance The new Ford Fiesta has earned a 5-star safety rating from Euro NCAP Euro NCAP Advanced rewards Since 2010 Euro NCAP – the European New Car Assessment Programme – has 7 presented Advanced rewards in recognition of new technologies which demonstrate a scientifically proven safety benefit for consumers and society. Ford has earned a Euro NCAP Advanced reward for the MyKey feature that makes its European debut on the new Ford Fiesta, New Fiesta Safety Rating New Fiesta Safety and Driver Assistance Features making Ford the first car manufacturer to receive the accolade for six different Euro NCAP crash tests new passenger • MyKey: Ford’s industry-first MyKey technology emergency services operators after an accident, in technologies: vehicles in Europe, subjecting them to makes its European debut on the new Fiesta. the correct language for the region trials including: MyKey enables parents to place certain restrictions • ESC: Electronic Stability Control is standard on the • MyKey – Ford Fiesta on young drivers to promote safer driving new Fiesta in all European markets. ESC senses • SYNC with Emergency Assistance – • Active City Stop: Ford Active City Stop can help when the Fiesta is losing grip and automatically • Frontal Impact Ford Fiesta, Ford B-MAX, Ford C-MAX, prevent collisions at speeds of up to 15 km/h and applies braking force to individual wheels to help • Car to Car Side Impact Ford Focus and Ford Kuga mitigate the effects of impacts at speeds of up the driver maintain stability • Pole Side Impact • Active City Stop – Ford B-MAX and to 30 km/h. -

Current Front Stiffness of European Vehicles with Regard to Compatibility

CURRENT FRONT STIFFNESS OF EUROPEAN VEHICLES WITH REGARD TO COMPATIBILITY Jos Huibers Eric de Beer TNO Automotive Crash Safety Centre The Netherlands Paper No. ID#239 This trend in stiffer vehicle fronts might result in ABSTRACT future modifications of the European side impact barrier, which is currently based on average vehicle EuroNCAP tests are carried out since 1997. The test fronts of old vehicles. This item is only mentioned procedure in general is comparible to the EC and will not be further discussed. Directive 96/79 with a test speed of 64 km/h. This increased test speed implies a higher frontal stiffness INTRODUCTION for new vehicle designs in order to achieve a high ranking. This frontal stiffness is one of the major Compatibility is an important subject in road traffic factors for compatibility in car to car collisions. safety research, because in a large part of the To support the European 4th framework accidents more than one road user is involved. In that compatibility research activity, load cell barriers are case the passive safety of the different road users is used in ENCAP tests carried out at the TNO Crash often not very well balanced. This leads to an Safety Centre and TRL. incompatible situation in which one of the parties suffers from the aggressiveness of the other. During In this paper global force displacement characteristics the last two decades, extensive research was done on of a number of different vehicle classes are compared the statistics of car-to-car crashes giving a/o. and analysed. It will be made clear that small interesting rates of aggressiveness, [1,2,3,4,]. -

Nuevo Mondeo Vignale Híbrido | Manual Del Propietario

FORD MONDEO VIGNALE Manual del Propietario La información presentada en esta publicación era correcta al momento de la impresión. Para asegurar un continuo desarrollo, nos reservamos el derecho de modificar especificaciones, diseño o equipo en cualquier momento y sin previo aviso ni obligación. Ninguna parte de esta publicación puede ser reproducida, transmitida, almacenada en un sistema de recuperación o traducida a otro idioma, de ninguna forma y por ningún medio, sin nuestra autorización por escrito. Se exceptúan los errores y las omisiones. © Ford Motor Company 2018 Todos los derechos reservados. Número de pieza: CG3821esARG 201812 20181210162319 Contenido Introducción Cinturones de seguridad Comprobación del estado del sistema MyKey ................................................................48 Reconocimientos ..................................................7 Modo de abrocharse los cinturones de seguridad ..........................................................35 Uso de MyKey con sistemas de arranque Acerca de este manual .......................................7 remotos .............................................................48 Glosario de símbolos ...........................................7 Ajuste de la altura de los cinturones de seguridad ..........................................................36 MyKey – Solución de problemas .................48 Grabación de datos .............................................9 Recordatorio de cinturones de seguridad Recomendación de las piezas de repuesto ...............................................................................36 -

FORD KUGA Introducing the Ford Kuga How You Use Your Car Changes Every Day

FORD KUGA Introducing the Ford Kuga How you use your car changes every day. The Ford Kuga is smart enough to do it all in style, whether it’s a weekday commute or a weekend away. 1-2 3-6 7-12 13-16 17-20 21-26 The smarter way to get there Technology Capability Sustainability Safety Choose your Ford Kuga The sophisticated driver and engine Hands-free and automatic technologies Whatever challenge is at hand, the The Ford Kuga off ers the latest in Ford To help protect you and give you real • Ambiente technology in the Ford Kuga is designed make life easier and safer. From a tailgate Ford Kuga adapts with ease. From its petrol and diesel technologies, including peace of mind, the Ford Kuga comes • Trend to get you where you want to go in the you can open with your foot to controlling All-Wheel-Drive system that adjusts a choice of two EcoBoost petrol engines equipped with the latest Ford safety • Titanium smartest possible way. the Satellite Navigation with simple instantly to changing road conditions, along with the 2.0L TDCi Diesel engine, technology along with the maximum voice commands, every feature is to fl exible rear seats that fold down for each delivering fuel effi ciency without 5-star ANCAP safety rating. 27-30 designed for maximum convenience. extra space, everything about the Ford compromising performance. Colours and accessories Kuga says, ‘no worries.’ 31-32 Specifying your Ford Kuga Ford Kuga Titanium shown. The smarter way to get there 1 Inspiring a sense of freedom and adventure, the Ford Kuga is powerful yet fuel 2 effi cient for the most rewarding drive. -

FT-New Kuga.Pdf

Kuga 21.25MY V1 GBR en R1_12:40_20.04.2021 0d1fdd7cb54f4d7dc749220d4c43b164-6d18b1af748948a6a7ece9335cac6f57-00000_book.indb 66 20/04/2021 12:27:52 Kuga 21.25MY V1 GBR en R1_12:40_20.04.2021 Kuga 21.25MYKuga 21.25MY V1 GBR en V1 R1_12:40_20.04.2021 GBR en R1_12:40_20.04.2021 RANGERANGE OVERVIEW OVERVIEW SELECT Zetec Titanium Edition ST-LineST-Line Edition Edition ST-LineST-Line X Edition X Edition VignaleVignale With a choice of exterior and interior styling, Kuga’s elegant entry model has a richer level of Kuga’s luxury models deliver elevated levels of The strikingThe strikingKuga ST-Line Kuga ST-Line Edition Editionhas a distinctly has a distinctlyBrimmingBrimming with athleticism with athleticism and advanced and advanced With uniqueWith uniquedesign featuresdesign features and exclusively and exclusively 2 standard features than ever before, including sophistication and comfort, from superior quality sporty character,sporty character, thanks thanksto its unique to its uniqueexterior exterior technology,technology, Kuga ST-Line Kuga ST-Line X Edition X Editionis prepared is prepared for sourced for sourced soft-touch soft-touch leathers, leathers, Kuga Vignale Kuga Vignale places places there’s a new Ford Kuga that’s right for you. impressive integrated technologies. materials to additional technologies. styling andstyling interior and interiordetailing. detailing. any drivingany occasion.driving occasion. you in ayou world in a of world unrivalled of unrivalled refinement. refinement. Key features Key features (additional to Zetec) -

Ford Europe FY 2020 Sales Release

FordSixth achieves Consecutive record Year share of in Commercial SUV sales and Vehicle grows Leadershipits European, www.youtube.com/FordofEurope │ NEWS commercialMustang Mach vehicle-E Readyshare leadership to Accelerate in Q3 Electrification 2020 www.twitter.com/FordEU FULL YEAR 2020 SALES Total Vehicle Passenger Vehicle Passenger Vehicle Commercial Vehicle Commercial Vehicle Total Vehicle Sales Market Share Sales Market Share Sales Market Share Euro 20* 974,982 7.1% 645,156 5.6% 329,826 14.6% Versus -26.8% -0.3 ppt -32.1% -0.6 ppt -13.6% +0.7 ppt FY 2019 HIGHLIGHTS “2020 was an unprecedented year and the pandemic is still affecting our • Full year 2020 total vehicle sales of 974,982 (-26.8 business. Our commercial vehicle per cent), market share 7.1 per cent down 0.3 strategy continues to flourish, with last percentage points compared to 2019 year marking the sixth consecutive year of European market leadership. Puma • Ford number one commercial vehicle brand for sixth and Kuga are leading the charge on our consecutive year across EU 20 markets and for 56 SUV growth, and now our electrification years in a row in the UK plan is accelerating with the launch of the award-winning Mustang Mach-E All-time full year CV market share record in the • that combines emotion with advanced European 20 markets of 14.6 per cent up 0.7 all-electric technology.” percentage points compared to 2019 • CV leadership in ten European markets (including Roelant de Waard, Vice President - Marketing, Sales & Service, Turkey) in 2020, increase of share in most markets Ford of Europe • Ranger clear leader in 2020 reaching a full year VEHICLE NEWS segment share of 34.9 per cent • Ford Fiesta and the Ford Transit Custom / Tourneo New products launched in 2020 Custom range took the No.1 and No.2 spots and home delivery trend fosters respectively in Britain’s best-selling new vehicles chart our success in CV segment and for 2020 leads to new records. -

Sports Racing Cars 1938 – 1957

Sports Racing Cars 1938 – 1957 Abarth Spyder Ferrari 166 MM Barchetta Touring Lister - Corvette Adler Trumpf Rennlimousine Ferrari 166 MM Berlinetta Touring LM Lister - Jaguar Aero Minor Sport Ferrari 166 MM/53 Spider Vignale Lister - MG Alfa Romeo 1900 Ferrari 166 S Coupé Allemano Lotus Eleven Alfa Romeo 1900 Sprint Coupé Touring Ferrari 166 SC Lotus Eleven Climax Alfa Romeo 1900 SS Zagato Ferrari 195 Inter Berlinetta Motto Lotus Mark IX Climax Alfa Romeo 1900 TI Ferrari 195 S Barchetta Fontana Magda Alfa Romeo 412 Spider Vignale Ferrari 195 S Barchetta Touring Maserati 150S Alfa Romeo 6C 2300 Pescara Spider Zagato Ferrari 212 Export Barchetta Maserati 200S Alfa Romeo 6C 2500 Ferrari 212 Export Berlinetta Vignale Maserati 200SI Alfa Romeo 6C 2500 'Freccia d'Oro' Ferrari 212 Export Spider Motto Maserati 300S Alfa Romeo 6C 2500 Competizione Berlinetta Ferrari 250 GT LWB Scaglietti Maserati 300S Fantuzzi Alfa Romeo 6C 2500 SS Ferrari 250 GT LWB Zagato Maserati 450S Alfa Romeo 6C 2500 SS Berlinetta Touring Ferrari 250 MM Pinin Farina Maserati A6GCS Alfa Romeo 6C 2500 SS Coupé Touring Ferrari 250 MM Spider Vignale Maserati A6GCS/53 Alfa Romeo 6C 2500 SS Spider Ferrari 250 Monza Maserati A6GCS/53 Fantuzzi Alfa Romeo 6C 2500 SS Spider Touring Ferrari 250 S Berlinetta Vignale Mercedes-Benz 220A Alfa Romeo 6C 3000 CM Berlinetta Colli Ferrari 290 MM Mercedes-Benz 300 SL Alfa Romeo 6C Spider Zagato Ferrari 290 MM Scaglietti Mercedes-Benz 300 SLR Alfa Romeo 8C 2300 Monza Ferrari 315 Sport MG Alfa Romeo 8C 2300A Ferrari 335 Sport MG EX182 Alfa Romeo