Transit and Bus Committee Meeting October 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Surface Water Supply of the United States 1958

Surface Water Supply of the United States 1958 Part 14. Pacific Slope Basins in Oregon and Lower Columbia River Basin Prepared under the direction of J. V. B. WELLS, Chief, Surface Water Branch GEOLOGICAL SURVEY WATER-SUPPLY PAPER 1568 Prepared in cooperation with the States of Oregon and Washington and with other agencies UNITED STATES GOVERNMENT PRINTING OFFICE, WASHINGTON : 1960 UNITED STATES DEPARTMENT OF THE INTERIOR FRED A. SEATON, Secretary GEOLOGICAL SURVEY Thomas B. Nolan, Director For sale by the Superintendent of Documents, U.S. Government Printing Office Washington 25, D.C. - Price $1 (paper cover) PREFACE This report was prepared by the Geological Survey in coopera tion with the States of Oregon and Washington and with other agen cies, by personnel of the Water Resources Division, L. B. Leopold, chief, under the general direction of J. V. B. Wells, chief, Surface Water Branch, and F. J. Flynn, chief, Basic Records Section. The data were collected and computed under supervision of dis trict engineers, Surface Water Branch, as follows: K. N. Phillips...............>....................................................................Portland, Oreg, F. M. Veatch .................................................................................Jacoma, Wash. Ill CALENDAR FOR WATER YEAR 1958 OCTOBER 1957 NOVEMBER 1957 DECEMBER 1957 5 M T W T F S S M T W T P S S M T W T P S 12345 1 2 1234567 6 7 8 9 10 11 12 3456789 8 9 10 11 12 13 14 13 14 15 16 17 18 19 10 11 12 13 14 15 16 15 16 17 18 19 20 21 20 21 22 23 24 25 26 17 18 19 20 -

M14A/D Select Bus Service April 2019

M14A/D Select Bus Service April 2019 New York City Transit Background • M14 was identified as a critical future SBS corridor in M14 Select Bus Service past BRT studies as far back as 2011 • M14A/D is second-busiest bus route in Manhattan (27,000 daily riders) and second-slowest in NYC • M14A and D connect to 18 subway lines and 16 other bus routes 2 Planning & Implementation To Date • Extensive public outreach helped to refine the 14th St M14 Select Bus Service design in preparation for full tunnel closure • 14th Street markings and SBS fare machines were partially installed in Fall 2018 • 2018 design was intended for M14 SBS route from 10th Av to Stuyvesant Cove ferry, with local bus service on M14A and D branches 3 Moving toward Full M14A/D SBS • Bring SBS improvements much earlier than original 2020 plan for full M14 SBS • Serve A and D branches on Lower East Side, not just 14 St • Make use of installed SBS fare equipment 4 Moving Forward March April May June 14th Street Public Outreach A/D Branches M14 Select Bus Service14th Street Planning & Analysis A/D Branches Fare Machine Installation SBS 14th St Markings Installation Launch • DOT & MTA are committed to launching • 14th Street bus lanes could be M14A & M14D SBS in Spring 2019 implemented in time for SBS launch • Accelerated public process intended to • Bus priority on the Lower East Side deliver SBS improvements to L train branches will be investigated for later customers implementation 5 SBS Elements Toolkit of SBS elements includes: • Camera-enforced bus lanes • Off-board fare -

The Street Railway Journal

Vol. X. MEW YORK CHICAGO, DECEMBER. Mo, 12. ' a ** v\ J? v THE STREET RAILWAYS OF WASHINGTON, D. CV7 r 1894 All the principal street railway lines operating in the car house and station will be erected, thro i?|jhFw^ipto^ro city of Washington are at present undergoing important the right of the street, the track will make a loop, by changes. Some are extending their present limits, while means of which the cable trains will be turned. This others are being rebuilt, one for cable traction and another will be a gravity loop, and the cable will not follow the for an underground electric system. In studying the line of the track, but will encircle a terminal sheave street railway situation of Washington, it must be remem- located in the street. The present car house in George- bered that all the street railway lines of the District of town will be abandoned and devoted to other purposes. Columbia are under the direct supervision of Con- The present length of rope, which operates the George- gress, and none of them can effect a change of motive town division from the central power station, is 2,350 ft., but power without a special act, and this has been secured in it will be correspondingly increased to operate the exten- FlG. 1.—CABLE CURVE AT PEACE MONUMENT, FOOT OF PENNSYLVANIA AVENUE—WASHINGTON, D. C. the case of the Columbia Railroad Company and other sion. The length of the rope which operates the Navy roads, which will be noted below. It should also be borne Yard end of the line is 31,500 ft., that on 14th Street in mind that an act of Congress, passed some years since, division is 27,700 ft., and on 7th Street division 33,250 ft. -

Sicilian Eatery

SICILIAN EATERY Concrete is a casual dining experience located on the border of Brooklyn neighborhoods Bedford Stuyvesant + Bushwick. 917-886-9660 The 3,000 sq ft space has a capacity of 75, featuring an open kitchen, dining area, full bar with seating, and performance stage. 906 Broadway, Concrete’s menu includes a variety of plates from both Italian and American cuisines, Brooklyn NY 11206 in addition to a selection of Sicilian street food favorites. 906broadway The bar offers a selection of top shelf liquors, Sicilian wines, and local beers. @gmail.com The list of specialty cocktails are curated exclusively for Concrete, with all cocktail syrups made fresh + in house by our bartending staff. @concretebrooklyn Open June 2018, the space features artwork from both local and international artists, www. including a custom mural from artist Mike Lee on the building’s Stockton St side. concrete-brooklyn The live event calendar is set to premiere in Fall 2018. .com Currently serving dinner from 5p - 11p, with brunch available on weekends. Located at 906 Broadway, Brooklyn NY 11206, accessible by the J/M/Z trains at Myrtle-Broadway + the B46 bus. THE NEAREST TRAINS ARE THE M/J/Z LINES AT MYRTLE - BROADWAY, OR FLUSHING AVE. WE ARE A 14 MINUTE WALK FROM THE HALSEY L TRAIN STATION IN BUSHWICK. THE B46, B47, B54, M1, M119 (AT MYRTLE AVE), AND B15 (AT LEWIS AVE) HAVE ROUTES TO MYRTLE / BROADWAY JUNCTION, AND ARE WITHIN A 3-10 MINUTE WALK FROM CONCRETE’S LOCATION. High resolution images can be downloaded here: https://www.dropbox.com/sh/1upry4klu8zc8ll/AADVl9DsBLjDfT5-E4H1iezNa?dl=0 Interior and Exterior Space Photography: Leonardo Mascaro http://www.leonardomascaro.com Food + Drink Photography: Paul Quitoriano http://www.paulcrispin.com DOP GRADE PRODUCTS Dnominazione di Origine Protetta certification ensures that products are locally grown and packaged. -

Leaders' Committee

Leaders’ Committee TfL Commissioner – Andy Byford Item no: 4 Report by: Spencer Palmer Job title: Director, Transport & Mobility Date: 9 February 2021 Contact Officer: Spencer Palmer Telephone: 020 7934 9908 Email: [email protected] Summary Since taking over the TfL Commissioner role from Mike Brown MVO last summer, Andy Byford has been keen to attend London Councils’ Leaders’ Committee to meet London’s Leaders and discuss his immediate and future priorities for TfL. Recommendations For information only Background The Mayor of London and the Board of Transport for London (TfL) confirmed the appointment of Andy Byford last summer as London's new Transport Commissioner, following an international recruitment and selection process. Mr Byford has extensive senior leadership experience running transport authorities across the globe. His most recent role was President and Chief executive Officer of New York City Transit Authority, where he was responsible for 50,000 staff and devised a $40bn five-year investment plan to renew the city’s transport system. He joined TfL on 29th June 2020, taking over from Mike Brown MVO, who left to take up his new role of overseeing the renovation of the Houses of Parliament. TfL Priorities Andy Byford has taken on the Commissioner role at a pivotal moment for the organisation and for London as TfL works to help the capital recover from the Covid-19 pandemic and support a safe and sustainable re-start. He has outlined his two main strategic priorities as getting the Elizabeth Line delivered and open and to lead the organisation out of Covid-19, including restoring ridership numbers and achieve a more sustainable financial situation for the organisation. -

Bus Plan 1-Year Update May 2019 Bus Plan Launched April 2018

Bus Plan 1-Year Update May 2019 Bus Plan launched April 2018 2 Network Redesign – Progress to Date Launched new express network in Staten Island . Travel times improved up to 5 minutes . Speed increased an average of 12% . All performance metrics have improved Began network redesign in the Bronx and Queens . Bronx outreach in fall 2018 . Bronx existing conditions report March 2019 . Queens kick-off April 2019 3 Network Redesign - Coming Up Bronx . Draft redesign plan – expected May 2019 . Final redesign plan – expected September 2019 Queens . 6 Open Houses scheduled in May . Existing conditions report – August 2019 . Draft redesign plan – expected November 2019 . Final redesign plan – expected April 2020 Remaining Boroughs . Brooklyn . Manhattan and Staten Island (Local) 4 Select Bus Service Progress to Date Coming Up in 2019 B82 SBS launched in October 2018 M14 SBS . Bus lanes . Finalizing design . Off-board fare collection . Off-board fare collection . 28,000 daily riders . Stop rationalization . Connects to 6 subway lines and 21 bus Continue to partner with DOT on corridor routes improvements on established SBS routes 5 Bus Priority Progress to Date Coming Up in 2019 Approximately 8 miles of new bus lane in 2018 24 street improvement projects with DOT . B82 SBS . 10-15 miles of new bus lanes . Fulton street bus lane extension . Many major bus corridors in all 5 boroughs . th Double bus lane on 5 Avenue 4 more TSP routes with DOT 13 routes with TSP through April 2019 . Q52/53 SBS, B82 SBS, Bx6 SBS . B35, Q5, and M1 launched since release of the Bus Plan Source: NYC DOT Better Buses Action Plan, April 2019 6 Traffic Enforcement Progress to Date Coming Up Hugh L Carey Tunnel approach On bus camera enforcement pilot . -

Bowery - Houston - Bleecker Transportation Study (Congestion Analysis)

Bowery - Houston - Bleecker Transportation Study (Congestion Analysis) Technical Memorandum No. 1 - Existing Conditions P.I.N. PTDT11D00.H07 DRAFT December 2011 Bowery – Houston - Bleecker Transportation Study Technical Memorandum No. 1 Existing Conditions PTDT11D00.H07 The preparation of this report has been financed in part through funds from the U.S. Department of Transportation, Federal Highway Administration (FTA) through the New York State Department of transportation and the New York Metropolitan Transportation Council. This document is disseminated by the New York City of transportation in the interest of information exchange. It reflects the views of the New York City Department of Transportation (NYCDOT) which is responsible for the facts and the accuracy of the data presented. The report does not necessarily reflect any official views or policies of the Federal Transit Administration, the federal Highway Administration or the State of New York. This report does not constitute a standard, specification or regulation. Prepared by: New York City Department of Transportation Janette Sadik-Khan, Commissioner Lori Ardito, First Deputy Commissioner Gerard Soffian, Deputy Commissioner Ryan Russo, Assistant Commissioner Margaret Forgione, Manhattan Borough Commissioner Naim Rasheed, Project Director Michael Griffith, Deputy Project Director Harvey LaReau, Project Manager Hilary Gietz, Principal Administrative Assistant Joe Li, City Planner Ali Jafri, Highway Transportation Specialist Milorad Ubiparip, Highway Transportation Specialist Eva Marin, Highway Transportation Specialist Table of Contents S.0 EXECUTIVE SUMMARY S.1 Introduction S.2 Demographics S.3 Zoning and Land Use S.4 Traffic and Transportation S.5 Public Transportation S.6 Parking S.7 Pedestrians and Bicycles S.8 Accidents/Safety S.9 Goods Movements S.10 Public Participation 1. -

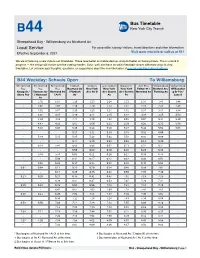

MTA B44 Bus Timetable

Bus Timetable B44 New York City Transit Sheepshead Bay - Williamsburg via Nostrand Av Local Service For accessible subway stations, travel directions and other information: Effective September 5, 2021 Visit www.mta.info or call us at 511 We are introducing a new style to our timetables. These read better on mobile devices and print better on home printers. This is a work in progress — the design will evolve over the coming months. Soon, we'll also have an online timetable viewer with more ways to view timetables. Let us know your thoughts, questions, or suggestions about the new timetables at new.mta.info/timetables-feedback. B44 Weekday: Schools Open To Williamsburg Sheepshead Sheepshead Sheepshead Flatbush Flatbush East Flatbush Crown Hts Bed-Stuy Williamsburg Williamsburg Bay Bay Bay Nostrand Av New York New York New York Fulton St / Bedford Av / Williamsbur Knapp St / Emmons Av Nostrand Av / Flatbush Av / Av D Av / Church Av / Eastern Nostrand Av Flushing Av g Br Plz / Shore Pky / Nostrand / Av U Av Av Py Lane 4 Av - 1:02 1:07 1:16 1:20 1:24 1:32 1:37 1:43 1:48 - 2:02 2:07 2:16 2:20 2:24 2:32 2:37 2:43 2:48 - 3:02 3:07 3:16 3:20 3:24 3:32 3:37 3:43 3:48 - 4:02 4:07 4:16 4:21 4:25 4:33 4:38 4:45 4:50 - 4:30 4:35 4:44 4:49 4:53 5:01 5:07 5:14 5:20 - 4:47 4:52 5:01 5:06 5:11 5:19 5:25 5:32 5:38 - 5:03 5:09 5:19 5:24 5:29 5:37 5:44 5:52 5:58 - - - 5:27 5:32 5:36 5:45 5:52 6:00 - - 5:19 5:25 5:35 5:40 5:44 5:53 6:00 6:09 - - - - 5:44 5:49 5:53 6:02 6:11 6:20 - - 5:34 5:41 5:53 5:58 6:02 6:13 6:22 6:31 - - - - 5:59 6:04 6:09 6:20 6:29 6:38 -

Fixing the L Train and Managing the Shutdown a Community Consensus Proposal

Fixing the L Train and Managing the Shutdown A Community Consensus Proposal November 2016 Contents Executive Summary / 3 Summary of Recommendations / 3 Introduction / 6 Impact on Commuters and Residents / 8 Implications/how to prepare for the shutdown / 10 Impact on Businesses / 11 How much do local businesses depend on the L train? / 11 How to prepare for the shutdown / 11 Providing the Best Travel Alternatives / 12 Prepare adjacent subway lines for higher ridership / 12 New rapid bus services with dedicated preferential treatments and auto-free zones / 13 Transform streets in Brooklyn to better connect people and cyclists to transit / 17 Improve ferry service and reduce fares to serve Williamsburg residents / 18 Making the Most of the Shutdown: Transforming the L Train / 19 Capital improvements at five stations / 20 Timing and funding / 20 Procurement and design / 21 An Inclusive Process / 22 Community Profiles /23 Manhattan / 24 Williamsburg/Greenpoint / 25 Bushwick/Ridgewood / 26 East New York/Brownsville/Canarsie / 27 2 Fixing the L Train and Managing the Shutdown: A Community Consensus Proposal | November 2016 Executive Summary The Metropolitan Transportation Authority has said it will shut ⊲ State Senator Martin M. Dilan down the L train tunnels under the East River for more than a ⊲ Council Member Stephen Levin year to repair the severe damage caused by Superstorm Sandy. ⊲ Council Member Antonio Reynoso That is grim news for the hundreds of thousands of New Yorkers ⊲ Manhattan Borough President Gale Brewer who rely on the L and who will have few easy alternatives to get ⊲ Brooklyn Borrough President Eric L. Adams to where they’re going every day. -

Brooklyn Ny Crown Heights

CROWN HEIGHTS BROOKLYN NY 250 UTICA AVENUE SPACE DETAILS LOCATION GROUND FLOOR Northwest corner of Lincoln Place APPROXIMATE SIZE Ground Floor 2,077 SF FRONTAGE 40 FT on Utica Avenue 50 FT on Lincoln Place CEILING HEIGHT Ground Floor 14 FT TERM Negotiable LINCOLN PLACE POSSESSION Immediate SITE STATUS Currently vacant NEIGHBORS Dollar Tree, Blink Fitness, Brooklyn Kids Academy, CityMD, Chase, Modell’s Sporting Goods, McDonald’s, Pay-o-matic, Popeyes, 50 FT Conrad’s Bakery, H&R Block, Texas Fried Chicken & Pizza, 2,077 SF Utica Fish Market, Met Foodmarket, Golden Krust, Subway, Feel Beauty Supply, Rent-A-Center, Rainbow Shops, Dunkin’, Portabella, Eastern Pediatrics, Allegiance, Pretty Girl, Boost Mobile, Bank of America, Family Vision Center, T-Mobile and Sprint COMMENTS Close proximity to the Utica Avenue subway station servicing the trains with an annual ridership of 8,954,499 Retail at the base of a new 87-unit residential development 40 FT HVAC in place UTICA AVENUE Food use is acceptable Utica Avenue, Park Place-Carrol Street Brooklyn, NY May 2019 PARK PLACE Rising Star Beauty Salon Crown Heights Cell Games and Beyond P&C Blink Boutique Lakou Cafe Vibez Palate Adonijah Health Food Tuba's Hair Braiding Sally Vip Salon UTICA AVENUE UTICA Hardee AREA RETAIL Diamond Kouture Hair Studio Top Shelf Ink Tatto Studio Love Express Deli ROCHESTER AVENUE SCHENECTADY AVENUE SCHENECTADY Utica Best Buy Wine and Liquor STERLING PLACE VIEW OF NORTHWEST CORNER FROM LINCOLN PLACE Restaurant Los Mercedes B46 + B46 (SBS) Crown Heights Deli and Tobacco -

The Bulletin R-42S MAKE THEIR FINAL, FINAL RUN Published by the Electric Railroaders’ Association, Inc

ERA BULLETIN — MARCH, 2020 The Bulletin Electric Railroaders’ Association, Incorporated Vol. 63, No. 3 March, 2020 The Bulletin R-42S MAKE THEIR FINAL, FINAL RUN Published by the Electric Railroaders’ Association, Inc. P. O. Box 3323 Grand Central Station New York, NY 10163 For general inquiries, or Bulletin submissions, contact us at bulletin@erausa. org or on our website at erausa. org/contact Editorial Staff: Jeffrey Erlitz Editor-in-Chief Ronald Yee Tri-State News and Commuter Rail Editor Alexander Ivanoff North American and World News Editor David Ross Production Manager Copyright © 2019 ERA This Month’s Cover Photo: Second Avenue Elevated, looking north from 34th The R-42s are seen at Hammels Wye on the last trip northbound from Far Rockaway-Mott Av to Inwood-207 St. Street in about 1937, pho- Marc A. Hermann photograph tographer unknown. MTA New York City Transit retired the last thusiasts joined MTA Chairman and CEO remaining R-42 subway cars from service Patrick J. Foye and NYC Transit President today, ending a 51-year run. The cars have Andy Byford riding the last R-42 in passen- been used on two dozen lines, each traveling ger service. more than seven million miles. They had a “These cars have served the MTA well as a memorable role in an iconic car-vs.-train reliable fleet over the last 50 years,” said Sal- In This Issue: chase in the classic 1971 film French Con- ly Librera, Senior Vice President, Department LIRR Main Line nection. of Subways for New York City Transit. “As Third-Track The final run followed a send-off ceremony technology advances, we’re looking to mod- at the New York Transit Museum, and was ernize our fleet of subway cars to best serve Project Update scheduled to proceed through a final trip on New Yorkers.” …Page 3 the A line from Euclid Av to Far Rockaway (Continued on page 2) to 207 St, before returning to Euclid Av to close its doors for the last time. -

Steadfast Nyc School Bus Members Continue to Fight to Preserve Employee Protections International Officers Lawrence J

OFFICIAL JOURNAL OF THE AMALGAMATED TRANSIT UNION | AFL-CIO/CLC MARCH / APRIL 2015 STEADFAST NYC SCHOOL BUS MEMBERS CONTINUE TO FIGHT TO PRESERVE EMPLOYEE PROTECTIONS INTERNATIONAL OFFICERS LAWRENCE J. HANLEY International President JAVIER M. PEREZ, JR. NEWSBRIEFS International Executive Vice President OSCAR OWENS International Secretary-Treasurer Iowa bus driver quits after threats INTERNATIONAL VICE PRESIDENTS Fed up with rowdy behavior and threats from students, a Davenport, LARRY R. KINNEAR IA, bus driver has called it quits. The City offers its CitiBus transit Ashburn, ON – [email protected] service for free to all Davenport students. Drivers and riders say the RICHARD M. MURPHY problem with students has gotten worse. The mayor is urging the Newburyport, MA – [email protected] transit system to clamp down on problem riders by removing them BOB M. HYKAWAY Calgary, AB – [email protected] from buses. JANIS M. BORCHARDT Madison, WI – [email protected] Detroit to hire 100 new bus drivers PAUL BOWEN In some good news out of Motown, Detroit says it wants to hire Canton, MI – [email protected] KENNETH R. KIRK more than 100 bus drivers as part of its efforts to improve public transit Lancaster, TX – [email protected] service across the region. Local 26 welcomed the announcement GARY RAUEN saying it should “definitely take some of the stress off the existing Clayton, NC – [email protected] manpower” and hopes it leads to restoring service that had been cut. MARCELLUS BARNES Flossmore, IL – [email protected] RAY RIVERA Lilburn, GA – [email protected] Enter First Annual ATU Photo Contest! YVETTE TRUJILLO Have a great photo of ATU members on the job, at a protest, rally, or Thornton, CO – [email protected] other event – showing what makes ATU the great union it is today? GARY JOHNSON, SR.