Fiscal Year Ended March 31, 2020 (FY2019) Results Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Third Quarter Results

Consolidated Financial Results for the First Nine Months from April 1 to December 31, 2016 2017・1・31 Index 02 Highlights of the Third Quarter, FY2017 09 Unit Information Copyright 2017 Nomura Real Estate Holdings, Inc. 1 Highlights of the Third Quarter, FY2017 Copyright 2017 Nomura Real Estate Holdings, Inc. 2 Summary of Financial Results • The cumulative result of FY2017 3Q was as follows: Operating revenue;¥368.9 billion (down 3.1% y/y); operating income; ¥49.1 billion (down 7.4% y/y); ordinary income;¥42.9 billion (down 8.8% y/y); and profit attributable to owners of parent;¥29.1 billion (increase 2.7% y/y). • In the Residential Development Unit, the number of housing units sold decreased to 3,074 (down 711 units y/y) while gross margin ratio and housing prices increased. The contract progress rate for the planned 5,650 units of this consolidated fiscal year was 90.1% as of the end of the current third quarter. • In the leasing business, tenant leasing made a satisfactory progress, and the vacancy rate as of the end of the third quarter improved to 1.0% (down 1.2 points from the end of the previous fiscal year). • Service Management Sector which consists of 3 Units, the Investment Management Unit, the Property Brokerage & CRE Unit, and the Property & Facility Management Unit marked a smooth progress. Especially in the Property Brokerage & CRE Unit, both the number of transactions and transaction value marked the highest figure ever as the third quarter. • No change in the consolidated operating result forecast and dividend forecast which was announced in October, 2016. -

Download Keisei Ueno Station Free Ebook

KEISEI UENO STATION DOWNLOAD FREE BOOK Timoteus Elmo | 60 pages | 29 Oct 2011 | Loc Publishing | 9786138111450 | English | United States Best way from Keisei Ueno to JR Ueno Station - Tokyo Forum Comfort 7. More travel options. It was for one night whilst in Tokyo. It takes approximately 0 min to drive from Keisei-Ueno to Ueno Station. Is this room comes with connecting rooms. Keisei Ueno Station is an underground station. To the best of our knowledge, these details are correct as of the last update: 14 Oct Train operators. Thank you. Double Room - Smoking - Breakfast Included 1 full bed. What's nearby. Rate your stay. It is close to restaurants entertainment Keisei Ueno Station and very very close to Ueno station. Japan: Keisei Electric Railway. Hotel Rainbow. The private bathroom is equipped with a bath, shower and high-tech toilet. Members of their staff were polite and helpful. Parking Private parking is available on site reservation is Keisei Ueno Station possible and costs JPY per day. Show Prices. Ver fotos y detalles. What are the travel Keisei Ueno Station in Keisei-Ueno? Accessible parking. The journey takes approximately 4 min. Las vistas eran a Ueno centro. Safety features Thermometers for guests provided by property Access to healthcare professionals First aid kits available Process in place to check health of guests Hand sanitizer in guest accommodation and common areas Staff follow all safety protocols as directed by local authorities. Ikebukuro UENO m. Is there a direct bus between Tokyo station and Keisei-Ueno? Clear all filters. Dormy Inn Ueno Okachimachi. Write a review. -

First Half of Fiscal Year Ending March 31, 2020 (FY2019) November 14, 2019 Results Presentation Keisei Electric Railway Co., Ltd

First Half of Fiscal Year Ending March 31, 2020 (FY2019) November 14, 2019 Results Presentation Keisei Electric Railway Co., Ltd. Contents 1. Consolidated Results for First Half of Fiscal Year Ending March 31, 2020 2. Consolidated Results Forecast for Fiscal Year Ending March 31, 2020 3. Progress in E4 Plan 4. Reference Material Copyright © Keisei Electric Railway Co., Ltd. 1 1-1. Overview of Results (Year on Year) Operating revenue, operating income, ordinary income, and net profit attributable to owners of parent posted record highs. FY2019 H1 FY2018 H1 % ■ Changes in operating revenue (by segment) Unit: million yen Million yen, % Change Result Result Change 3,353 327 Operating revenue 138,007 129,916 8,090 6.2 1,881 367 -514 3,078 Operating income 19,117 17,746 1,371 7.7 -403 138,007 (Operating income margin) 13.9 13.7 0.2pt - 129,916 Ordinary income FY2018FY2018 H1TransportationDistributionDistribution Real Leisure,Leisure, Construction OtherOther EliminationFY2019FY2019 H1 28,431 26,890 1,541 5.7 H1 Estate ServiceService H1 Share of profit of entities accounted for 9,770 9,799 -28 -0.3 using equity method ■ Changes in operating income (by segment) Unit: million yen Net profit attributable to owners of parent 21,176 20,520 655 3.2 277 67 1,165 -86 Depreciation 13,555 12,656 899 7.1 -46 151 19,117 -156 17,746 FY2018FY2018 TransportationH1 TransportationDistributionDistributionRealReal Estate Leisure,Leisure, Construction Construction OtherOther EliminationEliminationFY2019FY2019 H1 H1 Estate ServiceService H1 Copyright © Keisei Electric Railway Co., Ltd. 2 1-2. Overview of Results [Consolidated Balance Sheet/Consolidated Cash Flows] • The equity ratio increased due to an increase in shareholders’ equity. -

East Japan Railway Company Shin-Hakodate-Hokuto

ANNUAL REPORT 2017 For the year ended March 31, 2017 Pursuing We have been pursuing initiatives in light of the Group Philosophy since 1987. Annual Report 2017 1 Tokyo 1988 2002 We have been pursuing our Eternal Mission while broadening our Unlimited Potential. 1988* 2002 Operating Revenues Operating Revenues ¥1,565.7 ¥2,543.3 billion billion Operating Revenues Operating Income Operating Income Operating Income ¥307.3 ¥316.3 billion billion Transportation (“Railway” in FY1988) 2017 Other Operations (in FY1988) Retail & Services (“Station Space Utilization” in FY2002–2017) Real Estate & Hotels * Fiscal 1988 figures are nonconsolidated. (“Shopping Centers & Office Buildings” in FY2002–2017) Others (in FY2002–2017) Further, other operations include bus services. April 1987 July 1992 March 1997 November 2001 February 2002 March 2004 Establishment of Launch of the Launch of the Akita Launch of Launch of the Station Start of Suica JR East Yamagata Shinkansen Shinkansen Suica Renaissance program with electronic money Tsubasa service Komachi service the opening of atré Ueno service 2 East Japan Railway Company Shin-Hakodate-Hokuto Shin-Aomori 2017 Hachinohe Operating Revenues ¥2,880.8 billion Akita Morioka Operating Income ¥466.3 billion Shinjo Yamagata Sendai Niigata Fukushima Koriyama Joetsumyoko Shinkansen (JR East) Echigo-Yuzawa Conventional Lines (Kanto Area Network) Conventional Lines (Other Network) Toyama Nagano BRT (Bus Rapid Transit) Lines Kanazawa Utsunomiya Shinkansen (Other JR Companies) Takasaki Mito Shinkansen (Under Construction) (As of June 2017) Karuizawa Omiya Tokyo Narita Airport Hachioji Chiba 2017Yokohama Transportation Retail & Services Real Estate & Hotels Others Railway Business, Bus Services, Retail Sales, Restaurant Operations, Shopping Center Operations, IT & Suica business such as the Cleaning Services, Railcar Advertising & Publicity, etc. -

Chapter 2 Existing Conditions Summary

Final Report New Haven Hartford Springfield Commuter Rail Implementation Study 2 Existing Conditions Chapter 2 Existing Conditions Summary This chapter is a summary of the existing conditions report, necessary for comprehension of the remaining chapters. The entire report can be found in Appendix B of this report. 2.1 Existing Passenger Services on the Line The only existing passenger rail service on the Springfield Line is a regional service operated by Amtrak. Schedules for alternatives in Chapter 3 and the Recommended Action in Chapter 4 include current Amtrak service. Most Amtrak service on the line is shuttle trains, running between Springfield and New Haven, where they connect with other Amtrak Northeast Corridor trains. One round-trip train each day operates through the corridor to Boston to the north and Washington to the south. One round trip train each day operates to and from St. Albans, Vermont from New Haven. The trains also permit connections at New Haven with Amtrak’s Northeast Corridor (Washington to Boston) service, as well as Metro North service to New York, and Shore Line East local commuter service to New London. Departures are spread throughout the day, with trains typically operating at intervals of two to three hours. Springfield line services are designed as extensions of Amtrak’s Northeast Corridor service, and are not scheduled to serve local commuter trips (home to work trips). The Amtrak fare structure was substantially reduced in price since this study began. The original fare structure from November 2002 was shown in the existing conditions report, which can be found in Appendix B. -

Pdf/Rosen Eng.Pdf Rice fields) Connnecting Otsuki to Mt.Fuji and Kawaguchiko

Iizaka Onsen Yonesaka Line Yonesaka Yamagata Shinkansen TOKYO & AROUND TOKYO Ōu Line Iizakaonsen Local area sightseeing recommendations 1 Awashima Port Sado Gold Mine Iyoboya Salmon Fukushima Ryotsu Port Museum Transportation Welcome to Fukushima Niigata Tochigi Akadomari Port Abukuma Express ❶ ❷ ❸ Murakami Takayu Onsen JAPAN Tarai-bune (tub boat) Experience Fukushima Ogi Port Iwafune Port Mt.Azumakofuji Hanamiyama Sakamachi Tuchiyu Onsen Fukushima City Fruit picking Gran Deco Snow Resort Bandai-Azuma TTOOKKYYOO information Niigata Port Skyline Itoigawa UNESCO Global Geopark Oiran Dochu Courtesan Procession Urabandai Teradomari Port Goshiki-numa Ponds Dake Onsen Marine Dream Nou Yahiko Niigata & Kitakata ramen Kasumigajo & Furumachi Geigi Airport Urabandai Highland Ibaraki Gunma ❹ ❺ Airport Limousine Bus Kitakata Park Naoetsu Port Echigo Line Hakushin Line Bandai Bunsui Yoshida Shibata Aizu-Wakamatsu Inawashiro Yahiko Line Niigata Atami Ban-etsu- Onsen Nishi-Wakamatsu West Line Nagaoka Railway Aizu Nō Naoetsu Saigata Kashiwazaki Tsukioka Lake Itoigawa Sanjo Firework Show Uetsu Line Onsen Inawashiro AARROOUUNNDD Shoun Sanso Garden Tsubamesanjō Blacksmith Niitsu Takada Takada Park Nishikigoi no sato Jōetsu Higashiyama Kamou Terraced Rice Paddies Shinkansen Dojo Ashinomaki-Onsen Takashiba Ouchi-juku Onsen Tōhoku Line Myoko Kogen Hokuhoku Line Shin-etsu Line Nagaoka Higashi- Sanjō Ban-etsu-West Line Deko Residence Tsuruga-jo Jōetsumyōkō Onsen Village Shin-etsu Yunokami-Onsen Railway Echigo TOKImeki Line Hokkaid T Kōriyama Funehiki Hokuriku -

Northeast Corridor Chase, Maryland January 4, 1987

PB88-916301 NATIONAL TRANSPORT SAFETY BOARD WASHINGTON, D.C. 20594 RAILROAD ACCIDENT REPORT REAR-END COLLISION OF AMTRAK PASSENGER TRAIN 94, THE COLONIAL AND CONSOLIDATED RAIL CORPORATION FREIGHT TRAIN ENS-121, ON THE NORTHEAST CORRIDOR CHASE, MARYLAND JANUARY 4, 1987 NTSB/RAR-88/01 UNITED STATES GOVERNMENT TECHNICAL REPORT DOCUMENTATION PAGE 1. Report No. 2.Government Accession No. 3.Recipient's Catalog No. NTSB/RAR-88/01 . PB88-916301 Title and Subtitle Railroad Accident Report^ 5-Report Date Rear-end Collision of'*Amtrak Passenger Train 949 the January 25, 1988 Colonial and Consolidated Rail Corporation Freight -Performing Organization Train ENS-121, on the Northeast Corridor, Code Chase, Maryland, January 4, 1987 -Performing Organization 7. "Author(s) ~~ Report No. Performing Organization Name and Address 10.Work Unit No. National Transportation Safety Board Bureau of Accident Investigation .Contract or Grant No. Washington, D.C. 20594 k3-Type of Report and Period Covered 12.Sponsoring Agency Name and Address Iroad Accident Report lanuary 4, 1987 NATIONAL TRANSPORTATION SAFETY BOARD Washington, D. C. 20594 1*+.Sponsoring Agency Code 15-Supplementary Notes 16 Abstract About 1:16 p.m., eastern standard time, on January 4, 1987, northbound Conrail train ENS -121 departed Bay View yard at Baltimore, Mary1 and, on track 1. The train consisted of three diesel-electric freight locomotive units, all under power and manned by an engineer and a brakeman. Almost simultaneously, northbound Amtrak train 94 departed Pennsylvania Station in Baltimore. Train 94 consisted of two electric locomotive units, nine coaches, and three food service cars. In addition to an engineer, conductor, and three assistant conductors, there were seven Amtrak service employees and about 660 passengers on the train. -

Route No. 1: Airport Limousine Service (Bus) Route No. 2: Keisei

Route No. 1: Airport Limousine Service (Bus) Ticket has to be purchased on the day of your boarding at the Ticket Counter of Airport Limousine, which are located in the arrival lobby both at Passenger Terminal 1 and 2 respectively in Narita Airport. Schedule: North Wing of Passenger Terminal 2 → South Wing of Passenger Terminal 2 → South Wing of Passenger Terminal 1 (5 minutes later than Time Table) → North Wing of Passenger Terminal 1 (10 minutes later than Time Table) → Tokyo Dome Hotel (about 90 min.) → Destination Departure Time (Passenger Terminal 2): 08:00, 10:00, 14:15, 15:15, 16:15, 17:15, 18:35 Price: JP¥3,000.- (OW) Route No. 2: Keisei Skyliner (Train) Trains depart every 40 minutes. Ticket has to be purchased at the Keisei Ticket Counter, which are located in the arrival lobby both at Passenger Terminal 1 and 2 respectively in Narita Airport. You also can buy ticket at the Skyliner Ticket Office in front of the station entrances (B1F, both of Terminal 1 and Terminal 2). Schedule: Narita Airport → Airport Terminal 2 → Keisei UENO Station (51 min.) Price: JP¥1,920.- (OW) Remarks: After arriving at Keisei UENO station, just a few minutes’ walking is required to take JR YAMANOTE Line ( ), SHINAGAWA bound (platform #3, JR UENO station). Then, you change a train at JR AKIHABARA station (2nd stop) again. JR SOBU Line ( ), SHINJUKU bound (platform #5, JR AKIHABARA station), takes you to JR SUIDOBASHI station (2nd stop). It takes 3 minutes to JR AKIHABARA station from JR UENO station by JR YAMANOTE Line, and 4 minutes to JR SUIDOBASHI station from JR AKIHABARA station by JR SOBU Line. -

Durham E-Theses

Durham E-Theses Transience and durability in Japanese urban space ROBINSON, WILFRED,IAIN,THOMAS How to cite: ROBINSON, WILFRED,IAIN,THOMAS (2010) Transience and durability in Japanese urban space, Durham theses, Durham University. Available at Durham E-Theses Online: http://etheses.dur.ac.uk/405/ Use policy The full-text may be used and/or reproduced, and given to third parties in any format or medium, without prior permission or charge, for personal research or study, educational, or not-for-prot purposes provided that: • a full bibliographic reference is made to the original source • a link is made to the metadata record in Durham E-Theses • the full-text is not changed in any way The full-text must not be sold in any format or medium without the formal permission of the copyright holders. Please consult the full Durham E-Theses policy for further details. Academic Support Oce, Durham University, University Oce, Old Elvet, Durham DH1 3HP e-mail: [email protected] Tel: +44 0191 334 6107 http://etheses.dur.ac.uk Iain Robinson Transience and durability in Japanese urban space ABSTRACT The thesis addresses the research question “What is transient and what endures within Japanese urban space” by taking the material constructed form of one Japanese city as a primary text and object of analysis. Chiba-shi is a port and administrative centre in southern Kanto, the largest city in the eastern part of the Tokyo Metropolitan Region and located about forty kilometres from downtown Tokyo. The study privileges the role of process as a theoretical basis for exploring the dynamics of the production and transformation of urban space. -

Reservations PUBLISHED Overview 30 March 2015.Xlsx

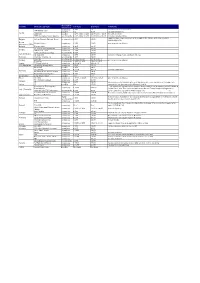

Reservation Country Domestic day train 1st Class 2nd Class Comments Information compulsory € 8,50 n.a. on board only; free newspaper WESTbahn trains possible n.a. € 5,00 via www.westbahn.at Austria ÖBB trains possible € 3,00 online / € 3,50 € 3,00 online / € 3,50 free wifi on rj-trains ÖBB Intercitybus Graz-Klagenfurt recommended € 3,00 online / € 3,50 € 3,00 online / € 3,50 first class includes drinks supplement per single journey. Can be bought in the station, in the train or online: Belgium to/from Brussels National Airport no reservation € 5,00 € 5,00 www.belgianrail.be Bosnia- Regional trains compulsory € 1,50 € 1,50 price depends on distance Herzegovina (ZRS) Bulgaria Express trains compulsory € 0,25 € 0,25 IC Zagreb - Osijek/Varazdin compulsory € 1,00 € 1,00 Croatia ICN Zagreb - Split compulsory € 1,00 € 1,00 IC/EC (domestic journeys) recommended € 2,00 € 2,00 Czech Republic SC SuperCity compulsory € 8,00 € 8,00 includes newspaper and catering in 1st class Denmark InterCity / InterCity Lyn recommended € 4,00 € 4,00 InterCity recommended € 1,84 to €5,63 € 1,36 to € 4,17 Finland price depends on distance Pendolino recommended € 3,55 to € 6,79 € 2,63 to € 5,03 France TGV and Intercités compulsory € 9 to € 18 € 9 to € 18 FYR Macedonia IC 540/541 Skopje-Bitola compulsory € 0,50 € 0,50 EC/IC/ICE possible € 4,50 € 4,50 ICE Sprinter compulsory € 11,50 € 11,50 includes newspapers Germany EC 54/55 Berlin-Gdansk-Gdynia compulsory € 4,50 € 4,50 Berlin-Warszawa Express compulsory € 4,50 € 4,50 Great Britain Long distance trains possible Free Free Greece Inter City compulsory € 7,10 to € 20,30 € 7,10 to € 20,30 price depends on distance EC (domestic jouneys) compulsory € 3,00 € 3,00 Hungary IC compulsory € 3,00 € 3,00 when purchased in Hungary, price may depend on pre-sales and currency exchange rate Ireland IC possible n/a € 5,00 reservations can be made online @ www.irishrail.ie Frecciarossa, Frecciargento, → all compulsory and optional reservations for passholders can be purchased via Trenitalia at compulsory € 10,00 € 10,00 Frecciabianca "Global Pass" fare. -

Official Guide T2 All En.Pdf

2020 , 1 December 2020 FLOOR GUIDE ENGLISH December Narita International Airport Terminal2 Narita Airport is working in conjunction with organizations such as Japan’s Ministry of Narita International Airport FLOOR GUIDE, Planned and Published by Narita International Airport Corporation (NAA), Published Planned andPublished by Narita International FLOOR GUIDE, Airport Narita International Justice and Ministry of Health, Labour and Welfare to combat the spread of COVID-19. Due to the spread of the virus, business hours may have changed at some terminal facilities and stores. For the latest information, please consult the Narita International Airport Official Website. Narita International Airport Ofcial Website 英語 CONTENTS INFORMATION & SERVICES Lost Item Inquiries/infotouch Interactive Digital Displays NariNAVI/Lounges …………………………………………………………4 Flight Information/ Terminals and Airlines ……………………………………… 5 Internet Services ……………………………………………………………5 General Information ………………………………………………………5 FLOOR MAP Terminal 2 Services Map ……………………………………… 6–7 B1F Railways (Airport Terminal2 Station) ……………………………………………… 8–9 1F International Arrival Lobby …………………………………………… 10–11 2F Parking Lot Accessway ……………………………………………… 12–13 3F International Departure Lobby (Check-in Counter) ………………… 14–15 4F Restaurants and Shops/Observation Deck ……………………… 16–17 3F International Departure Lobby (Boarding Gate)/ Duty Free and Shopping Area ……………………………………… 18–21 Domestic Flights …………………………………………………… 22–23 SHOPS AND FACILITIES Before Passport Control … 24–29 After Domestic Check-in -

Learn from Japan's Earthquake and Tsunami Crisis

Learn from Japan’s Earthquake and Tsunami Crisis International Field Experience Spring 2018 TOHOKU TRIP BOOKLET Center for Public Service, Portland State University Contents What to pack? --------------------------------------- 2 Transportation --------------------------------------- 2-7 Cell phone -------------------------------------------- 7 WiFi ---------------------------------------------------- 7 Smartphone Apps ---------------------------------- 8 Restrooms -------------------------------------------- 8 Laundry ----------------------------------------------- 8 Tips ---------------------------------------------------- 8 Smoking and Alcohol ------------------------------ 9 Sales Tax --------------------------------------------- 9 Credit Cards ------------------------------------------ 9 Currency ---------------------------------------------- 10-11 Safety -------------------------------------------------- 11 In case of Emergency ------------------------------ 11 Phrases and Vocabulary -------------------------- 12-14 2 What to pack? While Japan offers most items found in the U.S., consider preparing the following items as listed below: ● Clothing: ○ Prepare for hot & humid weather Average temperature in the Tohoku region is ~72 with humidity. Bringing cotton or other lightweight clothing items for the trip is recommended. ℉ However, please remember to dress appropriately. Avoid open-toed shoes, exposing shoulders/chest, or anything above the knee when visiting shrines/memorial sites. Occasionally you will need to remove your shoes,